Fresh and Packaged Asparagus Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435105 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fresh and Packaged Asparagus Market Size

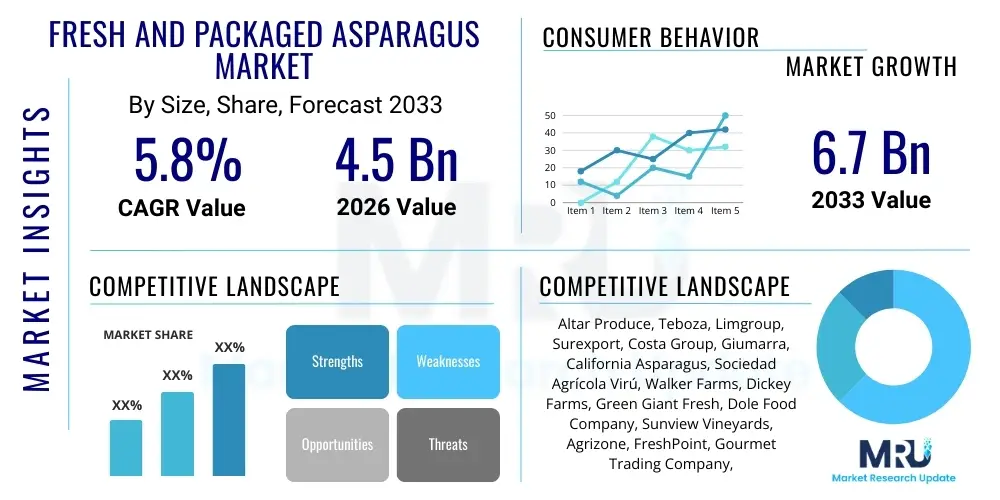

The Fresh and Packaged Asparagus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global consumer awareness regarding the significant health benefits associated with asparagus consumption, particularly its high nutritional content including vitamins K, A, and folate. Furthermore, the rising demand for convenient, ready-to-eat, and ready-to-cook vegetables, especially in developed economies, drives the packaged segment, supporting the overall market expansion and revenue generation across key producing and consuming regions.

The market expansion is heavily influenced by advancements in agricultural technology and cold chain logistics. Innovations in precision farming, such as IoT sensors and climate-controlled greenhouses, are enabling producers to achieve higher yields and consistent quality, mitigating risks associated with traditional open-field cultivation and seasonal variability. The demand for packaged asparagus, which often includes pre-cut, trimmed, or lightly cooked varieties, appeals directly to urban consumers seeking time-saving solutions. This convenience factor, coupled with effective branding and improved shelf-life achieved through modified atmosphere packaging (MAP), reinforces the market's value proposition and encourages higher per capita consumption globally.

Regionally, the market size is dictated by both production capabilities and consumption habits, with North America and Europe representing major revenue hubs due to established retail infrastructure and high purchasing power. The shift towards year-round availability, facilitated by efficient global trade routes connecting major suppliers like Peru, Mexico, and China to high-demand Western markets, ensures consistent supply and stable pricing dynamics. As emerging economies in Asia Pacific adopt Western dietary patterns and increase their focus on nutritious food items, they are expected to register the fastest growth rates, contributing significantly to the projected increase in market value by 2033, making the global asparagus sector highly dynamic and resilient.

Fresh and Packaged Asparagus Market introduction

The Fresh and Packaged Asparagus Market encompasses the trade, cultivation, processing, and distribution of both raw, unprocessed asparagus spears and various forms of packaged asparagus, including canned, jarred, frozen, and modified atmosphere packaged (MAP) fresh-cut varieties. Asparagus, scientifically known as Asparagus officinalis, is a perennial flowering plant valued for its young shoots (spears) which are utilized extensively in culinary applications globally, ranging from gourmet dishes to everyday meals. Major applications involve direct consumption as a side vegetable, incorporation into salads, stir-fries, and specialized food processing for institutional and retail markets. The primary benefit driving consumption is its strong nutritional profile, including anti-inflammatory properties, high fiber content, and status as a low-calorie, nutrient-dense food, aligning perfectly with contemporary health and wellness trends.

The market is critically shaped by the distinct segments of fresh versus packaged produce. The fresh segment demands stringent quality control and highly optimized cold chains due to the product's high perishability, typically sourcing from nearby or strategically located international suppliers capable of rapid transit. Conversely, the packaged segment, driven by the convenience and extended shelf life of frozen and canned products, allows for greater inventory stability and year-round utilization in industrial food preparation and budget-conscious retail environments. Key driving factors include rising disposable incomes in emerging markets, successful marketing campaigns highlighting the versatility and nutritional value of asparagus, and continuous innovation in packaging technologies that maintain freshness and minimize food waste throughout the supply chain.

Furthermore, the global shift towards plant-based diets and sustainable food sourcing has galvanized investment in asparagus cultivation. Asparagus cultivation, while initially capital-intensive and requiring patience due to its perennial nature, offers long-term yield stability and profitability. The market environment is characterized by intense competition among major growing nations leveraging seasonal advantages to dominate global trade flows. The integration of advanced farming practices, such as hydroponics and vertical farming experiments, although nascent, represents a future avenue for localized, sustainable fresh asparagus production, further diversifying the market landscape and ensuring consistent supply regardless of traditional climate restrictions or geographical limitations.

Fresh and Packaged Asparagus Market Executive Summary

The Fresh and Packaged Asparagus Market is poised for stable expansion, guided by robust business trends focusing on vertical integration, sustainable sourcing, and technological adoption across the supply chain. Key business trends indicate a consolidation among major growers and processors seeking to control quality and supply consistency from farm to shelf, alongside significant investment in cold storage and quick-freezing capabilities to minimize post-harvest losses. Regional trends show dominance by North America and Europe in terms of consumption value, driven by high consumer awareness and sophisticated retail distribution networks, while Latin America, particularly Peru and Mexico, remains the powerhouse in global fresh exports due to favorable climatic conditions and highly efficient production cycles. The Asia Pacific region is rapidly emerging, stimulated by changing dietary habits and the proliferation of modern retail formats, creating new avenues for both fresh and imported packaged asparagus products.

Segment trends underscore the enduring popularity of fresh asparagus, which commands a premium price point, often sourced regionally or via fast air freight to ensure maximum freshness and quality perception. However, the packaged segment, particularly frozen asparagus, is experiencing accelerated growth, driven by institutional demand (HORECA sector) and households prioritizing minimal preparation time and bulk purchasing efficiency. Within the packaged category, innovations are centered on enhancing nutritional retention and texture upon cooking, utilizing quick-freezing technologies. Color segmentation shows Green Asparagus maintaining its market leadership due to widespread availability and lower production costs, while White Asparagus retains niche popularity in European markets, often associated with gourmet cuisine and higher perceived luxury.

The market competitive landscape is defined by the necessity of adapting swiftly to climate volatility, stringent food safety regulations, and fluctuating labor costs. Strategic initiatives observed across the industry include diversification of sourcing locations to hedge against weather-related supply disruptions and aggressive implementation of automation solutions, particularly in harvesting and post-harvest handling. Overall, the executive assessment confirms a healthy, growth-oriented market where successful stakeholders are those who effectively manage supply chain complexity, capitalize on premium fresh products, and strategically leverage efficient packaging and preservation technologies to meet the dual demands of convenience and nutritional value that characterize modern consumer expectations.

AI Impact Analysis on Fresh and Packaged Asparagus Market

User inquiries regarding AI in the Fresh and Packaged Asparagus Market predominantly revolve around labor replacement, prediction accuracy, and quality assurance. Key themes include how AI-driven robotics can mitigate the severe labor shortages inherent in asparagus harvesting, the reliability of machine learning algorithms in predicting optimal harvest times and yields based on environmental data, and the application of computer vision systems for high-speed, non-destructive sorting and grading of spears. Consumers and industry stakeholders are keen to understand if AI integration will lead to increased production efficiency, lower retail prices, and, crucially, a higher consistency of product quality, addressing concerns about the highly variable nature of agricultural output and the difficulty of manual labor in maintaining uniform standards.

The implementation of Artificial Intelligence and Machine Learning (ML) is beginning to revolutionize labor-intensive aspects of the asparagus lifecycle. AI algorithms analyze massive datasets, including soil moisture, temperature, drone imagery, and historical yield data, to create highly accurate predictive models that optimize irrigation, fertilization schedules, and pest control, thereby maximizing resource efficiency and yield potential. Furthermore, machine vision systems integrated into processing lines are drastically improving the speed and precision of post-harvest grading, identifying defects, color variations, and spear thickness with far greater consistency than human operators. This capability is vital for the packaged segment where specific dimensional and aesthetic uniformity is essential for consumer appeal and automated processing.

Despite these technological advancements, the high initial capital investment required for specialized AI robotics, particularly autonomous harvesters capable of navigating varying terrain and delicate cutting, poses a significant adoption barrier for smaller farms. However, for large-scale operations supplying the packaged market, AI offers an unparalleled opportunity for operational scaling and cost reduction, mitigating reliance on seasonal migrant labor. The long-term trajectory suggests that AI will shift the labor focus from manual harvesting to sophisticated data management and machinery maintenance, necessitating new skills within the agricultural workforce and fundamentally reshaping the economics of asparagus production toward a more industrialized and technologically advanced farming model.

- Deployment of AI-powered computer vision for rapid defect detection and grading in packaging facilities.

- Integration of ML models for advanced yield forecasting, optimizing planting and harvest schedules based on climate data.

- Development of autonomous robotic harvesters to address chronic labor shortages and reduce labor costs significantly.

- AI-driven optimization of irrigation and nutrient delivery systems (Precision Agriculture) to conserve resources.

- Enhanced supply chain management through AI-predicted logistics demands, reducing transit time and spoilage rates.

DRO & Impact Forces Of Fresh and Packaged Asparagus Market

The Fresh and Packaged Asparagus Market is driven primarily by the escalating demand for healthy, convenient vegetables, supported by rapid advancements in cold chain infrastructure and preservation technologies. Restraints center around the perishable nature of the fresh product, high sensitivity to climate change impacts (water scarcity, extreme weather events), and the significant and unpredictable volatility of manual labor costs associated with traditional harvesting. Opportunities lie in expanding frozen and value-added packaged products, capitalizing on emerging markets' growing middle class, and integrating automation and sustainable farming practices to enhance operational resilience. Key impact forces include regulatory pressures concerning pesticide use, technological disruption from robotics, and shifts in global trade agreements affecting international sourcing and tariffs, collectively shaping profitability and market accessibility for producers globally.

Drivers contributing to market growth include the favorable nutritional profile of asparagus, actively promoted by health organizations and dietary trends emphasizing low-carb, high-fiber, and vitamin-rich foods, particularly in Western markets. Furthermore, improvements in Modified Atmosphere Packaging (MAP) technology have significantly extended the shelf life of fresh asparagus, reducing retail waste and increasing market reach. The increasing penetration of large-format retail (hypermarkets and supermarkets) globally ensures consistent demand and efficient distribution channels, making fresh and packaged asparagus readily available to a broader consumer base. These factors create a sustained upward pressure on global consumption volumes, necessitating increased production capacity and improved supply logistics efficiency.

Conversely, the market faces considerable restraints. Asparagus cultivation is inherently resource-intensive, requiring substantial upfront investment and a high dependency on consistent water supply, making it vulnerable to regional droughts and climate volatility. The most critical restraint, however, is the labor challenge; asparagus must be selectively hand-harvested daily during the peak season, resulting in high production costs and supply chain instability when labor availability is constrained. Opportunities, mitigating these risks, involve the widespread adoption of frozen asparagus, which locks in quality and nutritional value and bypasses the fresh product's ultra-short shelf life, enabling producers to serve industrial clients efficiently. Additionally, focusing on niche, high-value segments like certified organic or specialty colored asparagus offers premiumization strategies to offset rising operational expenditures.

Segmentation Analysis

The Fresh and Packaged Asparagus Market is comprehensively segmented based on product type, color, and distribution channel, providing a granular view of consumer preferences and market dynamics across various geographical regions. Analyzing these segments is critical for stakeholders to tailor production, processing, and marketing strategies effectively, ensuring maximum profitability. The primary segmentation criteria reflect variations in consumer requirements, where Product Type separates highly perishable, premium fresh produce from shelf-stable, convenient packaged goods, while Color segmentation addresses specific cultural and culinary demands across global markets.

The Product Type segmentation is foundational, dividing the market into Fresh Asparagus and Packaged Asparagus (which includes canned, frozen, and jarred varieties). The Fresh segment typically commands a higher price and dominates the consumer market in quality-sensitive regions, requiring sophisticated cold chain management. The Packaged segment, especially frozen asparagus, exhibits robust growth due to its convenience, extended usability, and reduced price volatility, making it a preferred choice for the Food Service (HORECA) sector and industrial food manufacturers. Furthermore, innovations within the packaged segment, such as microwavable pouches and steam-in-bag options, are driving consumer acceptance and reducing preparation barriers.

Color segmentation, distinguishing Green, White, and Purple asparagus, reflects varying production techniques and consumer traditions. Green asparagus accounts for the majority of global production and consumption due to its ease of cultivation and versatile culinary application. White asparagus, grown underground (etiolation) to prevent photosynthesis, is a specialty product highly valued in Europe, demanding higher labor intensity and thus fetching premium prices. Purple asparagus, known for its sweeter flavor and high anthocyanin content, remains a niche, high-value segment targeting health-conscious consumers. The Distribution Channel segmentation further details the sales landscape, dominated by Supermarkets/Hypermarkets but increasingly influenced by the expansion of Online Retail platforms and specialized food stores offering exotic or imported varieties.

- By Product Type:

- Fresh Asparagus

- Packaged/Processed Asparagus (Frozen, Canned, Jarred, Pickled)

- By Color:

- Green Asparagus

- White Asparagus

- Purple Asparagus

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Traditional Grocery Stores and Farmer Markets

- Food Service (HORECA)

- By Application/End-Use:

- Household Consumption

- Food Processing Industry

- Food Service Industry

Value Chain Analysis For Fresh and Packaged Asparagus Market

The value chain for the Fresh and Packaged Asparagus Market is inherently complex, spanning from specialized agricultural research and breeding (upstream) through intensive cultivation and harvesting, demanding sophisticated logistics (midstream), to final processing, packaging, and distribution (downstream). The upstream segment is characterized by genetic selection for disease resistance, yield optimization, and desired characteristics such as spear thickness and color. Cultivation involves long-term land commitment, significant initial capital, and highly optimized farming practices, including soil management and perennial root crown maintenance. The midstream processing stage is critical, encompassing immediate cooling post-harvest, sorting, trimming, and packaging—activities heavily influencing the final product quality and shelf life. The distribution channels determine market access, leveraging both direct sourcing models and indirect networks through wholesalers, importers, and major retail chain procurement centers.

Upstream analysis focuses heavily on input suppliers, including providers of seeds, fertilizers, irrigation systems, and specialized farm machinery. Significant value is created here through technological integration, such as precision agriculture tools, which enhance operational efficiency and resource utilization. The perennial nature of asparagus farming dictates that effective upstream investment in quality root crowns and sustainable soil health practices has a multi-year impact on profitability. Successful market players secure long-term contracts with reliable input suppliers and often invest in proprietary breeding programs to gain a competitive edge in terms of unique varieties or superior adaptation to local climates, minimizing reliance on generic inputs.

Downstream activities involve reaching the end consumer through various distribution mechanisms. Direct channels involve farm-to-consumer sales (e.g., farmers' markets, Community Supported Agriculture - CSA), emphasizing freshness and local appeal. Indirect distribution, which accounts for the vast majority of volume, utilizes large wholesalers and integrated retail supply chains. The choice between distributing fresh versus packaged product dictates the required downstream infrastructure: fresh requires highly controlled refrigerated trucking and storage, while packaged products utilize advanced processing facilities (freezing tunnels, canning lines) and less specialized, though still temperature-controlled, storage and transport. Strategic management of these distribution channels ensures product availability and optimizes inventory turnover, balancing the rapid sales cycle of fresh produce with the sustained market presence of packaged goods.

Fresh and Packaged Asparagus Market Potential Customers

The potential customers for the Fresh and Packaged Asparagus Market span a broad spectrum, categorized primarily into three major segments: major retail chains (supermarkets and hypermarkets), the Food Service/HORECA sector (Hotels, Restaurants, Cafés), and the industrial food processing sector. Retail customers, particularly large grocery chains, serve as the primary conduit for fresh asparagus reaching household consumers, demanding high volumes, stringent quality standards, and consistent year-round supply often necessitating global sourcing strategies. The Food Service sector, meanwhile, requires both fresh (for high-end dining) and large quantities of frozen or canned asparagus (for bulk meal preparation), valuing consistency, pre-cut formats, and stability in price and supply to manage kitchen costs effectively.

The growing preference for convenient meal solutions positions food processors as increasingly vital buyers. These industrial customers utilize packaged asparagus—predominantly frozen or canned—as an ingredient in prepared meals, frozen vegetable blends, soups, and specialized baby foods. This segment values stability of texture, ease of handling in automated processing lines, and robust sanitary standards enforced by strict industrial specifications. As the demand for ready-to-eat and heat-and-eat meals expands globally, especially among working professionals and time-constrained urban demographics, the role of food processors in driving demand for packaged asparagus input materials continues to escalate, offering steady, high-volume contracts to large-scale producers.

Furthermore, specialized institutional buyers, such as schools, hospitals, military bases, and catering companies, represent a consistent, albeit sometimes lower-margin, customer base. These institutions typically prioritize budget-friendly options and extended shelf life, making canned and frozen asparagus particularly attractive due to ease of storage and minimal preparation labor. Understanding the distinct purchasing criteria—whether it be the premium quality emphasis of high-end retailers, the cost efficiency focus of institutional buyers, or the ingredient specification needs of processors—is essential for growers and distributors aiming to maximize sales and tailor product offerings effectively across this diverse potential customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Altar Produce, Teboza, Limgroup, Surexport, Costa Group, Giumarra, California Asparagus, Sociedad Agrícola Virú, Walker Farms, Dickey Farms, Green Giant Fresh, Dole Food Company, Sunview Vineyards, Agrizone, FreshPoint, Gourmet Trading Company, Peruvian Harvest, Hijos de Rivera, Crown Jewels Produce, Fresca Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fresh and Packaged Asparagus Market Key Technology Landscape

The technological landscape in the Fresh and Packaged Asparagus Market is rapidly evolving, driven primarily by the need to address labor dependency, optimize yield consistency, and extend product shelf life. Key technologies focus on automation, precision agriculture, and advanced cold chain management. Automation, particularly the nascent integration of robotic harvesting systems utilizing complex sensor arrays and AI to selectively cut spears, promises to radically transform the upstream cultivation phase, mitigating the single greatest cost factor in production. Additionally, the widespread adoption of controlled environment agriculture (CEA) techniques, including specialized greenhouses, allows for year-round, high-density production in non-traditional growing regions, offering insulation against climate risk and ensuring local supply consistency.

Precision agriculture tools are crucial for maximizing resource efficiency in traditional farming. This includes the use of IoT sensors embedded in the soil to monitor moisture levels, nutrient uptake, and microclimate conditions in real-time. Data generated by these sensors feeds into sophisticated management systems that precisely control irrigation and fertilization, minimizing waste and ensuring optimal growth conditions for quality spear development. Furthermore, drone and satellite imagery facilitate high-resolution field mapping, enabling farmers to identify localized stressors and apply targeted interventions rather than blanket treatments, thereby reducing input costs and enhancing environmental sustainability through reduced chemical usage.

In the post-harvest phase, the technological focus shifts entirely to preservation and packaging. Modified Atmosphere Packaging (MAP) remains indispensable for fresh asparagus, significantly slowing down respiration rates and extending marketable life, which is critical for long-distance international trade. For the packaged segment, advancements in cryogenic freezing (Individual Quick Freezing - IQF) technology ensure that frozen asparagus retains superior texture, color, and nutritional integrity compared to older bulk freezing methods. These post-harvest technologies are foundational to global trade, enabling producers in Latin America and Asia to efficiently supply high-demand markets in Europe and North America with quality products throughout the year, independent of local seasonal availability constraints.

Regional Highlights

The global Fresh and Packaged Asparagus Market exhibits distinct consumption and production patterns across major geographical regions, influencing trade flows and investment priorities. North America, specifically the United States and Canada, represents a highly mature and lucrative market characterized by high per capita consumption of fresh produce, demanding premium quality and extensive product variety. Consumption is highly reliant on imports, particularly from Mexico and Peru, which maintain favorable bilateral trade agreements and climatic advantages. The demand here is strongly supported by well-established cold chains and a dominant retail landscape that effectively manages the rapid distribution of highly perishable fresh asparagus.

Europe stands out as a unique market, demonstrating high demand for both fresh Green asparagus (primarily imported) and a strong domestic tradition for White asparagus cultivation, particularly in Germany, Spain, and the Netherlands. European consumers place a significant emphasis on sustainability, local sourcing during the season, and organic certification, driving producers toward stringent environmental standards. The region also has a strong packaged goods sector, with canned and jarred white asparagus maintaining a loyal consumer base, catering to traditional culinary preferences and institutional requirements, demanding strategic differentiation in both sourcing and processing methods.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by the expanding middle class, increasing urbanization, and the Westernization of diets, leading to greater acceptance of high-value imported vegetables. China is a major global producer, but domestic consumption of both fresh and packaged asparagus is rising rapidly. Investment in modern supply chain infrastructure remains a key necessity in many APAC countries, providing significant opportunities for international exporters specializing in high-quality packaged and frozen products that can withstand less developed distribution networks, thereby accessing the burgeoning retail and food service industries across Southeast Asia.

- North America (US, Canada, Mexico): Dominant consumer market for fresh asparagus, heavily reliant on imports from Mexico and Peru; strong presence of packaged (frozen) products driven by convenience and food service demand. Mexico is a leading global supplier, leveraging proximity and year-round production cycles.

- Europe (Germany, Spain, Netherlands, France): High value market for specialty White asparagus; strong consumer focus on domestic sourcing and organic certification; sophisticated processing industry for canned and jarred varieties, particularly in Southern Europe.

- Asia Pacific (China, Japan, Australia): Fastest-growing consumption region; China is a major global producer; increasing demand for imported fresh and packaged goods fueled by lifestyle changes and rising disposable income; technological adoption in farming is accelerating in regions like Australia.

- Latin America (Peru, Chile): Global powerhouse for fresh asparagus exports, leveraging counter-seasonal advantages; Peru is the world's leading exporter, relying on intensive farming techniques and highly efficient air freight logistics to access international markets rapidly.

- Middle East and Africa (MEA): Emerging market with increasing penetration of modern retail; demand driven by expatriate populations and high-income segments; growth potential for packaged asparagus due to challenging local cultivation climates and logistical constraints.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fresh and Packaged Asparagus Market.- Altar Produce

- Teboza

- Limgroup

- Surexport

- Costa Group

- Giumarra

- California Asparagus

- Sociedad Agrícola Virú

- Walker Farms

- Dickey Farms

- Green Giant Fresh

- Dole Food Company

- Sunview Vineyards

- Agrizone

- FreshPoint

- Gourmet Trading Company

- Peruvian Harvest

- Hijos de Rivera

- Crown Jewels Produce

- Fresca Group

Frequently Asked Questions

What is the primary factor driving the demand for fresh versus packaged asparagus?

The primary driver for fresh asparagus is consumer preference for perceived superior flavor and nutritional value, catering to premium segments. Conversely, packaged asparagus (especially frozen) is driven by convenience, extended shelf life, minimal waste, and cost efficiency, appealing strongly to the food service industry and time-conscious households.

How does climate change impact global asparagus production?

Climate change severely impacts production through increased frequency of extreme weather events, such as excessive rainfall or droughts, leading to inconsistent yields and fluctuating supply. Asparagus cultivation is also highly sensitive to rising temperatures, which can necessitate substantial investments in protected cultivation (greenhouses) and advanced water management systems to ensure long-term viability.

Which region dominates the global export of fresh asparagus?

Latin America, specifically Peru and Mexico, dominates the global export of fresh asparagus. These countries benefit from highly advantageous climates that allow for year-round harvesting and efficient, well-established logistics chains, enabling them to supply North American and European markets during their off-seasons, ensuring continuous global availability.

What role does automation play in mitigating market restraints?

Automation, particularly the development and deployment of robotic harvesting and sophisticated optical sorting equipment, plays a critical role in mitigating the most significant market restraint: high labor costs and labor shortages. These technologies enhance efficiency, reduce manual handling errors, and provide necessary scalability for high-volume processors, stabilizing production economics.

Is the market experiencing a shift towards organic or specialty colored asparagus?

Yes, the market is experiencing a notable shift towards organic certification and specialty colors, such as purple asparagus. These segments command a premium price due to heightened consumer interest in health, sustainability, and unique culinary experiences, prompting growers to allocate resources to niche, value-added cultivation practices to enhance profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fresh and Packaged Asparagus Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fresh, Frozen, Preserved), By Application (Supermarkets/Hypermarkets, Convenience Stores, E-Commerce), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Fresh and Packaged Asparagus and Blueberries Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fresh Asparagus, Fresh Blueberries, Frozen Asparagus, Frozen Blueberries., Canned Asparagus, Canned Blueberries), By Application (Supermarkets/Hypermarkets, Convenience Stores, Online sales, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager