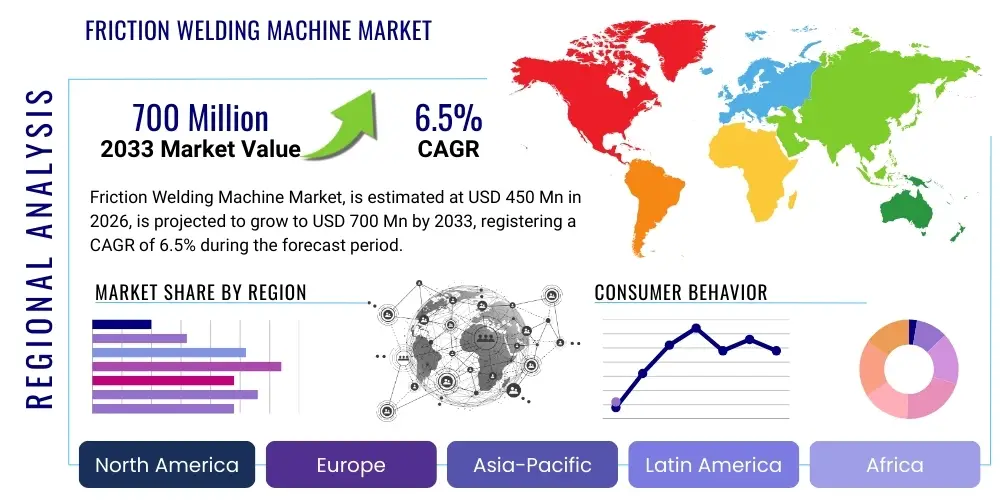

Friction Welding Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437871 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Friction Welding Machine Market Size

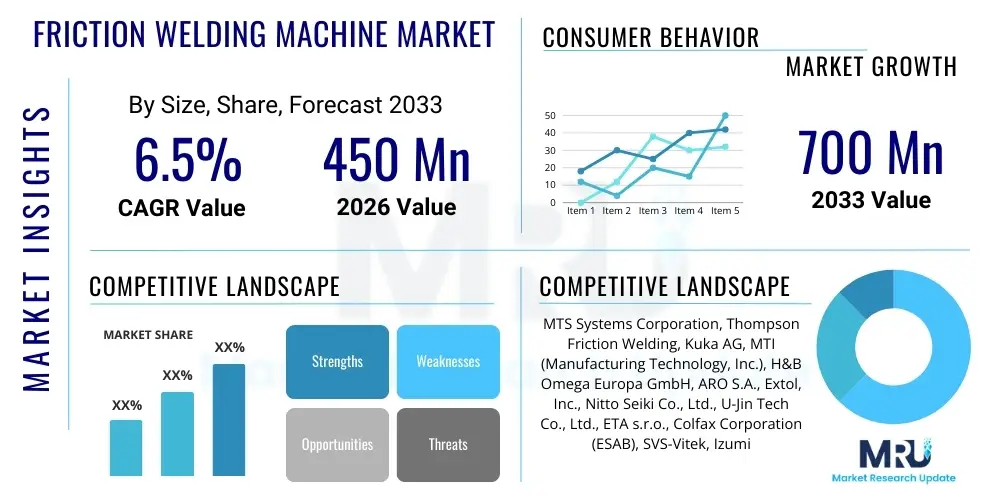

The Friction Welding Machine Market is projected to grow at a Compound Annualized Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033.

Friction Welding Machine Market introduction

The Friction Welding Machine Market encompasses highly specialized industrial equipment designed to join two materials, typically metals or thermoplastics, through the heat generated by mechanical friction. This solid-state welding process avoids melting the base materials, resulting in superior joint strength, minimal heat-affected zones (HAZ), and highly repeatable, contamination-free welds. Friction welding machines operate by rotating one workpiece against a stationary counterpart under high pressure, generating precise thermal energy at the interface. The resulting plastic deformation and subsequent forging action create metallurgical bonds that are often stronger than the parent materials themselves. These machines are integral to sectors demanding stringent quality control and high-volume production of complex parts.

Major applications of friction welding technology span critical industries such as aerospace, automotive manufacturing, oil and gas, and construction equipment production. In the automotive sector, they are crucial for joining dissimilar materials, fabricating lightweight components like aluminum drive shafts and engine valves, thereby supporting the global shift toward electric vehicles and enhanced fuel efficiency. The aerospace industry utilizes these machines for high-integrity components such as turbine blades, shafts, and landing gear assemblies where joint failure is unacceptable. Benefits driving market adoption include the ability to weld dissimilar metals previously deemed incompatible, reduced material wastage, high energy efficiency compared to traditional fusion welding, and inherent automation capabilities leading to lower operating costs and exceptional process control. The key driving factor is the escalating demand for high-performance, lightweight components across mobility sectors and the inherent cost efficiencies offered by solid-state joining techniques.

Friction Welding Machine Market Executive Summary

The Friction Welding Machine Market is experiencing robust growth fueled primarily by global business trends emphasizing lightweighting strategies in the transportation sector and the rapid expansion of electric vehicle (EV) manufacturing. Strategic investments in advanced manufacturing techniques, particularly in highly regulated industries like aerospace and defense, are significantly propelling demand for high-precision, solid-state welding solutions. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by burgeoning automotive production volumes in China, India, and Southeast Asian nations, coupled with massive infrastructure investments requiring reliable heavy machinery. North America and Europe maintain strong demand for sophisticated friction welding machines, particularly within niche high-value sectors focused on research, development, and high-tolerance component fabrication. Segment trends indicate a substantial surge in demand for rotary friction welding machines due to their versatility in joining axisymmetric components, while hybrid friction stir welding (FSW) is gaining traction for complex aluminum structures. The market is also trending towards greater automation, integration of advanced sensor technology for real-time quality monitoring, and the utilization of Artificial Intelligence (AI) for predictive maintenance and process optimization, ensuring higher throughput and decreased operational variability.

AI Impact Analysis on Friction Welding Machine Market

Users frequently inquire about how AI can enhance process reliability, predict component failure, and optimize welding parameters in complex friction welding operations. Key user concerns revolve around the integration cost of AI systems, the necessity for vast datasets to train effective predictive models, and ensuring data security in networked manufacturing environments. Expectations are high regarding AI’s ability to move beyond basic automation toward true adaptive manufacturing, where machine learning algorithms dynamically adjust speed, force, and time parameters based on real-time material properties and ambient conditions. Users anticipate that AI integration will drastically reduce the defect rate (PPM), minimize the reliance on destructive testing methods, and extend the lifespan of expensive welding tools and machinery through sophisticated predictive maintenance protocols. The overarching theme is leveraging AI to achieve zero-defect manufacturing and unprecedented levels of operational efficiency and consistency in solid-state joining.

- AI-driven Predictive Quality Control: Machine learning models analyze acoustic emissions, torque signatures, and displacement curves in real-time to predict joint integrity and potential defects before the weld is completed, minimizing scrap rates and optimizing production yield.

- Automated Parameter Optimization: AI algorithms dynamically tune welding parameters (rotation speed, friction force, forge force, time) based on workpiece geometry, material composition variations, and ambient temperature changes, ensuring optimal metallurgical bonding for diverse batches.

- Predictive Maintenance (PdM): Sensor data streams regarding spindle health, hydraulic pressure stability, and motor current draw are analyzed by AI to forecast potential mechanical failures, scheduling maintenance precisely when needed and maximizing machine uptime.

- Enhanced Process Monitoring and Traceability: AI systems collate and analyze vast amounts of operational data, providing comprehensive digital twin representations of the welding process for regulatory compliance, quality audits, and enhanced long-term traceability, crucial for aerospace standards.

- Robotics and Cobot Integration Optimization: AI facilitates seamless integration and path planning for robotic loading and unloading systems in fully automated friction welding cells, optimizing cycle times and reducing human interaction in hazardous environments.

- Material Characterization Support: Machine vision and AI assist in pre-weld inspection, identifying surface contamination or subtle geometrical inconsistencies that could compromise weld quality, leading to pre-emptive rejection or necessary surface preparation.

DRO & Impact Forces Of Friction Welding Machine Market

The Friction Welding Machine market is predominantly driven by the increasing global focus on material hybridization and the necessity for high-strength, lightweight components, particularly within the automotive and aerospace industries which demand repeatable, high-integrity joints. Restraints include the high initial capital investment required for these precision machines and the technical complexities associated with welding non-axisymmetric parts or extremely large components, which limit adoption among smaller or geographically restricted fabrication shops. Opportunities are substantial, revolving around the development of advanced hybrid friction stir welding (HFSW) processes for complex geometries, the integration of Industry 4.0 technologies like IoT and AI for process control, and the expansion of applications into emerging energy sectors such as hydrogen storage components and nuclear decommissioning. These market dynamics create powerful impact forces, compelling manufacturers to innovate constantly in automation capabilities, machine rigidity, and real-time process monitoring to meet the evolving regulatory and performance demands of end-users.

Market expansion is further bolstered by environmental regulations necessitating lighter vehicles to meet emission standards, thereby driving the adoption of friction welding for aluminum, magnesium, and steel combinations where traditional fusion welding is often infeasible or compromises material properties. The restraint imposed by skilled labor availability is being mitigated through increased automation and user-friendly interfaces, but the dependence on high-precision hydraulic and spindle systems remains a maintenance challenge. The primary opportunity lies in penetrating general manufacturing sectors by offering smaller, more accessible friction welding units (desktop or benchtop models) suitable for research institutions and small to medium-sized enterprises (SMEs) focused on specialized product development. The impact forces indicate a clear strategic shift towards customized solutions rather than standardized machinery, reflecting the unique specifications required by aerospace and defense contractors for their highly specialized materials and joint requirements, ensuring market growth remains concentrated around technological superiority and service delivery.

Segmentation Analysis

The Friction Welding Machine Market is comprehensively segmented based on machine type, welding method, material welded, and application, reflecting the diverse industrial requirements and technical specifications of end-users. Analysis by machine type reveals rotary friction welding machines dominate the market due to their established reliability and suitability for axisymmetric components, though linear and friction stir welding machines are rapidly gaining share in specialized areas like large plate joining and complex structural assemblies. Segmentation by application highlights the paramount importance of the automotive industry as the largest consumer, driven by mass production needs for engine components, turbochargers, and EV battery structures. Geographically, segmentation underscores the maturity of the North American and European markets contrasted with the high growth potential and increasing production capacity in the Asia Pacific region, particularly for standard friction welding equipment used in infrastructure and heavy machinery.

- By Machine Type:

- Rotary Friction Welding Machines (RFWM)

- Linear Friction Welding Machines (LFWM)

- Friction Stir Welding Machines (FSWM)

- Radial Friction Welding Machines (RFW)

- Friction Hydro Pillar Processing (FHPP) Machines

- By Welding Method:

- Continuous Drive Friction Welding

- Inertia Friction Welding

- Angular Friction Welding

- Hybrid Friction Welding Techniques

- By Material Welded:

- Ferrous Metals (Steel, Stainless Steel, Cast Iron)

- Non-Ferrous Metals (Aluminum, Copper, Titanium, Magnesium)

- Dissimilar Materials (Aluminum-Steel, Copper-Aluminum)

- Thermoplastics and Composites

- By Application/End-User Industry:

- Automotive (Engine Components, Drive Shafts, Chassis, EV Battery Trays)

- Aerospace and Defense (Turbine Blades, Landing Gear, Structural Components)

- Oil and Gas (Drill Pipes, Tool Joints, Subsea Equipment)

- Construction and Heavy Equipment (Hydraulic Cylinders, Axles)

- Electrical and Electronics (Busbars, Connectors, Heat Sinks)

- Medical Devices and Implants

Value Chain Analysis For Friction Welding Machine Market

The value chain for the Friction Welding Machine Market begins with upstream analysis focusing on raw material suppliers, predominantly specializing in high-grade steel, specialized alloys, and sophisticated hydraulic components necessary for constructing the robust machinery frame, spindle systems, and power units. Key upstream suppliers also include precision bearing manufacturers and advanced sensor technology providers crucial for real-time monitoring and closed-loop control systems integral to modern friction welding. Machine builders, the core component of the value chain, focus heavily on research and development to enhance machine rigidity, increase speed and forge force capacity, and integrate sophisticated control software (PLC/CNC). Optimization at the upstream level is essential, as the performance and longevity of the welding machine directly correlate with the quality of these foundational components, driving competition among specialized component suppliers to meet stringent industrial specifications.

Downstream analysis centers on the distribution channels and the final end-user industries. Distribution typically follows a multi-pronged approach: direct sales for large, customized linear or inertia welding systems to Tier 1 aerospace and automotive manufacturers, and indirect sales through specialized industrial equipment distributors and local system integrators for standardized rotary machines targeting smaller fabricators. Service and support constitute a critical downstream element, requiring highly trained engineers for installation, calibration, and long-term maintenance contracts, especially given the complexity of integrating these machines into automated production lines. Direct channels offer greater control over customer relationships and technical support, which is often preferred by major global manufacturers, whereas indirect channels allow for broader geographic reach and specialized regional application expertise.

The market structure is characterized by a mix of specialized Original Equipment Manufacturers (OEMs) who dominate the high-end, customized machinery segment and general industrial equipment suppliers who offer entry-level or standard rotary machines. The shift toward Industry 4.0 strongly influences the value chain, mandating closer integration between software developers (control systems and AI analytics) and hardware manufacturers. Effective downstream performance relies heavily on post-sales support and the provision of continuous training to end-users on advanced welding techniques and maintenance protocols, ensuring high customer satisfaction and repeat business in this capital-intensive sector.

Friction Welding Machine Market Potential Customers

The primary potential customers and end-users of friction welding machines are large-scale manufacturers operating in sectors where high-integrity joints, material dissimilarities, and component lightweighting are paramount strategic concerns. Within the automotive industry, key buyers include major OEM assembly plants and Tier 1 suppliers specializing in powertrain components such as engine valves, transmission shafts, axle tubes, and increasingly, battery enclosure assemblies for electric vehicles (EVs). These customers require machines capable of high throughput, stringent quality control, and the ability to join difficult material combinations like aluminum to steel, crucial for modern hybrid vehicle construction and structural battery frame development, driven by global mandates for reduced emissions and improved fuel economy.

Another significant customer segment is the aerospace and defense sector, including engine manufacturers (producing jet engine shafts and turbine blisks) and structural component fabricators (landing gear). These organizations demand linear and rotary friction welding machines that adhere to extremely high regulatory standards (e.g., NADCAP certification) and can handle high-performance alloys like titanium, nickel-based superalloys, and specialized steel grades. Reliability and traceability are critical purchasing criteria in this domain, often leading these customers to invest in highly customized, large-capacity inertia welding machines capable of handling immense forge forces and complex component geometries. The Oil & Gas industry represents a niche but high-value customer base, utilizing friction welding, particularly friction hydro pillar processing, for repairing and fabricating drill pipes, risers, and heavy-duty tool joints where strength and resistance to harsh environmental conditions are essential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTS Systems Corporation, Thompson Friction Welding, Kuka AG, MTI (Manufacturing Technology, Inc.), H&B Omega Europa GmbH, ARO S.A., Extol, Inc., Nitto Seiki Co., Ltd., U-Jin Tech Co., Ltd., ETA s.r.o., Colfax Corporation (ESAB), SVS-Vitek, Izumi Machine Mfg. Co., Ltd., American Friction Welding, BIAX Machining, Inc., Fori Automation, Inc., TWI Ltd. (Technology Provider), Bond Technologies, Inc., Wuxi South Friction Welding Equipment Co., Ltd., Tianjin Zhonghuan Friction Welding Equipment Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Friction Welding Machine Market Key Technology Landscape

The technological landscape of the Friction Welding Machine Market is defined by continuous advancements aimed at achieving greater precision, adaptability, and integration into automated manufacturing environments (Industry 4.0). A pivotal technology is the development of highly rigid, high-force inertia welding systems, utilizing flywheels to store kinetic energy and deliver immense forging pressure, which is crucial for welding large diameter components common in the oil and gas or construction sectors. Sophisticated closed-loop control systems, leveraging high-speed sensors (acoustic emission sensors, high-resolution encoders, and load cells), are now standard, enabling real-time monitoring and micro-adjustment of parameters like rotation speed stability and axial shortening tolerance. This technological maturity ensures that the metallurgical bond is consistently achieved within extremely narrow tolerances, minimizing internal defects and ensuring compliance with stringent regulatory requirements prevalent in critical applications.

Furthermore, the increased prominence of Linear Friction Welding (LFW) is transforming the market by allowing the joining of non-axisymmetric parts, particularly complex aerospace components like blisks (bladed disks) and structural elements. LFW machines require highly advanced hydraulic and control systems to manage the oscillating movement and maintain precise alignment under massive pressure, demanding complex synchronization algorithms. The rise of Friction Stir Welding (FSW) technology, often integrated with robotic systems, represents a major shift toward joining thin sheet materials and structures, especially aluminum alloys used extensively in high-speed rail and EV battery trays. FSW is valued for its ability to produce welds with minimal distortion and excellent mechanical properties, utilizing non-consumable tools to stir and soften the material without reaching the melting point.

Future technological advancements are heavily focused on leveraging digital connectivity and data analytics. Integrated condition monitoring systems (CMS) utilize IoT sensors to track machine health, vibration patterns, and energy consumption, feeding data into cloud platforms for sophisticated analysis. This digital integration facilitates predictive maintenance, maximizes machine uptime, and provides comprehensive data logging for regulatory audit trails. The ongoing miniaturization of friction welding systems for specialized applications, such as micro-joining in electronics and medical devices, also signifies a key technology trend, requiring exceptionally fine control over friction pressure and rotation to handle minute component sizes while maintaining the integrity of delicate materials.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to dominate the Friction Welding Machine Market, primarily driven by China's colossal automotive manufacturing base, which is rapidly pivoting towards electric vehicles, requiring vast numbers of friction-welded battery components and motor shafts. The region benefits from lower manufacturing costs, which spurs rapid adoption of advanced production technologies across India, South Korea, and Japan. Japan maintains its strength in high-precision, customized machinery, while the Southeast Asian nations contribute to volume demand for standard rotary machines used in construction equipment and general fabrication. Significant government investments in high-speed rail infrastructure and defense modernization further ensure sustained regional growth, making APAC the key strategic focus for global friction welding machine OEMs seeking high-volume market penetration.

- North America: North America represents a mature, high-value market characterized by high demand for highly customized, large-capacity friction welding machines, particularly within the aerospace and defense sectors, where component integrity is non-negotiable. The US remains the global leader in inertia friction welding technology, driven by military contracts and critical applications in space exploration and commercial aviation (e.g., turbine engine manufacturing). The regional market is highly focused on adopting Linear Friction Welding (LFW) for advanced structural components and emphasizes the integration of sophisticated automation and AI/ML technologies to enhance quality control and reduce reliance on manual labor, maintaining a strong market share in terms of technology spend per unit.

- Europe: Europe is characterized by stringent quality standards and a strong emphasis on sustainability and energy efficiency, driving the market toward advanced FSW and hybrid welding solutions. Germany, as a manufacturing powerhouse, leads in the production and adoption of high-precision rotary and linear friction welding machines utilized extensively by its dominant automotive (especially premium and luxury vehicle segments) and industrial machinery sectors. The shift toward electric mobility and the robust presence of key aerospace players (e.g., in France and the UK) ensure continuous investment in high-end friction welding technology, focused particularly on joining dissimilar lightweight alloys to meet strict EU environmental mandates.

- Latin America (LATAM): The LATAM market, while smaller, offers niche growth opportunities, particularly in Brazil and Mexico, linked to their robust automotive assembly sectors and oil and gas exploration activities. Demand is primarily centered on standard rotary friction welding machines for mass-produced components and maintenance applications in heavy machinery. Market growth is heavily dependent on foreign direct investment (FDI) in manufacturing and the stabilization of regional economic conditions, with procurement often prioritizing cost-effectiveness and local service support availability.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the upstream oil and gas sector, which necessitates specialized friction welding equipment for drill pipe manufacture and repair, especially in Saudi Arabia and the UAE. Demand is project-based and concentrated on high-load capacity machines (e.g., FHPP and Inertia Welding). Investment in friction welding technology is increasingly supported by regional diversification efforts aimed at establishing domestic manufacturing capabilities in defense and infrastructure, though market penetration remains challenging due to logistical complexities and the limited existing industrial base outside of the energy sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Friction Welding Machine Market.- MTS Systems Corporation

- Thompson Friction Welding (A Division of Avingtrans PLC)

- Kuka AG

- MTI (Manufacturing Technology, Inc.)

- H&B Omega Europa GmbH

- ARO S.A.

- Extol, Inc.

- Nitto Seiki Co., Ltd.

- U-Jin Tech Co., Ltd.

- ETA s.r.o.

- Colfax Corporation (ESAB)

- SVS-Vitek

- Izumi Machine Mfg. Co., Ltd.

- American Friction Welding

- BIAX Machining, Inc.

- Fori Automation, Inc.

- TWI Ltd. (Technology Provider)

- Bond Technologies, Inc.

- Wuxi South Friction Welding Equipment Co., Ltd.

- Tianjin Zhonghuan Friction Welding Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Friction Welding Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of friction welding over traditional fusion welding methods?

Friction welding, being a solid-state joining process, offers superior metallurgical properties by avoiding melting, resulting in finer grain structure and significantly reduced heat-affected zones (HAZ). Key advantages include high joint strength, the capability to weld dissimilar metals (e.g., aluminum to steel) without brittle intermetallic compounds, reduced energy consumption, minimal material distortion, and high repeatability, which is crucial for safety-critical components in aerospace and automotive applications.

Which industrial sectors are the largest consumers of Linear Friction Welding (LFW) machines?

The largest consumers of Linear Friction Welding (LFW) machines are the aerospace and defense industries, primarily utilizing LFW for the fabrication of complex, non-axisymmetric components such as jet engine blisks, turbine shafts, and critical structural elements made from high-performance alloys like titanium and nickel superalloys. LFW ensures high-quality, high-integrity welds necessary for maintaining stringent performance and safety standards in these demanding applications.

How is the global shift toward electric vehicles (EVs) impacting the demand for friction welding technology?

The shift toward EVs is significantly boosting demand for friction welding, especially for joining copper busbars, aluminum motor casings, and complex battery enclosure assemblies. Friction welding (including both rotary and friction stir variants) is highly efficient for reliably joining thin-walled aluminum structures and managing thermal properties, which is vital for the structural integrity and thermal management of modern EV battery packs.

What role does automation and Industry 4.0 play in the future development of the Friction Welding Machine Market?

Industry 4.0 plays a pivotal role by integrating AI, IoT sensors, and advanced control systems into friction welding processes. This integration enables real-time process monitoring, predictive quality control, automated parameter adjustment, and sophisticated predictive maintenance. This shift ensures zero-defect manufacturing capabilities, maximizes machine uptime, and facilitates seamless data traceability, meeting the demands of high-volume, precision manufacturing environments.

What is the main financial constraint preventing wider adoption of high-end friction welding machines among small and medium enterprises (SMEs)?

The main financial constraint is the high initial capital expenditure (CAPEX) required for purchasing sophisticated, high-force friction welding machines, particularly linear and inertia models, which often involve complex hydraulic systems and high-precision CNC controls. Additionally, the specialized technical expertise required for installation, maintenance, and process development represents a significant operational cost barrier for many SMEs compared to investing in more conventional fusion welding equipment.

Which specific material combinations are most commonly joined using rotary friction welding technology in the automotive sector?

In the automotive sector, rotary friction welding is frequently used to join dissimilar material combinations crucial for lightweighting and performance enhancement. Common combinations include aluminum to steel (often used in drive shafts and suspension components), high-carbon steel to low-carbon steel (for engine valves), and various ferrous materials for producing bimetallic components like turbocharger shafts. This process maintains the strength integrity necessary for critical rotating parts.

How do machine manufacturers ensure the quality and repeatability of welds in complex friction welding systems?

Manufacturers ensure quality and repeatability through highly rigid machine structures, precision spindle control, and sophisticated closed-loop monitoring systems. These systems precisely measure and record critical variables such as friction time, speed decay rate, applied force, and axial shortening (burn-off length). Statistical Process Control (SPC) and real-time data acquisition ensure that every weld meets the pre-set, narrow tolerance limits, critical for safety-related parts.

Beyond traditional manufacturing, what emerging application areas are adopting friction welding technology?

Emerging application areas include the medical device industry (joining dissimilar metals for implants and surgical tools), renewable energy (fabrication of specialized joints for wind turbine components and solar panel frames), and advanced material research involving metal matrix composites. The consistent, non-contaminating nature of friction welding makes it ideal for these high-value, sensitive applications where failure is highly consequential.

What technical limitations are associated with Friction Stir Welding (FSW) compared to traditional Rotary Friction Welding?

While FSW is excellent for joining plates and non-axisymmetric parts, its main technical limitations include the requirement for highly specialized tooling (which experiences wear), slower travel speeds compared to fusion welding, and difficulties in achieving high-quality welds on materials thicker than approximately 25mm due to the complexity of stirring tools and necessary machine rigidity. Additionally, FSW leaves a keyhole exit which often requires subsequent repair or finishing, unlike RFWM which produces a flash that is easily removed.

In the context of the Friction Welding Market, what is the significance of the "Forge Force" parameter?

The Forge Force parameter is of critical significance; it is the final, high-pressure axial load applied immediately after the friction stage concludes, during the forging phase. This massive, instantaneous force expels weakened, oxidized, or plasticized material (flash) from the joint interface and consolidates the solid-state bond, ensuring maximum joint area integrity and forming the final, high-strength metallurgical connection required for high-performance applications.

How does the energy efficiency of friction welding compare to arc welding processes, and why is this driving market adoption?

Friction welding processes are significantly more energy-efficient than traditional arc welding processes. Since friction welding only heats the material at the immediate joint interface rather than melting the entire cross-section, it consumes substantially less electrical energy per weld cycle. This inherent efficiency directly reduces operational costs and aligns with global sustainability initiatives, driving market adoption among large industrial users seeking to minimize their manufacturing energy footprint.

What is the difference between Continuous Drive Friction Welding and Inertia Friction Welding?

Continuous Drive Friction Welding maintains a constant rotational speed until the desired burn-off length or time is reached, after which the rotation is abruptly stopped, and the forge force is applied. Inertia Friction Welding, conversely, utilizes a flywheel pre-spun to a high speed; the motor is disconnected, and the kinetic energy stored in the flywheel provides the rotational friction until the rotational momentum is entirely depleted. Inertia welding is often preferred for larger components requiring very high initial energy input and forging pressures.

What are the primary challenges associated with welding dissimilar materials like aluminum and steel using friction welding?

The primary challenges involve managing the significant differences in thermal expansion coefficients and melting points between the materials. Friction welding successfully overcomes these challenges by avoiding the formation of brittle intermetallic compounds that typically cause joint failure in fusion welding. Success relies on precise control of the heat input and the forge force to ensure the metallurgical bond forms quickly and uniformly at the interface, promoting a diffusion bond rather than a fusion zone.

Which geographical region exhibits the fastest growth potential for friction welding machine sales, and what are the reasons?

The Asia Pacific (APAC) region exhibits the fastest growth potential, predominantly driven by the immense manufacturing scale in China, India, and Southeast Asia. The reasons include massive governmental investment in infrastructure, the rapid expansion of domestic automotive and heavy machinery manufacturing, and the urgent need to upgrade production processes to meet global quality standards, particularly in the booming electric vehicle component manufacturing sector.

How do machine manufacturers address the issue of 'flash' formation in friction welding, and what is its significance?

'Flash' is the plasticized, excess material expelled from the joint interface during the forge stage, carrying away contaminants and ensuring a clean, high-integrity bond. Manufacturers manage flash using specialized tooling and shrouds to contain it, often followed by automated deflashing or trimming processes (e.g., machining or shearing) integrated directly into the welding cell. The formation and removal of uniform flash are essential indicators of a successful solid-state weld.

What safety features are critical in modern friction welding machine designs, given the high forces and rotation speeds involved?

Critical safety features include robust mechanical guarding and interlocks to prevent access during high-speed rotation and high-pressure forging cycles. Modern machines incorporate advanced light curtains, emergency stop (E-stop) systems with rapid braking mechanisms, and comprehensive hydraulic system monitoring to prevent catastrophic failures, ensuring operator safety in highly automated manufacturing environments where immense kinetic energy is utilized.

How are oil and gas companies utilizing Friction Hydro Pillar Processing (FHPP) in their operations?

Oil and gas companies utilize FHPP primarily for repairing and fabricating heavy-duty tubular components, such as risers, drill pipes, and structural supports used in subsea and offshore environments. FHPP is an orbital friction welding technique that allows for the creation of high-strength, non-destructive, full-penetration welds in large diameter pipes, crucial for maintaining the integrity and safety of critical high-pressure infrastructure.

Discuss the role of Computer Numerical Control (CNC) in modern friction welding machines.

CNC plays a crucial role by providing highly accurate, repeatable control over all phases of the welding cycle—friction time, rotational speed, axial pressure, and forge force application. CNC systems allow complex, multi-step welding profiles to be programmed and stored, ensuring consistent execution across thousands of components and facilitating seamless integration into fully automated production lines for enhanced throughput and minimal process variability.

What are the technological limitations regarding the size and geometry of components that can be joined using current friction welding technology?

Rotary friction welding is primarily limited to axisymmetric components, although some fixtures can accommodate slightly non-circular parts. Linear friction welding handles non-axisymmetric parts but is restricted by the current capacity of machines, often limiting cross-sectional weld areas to under 50,000 mm^2. Extremely large or complex geometries still present significant challenges due to the need for massive machine rigidity and uniform pressure distribution across the entire interface.

How is titanium friction welding utilized in the medical device industry, and why is this technology preferred?

In the medical device industry, friction welding is highly preferred for joining titanium and its alloys (such as Ti-6Al-4V) in orthopedic implants, surgical instruments, and prosthetic components. The technology is favored because it produces sterile, high-strength welds that eliminate porosity and contaminants, maintaining the biocompatibility and corrosion resistance of titanium essential for long-term integration within the human body.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Friction Welding Machine Market Statistics 2025 Analysis By Application (Automotive Manufacturing, Tool & Machine Manufacturing, Aviation & Shipbuilding), By Type (Rotary Friction Welding Machine, Linear Friction Welding Machine, Friction Stir Welding Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Friction Welding Machine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Rotary Friction Welding, Linear Friction Welding, Friction Stir Welding), By Application (Automotive Manufacturing, Tool & Machine Manufacturing, Aviation & Shipbuilding, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager