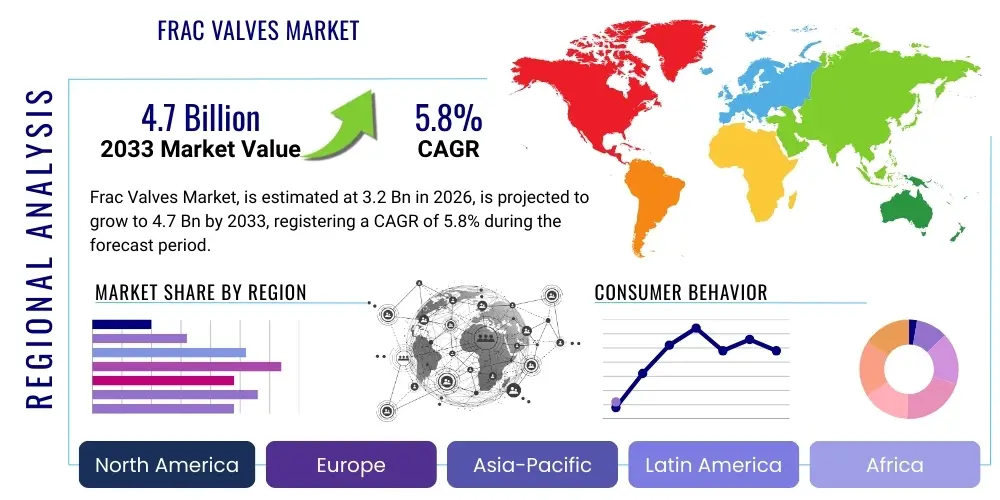

Frac Valves Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439716 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Frac Valves Market Size

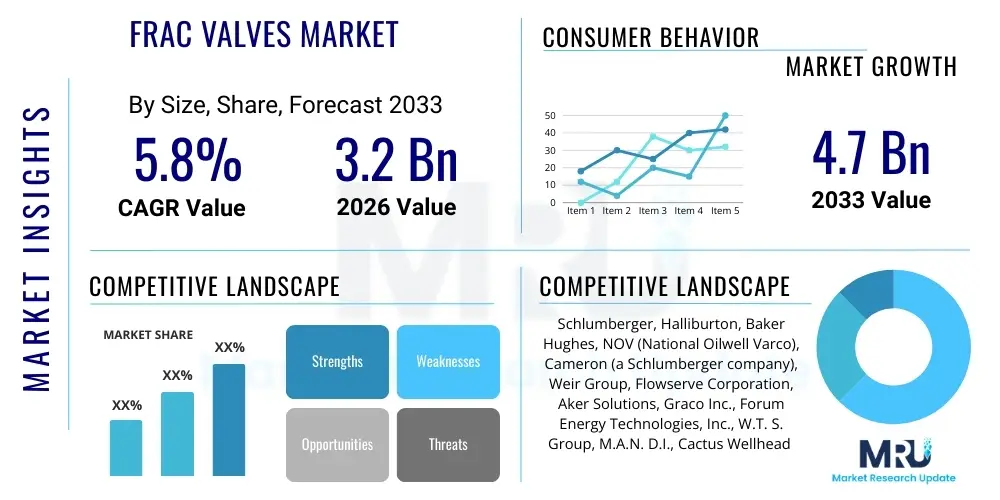

The Frac Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 4.7 Billion by the end of the forecast period in 2033. This growth is primarily fueled by the sustained global demand for energy, prompting extensive exploration and production activities in unconventional oil and gas reserves. The market's expansion is intrinsically linked to the continued adoption of hydraulic fracturing technologies, which heavily rely on high-performance frac valves to ensure operational efficiency, safety, and environmental compliance.

Frac Valves Market introduction

Frac valves are specialized, high-pressure flow control devices engineered to withstand the extreme conditions inherent in hydraulic fracturing operations, a critical process for extracting hydrocarbons from unconventional reservoirs such as shale formations. These valves are pivotal in managing the flow of fracturing fluid, proppant, and return fluids under immense pressures and abrasive conditions, ensuring precise control and preventing catastrophic failures. They are designed for robust performance, featuring materials and sealing technologies capable of enduring corrosive environments and high cycle counts, which is paramount for the integrity and efficiency of well completion projects. The intricate design of frac valves incorporates advanced metallurgy and sealing compounds to ensure durability and leak prevention, reflecting their indispensable role in modern oil and gas extraction methodologies. Their ability to operate reliably in highly demanding scenarios underscores their value in optimizing production yields and safeguarding personnel and environmental assets.

The product description for frac valves encompasses a range of types, each serving specific functions within the fracturing string. Key categories include gate valves, known for their full-bore design and robust shut-off capabilities; plug valves, valued for their quick quarter-turn operation and resistance to abrasion; check valves, essential for preventing backflow; and choke valves, used for controlled pressure reduction. These valves are fabricated from high-strength alloys, such as stainless steel or specialty steels, chosen for their resilience against corrosion, erosion, and high-pressure differentials. They come in various sizes and pressure ratings, typically ranging from 5,000 psi to 15,000 psi and even higher, to accommodate diverse well conditions and operational requirements. The manufacturing process adheres to stringent industry standards like API 6A and API 16C, ensuring reliability and interchangeability. Furthermore, modern frac valves often incorporate features such as extended service life components, modular designs for easier maintenance, and compatibility with automated control systems, enhancing their operational flexibility and cost-effectiveness over the life cycle of a well.

Major applications of frac valves are predominantly found in the upstream oil and gas sector, particularly in hydraulic fracturing operations for unconventional oil and gas extraction, including shale gas, tight oil, and coal bed methane (CBM) recovery. They are integral components of the fracturing tree, manifold systems, and wellhead assemblies, facilitating the injection of fracturing fluids downhole and managing the subsequent flowback. Beyond the core fracturing process, frac valves are also utilized in various stages of well completion and workover operations, including cementing, acidizing, and well testing, where precise flow control under high pressure is critical. The benefits derived from the deployment of high-quality frac valves are multifaceted, encompassing enhanced operational safety by preventing uncontrolled releases of hydrocarbons, improved well integrity and longevity through reliable sealing, increased efficiency by minimizing downtime due to valve failures, and significant cost savings over the long term through reduced maintenance and improved well productivity. The reliability of these valves directly impacts the economic viability and environmental footprint of hydraulic fracturing projects, making their selection and maintenance a top priority for operators.

Driving factors for the frac valves market are deeply rooted in the global energy landscape and technological advancements in the oil and gas industry. A primary driver is the persistent global demand for energy, which continues to spur exploration and production activities, particularly in unconventional reserves that require hydraulic fracturing. The continuous innovation in fracturing techniques, such as multi-stage fracturing and longer horizontal wells, necessitates more robust, reliable, and technologically advanced frac valves capable of enduring increasingly severe operating conditions. Furthermore, the growing focus on operational efficiency and safety across the oil and gas sector pushes manufacturers to develop valves that offer extended service life, easier maintenance, and enhanced automation capabilities, thereby reducing human intervention and potential risks. Environmental considerations also play a role, as valves designed to minimize fugitive emissions and improve sealing performance contribute to meeting stricter regulatory standards. The integration of digital technologies for real-time monitoring and predictive maintenance further enhances the appeal and functionality of modern frac valves, aligning with the industry's drive towards smarter and more sustainable operations.

Frac Valves Market Executive Summary

The Frac Valves Market is experiencing dynamic shifts driven by evolving business trends, regional growth patterns, and segment-specific innovations. Key business trends include a heightened focus on mergers and acquisitions among valve manufacturers to consolidate market share, leverage economies of scale, and broaden product portfolios. There is also a significant push towards digital transformation, integrating smart valve technologies with IoT and AI for enhanced predictive maintenance, real-time monitoring, and remote operation, which improves safety and operational efficiency while reducing lifecycle costs. Furthermore, sustainability initiatives are influencing product development, with companies investing in valves designed for reduced emissions and improved material longevity, aligning with environmental, social, and governance (ESG) goals. These business trends underscore an industry moving towards higher technological sophistication, operational resilience, and environmental responsibility, reflecting a broader strategic realignment to meet both energy demands and regulatory pressures effectively. The emphasis on advanced manufacturing techniques and rigorous quality control is also growing, ensuring that frac valves can perform reliably under the most extreme conditions, thereby mitigating risks and optimizing production outcomes for operators globally.

Regional trends significantly shape the Frac Valves Market, with North America, particularly the United States and Canada, remaining the dominant region due to extensive shale gas and tight oil developments. This dominance is supported by well-established infrastructure, a mature oilfield services sector, and continuous investment in unconventional drilling technologies. Asia Pacific is emerging as a rapidly growing market, fueled by increasing energy demands in countries like China and India, alongside the exploration of their own unconventional reserves and significant investments in oil and gas infrastructure. Latin America, specifically Argentina with its Vaca Muerta shale play, presents substantial opportunities, although market volatility and political factors can influence investment flows. The Middle East and Africa (MEA) region, while traditionally focused on conventional oil and gas, is gradually exploring unconventional resources, creating a nascent demand for frac valves. Europe, on the other hand, faces more stringent environmental regulations and public opposition to hydraulic fracturing, leading to a more subdued market, though specialized applications and mature basin revitalization efforts still offer niche opportunities. These geographical variations highlight a fragmented yet interconnected market where regional energy policies, geological potentials, and technological adoption rates dictate market dynamics and investment priorities.

Segment trends within the frac valves market reveal a clear preference for high-pressure and high-temperature (HPHT) rated valves, driven by the increasing depth and complexity of unconventional wells. There is a growing demand for valves made from advanced materials, such as specialty alloys and ceramics, that offer superior resistance to erosion, corrosion, and abrasion, extending valve lifespan and reducing maintenance frequency in harsh environments. Automation and remote operability are becoming standard features, with electronically actuated valves and integrated sensor technology gaining traction to enhance safety, reduce manual intervention, and optimize fracturing processes. Furthermore, modular valve designs that allow for easier and quicker repair or replacement of components are gaining popularity, reducing downtime and operational costs. The market is also seeing innovation in sealing technologies, with improved elastomer compounds and metal-to-metal seals designed to perform reliably under extreme pressures and temperatures, preventing leaks and ensuring well integrity. These trends underscore an industry-wide commitment to enhancing the performance, durability, and operational efficiency of frac valves, directly addressing the evolving challenges and demands of modern hydraulic fracturing operations across various geological formations.

AI Impact Analysis on Frac Valves Market

User questions regarding AI's impact on the Frac Valves Market often revolve around how artificial intelligence can enhance operational efficiency, improve safety protocols, reduce maintenance costs, and extend the lifespan of critical valve components. Users are keen to understand the practical applications of AI, such as predictive maintenance, real-time diagnostics, and optimized fracturing processes, and how these capabilities translate into tangible benefits for oil and gas operators. Concerns also frequently emerge regarding the integration challenges of AI systems with existing infrastructure, data security, and the need for specialized skill sets to manage these advanced technologies. The overarching theme is an expectation that AI will revolutionize the lifecycle management of frac valves, making operations smarter, safer, and more economically viable, while simultaneously posing questions about the implementation hurdles and the return on investment for adopting such sophisticated solutions.

- Predictive Maintenance: AI algorithms analyze sensor data (pressure, temperature, vibration) from frac valves to predict potential failures before they occur, optimizing maintenance schedules and reducing unplanned downtime.

- Operational Optimization: AI-driven systems monitor real-time flow dynamics and valve performance, adjusting parameters to ensure optimal fracturing fluid delivery, minimizing waste and maximizing well productivity.

- Enhanced Safety: AI can identify abnormal operational patterns or potential mechanical stresses in valves, alerting operators to mitigate risks, thereby preventing equipment failures and ensuring personnel safety.

- Design and Material Innovation: AI-powered simulations accelerate the design process for new frac valves, optimizing material selection and structural integrity to withstand extreme conditions more effectively.

- Supply Chain Efficiency: AI tools can forecast demand for specific frac valve components, optimizing inventory management and ensuring timely availability of parts, reducing lead times and logistical costs.

- Automated Control Systems: AI facilitates the development of intelligent, autonomous valve control systems that can respond dynamically to changing well conditions, reducing the need for manual intervention and improving precision.

- Data Analytics for Performance: AI analyzes historical operational data to identify trends in valve wear and performance degradation, providing insights for future design improvements and operational best practices.

DRO & Impact Forces Of Frac Valves Market

The Frac Valves Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that shape its growth trajectory and operational landscape. Key drivers include the ever-increasing global energy demand, which necessitates the continuous exploration and production of hydrocarbons from unconventional reserves, predominantly through hydraulic fracturing. Technological advancements in fracturing techniques, such as longer laterals and multi-stage completions, demand more robust, reliable, and advanced frac valves capable of enduring harsher downhole conditions, thereby driving innovation and market growth. Furthermore, the stringent focus on operational safety and environmental protection within the oil and gas industry encourages the adoption of high-integrity, leak-proof valves, compelling manufacturers to invest in superior materials and sealing technologies. The economic viability of unconventional plays, which heavily depends on efficient and reliable equipment, also acts as a powerful driver, pushing for valves that reduce downtime and improve overall well productivity. These factors collectively create a strong impetus for the expansion and technological evolution of the frac valves market, sustaining its critical role in the energy sector.

Conversely, several restraints pose challenges to the market's growth. The inherent volatility of crude oil and natural gas prices directly impacts investment decisions in exploration and production, leading to fluctuating demand for frac valves. Periods of low oil prices can significantly curtail new drilling and completion activities, causing project delays or cancellations. Stringent environmental regulations and public opposition to hydraulic fracturing in certain regions, particularly in Europe and parts of North America, can limit market access and impose additional compliance costs, acting as a significant barrier to expansion. The high initial investment required for advanced frac valves, especially those designed for ultra-HPHT applications or with integrated smart technologies, can deter smaller operators. Additionally, supply chain disruptions, geopolitical instability, and trade tensions can affect the availability and cost of raw materials and components, leading to manufacturing delays and increased product prices. These restraints necessitate strategic adaptation from market players, requiring them to diversify their offerings, explore new markets, and focus on cost-effective, high-performance solutions to mitigate risks.

Despite the restraints, significant opportunities exist for market expansion and innovation. The vast untapped unconventional reserves in emerging economies, such as China, Argentina, and parts of the Middle East and Africa, present substantial long-term growth prospects as these regions look to enhance their energy independence. The ongoing digital transformation within the oil and gas industry offers lucrative avenues for developing and integrating smart frac valves equipped with IoT sensors, AI-driven analytics, and remote monitoring capabilities, providing enhanced operational insights and predictive maintenance. Furthermore, the increasing emphasis on sustainable fracturing techniques, including the use of recycled water and environmentally friendly proppants, creates opportunities for manufacturers to develop valves compatible with these evolving fluid chemistries and processes. Impact forces such as global economic shifts, geopolitical tensions influencing energy policies, and rapid technological innovation continue to shape the market. For instance, a global economic recovery often correlates with increased energy consumption, boosting E&P investments. Regulatory shifts towards stricter environmental controls can either be a restraint or an opportunity, depending on how agile manufacturers are in adapting their products to meet new standards. Continuous innovation in materials science and automation technology fundamentally alters manufacturing processes and product capabilities, ensuring that frac valves remain at the forefront of safe and efficient hydrocarbon extraction. The interplay of these forces mandates a proactive and adaptive approach for companies operating within the frac valves market to capitalize on emerging trends and mitigate potential challenges effectively.

Segmentation Analysis

The Frac Valves Market is meticulously segmented across various parameters to provide a granular understanding of its diverse landscape and to cater to the specific requirements of the oil and gas industry. This segmentation typically includes categories based on valve type, pressure rating, material, application, and end-user, each influencing design, performance, and market demand. Understanding these segments is crucial for manufacturers to tailor their product offerings, for operators to select the most appropriate equipment for their specific well conditions, and for market analysts to accurately forecast growth trajectories. The differentiation across these segments reflects the highly specialized nature of hydraulic fracturing operations, which demand precise control, exceptional durability, and unwavering reliability under extreme operating conditions. Each segment category highlights distinct market needs and technological preferences, driving ongoing innovation in frac valve design and functionality to meet the evolving challenges of unconventional resource development and well completion projects globally. The comprehensive segmentation analysis offers a strategic framework for stakeholders to identify lucrative opportunities and develop targeted market penetration strategies.

- By Type:

- Gate Valves: Widely used for their full-bore design, providing minimal pressure drop and robust shut-off capabilities, critical for high-pressure fracturing operations.

- Plug Valves: Favored for their quick quarter-turn operation and resistance to abrasive media, commonly employed in manifold systems.

- Check Valves: Essential for preventing backflow of fracturing fluids or reservoir fluids, ensuring unidirectional flow and safety.

- Ball Valves: Offer tight shut-off and quick operation, often used in less abrasive sections or for isolation purposes.

- Choke Valves: Utilized for controlling flow rates and reducing pressure, crucial for managing well flowback and production.

- By Pressure Rating:

- Low-Pressure Valves: Typically up to 5,000 psi, used in less demanding applications or specific stages of fracturing.

- Medium-Pressure Valves: Ranging from 5,000 psi to 10,000 psi, common in many standard unconventional well completions.

- High-Pressure Valves: Exceeding 10,000 psi, designed for deep, complex, and high-pressure shale formations, representing a growing segment.

- By Material:

- Carbon Steel: Economical choice for less corrosive environments.

- Alloy Steel: Offers enhanced strength and corrosion resistance, suitable for moderate conditions.

- Stainless Steel: Provides superior corrosion resistance, used in more aggressive fluid environments.

- Specialty Alloys: High-nickel alloys and other advanced materials for ultra-corrosive, high-temperature, and high-pressure applications.

- By Application:

- Onshore: Dominant segment due to extensive shale plays in North America, China, and Argentina, requiring large volumes of frac valves.

- Offshore: Used in specialized deepwater or ultra-deepwater fracturing and completion operations, demanding extremely robust and reliable valves.

- By End-User:

- Oil & Gas Exploration & Production (E&P) Companies: Direct operators that procure valves for their well completion programs.

- Oilfield Service Providers: Companies that offer fracturing and well completion services, often owning and operating extensive fleets of frac valves.

- Wellhead Equipment Manufacturers: OEMs that integrate frac valves into complete wellhead systems and fracturing trees.

Value Chain Analysis For Frac Valves Market

The value chain for the Frac Valves Market is a complex and interconnected network, beginning with the sourcing of raw materials and extending through manufacturing, distribution, and end-user deployment, ultimately supported by aftermarket services. The upstream analysis focuses on the procurement of specialized raw materials crucial for valve construction. This includes high-grade steel alloys such as stainless steel, carbon steel, and various nickel-based alloys, chosen for their resilience against extreme pressure, temperature, and corrosive or abrasive fracturing fluids. Elastomers and specialized polymers for sealing components are also critical. Key suppliers in this stage include metallurgical companies and chemical manufacturers, which provide materials meeting stringent industry standards like API specifications. The quality and availability of these raw materials directly impact the cost, performance, and lead times of the final frac valve products. Manufacturers engage in rigorous material testing and often maintain long-term relationships with preferred suppliers to ensure consistent quality and supply chain stability, mitigating risks associated with material defects or shortages.

Midstream activities involve the design, manufacturing, and assembly of frac valves. This stage includes sophisticated engineering processes, advanced machining techniques, heat treatment, welding, and rigorous quality control testing to ensure each valve meets specified pressure ratings and performance criteria. Valve manufacturers, ranging from large multinational corporations to specialized niche players, invest heavily in research and development to innovate designs, integrate new materials, and enhance automation capabilities. Certification and compliance with industry standards (e.g., API 6A, NACE MR0175) are paramount during manufacturing to ensure product reliability and market acceptance. The manufacturing process is often capital-intensive, requiring specialized machinery and skilled labor. Downstream analysis encompasses the distribution and sales channels through which frac valves reach their end-users. This involves a mix of direct sales, where manufacturers sell directly to major E&P companies or large oilfield service providers, and indirect channels, which utilize a network of authorized distributors, agents, and local representatives. These distributors often provide localized inventory, technical support, and faster delivery times, particularly for smaller operators or in remote regions.

The distribution channel for frac valves is multifaceted, integrating both direct and indirect approaches to ensure broad market reach and efficient delivery. Direct sales are common for large, custom orders or strategic partnerships with major oil and gas companies, allowing manufacturers to maintain close client relationships and offer tailored solutions. Indirect distribution channels, comprising a network of specialized oilfield equipment distributors, agents, and often third-party logistics (3PL) providers, play a vital role in reaching a wider customer base, particularly in geographically diverse or emerging markets. These intermediaries often provide value-added services such as local warehousing, inventory management, technical support, and after-sales service, which are crucial for maintaining operational continuity for end-users. The choice of distribution strategy depends on factors such as market maturity, customer size, and the complexity of the product. Effective supply chain management is critical across both direct and indirect channels to minimize lead times, reduce transportation costs, and ensure the timely availability of frac valves and their spare parts. The involvement of global logistics partners further optimizes the delivery network, particularly for international sales. Ultimately, the efficiency and robustness of the entire value chain directly impact the overall market competitiveness and profitability of frac valve manufacturers.

Frac Valves Market Potential Customers

The primary potential customers for the Frac Valves Market are entities deeply embedded within the upstream oil and gas sector, specifically those engaged in the exploration, development, and production of hydrocarbons from unconventional reserves. These end-users can be broadly categorized into several key groups, each with distinct needs and purchasing considerations. Foremost among them are the major integrated oil and gas companies (IOCs) and national oil companies (NOCs) that operate extensive hydraulic fracturing programs globally. These large-scale operators demand high-performance, robust, and technologically advanced frac valves capable of withstanding extreme pressures and abrasive conditions in deep, complex wells. Their purchasing decisions are often driven by brand reputation, proven reliability, compliance with international standards, and the ability to integrate with existing wellhead infrastructure and digital control systems. They often engage in direct procurement from leading manufacturers, often requiring customization and comprehensive after-sales support to ensure operational continuity and maximize production efficiency over the entire lifecycle of their assets.

Another significant segment of potential customers comprises specialized oilfield service providers. These companies, such as Schlumberger, Halliburton, Baker Hughes, and Weatherford, offer a comprehensive suite of services including hydraulic fracturing, well completion, and production enhancement to E&P companies. They represent a substantial portion of the market demand, as they operate extensive fleets of fracturing equipment and require a large volume of frac valves for their operations across multiple well sites. Their purchasing criteria often prioritize valves that offer ease of maintenance, rapid deployment, modularity, and a favorable cost-to-performance ratio, given their need to optimize operational efficiency across numerous projects. Reliability and durability are paramount to minimize downtime, which directly impacts their service delivery and profitability. Furthermore, independent oil and gas producers, which often focus on specific unconventional plays, also constitute a vital customer base. These companies, while potentially smaller in scale than IOCs, require robust and cost-effective frac valve solutions to ensure the economic viability of their projects, often relying on distributors for procurement and technical support.

Beyond the core E&P and oilfield service providers, other potential customers include wellhead equipment manufacturers and engineering, procurement, and construction (EPC) firms involved in large-scale oil and gas infrastructure projects. Wellhead equipment manufacturers integrate frac valves into their complete wellhead assemblies and fracturing trees, acting as indirect buyers who incorporate these components into a larger system. Their selection is based on compatibility, performance specifications, and the ability of frac valve manufacturers to provide components that meet stringent API standards and deliver seamless integration. EPC firms, particularly those managing greenfield projects or significant expansions, may also procure frac valves as part of broader equipment packages for new fracturing sites or production facilities. Furthermore, rental companies specializing in oilfield equipment represent a niche but important customer segment, purchasing frac valves to supply operators with short-term or project-specific equipment needs. Each of these customer categories contributes to the overall demand for frac valves, driven by their unique operational requirements, project scales, and strategic objectives within the dynamic oil and gas industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Halliburton, Baker Hughes, NOV (National Oilwell Varco), Cameron (a Schlumberger company), Weir Group, Flowserve Corporation, Aker Solutions, Graco Inc., Forum Energy Technologies, Inc., W.T. S. Group, M.A.N. D.I., Cactus Wellhead LLC, TechnipFMC, FMC Technologies, ProFrac Services, Liberty Oilfield Services, U.S. Well Services, ValvTechnologies Inc., Apollo Valves |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frac Valves Market Key Technology Landscape

The Frac Valves Market is continuously evolving, driven by significant advancements in technology aimed at enhancing performance, safety, and operational efficiency in increasingly challenging hydraulic fracturing environments. A critical aspect of the technological landscape involves the development and application of advanced materials. Manufacturers are increasingly utilizing specialty alloys, such as nickel-based alloys, tungsten carbide, and ceramics, which offer superior resistance to corrosion, erosion, and abrasion compared to traditional carbon or alloy steels. These materials extend the operational lifespan of frac valves, reduce maintenance frequency, and ensure reliable performance under extreme pressures and temperatures, often exceeding 15,000 psi and 300°F. Furthermore, innovations in sealing technologies, including advanced elastomer compounds and metal-to-metal seals, are crucial for preventing leaks and ensuring well integrity, especially with aggressive fracturing fluids and high cycle counts. The focus on material science directly addresses the demanding conditions inherent in unconventional well completions, mitigating risks and improving overall well productivity.

Automation and remote monitoring capabilities represent another pivotal technological shift in the frac valves market. Modern frac valves are being integrated with sophisticated sensor technology, including pressure, temperature, and vibration sensors, which provide real-time data on valve performance and operational conditions. This data is often transmitted wirelessly and analyzed using advanced analytics platforms, enabling operators to remotely monitor valve health, detect anomalies, and make informed decisions without requiring personnel on the well pad. This not only enhances safety by reducing human exposure to hazardous environments but also optimizes operational efficiency by facilitating proactive maintenance and reducing downtime. Electronically actuated valves with precise control systems allow for automated sequencing of fracturing stages, improving accuracy and consistency. The development of digital twins for frac valves, where a virtual replica of a physical valve is created, further enhances predictive maintenance capabilities and allows for simulation of various operational scenarios, optimizing valve design and operational protocols before physical deployment. These advancements signify a move towards more intelligent, autonomous, and data-driven fracturing operations.

The integration of the Internet of Things (IoT) and artificial intelligence (AI) is transforming the frac valves market by enabling smarter and more predictive operations. IoT connectivity facilitates seamless data exchange between frac valves and central control systems, allowing for a holistic view of the fracturing process. AI algorithms process this vast amount of real-time and historical data to identify patterns, predict potential equipment failures, and recommend optimal operational adjustments. For example, AI-powered predictive maintenance can accurately forecast when a valve component is likely to fail, allowing for scheduled replacement rather than costly emergency repairs. Furthermore, AI contributes to optimizing fracturing fluid delivery, adjusting valve positions dynamically to maintain desired flow rates and pressures, thereby maximizing hydrocarbon recovery. The concept of "smart valves" that can autonomously respond to changing well conditions and communicate their status is becoming a reality, leading to more efficient, safer, and environmentally responsible fracturing operations. These technological advancements collectively drive the evolution of frac valves from purely mechanical components to integral parts of a sophisticated, intelligent well completion system, significantly impacting the overall efficiency and economics of unconventional resource development.

Regional Highlights

- North America: The dominant market for frac valves, primarily driven by extensive hydraulic fracturing activities in the United States (Permian Basin, Eagle Ford, Marcellus Shale) and Canada (Montney, Duvernay formations). The region benefits from robust infrastructure, technological leadership in unconventional drilling, and a mature oilfield services sector. Continuous investment in optimizing well completion designs and re-fracturing mature wells sustains high demand.

- Asia Pacific (APAC): Emerging as a significant growth region, propelled by rising energy consumption and increasing exploration of unconventional reserves, particularly in China (Sichuan Basin) and India. Countries like Australia also contribute with their CBM and shale gas projects. Investments in oil and gas infrastructure development and a push for energy independence are key drivers.

- Latin America: Presents substantial opportunities, particularly in Argentina's Vaca Muerta shale play, which holds immense potential. Brazil, Colombia, and Mexico also have developing unconventional resources. Market growth in this region is influenced by governmental policies, investment stability, and the adoption of advanced fracturing technologies.

- Middle East and Africa (MEA): While traditionally strong in conventional oil and gas, the region is gradually exploring unconventional resources, creating a nascent but growing market for frac valves. Countries like Saudi Arabia, UAE, and Algeria are investigating shale gas and tight oil potential, driven by long-term energy diversification strategies.

- Europe: Characterized by a more subdued frac valves market due to stringent environmental regulations, public opposition to hydraulic fracturing, and limited new unconventional drilling activities. However, opportunities exist in specialized applications, mature field optimization, and regions with less restrictive policies, such as parts of the UK for offshore applications or Eastern Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frac Valves Market.- Schlumberger

- Halliburton

- Baker Hughes

- NOV (National Oilwell Varco)

- Cameron (a Schlumberger company)

- Weir Group

- Flowserve Corporation

- Aker Solutions

- Graco Inc.

- Forum Energy Technologies, Inc.

- W.T. S. Group

- M.A.N. D.I.

- Cactus Wellhead LLC

- TechnipFMC

- FMC Technologies

- ProFrac Services

- Liberty Oilfield Services

- U.S. Well Services

- ValvTechnologies Inc.

- Apollo Valves

Frequently Asked Questions

Analyze common user questions about the Frac Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are frac valves and why are they crucial in the oil and gas industry?

Frac valves are specialized, high-pressure flow control devices designed to manage fluids during hydraulic fracturing operations. They are crucial because they ensure safety, prevent uncontrolled releases, maintain well integrity, and enable precise control over the injection of fracturing fluids and proppants into unconventional reservoirs, directly impacting the efficiency and success of hydrocarbon extraction.

What is the current market size and projected growth rate for the Frac Valves Market?

The Frac Valves Market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 4.7 Billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.8% from 2026 to 2033. This growth is driven by sustained global energy demand and increasing unconventional oil and gas exploration.

How does artificial intelligence (AI) impact the Frac Valves Market?

AI significantly impacts the Frac Valves Market by enabling predictive maintenance to prevent failures, optimizing operational efficiency through real-time adjustments, enhancing safety by identifying risks, accelerating design innovation, and improving supply chain management. AI integration leads to smarter, safer, and more cost-effective fracturing operations.

What are the key drivers and restraints influencing the Frac Valves Market?

Key drivers include rising global energy demand, technological advancements in E&P, and a focus on operational safety and well efficiency. Restraints encompass volatile oil and gas prices, stringent environmental regulations, high initial investment costs, and potential supply chain disruptions.

Which regions are leading the demand for frac valves and why?

North America, particularly the United States and Canada, leads the demand for frac valves due to extensive shale gas and tight oil developments, robust infrastructure, and technological leadership in unconventional drilling. Asia Pacific, especially China and India, is a rapidly growing market driven by increasing energy needs and unconventional resource exploration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager