Fragrance Wax Melts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436910 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Fragrance Wax Melts Market Size

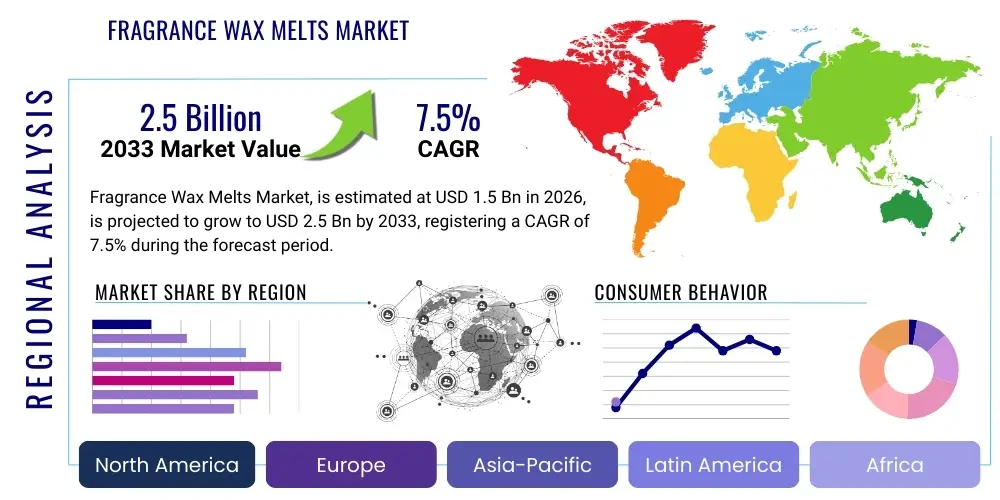

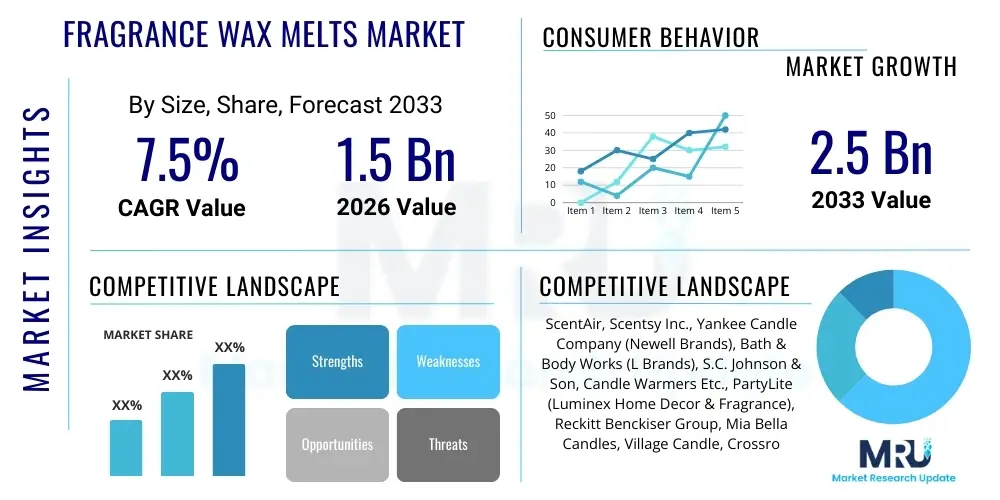

The Fragrance Wax Melts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Fragrance Wax Melts Market introduction

The Fragrance Wax Melts Market encompasses the production, distribution, and sale of scented wax pieces designed to be melted in wax warmers or burners to release aromatic compounds into the surrounding environment. These products offer a flameless alternative to traditional scented candles, appealing significantly to consumers prioritizing home safety and consistent scent delivery. The core product consists of various types of wax, primarily soy, paraffin, or a blend, infused with essential or synthetic fragrance oils. The increasing consumer interest in home aesthetics, wellness, and personalized ambiance drives market expansion, positioning wax melts as a staple in the modern home fragrance industry.

Major applications for fragrance wax melts are predominantly focused on residential use, serving as ambient scenting solutions in living rooms, bedrooms, and bathrooms. However, their application is expanding into commercial spaces such as boutique hotels, spas, small retail outlets, and professional offices seeking to establish a specific, welcoming atmosphere without the regulatory constraints associated with open flames. The fundamental benefits include enhanced safety due to the lack of wick and flame, cleaner air quality compared to some candle types, and the ability to easily interchange scents based on mood, season, or preference, offering versatility unmatched by single-use scent products.

Key driving factors propelling market growth include the rising consumer disposable income spent on home décor and luxury goods, coupled with a significant shift toward customizable and eco-friendly products. Manufacturers are increasingly adopting natural ingredients like organic soy wax and biodegradable packaging, addressing the environmental consciousness of modern consumers. Furthermore, the expansion of e-commerce channels facilitates greater product accessibility and allows niche artisanal brands to compete effectively with established industry giants, further diversifying the product offerings and stimulating market penetration globally.

Fragrance Wax Melts Market Executive Summary

The Fragrance Wax Melts Market is experiencing robust growth characterized by high innovation in raw materials and strategic geographical expansion. Business trends indicate a strong move toward direct-to-consumer (DTC) models and subscription services, capitalizing on the consumable nature of the product and fostering customer loyalty. Key players are investing heavily in R&D to develop novel wax formulations that offer longer melt times and enhanced scent throw, while simultaneously focusing on aesthetically pleasing designs and complex, layered fragrance profiles that mimic fine perfumery. Mergers and acquisitions remain low to moderate, but strategic partnerships focusing on sustainable sourcing and distribution efficiencies are becoming prevalent.

Regionally, North America maintains market dominance due to high consumer spending on home ambiance products and a mature retail infrastructure. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, primarily fueled by rapid urbanization, increasing middle-class populations in China and India, and the Westernization of home décor trends. European markets show stable growth, heavily leaning toward premium, organic, and locally sourced wax melts, influenced by stringent EU regulations regarding ingredient transparency and sustainable practices. Manufacturers are customizing fragrance offerings regionally, such as integrating traditional or culturally specific scents in APAC and MEA to maximize localized appeal.

Segment trends reveal that the natural wax segment, particularly soy wax, is rapidly gaining market share over traditional paraffin wax due to perceived health and environmental advantages. In terms of application, residential use remains the largest segment, but the commercial segment, driven by hospitality and retail, offers substantial untapped potential. The demand for complex, seasonal, and limited-edition scents drives volume, while product innovation in electric warmers and smart scent systems enhances the overall user experience, supporting premium pricing strategies across advanced markets. The market is increasingly polarizing between mass-market affordability and niche, high-end, artisan offerings.

AI Impact Analysis on Fragrance Wax Melts Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fragrance Wax Melts Market often center on its role in predictive consumer behavior analysis, supply chain efficiency, and personalized scent development. Common questions ask how AI can optimize inventory levels to match fluctuating seasonal demand, whether AI-driven tools can help small businesses in scent formulation, and how generative AI will affect fragrance trend forecasting. The key concern is centered on the potential displacement of artisanal craftsmanship by algorithmic optimization, though expectations remain high regarding AI's ability to streamline operations, reduce waste, and provide hyper-personalized product recommendations based on individual purchasing history and expressed preferences across digital platforms.

In terms of manufacturing and logistics, AI and Machine Learning (ML) algorithms are being deployed to optimize batch consistency, predicting the ideal curing time and temperature required for various wax and oil combinations to ensure maximum scent throw and longevity. Predictive maintenance for production equipment using IoT sensors and AI prevents costly downtime. Furthermore, sophisticated demand planning tools analyze retail data, social media sentiment, and weather patterns to accurately forecast regional needs, dramatically reducing overstocking of seasonal fragrances and minimizing waste within the perishable fragrance components of the supply chain.

The most transformative impact of AI is anticipated in consumer engagement and personalization. AI-driven scent recommenders analyze customer purchase data, demographic information, and even physiological responses (if using proprietary apps) to suggest novel scent combinations or personalized wax melt collections. For instance, Generative AI models are being tested to aid perfumers in predicting which new fragrance notes will achieve the highest market acceptance, thereby accelerating the product development lifecycle and ensuring new launches are strategically aligned with emerging olfactory trends globally.

- AI-driven demand forecasting optimizes seasonal inventory management and reduces obsolescence.

- Machine Learning algorithms enhance production consistency, particularly in wax blending and scent infusion processes.

- Generative AI assists perfumers in creating novel fragrance profiles by analyzing millions of existing scent data points.

- AI-powered personalized recommendation engines increase conversion rates on e-commerce platforms.

- Automated quality control systems use computer vision to ensure uniformity in wax melt shape and color.

- Optimization of complex global supply chains through ML identifies the most efficient and sustainable sourcing routes for raw materials.

DRO & Impact Forces Of Fragrance Wax Melts Market

The market dynamics are primarily shaped by robust consumer demand for flameless home fragrance alternatives (Driver) coupled with ongoing challenges related to the volatility of raw material costs (Restraint). The increasing focus on eco-friendly and sustainable products presents a significant growth Opportunity for brands capable of innovating in natural wax and biodegradable packaging. These forces collectively dictate the competitive environment, influencing pricing strategies and market entry barriers, while regulatory scrutiny regarding fragrance ingredients acts as an external Impact Force demanding greater transparency and compliance from manufacturers.

Key drivers include the pervasive trend of home nesting and interior decoration, which drives expenditure on premium home scents. Consumers view wax melts not just as air fresheners but as components of their overall interior design and mood management strategy. The inherent safety factor of flameless operation—a crucial selling point, especially in households with children or pets—further accelerates adoption over traditional candles. Conversely, a primary restraint is the market saturation in established economies, which necessitates high expenditure on marketing differentiation. Furthermore, the reliance on petroleum-derived paraffin wax (though declining) and fluctuating prices of essential oils introduce cost unpredictability, pressuring profit margins for smaller manufacturers.

Opportunities are abundant in emerging markets where the concept of home fragrance is still nascent but rapidly growing, offering vast scaling potential. Innovation in smart warming technology, integrating features like programmable timers and remote control functionality via smart home ecosystems, creates premium niches. The impact forces prominently include evolving consumer preference for clean label products, which pushes manufacturers towards natural soy, coconut, and beeswax blends, demanding verifiable sourcing and ethical production practices. Additionally, competition from alternative scent delivery systems, such as diffusers and nebulizers, exerts competitive pressure, mandating continuous product diversification and enhancement in the wax melts segment.

Segmentation Analysis

The Fragrance Wax Melts Market is comprehensively segmented based on product type (wax material), application, and distribution channel, providing a granular view of consumer preferences and operational strategies. Analysis reveals that the material segment is undergoing rapid change, prioritizing natural, non-toxic alternatives. Application segmentation highlights the dominance of household consumers, yet increasing penetration in commercial environments signifies diversification potential. Distribution channels underscore the increasing reliance on digital platforms for specialized or artisanal purchases, contrasting with the high volume sales generated through conventional retail chains.

- By Product Type (Wax Material):

- Soy Wax Melts

- Paraffin Wax Melts

- Beeswax Melts

- Coconut Wax Melts

- Blended Wax Melts

- By Application:

- Residential

- Commercial (Hotels, Spas, Retail Stores)

- By Distribution Channel:

- Offline (Supermarkets, Hypermarkets, Specialty Stores)

- Online (E-commerce Platforms, Company Websites)

- By Fragrance Type:

- Floral

- Fruity

- Earthy/Woody

- Spicy/Gourmand

- Clean/Fresh

Value Chain Analysis For Fragrance Wax Melts Market

The value chain for fragrance wax melts begins with the Upstream Analysis, which involves the sourcing of primary raw materials: wax and fragrance oils. Wax procurement is highly critical, ranging from agricultural suppliers for natural waxes (soybeans, coconut) to petrochemical refineries for paraffin wax. Fragrance oils, whether synthetic or derived from essential oils, are sourced from specialized chemical and natural ingredient providers, forming the quality basis of the final product. Upstream efficiency heavily relies on long-term supplier contracts and strict quality control to manage ingredient consistency and fluctuating commodity prices, particularly for highly demanded, sustainably certified raw materials.

The subsequent phase involves manufacturing and processing, where crude wax is refined, blended, and infused with meticulously measured fragrance compounds before being molded and cured. This transformation process is critical for achieving optimal scent throw and melt duration. Distribution channels then dictate how the product reaches the consumer. Direct channels involve manufacturers selling through their own branded e-commerce platforms or physical stores, offering maximum control over branding and pricing. Indirect channels involve utilizing wholesalers, distributors, large-scale supermarkets, and specialized home goods retailers, which enable broad market penetration and logistical scaling.

Downstream analysis focuses on marketing, retailing, and consumer engagement. Success in the downstream market is determined by effective branding, packaging design, and strategic placement, particularly in the rapidly growing online retail space. The indirect channel dominates high-volume sales, utilizing the infrastructure of major retail chains to reach mass consumer segments. Conversely, the direct channel is preferred for premium, customized, or limited-edition launches, allowing brands to capture higher margins and establish a strong brand narrative directly with the end-user, thereby significantly influencing brand loyalty and repurchase rates in a highly competitive discretionary market.

Fragrance Wax Melts Market Potential Customers

Potential customers for fragrance wax melts are broadly segmented into two major categories: the vast residential consumer base and the targeted commercial sector. Residential customers primarily consist of homeowners and renters aged 25-55, particularly millennials and Gen Z, who place high value on home ambiance, self-care, and personalized scent experiences. This group actively seeks flameless safety alternatives and often purchases in multiple scents to match different rooms or seasonal moods. These buyers are highly influenced by social media trends, product aesthetics, and reviews emphasizing sustainability and clean ingredient lists, making them receptive to subscription models and new product introductions.

The secondary, but rapidly expanding, customer segment resides within the commercial and institutional sectors. These include boutique hotels, high-end spas, wellness centers, and specialized retail boutiques that leverage ambient scenting to enhance customer experience, establish brand identity, and influence purchasing behavior. For instance, a luxury spa uses relaxing essential oil blends to foster tranquility, while a high-street clothing retailer might use a distinct, energizing scent to create a memorable shopping environment. Commercial customers typically purchase in large bulk orders, prioritizing long-lasting scent performance, low maintenance, and professional grade warmers compliant with commercial safety standards.

Furthermore, niche customer groups include gift buyers and DIY enthusiasts. Wax melts are popular impulse buys or gifts due to their affordability and broad appeal, particularly during holidays and special occasions. The DIY segment involves small entrepreneurs or hobbyists who purchase raw materials (waxes, oils, molds) to create custom melts, reflecting the broader trend toward personalization and artisanal production. Understanding these diverse end-users requires manufacturers to tailor product offerings—from affordable, mass-produced multi-packs for volume residential buyers to custom-scented, ethically sourced, and beautifully packaged options for commercial luxury clients and gift markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ScentAir, Scentsy Inc., Yankee Candle Company (Newell Brands), Bath & Body Works (L Brands), S.C. Johnson & Son, Candle Warmers Etc., PartyLite (Luminex Home Decor & Fragrance), Reckitt Benckiser Group, Mia Bella Candles, Village Candle, Crossroads Candles, Better Homes & Gardens (Walmart), Walmart Inc. (Private Label), The Flaming Candle, Vella Fragrances |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fragrance Wax Melts Market Key Technology Landscape

The technology landscape in the Fragrance Wax Melts Market encompasses advanced techniques in raw material processing, manufacturing automation, and the development of supporting electrical warming devices. Manufacturing efficiency relies heavily on precision blending and casting technology. Automated pouring machines ensure volumetric consistency, crucial for product uniformity. Furthermore, innovative encapsulation technologies are being explored to micro-encapsulate fragrance oils within the wax matrix, allowing for a more controlled, sustained release of scent over longer periods, significantly improving the perceived value and performance of the wax melt product compared to simple infusion techniques.

In terms of wax formulation, advancements focus primarily on thermal stability and sustainability. Researchers are optimizing blends of natural waxes to achieve a lower melting point, which enhances safety and improves scent throw at lower heating temperatures. The development of specialized food-grade or cosmetic-grade waxes ensures cleaner burning characteristics and compliance with increasing consumer scrutiny regarding indoor air quality. Sophisticated analytical instruments, such as Gas Chromatography-Mass Spectrometry (GC-MS), are utilized to verify the purity and concentration of fragrance components, ensuring batch-to-batch consistency and adherence to allergen regulations.

The supporting warming technology is rapidly evolving toward smart devices. Electric warmers are increasingly integrating features like induction heating (for precise temperature control), Wi-Fi connectivity, and app integration, allowing users to schedule scent diffusion, monitor remaining wax levels, and adjust temperature remotely. These smart warmers utilize low-voltage circuitry and highly efficient heating elements, aligning with energy conservation trends. This technological integration transforms the wax melt experience from a simple heating process into a sophisticated, integrated home ambiance solution, creating a potential barrier to entry for lower-cost, unsophisticated warmers.

Regional Highlights

- North America: This region holds the largest market share, driven by a high disposable income, strong cultural emphasis on home ambiance (particularly in the US), and the established presence of market leaders like Scentsy and Yankee Candle. The market is mature but highly responsive to seasonal and limited-edition product cycles. High regulatory standards regarding consumer product safety drive innovation in flameless alternatives.

- Europe: Characterized by stable growth and a strong preference for natural and ethically sourced ingredients. Western European countries (Germany, UK, France) dominate consumption, emphasizing sophisticated fragrance profiles and premium packaging. Sustainability certifications and organic labeling are highly valued, mandating strict compliance from manufacturers.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid urbanization, rising middle-class income, and increasing adoption of Western lifestyle products. Key growth markets include China, India, and Southeast Asian nations. Market penetration is currently lower than in the West, offering substantial expansion opportunities, particularly in mass-market and mid-range segments.

- Latin America (LATAM): Growth is moderate but accelerating, primarily concentrated in urban centers like Brazil and Mexico. Price sensitivity is a key factor, favoring affordable paraffin or blended wax products, though there is an emerging niche for imported luxury and specialized artisanal scents targeting higher-income consumers.

- Middle East and Africa (MEA): Marked by a strong cultural affinity for intense, rich fragrances (oud, frankincense). The market is highly segmented, with the GCC countries representing a significant luxury segment focused on customized, highly concentrated wax melts, while African markets show potential for low-cost, high-volume products distributed through traditional retail channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fragrance Wax Melts Market.- Scentsy Inc.

- Yankee Candle Company (Newell Brands)

- Bath & Body Works (L Brands)

- S.C. Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Candle Warmers Etc.

- PartyLite (Lumix Home Decor & Fragrance)

- The Tofino Candle Co.

- Village Candle

- Crossroads Candles

- Mia Bella Candles

- Better Homes & Gardens (Walmart Private Label)

- Walmart Inc. (Retailer/Private Label)

- P&G (Air Care Division)

- Stoneglow Candles

- Pink Zebra

- The Flaming Candle Company (Raw Material Supplier)

- ScentAir (Commercial Focus)

- Vella Fragrances

- California Exotic Novelties (Home Fragrance Division)

Frequently Asked Questions

Analyze common user questions about the Fragrance Wax Melts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between soy wax melts and paraffin wax melts?

Soy wax melts are derived from soybean oil, offering a cleaner, slower burn and are generally considered more eco-friendly and sustainable. Paraffin wax melts are petroleum-derived, typically offering a stronger initial scent throw but often containing more synthetic compounds and burning faster. Consumers prioritize soy melts for non-toxicity.

Are fragrance wax melts safer than traditional wicked candles?

Yes, wax melts are generally considered safer because they are flameless. They rely on a low-temperature warming plate or light bulb to melt the wax, eliminating the risks associated with open flames, soot production, and fire hazards common with wicked candles.

How does the sustainability trend affect raw material sourcing in the wax melts market?

The sustainability trend drives demand for renewable and biodegradable raw materials, notably soy wax and coconut wax, replacing traditional petroleum-based paraffin. This shift necessitates ethical sourcing verification, reduced reliance on synthetic dyes, and the adoption of recyclable or compostable packaging.

Which distribution channel is dominating the sales of premium fragrance wax melts?

The online distribution channel, encompassing specialized e-commerce platforms and brand-direct websites, is dominating premium wax melt sales. This channel allows niche brands to effectively communicate their story, control brand aesthetics, and manage high-margin customized or subscription-based offerings.

What technological innovations are shaping the future of wax melting devices?

Future wax melting devices are integrating smart technology, including Wi-Fi connectivity, app controls, programmable timers, and induction heating. These innovations enhance user convenience, provide precise temperature regulation for optimal scent diffusion, and integrate the devices into smart home ecosystems.

Sustainability and Ethical Sourcing in Fragrance Wax Melts

The imperative for sustainability is fundamentally reshaping the Fragrance Wax Melts Market, shifting consumer focus from mere scent appeal to the ethical provenance and environmental impact of the product. Consumers are increasingly scrutinizing ingredient lists, demanding transparency regarding the source of waxes, oils, and packaging materials. This trend has catalyzed a significant movement away from traditional paraffin wax, which is derived from petroleum, toward natural alternatives such as soy, coconut, and beeswax. Manufacturers are responding by certifying their materials through third-party organizations, highlighting non-GMO origins, and ensuring zero-deforestation practices in their supply chains, thus establishing a critical competitive differentiator.

Ethical sourcing extends beyond the primary wax material to the fragrance compounds themselves. There is growing resistance to phthalate and paraben usage, pushing brands toward the utilization of higher concentrations of natural essential oils or carefully engineered, synthetic ‘clean scents.’ Companies are investing in traceable supply chains for botanical extracts, often forming direct partnerships with global farmers to ensure fair trade practices and consistent quality. This commitment to ethical sourcing not only meets consumer moral expectations but also provides a premium narrative that justifies higher price points in the luxury and specialty segments of the market.

Furthermore, packaging innovation is a core component of the sustainability drive. The industry is rapidly adopting biodegradable, compostable, or highly recyclable packaging solutions, moving away from single-use plastics typically used for clam-shell wax melt containers. Brands are exploring materials such as glassine bags, recycled cardboard, and post-consumer recycled (PCR) plastics. The reduction of overall packaging weight and size, often termed 'lightweighting,' contributes to lower carbon emissions during transportation, demonstrating a holistic approach to environmental responsibility that influences purchasing decisions, especially among Gen Z and Millennial consumers globally.

Evolution of Scent Profiles and Consumer Preferences

The fragrance landscape within the wax melts market is becoming increasingly sophisticated, moving away from simple, linear scent profiles towards complex, layered experiences mirroring high-end perfumery. Consumers now seek scents that evoke specific moods, memories, or environments, pushing demand for highly nuanced categories such as "gourmand," "atmospheric," and "gender-neutral" fragrances. This evolution is driven by the desire for home scenting to be an extension of personal style and wellness routines. Manufacturers are employing master perfumers to create unique blends that combine top, middle, and base notes, ensuring the scent evolves subtly as the wax melts, maintaining consumer interest throughout the product life cycle.

Seasonal demand continues to play a pivotal role, with predictable spikes in demand for comforting, spicy, and woody scents during the autumn and winter months, contrasting sharply with the preference for light, fresh, floral, and fruity notes during spring and summer. However, the emergence of "transitional scents"—fragrances designed to bridge seasons or work year-round, such as clean linen or sophisticated earthy musk blends—is providing manufacturers with greater product stability and reducing inventory volatility. The use of limited-edition and highly collectible fragrance lines successfully harnesses the fear of missing out (FOMO) and drives rapid consumer adoption, proving highly effective in e-commerce and direct sales models.

Crucially, the intersection of wellness and fragrance has spurred the growth of aromatherapy-focused wax melts. Consumers are purchasing scents specifically linked to functional benefits, such as lavender and chamomile for relaxation and sleep, citrus notes for energy and focus, or eucalyptus and mint for respiratory clarity. This functional segmentation allows brands to position their products within the broader wellness economy, attracting health-conscious consumers willing to invest more in products perceived to offer therapeutic benefits, further broadening the market appeal beyond traditional air freshening.

Distribution Channel Dynamics and E-commerce Dominance

The distribution landscape for fragrance wax melts is characterized by a dual structure: the high-volume, accessibility-driven offline retail network, and the rapidly scaling, experience-focused online channel. Offline channels, primarily composed of hypermarkets, supermarkets, and specialty home goods stores (such as Yankee Candle or Bed Bath & Beyond), remain vital for mass-market penetration and impulse purchases. These channels offer immediate gratification and allow consumers to physically test the scent before purchase. Strategic shelf placement and seasonal promotions are critical to maximizing turnover within this traditional retail environment, often leveraging private label or exclusive deals to drive customer traffic.

However, the shift toward e-commerce has fundamentally transformed the market, particularly benefiting smaller, artisanal, and direct-to-consumer (DTC) brands. Online platforms offer unparalleled reach, lower operating costs relative to physical retail, and the critical ability to analyze detailed customer data. DTC models leverage subscription boxes, personalized recommendation engines (often AI-driven), and robust loyalty programs, ensuring a predictable, recurring revenue stream due to the consumable nature of the product. The digital channel effectively overcomes the challenge of "sniffing" scents virtually by employing enhanced visualization, detailed ingredient descriptions, and a heavy reliance on user-generated content and reviews.

Furthermore, the online environment facilitates global market expansion without the need for extensive physical infrastructure. Manufacturers utilize third-party logistics (3PL) providers and large marketplaces like Amazon and Etsy to access international consumers quickly. The efficiency of the online supply chain, particularly for handling customized orders and complex variations of scent/color/wax combinations, far surpasses the logistical capabilities of traditional retail, securing the online channel's position as the fastest-growing segment and the primary arena for brand differentiation and customer retention strategies.

Manufacturing Innovations and Safety Standards Compliance

Manufacturing in the Fragrance Wax Melts Market is undergoing significant innovation driven by the need for quality consistency, cost efficiency, and stringent safety compliance. Modern production facilities utilize highly sophisticated automated mixing and temperature control systems to manage the critical process of wax melting and fragrance oil infusion. Achieving the perfect ‘bloom’—the precise moment when the fragrance oil binds optimally with the wax structure—requires industrial mixers and temperature sensors that maintain tolerances within a fraction of a degree, ensuring that the scent throw is maximized without burning off volatile oil components.

Safety standards compliance is a non-negotiable aspect of manufacturing, particularly concerning ingredients and warming devices. In regions like North America and the EU, regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) govern the use of fragrance components, requiring detailed allergen disclosure and toxicological assessments. Manufacturers must adhere to industry standards set by organizations like the National Candle Association (NCA) and European Candle Association (ECA), ensuring not only the safety of the wax melt itself but also the safety and thermal efficiency of the accompanying electric warmers, often necessitating UL or CE certification for electrical components.

The pursuit of cleaner, safer products has spurred innovation in clean burn technology and non-toxic formulations. This includes research into natural stabilizers and antioxidants that prevent wax discoloration and scent degradation without relying on harsh chemicals. Process optimization, often guided by Lean manufacturing principles, reduces material waste during molding and packaging, contributing to both environmental goals and cost savings. This blend of automated precision, strict compliance, and chemical innovation defines the current technological edge in high-quality wax melt production.

Competitive Landscape and Strategic Imperatives

The Fragrance Wax Melts Market exhibits a highly competitive structure, characterized by a few global conglomerates alongside numerous mid-sized and artisanal niche players. Market leaders like Scentsy, Yankee Candle (Newell Brands), and Bath & Body Works benefit from extensive brand recognition, vast distribution networks, and massive R&D budgets allowing for continuous product cycles. Their strategic imperative is to maintain market share dominance through aggressive pricing in mass retail and continuous introduction of new, highly publicized seasonal scents and warmer designs.

Mid-tier and specialized competitors focus on differentiation through niche positioning, often emphasizing sustainability, exclusivity, or highly unique fragrance profiles that large companies find difficult to replicate efficiently. These players utilize targeted digital marketing and specialized retail partnerships to cultivate strong, loyal customer bases. The primary competitive strategies involve accelerating time-to-market for emerging scent trends, creating highly aesthetic and gift-worthy packaging, and offering competitive subscription services that prioritize convenience and discovery.

A key strategic imperative across the entire market is vertical integration, especially concerning fragrance oil sourcing and warmer manufacturing. Controlling these aspects allows companies to ensure quality consistency, manage costs more effectively, and respond faster to supply chain disruptions. Furthermore, successful players are focusing heavily on intellectual property protection, particularly regarding unique wax formulations and proprietary warmer technology, ensuring long-term product differentiation against lower-cost imitators entering the market, especially from APAC manufacturing hubs.

Key Consumer Behavior Trends Driving Market Demand

Contemporary consumer behavior is heavily influenced by the 'nesting' trend, where individuals invest significantly in making their living spaces comfortable, personalized, and conducive to mental wellness. This trend is a major driver for fragrance wax melts, as they offer an accessible and versatile way to modify the home environment instantly. Consumers view the choice of home scent as an extension of their personal brand and aesthetic, leading to multi-scent purchasing for different rooms or activities (e.g., energizing scents for the home office, relaxing scents for the bedroom).

The shift towards experiential shopping, driven by digital platforms, also profoundly impacts the market. While purchasing scents online presents a challenge, consumers rely heavily on detailed digital storytelling, high-resolution imagery, and user reviews to bridge the sensory gap. Brands that successfully create a strong emotional narrative around their products—linking scents to nostalgia, travel, or specific moods—tend to outperform those that rely solely on product descriptions. This indicates a high consumer value placed on the 'story' behind the fragrance.

Finally, there is an increasing demand for convenience and flexibility. The popularity of wax melts, compared to traditional home fragrance methods, stems from their ability to be easily swapped out without committing to an entire candle burn cycle. This desire for low-commitment, high-flexibility scenting solutions is further reinforced by the success of subscription box services, which automatically deliver new or familiar scents on a recurring basis, aligning with the modern consumer's preference for automation and curated discovery.

Influence of Health and Wellness on Product Development

The rising global consciousness surrounding health and wellness has become a central determinant in the formulation and marketing of fragrance wax melts. Consumers are increasingly concerned about indoor air quality and the potential toxins released by scented products, leading to a strong preference for "clean label" products. This necessitates the exclusion of known irritants like phthalates, parabens, and certain synthetic musks, prompting manufacturers to prioritize ingredient safety above all else, often adopting standards stricter than regulatory requirements.

Product development is highly focused on integrating genuine therapeutic benefits derived from natural essential oils. Wax melts infused with high-quality essential oils are marketed as tools for relaxation, stress reduction, or immune support, positioning them within the lucrative functional wellness segment. For example, blends containing high concentrations of certified organic bergamot or patchouli are specifically developed and tested for their mood-altering properties, moving the product beyond simple air freshening into a self-care category.

Furthermore, the focus on non-toxic, pet-friendly, and child-safe formulations is critical, especially in the context of flameless operation. Brands actively highlight that their products are paraffin-free and feature low Volatile Organic Compound (VOC) profiles, addressing a primary consumer anxiety about home air pollution. This strong alignment with health and safety credentials builds consumer trust and is essential for capturing market share among young families and health-conscious demographics.

Analysis of Market Challenges

Despite robust growth, the Fragrance Wax Melts Market faces several structural and competitive challenges that necessitate careful strategic navigation. The volatility and uncertainty of commodity prices, particularly for natural wax raw materials (soy, coconut) and high-quality essential oils, pose a continuous financial risk. Climate variability and agricultural yields directly impact supply and pricing, making predictable cost management difficult for high-volume manufacturers, often requiring extensive hedging strategies or diversification of suppliers across multiple geographies.

Intense competition from substitute products represents another significant challenge. The home fragrance market is saturated with alternatives, including reed diffusers, ultrasonic essential oil diffusers, scented candles, and smart home scenting systems. The latter, utilizing nebulization or dry air technology, often appeal to the high-end consumer by offering superior control and perceived 'cleanliness' compared to melted wax. This competitive pressure forces wax melt manufacturers to continuously innovate, not just in scent, but in the performance and design of their warming technology.

Finally, overcoming the logistical hurdle of sensory marketing in the digital age remains a key challenge for small and large players alike. The inability for online consumers to physically smell a product before purchase is a significant barrier to conversion, resulting in higher return rates and the need for expensive sampling programs. Brands must invest heavily in high-fidelity digital marketing, user testimonials, and scent description mapping to mitigate this sensory gap, demanding substantial expenditure on digital content creation and influencer partnerships to effectively convey the olfactory experience.

Future Growth Strategies and Market Opportunities

To capitalize on future growth, market participants must prioritize innovation in two key areas: smart product integration and personalized customer experience. Integrating wax warmers with smart home platforms (e.g., Amazon Alexa, Google Home) allows for voice control, automated scent scheduling, and temperature management, creating a premium product tier that addresses the modern demand for connected devices. This technological advancement also provides manufacturers with valuable data on usage patterns, informing future product development and inventory management.

The greatest market opportunity lies in hyper-personalization, moving beyond generalized segment marketing. Utilizing consumer data from purchase history, geographic location, and lifestyle profiles, companies can offer bespoke scent blending services or highly tailored subscription boxes. Implementing AI algorithms that suggest new scents based on past preferences and predicted seasonal shifts will enhance customer lifetime value and create strong loyalty in a market where consumers often switch brands based on scent preference or trend.

Furthermore, strategic geographic expansion into underserved emerging markets, particularly in secondary cities within APAC and LATAM, represents a crucial growth vector. This requires localized product adaptation, including offering more accessible price points and introducing fragrance profiles that align with regional olfactory preferences and cultural norms. Developing localized supply chains in these regions will minimize import costs and duties, allowing for competitive pricing and faster market penetration against local competitors, securing long-term global scaling capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager