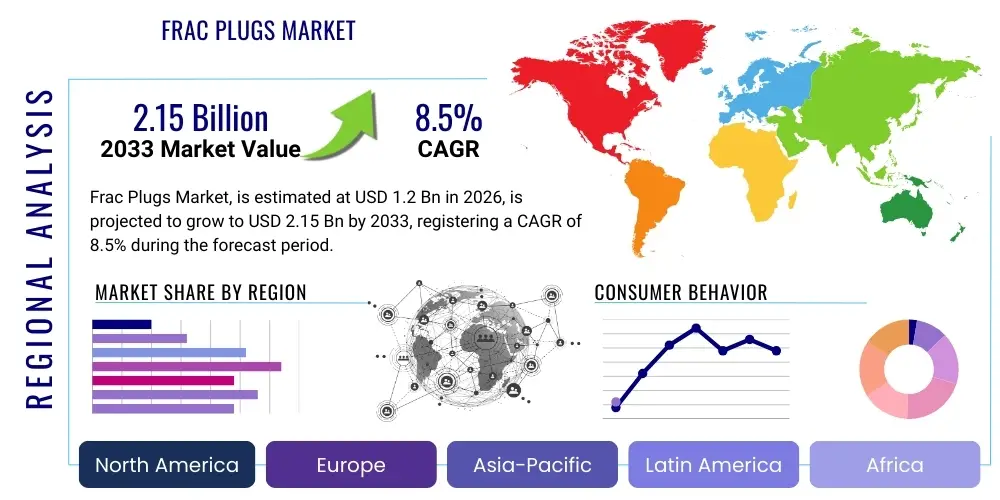

Frac Plugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438956 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Frac Plugs Market Size

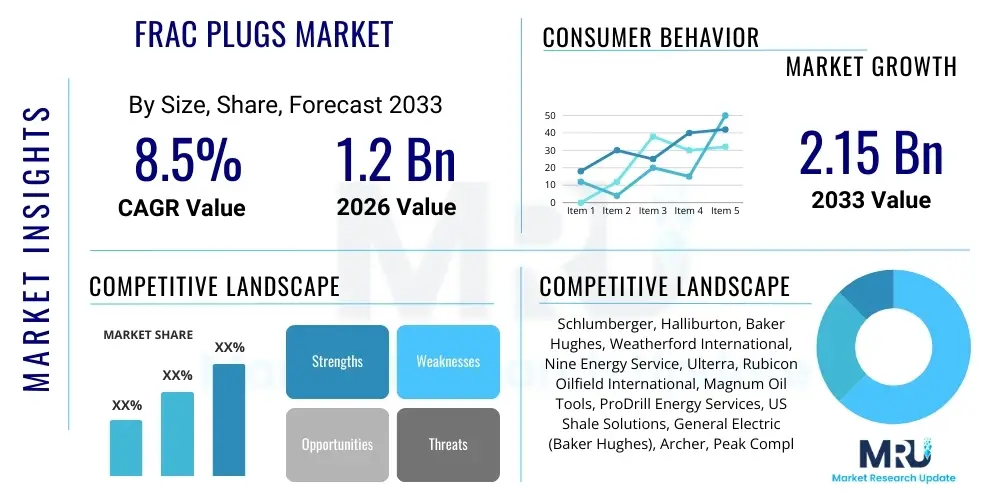

The Frac Plugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Frac Plugs Market introduction

The Frac Plugs Market encompasses the manufacturing, distribution, and utilization of specialized downhole tools designed to isolate sections of a wellbore during hydraulic fracturing operations, particularly in unconventional oil and gas plays such as shale formations and tight gas reservoirs. Frac plugs are critical components that enable operators to achieve zonal isolation efficiently, allowing successive stages of hydraulic fracturing fluid to be pumped effectively into the targeted rock layer. These plugs must possess high differential pressure capacity, reliable sealing mechanisms, and increasingly, rapid drill-out times or complete dissolvability to minimize non-productive time (NPT) and associated costs.

The core product, the frac plug, serves several major applications, primarily centered around multi-stage horizontal well fracturing. Key benefits derived from their use include optimized reservoir stimulation, enhanced hydrocarbon recovery rates, and the ability to conduct complex fracturing designs with precision. Driving factors for market expansion are fundamentally linked to the resurgence and technological advancement within the global unconventional resource development sector, especially in North America. The continued pursuit of energy independence, coupled with stabilized oil prices making unconventional extraction economically viable, reinforces the essential role of reliable and high-performance frac plugs in modern well completion strategies. Additionally, the shift towards composite and dissolvable materials represents a significant technological uplift, driving demand for innovative solutions.

Frac Plugs Market Executive Summary

The Frac Plugs Market is characterized by robust business trends focusing heavily on material science innovation, specifically the development and adoption of composite and fully dissolvable plugs. The primary business objective across leading manufacturers is the reduction of total well completion time and operational complexity. This involves creating plugs that require minimal intervention for removal, leading to faster production timelines and lower overall costs per stimulated stage. Furthermore, market competition is intensifying, driven by intellectual property related to high-pressure/high-temperature (HP/HT) capabilities and environmentally benign dissolution properties. Investment in automated manufacturing processes for precision engineering of these downhole tools is a pervasive trend.

Regionally, North America, particularly the Permian Basin and other active shale plays in the United States and Canada, remains the undisputed epicenter of demand, accounting for the vast majority of market revenue due to the maturity and intensity of hydraulic fracturing operations. However, emerging regional trends indicate growing opportunities in developing unconventional fields globally, notably in the Asia Pacific (specifically China and Australia) and parts of Latin America (Argentina’s Vaca Muerta). These regions are increasingly adopting North American completion technologies, signaling a mid-to-long-term diversification of market consumption.

Segment trends highlight a substantial shift from traditional cast iron and aluminum plugs towards composite materials, which offer superior strength-to-weight ratios and easier drill-out. The fastest-growing segment, however, is the Dissolvable Frac Plugs sector. This segment is experiencing accelerated growth driven by operator preference for intervention-less solutions that eliminate the need for a dedicated milling trip, thereby saving significant rig time and operational expenditure. This technological pivot dictates the direction of R&D investment and market share gains moving forward.

AI Impact Analysis on Frac Plugs Market

User queries regarding AI's impact on the Frac Plugs Market primarily center on optimizing operational efficiency, predicting plug failure rates, and automating logistics within the supply chain. Key concerns revolve around how machine learning can analyze vast datasets from drilling and fracturing operations to determine the optimal plug design, material composition, and setting depth for specific geological profiles, thus moving beyond generalized engineering estimates. Users also inquire about the role of AI in predictive maintenance for associated pumping and coiled tubing equipment and streamlining inventory management to ensure just-in-time delivery of specialized plug components, which is critical for continuous fracturing spreads. The expectation is that AI integration will lead to customized, highly reliable frac plug selection and placement, significantly reducing the risk of premature failure and maximizing the effectiveness of each stimulated stage.

- AI algorithms optimize frac plug material selection based on real-time reservoir parameters (temperature, pressure, fluid chemistry).

- Predictive analytics minimizes non-productive time (NPT) by forecasting potential plug failure points during setting or pressurization.

- Machine learning enhances supply chain logistics, ensuring optimal inventory levels of specific plug sizes and dissolution chemistries across active basins.

- AI assists in analyzing post-frac acoustic and pressure data to validate plug effectiveness and inform future completion strategies.

- Automated interpretation of geological data supports the precise placement and setting mechanism calibration of plugs downhole.

DRO & Impact Forces Of Frac Plugs Market

The dynamics of the Frac Plugs Market are shaped by powerful Drivers, structural Restraints, and significant Opportunities, which collectively constitute the Impact Forces influencing market growth. The primary driver is the sustained global demand for energy, fueling intensive hydraulic fracturing activities in unconventional reservoirs, particularly in North America. Coupled with this is the continuous advancement in well completion efficiency, where operators prioritize maximizing the number of fracturing stages per well to boost ultimate recovery. Technological innovation, specifically the commercial viability of dissolvable plugs and high-strength composites, acts as a pivotal growth catalyst by offering tangible cost and time savings.

Conversely, the market faces notable restraints, chiefly the inherent volatility of crude oil and natural gas prices. Fluctuations directly influence E&P (Exploration and Production) capital expenditure, leading to cyclical market downturns that disproportionately affect specialized service sectors like completion tools. Furthermore, increasing environmental scrutiny and stringent regulatory requirements regarding well integrity, waste disposal, and chemical usage pose operational and compliance challenges, potentially slowing down the adoption of new plug materials or processes that do not meet environmental sustainability goals. The high initial capital cost associated with complex plug manufacturing technology also presents a barrier to entry for smaller competitors.

Opportunities abound, primarily driven by geographical diversification into emerging unconventional plays outside the traditional US market, such as those in the Middle East, Asia Pacific, and Latin America. The rapid penetration of completely intervention-less completion technologies, where dissolvable plugs are central, promises sustained growth. Additionally, focused R&D on developing next-generation environmentally friendly materials—plugs that dissolve completely into benign components—offers a significant competitive advantage and addresses regulatory pressures. The impact forces indicate a market resilient to short-term price volatility but fundamentally driven by technological efficiency gains and the necessity for faster, cheaper, and safer well completions.

Segmentation Analysis

The Frac Plugs Market segmentation provides a granular view of demand based on material type, product type, well type, and application, reflecting diverse operational requirements across the oil and gas industry. The material segmentation—encompassing composite, dissolvable, and conventional plugs—is the most dynamic, highlighting the industry's rapid transition toward advanced materials that reduce intervention and accelerate production. Product segmentation differentiates between ball-and-seat designs, plug-and-collar systems, and specialized dissolvable variants, reflecting engineering solutions tailored to specific well geometries and pressure demands. Analysis of these segments is critical for understanding current market shares and forecasting where future R&D expenditures will be concentrated, predominantly favoring the lightweight, high-performance categories.

Further analysis by well type, distinguishing between horizontal and vertical wells, overwhelmingly shows that horizontal wells dominate consumption, corresponding directly to the complexity and stage requirements of modern hydraulic fracturing in shale. The application segmentation, which separates onshore and offshore activities, indicates that while onshore unconventional plays are the primary revenue generator, offshore operations are demanding extremely specialized, high-integrity plugs for deeper, more challenging environments. Understanding these segmented demands allows manufacturers to align their product portfolios with immediate high-volume needs (onshore, horizontal) while strategically developing niche, high-margin products (offshore, high-pressure/high-temperature).

- By Material Type:

- Composite Frac Plugs

- Dissolvable/Soluble Frac Plugs

- Conventional (Cast Iron/Aluminum) Frac Plugs

- By Product Type:

- Ball-and-Seat Frac Plugs

- Plug-and-Collar Frac Plugs

- Retrievable Frac Plugs

- By Well Type:

- Horizontal Wells

- Vertical Wells

- By Application:

- Onshore

- Offshore

Value Chain Analysis For Frac Plugs Market

The value chain for the Frac Plugs Market begins with upstream analysis centered on the sourcing and processing of specialized raw materials, including high-strength polymers, advanced composites (like fiberglass and carbon fiber), and proprietary dissolvable alloys (magnesium, zinc). This phase involves meticulous quality control to ensure material specifications meet the rigorous demands of downhole environments, particularly concerning pressure, temperature resistance, and controlled dissolution kinetics. Key upstream activities also include intellectual property development related to material science, which dictates the performance characteristics and competitive pricing of the final plug design. Manufacturers often maintain close relationships with chemical and materials suppliers to ensure consistent access to specialized inputs required for composite and dissolvable plug manufacturing.

Midstream activities involve the high-precision manufacturing, assembly, and testing of the frac plugs. This requires sophisticated CNC machining, automated assembly lines, and stringent pressure testing protocols. The manufacturing process often involves complex design elements, such as intricate gripping slips, robust elastomer seals, and controlled internal mechanisms. Once manufactured, the downstream segment involves logistics, inventory management, and distribution. Frac plugs are typically distributed directly to major oilfield service providers (OFS), E&P companies, or through specialized distribution channels that offer integration with broader well completion packages. Direct sales channels are often favored for highly customized or proprietary dissolvable plugs, allowing the manufacturer to provide necessary technical support and training directly to the field operations team.

Indirect distribution channels, such as third-party completion tool rental services or local stocking points, are utilized for high-volume, standardized composite plugs. However, given the high-stakes nature of hydraulic fracturing operations, end-users heavily rely on robust technical support and field service expertise provided by the manufacturer. The entire value chain is characterized by a high degree of integration between design, material science, and field application, ensuring that the plug performs reliably under extreme conditions, which ultimately drives market value and profitability.

Frac Plugs Market Potential Customers

The primary customers and end-users of frac plugs are entities involved in the exploration and production (E&P) of oil and natural gas, particularly those operating unconventional wells requiring multi-stage hydraulic fracturing. This includes major integrated oil companies (IOCs) such as ExxonMobil and Chevron, national oil companies (NOCs) like Saudi Aramco and Sinopec, and, most crucially, independent oil and gas operators focused specifically on shale and tight oil plays. These independent operators often drive the demand for cost-efficient, high-performance plugs due to their aggressive well completion schedules and focus on lowering lifting costs.

A second major segment of buyers includes Oilfield Service (OFS) providers, such as Schlumberger, Halliburton, and Baker Hughes. These service companies purchase frac plugs in massive volumes, either incorporating them into comprehensive well completion service packages offered to E&P clients or reselling them as part of their downhole tool product line. OFS companies often drive the adoption of new technologies, such as dissolvable plugs, as they seek solutions that provide competitive advantages in terms of operational efficiency and safety. The purchasing decisions of these large buyers are influenced heavily by material performance, reliability track record, supply chain resilience, and compatibility with proprietary pump-down and coiled tubing equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton, Baker Hughes, Weatherford International, Nine Energy Service, Ulterra, Rubicon Oilfield International, Magnum Oil Tools, ProDrill Energy Services, US Shale Solutions, General Electric (Baker Hughes), Archer, Peak Completion Technologies, Innovex Downhole Solutions, Purple Rock LLC, Evolution Oil Tools, Core Laboratories, DynaStage Frac Tools, GR Energy Services, Owen Oil Tools |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frac Plugs Market Key Technology Landscape

The technological landscape of the Frac Plugs Market is undergoing a rapid evolution, primarily driven by the demand for plugs that minimize intervention and reduce rig time. The most disruptive technology is the development and commercial scaling of Dissolvable Frac Plugs, typically manufactured from specialized alloys (such as magnesium or zinc) or polymers that degrade completely upon exposure to downhole fluids and temperature over a controlled period. This innovation eliminates the costly and time-consuming milling process required to remove conventional plugs, saving several days of rig time per well. Manufacturers are competing fiercely on refining the dissolution chemistry to control the time frame precisely, ensuring the plug holds pressure reliably during fracturing but dissolves swiftly afterward, leaving the wellbore unobstructed for production.

A secondary, yet crucial, area of technological focus is advanced Composite Frac Plugs. While not dissolvable, these plugs utilize high-strength, lightweight materials (e.g., carbon fiber, fiberglass composites) that are significantly easier and faster to drill out than traditional cast iron or aluminum plugs. Innovations in composite technology center on optimizing the design to maintain maximum pressure integrity while minimizing the debris volume generated during milling. Furthermore, technological progress includes improvements in the setting mechanisms—moving towards reliable hydraulic or specialized mechanical setting tools—and optimizing the elastomer seals for superior performance in high-pressure, high-temperature (HP/HT) environments, which are becoming common in deeper, unconventional plays. The integration of telemetry and smart sensors into placement tools is also emerging, ensuring precise real-time monitoring of the plug-setting process downhole.

Regional Highlights

The regional analysis of the Frac Plugs Market confirms North America as the dominant market, owing to the prolific and sustained development of major unconventional reservoirs like the Permian Basin, Bakken, and Marcellus. The United States and Canada are the global leaders in hydraulic fracturing activity, characterized by complex, multi-stage completions that utilize thousands of frac plugs annually. This region serves not only as the largest consumer but also as the primary hub for technological innovation and commercial scaling of advanced dissolvable and composite plug technologies. The established infrastructure, mature service industry, and high density of E&P operators contribute to the region's overwhelming market share and influence global pricing and technology standards. Europe currently holds a relatively minor share due to restrictive regulatory environments and political opposition to hydraulic fracturing, particularly in nations like the UK and Germany. However, potential future development in select Eastern European tight gas areas could slowly introduce localized demand. Conversely, the Asia Pacific (APAC) region is demonstrating strong potential for market growth. China's efforts to develop massive shale gas resources and Australia's unconventional gas projects are driving increasing adoption of high-stage completion techniques, directly increasing the demand for frac plugs. Companies are leveraging successful North American models and adapting them to the unique geological and logistical challenges of the APAC region. The Middle East and Africa (MEA) region, traditionally known for conventional oil production, is showing nascent interest in utilizing advanced fracturing techniques to enhance recovery from existing fields and unlock tighter reservoirs in countries like Saudi Arabia and the UAE. While adoption rates are slower compared to North America, the sheer scale of potential unconventional resources in the region represents a significant long-term opportunity for frac plug manufacturers specializing in high-strength, high-temperature tools. Latin America, propelled primarily by Argentina’s Vaca Muerta shale play, is a crucial emerging market where fracturing intensity is steadily climbing, positioning it as a key consumer of completion technologies in the medium term.- North America: Dominant market share due to intensive and technologically advanced horizontal drilling and multi-stage fracturing in the US (Permian, Haynesville) and Canada. Highest penetration of dissolvable plug technology.

- Asia Pacific (APAC): Fastest growing region, driven by Chinese governmental efforts to exploit domestic shale gas resources and increasing unconventional activity in Australia and India.

- Middle East and Africa (MEA): Emerging demand focused on enhancing recovery from mature conventional fields and preliminary exploration of tight gas resources; demand favors HP/HT capable plugs.

- Latin America: Key growth driven by Argentina’s Vaca Muerta shale, signaling increasing investment in advanced hydraulic fracturing techniques across the continent.

- Europe: Limited market activity constrained by regulatory restrictions on hydraulic fracturing, with demand focused on mature North Sea operations or niche geothermal applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frac Plugs Market.- Schlumberger

- Halliburton

- Baker Hughes

- Weatherford International

- Nine Energy Service

- Ulterra

- Rubicon Oilfield International

- Magnum Oil Tools

- ProDrill Energy Services

- US Shale Solutions

- General Electric (Baker Hughes)

- Archer

- Peak Completion Technologies

- Innovex Downhole Solutions

- Purple Rock LLC

- Evolution Oil Tools

- Core Laboratories

- DynaStage Frac Tools

- GR Energy Services

- Owen Oil Tools

Frequently Asked Questions

Analyze common user questions about the Frac Plugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using dissolvable frac plugs over composite plugs?

The primary benefit of dissolvable frac plugs is the complete elimination of the dedicated milling trip required to remove them. This saves substantial rig time, reduces operational complexity, and significantly lowers the overall well completion cost compared to composite plugs, which still require intervention for removal.

Which geographical region dominates the consumption of frac plugs globally?

North America, specifically the United States and Canada, dominates the global consumption of frac plugs. This dominance is driven by the high volume of multi-stage hydraulic fracturing operations conducted in mature unconventional basins like the Permian and Appalachian regions.

What materials are typically used to manufacture advanced frac plugs?

Advanced frac plugs are primarily manufactured using specialized high-strength composite materials (fiberglass and carbon fiber reinforced polymers) for drillable plugs, and proprietary dissolvable alloys, mainly magnesium and zinc, for intervention-less completion systems.

How does oil price volatility impact the Frac Plugs Market?

Oil price volatility directly restrains the Frac Plugs Market by influencing E&P capital expenditure. Lower and unstable prices typically lead operators to defer or scale back drilling and completion programs, reducing the immediate demand for completion tools like frac plugs.

What technological advancement is currently driving the most growth in the market?

The development and widespread commercial adoption of intervention-less, fully dissolvable frac plug technology is the key driver of market growth, as it addresses the industry's critical need to optimize efficiency and minimize non-productive time during well completion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Frac Plugs Market Size Report By Type (Composite Plugs, Dissolvable Plugs, Cast Iron Plugs), By Application (Vertical Wells, Horizontal Wells), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Frac Plugs Market Statistics 2025 Analysis By Application (Vertical Wells, Horizontal Wells), By Type (Composite Plugs, Dissolvable Plugs, Cast Iron Plugs), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Dissolvable Frac Plugs Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mg Alloy, PGA (Polyglycolic Acid)), By Application (Vertical Wells, Horizontal Wells), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager