Fresh Fruits and Vegetables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437264 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Fresh Fruits and Vegetables Market Size

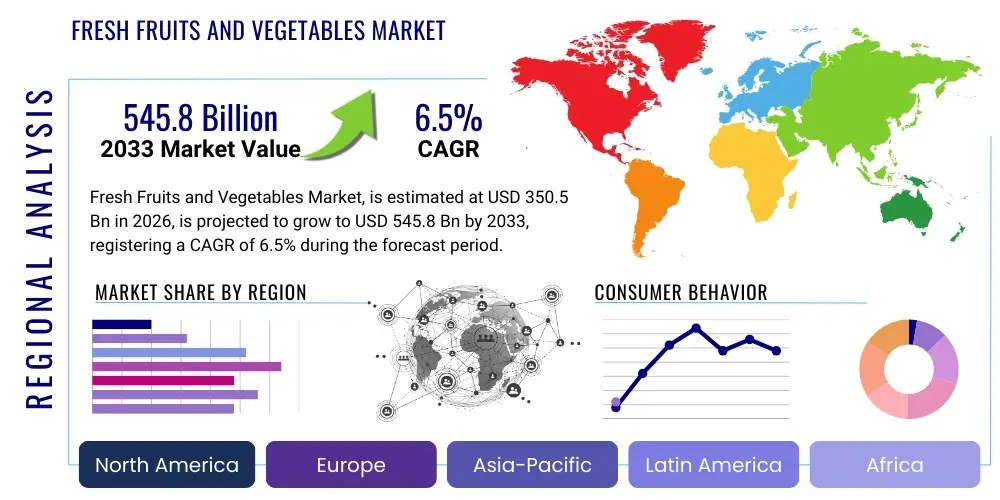

The Fresh Fruits and Vegetables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 545.8 Billion by the end of the forecast period in 2033.

Fresh Fruits and Vegetables Market introduction

The Fresh Fruits and Vegetables Market encompasses the cultivation, harvesting, processing, packaging, distribution, and sale of perishable plant-based edible products consumed in their fresh or minimally processed state. This sector is foundational to global food security and public health, driven by increasing consumer awareness regarding nutrition and the shift towards plant-centric diets. Major applications include direct consumer consumption, food service industries, and ingredient sourcing for specialized food processing, such as fresh-cut produce and ready-to-eat meals. The inherent benefits of these products—high vitamin, mineral, and antioxidant content—are directly fueling market expansion. Key driving factors include population growth, rising disposable income in developing economies, advanced cold chain logistics enabling longer transit distances, and widespread governmental and health organization initiatives promoting the consumption of five servings of fruits and vegetables daily.

Fresh Fruits and Vegetables Market Executive Summary

The global fresh fruits and vegetables market is witnessing robust growth, largely underpinned by critical shifts in business operations focusing on sustainability and digitalization. Business trends highlight the increasing investment in controlled environment agriculture (CEA), such as vertical farms and greenhouses, which offers consistent yield regardless of climatic volatility and reduces transportation costs by locating production closer to urban consumption centers. Regional trends indicate that Asia Pacific (APAC) is poised for the fastest expansion, driven by massive population density, rapid urbanization, and the modernization of traditional supply chains. North America and Europe remain mature markets characterized by high demand for organic, locally sourced, and exotic produce. Segment trends demonstrate significant growth in the ready-to-eat and fresh-cut segment, reflecting consumer demand for convenience, while distribution is increasingly shifting towards e-commerce platforms, requiring sophisticated last-mile cold chain management systems to minimize spoilage and maintain quality standards, thereby redefining traditional grocery retail models.

AI Impact Analysis on Fresh Fruits and Vegetables Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fresh Fruits and Vegetables Market primarily revolve around optimizing yield, improving quality control, and ensuring supply chain resilience. Consumers and industry stakeholders are concerned with how AI can mitigate labor shortages through automation, reduce the environmental footprint associated with cultivation and logistics, and predict market demand fluctuations more accurately. Key themes emerging from this analysis include the potential for precision agriculture to revolutionize farming practices, the use of computer vision for automated quality grading and sorting, and leveraging predictive analytics to minimize post-harvest losses, which are currently a major financial and resource drain globally. Expectations are high that AI will lead to a more efficient, sustainable, and transparent fresh produce supply chain.

AI's role in diagnostics and predictive maintenance within controlled environments, such as identifying early signs of plant disease or optimizing nutrient delivery schedules, provides growers with actionable, real-time insights, shifting farming from reactive management to proactive intervention. Furthermore, in the complex domain of cold chain management, machine learning algorithms analyze historical temperature data, external weather patterns, and transportation durations to dynamically adjust cooling parameters, ensuring optimal preservation conditions from farm gate to consumer retail shelf. This enhanced data visibility facilitated by AI significantly reduces waste and improves overall product integrity and shelf life.

The integration of AI-powered robotics in harvesting and packaging operations addresses critical challenges related to labor intensity and consistency. Robotics equipped with advanced sensors can accurately assess ripeness and gently harvest delicate produce, mitigating bruising and mechanical damage often associated with manual handling. In logistics, AI optimizes routing and inventory management by predicting store-level demand variations and adjusting shipment sizes accordingly, minimizing overstocking and subsequent product degradation. These technological implementations are crucial for sustaining margins in a highly competitive, low-margin sector.

- AI-powered predictive analytics optimize planting schedules and crop yield forecasting.

- Computer vision systems enable automated, rapid quality grading and sorting of produce.

- Machine learning algorithms enhance cold chain monitoring and real-time temperature adjustments.

- Robotics and automation mitigate manual labor shortages during harvesting and packaging.

- AI assists in early detection and diagnosis of plant diseases and pest infestations (precision agriculture).

- Optimization of irrigation and fertilization schedules leading to reduced water and resource usage.

DRO & Impact Forces Of Fresh Fruits and Vegetables Market

The market trajectory is significantly shaped by dynamic market forces encompassing drivers (D), restraints (R), and opportunities (O). The primary drivers include escalating global health consciousness, leading to increased dietary recommendations favoring produce, and the rapid expansion of organized retail and e-commerce platforms enhancing accessibility. Conversely, major restraints involve the highly perishable nature of the products, which necessitates costly and complex cold chain infrastructure, alongside susceptibility to volatile weather events and disease outbreaks impacting supply consistency. Opportunities are abundant in the areas of technological innovation, specifically vertical farming and genetic research for improved shelf life, and the expansion into emerging markets adopting Western dietary patterns. These individual factors collectively exert a powerful impact force, driving supply chain innovation while concurrently raising capital expenditure requirements across the value chain.

Drivers of Market Growth

One of the most powerful drivers is the widespread recognition of the link between fresh produce consumption and chronic disease prevention. Global health authorities and public campaigns actively promote higher consumption rates, influencing consumer purchasing habits across all demographic segments, particularly in developed nations where lifestyle diseases are prevalent. This health trend is translating directly into higher average spending on fresh, non-processed foods, leading to sustained demand irrespective of minor price fluctuations. Furthermore, the rising adoption of flexitarian, vegetarian, and vegan diets globally acts as a perpetual stimulus, broadening the consumer base and increasing the frequency of produce purchases.

The globalization of trade and improvements in transport infrastructure have dramatically expanded the year-round availability of non-seasonal and exotic fruits and vegetables, satisfying continuous consumer demand. Specialized shipping, including controlled atmosphere storage technology (CA storage) in sea freight containers, has reduced reliance on expensive air freight, making long-distance sourcing economically viable. This diversification of sourcing regions mitigates localized supply shocks, ensuring a more stable global market. Additionally, the proliferation of large supermarket chains and the subsequent rise of organized retail formats, especially in emerging economies, provide dedicated, climate-controlled spaces for fresh produce, improving quality and reducing in-store waste.

Technological advancement in seed breeding and post-harvest handling plays a critical supporting role. Research and Development (R&D) efforts are continuously generating new varieties of fruits and vegetables that boast longer shelf lives, enhanced disease resistance, and improved nutritional profiles. This ensures that growers can achieve higher yields per hectare with lower risk, while consumers benefit from produce that maintains freshness for longer after purchase, tackling one of the industry's longest-standing challenges. These technological investments create a positive feedback loop, encouraging further expansion and consolidation within the farming and distribution sectors.

- Increasing consumer focus on health and nutrition (Dietary shifts toward plant-based foods).

- Expansion of organized retail and modern trade infrastructure globally.

- Improvements in cold chain logistics and controlled atmosphere storage technologies.

- Governmental support and initiatives promoting agriculture and food safety standards.

- Rising global population and urbanization driving demand for convenience products (fresh-cut).

Market Restraints and Challenges

The primary constraint facing the fresh fruits and vegetables market is the extremely short shelf life and high susceptibility to spoilage, fungal growth, and bacterial contamination. This inherent perishability mandates significant investment in specialized infrastructure, including refrigeration units, rapid transit methods, and meticulous handling protocols, substantially elevating operational costs compared to non-perishable food items. Any failure in the cold chain system, particularly in regions with underdeveloped infrastructure or frequent power outages, results in substantial post-harvest losses, severely affecting profitability and resource efficiency.

External environmental factors, such as increasing climate volatility, drought, unseasonal rainfall, and the emergence of new plant diseases resistant to conventional treatments, represent significant restraints on production volume and consistency. Growers face heightened risks related to crop failure, requiring expensive mitigation strategies, including specialized irrigation systems or relocation to more climatically stable zones. Regulatory complexity, particularly regarding pesticide use, residue levels, and international phytosanitary standards, also imposes burdens on cross-border trade, requiring rigorous testing and certification processes that slow down the supply chain and increase compliance costs.

Furthermore, the fresh produce industry is highly labor-intensive, especially for hand-harvested items, leading to susceptibility to wage inflation and persistent labor shortages in key growing regions, particularly in developed countries. Automation adoption remains challenging due to the variability in size, shape, and fragility of different produce items, making generalized robotic solutions difficult to implement widely. This dependency on manual labor makes the sector vulnerable to economic shocks and migration restrictions, contributing to unpredictable supply costs and potentially impacting retail prices, which can dampen consumer demand sensitive to price fluctuations.

- High perishability and significant post-harvest losses (spoilage rates).

- Dependency on specialized and costly cold chain infrastructure.

- Vulnerability to climate change, extreme weather events, and disease outbreaks.

- Fluctuating commodity prices and high labor intensity in farming operations.

- Strict governmental regulations and stringent phytosanitary standards in international trade.

Market Opportunities

The most compelling opportunity lies in the rapid development and commercialization of Controlled Environment Agriculture (CEA), particularly vertical farming and advanced greenhouse technology. CEA minimizes external risks, such as weather and pests, allows for hyper-local production near high-density urban centers, drastically reducing transportation emissions and costs, and provides consistent, predictable yields year-round. This opportunity appeals strongly to retailers seeking dependable, locally branded supply sources and consumers prioritizing sustainability and local provenance.

The surging demand for certified organic, non-GMO, and ethically sourced produce presents significant premium market opportunities. Consumers are increasingly willing to pay a higher price point for products associated with sustainable farming practices, transparency regarding origin, and enhanced environmental stewardship. Market participants who invest in certifications, implement blockchain technology for enhanced traceability, and effectively communicate their sustainability narratives can capture high-value niche segments, improving overall profit margins beyond conventional bulk produce sales.

Digital transformation, particularly the integration of Internet of Things (IoT) sensors, advanced data analytics, and e-commerce logistics, offers avenues for optimizing the distribution bottleneck. Developing sophisticated Direct-to-Consumer (D2C) channels and perfecting 'last-mile' refrigerated delivery services allows producers to bypass traditional intermediaries, gaining greater control over pricing and customer experience. This shift also creates opportunities for specialized services focused purely on ensuring quality assurance and minimizing delivery time, thus satisfying the growing consumer expectation for quick, fresh delivery.

- Investment in Controlled Environment Agriculture (CEA) like vertical and indoor farming.

- Growing market penetration of organic, non-GMO, and specialty/exotic produce.

- Technological integration (IoT, Blockchain) for enhanced traceability and supply chain transparency.

- Expansion of e-commerce and direct-to-consumer (D2C) distribution models.

- Development of new functional and nutraceutical-rich produce varieties through biotechnology.

Impact Force Analysis

The Fresh Fruits and Vegetables Market is currently experiencing a high-impact force driven by the convergence of health awareness (Driver) and technological innovation (Opportunity). The fundamental societal shift towards preventative health measures elevates the intrinsic value of fresh produce, ensuring continuous market pull. Concurrently, the necessity of overcoming inherent restraints like perishability and climate risk pushes continuous, high-level investment into technologies such as precision agriculture and advanced post-harvest treatments. These investments generate a potent impact force that simultaneously addresses operational inefficiencies, enhances product quality, and supports the market's overall scale and sustainability.

However, this positive driving force is partially counterbalanced by the medium-to-high impact of supply chain complexity and environmental volatility (Restraints). While technology offers solutions, the immediate capital expenditure required for global cold chain implementation and the time needed for mass adoption of CEA techniques prevent a seamless transition. Geopolitical instability and trade wars occasionally interrupt established supply routes, amplifying localized price spikes and supply variability. The market is thus characterized by accelerated growth potential mediated by inherent systemic risks related to logistics and nature, mandating highly adaptive and resilient business strategies.

The long-term outlook suggests that the positive impact forces, particularly those related to digitalization and sustainable sourcing, will increasingly dominate. As emerging economies stabilize their regulatory frameworks and expand modern retail infrastructure, the market will consolidate, leading to higher efficiency and reduced wastage rates. Companies that successfully leverage data analytics to predict demand and integrate vertical farming methods into their core supply strategy will realize superior margins and market dominance, transforming the traditional agricultural model into a technology-intensive, high-value industry segment.

Segmentation Analysis

The Fresh Fruits and Vegetables Market segmentation allows for a detailed understanding of consumer preferences, distribution efficacy, and regional consumption patterns. The market is primarily segmented based on product type into fruits and vegetables, each exhibiting distinct growth dynamics influenced by seasonality, storage requirements, and culinary usage. Further segmentation by distribution channel is crucial, differentiating between traditional wholesale markets, modern organized retail (supermarkets and hypermarkets), and the rapidly expanding online retail sector. Geographic segmentation highlights the disparity in maturity, infrastructure, and growth rates between developed regions like North America and Europe, which focus on value-added convenience products, and rapidly developing regions such as Asia Pacific, which are modernizing basic food infrastructure.

The fruits segment generally commands a higher perceived value and benefits heavily from the convenience trends, particularly in categories like berries, grapes, and citrus, which are often consumed as snacks. The vegetable segment, foundational to meal preparation globally, sees robust demand driven by staple consumption and high growth in niche segments such as leafy greens and root vegetables cultivated through controlled methods. Analyzing the distribution channels reveals a structural shift: while traditional markets still dominate in volume in many developing nations, the quality assurance and standardized handling protocols offered by supermarkets and e-commerce platforms are increasingly preferred by the urban middle class, prioritizing convenience, traceability, and hygiene standards.

Strategic analysis of these segments is vital for market participants to tailor their investment strategies. For instance, producers targeting high-value consumers in mature markets should focus on organic certification and packaging innovation for the fresh-cut segment, typically distributed through high-end retailers. Conversely, companies aiming for mass market penetration in populous regions must prioritize cost-effective bulk handling, resilient logistics, and strong relationships with large wholesale distributors and hypermarket chains, which rely on volume efficiency to maintain competitive pricing.

- Product Type

- Fruits (e.g., Citrus, Berries, Tropical Fruits, Pome Fruits)

- Vegetables (e.g., Leafy Greens, Root Vegetables, Bulb Vegetables, Cruciferous Vegetables)

- Distribution Channel

- Supermarkets and Hypermarkets

- Traditional Markets and Street Vendors

- Convenience Stores and Retail Outlets

- Online Retail and E-commerce Platforms

- Food Service Sector (Horeca)

- Form

- Whole/Fresh

- Fresh-Cut/Pre-packaged

Value Chain Analysis For Fresh Fruits and Vegetables Market

The value chain for fresh fruits and vegetables is inherently complex due to the product's delicate nature, starting with upstream activities involving agricultural input suppliers (seeds, fertilizers, machinery) and primary producers (farmers/growers). Upstream dynamics are heavily influenced by biotechnology advancements focusing on yield improvement and disease resistance, necessitating high capital investment in modern farming techniques and land preparation. Successful farmers integrate precision agriculture tools, optimizing resource allocation based on real-time field data, forming the crucial foundation for maintaining quality and volume required downstream.

The midstream segment involves critical post-harvest activities: harvesting, sorting, grading, packaging, and storage (cold storage). Efficiency at this stage is paramount, as quality deterioration accelerates post-harvest. The distribution channel then takes over, encompassing logistics providers, wholesalers, and various intermediaries who manage the movement of temperature-sensitive goods through regional and international networks. Direct distribution involves producers selling directly to major retailers or food service clients, offering greater control but higher complexity, while indirect distribution relies on multiple specialized wholesalers and aggregators, common in traditional markets.

Downstream activities focus on the final point of sale, including supermarkets, traditional wet markets, and e-commerce platforms, where the produce is merchandised and sold to the end consumer. Traceability and consumer trust are vital downstream components; modern retail relies on stringent quality checks and clear labeling regarding origin and handling. The integration of advanced cold chain infrastructure across the entire chain—from refrigerated storage at the farm to temperature-controlled display cases in stores—is the defining feature that determines profitability and minimizes the substantial waste inherent in this market segment.

Fresh Fruits and Vegetables Market Potential Customers

The primary end-users and potential customers of the Fresh Fruits and Vegetables Market are segmented across both B2C (Business-to-Consumer) and B2B (Business-to-Business) categories. The B2C segment, consisting of individual households and consumers, is the largest volume purchaser, driven by daily consumption needs and increasingly by health and wellness trends. Within this segment, urban consumers, particularly those with higher disposable incomes, exhibit a strong preference for pre-packaged, organic, and exotic varieties, typically sourced through modern retail channels and specialized online grocers seeking convenience and premium quality products.

The B2B segment constitutes a major growth engine, encompassing the Food Service sector (hotels, restaurants, catering – HORECA), institutional buyers (schools, hospitals, corporate cafeterias), and the food processing industry. The HORECA sector demands consistent quality, specific cuts, and reliable year-round supply for menu planning, often relying on specialized suppliers for large volumes of fresh-cut or prepared vegetables and fruits. The processing industry uses fresh produce as raw materials for juices, frozen foods, and ready-to-eat meals, requiring high-volume, standardized inputs that meet strict industrial specifications and safety standards, making them highly sensitive to price and quality consistency.

Emerging potential customers include players in the nutraceutical and functional food sector, which utilize specific fruits and vegetables recognized for high levels of specific nutrients or bioactive compounds, such as high-anthocyanin berries or specialized leafy greens. These buyers prioritize genetic strain and cultivation methods that maximize functional ingredient concentration. Furthermore, the burgeoning meal kit delivery services represent a rapidly growing B2B customer base, requiring highly precise, small-batch, pre-portioned fresh ingredients delivered in complex logistical formats that adhere to strict freshness and portion size requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 545.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dole plc, Fresh Del Monte Produce Inc., Total Produce, Chiquita Brands International, Driscoll's, Bonduelle SA, Olam International, Syngenta AG, Bayer AG (Crop Science Division), Costa Group, The Greenery, Limoneira Co., Sunripe Produce, California Giant Berry Farms, Rijk Zwaan, G’s Fresh, T&G Global, Fyffes, Zespri Group Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fresh Fruits and Vegetables Market Key Technology Landscape

The technological landscape in the fresh produce market is rapidly evolving, driven by the imperative to increase yield, reduce post-harvest loss, and ensure year-round supply consistency. Key technologies currently transforming the sector include advanced precision agriculture techniques, leveraging IoT sensors and Big Data analytics to monitor soil health, microclimate conditions, and plant nutrient uptake with unprecedented granularity. This allows for highly targeted application of water and fertilizer (fertigation), significantly boosting resource efficiency and minimizing environmental run-off, moving away from generalized farming practices.

Another pivotal technology is Controlled Environment Agriculture (CEA), particularly Vertical Farming (VF) systems, which use hydroponics or aeroponics under LED lighting in multi-layered indoor facilities. VF technology provides complete control over growing parameters, shielding crops from external weather threats and diseases, and, crucially, allowing production right within city limits. This drastically shortens the supply chain, enhancing freshness and reducing carbon footprint. While the initial capital expenditure for VF remains high, the consistent, predictable, and high-quality output provides strong justification for continued investment, especially for high-value items like leafy greens and herbs.

Furthermore, cold chain innovations are central to market operations. Technologies such as modified atmosphere packaging (MAP), controlled atmosphere (CA) shipping containers, and non-destructive quality testing using hyperspectral imaging ensure that produce remains in its optimal state during transit and storage. Blockchain technology is also gaining traction, offering immutable digital records of a product's journey from farm to fork, satisfying the increasing consumer and regulatory demand for transparency and rapid traceability in case of recalls or contamination incidents. This robust technological infrastructure is essential for maintaining global trade flows and ensuring consumer safety.

Regional Highlights

- Asia Pacific (APAC): APAC is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid economic development, massive population size, and improving logistics infrastructure, particularly in countries like China, India, and Southeast Asia. The region is transitioning from traditional, disorganized markets to modern retail formats (supermarkets and hypermarkets), driven by an expanding urban middle class prioritizing hygiene and convenience. Investment in cold storage facilities and improved road networks is critical to minimizing the high post-harvest losses historically associated with the region. Local production is massive but increasingly complemented by imports to satisfy demand for exotic and seasonal produce year-round, making APAC a nexus of global trade in fruits and vegetables.

- North America (NA): North America represents a mature and high-value market, characterized by sophisticated cold chain logistics and extremely high consumer demand for ready-to-eat and organic products. The market growth here is less volume-driven and more value-driven, focused on product differentiation, traceability, and sustainability certifications. The US and Canada are leaders in adopting CEA technologies, with significant investment in large-scale greenhouse complexes and vertical farms to ensure local, non-seasonal supply of popular items like berries and tomatoes, mitigating reliance on seasonal imports from Mexico and Central America.

- Europe: The European market is highly regulated and emphasizes sustainability, local sourcing, and environmental standards (e.g., farm-to-fork strategy). Western European countries like Germany, the UK, and France show strong preference for locally grown produce when available, boosting the protected cultivation sector (greenhouses). Demand for organic fruits and vegetables is particularly robust, often driven by strict domestic labeling and quality schemes that exceed international standards. The region also acts as a major importer of tropical and off-season produce, maintaining highly efficient port logistics and customs processes to manage perishable imports from Africa and Latin America.

Eastern Europe is showing faster relative growth as modern retail penetrates previously underserved areas, mirroring trends seen in APAC. The focus across the continent is on reducing food miles and minimizing plastic packaging, leading to innovation in biodegradable and recyclable packaging materials for fresh produce. The complex network of intra-European trade requires highly standardized phytosanitary procedures, contributing to a premium placed on reliable, certified suppliers who can navigate these regulatory hurdles seamlessly.

- Latin America (LATAM): LATAM is critical primarily as a massive exporting hub, specializing in high-demand products like avocados, bananas, citrus, and table grapes, utilizing its diverse climate zones for counter-seasonal supply to North America and Europe. Investment focuses heavily on developing infrastructure linking inland production areas to major ports and ensuring compliance with stringent importing country standards, especially pesticide residue limits. Brazil, Mexico, and Chile are the dominant players, leveraging free trade agreements to maintain competitive advantage in global markets.

Domestic markets in LATAM are developing, showing increasing demand for processed and pre-cut produce, reflecting urbanization and lifestyle changes. However, internal distribution often faces challenges related to infrastructure gaps and security concerns, leading to higher localized losses. Modernization efforts focus on integrating smaller producers into large export cooperatives that can afford necessary quality certifications and advanced post-harvest technology to meet international requirements.

The transition to organized retail in countries such as India and Indonesia is creating immense opportunities for standardized and packaged fresh produce. Consumers in major metropolitan areas are readily adopting e-commerce for grocery shopping, necessitating advanced last-mile cold chain solutions. Furthermore, government initiatives in agriculture focus on modernizing farming techniques and promoting crop diversification, aiming to enhance domestic food security while catering to specialized export demands. Labor availability remains high, but efficiency is being addressed through localized automation.

Consumer spending power allows for premium pricing of specialized items, particularly organic produce and functional foods incorporating specific vegetables or fruits. Retail consolidation is high, giving major supermarket chains significant leverage over suppliers regarding quality standards and pricing. Regulatory compliance, particularly concerning food safety (e.g., FSMA in the US), is rigorously enforced, pushing suppliers to adopt sophisticated tracking and quality control measures, including blockchain implementation for supply chain visibility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fresh Fruits and Vegetables Market.- Dole plc

- Fresh Del Monte Produce Inc.

- Total Produce

- Chiquita Brands International

- Driscoll's

- Bonduelle SA

- Olam International

- Syngenta AG (Seed Division)

- Bayer AG (Crop Science Division)

- Costa Group

- The Greenery

- Limoneira Co.

- Sunripe Produce

- California Giant Berry Farms

- Rijk Zwaan

- G’s Fresh

- T&G Global

- Fyffes

- Zespri Group Ltd.

- Earthbound Farm

Frequently Asked Questions

Analyze common user questions about the Fresh Fruits and Vegetables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the fresh fruits and vegetables market?

The market growth is primarily driven by escalating global health consciousness and dietary shifts towards plant-based consumption, coupled with significant advancements in cold chain logistics and the rapid expansion of organized retail and e-commerce platforms which enhance product availability and freshness.

How is vertical farming impacting the traditional supply chain for fresh produce?

Vertical farming (VF) significantly impacts the supply chain by allowing year-round, hyper-local production close to urban consumption centers. This reduces transportation costs, minimizes climate-related risks, shortens time-to-market, and offers consistent, high-quality yields, challenging the dependency on distant, open-field conventional agriculture.

What role does technology play in minimizing post-harvest losses in this market?

Technology minimizes post-harvest losses through several means, including the use of advanced Modified Atmosphere Packaging (MAP), sophisticated cold chain monitoring via IoT sensors, and AI-powered sorting and grading systems that quickly identify and separate damaged produce, ensuring extended shelf life and maintained quality during transit.

Which regional market is expected to show the fastest growth rate?

Asia Pacific (APAC) is projected to exhibit the fastest growth rate, fueled by substantial population growth, increasing urbanization, rising disposable incomes, and widespread modernization of the traditional retail and distribution infrastructure, particularly in emerging economies like India and China.

What are the main challenges related to fresh produce distribution?

The main challenges are the high capital cost required for maintaining an uninterrupted cold chain (refrigeration), the inherent risk of spoilage and contamination due to product perishability, and the complexity of navigating stringent international phytosanitary and food safety regulations for cross-border trade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager