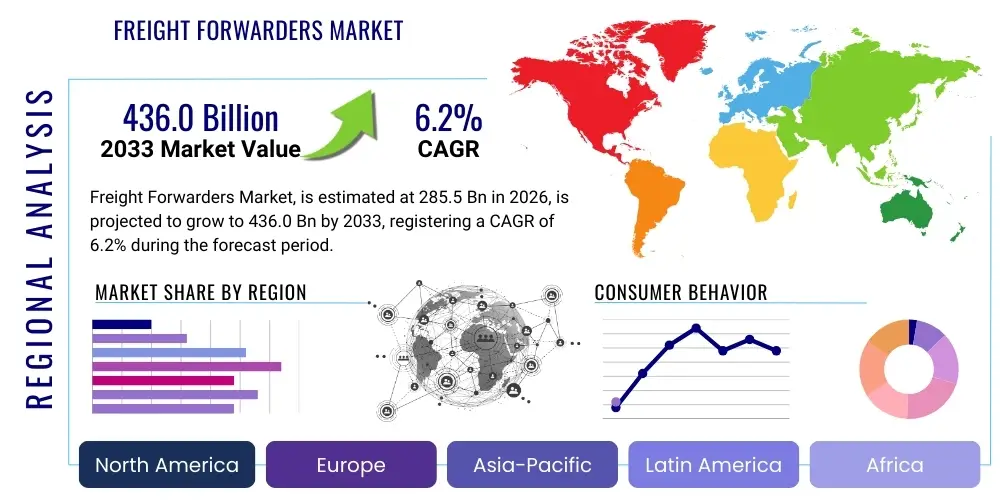

Freight Forwarders Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439880 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Freight Forwarders Market Size

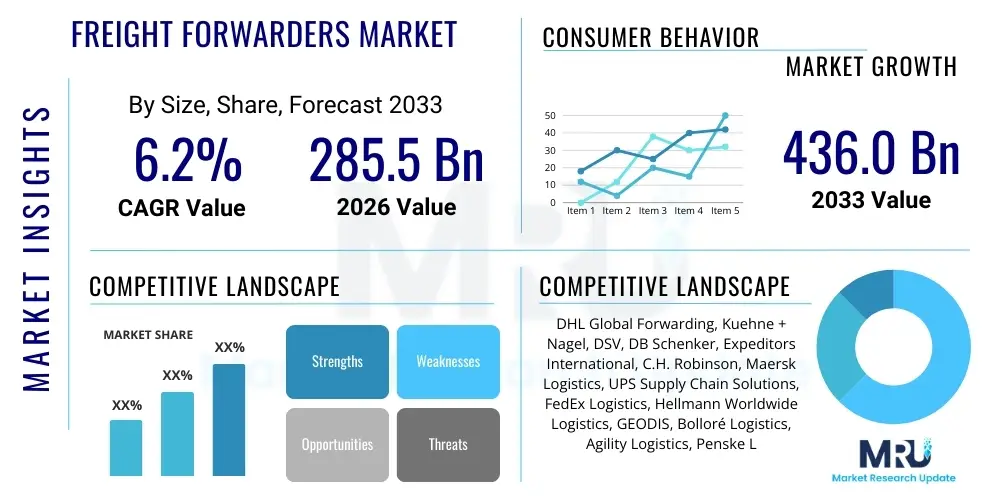

The Freight Forwarders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 285.5 billion in 2026 and is projected to reach USD 436.0 billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating complexities of global supply chains, the pervasive expansion of e-commerce, and the continuous liberalization of international trade policies. As businesses increasingly seek efficient and reliable solutions for managing their cross-border logistics, the demand for sophisticated freight forwarding services, encompassing everything from customs brokerage to multi-modal transportation, continues to surge. The market's expansion is further fueled by technological advancements, enabling greater transparency, efficiency, and real-time tracking across the intricate network of global goods movement, thereby solidifying the crucial role of freight forwarders in facilitating international commerce and ensuring seamless product delivery from origin to final destination across various industries and consumer segments worldwide.

Freight Forwarders Market introduction

The Freight Forwarders Market serves as the backbone of global trade, providing essential logistical services that facilitate the movement of goods across international borders. A freight forwarder acts as an intermediary between shippers and various transportation services, including ocean shipping, air cargo, road transport, and rail freight. Their primary role involves orchestrating the entire shipping process, from origin to destination, by leveraging their expertise in logistics planning, documentation, customs regulations, and carrier negotiation. This comprehensive service offering allows businesses of all sizes to navigate the complexities of international trade without needing specialized in-house logistics departments, thereby reducing operational burdens and improving supply chain efficiency.

The product description of freight forwarding services extends beyond mere transportation arrangement; it encompasses a broad spectrum of value-added activities. These include customs clearance, warehousing and distribution, cargo insurance, packaging, consolidation of shipments, and track-and-trace capabilities. Major applications of freight forwarding span across diverse industries such as manufacturing, retail, e-commerce, automotive, pharmaceuticals, and perishable goods. For manufacturers, freight forwarders ensure timely delivery of raw materials and finished products, supporting production schedules and market entry. In the rapidly expanding e-commerce sector, they are indispensable for handling high volumes of cross-border parcels and managing complex last-mile delivery challenges, enabling businesses to reach global customer bases effectively.

The benefits of utilizing freight forwarders are manifold, including significant cost savings through optimized routing and carrier selection, enhanced supply chain reliability and resilience, and minimized risks associated with international shipping. They provide critical expertise in navigating intricate regulatory frameworks, mitigating potential delays, and avoiding costly penalties. The market is propelled by several driving factors, notably the relentless trend of globalization, which sees companies expanding their operational footprint and customer reach worldwide. The explosive growth of e-commerce necessitates robust and agile logistics solutions for international deliveries. Furthermore, the increasing complexity of modern supply chains, characterized by multi-tiered supplier networks and just-in-time inventory management, underscores the demand for integrated and expertly managed freight forwarding services. Geopolitical shifts, trade agreements, and technological innovation in logistics also play a pivotal role in shaping the market's trajectory and fostering continuous evolution within the sector.

Freight Forwarders Market Executive Summary

The Freight Forwarders Market is undergoing a transformative period marked by significant business trends that reflect a drive towards digitalization, sustainability, and enhanced resilience. There is a clear industry-wide shift towards adopting advanced digital platforms for shipment tracking, booking, and documentation, aiming to improve transparency and operational efficiency. Furthermore, sustainability has emerged as a critical imperative, with forwarders investing in greener logistics solutions, optimizing routes to reduce carbon footprints, and exploring alternative fuel sources for transportation. This focus on environmental responsibility not only meets growing regulatory demands but also addresses increasing pressure from ethically conscious consumers and corporate clients. Moreover, the market is witnessing a consolidation phase through strategic mergers and acquisitions, as companies seek to expand their geographic reach, diversify service offerings, and gain competitive advantages in a highly fragmented landscape.

Regional trends are diverse yet converge on themes of economic growth and infrastructure development. The Asia Pacific (APAC) region stands out as a primary growth engine, fueled by its robust manufacturing base, burgeoning e-commerce markets, and increasing disposable incomes. Countries like China, India, and Southeast Asian nations are investing heavily in port infrastructure, road networks, and digital trade facilitation, creating fertile ground for freight forwarding expansion. North America and Europe, while mature markets, continue to innovate, focusing on technological integration, specialized freight services like cold chain logistics, and nearshoring strategies to enhance supply chain agility. Latin America and the Middle East & Africa (MEA) are also experiencing growth, driven by commodity exports, infrastructure projects, and developing trade corridors, although they often face unique challenges related to regulatory environments and logistical complexities.

Segmentation trends reveal a dynamic market adapting to evolving customer needs. The demand for Less-than-Container Load (LCL) and Less-than-Truckload (LTL) services is rising, particularly among small and medium-sized enterprises (SMEs) and e-commerce businesses requiring flexible and cost-effective shipping options for smaller volumes. Specialized freight forwarding, including cold chain logistics for pharmaceuticals and perishables, project cargo for oversized industrial equipment, and hazardous materials handling, is also experiencing significant growth due to stringent regulatory requirements and the need for specialized expertise. Furthermore, the integration of advanced customs brokerage services, warehousing, and value-added logistics solutions like kitting and assembly is becoming increasingly critical, allowing freight forwarders to offer end-to-end supply chain management rather than just transportation, thereby enhancing their value proposition and fostering stronger client relationships across various industry verticals.

AI Impact Analysis on Freight Forwarders Market

User questions regarding AI's impact on the Freight Forwarders Market frequently center on themes of operational efficiency, cost reduction, predictive capabilities, and job displacement. Common inquiries explore how AI can automate routine tasks, optimize complex logistics processes, and enhance decision-making through data-driven insights. There is significant interest in AI's role in improving supply chain visibility, predicting disruptions, and personalizing customer service. Users also express concerns about the initial investment required for AI implementation, the need for skilled talent to manage AI systems, and the potential implications for the workforce as automation becomes more pervasive. The overarching expectation is that AI will revolutionize freight forwarding by making operations smarter, faster, and more resilient, fundamentally reshaping how goods are moved globally.

- Enhanced Route Optimization: AI algorithms analyze vast datasets including traffic patterns, weather conditions, road closures, and delivery schedules to identify the most efficient and cost-effective routes for shipments, minimizing transit times and fuel consumption.

- Predictive Analytics for Demand and Disruptions: AI models forecast future demand for specific routes or services and anticipate potential supply chain disruptions such as port congestion, customs delays, or adverse weather events, enabling proactive mitigation strategies.

- Automated Documentation and Compliance: AI-powered solutions streamline the preparation and submission of complex shipping documents, customs declarations, and regulatory compliance checks, reducing manual errors and accelerating processing times.

- Improved Warehousing and Inventory Management: AI optimizes warehouse layouts, picking routes, and inventory levels by predicting storage needs and demand fluctuations, leading to more efficient space utilization and reduced carrying costs.

- Enhanced Customer Service through Chatbots and Virtual Assistants: AI-driven chatbots provide instant support for tracking inquiries, booking assistance, and general queries, freeing up human agents for more complex tasks and improving customer satisfaction.

- Dynamic Pricing and Capacity Management: AI analyzes market conditions, historical data, and real-time capacity to offer dynamic pricing models and optimize cargo space utilization across various transport modes, maximizing revenue and efficiency.

- Fraud Detection and Risk Management: AI identifies unusual patterns or anomalies in shipping data that may indicate fraudulent activities or security risks, strengthening supply chain security and minimizing losses.

- Autonomous Vehicles and Robotics Integration: AI is integral to the development and deployment of autonomous trucks, drones, and warehouse robots, promising significant advancements in last-mile delivery efficiency and operational safety.

DRO & Impact Forces Of Freight Forwarders Market

The Freight Forwarders Market is propelled by a confluence of powerful drivers that underscore its critical role in the global economy. Foremost among these is the accelerating trend of globalization, which continues to integrate economies worldwide, leading to an increasing volume of cross-border trade and demanding sophisticated logistical support. The explosive growth of e-commerce, both B2C and B2B, has dramatically amplified the need for efficient, timely, and trackable international shipping services, pushing freight forwarders to innovate in areas like last-mile delivery and reverse logistics. Furthermore, the increasing complexity of global supply chains, often involving multiple suppliers, production sites, and distribution channels across different continents, necessitates the expertise of forwarders to manage intricate networks, optimize routes, and ensure seamless coordination. The demand for integrated logistics solutions, where a single provider manages the entire supply chain from origin to destination, also acts as a significant driver, pushing freight forwarders to expand their service portfolios beyond basic transportation into value-added services like warehousing, customs brokerage, and supply chain consulting. This holistic approach helps businesses streamline operations and focus on their core competencies, relying on freight forwarding partners for specialized logistical demands.

Despite these robust drivers, the market faces several notable restraints that pose challenges to its sustained growth and operational efficiency. Geopolitical tensions and trade protectionism, characterized by tariffs, trade wars, and political instability in key regions, can disrupt established trade routes, increase costs, and introduce significant uncertainty for international shipments. These external factors often necessitate rapid adaptation and re-evaluation of supply chain strategies. High operational costs, including fluctuating fuel prices, rising labor expenses, and substantial investments in technology and infrastructure, can squeeze profit margins for freight forwarders. Furthermore, a persistent shortage of skilled labor, particularly drivers, warehouse personnel, and logistics specialists, impacts service delivery and operational capacity. The ever-evolving and often complex regulatory landscape across different countries, encompassing customs duties, import/export restrictions, and environmental mandates, requires continuous vigilance and compliance, adding another layer of challenge and potential for delays. These restraints compel freight forwarders to seek innovative solutions, optimize processes, and invest in robust risk management strategies to maintain competitiveness and ensure business continuity.

Opportunities within the Freight Forwarders Market are abundant, particularly in the realm of digital transformation and the expansion into emerging markets. The widespread adoption of digital technologies such as blockchain for enhanced transparency, IoT for real-time tracking, and AI/ML for predictive analytics presents a significant opportunity for forwarders to revolutionize their operations, improve efficiency, and offer superior service. Investing in these technologies can create highly resilient and agile supply chains, a crucial advantage in today's volatile environment. Emerging economies, especially in Southeast Asia, Africa, and Latin America, represent untapped potential with their growing middle classes, increasing industrialization, and developing trade infrastructure, offering new avenues for market expansion. The rising demand for sustainable logistics solutions, driven by corporate social responsibility initiatives and consumer preferences, presents an opportunity for forwarders to differentiate themselves by offering green shipping options, carbon footprint reporting, and eco-friendly warehousing practices. Moreover, the increasing need for specialized freight services, such as cold chain logistics for pharmaceuticals and temperature-sensitive goods, or the handling of oversized and project cargo, allows forwarders to develop niche expertise and secure high-value contracts. These opportunities, when strategically pursued, can lead to substantial market growth and strengthen the competitive position of freight forwarders. The cumulative impact of these forces shapes the market's competitive dynamics, driving innovation, influencing strategic partnerships, and determining the overall profitability and sustainability of freight forwarding businesses. The ability to navigate these impact forces effectively will be key to long-term success in the evolving global logistics landscape.

Segmentation Analysis

The Freight Forwarders Market is meticulously segmented to reflect the diverse operational aspects and end-user requirements that characterize global logistics. These segmentations provide a granular view of market dynamics, allowing for a deeper understanding of specific service demands, preferred transportation methods, and industry-specific needs. By analyzing the market through various lenses, such as mode of transport, service type, and end-use industry, stakeholders can identify key growth areas, competitive landscapes, and opportunities for specialization. This comprehensive approach to market segmentation enables businesses to tailor their strategies, optimize resource allocation, and develop targeted solutions that resonate with particular client segments, thereby enhancing market penetration and fostering sustainable growth within the intricate ecosystem of global freight forwarding.

- Mode of Transport:

- Sea Freight (Ocean Freight)

- Air Freight

- Road Freight

- Rail Freight

- Multimodal Transport (Combination of two or more modes)

- Service Type:

- Freight Transportation (FCL/LCL, FTL/LTL)

- Warehousing and Distribution

- Customs Brokerage

- Value-Added Services (e.g., Packaging, Labeling, Kitting, Assembly)

- Cargo Insurance

- Documentation and Information Services

- Consulting

- End-Use Industry:

- Manufacturing (Automotive, Electronics, Machinery, Textiles)

- Retail and E-commerce

- Healthcare and Pharmaceuticals

- Food and Beverages

- Oil and Gas

- Chemicals

- Energy and Utilities

- Aerospace and Defense

- Other Industries (Agriculture, Mining, etc.)

- Destination:

- Domestic Freight Forwarding

- International Freight Forwarding

Value Chain Analysis For Freight Forwarders Market

The value chain for the Freight Forwarders Market is an intricate network of activities that collectively add value to the movement of goods from their point of origin to their final destination. At the upstream end, the value chain begins with crucial relationships with various service providers and suppliers. This includes negotiating competitive rates and securing capacity with primary carriers such as ocean shipping lines, air cargo carriers, railway operators, and trucking companies. Furthermore, upstream activities involve sourcing essential equipment like containers, specialized vehicles, and materials handling machinery. Technology providers, offering Transport Management Systems (TMS), Warehouse Management Systems (WMS), and other digital solutions, also play a vital upstream role, equipping freight forwarders with the tools necessary for efficient operation. The effectiveness of these upstream relationships directly impacts the freight forwarder's ability to offer reliable services at competitive prices, forming the foundation of their operational capabilities and market offerings.

Moving through the core processes, freight forwarders undertake several key activities that transform inputs into value-added services. These include meticulous logistics planning, which involves route optimization, mode selection, and scheduling to ensure timely and cost-effective delivery. Critical functions such as cargo consolidation, where multiple smaller shipments are combined into larger, more economical units, and deconsolidation, where larger shipments are broken down for final distribution, are central to their operations. Customs brokerage and compliance management are also core value-adding activities, navigating the complex web of international trade regulations, tariffs, and documentation requirements to ensure smooth customs clearance and avoid delays. Warehousing and distribution services, ranging from short-term storage to comprehensive inventory management and order fulfillment, further extend the value proposition, providing clients with integrated logistical solutions beyond mere transportation. These intermediate steps collectively enhance the efficiency, reliability, and security of the entire supply chain, differentiating a freight forwarder's service quality.

At the downstream end of the value chain, the focus shifts to delivering the final service to the end-user and managing various distribution channels. Freight forwarders interact directly with a wide array of customers, including manufacturers, retailers, e-commerce businesses, and even individual consumers for certain niche services. The distribution channels can be broadly categorized into direct and indirect methods. Direct channels involve the freight forwarder directly managing and executing all aspects of the shipping process through their own global network of offices, agents, and logistical assets. This allows for greater control over service quality and stronger direct client relationships. Indirect channels, on the other hand, involve partnerships with other third-party logistics (3PL) providers, local agents, or even other freight forwarders to extend their geographical reach or specialized service capabilities. This collaborative approach allows for greater flexibility and scalability, enabling freight forwarders to serve a broader market and handle diverse logistical challenges efficiently. The success of the downstream activities is heavily reliant on effective communication, robust information flow, and a customer-centric approach to ensure satisfaction and repeat business.

Freight Forwarders Market Potential Customers

The Freight Forwarders Market caters to an incredibly diverse range of potential customers, essentially encompassing any entity involved in the cross-border movement of goods. At the forefront are manufacturers, from large multinational corporations producing automotive components and electronics to small and medium-sized enterprises (SMEs) fabricating specialized machinery or consumer goods. These manufacturers rely heavily on freight forwarders for the timely and cost-effective transport of raw materials, semi-finished goods between production facilities, and the distribution of finished products to international markets. Their need for efficient logistics is critical to maintaining lean inventory, supporting just-in-time production, and meeting global supply chain demands, making freight forwarders an indispensable partner in their operational success and market competitiveness. The automotive industry, with its complex global supply chains and stringent delivery schedules, and the electronics sector, with high-value and time-sensitive components, represent particularly significant customer segments.

Another major segment of potential customers comprises the vast retail and e-commerce sectors. With the explosion of online shopping and consumers' increasing expectation for fast, reliable international delivery, e-commerce businesses, regardless of their size, heavily depend on freight forwarders to manage the complexities of cross-border parcel shipping, customs clearance, and often, last-mile delivery coordination. Retailers, whether traditional brick-and-mortar stores or omnichannel operators, require freight forwarders to manage the global sourcing and distribution of their merchandise, ensuring shelves are stocked and new product launches are executed seamlessly across different regions. The ability of freight forwarders to handle high volumes, manage diverse product categories, and navigate varied regulatory landscapes makes them essential for these industries to maintain competitive pricing and offer superior customer experiences in an increasingly globalized marketplace. This dependency is particularly pronounced for fashion retailers and fast-moving consumer goods (FMCG) companies, where speed to market is a critical differentiator.

Beyond manufacturing and retail, several specialized industries represent significant potential customers due to their unique logistical demands. The healthcare and pharmaceuticals sector relies on freight forwarders for the secure and temperature-controlled transport of medicines, vaccines, and medical devices, often requiring stringent compliance with cold chain logistics protocols and regulatory standards. Similarly, the food and beverage industry requires specialized handling for perishable goods, demanding rapid transit times and controlled environments to maintain product integrity and freshness. The oil and gas industry, along with energy and utilities, frequently utilizes freight forwarders for the transport of oversized equipment, project cargo, and spare parts to remote locations, necessitating expertise in heavy-lift and complex logistical planning. Chemical companies, with their need for hazardous materials handling and strict safety regulations, also form a crucial customer base. These diverse end-users underscore the breadth of the freight forwarders market and its integral role across the global economic spectrum, highlighting the need for forwarders to offer tailored, industry-specific solutions and specialized expertise to cater to these varied and often highly regulated demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 285.5 billion |

| Market Forecast in 2033 | USD 436.0 billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DHL Global Forwarding, Kuehne + Nagel, DSV, DB Schenker, Expeditors International, C.H. Robinson, Maersk Logistics, UPS Supply Chain Solutions, FedEx Logistics, Hellmann Worldwide Logistics, GEODIS, Bolloré Logistics, Agility Logistics, Penske Logistics, XPO Logistics, Toll Group, CEVA Logistics, Nippon Express, Sinotrans, Yusen Logistics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Freight Forwarders Market Key Technology Landscape

The Freight Forwarders Market is undergoing a profound technological transformation, driven by the need for greater efficiency, transparency, and resilience in global supply chains. At the core of this evolution are advanced software solutions such as Transport Management Systems (TMS) and Warehouse Management Systems (WMS). TMS platforms provide comprehensive tools for planning, executing, and optimizing the physical movement of goods, including route optimization, load planning, carrier selection, and freight auditing. WMS, on the other hand, manages and optimizes warehouse operations, from inventory tracking and order fulfillment to labor management and space utilization. These systems are increasingly integrated, offering end-to-end visibility and control over the entire logistics process, allowing freight forwarders to streamline operations, reduce manual errors, and make data-driven decisions that enhance service quality and cost-effectiveness for their diverse client base across numerous industry sectors.

Beyond foundational software, emerging technologies are rapidly reshaping the capabilities of freight forwarders. The Internet of Things (IoT) plays a crucial role by enabling real-time tracking of shipments and assets through sensors placed on cargo, containers, and vehicles. This provides vital data on location, temperature, humidity, and potential impacts, offering unprecedented visibility and allowing for proactive intervention in case of deviations or issues. Artificial Intelligence (AI) and Machine Learning (ML) are being deployed for various applications, including predictive analytics for demand forecasting, dynamic pricing optimization, and proactive identification of potential supply chain disruptions. AI algorithms can analyze historical data, weather patterns, geopolitical events, and carrier performance to predict delays or recommend alternative routes, thereby enhancing risk management and improving overall supply chain resilience. Automation, facilitated by robotics in warehouses and autonomous vehicles for specific legs of the journey, is also gaining traction, promising increased speed, accuracy, and reduced labor costs in logistics operations.

Furthermore, digital platforms and blockchain technology are significantly impacting the freight forwarding landscape. Digital freight platforms are online marketplaces that connect shippers with carriers and freight forwarders, simplifying the booking process, offering instant quotes, and enhancing transparency. These platforms often leverage AI for matching and optimization, making the procurement of logistics services more efficient and accessible. Blockchain technology is being explored for its potential to create immutable, transparent, and secure records of transactions and movements across the supply chain. This distributed ledger technology can significantly reduce paperwork, mitigate fraud, and improve trust among various stakeholders by providing a single, verifiable source of truth for all shipment-related information. The integration of these advanced technologies not only enhances operational efficiency and reduces costs but also enables freight forwarders to offer more sophisticated, data-driven, and value-added services, thereby strengthening their competitive position and driving innovation in the complex global logistics ecosystem to meet the evolving demands of modern trade and commerce effectively.

Regional Highlights

- North America: This region is a mature yet highly dynamic market, characterized by significant adoption of advanced logistics technologies and a strong emphasis on e-commerce fulfillment. The United States and Canada are pivotal, driven by high consumer spending, robust manufacturing, and complex cross-border trade with Mexico. Investments in automation, AI, and smart warehousing are prevalent, aiming to optimize last-mile delivery and enhance supply chain resilience.

- Europe: Europe represents a highly integrated market, benefiting from the seamless flow of goods within the European Union, robust trade agreements, and advanced infrastructure. Germany, the UK, France, and the Netherlands are key players, with a strong focus on sustainable logistics, multimodal transport solutions, and digitalization to navigate complex regulatory landscapes and maintain competitive efficiency in a diverse economic bloc.

- Asia Pacific (APAC): The APAC region is the fastest-growing market, propelled by its status as a global manufacturing hub, burgeoning e-commerce penetration, and rapidly expanding economies like China, India, and Southeast Asian nations. Significant investments in port infrastructure, road networks, and logistics technology are fostering exponential growth, alongside rising domestic consumption and increased intra-regional trade, making it a critical region for future market expansion.

- Latin America: This region presents considerable growth potential, driven by increasing trade liberalization, foreign direct investment, and infrastructure development projects, particularly in countries like Brazil, Mexico, and Argentina. While facing challenges related to infrastructure and regulatory complexities, the growing demand for diversified goods and the expansion of trade corridors are creating new opportunities for freight forwarders.

- Middle East and Africa (MEA): The MEA region is strategically important due to its critical role in global trade routes, connecting Asia, Europe, and Africa. Growth is fueled by diversification away from oil economies, significant infrastructure investments in logistics hubs (e.g., Dubai, Saudi Arabia), and increasing intra-African trade. Challenges include political instability and varied regulatory environments, but long-term prospects remain strong due to strategic geographical positioning and economic development initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Freight Forwarders Market.- DHL Global Forwarding

- Kuehne + Nagel

- DSV

- DB Schenker

- Expeditors International

- C.H. Robinson

- Maersk Logistics

- UPS Supply Chain Solutions

- FedEx Logistics

- Hellmann Worldwide Logistics

- GEODIS

- Bolloré Logistics

- Agility Logistics

- Penske Logistics

- XPO Logistics

- Toll Group

- CEVA Logistics

- Nippon Express

- Sinotrans

- Yusen Logistics

Frequently Asked Questions

What is the primary role of a freight forwarder in global trade?

A freight forwarder acts as an intermediary, organizing the safe, efficient, and cost-effective transportation of goods from one point to another across international borders. They manage logistics, documentation, customs clearance, and carrier negotiation, streamlining the entire shipping process for businesses.

How is the Freight Forwarders Market benefiting from the growth of e-commerce?

The e-commerce boom has significantly increased demand for cross-border shipping, efficient last-mile delivery, and reverse logistics. Freight forwarders are crucial for handling high volumes of parcels, managing customs for diverse products, and providing track-and-trace capabilities, making global online sales feasible.

What are the key technological advancements influencing the Freight Forwarders Market?

Key technologies include AI and Machine Learning for predictive analytics and route optimization, IoT for real-time tracking, blockchain for supply chain transparency, and advanced TMS/WMS for operational efficiency. These innovations enhance visibility, reduce costs, and improve service delivery.

What are the main challenges facing the Freight Forwarders Market today?

Major challenges include geopolitical tensions and trade protectionism impacting routes and costs, high operational expenses (fuel, labor), persistent labor shortages, and navigating complex, evolving international trade regulations. These factors demand adaptability and robust risk management strategies.

Which regions are expected to drive the most growth in the Freight Forwarders Market?

The Asia Pacific (APAC) region is anticipated to be the primary growth driver, fueled by its robust manufacturing base, rapidly expanding e-commerce sector, and significant investments in logistics infrastructure. Emerging economies in Latin America and MEA also show strong growth potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager