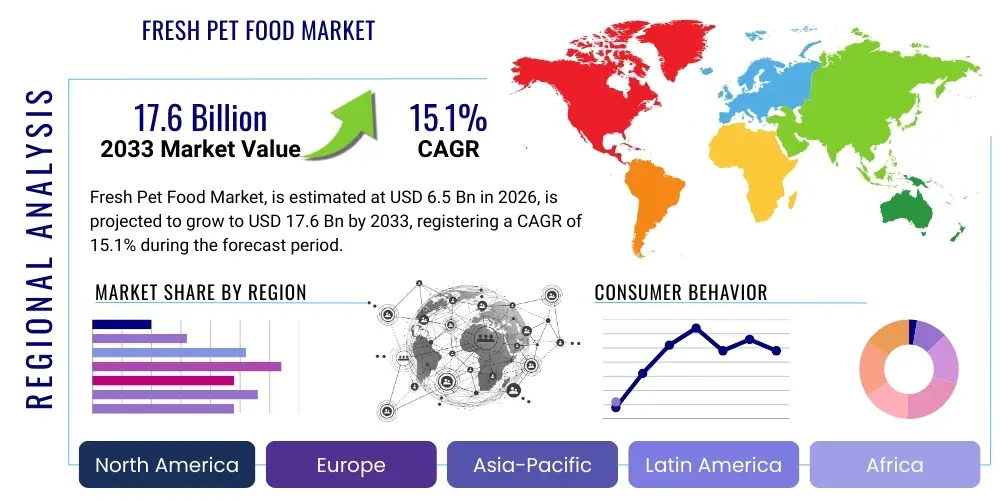

Fresh Pet Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437614 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Fresh Pet Food Market Size

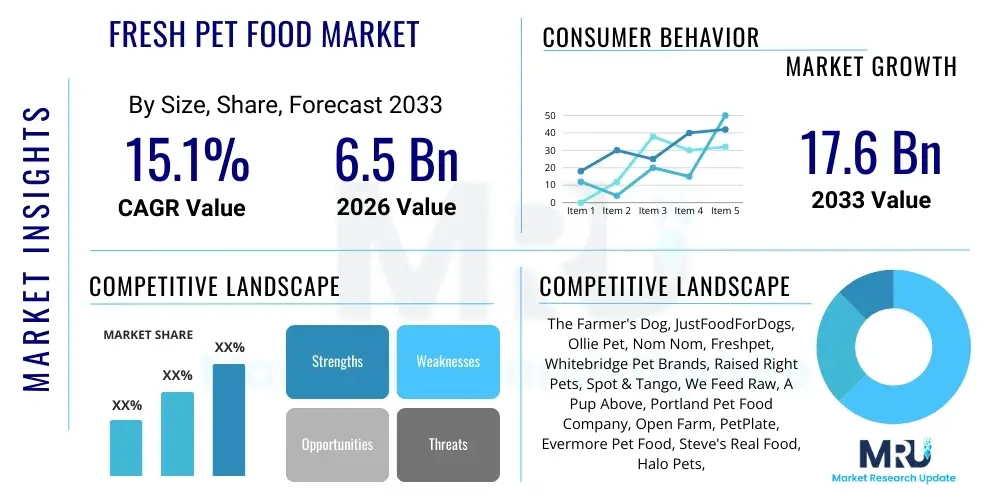

The Fresh Pet Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.1% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 17.6 Billion by the end of the forecast period in 2033.

Fresh Pet Food Market introduction

The Fresh Pet Food Market encompasses commercially prepared meals for companion animals, primarily dogs and cats, characterized by minimal processing, human-grade ingredients, and the requirement for refrigeration or freezing. This category stands in stark contrast to conventional highly processed dry kibble or canned foods. The primary product description centers on high-quality proteins, fresh vegetables, and beneficial supplements, offering enhanced nutritional bioavailability and palatability. This market evolution is fundamentally driven by the increasing humanization of pets, where owners treat their animals as family members and prioritize health outcomes over cost efficiency, leading to a willingness to pay a premium for perceived superior nutrition.

Major applications of fresh pet food include daily dietary regimens for maintaining optimal pet health, addressing specific nutritional deficiencies, and managing chronic health conditions such as allergies, obesity, and digestive sensitivities. Veterinarians and pet nutritionists increasingly recommend fresh food diets due to their higher moisture content, improved nutrient retention, and reduced reliance on synthetic preservatives, fillers, and rendered products. The benefits associated with adopting fresh pet food are substantial, including shinier coats, improved energy levels, better digestion, and potential longevity improvements, serving as strong driving factors for consumer adoption globally.

Key driving factors fueling market expansion involve widespread media coverage highlighting the negative aspects of highly processed commercial pet foods, technological advancements in cold chain logistics facilitating broader distribution, and the explosive growth of direct-to-consumer (D2C) subscription services. Furthermore, robust consumer demand for ingredient transparency, coupled with rising disposable incomes in developed economies, reinforces the market's trajectory towards mainstream acceptance. The emphasis on preventive health measures for pets further solidifies fresh pet food as a high-growth category within the overall pet industry landscape.

Fresh Pet Food Market Executive Summary

The Fresh Pet Food Market is witnessing dynamic shifts characterized by substantial business consolidation and rapid expansion of specialized logistics networks. Current business trends indicate a strong move toward personalized nutrition, where subscription models leverage data analytics to customize recipes based on breed, age, weight, and specific health requirements of the pet. This customization enhances customer loyalty and provides predictable recurring revenue streams for market players. Furthermore, established CPG (Consumer Packaged Goods) giants are increasingly acquiring or forming strategic partnerships with specialized fresh food providers to quickly gain market share and diversify their pet portfolio, signaling mainstream validation of this premium category.

Regional trends demonstrate North America leading the market in both consumption volume and innovation, largely due to high pet ownership rates coupled with significant consumer spending on pet wellness. Europe follows closely, driven by stringent food quality regulations and a mature market for organic and natural products. The Asia Pacific region, particularly countries like China and Japan, presents the highest future growth potential, fueled by rapidly rising disposable incomes, urbanization, and the adoption of Western pet ownership practices. However, logistical challenges associated with maintaining the cold chain in diverse geographical regions remain a critical factor influencing localized market growth rates and distribution strategies.

Segmentation trends highlight the dominance of dog food within the Fresh Pet Food segment, although fresh food options for cats are experiencing the fastest percentage growth, driven by increasing recognition of feline specific nutritional needs. Distribution channel analysis reveals that online retail, especially D2C subscription services, is the preferred method for purchasing fresh pet food, capitalizing on convenience and the ability to manage recurring deliveries. However, specialty pet stores and refrigerated sections within major grocery chains are essential for consumer trial and immediate purchases, creating an omnichannel strategy necessity for brands aiming for comprehensive market penetration.

AI Impact Analysis on Fresh Pet Food Market

User queries regarding AI in the Fresh Pet Food Market frequently revolve around personalization algorithms, supply chain efficiency, and quality control assurances. Users are keen to understand how AI can move beyond simple breed recommendations to predict health outcomes based on real-time consumption data, optimize inventory management for highly perishable products, and ensure ingredient integrity from sourcing to delivery. The key themes summarized across these inquiries emphasize the desire for hyper-personalized nutrition plans, minimization of waste due to shelf-life constraints, and the use of machine learning to detect inconsistencies or contaminants in the raw ingredient pipeline, ultimately enhancing safety and efficacy for the end consumer.

- AI-driven personalized nutrition planning based on metabolic data, activity levels, and genetic profiles, optimizing macro and micro-nutrient ratios.

- Machine learning optimization of the cold chain logistics, predicting demand fluctuations, minimizing spoilage, and streamlining last-mile delivery schedules.

- Enhanced inventory management and predictive sourcing, using AI algorithms to forecast raw material needs and prevent supply shortages for seasonal ingredients.

- Automated quality control systems utilizing computer vision and sensors to inspect ingredient quality and detect foreign objects during the manufacturing process.

- Development of smart packaging solutions monitored by AI, tracking temperature fluctuations and freshness indicators throughout transit to ensure product integrity.

- Chatbot and natural language processing (NLP) applications for instant customer support, providing personalized feeding guides and addressing nutritional concerns rapidly.

- Predictive modeling for disease prevention in pets, correlating fresh food intake data with veterinary outcomes to refine diet recommendations scientifically.

DRO & Impact Forces Of Fresh Pet Food Market

The Fresh Pet Food Market is fundamentally shaped by a powerful confluence of drivers, restraints, and opportunities, collectively determining its growth trajectory and competitive intensity. Primary drivers include the ongoing trend of pet humanization, prompting owners to invest significantly in high-quality, human-grade food; heightened awareness regarding the nutritional deficiencies and processing concerns associated with conventional kibble; and robust consumer demand for ingredient transparency and clean-label products. These drivers create a sustained upward pressure on premiumization, attracting significant investment and innovation into the sector. However, the market faces significant restraints, most notably the high premium price point compared to mass-market alternatives, which limits adoption among budget-conscious consumers. Furthermore, the short shelf life and complex regulatory requirements associated with refrigerated distribution necessitate substantial infrastructural investments in cold chain management, posing logistical challenges, especially in emerging markets.

Significant opportunities exist through the vertical integration of supply chains, allowing companies to better control costs, quality, and sustainability metrics. The increasing acceptance of subscription-based models not only secures predictable recurring revenue but also allows for continuous customer feedback loops and data collection, fueling further personalization. The expansion into novel geographical markets, particularly in high-growth urban centers across Asia, represents a substantial avenue for revenue growth. These opportunities, when leveraged with technological advancements in preservation techniques like High-Pressure Processing (HPP), can mitigate some of the inherent logistical restraints and broaden market accessibility.

The impact forces within this market are high, driven primarily by intense competitive rivalry among established pet food manufacturers entering the fresh segment and innovative D2C startups. Consumer influence is exceptionally high, as purchasing decisions are strongly motivated by perceived health benefits and ethical sourcing, forcing companies to maintain rigorous standards of quality and transparency. Regulatory impact is moderate but growing, particularly concerning labeling and safety standards for human-grade claims. Technological innovation surrounding packaging, delivery models, and formulation is a continuously high impact force, dictating which companies can maintain freshness and efficiency while scaling their operations effectively.

Segmentation Analysis

The Fresh Pet Food Market is systematically segmented across various dimensions, including the type of product formulation (refrigerated vs. frozen), the specific animal species catered to (dog vs. cat), and the critical distribution channels employed to reach consumers. Analyzing these segments provides strategic insights into consumer preferences and logistical dependencies. The Frozen Fresh Pet Food segment, requiring strict temperature control, typically caters to bulk purchasers or those seeking longer-term storage capabilities, whereas Refrigerated Fresh Pet Food focuses on ready-to-serve convenience and often dominates the subscription delivery market. Pet Type segmentation clearly shows dogs as the dominant consumer base, yet specialized cat formulations are emerging as a significant growth area due to increasing understanding of obligate carnivore nutritional needs.

- Product Type:

- Refrigerated Fresh Pet Food (Ready-to-serve, shorter shelf life)

- Frozen Fresh Pet Food (Requires thawing, longer storage life)

- Pet Type:

- Dogs

- Cats

- Distribution Channel:

- Online Retail (D2C Subscriptions, E-commerce Platforms)

- Offline Retail (Specialty Pet Stores, Supermarkets/Hypermarkets, Veterinary Clinics)

Value Chain Analysis For Fresh Pet Food Market

The value chain for Fresh Pet Food is fundamentally focused on maintaining freshness and quality, starting significantly upstream with the sourcing of human-grade, high-quality raw ingredients. Upstream analysis involves establishing robust relationships with local, transparent suppliers of meats, organs, and fresh produce. This stage is critical as the quality of the final product is highly dependent on the initial sourcing, often requiring rigorous audits and certifications to ensure human-grade compliance, distinguishing these inputs from conventional feed-grade materials. Due to the perishable nature, inventory turnover must be rapid, necessitating sophisticated logistics at the procurement stage to minimize holding times and maximize ingredient freshness before processing.

The manufacturing and processing stage involves minimal cooking (often gentle steam cooking or HPP) to preserve nutrient integrity while ensuring pathogen elimination. Unlike traditional pet food production which involves extrusion, the fresh food process emphasizes batch control and high standards of hygiene, often resembling a human food kitchen environment. Downstream activities are dominated by specialized cold chain distribution, which constitutes a major cost and complexity factor. This involves refrigerated storage, specialized packaging to maintain temperature stability, and a reliable network for timely delivery, often directly to the consumer's doorstep via proprietary logistics or specialized third-party carriers.

Distribution channels are polarized into direct and indirect methods. The direct channel, primarily D2C e-commerce subscriptions, offers maximum control over the customer experience, inventory, and crucial temperature monitoring throughout transit, solidifying customer loyalty. The indirect channel involves partnerships with specialized offline retailers, particularly specialty pet stores and increasingly, grocery store chains that allocate refrigerated shelf space. While indirect channels expand market reach and visibility, they require complex wholesale agreements and meticulous oversight to ensure retailers adhere to strict cold storage protocols, impacting the brand’s quality promise. The efficiency of this cold chain distribution model ultimately determines the geographical scalability and profitability of fresh pet food businesses.

Fresh Pet Food Market Potential Customers

The primary potential customers and end-users of fresh pet food are highly engaged pet owners characterized by elevated disposable incomes and a strong emotional bond with their animals, frequently referred to as the 'pet humanization' segment. These buyers prioritize their pets' long-term health and are often proactively seeking natural, preservative-free dietary solutions to address or prevent health issues like allergies, skin conditions, or digestive tract problems. This customer segment is highly informed, actively researches ingredient labels, and seeks recommendations from veterinarians or specialized pet nutritionists. They are willing to absorb the premium cost associated with fresh ingredients and demanding logistics because they perceive the health returns as a worthwhile investment in their companion's quality of life.

A significant subset of potential buyers includes younger millennials and Gen Z pet owners who are particularly attuned to sustainability and ethical sourcing claims. These consumers not only demand transparency regarding what is in the food but also where it comes from, favoring brands that emphasize locally sourced, farm-to-bowl models and sustainable packaging solutions. They are heavy users of subscription services, valuing the convenience and seamless recurring deliveries that integrate easily into their busy lifestyles. The D2C model perfectly captures this demographic by offering personalized communication, flexible delivery schedules, and engaging digital content detailing product origins and nutritional science.

Furthermore, veterinary clinics constitute a critical customer interface, as they are often the primary source of specialized dietary recommendations for therapeutic purposes. Owners of senior pets or those with chronic conditions like renal disease or diabetes form another vital potential customer group, where fresh, high-moisture diets tailored to specific physiological needs are recommended to improve hydration and nutrient absorption. Successful market penetration relies heavily on educating and securing endorsements from this veterinary professional community, establishing the product as a medically supported, rather than just trendy, alternative to conventional therapeutic diets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 17.6 Billion |

| Growth Rate | 15.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Farmer's Dog, JustFoodForDogs, Ollie Pet, Nom Nom, Freshpet, Whitebridge Pet Brands, Raised Right Pets, Spot & Tango, We Feed Raw, A Pup Above, Portland Pet Food Company, Open Farm, PetPlate, Evermore Pet Food, Steve's Real Food, Halo Pets, Stella & Chewy’s, Primal Pet Foods, Blue Buffalo (Fresh Line), Nestle Purina (Fresh Line). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fresh Pet Food Market Key Technology Landscape

The technological landscape in the Fresh Pet Food market is predominantly focused on advanced food preservation techniques and sophisticated cold chain management systems designed to extend shelf life while maintaining nutritional integrity. High-Pressure Processing (HPP) stands as a critical technology, utilizing immense water pressure instead of heat or chemicals to inactivate pathogens, thereby ensuring food safety without compromising the fresh quality, color, flavor, or nutrient density of the ingredients. HPP enables brands to achieve clean-label status, reducing the reliance on artificial preservatives, and is increasingly seen as a differentiator in the premium segment. Furthermore, flash-freezing technologies are utilized to lock in freshness immediately post-preparation, offering a viable solution for D2C brands targeting customers seeking longer storage options.

Beyond preservation, supply chain technology is paramount. The integration of Internet of Things (IoT) sensors into packaging and refrigerated transport vehicles allows for real-time monitoring of temperature and humidity, providing auditable data that assures consumers and regulators of strict compliance with cold chain requirements. These systems utilize cloud-based platforms and advanced telematics to predict potential distribution risks, ensuring that perishable goods maintain optimal conditions from the production facility to the consumer’s freezer. This level of transparency and real-time monitoring is non-negotiable for scaling operations in the fresh food category.

Moreover, digitalization is playing a crucial role in customer interface and product customization. Companies employ sophisticated data analytics and AI algorithms to manage complex subscription logistics, predict optimal delivery windows, and reduce food waste. Furthermore, proprietary formulation software utilizes AI to generate highly personalized meal plans, adjusting recipes automatically based on inputs gathered from customer surveys, veterinary recommendations, and ongoing consumption feedback. This combination of advanced food science, preservative-free processing, and intelligent logistics defines the technological competitiveness within the Fresh Pet Food sector.

Regional Highlights

- North America: This region dominates the global fresh pet food market, driven by high pet ownership rates, advanced understanding of pet nutrition, and substantial consumer willingness to pay for premium, specialized diets. The US and Canada are home to many of the leading D2C fresh pet food brands, which benefit from well-established cold chain logistics infrastructure and sophisticated e-commerce penetration. Regulatory clarity regarding "human-grade" labeling further solidifies this region's position as the primary incubator for fresh pet food innovation and consumption volume.

- Europe: Europe represents a mature market with high demand for natural and organic pet food, easily transitioning consumers to the fresh segment. Countries like the UK, Germany, and France show strong growth, fueled by stringent EU regulations concerning animal welfare and food safety, which align well with the fresh, minimally processed ethos. The market is often fragmented, with strong regional players focusing on locally sourced ingredients and environmentally sustainable business practices, appealing to the European consumer base focused on environmental responsibility.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is propelled by increasing urbanization, rising disposable incomes, and the growing influence of Western pet care trends, particularly in China, Japan, and South Korea. While the cold chain infrastructure presents challenges, the burgeoning middle class is eager to adopt premium products. Market entry strategies often focus on strategic partnerships with local e-commerce platforms and establishing localized production facilities to manage logistical complexities and customs duties efficiently.

- Latin America (LATAM): The LATAM market is currently characterized by niche demand, mainly concentrated in urban centers such as Sao Paulo and Mexico City, where consumer wealth and access to advanced retail infrastructure are higher. Growth is contingent upon improving refrigerated logistics and increasing consumer education regarding the nutritional benefits of fresh food over cheaper processed alternatives. Local producers are starting to emerge, often focusing on region-specific sourcing to minimize supply chain reliance on international imports.

- Middle East and Africa (MEA): MEA remains the smallest but highly emergent market, with demand primarily confined to high-net-worth individuals and expatriate communities in the UAE and Saudi Arabia. Market growth is heavily influenced by the expansion of international retailers and specialized pet stores. The extreme climatic conditions necessitate robust, high-cost cold storage solutions, making this region challenging but offering high potential returns for specialized, premium brands willing to invest in necessary infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fresh Pet Food Market.- The Farmer's Dog

- JustFoodForDogs

- Ollie Pet

- Nom Nom

- Freshpet

- Whitebridge Pet Brands

- Raised Right Pets

- Spot & Tango

- We Feed Raw

- A Pup Above

- Portland Pet Food Company

- Open Farm

- PetPlate

- Evermore Pet Food

- Steve's Real Food

- Halo Pets

- Stella & Chewy’s

- Primal Pet Foods

- Blue Buffalo (Fresh Line)

- Nestle Purina (Fresh Line)

Frequently Asked Questions

Analyze common user questions about the Fresh Pet Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fresh pet food and conventional kibble?

Fresh pet food is minimally processed, uses human-grade ingredients, and contains no artificial preservatives or fillers, requiring refrigeration or freezing. In contrast, conventional kibble is highly processed using extrusion at high temperatures, which often degrades nutrient content and necessitates the addition of synthetic vitamins and preservation agents for long-term shelf stability. Fresh food generally offers higher palatability and better nutrient bioavailability.

Why are D2C subscription models so prevalent in the Fresh Pet Food Market?

D2C subscription models dominate because fresh pet food is perishable and requires consistent, timely deliveries under cold chain management. Subscriptions ensure a steady supply, reduce waste for the consumer, and allow brands to collect vital consumption data, enabling sophisticated personalization of meal plans. This model enhances customer retention and guarantees the product maintains its integrity from production directly to the end-user.

What logistical challenges impact the expansion of the Fresh Pet Food Market globally?

The main challenge is maintaining a consistent and reliable cold chain distribution network. Fresh pet food requires specialized refrigerated transportation and storage at every point of the supply chain, which increases operational complexity and cost, especially when scaling into regions with underdeveloped cold logistics infrastructure or areas facing extreme climatic variations.

Is fresh pet food typically suitable for pets with specific dietary restrictions or allergies?

Yes, fresh pet food is often highly recommended for pets with allergies or dietary sensitivities because the recipes typically contain limited, clearly defined, and easily digestible ingredients. Many companies offer single-protein source options or novel protein diets, which simplifies the process of elimination diets and minimizes exposure to common allergens often found in highly mixed processed feeds.

Which technology is essential for ensuring the safety and quality of fresh pet food during production?

High-Pressure Processing (HPP) is an essential, non-thermal technology used to ensure the safety and quality of fresh pet food. HPP utilizes hydrostatic pressure to eliminate harmful bacteria and pathogens while preserving the raw nutritional value, flavor, and texture of the ingredients without resorting to chemical preservatives or high-heat sterilization methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager