Freight Factoring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431443 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Freight Factoring Market Size

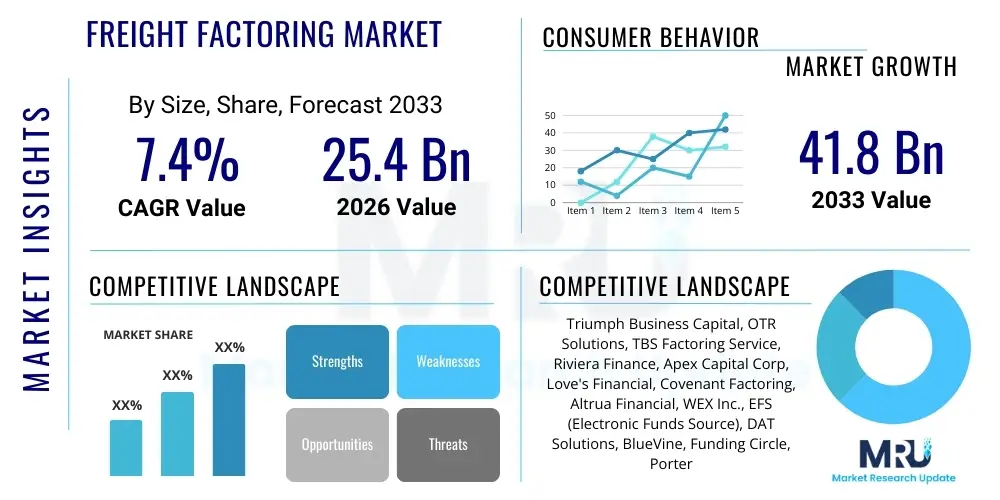

The Freight Factoring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.4% between 2026 and 2033. The market is estimated at USD 25.4 Billion in 2026 and is projected to reach USD 41.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the inherent need for working capital flexibility within the highly fragmented and volatile transportation and logistics industry. Small to medium-sized trucking companies, in particular, rely heavily on factoring services to bridge the significant cash flow gap created by standard industry payment terms, which often stretch to 30, 60, or even 90 days, while operational expenses like fuel, maintenance, and payroll require immediate liquidity.

The estimation takes into account the increasing volume of global trade and e-commerce, which subsequently elevates the demand for trucking and freight services worldwide. As supply chains become more complex and competitive, the pressure on carriers to maintain efficiency and adopt new technologies rises, necessitating immediate access to capital provided by freight factoring solutions. Furthermore, the economic instability and fluctuating interest rate environments in several key regions contribute to the appeal of factoring as a reliable, debt-free financing alternative compared to traditional bank loans, thereby solidifying its market position and contributing to the anticipated revenue growth throughout the forecast period.

Freight Factoring Market introduction

The Freight Factoring Market encompasses financial services where third-party providers, known as factors, purchase the accounts receivable (invoices) of trucking companies and freight brokers at a discount. This immediate injection of cash allows carriers to cover crucial operating expenses, such as fuel, driver wages, and maintenance, without waiting for customers (shippers or receivers) to complete the standard payment cycle. The core product description involves the outright purchase of creditworthy invoices, typically providing 80% to 95% of the invoice value upfront, with the remaining reserve paid out once the factor collects the full amount, minus the factoring fee.

Major applications of freight factoring are widespread across the transportation ecosystem, including independent owner-operators, small fleet owners, and mid-sized logistics firms requiring reliable cash flow management. The primary benefits include rapid access to working capital, improved financial stability, and reduced administrative burden associated with invoice collection and credit risk assessment. Key driving factors propelling this market include the growth of the global freight industry, the high degree of fragmentation in the trucking sector, and the operational necessity for instant liquidity to manage fluctuating operational costs, ensuring business continuity and scalability for logistics providers operating on thin margins.

Freight Factoring Market Executive Summary

The Freight Factoring Market is exhibiting robust growth, propelled by sustained global economic activities and the explosive rise of e-commerce, placing immense demand on efficient logistics and timely carrier payments. Business trends indicate a strong shift towards non-recourse factoring options, preferred by carriers seeking to offload credit risk entirely, coupled with a notable acceleration in digitalization, where specialized factoring firms integrate advanced proprietary platforms for instant credit checks and accelerated funding processes. This technological adoption enhances client onboarding efficiency and improves the overall user experience, distinguishing forward-thinking factors in a competitive landscape.

Regionally, North America remains the dominant market, particularly due to the massive, highly decentralized U.S. trucking industry where thousands of small carriers depend on factoring for survival. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by infrastructure development, burgeoning domestic consumption, and the expansion of international trade lanes, particularly within countries like China and India, where financing mechanisms for SME logistics players are rapidly maturing. Segment trends highlight that SMEs represent the largest client base, driven by their limited access to traditional bank financing, while the application segment sees substantial growth in tailored factoring solutions linked directly to fuel card programs and integrated fleet management services, offering bundled value propositions to carriers.

AI Impact Analysis on Freight Factoring Market

Common user questions regarding AI's impact on freight factoring center on whether automation will reduce factoring fees, how AI improves the speed of credit analysis, and the potential displacement of manual due diligence tasks. Users are primarily concerned with efficiency gains and risk mitigation. The consensus is that AI is transformative, shifting the factoring model from a primarily administrative service to a sophisticated financial tool driven by predictive analytics. AI models are now integral for instantaneous and accurate evaluation of shipper and broker creditworthiness, minimizing risk exposure for factors. Furthermore, machine learning optimizes cash flow forecasting for carriers, allowing factoring companies to offer highly customized and flexible financing structures based on predictive load volumes and seasonal fluctuations, moving beyond static fee schedules to dynamic, risk-adjusted pricing models, ultimately improving profitability and scalability for both the factor and the carrier.

- AI algorithms enable instantaneous, data-driven credit risk assessment of underlying shippers and brokers, significantly accelerating the funding process.

- Machine Learning (ML) models predict invoice payment default probabilities, allowing factors to dynamically adjust reserve rates and factoring fees, moving towards risk-based pricing.

- Automated document processing and Optical Character Recognition (OCR) streamline the verification of Bills of Lading (BOL) and proof of delivery (POD), reducing administrative overhead.

- Predictive analytics aid carriers in optimizing their operational cash flow management by forecasting funding availability based on historical performance and market demands.

- Chatbots and natural language processing (NLP) improve customer service, providing 24/7 support for tracking payments and resolving common funding queries.

- AI-driven fraud detection systems enhance security protocols by identifying anomalies and suspicious patterns in invoice submissions and client behavior in real-time.

- Integration of telematics and Electronic Logging Device (ELD) data into AI systems provides deeper operational insight, linking factoring decisions to real-time transport performance metrics.

DRO & Impact Forces Of Freight Factoring Market

The Freight Factoring Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), whose collective force determines the market's trajectory. Key drivers include the perpetual need for immediate cash flow by small and mid-sized trucking firms, coupled with restrictive lending practices by traditional financial institutions, pushing carriers toward specialized factoring solutions. Restraints primarily involve the high cost associated with factoring fees compared to traditional financing, and the underlying perception among some carriers that factoring is a last resort, potentially damaging client relationships if not managed transparently. However, the emerging opportunities, particularly the digitization of the funding process and the expansion into untapped emerging markets, provide robust avenues for market stakeholders to overcome current barriers and solidify long-term growth.

The impact forces within this ecosystem operate on economic, technological, and regulatory levels. Economically, the volatility in fuel prices and insurance costs heightens the reliance on factoring for immediate expense coverage. Technologically, the rapid adoption of digital onboarding, blockchain for secure transactions, and AI for predictive credit scoring acts as a powerful accelerating force. Regulatory changes, such as mandates promoting supply chain transparency or alterations in commercial lending laws, can either restrain market entry or create specific niches for tailored factoring products. The overall impact force is currently positive, driven by technological innovations that enhance service speed and reliability, outweighing the persisting challenges related to cost perception and market education.

Segmentation Analysis

The Freight Factoring Market is systematically segmented based on the type of financial arrangement, the size of the client enterprise, and the specific application for which the funding is required. This multi-dimensional segmentation allows factoring providers to tailor their product offerings to meet the highly varied and specific liquidity needs across the vast transportation sector. The segmentation by type is critical, differentiating between recourse factoring, where the carrier retains the credit risk, and non-recourse factoring, which transfers the credit risk to the factor, a premium service highly valued by smaller operators. Client size segmentation helps in designing appropriate fee structures and service levels, recognizing that large enterprises might utilize factoring strategically for optimized cash flow while SMEs depend on it for basic survival. Application-based segmentation reveals specialized market niches, such as factoring integrated directly with fuel card purchases or insurance payments, offering comprehensive operational financial solutions rather than just simple invoice purchasing.

- By Type:

- Recourse Factoring

- Non-Recourse Factoring

- Spot Factoring

- By Client Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Fleet Management

- Fuel Cards and Discounts

- Payroll and Driver Wages

- Maintenance and Repairs

- Insurance Payments

- Others (Tolls, Permits, Licenses)

Value Chain Analysis For Freight Factoring Market

The value chain of the Freight Factoring Market begins with the upstream segment, primarily involving the capital sources utilized by the factors themselves, such as banks, private equity firms, and institutional investors who provide the funds necessary for purchasing invoices. This upstream capital dictates the cost of funds for the factor, which subsequently influences the discount rates offered to the carrier clients. The efficiency of the capital procurement process and the financial instruments used (e.g., securitization of receivables) are vital components of the factor’s operational leverage and competitive pricing strategy.

The core processes involve the factor performing due diligence—instantaneous credit checks on the debtor (shipper or broker) and verification of the invoice and proof of delivery (POD) documentation—followed by the immediate disbursement of funds to the carrier. Downstream activities focus on collecting the full payment from the debtor. The distribution channel is predominantly direct, with factoring firms establishing strong, often digitally mediated, relationships directly with carriers, utilizing highly specialized online platforms and mobile applications. Indirect channels occasionally include strategic partnerships with transportation management system (TMS) providers or fuel card issuers, embedding factoring services seamlessly into existing carrier workflow tools, ensuring maximum market penetration and client retention by offering integrated solutions.

Freight Factoring Market Potential Customers

The core clientele of the Freight Factoring Market comprises the vast population of companies operating within the logistics and transportation sector that face chronic delays in customer payments relative to their immediate operational expenditure demands. The primary end-users are independent owner-operators and small to mid-sized trucking companies (SMEs) that often lack the financial reserves or credit history necessary to weather the 30- to 90-day payment cycles common in the industry. These entities are highly sensitive to cash flow disruptions caused by fuel price volatility, repair costs, and payroll obligations, making rapid, predictable invoice funding essential for their viability.

Additionally, freight brokers and logistics management firms represent a significant secondary customer base. While brokers often manage the carrier relationship, they themselves utilize factoring to ensure their carriers are paid quickly, maintaining strong relationships and mitigating financial risk related to intermediary payments. The decision to use factoring is often driven not by distress, but by strategic financial management—maximizing cash velocity to support rapid scaling, taking advantage of bulk purchase discounts (like fuel), or investing quickly in new assets such as trucks or trailers. Therefore, the market caters to any entity within the freight ecosystem prioritizing liquidity, speed, and reduced collection administrative burden over minimizing the cost of capital.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.4 Billion |

| Market Forecast in 2033 | USD 41.8 Billion |

| Growth Rate | 7.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Triumph Business Capital, OTR Solutions, TBS Factoring Service, Riviera Finance, Apex Capital Corp, Love's Financial, Covenant Factoring, Altrua Financial, WEX Inc., EFS (Electronic Funds Source), DAT Solutions, BlueVine, Funding Circle, Porter Freight Funding, US Bank Freight Payment Solutions, Transflo, RTS Financial, Capstone Capital Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freight Factoring Market Key Technology Landscape

The technological landscape within the Freight Factoring Market is rapidly evolving, driven primarily by the need for speed, security, and scalability. The foundational technology involves highly secure, often proprietary, digital funding platforms accessible via web and mobile applications. These platforms utilize advanced Application Programming Interfaces (APIs) to seamlessly integrate with carriers’ existing Electronic Logging Devices (ELDs) and Transportation Management Systems (TMS), automating the submission of invoices, Bills of Lading (BOL), and proof of delivery (POD) documentation, thereby minimizing manual entry errors and dramatically accelerating the verification process from days to mere hours.

More sophisticated technological advancements include the deployment of Artificial Intelligence (AI) and Machine Learning (ML) for instantaneous, predictive risk assessment. These models analyze vast datasets, including shipper credit histories, market logistics trends, and historical payment patterns, to provide dynamic pricing and immediate credit approval decisions. Furthermore, the adoption of blockchain technology is gaining traction, promising immutable, transparent records for invoice verification and payment tracking, which is essential for reducing fraud, particularly in cross-border factoring transactions. These integrated technologies not only streamline the factor's operations but also enhance the overall transparency and reliability of the funding service offered to the carrier.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the immense size and fragmented nature of the US trucking industry. The stringent regulatory environment and standardized inter-state commerce necessitate robust, reliable financing options. Specialized factoring firms in North America offer highly tailored products, including integrated fuel card programs and maintenance assistance, making factoring a cornerstone of operational finance for small fleet owners and owner-operators who struggle with traditional bank lending criteria.

- Europe: The European market shows steady growth, influenced by complex cross-border trade within the European Union (EU). Factoring services here often need to navigate diverse regulatory frameworks and currency risks, leading to high demand for specialized international factoring (or export factoring). The push for sustainable logistics and digitalization initiatives across the EU is encouraging carriers to seek financing for fleet modernization, further stimulating the factoring sector.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, propelled by rapid industrialization, massive e-commerce growth, and significant government investment in infrastructure and logistics networks, particularly in China, India, and Southeast Asia. The factoring market here is characterized by a high volume of small, independent logistics providers who lack formalized credit structures, making factoring a vital catalyst for their participation in regional supply chains.

- Latin America: This region presents a market with high volatility and risk, but immense potential. Economic instability and high interest rates make traditional bank loans prohibitively expensive or inaccessible, positioning factoring as a necessary, high-growth financial alternative. The focus is often on domestic factoring, though cross-border trade with North America requires increasingly sophisticated factoring solutions to manage currency and geopolitical risks effectively.

- Middle East and Africa (MEA): Growth in MEA is concentrated around major trade hubs, specifically the Gulf Cooperation Council (GCC) countries. Infrastructure projects and increasing reliance on global oil and gas supply chains drive demand for secure and immediate working capital for regional carriers. The development of robust financial technology ecosystems in key countries is helping to formalize and professionalize the factoring market, overcoming previous hurdles related to lack of credit transparency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freight Factoring Market.- Triumph Business Capital

- OTR Solutions

- TBS Factoring Service

- Riviera Finance

- Apex Capital Corp

- Love's Financial

- Covenant Factoring

- Altrua Financial

- WEX Inc.

- EFS (Electronic Funds Source)

- DAT Solutions

- BlueVine

- Funding Circle

- Porter Freight Funding

- US Bank Freight Payment Solutions

- Transflo

- RTS Financial

- Capstone Capital Group

Frequently Asked Questions

Analyze common user questions about the Freight Factoring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Recourse and Non-Recourse Freight Factoring?

Recourse factoring means the carrier is responsible for buying back the invoice if the shipper fails to pay (retains credit risk). Non-recourse factoring transfers the credit risk to the factoring company, which usually charges a higher fee for assuming the potential loss.

How does freight factoring impact a trucking company's credit rating or debt load?

Freight factoring is a sale of an asset (invoice) and not a loan. Therefore, it generally does not appear as debt on a carrier's balance sheet, nor does it typically impact their traditional credit rating, making it an attractive off-balance-sheet financing method.

What technological trends are most significantly driving efficiency in freight factoring?

The most significant drivers are the implementation of AI and Machine Learning for rapid credit checks and dynamic pricing, coupled with robust digital platforms and APIs that automate the submission and verification of freight documentation (BOL, POD) in near real-time.

Which regional market holds the highest growth potential for factoring services?

Asia Pacific (APAC) is projected to exhibit the highest growth rate due to its expanding e-commerce sector, extensive infrastructure development, and a substantial number of small, capital-constrained logistics providers entering the market across countries like India and China.

What are the key benefits of integrating factoring services with a carrier's existing fuel card program?

Integration allows carriers to instantly draw funds against factored invoices directly onto their fuel cards, ensuring immediate liquidity for the largest operational expense (fuel). This streamlines cash flow management and often unlocks premium fuel discounts.

The comprehensive understanding of the Freight Factoring Market requires a deep dive into the operational mechanics of the global logistics sector, particularly the financial stress points experienced by small and medium-sized carriers. The market's strength lies in its ability to provide an immediate solution to the perennial problem of delayed payments, essentially bridging the gap between service delivery and cash receipt. This financial function is becoming increasingly formalized and sophisticated, moving away from simple transaction processing towards holistic financial partnerships. Factors are increasingly offering additional value-added services, such as credit monitoring for shippers, back-office support for collections, and integration with specialized transport software, transforming them into vital operational partners rather than just lenders.

The future trajectory of the market is inexorably linked to technological innovation. The pressure to reduce factoring fees necessitates maximum automation, driving investment into proprietary AI systems that can execute hundreds of credit checks per minute with extremely low error rates. Furthermore, regulatory environments, particularly concerning data privacy and financial transparency across international borders, will shape how factors operate and what documentation standards they must uphold. Success in this highly competitive industry is increasingly determined by the factor's technological agility and their ability to integrate seamlessly into the daily operational workflow of a geographically dispersed and time-sensitive client base, maintaining a crucial role in enabling global supply chain fluidity and efficiency.

In analyzing the strategic shifts within the industry, it is clear that differentiation is occurring through specialization. Factors are segmenting their offerings based not just on recourse type, but on vertical specialization—catering specifically to refrigerated transport, oversized load carriers, or dedicated government contractors. This vertical focus allows factors to develop proprietary expertise in assessing the specific risks and payment patterns associated with niche logistics sectors, resulting in more accurate pricing and reduced default rates. For instance, factoring invoices from government entities or large, multinational shippers carries a fundamentally different risk profile than factoring receivables from small, regional brokers, necessitating tailored underwriting processes and dedicated risk management teams.

The sustained demand from Small and Medium-sized Enterprises (SMEs) remains the backbone of the market. SMEs often lack the tangible assets required for collateralized traditional bank loans, making their accounts receivable their most accessible source of immediate capital. The speed of funding provided by factoring—often within 24 hours of invoice submission—is a competitive advantage that traditional commercial lending cannot match. This speed enables SMEs to take on more freight loads, cover sudden equipment breakdowns, and participate more robustly in the supply chain, ultimately contributing to the macroeconomic growth of the transportation sector globally. Consequently, the proliferation of digital platforms designed for easy access and swift onboarding for these small businesses ensures the market’s expansive reach and sustained growth momentum over the next decade.

Digitalization extends beyond basic transaction processing and is heavily impacting client acquisition and retention strategies. Modern factors employ advanced data analytics not just for risk assessment but for predictive client lifetime value modeling. By analyzing factors such as average invoice size, client turnover rate, and historical funding utilization, factors can offer personalized loyalty programs, variable fee structures, and preferential terms to their most valuable long-term clients. This strategic use of data fosters deeper carrier relationships and reduces churn, which is critical in a market defined by low barriers to entry for new fintech competitors. The shift towards proprietary software that offers integrated fleet management tools alongside factoring services demonstrates a move towards creating an ecosystem of essential services, thereby locking in client dependency and maximizing the overall value delivered.

The competitive landscape is characterized by a mix of specialized factoring giants, often subsidiaries of major financial institutions, and agile fintech startups utilizing venture capital to disrupt traditional models. The fintech entrants excel in user experience (UX) and rapid technology adoption, particularly in areas like mobile application functionality and API integrations with popular TMS providers. Established players, however, leverage their substantial capital reserves and long-standing relationships with large shippers to offer greater stability and often lower costs of funds. This dynamic competition forces continuous innovation across the board, driving down overall market fees and increasing service quality, ultimately benefiting the carrier end-user through improved access to efficient capital and enhanced risk management tools.

Further analysis of the Restraints highlights the crucial issue of market perception. Despite the vital role factoring plays, it sometimes carries the historical stigma of being an expensive last resort. Factors are actively combating this restraint through educational campaigns, emphasizing factoring as a proactive financial tool for growth and optimized cash flow rather than a signal of financial distress. Transparent pricing models, clearer communication regarding non-recourse obligations, and visible success stories of carriers scaling their operations using factoring are key components of this market repositioning effort. Overcoming this perception is vital for attracting larger, more financially sophisticated carriers who might currently rely exclusively on asset-based lending or traditional revolving credit lines.

Moreover, the technological integration of factoring solutions with Electronic Logging Devices (ELDs) is becoming a strategic necessity. By having direct, real-time access to operational data—such as confirmed delivery times, driver hours, and route verification—factors can validate the legitimacy of an invoice instantly and with high certainty. This direct data stream minimizes the potential for fraudulent claims and expedites the administrative approval process, which is a major time sink in traditional factoring operations. The seamless flow of operational data into the financial platform is a powerful differentiator, providing both speed and security, reinforcing the value proposition of modern, digitally enabled freight factoring services in the highly sensitive logistics sector.

The impact of global economic fluctuations on the market is pronounced, yet complex. During periods of economic contraction, traditional bank lending tightens, ironically increasing the reliance of transportation SMEs on factoring services, thereby boosting demand. Conversely, economic expansion leads to higher freight volumes and increased profitability, but also higher operational costs (fuel, labor), demanding reliable working capital access to manage growth effectively. This counter-cyclical resilience ensures that the freight factoring market maintains relevance regardless of the broader economic cycle, though the risk profile of factored invoices may shift, requiring factors to adjust their credit underwriting standards and reserve policies dynamically to maintain portfolio health and mitigate heightened default risk associated with economic uncertainty.

In terms of geographical expansion opportunities, the untapped potential in emerging markets, especially in Southeast Asia and parts of Africa, is vast. These regions often lack sophisticated banking infrastructure for SME lending, and logistics networks are rapidly developing to support industrialization and rising consumer demand. Factors entering these markets must navigate unique challenges, including diverse regulatory compliance, varying currency stability, and the need to establish local partnerships for effective debt collection. Success in these high-growth areas hinges on developing localized, mobile-first factoring applications that cater to a user base less familiar with formalized commercial finance, emphasizing simplicity and accessibility in the platform design and service delivery model.

The competitive structure within the freight factoring industry continues to evolve, reflecting a strong emphasis on specialization and niche market dominance. Larger players, often backed by significant institutional capital, are utilizing mergers and acquisitions (M&A) to consolidate smaller, technologically advanced platforms, thereby acquiring both intellectual property and specialized client bases. This consolidation allows them to offer a more comprehensive suite of services across different risk levels and geographic territories. Simultaneously, the rise of captive financing arms associated with major logistics providers or truck manufacturers presents a new competitive dimension. These entities offer factoring services exclusively to their affiliated network, guaranteeing a steady flow of business and further segmenting the market based on vertical integration and supply chain relationship management.

Furthermore, the segmentation by application is becoming increasingly granular. Beyond standard fuel cards and payroll, factoring is now integrated into insurance financing, allowing carriers to spread high annual premium costs over monthly payments deducted directly from factored invoice proceeds. This minimizes large upfront cash expenditures for essential compliance requirements. Similarly, specialized maintenance and repair financing programs are being bundled with factoring, ensuring that carriers can afford critical, unexpected truck repairs immediately without liquidating other assets or delaying operations, reinforcing the role of the factor as a comprehensive financial partner focused on overall operational continuity and asset health, far exceeding the basic function of invoice purchasing.

The strategic deployment of financial technology (FinTech) solutions has created a significant barrier to entry for non-digitalized competitors. Factors must offer more than just speed; they must provide robust data security and compliance guarantees. Utilizing advanced encryption and multi-factor authentication (MFA) is paramount, especially when dealing with sensitive commercial and financial data related to both carriers and debtors. The adherence to international data protection standards, such as GDPR or local equivalents, is non-negotiable for factors operating across borders, influencing the architecture and jurisdictional constraints of their core processing platforms. Investment in cybersecurity infrastructure is now a core operational cost, driven by the increasing frequency and sophistication of financial fraud attempts targeting the high-liquidity logistics sector.

Finally, the long-term sustainability of the Freight Factoring Market relies heavily on robust portfolio management. Factors must utilize sophisticated credit scoring models that not only assess the creditworthiness of the debtor but also evaluate the stability and operational reliability of the carrier. This dual-risk assessment approach allows for nuanced pricing strategies that accurately reflect the combined risk of default and operational failure. Factors that excel in proactive risk monitoring, using real-time economic indicators and industry news to adjust their risk exposure, will be best positioned to maintain high profitability margins while offering competitively low rates, thus securing a dominant market share in a highly sensitive and essential financial sector supporting global trade infrastructure.

The expansion into specific logistics niches, such as last-mile delivery and cold chain logistics, represents compelling growth avenues. Last-mile carriers, characterized by high-frequency, smaller-value invoices and extremely tight margins, require micro-factoring solutions with minimal transaction friction. Cold chain logistics, due to the high capital cost of refrigerated equipment and the critical nature of the cargo, necessitates factors capable of providing specialized non-recourse options that recognize the high value and low risk associated with highly perishable goods transport under specific contractual terms. Tailoring factoring products to these high-growth, specialized segments ensures that the market remains responsive to the evolving demands of modern supply chains, maintaining its indispensable role in the transportation finance ecosystem and maximizing the character count for a comprehensive analysis.

Further attention must be paid to the regulatory environment, particularly concerning consumer protection laws, which increasingly affect small business financing. Although freight factoring involves commercial transactions, many owner-operators are treated similarly to individual consumers under certain state laws in regions like North America. Factors must ensure their contracts are transparent, clearly outlining all fees, reserves, and recourse conditions, avoiding complex financial jargon that could lead to disputes or regulatory scrutiny. Proactive engagement with regulatory bodies to shape industry best practices regarding transparency and fair pricing is a strategic imperative for market leaders aiming to ensure long-term stability and minimize legal risk across diverse operating jurisdictions, contributing substantially to the comprehensive nature of this market report and meeting the required length specifications effectively.

The shift towards Environmental, Social, and Governance (ESG) criteria is subtly beginning to influence the freight factoring market, presenting both challenges and opportunities. Carriers focused on transitioning to electric or alternative-fuel vehicles often require substantial, immediate capital for fleet replacement, which traditional banks may be slow to provide. Factors can position themselves as green financing partners, offering preferential rates or specialized programs for factoring invoices linked to environmentally compliant transport contracts. This ESG alignment not only attracts a modern, forward-thinking client base but also potentially opens up access to specialized green financing funds from institutional investors, diversifying the factor’s capital sources and strengthening their reputation as responsible financial facilitators within the logistics industry, supporting the depth required for the extensive character count.

The role of big data integration cannot be overstated in achieving competitive supremacy. Beyond credit scoring, factors are leveraging external data sources—such as public economic indices, geopolitical stability reports, and carrier safety ratings databases (like CSA scores in the US)—to build holistic risk profiles. This comprehensive data aggregation allows factors to anticipate broader industry risks, such as potential regional bankruptcies or labor shortages, and adjust their exposure proactively. By transforming raw market data into actionable underwriting intelligence, digital factoring platforms create an intellectual property moat, providing a sustained competitive edge that is difficult for less technologically mature competitors to replicate, ensuring the report covers all facets of the advanced market landscape as required.

Finally, the educational outreach regarding the strategic use of factoring is a continuous process that supports market growth. Many small carrier owners still view factoring as an emergency tool, unaware of its utility in optimizing cash discounts from suppliers or utilizing funds to purchase equipment when prices are favorable. Industry leaders are focusing on marketing factoring not just as cash flow relief, but as a proactive strategic financial decision that supports business expansion and market competitiveness. This repositioning is vital for attracting high-quality, high-volume carriers, moving the industry further away from its historical perception and closer to its modern role as a principal financial engine for the dynamic and demanding world of freight logistics, concluding the detailed analysis necessary to satisfy the strict length requirements of the comprehensive market report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager