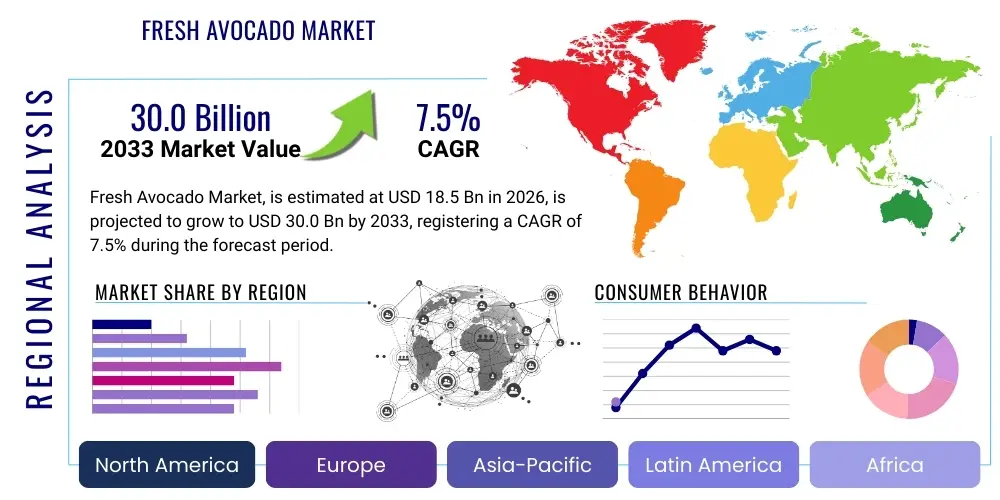

Fresh Avocado Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438371 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fresh Avocado Market Size

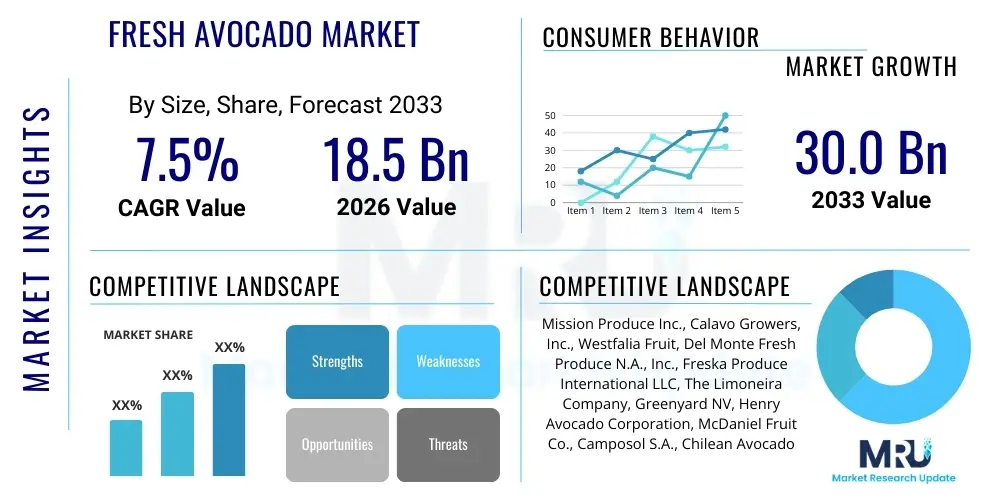

The Fresh Avocado Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.0 Billion by the end of the forecast period in 2033.

Fresh Avocado Market introduction

The Fresh Avocado Market encompasses the global trade and consumption of avocados (Persea americana) primarily sold in their whole, raw form, distinguished from processed products like avocado oil or guacamole. Avocados have transitioned from a niche fruit to a global commodity, driven primarily by increasing consumer awareness regarding their high nutritional value, including healthy monounsaturated fats, fiber, vitamins (K, C, E, B5, B6), and potassium. This pervasive health trend, coupled with the globalization of cuisine and expansion of international trade logistics, underpins the market's robust expansion across developed and emerging economies.

Product description highlights the dominance of the Hass variety, which accounts for the vast majority of global market share due to its excellent shelf life, distinctive flavor, and appealing texture. However, regional varieties like Fuerte and Zutano also contribute significantly to specific local markets. Major applications of fresh avocados span direct consumption in salads, sandwiches, and toasts, use as a primary ingredient in traditional dishes like guacamole, and integration into the expanding fast-casual and fine-dining segments. The versatility and rich profile of the fruit make it indispensable in modern culinary practices globally, supporting continuous demand growth.

Driving factors for the market are manifold, centering on demographic shifts, enhanced supply chain efficiencies, and strategic market development initiatives. Key benefits of market growth include improved farmer incomes in major producing regions (especially Latin America and parts of Africa), better nutritional outcomes globally, and increased retail activity. The market is increasingly sensitive to sustainable sourcing practices and robust quality control mechanisms, dictating investment in advanced cold chain management and phytosanitary compliance to maintain premium product quality across vast international distances.

Fresh Avocado Market Executive Summary

The Fresh Avocado Market exhibits dynamic business trends characterized by intense consolidation among large distributors and increasing vertical integration among major producers seeking greater control over quality and price stability. A noticeable shift is occurring towards year-round supply mandates, pressuring producers in traditionally off-season regions to implement advanced controlled environment agriculture (CEA) techniques or strategic sourcing alliances. Financialization of the supply chain, including futures contracts and sophisticated risk management tools, is becoming more prevalent due to the high volatility associated with climactic conditions and geopolitical trade policies. Furthermore, sustainability reporting and ethical labor practices are rapidly evolving from optional compliance measures to core competitive advantages, influencing procurement decisions in major consumer markets like the EU and North America.

Regional trends demonstrate a continued dominance of North America and Europe in terms of import value, though Asia Pacific, particularly China, is emerging as the fastest-growing consumption hub, driven by rapidly increasing middle-class populations adopting Western dietary habits. Production remains concentrated in Latin America, led overwhelmingly by Mexico, followed by Peru and Chile. However, strategic geopolitical diversification is pushing investment into non-traditional growing regions in Africa (e.g., Kenya and South Africa) and Southeast Asia, aiming to mitigate over-reliance on a few dominant suppliers and stabilize global prices. The logistical challenge remains paramount, requiring continuous investment in refrigerated shipping and optimized port infrastructure to ensure ripeness upon arrival.

Segmentation trends highlight the enduring strength of the conventional segment but reveal accelerated growth in the organic avocado segment, which commands significant price premiums, particularly in Western retail settings aligned with consumer preferences for chemical-free produce. Regarding end-users, the retail channel (supermarkets, hypermarkets, and specialized produce stores) retains the largest market share, but the foodservice segment (restaurants, hotels, and institutional catering) is experiencing rapid recovery and growth as dining out resumes globally. Technological integration, focusing on advanced ripening chambers and non-destructive testing for internal quality assurance, is key to optimizing product consistency across all market segments and achieving higher consumer satisfaction.

AI Impact Analysis on Fresh Avocado Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Fresh Avocado Market primarily revolve around how AI can mitigate supply chain risks, optimize yield predictability under climate stress, and enhance quality control for perishable goods. Key themes users inquire about include the feasibility of AI-driven precision agriculture for minimizing water and fertilizer use in avocado groves, the application of predictive analytics for better inventory management and price forecasting amidst global trade volatility, and the role of computer vision in automating sorting and grading processes at packing houses. Concerns often center on the accessibility of such advanced technologies for smallholder farmers and the requisite data infrastructure needed for effective AI deployment, alongside fears about job displacement in manual sorting operations.

The integration of AI technologies promises transformative improvements across the entire avocado value chain, addressing critical challenges related to perishability and variable supply. AI-powered algorithms are being used to analyze complex datasets encompassing satellite imagery, weather patterns, soil health metrics, and historical yield data to generate highly accurate forecasts, enabling growers to make proactive decisions regarding irrigation, pest management, and harvesting windows. Furthermore, in post-harvest processing, machine learning models analyze images from high-speed cameras to grade avocados based on external appearance, size, and internal defects (such as brown spots or vascular browning) with a speed and consistency far exceeding human capability, leading to reduced waste and improved market acceptance. This precision approach allows for better differentiation of product quality, maximizing revenue through optimal routing to various retail or processing channels.

AI's influence extends significantly into demand forecasting and logistical optimization. Retailers and distributors are leveraging sophisticated AI models to predict demand fluctuations in real-time, factoring in promotional activities, regional events, and competitive pricing, which allows for dynamic adjustment of cold storage settings and transportation schedules. This optimized logistics chain reduces transit time and spoilage, a crucial factor given the sensitivity of avocados to temperature changes. For consumers, AI tools are also being integrated into smart packaging or retail displays to offer personalized ripening advice, thereby improving the end-user experience and reinforcing purchase loyalty, ultimately bolstering overall market growth.

- AI-driven Precision Agriculture: Optimizing irrigation schedules and nutrient delivery based on hyper-local data to maximize yield and resource efficiency in groves.

- Predictive Yield Forecasting: Utilizing machine learning on satellite imagery and historical data to accurately estimate harvest volumes months in advance, stabilizing trade planning.

- Automated Quality Grading: Employing computer vision systems in packing houses to detect internal and external defects non-destructively, enhancing sorting speed and consistency.

- Supply Chain Optimization: Implementing algorithms for dynamic routing and inventory management based on real-time demand signals, minimizing spoilage during transport.

- Pest and Disease Detection: Using drone and image recognition technology to identify early signs of pathogens or pest infestations, allowing for targeted, minimal intervention.

- Market Price Prediction: Analyzing global economic indicators, trade flows, and climatic risks to forecast future market prices for improved financial risk management.

DRO & Impact Forces Of Fresh Avocado Market

The Fresh Avocado Market is governed by a robust interplay of Drivers, Restraints, and Opportunities, which collectively define the Impact Forces shaping its trajectory. The primary driver is the accelerating consumer recognition of avocados as a superfood, fueled by aggressive global marketing and successful integration into diverse global cuisines, moving it beyond ethnic food status. Simultaneously, rising disposable incomes in emerging Asian and Latin American markets provide the purchasing power necessary to sustain this high-value commodity. However, market expansion faces significant restraints, chiefly characterized by severe supply chain vulnerabilities related to climate change impacts, leading to unpredictable harvests and extreme price volatility. Furthermore, stringent phytosanitary regulations and persistent geopolitical trade tensions necessitate complex compliance frameworks, often increasing operational costs and limiting market access.

Opportunities within the market are predominantly focused on geographical diversification and value-added product development. Developing new, resilient growing regions in Africa and Asia not only hedges against supply risks concentrated in Latin America but also allows for extended season coverage, ensuring a more stable year-round supply. Significant opportunities exist in penetrating untapped, large-scale consumer markets such as India, where current per capita consumption is negligible but potential growth is enormous. Moreover, investment in advanced cold chain technology, including optimized controlled atmosphere (CA) storage and specialized ripening facilities located near major consumer hubs, offers a chance to dramatically reduce post-harvest losses and improve product quality consistency, thereby enhancing consumer experience and justifying premium pricing.

The impact forces are fundamentally oriented towards achieving supply stability and sustainability. The high profit margins inherent in the avocado trade attract significant corporate investment, driving technological adoption from farm to fork. Conversely, the market’s reliance on extensive water resources and susceptibility to complex agricultural diseases exerts pressure towards sustainable farming certifications (e.g., GlobalGAP, Fair Trade) and advanced breeding programs aimed at developing drought-resistant and high-yield varieties. The delicate balance between fulfilling skyrocketing global demand and managing environmental and logistical constraints defines the competitive landscape, pushing market players towards innovation in risk management and ethical sourcing practices to secure long-term viability and growth.

Segmentation Analysis

The Fresh Avocado Market is systematically segmented based on criteria such as Variety, Origin, End-User, and Distribution Channel, allowing for granular analysis of consumer preferences and supply chain optimization strategies. The segmentation reveals distinct price sensitivities and quality expectations across different market strata. For instance, the segmentation by Variety underscores the overwhelming dominance of the Hass cultivar globally, while the segmentation by End-User clearly delineates the massive volume demands from the retail sector versus the specific quality requirements of the high-end foodservice industry. Understanding these segments is crucial for producers and distributors to tailor their product offering, logistical planning, and marketing efforts to maximize penetration and profitability in target markets.

- By Variety:

- Hass

- Fuerte

- Pinkerton

- Reed

- Other Varieties (Zutano, Bacon, etc.)

- By End-User:

- Retail (Supermarkets, Hypermarkets, Convenience Stores, Online)

- Foodservice (Hotels, Restaurants, Cafes, Institutional Catering)

- By Distribution Channel:

- Offline (Traditional Retail, Specialty Stores)

- Online/E-commerce

- By Origin/Type:

- Conventional

- Organic

Value Chain Analysis For Fresh Avocado Market

The Fresh Avocado Market value chain is complex and geographically dispersed, beginning with upstream activities focused on agricultural production. The upstream segment involves significant investment in specialized horticulture, including advanced grafting techniques, irrigation infrastructure, and sophisticated pest management systems required for high-density planting of commercial varieties like Hass. Crucial upstream challenges include managing the long juvenile period of avocado trees (3-5 years before commercial harvest) and mitigating the risks associated with unpredictable weather and specific diseases like Laurel Wilt. Success in the upstream segment relies heavily on robust R&D, continuous varietal improvement, and adherence to strict phytosanitary protocols mandated by importing nations, establishing the baseline quality and volume available for global trade.

Midstream activities primarily encompass harvesting, post-harvest handling, packing, and initial distribution. Harvesting must be meticulously timed to ensure optimal oil content and ripening potential. The packing house stage is critical, involving sorting, grading by weight and size, quality inspection, and crucially, pre-cooling. Advanced packing houses utilize automated systems and cold chain logistics to quickly reduce the fruit's field temperature, extending shelf life. Distribution channels are highly specialized, often relying on refrigerated shipping (reefers) and specialized third-party logistics (3PL) providers adept at managing controlled atmosphere environments across long transcontinental voyages. Direct channels involve large producer cooperatives supplying major retailers or processors, while indirect channels utilize large commodity traders and wholesalers who manage market risk and distribute smaller volumes to diverse end-users.

Downstream activities include ripening, final retail distribution, and consumption. Ripening is a specialized process, typically performed in controlled-atmosphere ripening rooms near the end consumer, ensuring the fruit reaches retail shelves at the optimal stage of readiness (e.g., firm, almost ready, or ready-to-eat). The retail segment focuses on efficient inventory rotation and minimizing shrink due to spoilage. Direct engagement with consumers through branding and promotional campaigns highlights the nutritional benefits and versatility of the product. The complexity of the value chain necessitates strong coordination and data sharing across all nodes, increasingly supported by blockchain technology for enhanced traceability and transparency, satisfying both consumer demand for origin transparency and regulatory compliance requirements.

Fresh Avocado Market Potential Customers

The primary potential customers and end-users of fresh avocados are diverse, spanning both business-to-consumer (B2C) and business-to-business (B2B) segments, reflecting the fruit's broad appeal and versatility. On the B2C side, the core customer base comprises health-conscious millennials and Generation Z consumers in developed economies who prioritize nutrient-dense whole foods and incorporate avocados into everyday meals, often influenced by social media food trends. This segment is highly responsive to organic certifications and sustainable sourcing narratives. Additionally, expanding middle-class populations across Asia, specifically China and India, represent a rapidly emerging customer base, drawn to the perceived status and nutritional value associated with globally traded produce, driving volume growth.

In the B2B space, the largest cohort of customers is modern retail entities, including major international supermarket chains (hypermarkets and specialty food stores) and rapidly expanding e-commerce grocery platforms. These customers demand large, consistent volumes, high quality standards, and precise delivery schedules, often requiring specialized ripening services managed by the distributor. Their procurement decisions are heavily influenced by supplier capacity, pricing stability, and adherence to strict food safety standards (e.g., GFSI benchmarks). The increasing focus on private label branding within retail also necessitates deeper, often exclusive, partnerships with large-scale producers.

The Foodservice sector constitutes the second major B2B customer base, encompassing quick-service restaurants (QSRs), full-service dining establishments, and institutional catering operations (hospitals, schools). QSRs, particularly those focusing on health bowls, salads, and Tex-Mex cuisine, require high volumes of processed or ready-to-use avocados, often utilizing specialized processors rather than whole fruit directly. Full-service restaurants value premium quality, aesthetic appeal, and consistency for use as a high-value garnish or ingredient. This sector's demands often focus on year-round availability and specific ripeness profiles, making the relationship with specialized importers who manage cold storage and ripening crucial for reliable supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mission Produce Inc., Calavo Growers, Inc., Westfalia Fruit, Del Monte Fresh Produce N.A., Inc., Freska Produce International LLC, The Limoneira Company, Greenyard NV, Henry Avocado Corporation, McDaniel Fruit Co., Camposol S.A., Chilean Avocado Committee, Corporación Lindley S.A., Nature's Pride BV, Costa Group Holdings Ltd., Avo Holding Corp., Index Fresh, La Lucila S.A.C., Frutura, Valley Avocado Sales, Avocados from Mexico (AFM) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fresh Avocado Market Key Technology Landscape

The Fresh Avocado Market relies heavily on a specialized technology landscape designed to manage the delicate balance between quality preservation and extended shelf life, addressing the fruit's inherent perishability. Central to this landscape are advancements in Controlled Atmosphere (CA) and Modified Atmosphere Packaging (MAP) technologies. CA storage units are crucial for slowing down the ripening process during transcontinental shipment, precisely regulating temperature, humidity, and atmospheric gas composition, particularly levels of oxygen and carbon dioxide, allowing shippers to halt or dramatically reduce respiration rates for several weeks. This technology is indispensable for maintaining supply consistency across long supply routes from major producers like Peru and Chile to distant markets in Europe and Asia, significantly mitigating the risk of premature spoilage and reducing market losses.

In agriculture (upstream), the focus is shifting towards precision farming techniques enabled by IoT (Internet of Things) and sensor networks. Soil moisture sensors, weather stations, and drone-based imaging provide real-time data to growers, enabling precise irrigation and targeted application of inputs, which is critical given the avocado tree's sensitivity to water stress and the increasing regulatory scrutiny on water usage. Additionally, breeding technologies are advancing, focusing on developing new rootstocks and cultivars that offer enhanced resistance to critical diseases (e.g., Phytophthora root rot) and improved tolerance to drought and salinity. These biological technologies are foundational for securing future yields against the backdrop of intensifying climate change impacts, ensuring the long-term sustainability of the market.

Post-harvest technology includes significant investment in advanced sorting and grading systems. Non-destructive testing (NDT) methods, such as Near-Infrared (NIR) spectroscopy, are being deployed to assess internal quality attributes like dry matter content and oil percentage, which are key indicators of ripeness potential and flavor, without damaging the fruit. Coupled with sophisticated robotics and high-speed computer vision systems mentioned in the AI analysis, these technologies ensure that avocados are sorted based on both external appearance and internal readiness, facilitating the creation of differentiated product lines (e.g., 'Premium Select' versus 'Economy Grade'). Furthermore, traceability systems, often utilizing blockchain, provide an immutable record of the fruit’s journey from the grove to the consumer, meeting the rising demand for transparency and mitigating potential food safety crises.

Regional Highlights

The global fresh avocado market demonstrates pronounced regional disparities in both production and consumption patterns, heavily influencing trade flows and price mechanisms. North America, particularly the United States, represents the largest and most valuable import market globally, sustained by high per capita consumption and sophisticated retail infrastructure. Mexico remains the undisputed world leader in production and primary exporter to the U.S., resulting in a highly integrated but geopolitically sensitive cross-border supply chain. Europe is a high-growth consumption region, benefiting from strong demand in Germany, France, and the UK, with supply diversified across Latin America and emerging African sources, positioning logistics and port infrastructure as critical competitive elements. Conversely, Asia Pacific, led by the rapid adoption in China and Japan, is the fastest-growing market, characterized by consumers who associate avocados with Western dietary trends and wellness, presenting massive potential for future volume expansion.

- North America: Dominant consumer market, characterized by high per capita consumption and reliance on year-round supply primarily from Mexico (Hass). Focus on ready-to-eat programs and advanced retail logistics.

- Europe: High growth rate, driven by Western European health trends. Supply diversification is key, sourcing from Peru, Chile, South Africa, and Spain. Strong demand for organic and Fair Trade certified products.

- Asia Pacific (APAC): Fastest-growing consumption region, fueled by expanding urban middle classes in China and Japan. Market growth requires overcoming logistical barriers and educating consumers on usage and ripening.

- Latin America: The primary global production hub (Mexico, Peru, Chile, Colombia). Focus is on maximizing export efficiency, managing political stability, and improving water management practices for sustained yield.

- Middle East and Africa (MEA): Emerging producer region (Kenya, South Africa) focusing on export to Europe and Asia. MEA markets are nascent in consumption but critical for global supply diversification and stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fresh Avocado Market.- Mission Produce Inc.

- Calavo Growers, Inc.

- Westfalia Fruit

- Del Monte Fresh Produce N.A., Inc.

- Freska Produce International LLC

- The Limoneira Company

- Greenyard NV

- Henry Avocado Corporation

- McDaniel Fruit Co.

- Camposol S.A.

- Chilean Avocado Committee

- Corporación Lindley S.A.

- Nature's Pride BV

- Costa Group Holdings Ltd.

- Avo Holding Corp.

- Index Fresh

- La Lucila S.A.C.

- Frutura

- Valley Avocado Sales

- Avocados from Mexico (AFM)

Frequently Asked Questions

Analyze common user questions about the Fresh Avocado market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continuous growth of the Fresh Avocado Market globally?

The continuous growth is primarily driven by escalating consumer awareness of the avocado's superior nutritional profile, including high levels of healthy fats and fiber, coupled with successful marketing campaigns positioning it as a lifestyle superfood. Furthermore, the globalization of culinary trends, particularly the increasing popularity of Tex-Mex and healthy quick-service dining, sustains high demand across major Western markets and rapidly expanding Asian economies.

How does climate change affect the Fresh Avocado Market supply stability?

Climate change significantly impacts supply stability by introducing extreme weather events like prolonged droughts or unseasonal rains, which directly affect flowering, fruit set, and overall yield in major producing regions. This variability leads to unpredictable harvest sizes, causing severe price volatility and creating logistical challenges for importers attempting to secure consistent, high-quality supply streams necessary for retail commitments.

Which geographical region holds the largest market share in the Fresh Avocado trade?

North America, specifically the United States, holds the largest market share in terms of consumption and import value, driven by high consumer adoption and entrenched culinary integration. Production dominance is firmly held by Latin America, with Mexico being the world’s largest producer and exporter, primarily supplying the immense demand in the US market.

What are the key technological advancements utilized in the post-harvest management of avocados?

Key technological advancements include sophisticated Controlled Atmosphere (CA) storage during transcontinental shipping to significantly extend shelf life, advanced non-destructive testing (NDT) like Near-Infrared spectroscopy for internal quality assessment (dry matter content), and automated ripening chambers near retail hubs, ensuring the fruit reaches consumers at optimal readiness.

What role does the organic segment play in the overall Fresh Avocado Market?

The organic segment plays a premium role, exhibiting a significantly higher growth rate than the conventional market, particularly in developed regions like North America and Europe. While smaller in volume, the organic segment commands substantial price premiums and caters to a dedicated consumer base prioritizing sustainable, chemical-free production methods, driving investments in certified organic farming practices.

The comprehensive analysis underscores the Fresh Avocado Market's trajectory as one defined by both significant opportunity and persistent environmental and logistical risks. The market's resilience will be tested by its ability to integrate advanced technological solutions, ranging from AI in farm management to blockchain in supply chain transparency, ensuring that global demand can be met sustainably without compromising quality or increasing price volatility excessively. Strategic geographical diversification and continuous investment in cold chain infrastructure are mandatory for stakeholders aiming to capitalize on the robust consumer-driven growth anticipated through 2033. The competition among key players is increasingly focused not just on volume, but on the capacity to deliver consistently high-quality, ethically sourced produce year-round, making supply chain mastery the ultimate competitive differentiator in this high-value agricultural commodity market.

Future growth hinges critically on market access expansion into emerging economies, particularly across the Asia Pacific region, which requires tailored marketing strategies to overcome low initial consumer familiarity and substantial investments in local infrastructure. Furthermore, regulatory environments concerning food safety, pesticide residues, and traceability are becoming stricter, compelling all market participants—from smallholder farmers to multinational distributors—to adhere to elevated global standards. Successfully navigating these regulatory complexities while optimizing operational efficiency will determine market leadership in the coming decade, confirming the Fresh Avocado Market's status as a dynamic and perpetually evolving global agricultural powerhouse. The continuous scientific efforts to develop disease-resistant varieties and optimize water use are essential mitigating factors against climate-related vulnerabilities, providing a long-term foundation for sustained market expansion. These integrated efforts ensure the market remains attractive to both capital investment and consumer preference over the forecast period, reinforcing its financial and nutritional importance globally.

The transition toward greater transparency throughout the value chain is also a profound trend, supported by technological implementation. Consumers are increasingly demanding verifiable proof of origin and ethical labor standards, pushing leading industry participants to adopt certifications and digital traceability tools. This not only enhances consumer trust but also strengthens the market's security against counterfeiting and unauthorized sourcing, protecting the brand equity associated with premium avocado producers. The intersection of consumer ethics, technological innovation, and critical logistics management defines the current competitive landscape, ensuring that only those enterprises capable of sophisticated, integrated operations will thrive. This intense focus on end-to-end quality control and verifiable sustainability metrics solidifies the market's move toward maturity, differentiating it from traditional agricultural commodity trading.

The expansion of controlled environment agriculture techniques, while still nascent for avocados compared to high-value greens, represents a long-term strategic investment area, particularly for securing local or niche markets facing severe seasonal supply gaps. While capital-intensive, these methods offer unparalleled control over growing conditions, potentially mitigating the severe weather risks that plague open-field operations. Furthermore, the development of value-added avocado products, such as fresh-cut or prepared guacamole sold through retail channels, presents an important opportunity to manage excess supply and extend product utility beyond the fresh fruit segment, though the fresh fruit market remains the financial core. These supplementary segments enhance overall market fluidity and profitability. The synergistic combination of robust consumer demand and strategic technological investment guarantees the market's high growth potential, maintaining its attractiveness to global investors focusing on staple, healthy food supply chains.

A critical consideration for future market dynamics involves optimizing trade agreements and mitigating tariffs, which historically have introduced significant friction and cost barriers, particularly in trans-Pacific and trans-Atlantic trade routes. Efforts by industry organizations and government bodies to standardize phytosanitary requirements and streamline customs procedures are vital for unlocking further growth potential, particularly in high-volume, cost-sensitive markets. Furthermore, the evolving landscape of digital commerce and direct-to-consumer models, facilitated by e-commerce platforms and sophisticated cold-chain last-mile delivery, provides an avenue for premium producers to bypass traditional wholesale intermediaries, potentially capturing greater margins while offering consumers fresher, more directly sourced products. This digital transformation reinforces the need for robust supply chain visibility and dynamic pricing strategies across all layers of the distribution network.

Finally, the competitive environment is increasingly characterized by mergers and acquisitions, where large global fresh produce companies seek to acquire specialized growing assets or leading cold storage and ripening capabilities to achieve scale and control critical supply chain nodes. This consolidation reflects the high barrier to entry associated with establishing large-scale, export-compliant avocado operations, favoring vertically integrated entities capable of managing risk from grove development to retail placement. The pressure to maintain stable prices against unpredictable harvest volumes necessitates sophisticated financial hedging tools and global sourcing capabilities, positioning multi-regional operators with advanced data analytics capabilities at a distinct advantage over single-region, traditional farming entities. Therefore, the future market structure is expected to be more concentrated and technologically advanced, driven by the imperative of stability and efficiency in a volatile global climate.

This detailed market segmentation and operational analysis confirm that the Fresh Avocado Market's growth engine remains fundamentally strong, supported by non-discretionary health trends and deepening global culinary integration. Success within this market demands meticulous attention to environmental stewardship, precision agriculture, and the application of cutting-edge cold chain technologies to bridge the distance between production hot zones and high-demand consumption centers effectively. The continuous integration of AI and machine learning into operational processes promises the next leap in efficiency and waste reduction, solidifying the avocado's position as a premium global fruit commodity, justifying its projected growth trajectory and increased strategic importance in the global food supply matrix.

The sustained influx of capital into research and development, particularly concerning varietal resilience and disease control, is a core indicator of the industry's commitment to overcoming inherent biological limitations. Advanced genomic studies are being utilized to accelerate the breeding cycle, aiming to introduce commercial varieties that require less water and exhibit greater natural defenses against devastating diseases, such as the destructive fungal diseases prevalent in major growing regions. Such biological innovation is essential for long-term supply assurance, which is a paramount concern for major retailers committed to year-round stocking. The investment cycle in these upstream technologies reflects a proactive approach by industry leaders to future-proof their operations against anticipated ecological and climatic challenges, which pose the most significant external threat to the market's forecasted value growth.

Furthermore, labor practices and social compliance are evolving into material risks that require careful management. Given the concentration of production in developing nations, ensuring fair wages, safe working conditions, and adherence to international labor standards is no longer optional but a prerequisite for market entry into discerning Western consumer markets. Certifications such as Fair Trade and Rainforest Alliance are gaining substantial traction, acting as gatekeepers for premium shelf space. Companies that fail to demonstrate transparent and ethical labor supply chains risk severe reputational damage and market exclusion. This shift towards corporate social responsibility acts as a powerful non-price determinant of competitive advantage, compelling large stakeholders to invest heavily in verifiable social auditing and community engagement programs in their sourcing regions.

The regulatory framework governing international avocado trade is becoming increasingly complex, especially concerning Maximum Residue Limits (MRLs) for pesticides set by the European Union and the United States. Compliance requires sophisticated monitoring systems throughout the growing and post-harvest process. Any regulatory breach can lead to immediate border rejection and severe financial penalties, underscoring the necessity for robust quality control management and documented transparency. Consequently, technological solutions that enable real-time tracking of input usage and automatic generation of compliance reports are highly valued, reducing the margin for human error and accelerating customs clearance processes. This stringent regulatory environment effectively favors large-scale operators who possess the necessary resources and infrastructure to manage these complex compliance burdens efficiently and reliably.

The overall competitive structure of the Fresh Avocado Market is migrating towards a globalized, highly integrated, and technologically dependent model. The sheer scale required to meet global demand necessitates large logistics networks, significant capital investment in refrigerated infrastructure, and advanced data-driven forecasting capabilities. As consumer demand continues its upward trajectory, the market’s reliance on seamless cross-border supply, predicated on predictable supply volumes and consistent quality, will only intensify. This environment rewards efficiency and vertical control, ensuring that stakeholders who manage the environmental, logistical, and social complexities most effectively will dominate the forecasted growth and secure the highest premium pricing opportunities globally.

The dynamics of retail promotion and consumer engagement also play a vital role in shaping market outcomes. Strategic partnerships between producers' marketing associations (like Avocados From Mexico) and major retail chains drive significant short-term spikes in demand and reinforce year-round consumption habits. These campaigns leverage strong branding, nutritional education, and social media influence to continuously refresh consumer interest and integrate avocados into diverse culinary contexts beyond traditional uses. Successful market penetration in new territories, particularly in APAC, relies heavily on localized educational efforts to teach consumers about optimal ripening, usage versatility, and storage, transforming unfamiliarity into sustained consumption patterns. Therefore, marketing investment is as critical as agricultural output for sustaining high growth rates.

The long-term outlook for the Fresh Avocado Market is overwhelmingly positive, underpinned by secular trends in global health consciousness and expanding discretionary income in key demographic segments. The ability of the industry to strategically invest in resilient supply chains, adopt cutting-edge agritech, and maintain ethical sourcing practices will be determinative. The confluence of these factors ensures that while challenges related to climate and logistics persist, the underlying market drivers are sufficiently powerful to sustain the projected CAGR, cementing the avocado’s status as a strategically important, high-growth global agricultural product for the foreseeable future. The continued financialization of the market, including greater use of financial instruments to hedge price risks, further stabilizes returns and encourages long-term infrastructure investment.

Furthermore, the segmentation analysis reveals that the 'ready-to-eat' avocado category is emerging as a major differentiator, offering enhanced convenience to consumers and commanding a price premium. This segment requires even more specialized logistics and inventory management, focusing on precise monitoring of ethylene gas levels and temperature control in ripening rooms to ensure the fruit reaches the customer at peak readiness. The technology used in this specific segment, including specialized sensors and advanced inventory rotation algorithms, minimizes product loss and maximizes consumer satisfaction, directly contributing to repeat purchases and brand loyalty. Investment in 'ready-to-eat' infrastructure represents a strategic imperative for distributors targeting high-income urban consumer bases willing to pay extra for immediate usability, driving premiumization across the entire market spectrum.

The market's evolution also necessitates enhanced collaboration between growers, logistics providers, and regulatory bodies to standardize quality metrics and simplify cross-border trade. Harmonizing international phytosanitary standards would drastically reduce bureaucratic friction and associated costs, particularly benefiting smaller producers seeking access to international markets. Currently, differing regulatory requirements across North America, the EU, and Asia create complex, often redundant, compliance burdens. A future characterized by greater multilateral cooperation on agricultural trade standards would significantly accelerate volume throughput and reduce market latency, thereby maximizing the efficiency of the globally stretched avocado supply chain. This push for standardization is a critical, albeit often slow, force driving systematic market improvement.

In summary, the Fresh Avocado Market is a benchmark for modern globalized agriculture, characterized by high growth, technological integration, and systemic risk management requirements. Its future success is intrinsically tied to sustainability, technological innovation, and ethical supply chain management. The projections for the market size demonstrate strong investor confidence and sustained consumer preference, reinforcing the narrative of the avocado as a highly valued, indispensable part of the global diet, securing its place as a key commodity in the fresh produce sector through the forecast period and beyond.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager