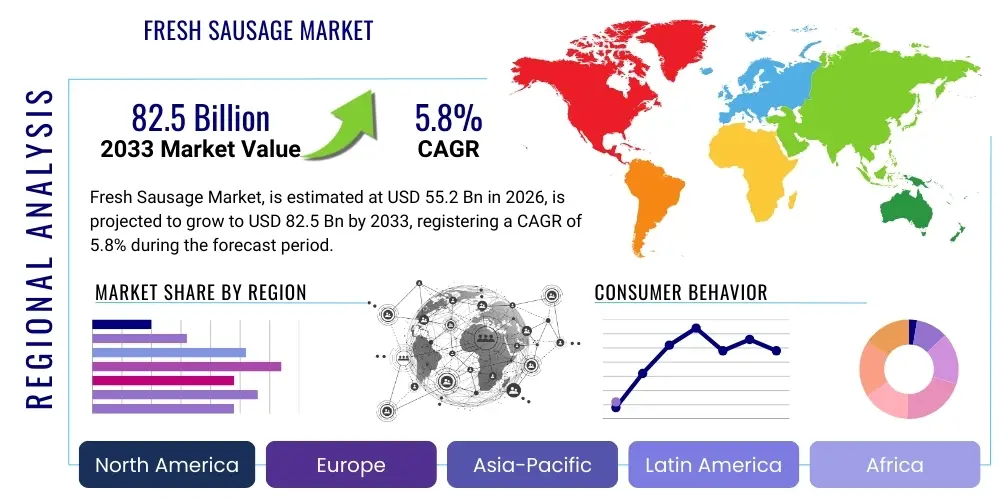

Fresh Sausage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438563 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fresh Sausage Market Size

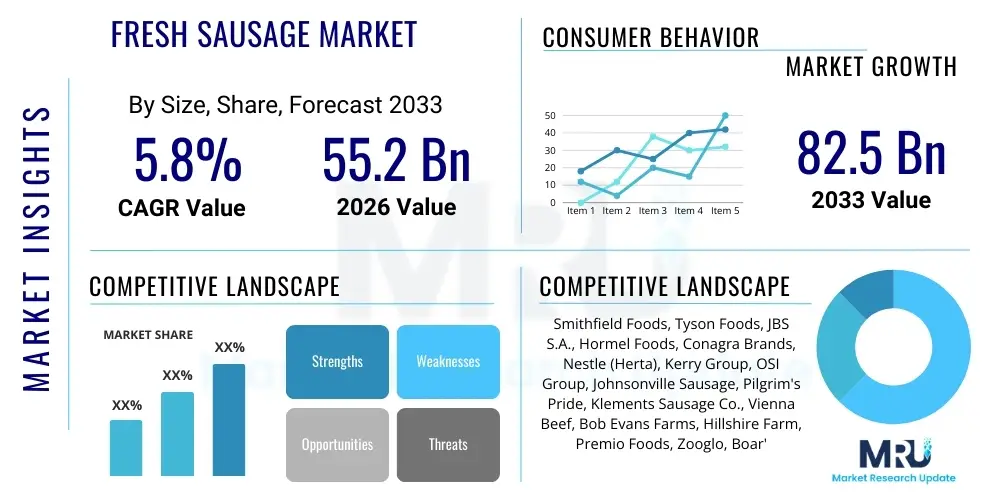

The Fresh Sausage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 55.2 Billion in 2026 and is projected to reach USD 82.5 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by rising global protein consumption, evolving consumer preferences for convenient and ready-to-cook meal solutions, and continuous innovation in flavor profiles and ingredient transparency within the meat processing sector. The market's valuation reflects its essential role in diverse global cuisines and the stable demand generated by both retail and foodservice channels.

Fresh Sausage Market introduction

The Fresh Sausage Market encompasses ready-to-cook or uncured ground meat products that typically contain spices, seasonings, and binding agents, distinguished by requiring refrigeration and cooking prior to consumption. Unlike cured or smoked sausages, freshness is maintained through a strict cold chain, appealing strongly to consumers seeking minimally processed meat products. Major applications of fresh sausage include breakfast preparations, grilling, culinary ingredients in pasta dishes, and use in sandwiches and quick-service restaurant (QSR) menus. The versatility of preparation methods, ranging from frying and baking to grilling, further solidifies its position as a household staple across various cultures, particularly in North America and Europe where breakfast sausage and Italian sausage variants dominate market share.

Product description criteria emphasize the meat source (pork, beef, chicken, turkey, or blends), casing type (natural or collagen), and spice blend authenticity (e.g., bratwurst, chorizo, merguez). Benefits derived by consumers include high protein content, affordability relative to other premium meat cuts, and exceptional culinary convenience. The increasing focus on clean label ingredients, coupled with the demand for lower fat and sodium options, drives continuous product reformulations. Manufacturers are increasingly integrating plant-based proteins into hybrid fresh sausages or developing entirely meat-free alternatives to capitalize on flexitarian trends, broadening the traditional definition and scope of the market.

Driving factors propelling market growth include rapid urbanization in developing economies leading to increased disposable incomes and shifting dietary patterns towards protein-rich foods. Furthermore, the expansion of the frozen food segment, offering fresh sausage products in convenient, long-shelf-life formats, supports market penetration into busy consumer lifestyles. Robust marketing strategies emphasizing the natural and wholesome qualities of fresh, unprocessed meat are critical for maintaining consumer trust and driving consumption frequency, particularly in regions with established traditions of fresh meat consumption.

Fresh Sausage Market Executive Summary

The Fresh Sausage Market exhibits dynamic growth propelled by key business trends focusing on sustainability, premiumization, and technological integration across the supply chain. Business trends indicate a shift towards incorporating functional ingredients, such as probiotics and fiber, into formulations to enhance perceived health benefits. Strategic mergers and acquisitions are common as large meat processors seek to acquire smaller artisanal brands known for specialty flavors or ethically sourced ingredients, thereby consolidating market expertise and distribution networks. Packaging innovation, specifically modified atmosphere packaging (MAP) and vacuum skin packaging (VSP), plays a crucial role in extending shelf life and reducing food waste, addressing both consumer concerns and operational efficiencies.

Regionally, North America and Europe maintain dominance due to high per capita meat consumption and entrenched culinary habits, but the Asia Pacific region is emerging as the fastest-growing market segment. This accelerated growth in APAC is attributed to the Westernization of diets, expansion of organized retail, and a significant increase in demand for convenient packaged protein products among the middle class. Investment in advanced chilling and distribution infrastructure in emerging markets is paramount to maintaining the cold chain integrity required for fresh sausage products, representing a key regional challenge and opportunity. Regulatory harmonization concerning food safety standards across international borders is simplifying export processes, encouraging cross-border trade, and further diversifying regional product availability.

Segment trends underscore the rising preference for poultry-based fresh sausages (chicken and turkey) due to their healthier perception compared to traditional pork or beef options. The growth of the foodservice segment, driven by rapid expansion of fast-casual dining and quick-service restaurants utilizing fresh sausage for breakfast menus, is a significant consumption driver. Simultaneously, the organic and natural segment commands higher price points, reflecting consumer willingness to pay a premium for certified animal welfare practices and clean label certifications. Manufacturers are increasingly focusing R&D on non-meat casings (e.g., alginate or plant-based cellulose) to cater to varied dietary needs and improve processing efficiency, indicating a major trend in ingredient innovation.

AI Impact Analysis on Fresh Sausage Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Fresh Sausage Market frequently revolve around optimizing raw material procurement, enhancing product quality control and traceability, and predicting fluctuating consumer demand for specific flavors or cuts. Users are keenly interested in how machine learning algorithms can minimize waste during the grinding and stuffing processes, which are traditionally susceptible to human error. There is significant concern about maintaining artisanal quality and traditional flavor profiles while implementing automated, AI-driven production lines, focusing on the potential loss of traditional craft. Additionally, stakeholders consistently ask about the role of AI in supply chain resilience—specifically, using predictive analytics to mitigate risks associated with sudden livestock price volatility or unexpected regulatory changes affecting meat sourcing.

AI is strategically transforming fresh sausage production by enabling sophisticated predictive modeling. This technology analyzes historical sales data, seasonal variations, social media trends, and geopolitical events to accurately forecast demand for specific product SKUs, allowing manufacturers to optimize production scheduling, thereby reducing inventory costs and spoilage risk inherent to fresh products. Furthermore, AI-powered computer vision systems deployed on processing lines conduct continuous, real-time quality checks, identifying anomalies in meat texture, fat-to-lean ratio, and consistency of the emulsification before stuffing. This rigorous digital inspection surpasses manual checks, ensuring unparalleled product standardization and adherence to precise specifications, which is crucial for maintaining brand reputation in the competitive fresh meat segment.

In the realm of food safety and traceability, AI platforms provide end-to-end monitoring from farm to fork. Blockchain integration, augmented by AI analysis, logs every step—from animal rearing conditions and slaughterhouse data to processing temperatures and transit times. Should a contamination issue arise, AI algorithms can pinpoint the source and affected batches instantly, minimizing recall scope and speed, thus protecting consumer health and minimizing financial losses for manufacturers. The implementation of generative AI tools is also being explored for rapid formulation development, simulating how ingredient adjustments (e.g., varying spice ratios, using alternative binding agents) will affect flavor profiles and texture, accelerating the time-to-market for innovative fresh sausage products.

- Predictive Demand Forecasting: AI algorithms analyze large datasets (weather, sales, social media) to predict localized consumer demand for specific fresh sausage variants, optimizing stock levels and minimizing perishability.

- Automated Quality Control: Machine learning integrated with vision systems monitors meat particle size, fat dispersion, and casing integrity in real time, ensuring consistent product quality and reducing line stoppages due to errors.

- Supply Chain Optimization: AI models assess raw material availability and price fluctuations (pork belly, seasoning costs) to recommend optimal procurement timing and sourcing strategies.

- Enhanced Traceability and Safety: Utilizing AI-supported blockchain technology to record and verify provenance data, providing instant auditability for regulatory compliance and rapid recall management.

- Process Efficiency: Optimizing grinder and stuffer machine settings (speed, pressure, temperature) using reinforcement learning to reduce operational energy consumption and material waste.

- New Product Development: Generative AI assists R&D teams in simulating and refining complex spice and ingredient combinations for novel fresh sausage formulations, reducing reliance on lengthy physical testing.

DRO & Impact Forces Of Fresh Sausage Market

The Fresh Sausage Market is shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal Impact Forces that dictate market direction and profitability. A major driver is the accelerating consumer desire for convenient, protein-rich meal solutions, particularly in time-constrained urban settings, making pre-seasoned fresh sausage a primary choice. Opportunities arise primarily from the clean label movement, pushing manufacturers towards sourcing certified ingredients, using natural preservatives, and focusing on transparency in packaging, which allows premium pricing. However, the market faces significant restraints, chiefly the stringent cold chain management requirements which increase logistical costs and limit market reach in regions lacking robust refrigeration infrastructure, coupled with growing public health concerns regarding high sodium and saturated fat content in traditional sausage varieties.

Key impact forces include the increasing regulatory scrutiny on meat processing hygiene and labeling standards (e.g., FSMA in the US, EFSA in Europe), requiring substantial capital investment in compliance technology and robust HACCP protocols. Economic volatility, particularly concerning feed costs and livestock diseases, directly impacts the primary raw material supply and profitability margins, forcing processors to adopt advanced hedging strategies. The competitive intensity within the fresh meat sector remains high, driven by the presence of both global corporations and specialized local butchers, necessitating continuous product differentiation through unique flavor introductions, sustainable sourcing claims, or value-added attributes like low-sodium formulations.

The transition towards sustainable practices presents a dual force—a restraint due to the increased cost of sustainable packaging and certified animal welfare, yet a critical opportunity for market leaders to build brand loyalty and capture the environmentally conscious consumer segment. Furthermore, the rising adoption of flexitarian diets globally acts as a restraint on traditional meat volume growth but simultaneously opens substantial opportunity for manufacturers to innovate with hybrid products (meat mixed with plant proteins) or focus on premium, small-batch artisanal fresh sausages that emphasize ethical sourcing and high-quality, recognizable ingredients. Successfully navigating these forces requires strategic investment in cold chain logistics, consumer-centric flavor innovation, and transparent communication regarding product sourcing and nutritional profiles.

- Drivers:

- Rising global demand for convenient, ready-to-cook protein products suitable for quick meals.

- Increased consumption of Western-style and protein-heavy breakfasts globally.

- Continuous innovation in flavor profiles (ethnic and gourmet varieties) appealing to diverse consumer palates.

- Expansion of organized retail channels (supermarkets, hypermarkets) providing better accessibility and standardized quality control.

- Restraints:

- High operational costs and logistical complexity associated with maintaining the strict cold chain integrity required for fresh, uncured products.

- Growing consumer awareness and sensitivity regarding high saturated fat and sodium levels in traditional fresh sausage formulations.

- Volatility in raw material (meat and spices) pricing due to climate change, diseases, and global trade policies.

- Short shelf life compared to cured or frozen alternatives, leading to potential inventory losses.

- Opportunities:

- Development and commercialization of clean label fresh sausages using natural preservatives and verifiable ingredients.

- Growing market for premium, artisanal, and regionally specific fresh sausage variants emphasizing superior animal welfare and traceable sourcing.

- Innovation in hybrid products blending meat proteins with plant-based alternatives to target flexitarian consumers.

- Expansion into emerging markets through strategic partnerships and investment in modern cold storage infrastructure.

- Impact Forces (Internal/External):

- Regulatory Pressure: Intensifying global food safety standards and labeling requirements (e.g., nitrite limits, allergen declarations).

- Technological Advancements: Use of HPP (High-Pressure Processing) for shelf life extension without chemical additives.

- Consumer Health Trends: Shift towards leaner meat cuts (chicken/turkey sausage) and reduced sodium formulations.

- Sustainability Demands: Pressure from consumers and NGOs to adopt sustainable packaging and reduce the environmental footprint of meat production.

Segmentation Analysis

The Fresh Sausage Market segmentation provides a detailed framework for understanding specific consumer preferences, distribution methodologies, and key product attributes driving demand. The market is primarily segmented based on meat type (pork, beef, poultry, mixed/other), which determines nutritional profile and culinary application; by product type (links, patties, bulk/ground), dictating convenience and preparation method; by casing type (natural, collagen, synthetic), influencing texture and processing ease; and by distribution channel, differentiating between retail and foodservice consumption. These classifications are crucial for manufacturers to tailor their production, marketing, and supply chain strategies to effectively target distinct consumer demographics, ranging from quick-service restaurants needing standardized patties to retail consumers seeking premium, naturally cased links.

Within the segmentation based on meat type, pork sausage historically holds the largest share, particularly in established Western markets, due to its traditional flavor profile and versatility. However, poultry-based sausages (chicken and turkey) are exhibiting the highest growth trajectory, primarily fueled by the perception of being healthier, lower in saturated fats, and accommodating various dietary constraints. Geographic segmentation further reveals distinct consumption patterns; for instance, chorizo and morcilla varieties dominate in Iberian and Latin American cultures, while bratwurst and various breakfast sausages are staples in North America and Northern Europe, necessitating highly localized product development and flavor customization by global players.

Furthermore, the segmentation by distribution channel highlights the critical distinction between high-volume, standardized products demanded by the foodservice sector (hotels, restaurants, institutions) and the broader variety and enhanced packaging quality required by the retail segment (supermarkets, convenience stores, online grocery platforms). The e-commerce channel, though still nascent for highly perishable fresh sausage, is expanding rapidly, requiring sophisticated cold-chain logistics for last-mile delivery. Analysis across these segments allows companies to allocate resources effectively, focusing on high-growth segments such as premium, artisanal patties sold through specialized retail, or high-efficiency, frozen link production for national quick-service chains.

- By Meat Type:

- Pork Sausage

- Beef Sausage

- Poultry Sausage (Chicken and Turkey)

- Blended/Other Meats (Veal, Lamb, Specialty Game)

- By Product Type:

- Links/Ropes

- Patties

- Bulk/Ground Sausage Meat

- By Casing Type:

- Natural Casings (Intestine-based)

- Collagen Casings (Edible)

- Synthetic/Cellulose Casings (Inedible/Plant-based)

- By Distribution Channel:

- Retail Sales (Supermarkets, Hypermarkets, Convenience Stores)

- Foodservice (Restaurants, Hotels, Institutional Catering, QSR)

- Online/E-commerce

Value Chain Analysis For Fresh Sausage Market

The Fresh Sausage Market value chain begins with the upstream segment encompassing livestock farming and raw material sourcing, which is highly sensitive to external factors like feed costs, disease outbreaks, and ethical farming standards. Raw material quality—specifically the ratio of lean muscle to fat—is paramount as it directly impacts the final sausage texture and flavor profile. Meat processors then engage in intermediate production stages including grinding, seasoning, emulsification (critical for texture binding), and stuffing into casings. Efficiency in these upstream and intermediate processes is optimized through automation and strict temperature control to prevent bacterial growth and maintain freshness, representing a significant capital investment area for manufacturers.

Downstream analysis focuses on the final product distribution and market reach. The distribution channel segment is bifurcated into direct channels (selling directly to large institutional buyers or through company-owned retail outlets) and indirect channels (relying on wholesalers, large grocery distributors, and third-party logistics providers). Due to the product's high perishability, the effectiveness of the cold chain logistics network is the most critical element in the downstream segment. Distributors must employ refrigerated transport and maintain precise inventory management to minimize stock rotation risks and spoilage, thereby preserving product integrity and profitability until the point of sale, whether in a supermarket chiller or a restaurant kitchen.

The market structure is characterized by intense integration among major players, often owning or controlling significant portions of the supply chain, from animal processing to packaging. Direct distribution is favored by specialized artisanal producers aiming to control product quality and brand perception, particularly for premium offerings. Conversely, high-volume producers serving national retail chains rely heavily on indirect channels and robust third-party cold chain management to achieve maximum market penetration, making strategic partnerships with leading 3PL companies essential for scaling operations effectively and ensuring product freshness across wide geographical regions.

Fresh Sausage Market Potential Customers

Potential customers for the Fresh Sausage Market span a broad spectrum, reflecting the product's fundamental role in global diets, yet they can be segmented into high-volume institutional buyers and diverse end-user consumers. Institutional buyers include the burgeoning Quick Service Restaurant (QSR) sector, which requires consistently sized, pre-cooked, or ready-to-cook fresh sausage patties and links for breakfast and sandwich offerings. Furthermore, institutional catering services for schools, hospitals, and corporate cafeterias are major consumers, prioritizing bulk packaging, competitive pricing, and certified nutritional profiles. These buyers demand reliable supply volumes and strict adherence to specific product specifications, driving standardization across manufacturing lines.

The largest consumer base remains the household segment, categorized primarily by demographic and lifestyle factors. Busy working professionals and families represent a key segment driving demand for convenient, pre-seasoned fresh sausage that reduces meal preparation time. This segment is highly responsive to packaging innovations that simplify cooking (e.g., resealable trays) and value propositions related to high protein and minimal artificial ingredients (clean label). Another increasingly significant segment is the health-conscious consumer, who prefers fresh sausages made from leaner meats (chicken, turkey) or those fortified with functional ingredients, often purchasing from high-end retail channels that specialize in organic and welfare-certified products.

Geographically, customers in established markets such as Western Europe exhibit a preference for traditional, region-specific varieties like German Bratwurst or Italian Salsiccia, demanding authenticity and high-quality, natural casings. Conversely, customers in rapidly developing Asian economies are more experimental, seeking novel flavor combinations and Western-style packaged meats, driving demand for innovative, smaller-sized convenience packs. Targeting these diverse customer groups requires manufacturers to maintain a diversified product portfolio, balancing high-volume, standardized offerings for institutional use with premium, specialty products for the discerning retail consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.2 Billion |

| Market Forecast in 2033 | USD 82.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smithfield Foods, Tyson Foods, JBS S.A., Hormel Foods, Conagra Brands, Nestle (Herta), Kerry Group, OSI Group, Johnsonville Sausage, Pilgrim's Pride, Klements Sausage Co., Vienna Beef, Bob Evans Farms, Hillshire Farm, Premio Foods, Zooglo, Boar's Head, Coleman Natural, Niman Ranch, Applegate Farms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fresh Sausage Market Key Technology Landscape

The technological landscape of the Fresh Sausage Market is defined by continuous advancements aimed at improving food safety, enhancing efficiency, and extending the crucial short shelf life of the product. High-speed, continuous-process emulsification and blending equipment are foundational technologies, ensuring perfect fat-to-lean ratios and consistent texture required for high-volume production, drastically reducing processing time compared to traditional batch mixing. Furthermore, advanced stuffing and linking machines, incorporating servo-motor technology, allow for precise weight control and minimal product giveaway, which is essential for managing raw material costs. Automation in the handling and packaging stages, including robotic pick-and-place systems, ensures minimal human contact, thereby significantly reducing the risk of contamination and improving overall hygiene compliance with stringent food safety regulations.

In preservation and packaging, the adoption of Modified Atmosphere Packaging (MAP) and Vacuum Skin Packaging (VSP) technology is widespread. MAP utilizes specific gas mixtures (usually carbon dioxide and nitrogen) to inhibit microbial growth and discoloration, effectively extending the refrigerated shelf life of fresh sausage by several days without relying on synthetic chemical preservatives. VSP, by eliminating air and tightly adhering the film to the product, not only preserves freshness but also enhances the visual appeal and prevents freezer burn for products intended for freezing. The ongoing evolution in packaging film barrier properties, focusing on sustainable and biodegradable materials, is a major area of R&D investment, aligning technological progress with environmental demands.

Beyond the processing line, the integration of digital technologies is rapidly gaining traction. These include sophisticated Temperature Monitoring Systems (TMS) deployed throughout the cold chain, utilizing IoT sensors to provide real-time data logging and alerts for temperature deviations during storage and transit. This digital oversight is crucial for maintaining product integrity and provides verifiable documentation for compliance purposes. Additionally, the development of rapid pathogen testing kits and near-infrared (NIR) spectroscopy tools allows for quick, non-destructive analysis of raw meat quality (e.g., fat content, moisture) before processing, ensuring only optimal ingredients enter the value chain, which is a pivotal step in preventing massive batch losses and maintaining premium product quality standards.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for fresh sausage, driven by high per capita consumption of breakfast sausage and Italian sausage varieties. The market here is characterized by strong demand for both conventional and premium, hormone-free, and antibiotic-free products. Technological adoption is high, focusing on highly automated processing lines and advanced packaging solutions (VSP, MAP) to meet retailer demands for extended shelf life. The regional trend is significantly influenced by the QSR sector, which dictates massive, standardized orders for fresh sausage patties, making consistency a primary competitive metric. Innovation is centered around reducing sodium content and incorporating international flavors like Chorizo and Andouille into mainstream offerings, catering to a diverse, convenience-seeking consumer base.

- Europe: Europe is a diverse and robust market, highly fragmented by country-specific culinary traditions, ranging from German Bratwurst and Italian Salsiccia to Spanish Botifarra. Western Europe holds a substantial market share, but growth is slower and highly focused on sustainability, animal welfare, and clean labeling. European consumers exhibit a stronger preference for traditionally prepared, high-quality, artisanal fresh sausages often featuring natural casings. Strict EU regulations regarding meat origin and ingredient transparency (e.g., nitrites/nitrates reduction efforts) compel manufacturers to continuously reformulate products. Central and Eastern Europe are experiencing higher growth rates, driven by improving economic conditions and increased adoption of packaged meat products, moving away from traditional butcher-only sourcing.

- Asia Pacific (APAC): The Asia Pacific region is forecast to be the fastest-growing market segment, although starting from a lower base of packaged fresh sausage consumption. This growth is spurred by rapid urbanization, increased disposable income, and the gradual adoption of Western breakfast and meal patterns, especially in metropolitan areas of China, India, and Southeast Asian countries. The establishment of modern cold chain logistics and the proliferation of organized retail (hypermarkets and international grocery chains) are critical enablers. Pork-based fresh sausages remain popular in many cultures within APAC, but the market also sees significant innovation in poultry-based products. Challenges include navigating diverse local tastes and the highly fragmented nature of local distribution networks, requiring global players to invest heavily in localized flavor profiles and market entry strategies.

- Latin America: Latin America shows solid growth, primarily fueled by traditional consumption patterns and a strong cultural affinity for fresh, spiced meats like chorizo and longaniza, often sold in bulk or through traditional butcheries (carnicerías). The market is transitioning, with packaged fresh sausage gaining prominence in large urban centers due to convenience and perceived hygiene benefits compared to unpackaged options. Brazil and Mexico are the dominant markets, where local processors face competition from international brands expanding their footprints. Investment is focusing on improving processing hygiene and extending shelf life to service the expanding middle class across the region, while economic volatility remains a significant factor influencing consumer purchasing power.

- Middle East and Africa (MEA): The MEA region is characterized by high demand for poultry (chicken and turkey) and beef fresh sausages, largely due to religious dietary restrictions (Halal certification being paramount). Growth is modest but steady, driven by increasing expatriate populations and high levels of imported processed meat products, particularly in the Gulf Cooperation Council (GCC) countries. The market requires specialized production capabilities to ensure strict Halal compliance throughout the entire supply chain, from slaughter to packaging. South Africa acts as a regional manufacturing hub, utilizing advanced processing techniques to service neighboring markets, while focusing on products that cater to local culinary traditions like Boerewors (a type of fresh coiled sausage).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fresh Sausage Market.- Smithfield Foods (WH Group)

- Tyson Foods, Inc.

- JBS S.A.

- Hormel Foods Corporation

- Conagra Brands, Inc.

- Johnsonville Sausage, LLC

- Klements Sausage Co.

- Vienna Beef Ltd.

- Bob Evans Farms (owned by Post Holdings)

- Hillshire Farm (owned by Tyson Foods)

- Premio Foods

- Kerry Group plc (Sausage Seasonings and Ingredients)

- OSI Group LLC

- Nestlé (Herta brand)

- Pilgrim's Pride Corporation (JBS subsidiary)

- Zooglo Food Group

- Boar's Head Brand

- Coleman Natural Foods

- Niman Ranch (Perdue Farms)

- Applegate Farms (Hormel Foods)

Frequently Asked Questions

Analyze common user questions about the Fresh Sausage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fresh sausage and cured sausage?

Fresh sausage is uncured and must be cooked fully before consumption, requiring constant refrigeration (cold chain management). Cured sausage, conversely, undergoes a curing process involving salts/nitrites and is often smoked, enabling a longer shelf life and sometimes allowing consumption without further cooking, depending on the variety.

Which factors are driving the demand for poultry-based fresh sausage?

Demand is driven primarily by consumer perception of poultry options (chicken/turkey) as being leaner, lower in saturated fats, and healthier than traditional pork or beef variants, aligning with prevailing health and wellness trends globally.

How is the clean label trend influencing fresh sausage manufacturing?

The clean label trend mandates manufacturers to remove artificial additives, synthetic preservatives, and ambiguous ingredients. This forces the use of natural ingredients like celery powder (as a natural source of nitrates) and vinegar-based preservatives, simultaneously increasing production costs and justifying premium pricing.

What major logistical challenge affects the profitability of the Fresh Sausage Market?

The most significant challenge is the required maintenance of a stringent, unbroken cold chain (refrigeration) from the processing plant to the final consumer. Failure to maintain temperature integrity results in rapid spoilage, high inventory waste, and significant logistical costs across distribution networks.

How are manufacturers addressing the growing demand for sustainable fresh sausage products?

Manufacturers are focusing on two key areas: adopting sustainable packaging (e.g., recyclable or bio-degradable films) and implementing certified animal welfare programs (e.g., pasture-raised or antibiotic-free sourcing) to assure environmental and ethical transparency demanded by modern consumers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager