Freezing Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432652 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Freezing Device Market Size

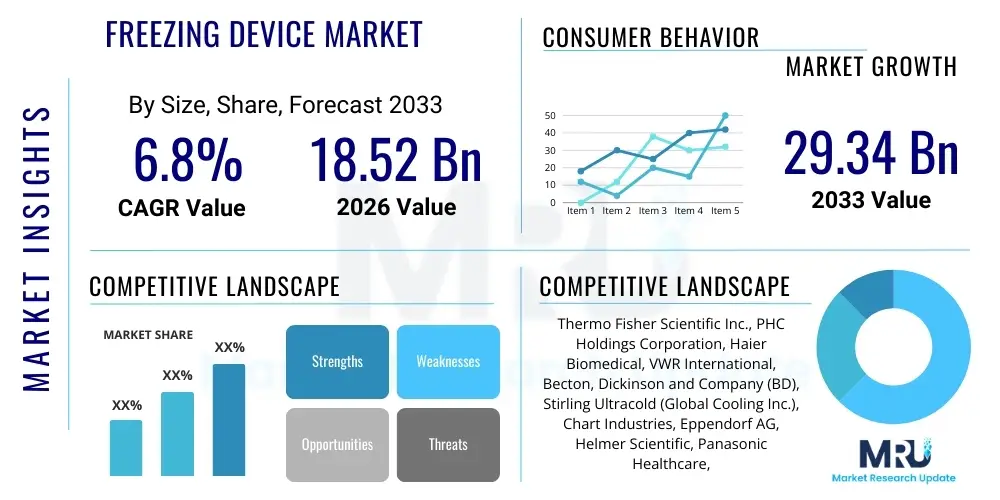

The Freezing Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2026 and 2033. The market is estimated at USD 18.52 Billion in 2026 and is projected to reach USD 29.34 Billion by the end of the forecast period in 2033.

Freezing Device Market introduction

The Freezing Device Market encompasses a diverse range of equipment designed to maintain substances or environments at cryogenic or ultra-low temperatures, critical for preservation, processing, and storage across various high-value industries. These devices, ranging from laboratory-grade ultra-low temperature (ULT) freezers and biomedical cryopreservation systems to large industrial blast freezers and cold storage units, are fundamental components of the global cold chain infrastructure. Product descriptions vary significantly by application, focusing on thermal uniformity, energy efficiency, temperature range capabilities (down to -196°C for liquid nitrogen systems), and safety features, particularly in pharmaceutical and clinical settings where sample integrity is paramount.

Major applications of freezing devices span healthcare, where they are essential for storing vaccines, biological samples, organs, blood plasma, and cell therapies, and the food processing industry, used for rapid freezing of perishable goods to maximize shelf life and retain nutritional quality. Industrially, freezing devices are integral in chemical processing, material science research, and electronics manufacturing for specialized testing and cooling requirements. The primary benefit derived from these devices is the long-term stabilization and preservation of temperature-sensitive materials, preventing degradation and enabling global distribution across complex supply chains.

The market growth is substantially driven by the global expansion of the biotechnology and pharmaceutical sectors, particularly the increased research and development activities involving gene and cell therapies which necessitate stringent cold chain requirements. Furthermore, the rising demand for frozen and ready-to-eat meals, coupled with stricter food safety regulations, compels food processors to invest in advanced freezing technology. Technological advancements focused on enhanced energy efficiency, integration of Internet of Things (IoT) sensors for real-time monitoring, and the shift towards sustainable, natural refrigerants are also significant factors fueling market expansion.

Freezing Device Market Executive Summary

The Freezing Device Market is characterized by robust growth, propelled by the globalization of clinical trials, the expanding biologics pipeline, and significant infrastructural investments in cold chain logistics, particularly in emerging economies of the Asia Pacific. Current business trends indicate a strong move toward decentralized storage solutions and modular freezing units that offer scalability and flexibility for diverse laboratory and manufacturing environments. There is a concerted effort among manufacturers to integrate predictive maintenance capabilities and remote diagnostics via cloud platforms to minimize operational downtime and improve regulatory compliance, positioning efficiency and reliability as core competitive differentiators in the market.

Regionally, North America maintains market dominance due to high concentration of leading pharmaceutical and biotech firms, coupled with substantial government and private funding directed toward biomedical research and cryogenic storage facilities. However, the Asia Pacific region is forecast to exhibit the fastest growth, driven by rapid urbanization, increasing accessibility to advanced healthcare infrastructure, and massive population size requiring extensive vaccine distribution networks. European markets focus heavily on sustainability, witnessing increased adoption of eco-friendly refrigeration technologies utilizing refrigerants with low Global Warming Potential (GWP), often spurred by stringent EU environmental directives.

Segment trends reveal that the ultra-low temperature freezer segment (ULT) remains highly critical due to the storage requirements of high-value therapeutics, including mRNA vaccines and advanced cell therapies. By application, the healthcare and life sciences sector dominates the market, yet the food and beverage sector shows promising growth, spurred by innovations in flash freezing and cryogenic freezing methods that improve product quality. Furthermore, the rise in demand for custom-built, large-scale cryogenic vessels for industrial gas storage and processing underscores the diversity of market needs beyond traditional clinical applications, necessitating a tailored approach to device manufacturing and supply chain management.

AI Impact Analysis on Freezing Device Market

Common user questions regarding AI's impact on the Freezing Device Market frequently revolve around optimizing energy consumption, enhancing predictive maintenance capabilities, and improving the accuracy and security of cold chain monitoring. Users are keenly interested in how Artificial Intelligence can move beyond simple alarm systems to proactively identify mechanical failures before they occur, thereby safeguarding irreplaceable biological samples or high-value pharmaceutical products. Furthermore, inquiries focus on leveraging machine learning algorithms to fine-tune defrost cycles and compressor operation based on real-time usage patterns, striving for maximum energy efficiency and reduced operational costs in power-intensive ULT environments.

AI’s primary influence is establishing a new paradigm for intelligent cold chain management, transforming devices from passive storage units into active, smart components of a vast logistics network. AI algorithms analyze historical performance data, environmental variables (ambient temperature, humidity), and user access logs to develop highly accurate models for predicting component lifespan, particularly compressors and cooling loops. This shift enables service providers to transition from reactive repair models to proactive, scheduled maintenance, significantly reducing the risk of catastrophic failures and ensuring high uptime, which is essential for regulated industries like healthcare and pharmaceuticals.

Moreover, AI is playing a crucial role in optimizing the energy footprint of large-scale freezing farms. By integrating with Building Management Systems (BMS), AI can dynamically adjust the operational parameters of multiple freezers simultaneously, balancing cooling loads, scheduling high-power operations during off-peak hours, and identifying underperforming units for immediate diagnostics. This sophisticated layer of intelligence ensures thermal stability while minimizing environmental impact and operational expenditure, addressing the dual consumer demand for reliability and sustainability in advanced freezing technologies.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature logs, power draw) to forecast component failure, minimizing downtime and protecting high-value assets.

- Energy Optimization: Machine learning fine-tunes compressor cycles and defrost schedules based on load and ambient conditions, significantly reducing energy consumption.

- Anomaly Detection: AI enhances real-time monitoring by identifying subtle temperature fluctuations or unauthorized access patterns that deviate from normal operation, improving security and integrity.

- Supply Chain Optimization: AI integrates freezing device data into broader cold chain logistics, optimizing routes and transit times to maintain stringent temperature requirements globally.

- Automated Compliance Reporting: AI systems automatically collate and analyze temperature records, generating detailed, audit-ready reports that meet stringent regulatory standards (e.g., FDA, EMA).

DRO & Impact Forces Of Freezing Device Market

The Freezing Device Market is primarily driven by escalating R&D spending in personalized medicine and biopharmaceuticals, the continuous expansion of global vaccination programs (requiring complex cold chain networks), and increasingly stringent regulations governing the storage of sensitive biological materials. Restraints largely center on the substantial initial investment costs associated with ultra-low temperature equipment, the high energy consumption of traditional compressor-based systems leading to elevated operational expenses, and the logistical complexities associated with transporting and maintaining sensitive materials across diverse climates. Opportunities abound in the development of sustainable cooling technologies, particularly the use of Stirling engine cryocoolers and non-fluorocarbon refrigerants, and the integration of advanced IoT and AI solutions for enhanced monitoring and energy management. The market dynamics are highly influenced by the Impact Forces of rapid technological obsolescence necessitating frequent device upgrades, coupled with significant pressure from end-users, particularly large academic institutions and hospitals, demanding greater reliability and lower Total Cost of Ownership (TCO).

Market growth is significantly bolstered by increasing global health security measures, necessitating reliable infrastructure for rapid deployment and storage of vaccines, exemplified by the logistical lessons learned during the recent global pandemic. The pharmaceutical sector's pivot toward complex biological drugs (like monoclonal antibodies and cell therapies) means that stable, reliable ultra-low temperature environments are non-negotiable, acting as a powerful market driver. However, the reliance on HFC and HCFC refrigerants, which face phasing out due to environmental mandates (like the Kigali Amendment), represents a critical challenge, pushing manufacturers to invest heavily in redesigning cooling systems around natural refrigerants such as CO2 or hydrocarbons, adding complexity to current product lines.

The combined impact of these forces establishes a competitive landscape where innovation is focused on efficiency and connectivity. Impact forces such as strict regulatory oversight from bodies like the WHO and FDA require manufacturers to provide meticulous validation and tracking capabilities, driving the adoption of digital logging and cloud-based data management systems. Furthermore, market opportunities are amplified by the growing interest in biorepositories and biobanking services worldwide, which require long-term, highly secure cryopreservation facilities, fostering specialized market niches for advanced liquid nitrogen and mechanical cryofreezing solutions.

Segmentation Analysis

The Freezing Device Market is comprehensively segmented based on product type, temperature range, application, and end-user, reflecting the diverse needs across scientific, industrial, and clinical domains. Segmentation allows manufacturers and suppliers to tailor solutions, whether focusing on maintaining -80°C for biomedical research or providing large-scale blast freezing capabilities for commercial food processing. The complexity of the cold chain requires specialized equipment, ranging from highly precise laboratory-scale freezers to massive walk-in cold rooms and cryogenic tanks. Understanding these segments is crucial for strategic market entry and for developing technologies optimized for specific temperature thresholds and volume requirements.

- By Product Type:

- Freezers (Upright Freezers, Chest Freezers)

- Cryopreservation Systems (Liquid Nitrogen Freezers, Cryogenic Storage Tanks)

- Refrigerators and Chillers

- Ultra-Low Temperature (ULT) Freezers (-80°C and below)

- Blast Freezers and Plate Freezers (Industrial Scale)

- By Temperature Range:

- Standard Freezers (0°C to -40°C)

- Low Temperature Freezers (-40°C to -80°C)

- Ultra-Low Temperature Freezers (Below -80°C)

- Cryogenic Storage Systems (Below -150°C)

- By Application:

- Biopharmaceuticals and Biotechnology (Vaccine storage, Drug substance preservation)

- Blood and Blood Products Storage (Plasma, Whole Blood)

- Tissue and Organ Banking

- Food Processing and Storage (Flash freezing, Bulk storage)

- Chemical and Material Science Research

- Academic and Research Laboratories

- By End-User:

- Hospitals and Blood Banks

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Clinical Laboratories

- Food and Beverage Companies

- Contract Research and Manufacturing Organizations (CROs/CMOs)

Value Chain Analysis For Freezing Device Market

The value chain for the Freezing Device Market is multi-layered, beginning with the upstream supply of specialized components and ending with extensive maintenance and monitoring services provided to end-users. Upstream activities involve sourcing high-quality, durable materials, including specialized insulation panels, robust stainless steel components, advanced temperature sensors, and complex refrigeration system components such as compressors (often cascade systems for ULTs), heat exchangers, and precise electronic controls. The reliability of these components, particularly the energy-intensive compressors, dictates the overall performance and lifespan of the final device, making supplier qualification and risk management crucial.

Midstream activities encompass the manufacturing, assembly, and rigorous quality testing of the freezing devices. Manufacturers integrate these sourced components, applying complex engineering principles to ensure thermal uniformity, energy efficiency, and compliance with stringent regulatory standards (e.g., ISO, GMP). The manufacturing segment is highly focused on optimizing system architecture, incorporating features like vacuum insulation panels and redundant cooling systems to enhance reliability. Certification and validation services for the manufactured units form a critical part of this stage, especially for devices destined for clinical or pharmaceutical use.

Downstream activities involve the distribution channel, which is highly specialized. Direct sales are common for high-value or custom-built devices, allowing manufacturers to provide specialized installation and training. Indirect channels involve distributors, authorized resellers, and third-party logistics (3PL) providers, particularly for bulk storage solutions and standardized laboratory freezers. These channels are responsible for timely delivery, complex installation, and providing post-sale support, including maintenance contracts and calibration services. The final stage involves the end-users—hospitals, labs, and manufacturing facilities—who rely on robust after-sales support to ensure continuous operation and data integrity throughout the device lifecycle.

Freezing Device Market Potential Customers

The primary customers for freezing devices are large organizations operating in highly regulated and research-intensive fields where temperature control is non-negotiable for product efficacy and safety. End-users in the life sciences sector, including pharmaceutical majors and emerging biotech startups, are crucial buyers due to the critical need for storing proprietary drug candidates, viral vectors, and advanced cell and gene therapy components at ultra-low or cryogenic temperatures. These customers prioritize reliability, redundancy, and seamless data logging capabilities to satisfy regulatory requirements and protect high-value inventory.

Hospitals, clinical laboratories, and centralized blood banks constitute another major customer segment, requiring devices for the safe storage of blood products, patient samples, tissue cultures, and vaccines. Their purchasing decisions are heavily influenced by capacity, ease of use (ergonomics), and energy efficiency, given the continuous operational demands of healthcare environments. Furthermore, the expansion of large, institutional biorepositories and biobanks, which serve as long-term repositories for massive collections of biological specimens for academic and clinical research, drives significant demand for industrial-scale cryogenic storage systems and sophisticated inventory management software integrated with the freezing hardware.

Beyond the clinical sphere, the food and beverage industry represents a substantial customer base, particularly large food processors and logistics firms specializing in the frozen supply chain. These companies require high-throughput freezing solutions such as blast freezers, spiral freezers, and industrial cold rooms to rapidly chill and store perishable goods, maintaining quality and extending shelf life for global distribution. Their focus is on throughput capacity, speed of freezing (to minimize ice crystal formation), and compliance with food safety and HACCP standards, leading to demand for customized industrial freezing installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.52 Billion |

| Market Forecast in 2033 | USD 29.34 Billion |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific Inc., PHC Holdings Corporation, Haier Biomedical, VWR International, Becton, Dickinson and Company (BD), Stirling Ultracold (Global Cooling Inc.), Chart Industries, Eppendorf AG, Helmer Scientific, Panasonic Healthcare, Arctiko A/S, Remi Group, K2 Scientific, Blue M, Sanyo Biomedical, Binder GmbH, LEEC Ltd., Godrej & Boyce, Desmon Scientific, and Custom Biogenic Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freezing Device Market Key Technology Landscape

The technology landscape of the Freezing Device Market is rapidly evolving, driven primarily by the critical need for enhanced energy efficiency, greater thermal stability, and superior monitoring capabilities. The dominant technology remains the vapor compression refrigeration system, which, for ultra-low temperature (ULT) applications, often utilizes cascade refrigeration cycles to achieve temperatures down to -86°C. However, innovation in this domain focuses on variable speed compressors and hydrocarbon (HC) refrigerants (R290, R600a) to significantly reduce power consumption compared to older HFC-based systems, meeting both economic and environmental mandates.

A major technological disruptor gaining traction, particularly in the ULT segment, is Stirling Engine Technology. Stirling cryocoolers offer a non-compressor-based approach to cooling, characterized by reduced moving parts, significantly lower energy usage, and the ability to operate without ozone-depleting or high-GWP refrigerants. These systems provide exceptional temperature uniformity and rapid recovery times following door openings, making them highly desirable for storing temperature-sensitive materials like vaccines and specialized cell cultures where integrity cannot be compromised. The adoption of Stirling technology represents a major strategic pivot for manufacturers seeking to differentiate based on sustainability and reduced total cost of ownership (TCO).

Furthermore, digital integration and smart technologies are becoming standard features across all device types. This includes the deployment of sophisticated IoT sensors for continuous data logging, remote monitoring via cloud platforms, and advanced alarm systems that can notify users globally of temperature excursions or mechanical issues. The emphasis is on data security, accessibility, and automated compliance tracking, ensuring that end-users can easily generate audit trails and maintain regulatory adherence. Advanced insulation materials, such as vacuum insulation panels (VIP), are also critical, enabling thinner wall designs for increased internal capacity without sacrificing temperature performance or structural integrity.

Regional Highlights

- North America: Market Dominance Fueled by Biotech Investment

North America, led by the United States, commands the largest share of the global Freezing Device Market. This dominance is attributed to several key factors: the presence of a mature and expansive biotechnology and pharmaceutical industry, consistently high levels of R&D investment in gene and cell therapies, and the establishment of stringent regulatory frameworks that necessitate reliable, compliant cold storage solutions. The region is a key early adopter of cutting-edge technologies, including Stirling cryocoolers and advanced automated cryogenic handling systems. The high density of academic research institutions and large commercial biobanks further solidifies its position, driving demand for high-capacity, ultra-low temperature freezers and associated monitoring software.

The market in this region is also characterized by a strong focus on laboratory automation and data integration, spurred by the need for efficiency in high-throughput research settings. Furthermore, significant government initiatives aimed at pandemic preparedness and expanding national strategic stockpiles (including vaccine storage) ensure continued investment in robust, reliable freezing infrastructure. The competitive landscape is mature, emphasizing technological differentiation based on energy efficiency, sample safety features, and robust after-sales service networks.

- Asia Pacific (APAC): Fastest Growth Due to Infrastructure Expansion

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is primarily fueled by massive infrastructure development across developing economies like China, India, and South Korea, coupled with significant foreign direct investment into the healthcare and life sciences sectors. Increased awareness regarding food safety and the shift toward modern retail channels demanding extensive cold chains also contribute substantially to market growth in countries with large populations.

Key drivers include the burgeoning domestic pharmaceutical manufacturing base, particularly in vaccine production, and the expanding network of hospitals and clinical research organizations. While the market historically favored lower-cost equipment, there is a distinct and accelerating shift towards premium, high-efficiency ULT freezers to meet international quality standards for high-value biological samples. Japan and Australia remain critical markets for advanced laboratory equipment, while China and India focus on scaling up large-volume cold storage and distribution solutions to serve vast internal markets effectively.

- Europe: Focus on Sustainability and Regulatory Compliance

Europe holds a significant market share, driven primarily by strong regulatory focus on environmental sustainability and adherence to high quality standards (e.g., GMP). European Union directives promoting the phase-down of high Global Warming Potential (GWP) refrigerants have accelerated the adoption of natural refrigerant-based freezing devices (e.g., R290, R600a). The region boasts a highly active biopharmaceutical sector, notably in Germany, the UK, and Switzerland, fostering consistent demand for highly accurate and validated cold storage equipment for advanced therapeutics.

The European market places a premium on traceability and documentation, fostering strong demand for sophisticated IoT-enabled freezers that provide seamless data integration and remote diagnostic capabilities. Furthermore, government initiatives supporting research into chronic diseases and aging populations ensure stable investment in university research laboratories and public health systems, which are major end-users of low and ultra-low temperature freezing technologies.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Market Dynamics

LATAM and MEA represent emerging markets with growth spurred by improving healthcare access, increased pharmaceutical imports, and necessary upgrades to foundational cold chain infrastructure. Brazil and Mexico in LATAM, and the UAE and Saudi Arabia in the MEA region, are investing heavily in modernizing hospitals and establishing regional hubs for pharmaceutical logistics. While initial adoption may focus on essential cooling devices, the demand for specialized ULT freezers is rising, particularly in areas focusing on clinical trials and specialized vaccine distribution programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freezing Device Market.- Thermo Fisher Scientific Inc.

- PHC Holdings Corporation

- Haier Biomedical

- Becton, Dickinson and Company (BD)

- Chart Industries

- Eppendorf AG

- Helmer Scientific

- Stirling Ultracold (Global Cooling Inc.)

- VWR International

- Panasonic Healthcare

- Arctiko A/S

- Remi Group

- K2 Scientific

- Blue M

- Sanyo Biomedical

- Binder GmbH

- LEEC Ltd.

- Godrej & Boyce

- Desmon Scientific

- Custom Biogenic Systems

Frequently Asked Questions

Analyze common user questions about the Freezing Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Freezing Device Market?

Market growth is primarily driven by the escalating demand for advanced cold storage solutions required for biopharmaceuticals, especially cell and gene therapies and next-generation vaccines. The global expansion of the cold chain logistics network, combined with increasing investments in academic and clinical research infrastructure worldwide, further accelerates market expansion. Additionally, regulatory requirements for secure sample integrity push pharmaceutical companies and biobanks towards high-reliability freezing devices.

How is the transition to natural refrigerants impacting the design of Ultra-Low Temperature (ULT) freezers?

The transition, mandated by global environmental agreements like the Kigali Amendment, forces manufacturers to redesign ULT freezers to utilize natural refrigerants (like hydrocarbons R290 and R600a). This shift results in more energy-efficient models with lower operating costs and significantly reduced Global Warming Potential (GWP), making sustainability a critical design criterion for new freezing devices and leading to higher initial unit costs but lower long-term TCO.

Which end-user segment is expected to show the highest growth rate in adopting freezing devices?

The Pharmaceutical and Biotechnology Companies segment is anticipated to exhibit the highest growth rate, driven by the expanding pipelines of biologic drugs and the specialized storage needs of clinical trial materials. The complexity and high value of these temperature-sensitive products necessitate continuous investment in high-precision, validated ultra-low temperature and cryogenic storage devices, often integrated with advanced remote monitoring and data logging systems.

What role does IoT and AI play in enhancing freezing device performance and reliability?

IoT sensors provide real-time performance data, enabling remote monitoring, predictive maintenance, and automatic temperature logging for compliance. AI algorithms analyze this data to optimize compressor cycles for maximum energy efficiency, identify subtle anomalies indicative of impending component failure, and improve the overall reliability and security of critical cold storage assets.

What is the competitive strategy being adopted by key players in the Freezing Device Market?

Leading companies are focusing on vertical integration, expanding their service portfolios to include complete cold chain management solutions (software, hardware, and validation services). Strategic focus areas include developing highly energy-efficient products (Stirling technology), improving data security and compliance features (AEO), and expanding manufacturing presence in fast-growing APAC markets to capture emerging demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager