Franchise Resale Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438520 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Franchise Resale Market Size

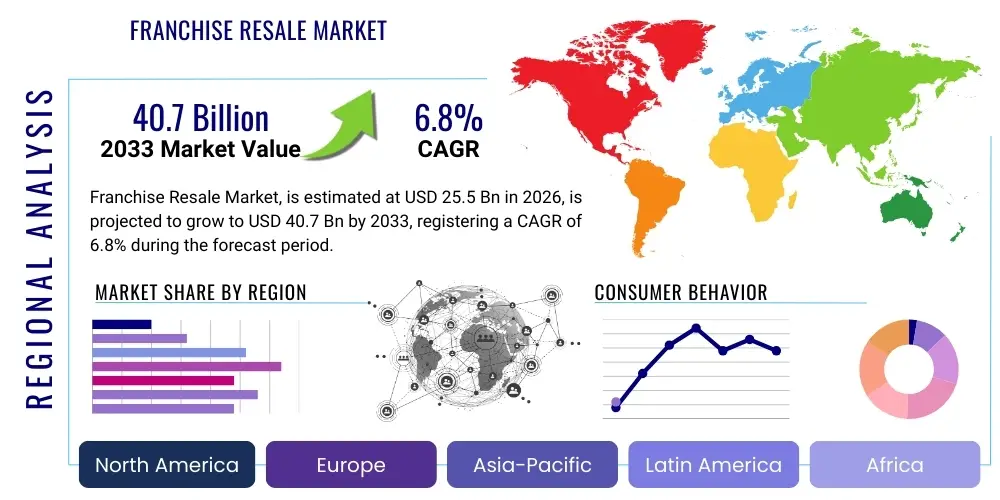

The Franchise Resale Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.7 Billion by the end of the forecast period in 2033.

Franchise Resale Market introduction

The Franchise Resale Market encompasses the structured buying and selling of established franchised business units, transitioning ownership from one franchisee to another, or occasionally back to the franchisor. This segment is distinct from new franchise sales as it involves the valuation and transfer of an ongoing concern, complete with existing customer bases, operational history, and established vendor relationships. The market’s resilience is underpinned by the inherent stability associated with purchasing a proven business model, significantly mitigating the initial risks often faced by startup ventures. This inherent reduction in business failure rates makes resales highly attractive to prospective entrepreneurs seeking immediate cash flow and operational stability within a recognized brand framework.

Key drivers propelling this market expansion include a maturing franchise system landscape globally, characterized by an increasing number of franchisees reaching retirement age or seeking diversification opportunities. Furthermore, sophisticated financial tools and dedicated brokerage services specializing in franchise transfers have streamlined the transaction process, enhancing liquidity and accessibility for buyers and sellers alike. The appeal of entering a market with verifiable historical performance data—including revenue, profitability margins, and operational costs—provides a significant informational advantage, driving demand across various sectors, particularly quick-service restaurants, essential services, and automotive maintenance franchises.

Major applications of franchise resales span across investment diversification, entrepreneurial entry into established industries, and strategic expansion for multi-unit operators. The primary benefit is the accelerated path to profitability; acquiring an operational unit eliminates the time and capital expenditures associated with site selection, build-out, initial training, and brand establishment. The market benefits from favorable economic conditions that encourage small business investment and lending activity, positioning the resale segment as a cornerstone of small and medium enterprise (SME) growth within the broader commercial ecosystem.

Franchise Resale Market Executive Summary

The Franchise Resale Market is currently undergoing a period of robust expansion, driven primarily by demographic shifts among current franchise owners and heightened investor confidence in established business models. Business trends indicate a marked increase in the professionalization of franchise brokerage services, leveraging advanced data analytics for accurate business valuation and sophisticated deal structuring. Strategic buyers, often existing multi-unit operators, are aggressively pursuing resale opportunities to achieve economies of scale and geographic clustering, leading to higher average transaction values, particularly in high-demand sectors like health and wellness and specialized retail services.

Regionally, North America remains the epicenter of resale activity, distinguished by a highly developed franchise legal framework and a deep pool of experienced buyers and sellers. However, the Asia Pacific region, particularly emerging economies, is exhibiting the highest growth trajectory, spurred by rapid urbanization and the proliferation of globally recognized franchise brands that are now reaching maturity cycles suitable for secondary market transactions. Europe maintains steady growth, focusing heavily on service-based franchises, though regulatory differences across member states present unique complexities in cross-border resale activities.

Segmentation trends highlight the enduring dominance of the Food & Beverage segment in terms of volume, while the Business Services segment commands significant interest due to its typically higher profitability margins and scalable operational structure. A notable trend is the increasing utilization of technology-enabled resale platforms, improving market transparency and efficiency. The shift towards semi-absentee or passive ownership models is also influencing the types of franchises that appeal most to investors seeking diversification, positioning specific service-based resales favorably in the current market environment.

AI Impact Analysis on Franchise Resale Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Franchise Resale Market reveals three major thematic concerns: the accuracy of AI-driven valuation models, the efficiency gains in due diligence processes, and the transformation of buyer-seller matching. Users are keenly interested in whether AI can overcome subjective valuation biases inherent in traditional methods, seeking guarantees that machine learning algorithms will provide fairer, data-backed valuations based on comprehensive operational and market data, rather than relying solely on broker estimation. Furthermore, there is significant user expectation that AI systems will dramatically shorten the due diligence period by automating financial statement analysis and compliance checking, thereby accelerating the often lengthy sales cycle.

The integration of AI technologies is fundamentally reshaping the operational and transactional landscape of franchise resales. AI-powered platforms are beginning to standardize the valuation process by analyzing vast datasets, including local market performance, macroeconomic indicators, competitor sales data, and historical unit profitability, leading to more granular and defensible valuations. This enhanced precision reduces negotiation friction and instills greater confidence in both parties regarding the fairness of the deal price. By leveraging predictive analytics, AI can also forecast the future performance potential of a specific franchised unit under new ownership, a critical metric for financiers and prospective buyers evaluating long-term return on investment.

In addition to valuation, AI algorithms are optimizing the crucial matching process. Brokerage firms are deploying sophisticated AI tools to match highly specific buyer profiles—considering capital availability, industry experience, risk tolerance, and geographic preference—with ideal resale opportunities. This algorithmic approach minimizes time wastage on unsuitable prospects and increases the likelihood of a successful and swift transaction. Moreover, AI assists in the compliance and document generation phase, automatically flagging missing documents or regulatory discrepancies during initial data compilation, significantly enhancing the efficiency and security of the entire resale pipeline, thereby institutionalizing the market processes.

- AI-driven automated business valuation models enhancing pricing accuracy and reducing subjective bias.

- Predictive analytics forecasting future unit performance based on historical data and local market trends.

- Automated due diligence processes accelerating financial review and regulatory compliance checks.

- Sophisticated AI matching algorithms connecting buyer investment profiles with optimal resale opportunities.

- Chatbots and natural language processing (NLP) assisting buyers with preliminary information gathering and FAQ resolution.

- Enhanced security and fraud detection in financial documentation transfer through machine learning algorithms.

- Optimization of marketing efforts for listings by identifying the most receptive buyer demographics and channels.

DRO & Impact Forces Of Franchise Resale Market

The Franchise Resale Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that define its growth trajectory and resilience. Key drivers include the proven success rate of purchasing an established franchise over a startup, providing a safer investment harbor for entrepreneurs, coupled with a consistent supply of listings generated by aging franchisees seeking exit strategies. Restraints principally revolve around complex financing requirements for secondary market transactions, often requiring specialized Small Business Administration (SBA) loans or seller financing, alongside the inherent reliance on franchisor approval for transfers, which can sometimes delay or derail a deal. Opportunities emerge from the globalization of franchise models, the rise of specialized resale brokerage firms offering comprehensive services, and the increasing use of digital platforms to enhance market transparency and access to capital, particularly for sophisticated investment groups.

Impact forces currently shaping the market are predominantly technological and macroeconomic. Technological advancements, notably in digitalization and specialized brokerage software, are driving efficiency and liquidity, essentially lowering the cost and time involved in a transaction. Macroeconomic conditions, specifically interest rate fluctuations and access to credit, profoundly influence buyer purchasing power and investment willingness. When credit is cheap, strategic multi-unit buyers are more aggressive, inflating valuations. Conversely, economic uncertainty often leads to a higher volume of sellers (distressed or opportunistic) but fewer readily available buyers, potentially suppressing prices.

Furthermore, regulatory impact forces, while varied globally, often dictate the complexity of the transfer process. Stringent franchise disclosure requirements and robust contract laws, such as those prevalent in the US, create a standardized, albeit lengthy, transfer process. Social factors, such as the increasing desire for portfolio diversification among high-net-worth individuals who view established franchises as tangible, inflation-resistant assets, also contribute significant upward pressure on demand. These interacting forces create a dynamic market environment where resilience is derived from the fundamentally sound nature of established franchise operations, making them attractive despite short-term economic headwinds.

Segmentation Analysis

The Franchise Resale Market is effectively segmented based on several key dimensions, providing clarity on transactional volume, valuation metrics, and strategic buyer focus. Segmentation by Franchise Type remains crucial, separating high-volume, quick-turnover sectors like Food & Beverage from high-value, service-intensive sectors such as Business Consulting and Healthcare Services. Understanding the distribution of activity across these segments is essential, as the investment threshold, operational complexity, and typical buyer profile vary significantly. For instance, retail resales often attract passive investors due to established management structures, while skilled trade service resales appeal more to owner-operators seeking hands-on involvement.

Investment Range segmentation categorizes the market based on the total sale price, which directly correlates with the required financing structure and the target buyer demographic. Lower-tier resales (under $100,000) are typically cash-based or involve simple seller financing, attracting first-time entrepreneurs. Mid-tier resales ($100,000 to $500,000) form the backbone of the market, heavily reliant on SBA financing. High-tier transactions (above $500,000, often multi-unit packages) are dominated by sophisticated investment groups and existing large franchisees seeking accelerated expansion, demanding complex financial modeling and due diligence.

Segmentation by Resale Channel reflects the primary method through which transactions are brokered. The dominant channel is specialized Franchise Brokerage, where dedicated professionals manage valuation, listing, and negotiation. Direct Sales, though less common for large transactions, represent owner-to-owner transfers that bypass commission structures but lack the professional intermediation needed for complex regulatory compliance. The emergence of online listing platforms and limited auction models introduces digital channels that enhance visibility but still often require traditional brokerage services for final closing procedures.

- By Franchise Type

- Food & Beverage (QSR, Fast Casual, Coffee Shops)

- Retail (Convenience Stores, Specialized Retail)

- Services (Business Services, Home Services, Education)

- Automotive (Maintenance, Repair, Detailing)

- Health & Wellness (Fitness Centers, Medical Non-Clinical)

- By Investment Range

- Below $100,000

- $100,000 - $500,000

- Above $500,000

- By Resale Channel

- Franchise Brokerage Networks

- Direct Owner Sale

- Online Listing Platforms

Value Chain Analysis For Franchise Resale Market

The value chain of the Franchise Resale Market begins with upstream activities focused on the readiness and preparation of the franchised unit for sale. This crucial phase involves the franchisee deciding to exit, engaging a specialized valuation expert or broker, and compiling comprehensive financial and operational documentation (the Franchise Disclosure Document, FDD, along with profit and loss statements, lease agreements, and vendor contracts). Upstream efficiency is directly dependent on the franchisee’s organizational discipline and the franchisor’s cooperation in providing accurate historical data. The quality and completeness of this documentation significantly impact the speed and ultimate valuation achieved during the transaction.

The core midstream activity involves brokerage, valuation, marketing, and the extensive due diligence process. Brokerage firms act as the central distribution channel, connecting sellers with a vetted network of potential buyers and financing sources. They manage the marketing of the listing while maintaining confidentiality, facilitate negotiations, and structure the purchase agreement. Due diligence, often supported by external legal and accounting firms, represents the most complex part of the value chain, ensuring the accuracy of representations and compliance with all franchise transfer regulations. Effective intermediation at this stage minimizes risk and accelerates closing.

Downstream activities center on the formal transfer, which requires mandatory franchisor approval, securing financing (often through specialized commercial or SBA lenders), and the final closing. Post-sale, the value chain extends into the transition phase, involving training provided by the selling franchisee and the franchisor to the new owner, ensuring business continuity. Distribution channels are predominantly indirect, relying on professional franchise resale brokers and specialized intermediary firms like Transworld Business Advisors or Sunbelt Business Brokers, which possess the requisite expertise in complex franchise law and specialized financing options. Direct sales are rare for complex or high-value transactions due to the high regulatory and informational asymmetry risks involved.

Franchise Resale Market Potential Customers

Potential customers in the Franchise Resale Market are broadly categorized into three distinct segments: first-time individual entrepreneurs, experienced multi-unit operators, and institutional investment groups. First-time buyers are attracted to resales because the established operational framework, existing customer base, and immediate cash flow drastically lower the entry barrier and perceived risk compared to starting a new venture from scratch. These buyers typically focus on single-unit transactions within the low-to-mid investment range and prioritize established brands in stable industries such as quick-service food or home services, seeking a direct path to self-employment and established systems for support.

Experienced multi-unit operators represent a significant portion of sophisticated demand. These buyers leverage their existing infrastructure, established supply chains, and managerial expertise to acquire additional units, often in clusters near existing locations, maximizing geographical saturation and achieving substantial economies of scale. For them, resales offer speed to market, bypassing lengthy build-out times and immediately integrating a profitable asset into their larger portfolio. Their focus tends to be on mid-to-high investment range opportunities, particularly package deals or distressed assets that can be rapidly turned around.

Finally, institutional investors, including private equity firms and family offices, are increasingly recognizing franchised resales as attractive, recession-resistant assets with predictable income streams. These groups often target large-scale acquisitions, acquiring dozens of units or even entire regions from retiring franchisees or corporate divestitures. They prioritize stable brands with strong system-wide performance and sophisticated reporting capabilities, aiming for passive ownership structures managed by professional operational teams. The resale market provides these financial buyers with tangible assets offering higher yields than traditional fixed-income investments, cementing their position as major financial drivers in the high-end segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FranNet, Transworld Business Advisors, Vested Business Brokers, Murphy Business, Sunbelt Business Brokers, The Franchise Consulting Group, Business Brokers of America, VR Business Brokers, BizBuySell, Link Business, Franchise Clique, Global Franchise Group, Exit Planning Solutions, The Entrepreneur's Source, BrokerMatch, Franchise Flippers, Franchise Street, National Franchise Sales, Business Team, Corporate Investment International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Franchise Resale Market Key Technology Landscape

The technological landscape supporting the Franchise Resale Market is rapidly evolving, moving beyond simple listing services toward integrated platform solutions that manage the entire transaction lifecycle. Central to this evolution are proprietary Customer Relationship Management (CRM) systems specifically tailored for franchise brokerage. These systems handle lead generation, track communication history with buyers and sellers, manage document flow, and automate many of the initial qualification steps. Advanced database management is crucial for securely housing sensitive financial information and ensuring compliance with stringent disclosure regulations mandated by federal and state authorities, thereby reducing regulatory risk during the transfer process.

Furthermore, specialized valuation software, incorporating artificial intelligence and machine learning algorithms, is becoming standard practice. These tools ingest vast amounts of historical sales data, comparable market analyses (CMAs), and brand-specific key performance indicators (KPIs) to generate accurate, real-time business appraisals. This technology not only standardizes pricing but also provides crucial justification for the asking price, greatly facilitating negotiations and supporting lender underwriting decisions. The shift from subjective, broker-dependent valuations to data-driven models is a major technological disruption enhancing market efficiency.

Digital signature platforms and secure data rooms (virtual closing environments) are indispensable technologies facilitating the rapid exchange and execution of legal documents, including non-disclosure agreements (NDAs) and purchase agreements, particularly critical in multi-party transactions involving sellers, buyers, franchisors, and lenders across various geographies. Additionally, predictive modeling tools are now being used to analyze operational data provided by the franchisor to assess the transferability potential and identify potential post-acquisition risks, providing buyers with an unprecedented level of operational clarity before commitment. The overall trend emphasizes automation, security, and data-backed decision-making across all stages of the resale process.

Regional Highlights

Regional dynamics play a crucial role in shaping the Franchise Resale Market, influenced by economic maturity, regulatory environment, and cultural acceptance of franchising as a business ownership model. North America, dominated by the United States, represents the largest and most mature market. The density of established franchise systems, coupled with robust infrastructure for specialized financing (SBA loans) and a highly organized brokerage network, ensures high liquidity and transaction volume. Key states like California, Texas, and Florida, with high populations and favorable business climates, serve as hubs for complex, multi-unit resales, particularly in the service and QSR sectors.

Europe presents a fragmented but steadily growing market. The UK, Germany, and France are leaders in resale activity, benefiting from established service and retail franchise systems. However, the legal complexities arising from varying national labor laws, taxation regimes, and franchise legislation across the continent mean that cross-border resales are significantly more intricate than domestic transactions. The market is driven by small, independent service franchises and specialized B2B concepts, often attracting highly specific local buyers rather than broad institutional investment.

Asia Pacific (APAC) is projected to exhibit the fastest growth, largely centered in Australia, which has a highly developed franchise system mirroring the US model, and rapidly expanding markets like India and China. While the absolute volume of resales is currently lower than in North America, the rapid maturity of international brands introduced over the last two decades is beginning to generate a steady stream of exit opportunities. Growth is catalyzed by increasing middle-class wealth, a growing appetite for entrepreneurship, and the adoption of Western franchise standards, although transparency and consistent valuation standards remain evolving challenges in several developing APAC countries.

- North America (USA, Canada): Largest market share; highly liquid; robust SBA financing availability; high concentration of specialized brokers; key sectors include QSR, Automotive, and Business Services.

- Europe (UK, Germany, France): Steady, mature growth; regulatory complexity due to diverse national laws; strong focus on local service franchises and retail concepts; increasing adoption of standardized valuation methods.

- Asia Pacific (Australia, India, China): Fastest growing region; driven by brand maturity and middle-class entrepreneurship; Australia acts as a regional benchmark; regulatory environment is maturing, leading to gradual professionalization of the resale process.

- Latin America (Brazil, Mexico): Emerging market potential; activity concentrated in major metropolitan areas; greater reliance on seller financing and direct negotiation; currency volatility remains a critical risk factor impacting valuation stability.

- Middle East and Africa (MEA): Niche market focused on established F&B and retail brands in key economic hubs (UAE, Saudi Arabia); transactions are often high-value but low-volume; growth constrained by geopolitical stability and varying levels of legal protection for franchisees.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Franchise Resale Market.- FranNet

- Transworld Business Advisors

- Vested Business Brokers

- Murphy Business

- Sunbelt Business Brokers

- The Franchise Consulting Group

- Business Brokers of America

- VR Business Brokers

- BizBuySell

- Link Business

- Franchise Clique

- Global Franchise Group

- Exit Planning Solutions

- The Entrepreneur's Source

- BrokerMatch

- Franchise Flippers

- Franchise Street

- National Franchise Sales

- Business Team

- Corporate Investment International

Frequently Asked Questions

Analyze common user questions about the Franchise Resale market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current average time required to complete a franchise resale transaction?

The average time for a franchise resale transaction typically ranges from 6 to 12 months, influenced by the complexity of due diligence, speed of financing approval (especially SBA loans), and the mandatory timeline required for franchisor transfer approval and training scheduling.

How is the valuation of an established franchise unit typically determined in the resale market?

Valuation is primarily determined using a combination of methods, including the Seller’s Discretionary Earnings (SDE) multiple, asset valuation, and comparative market analysis (CMA). Sophisticated brokers increasingly rely on AI-enhanced models that factor in local market conditions, system-wide performance benchmarks, and projected cash flow.

What are the primary financial risks associated with purchasing an existing franchise unit?

Key financial risks include inheriting undisclosed liabilities, underestimating deferred maintenance costs, facing unexpected franchisor capital expenditure mandates, and potential loss of key staff following the ownership transition. Thorough due diligence by a specialized attorney mitigates these risks substantially.

What role does the original franchisor play in the resale process?

The franchisor holds a critical veto right over the sale. They must approve the buyer’s financial standing, operational qualifications, and training completion before finalizing the transfer. Franchisor cooperation is essential for accessing necessary historical operating data and completing the transaction.

Which segments of the franchise resale market are exhibiting the highest growth rates?

The highest growth is observed in essential service franchises (e.g., home repair, senior care, education services) and specialized B2B segments, driven by their recession-resilience and low inventory requirements compared to traditional retail or QSR concepts. The APAC region leads geographic growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager