Fractional HP Motor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432903 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fractional HP Motor Market Size

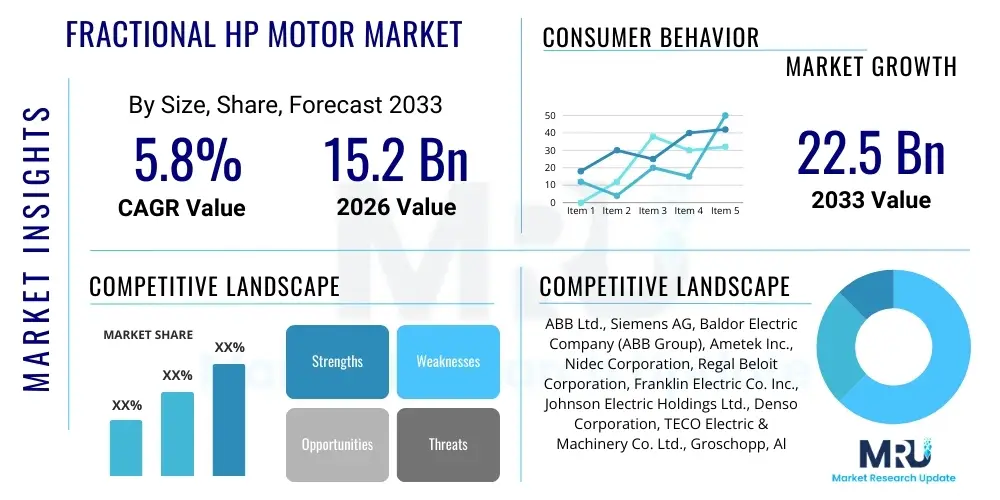

The Fractional HP Motor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 22.5 Billion by the end of the forecast period in 2033.

Fractional HP Motor Market introduction

The Fractional Horsepower (FHP) Motor Market encompasses motors with output power typically defined as less than one horsepower (746 Watts). These motors are ubiquitous across various industries, serving as the foundational power source for small, automated, and precision equipment. The robust growth in this sector is intrinsically linked to the expansion of consumer electronics, HVAC systems, and the proliferation of automated manufacturing processes. FHP motors are essential components in optimizing energy efficiency and providing reliable motion control in compact applications, making them indispensable in modern appliances and industrial machinery.

The product portfolio within the FHP motor segment is vast, including AC induction motors, DC motors (Brushed and Brushless DC or BLDC), and synchronous motors. BLDC motors, in particular, are witnessing rapid adoption due to their superior energy efficiency, longer operational lifespan, and precise speed control capabilities. Major applications span household appliances like refrigerators, washing machines, and vacuum cleaners, industrial uses such as small pumps, fans, and medical devices, and automotive applications, including power steering and window lifts. The versatility and customization inherent in FHP motor designs allow them to meet diverse operational specifications across numerous verticals.

The primary benefits driving market demand include improved energy conservation due to advanced motor technologies, reduced maintenance requirements, and the necessity for compact yet powerful actuators in miniaturized equipment. Key driving factors involve stringent energy efficiency regulations imposed globally, requiring manufacturers to integrate high-efficiency FHP motors, particularly BLDC types, into their products. Furthermore, the rapid industrialization in developing economies and the rising adoption of robotics and automation across sectors are significantly fueling the market expansion, cementing the FHP motor's role as a critical enabler of modern electromechanical systems.

Fractional HP Motor Market Executive Summary

The Fractional HP Motor Market is characterized by intense technological innovation, focusing primarily on enhancing power density and energy efficiency. Current business trends indicate a strong shift towards digitalization and the integration of IoT capabilities within motor control systems, allowing for predictive maintenance and optimized operational performance. Geographically, Asia Pacific remains the dominant revenue generator, driven by extensive manufacturing activity, increasing disposable income leading to higher demand for premium appliances, and massive infrastructural development. North America and Europe, while mature markets, are leading the adoption of sophisticated BLDC technologies due to strict environmental mandates and high labor costs necessitating advanced automation.

Segment-wise, the BLDC motor segment is exhibiting the highest growth trajectory, displacing traditional brushed DC motors in high-performance applications where longevity and minimal noise are paramount. The application landscape is heavily dominated by the HVAC and refrigeration sector, where FHP motors are central to fan, blower, and compressor operation. A critical trend across all segments is the increasing demand for customizable motor solutions that integrate seamlessly with specific end-user equipment requirements, prompting manufacturers to invest heavily in specialized R&D to maintain competitive advantage and intellectual property.

The market faces challenges related to raw material price volatility, specifically copper and rare earth magnets, which impacts manufacturing costs. However, strategic partnerships and supply chain localization efforts are being pursued to mitigate these risks. The overall outlook remains highly positive, supported by the global imperative for energy-efficient solutions and the unstoppable trend toward automation in consumer, commercial, and industrial settings. Stakeholders must prioritize investment in smart motor technologies and localized production facilities to capture emerging opportunities, particularly within rapidly industrializing nations.

AI Impact Analysis on Fractional HP Motor Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) algorithms are being integrated into motor control units (MCUs) to optimize performance, predict failures, and extend operational life in FHP motor applications. Key themes center around the feasibility and cost-effectiveness of implementing AI-driven diagnostics in high-volume, low-cost motors used in consumer goods, and the role of AI in improving manufacturing precision. Concerns often revolve around data security, the complexity of sensor integration required for effective data gathering, and the technical skill gap required to maintain these advanced systems, particularly in small and medium enterprises. Expectations are high regarding AI's potential to dramatically reduce downtime through sophisticated predictive maintenance models.

- AI enhances predictive maintenance by analyzing vibration, temperature, and current signatures to forecast motor failure long before catastrophic events occur.

- Machine learning algorithms optimize motor control parameters in real-time, resulting in improved energy efficiency and reduced power consumption, particularly under variable load conditions.

- AI-driven quality control systems accelerate manufacturing processes by identifying minute defects during production, ensuring higher consistency and reliability of FHP motor batches.

- Integration of AI facilitates smart system management, allowing FHP motors to communicate status and synchronize operations within larger IoT ecosystems, such as smart HVAC networks or industrial robots.

- AI assists in the sophisticated design and simulation phases, utilizing generative design tools to create highly optimized motor topologies that maximize power density while minimizing material use.

DRO & Impact Forces Of Fractional HP Motor Market

The dynamics of the Fractional HP Motor Market are shaped by a strong interplay of growth accelerators, operational hurdles, and substantial areas for market expansion. Key drivers include stringent global energy efficiency standards, rapid urbanization increasing demand for white goods, and technological advancements focusing on compact, high-performance motors like BLDC variants. Restraints primarily involve the volatile pricing and supply chain instability of critical raw materials, such as rare earth magnets and specialized copper windings, coupled with the ongoing challenge of miniaturizing power electronics without compromising heat dissipation capabilities, which increases R&D intensity.

Opportunities are abundant in the emerging fields of medical devices, electric vehicles (EVs) for auxiliary functions, and sophisticated drone technology, all requiring highly efficient, lightweight FHP motors. The move towards Industry 4.0 adoption globally also presents significant potential for motors equipped with integrated sensors and advanced connectivity features. Impact forces are strong, primarily driven by economic factors (demand surge from housing and construction sectors) and technological disruption (the shift from brushed to brushless technology). Regulatory pressures, particularly related to Minimum Energy Performance Standards (MEPS), act as a continuous force pushing technological innovation forward, making obsolescence a constant factor for older motor designs.

The overall market trajectory indicates that while initial costs for advanced FHP motors (like high-efficiency BLDC types) remain higher, the lifecycle cost savings derived from lower energy consumption and reduced maintenance justify the investment. Therefore, market penetration is accelerating, especially in developed economies with high energy costs. Successful market participation requires manufacturers to strategically manage their supply chains and rapidly adapt to evolving regulatory landscapes, ensuring their product offerings consistently meet or exceed the highest efficiency benchmarks set by international bodies.

Segmentation Analysis

The Fractional HP Motor Market is segmented based on Motor Type, Power Output, and Application, reflecting the diversity of product specifications required across various end-use industries. The differentiation by Motor Type—ranging from traditional AC induction to advanced BLDC motors—highlights the technological migration occurring across the sector, favoring motors with superior efficiency and control. Power Output segmentation delineates market needs, classifying motors based on horsepower, catering separately to small-scale precision instruments and medium-duty applications like blowers or small pumps. Application analysis provides a crucial view of demand concentration, showing the dominance of sectors like household appliances and HVAC, while identifying high-growth niche markets such as medical devices and automotive auxiliaries.

- By Motor Type (AC Motors, DC Motors, Universal Motors, Synchronous Motors)

- By Power Output (Below 1/8 HP, 1/8 HP to 1/4 HP, 1/4 HP to 1 HP)

- By Application (Industrial Machinery, HVAC and Refrigeration, Household Appliances, Automotive, Medical Devices)

Value Chain Analysis For Fractional HP Motor Market

The value chain of the Fractional HP Motor Market begins with upstream activities focused on the procurement of specialized materials, including magnetic materials (ferrite, neodymium), copper wire, electrical steel laminations, and specialized polymers for casings. High dependency on rare earth elements for advanced magnets introduces a notable geopolitical risk at this stage. Effective cost management and securing long-term supply agreements are crucial for manufacturers to maintain competitive pricing and production stability. The transformation stage involves high-precision machining, winding, assembly, and rigorous quality testing, often requiring automated lines to achieve the necessary volumes and consistency.

Downstream activities include distribution, sales, and aftermarket services. FHP motors reach end-users through a complex network comprising original equipment manufacturers (OEMs), authorized distributors, and direct sales channels. OEMs, particularly those in the HVAC, automotive, and appliance sectors, represent the largest direct customers, integrating motors into their final products. The distribution channel is critical for reaching smaller enterprises and providing replacement parts, often relying on global logistics networks and local stocking to ensure rapid availability and minimize system downtime for industrial users. Direct sales are generally reserved for highly specialized, customized motor solutions or very large volume contracts with major global manufacturers.

Both direct and indirect distribution channels play synergistic roles. Direct channels offer better technical support and customization feedback, strengthening the relationship between the motor manufacturer and the OEM. Indirect channels, through specialized distributors and wholesalers, provide market breadth, crucial inventory management services, and efficient supply of standard motor configurations across diverse geographical areas. The increasing complexity of motor specifications mandates that distributors possess strong technical expertise to assist clients in selecting the appropriate motor, thereby adding significant value throughout the sales cycle.

Fractional HP Motor Market Potential Customers

The market for Fractional HP Motors is highly diversified, encompassing a broad range of end-users whose operations depend on precise and reliable motion control in compact systems. The largest group of potential customers comprises Original Equipment Manufacturers (OEMs) specializing in consumer durables and major household appliances. These buyers require motors in massive volumes, emphasizing cost efficiency, high reliability, and adherence to specific noise level restrictions. Key appliance sectors include manufacturers of refrigerators, washing machines, dryers, dishwashers, and small kitchen gadgets, constantly seeking motors with improved energy efficiency ratings to meet consumer demands and regulatory standards.

Another significant customer segment includes the Heating, Ventilation, and Air Conditioning (HVAC) industry. HVAC manufacturers purchase FHP motors for blowers, condensers, pumps, and damper actuation systems. This segment prioritizes durability, continuous operational capability, and efficiency, given that HVAC systems are significant consumers of commercial and residential electricity. Furthermore, the burgeoning automotive sector represents a substantial buyer, particularly for auxiliary functions in electric vehicles (EVs) such as cabin climate control, battery cooling fans, electronic power steering, and window operation, where high power density and lightweight design are paramount requirements.

Finally, industrial automation and medical equipment manufacturers represent high-value potential customers. Industrial end-users utilize FHP motors in robotics, conveyors, small machine tools, and packaging equipment, demanding motors capable of highly accurate position and speed control. The medical sector, covering devices like ventilators, infusion pumps, dental tools, and laboratory equipment, requires highly specialized, sterilized, and ultra-reliable motors, often custom-designed for silent operation and minimal vibration, making them a premium segment within the FHP motor market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 22.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Baldor Electric Company (ABB Group), Ametek Inc., Nidec Corporation, Regal Beloit Corporation, Franklin Electric Co. Inc., Johnson Electric Holdings Ltd., Denso Corporation, TECO Electric & Machinery Co. Ltd., Groschopp, Allied Motion Technologies Inc., Maxon Motor AG, Danaher Corporation, Toshiba Corporation, WEG S.A., Brook Crompton, Mitsubishi Electric Corporation, Rotor Technology, Crouzet Motors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fractional HP Motor Market Key Technology Landscape

The technological landscape of the Fractional HP Motor market is rapidly evolving, driven primarily by the shift towards brushless technology and advanced materials science. Brushless DC (BLDC) motors represent the pinnacle of current FHP motor technology, offering significant advantages over traditional brushed motors, including higher efficiency, superior torque-to-weight ratio, and maintenance-free operation over extended lifespans. Ongoing R&D focuses on optimizing the geometric design of the magnetic circuit and employing high-grade rare-earth magnets (like Neodymium) to maximize power density and minimize physical footprint, critical for applications in robotics and miniaturized medical devices.

Furthermore, sensorless control technology is gaining prominence. Traditional BLDC motors require Hall effect sensors or encoders to determine rotor position for precise commutation. Sensorless control utilizes complex back-EMF estimation algorithms, eliminating the need for physical sensors. This innovation reduces material costs, simplifies assembly, and improves the motor’s resilience in harsh environments, making it ideal for applications where space and cost are constrained. Sensorless technology is rapidly being adopted across various appliance and automotive applications, providing a robust and cost-effective solution for variable speed requirements.

The integration of advanced microcontrollers (MCUs) and power electronics is also central to the modern FHP motor landscape. These components manage sophisticated motor control algorithms, enabling features like Field-Oriented Control (FOC) for precise speed and torque regulation, harmonic filtering, and integrated communication protocols (e.g., Modbus, CAN bus). This digitalization allows for seamless integration into IoT networks and facilitates the implementation of AI-driven diagnostic tools, transforming the FHP motor from a simple mechanical component into a smart, connected actuator capable of self-reporting and predictive maintenance.

Regional Highlights

The regional analysis reveals distinct market dynamics influenced by regulatory frameworks, industrial capacity, and technological adoption rates across different geographies. Asia Pacific (APAC) currently holds the dominant share in the Fractional HP Motor Market, primarily due to China's role as the global manufacturing hub for appliances and consumer electronics. Rapid infrastructure development, increasing demand for HVAC systems due to urbanization and climate change, and substantial investments in industrial automation, particularly in countries like India, South Korea, and Japan, solidify APAC’s leading position and high growth forecast. The focus here is often on high-volume production and cost optimization.

North America and Europe represent mature markets characterized by stringent energy efficiency regulations (e.g., EU’s Ecodesign requirements). This regulatory environment necessitates a mandatory transition toward premium, high-efficiency motor types, especially BLDC and synchronous reluctance motors, driving higher average selling prices in these regions. North America specifically benefits from robust R&D in aerospace, medical technology, and electric vehicle component manufacturing, segments requiring highly specialized and precise FHP motor solutions. Europe, driven by Industry 4.0 initiatives, focuses heavily on integrating smart motor technologies into factory automation systems.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting considerable growth potential. LATAM's growth is spurred by expanding industrial bases and increasing consumer purchasing power, driving demand for modern appliances. MEA, particularly the GCC countries, is witnessing significant infrastructural investments, leading to high demand for FHP motors in large-scale commercial and residential HVAC projects. While these regions currently lag in adopting the most advanced motor types, improving energy infrastructure and tightening local regulations are expected to accelerate the uptake of higher efficiency FHP motors over the forecast period, transitioning from traditional AC motors to more efficient alternatives.

- Asia Pacific (APAC): Dominant market share fueled by mass manufacturing, urbanization, and rapid expansion of the consumer appliance sector, especially in China and India.

- North America: High penetration of advanced BLDC motors, driven by sophisticated automotive auxiliary applications, medical device manufacturing, and adherence to strict energy performance standards.

- Europe: Growth supported by robust industrial automation (Industry 4.0), strong regulatory emphasis on energy efficiency, and high demand from the specialized industrial machinery segment.

- Latin America: Emerging market growth driven by industrialization, increasing urbanization rates, and modernization of commercial and residential infrastructure, particularly HVAC systems.

- Middle East and Africa (MEA): Significant potential linked to major construction and infrastructure projects, particularly in air conditioning and ventilation systems necessary for extreme climate control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fractional HP Motor Market.- ABB Ltd.

- Siemens AG

- Baldor Electric Company (ABB Group)

- Ametek Inc.

- Nidec Corporation

- Regal Beloit Corporation

- Franklin Electric Co. Inc.

- Johnson Electric Holdings Ltd.

- Denso Corporation

- TECO Electric & Machinery Co. Ltd.

- Groschopp

- Allied Motion Technologies Inc.

- Maxon Motor AG

- Danaher Corporation

- Toshiba Corporation

- WEG S.A.

- Brook Crompton

- Mitsubishi Electric Corporation

- Rotor Technology

- Crouzet Motors

Frequently Asked Questions

Analyze common user questions about the Fractional HP Motor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Brushless DC (BLDC) motors in the FHP segment?

The primary driver is the superior energy efficiency and longevity offered by BLDC motors compared to traditional brushed motors. Global regulatory standards mandating higher efficiency in appliances and industrial equipment necessitate the shift to BLDC technology to reduce lifecycle operational costs and meet MEPS compliance.

Which application segment holds the largest share in the Fractional HP Motor Market?

The Household Appliances segment currently holds the largest market share, driven by the massive volume requirements for motors used in refrigerators, washing machines, and HVAC systems globally. This segment is highly sensitive to consumer disposable income and global housing market trends.

How does raw material volatility impact the pricing of Fractional HP Motors?

Volatility in the pricing of raw materials, particularly rare earth magnets (Neodymium) essential for high-efficiency BLDC motors and copper for windings, directly increases the manufacturing cost. This volatility forces manufacturers to adjust pricing strategies and seek alternative, less expensive magnetic materials, impacting the final product cost and profitability margins.

What is the significance of the 1/4 HP to 1 HP segment in the industrial application category?

The 1/4 HP to 1 HP segment is crucial for light industrial machinery, pumps, small machine tools, and commercial HVAC systems. Motors in this power range offer the necessary torque and reliability for continuous duty cycles in manufacturing and commercial environments, making them central to industrial automation upgrades.

How is Industry 4.0 influencing the design requirements for FHP motors?

Industry 4.0 demands FHP motors with integrated intelligence, requiring embedded sensors, microcontrollers, and communication interfaces. This allows motors to self-monitor performance, report diagnostics to central systems, and participate in predictive maintenance routines, enhancing overall smart factory efficiency and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager