Fried Chicken Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433233 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fried Chicken Powder Market Size

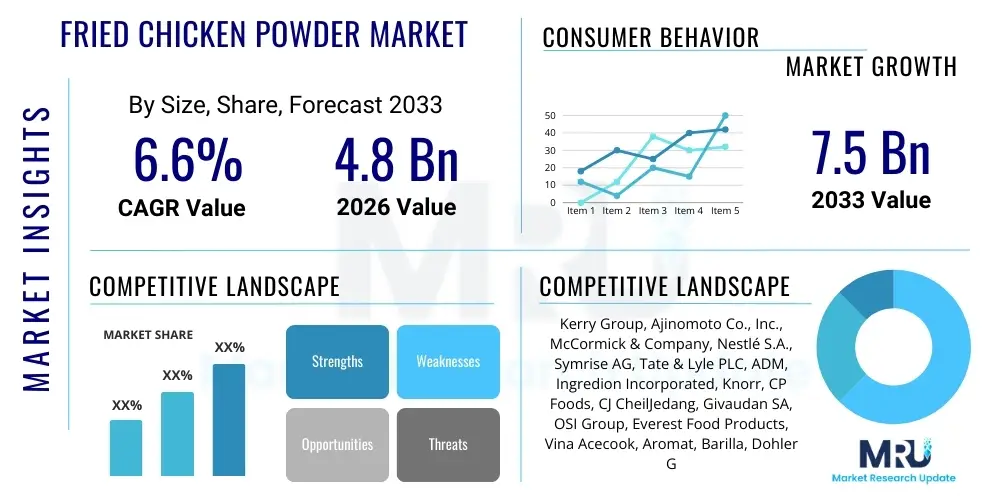

The Fried Chicken Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating proliferation of Quick Service Restaurants (QSRs) globally, particularly across Asian and Latin American economies, where fried chicken remains a highly popular and affordable protein source. Furthermore, the increasing consumer preference for convenient home meal solutions is driving the demand for pre-mixed seasoning powders that offer consistent flavor and texture with minimal preparation time.

Fried Chicken Powder Market introduction

The Fried Chicken Powder Market encompasses the production, distribution, and sale of specialized dry mixes used to coat chicken pieces prior to frying, ensuring a crispy texture and rich flavor profile. These powders are sophisticated blends of flours (wheat, rice, or corn), starches, and a complex matrix of spices, herbs, flavor enhancers (such as monosodium glutamate), and functional ingredients designed to enhance adherence, texture, and taste retention under high heat. The product is indispensable in both commercial foodservice settings and household kitchens, serving as a critical component in preparing universally popular dishes like crispy chicken wings, tenders, and drumsticks. The technological sophistication of modern fried chicken powders lies in achieving maximum crunchiness while minimizing oil absorption, aligning with evolving consumer expectations for lighter, yet satisfying, convenience foods.

Major applications of fried chicken powder span across the commercial sector, predominantly Quick Service Restaurants (QSRs) and institutional catering, where standardization and bulk availability are paramount. In the household segment, demand is driven by ease of use and the ability to replicate restaurant-quality flavors at home. Key benefits include flavor consistency, extended shelf life, simplified cooking processes, and cost-effectiveness compared to scratch-made batters. The market is witnessing continuous innovation focused on optimizing the balance between texture and health attributes, such as introducing powders fortified with fiber or those using healthier oil absorption modifiers.

Driving factors for sustained market growth include rapid urbanization, increasing disposable incomes in emerging markets, and the strong global influence of Western fast-food culture, which heavily features fried chicken. Furthermore, manufacturers are capitalizing on regional flavor preferences by introducing localized spice blends—ranging from extremely spicy Korean variants to milder, herb-infused European styles—thereby expanding their consumer base and relevance in diverse geographic markets. The market's resilience is also supported by its adaptability to various cooking methods, including air frying and oven baking, catering to health-conscious consumers seeking reduced-fat alternatives.

Fried Chicken Powder Market Executive Summary

The Fried Chicken Powder Market exhibits robust growth driven by high demand from the foodservice industry and increasing adoption in domestic settings. Current business trends indicate a strong focus on product diversification, particularly the development of clean-label, low-sodium, and gluten-free formulations to address evolving health trends. Strategic alliances between flavor houses and major QSR chains are accelerating innovation in customized flavor profiles, positioning consistency and unique taste as primary competitive advantages. Supply chain resilience, particularly the sourcing of high-quality spices and functional flours, remains a critical operational priority for leading market players navigating global logistical disruptions and commodity price volatility.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, characterized by massive consumption volumes in countries like China, India, and Indonesia, driven by rapid QSR expansion and favorable demographic trends. North America and Europe demonstrate mature market conditions, where growth is primarily sustained through premiumization, focusing on specialty ingredients and unique flavor fusions. The Middle East and Africa (MEA) are emerging as high-potential markets, spurred by rapid infrastructure development, increased tourism, and a burgeoning appetite for convenient, Western-style fast food, necessitating localized product offerings that adhere to specific dietary and religious requirements, such as Halal certification.

Segment trends reveal that the Foodservice/Horeca application segment holds the largest market share due to bulk purchasing and standardized operational requirements across international chains. However, the Household segment is demonstrating faster penetration, amplified by pandemic-induced shifts toward home cooking and the enhanced convenience offered by pre-packaged kits. Regarding product type, the Original/Classic flavor remains foundational, but the Spicy segment is experiencing the most dynamic growth, reflecting a global palate shift toward bolder and more intense heat profiles. Distribution is becoming increasingly omnichannel, with e-commerce platforms playing a crucial role in reaching household consumers, although traditional Supermarkets and Hypermarkets remain critical for large-volume retail sales.

AI Impact Analysis on Fried Chicken Powder Market

User inquiries regarding AI's role in the Fried Chicken Powder Market frequently center on three main themes: precision flavor matching, supply chain optimization, and automated quality control. Users express concerns about maintaining the artisanal quality of spices while leveraging AI for standardization. They anticipate AI tools will revolutionize Research and Development (R&D) by predicting successful flavor combinations based on regional consumer data and ingredient molecular profiles, leading to faster product launch cycles. Furthermore, significant interest exists in how AI-driven predictive maintenance and yield optimization in spice processing can stabilize costs and ensure consistent ingredient quality, mitigating geopolitical risks associated with global spice sourcing. The consensus expectation is that AI will enhance operational efficiency and innovation velocity without replacing the core chemistry of flavor formulation.

- AI-driven Predictive Flavor Formulation: Utilizing machine learning algorithms to analyze vast datasets of consumer preferences, regional taste profiles, and molecular interactions of ingredients to rapidly prototype and launch novel flavor variants, minimizing human trial-and-error.

- Supply Chain and Inventory Optimization: Implementing AI models to forecast demand volatility, optimize inventory levels of raw spices and flours, and track ingredient provenance in real-time, significantly reducing waste and improving traceability.

- Automated Quality Control (AQC): Employing computer vision and sensor technology during the blending and packaging process to ensure particle size uniformity, color consistency, and immediate detection of contaminants, ensuring strict adherence to global food safety standards.

- Personalized Consumer Recommendations: Using AI insights derived from retail data (e-commerce and loyalty programs) to recommend customized powder blends or usage instructions to individual consumers, driving higher engagement and repeat purchases in the Household segment.

- Efficiency in Manufacturing Operations: Applying AI and Robotics Process Automation (RPA) in blending, filling, and packaging lines to maximize throughput, reduce operational downtime, and achieve energy efficiency during the complex blending process.

DRO & Impact Forces Of Fried Chicken Powder Market

The dynamics of the Fried Chicken Powder Market are shaped by powerful Drivers promoting expansion, stringent Restraints limiting growth, and compelling Opportunities offering pathways for innovation, all modulated by pervasive Impact Forces. The primary driver remains the unceasing global demand for convenience food, championed by the rapid expansion of international QSR franchises into developing economies. This is coupled with continuous product innovation, particularly the introduction of functional ingredients that address texture, oil absorption, and flavor intensity in increasingly sophisticated ways. Conversely, significant restraints include the growing global health consciousness, leading consumers to seek lower-fat and lower-sodium alternatives, which pressures manufacturers to reformulate products traditionally reliant on high sodium content for flavor enhancement and preservation. Furthermore, price volatility and complex logistics associated with sourcing high-quality, exotic spices present ongoing cost management challenges.

Opportunities for market players are abundant in the domains of clean-label and specialty ingredients. Developing gluten-free, organic, and non-GMO certified powders unlocks premium segments in developed markets where discerning consumers prioritize ingredient transparency. Furthermore, leveraging technology to create unique, geographically authentic flavor profiles (e.g., specific regional Korean or Sichuan spices) allows companies to capture niche market enthusiasm and establish intellectual property in flavor differentiation. Strategic partnerships with food technology startups focusing on flavor encapsulation and delivery systems also represent a significant avenue for enhancing product performance and shelf stability, especially in humid climates.

Impact forces significantly influencing the market trajectory include rapid technological advancements in food processing, such as microwave-vacuum drying and supercritical fluid extraction for flavor production, which enable the creation of highly concentrated and stable flavor molecules. More critically, global regulatory frameworks, particularly concerning allergen labeling (e.g., wheat components) and maximum permissible sodium levels in packaged foods, necessitate frequent and expensive product adjustments. Socio-economic factors, such as shifting dietary patterns toward plant-based alternatives, are forcing key players to innovate with plant-based coating systems that replicate the texture and flavor profiles traditionally achieved using chicken-derived ingredients or complex wheat protein structures. These forces mandate constant vigilance in R&D and regulatory compliance across all operating regions.

Segmentation Analysis

The Fried Chicken Powder Market is intricately segmented based on product type, application, and distribution channel, reflecting the diverse needs of commercial enterprises versus household consumers. Segmentation provides crucial insights into targeted marketing strategies and product development priorities. The core segmentation revolves around differentiating between classic flavor profiles (Original, Crispy) and specialized flavors (Spicy, Regional Specialty), with application driving volume, emphasizing the significant distinction between bulk requirements in the Foodservice sector and smaller, consumer-friendly packaging in the Retail segment. Understanding these granular divisions is essential for navigating market maturity in different geographical areas and allocating resources effectively for market penetration.

The evolving consumer landscape, marked by a demand for both convenience and health, has led to further sub-segmentation within product type, specifically targeting functional attributes like low sodium, high fiber, and specific certifications (Halal, Kosher). The distribution channel analysis is critical as the shift towards e-commerce platforms is rapidly changing how household consumers access these products, although institutional buyers continue to rely on direct B2B supply contracts and specialized food distributors. This multi-layered segmentation underscores the complexity of the global market and the necessity for tailored supply chain and marketing efforts.

- By Type:

- Original/Classic Flavor

- Spicy Flavor (e.g., Korean Spicy, Buffalo)

- Extra Crispy/Tempura Style

- Specialty & Regional Flavors (e.g., Herb & Garlic, Curry)

- By Application:

- Foodservice/Horeca (Quick Service Restaurants, Institutional Catering)

- Household/Retail

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Specialty Food Stores

- By Nature:

- Conventional

- Organic

- By Ingredient Base:

- Wheat-Based

- Gluten-Free (Rice Flour, Corn Starch Based)

Value Chain Analysis For Fried Chicken Powder Market

The Value Chain for the Fried Chicken Powder Market begins with the highly specialized Upstream Analysis, which involves the sourcing and processing of core raw materials, predominantly flours (wheat, corn, rice), starches, and a complex array of global spices and flavor enhancers. The integrity and stability of this upstream segment are vital, as quality fluctuations in raw materials directly impact the final product's performance and flavor profile. Key activities include bulk milling, specialized spice grinding, and the production of functional ingredients like binding agents and anti-caking compounds. Leading manufacturers invest heavily in backward integration or strong supplier relationships to ensure traceability and consistent quality, mitigating risks associated with commodity price volatility and seasonal harvest variations.

The Midstream component focuses on formulation, blending, and manufacturing. This phase involves advanced R&D for flavor matching and texture optimization, followed by high-precision batch blending to ensure uniformity across production runs. Packaging and quality assurance protocols are rigorous, adhering to international food safety and hygiene standards. The Downstream Analysis focuses on the distribution channels, which are bifurcated into Direct and Indirect models. Direct distribution is crucial for large commercial clients (QSRs and major food processors), involving large-scale B2B contracts and dedicated logistics networks. This ensures timely delivery and bulk pricing advantages required by institutional buyers.

Indirect distribution encompasses the retail channel, utilizing wholesalers, distributors, and modern trade outlets (Supermarkets/Hypermarkets). The growth of e-commerce has significantly revolutionized this indirect path, enabling direct-to-consumer sales and increasing market reach, especially for specialty or niche flavor variants. The successful management of the downstream logistics, including inventory management across varied climate zones, is critical for maintaining product integrity and maximizing market penetration across both high-volume commercial and fragmented retail segments.

Fried Chicken Powder Market Potential Customers

The primary End-Users and buyers of fried chicken powder fall into two distinct yet equally important categories: the global Foodservice industry (Horeca) and the individual Household consumer. Within the Foodservice sector, Quick Service Restaurants (QSRs) represent the most significant customer segment, relying entirely on standardized powder blends to maintain brand consistency and operational efficiency across thousands of global outlets. Institutional caterers, including those servicing schools, hospitals, and corporate dining facilities, also constitute major bulk purchasers, prioritizing cost-effectiveness, safety certifications, and scalable supply chains for mass production.

The second major group is the vast and fragmented Household segment. These consumers, driven by convenience, affordability, and the desire for experiential cooking, purchase smaller retail packs. This group includes young professionals seeking quick meal solutions, families utilizing the product for easy home dinners, and cooking enthusiasts experimenting with global flavor profiles. Successful targeting of this group requires sophisticated retail packaging, clear usage instructions, and availability across diverse distribution channels, including online grocery platforms, where recipe inspiration and flavor variety drive purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.6% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kerry Group, Ajinomoto Co., Inc., McCormick & Company, Nestlé S.A., Symrise AG, Tate & Lyle PLC, ADM, Ingredion Incorporated, Knorr, CP Foods, CJ CheilJedang, Givaudan SA, OSI Group, Everest Food Products, Vina Acecook, Aromat, Barilla, Dohler GmbH, Frutarom (IFF), Griffith Foods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fried Chicken Powder Market Key Technology Landscape

The technological landscape of the Fried Chicken Powder Market is focused heavily on achieving superior texture, extended shelf stability, and flavor delivery customization. A crucial technology is flavor encapsulation, where volatile flavor compounds and spice extracts are protected within a matrix (often gum arabic or maltodextrin). This technology ensures that the flavor profile remains consistent throughout the manufacturing, storage, and frying processes, resisting degradation from heat, moisture, or oxidation. Encapsulation is particularly vital for exotic and expensive spice blends, maximizing their impact while minimizing the required concentration. Furthermore, advanced milling technologies are employed to ensure the uniformity of particle size in flours and starches, which is directly correlated with the batter’s adhesion properties and the final fried product's desired crispness and consistency, especially important for high-speed QSR operations.

Another significant area of technological investment is the development of functional starches and hydrocolloids. These ingredients are engineered to specifically control oil absorption during the frying process, allowing manufacturers to market lower-fat finished products, addressing major consumer health concerns. Modified starches contribute significantly to the characteristic 'shatter' crunch required by consumers, while specialized proteins and binding agents ensure the coating remains intact and adheres securely to the chicken surface, minimizing waste and improving product presentation. The optimization of these functional ingredients requires precise control over pH and moisture content during the powder blending stage.

Finally, the adoption of aseptic processing and high-barrier packaging technologies is essential for extending the shelf life of these dry powder mixtures, especially in regions with high humidity. Nitrogen flushing and vacuum packaging minimize oxidation and maintain the potency of natural flavors and colors over time. Manufacturers are also increasingly utilizing spectral analysis and near-infrared (NIR) sensors during production for real-time quality checks, ensuring that every batch meets stringent compositional and flavor specifications, thus reinforcing brand consistency and reducing the risk of costly recalls due to ingredient imbalance.

Regional Highlights

The Fried Chicken Powder Market exhibits significant heterogeneity across global regions, driven by varying cultural preferences, economic development levels, and the maturity of the foodservice infrastructure. Asia Pacific (APAC) represents the powerhouse of the global market, accounting for the largest share in terms of volume and demonstrating the highest growth trajectory. This dominance is attributable to the massive population base, rapid urbanization, proliferation of local and international fast-food chains (QSRs), and the deep cultural integration of fried chicken dishes in national cuisines, such as in South Korea (Chimaek) and China. India and Southeast Asian nations are driving demand due to rising middle-class disposable income and a strong preference for convenience foods, fueling robust expansion in both the Horeca and household segments, often favoring spicier and bolder flavor profiles.

North America and Europe constitute mature markets characterized by stable, moderate growth rates. In these regions, the focus is less on volume expansion and more on premiumization and addressing evolving dietary needs. Demand in North America is sustained by the dominance of established QSR brands and a high propensity for ready-to-use meal solutions. European growth is stimulated by multicultural food trends and the increasing popularity of global cuisine, particularly in countries like the UK and Germany. Key trends here include the demand for clean-label, non-GMO, and lower-sodium alternatives, prompting manufacturers to invest in high-cost, specialized ingredients and organic certifications to appeal to the health-conscious consumer base.

Latin America (LATAM) and the Middle East & Africa (MEA) are identified as high-potential emerging markets. LATAM's growth is supported by economic recovery, increased foreign investment in fast food, and large, young populations with a growing appetite for processed convenience foods. In MEA, market penetration is accelerating, particularly in the GCC countries and South Africa, fueled by changing lifestyles and disposable incomes. Essential requirements in MEA include stringent adherence to Halal standards, necessitating specific sourcing and processing certifications, and the customization of flavor profiles to match regional spice preferences, presenting a critical entry barrier for international players who fail to adapt their formulation strategy. Investment in regional production facilities is key to overcoming logistical and trade barriers in these regions.

- Asia Pacific (APAC): Market leader and fastest-growing region, driven by massive QSR expansion (China, India, Indonesia) and high household consumption. Focus on cost-effectiveness and localized spicy flavors.

- North America: Mature market sustained by established major QSR chains. Growth is focused on premiumization, healthy reformulation (low sodium, gluten-free), and technological integration in manufacturing.

- Europe: Steady growth propelled by ethnic food trends and high consumer demand for transparency and sustainability. Significant demand for certified organic and clean-label products across Western Europe.

- Latin America (LATAM): Emerging market characterized by rapid urbanization and increasing convenience orientation. High potential for growth in the retail segment, with a preference for value-based product offerings.

- Middle East & Africa (MEA): High-potential region requiring specific Halal certification and localized flavor customization. Market expansion is linked to tourism growth and rising per capita expenditure on prepared foods, especially in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fried Chicken Powder Market.- Kerry Group

- Ajinomoto Co., Inc.

- McCormick & Company

- Nestlé S.A.

- Symrise AG

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- Ingredion Incorporated

- Knorr (Unilever Food Solutions)

- CP Foods (Charoen Pokphand Foods)

- CJ CheilJedang

- Givaudan SA

- OSI Group

- Everest Food Products

- Vina Acecook

- Aromat (Maggi/Nestlé)

- Barilla G. e R. Fratelli S.p.A. (Focusing on binding agents)

- Dohler GmbH

- Frutarom (IFF)

- Griffith Foods

Frequently Asked Questions

Analyze common user questions about the Fried Chicken Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Fried Chicken Powder Market?

The Fried Chicken Powder Market is anticipated to grow at a CAGR of 6.6% between 2026 and 2033. This growth is primarily fueled by the rapid expansion of the Quick Service Restaurant (QSR) sector globally and increasing consumer reliance on convenient home meal solutions, particularly in the Asia Pacific region.

Which segmentation dominates the Fried Chicken Powder Market in terms of application?

The Foodservice/Horeca application segment holds the dominant market share. This is due to the standardized operational requirements and large bulk purchasing volumes necessitated by major international fast-food chains and institutional caterers who require consistent flavor and texture across all outlets.

What are the key health-related restraints affecting market growth?

Key restraints include increasing global consumer health consciousness regarding high sodium content and the deep-frying process associated with the final product. This pressure drives manufacturers to focus heavily on R&D for lower-sodium, gluten-free, and healthier oil absorption-controlling formulations to maintain market relevance.

How is Asia Pacific positioned in the global Fried Chicken Powder Market?

Asia Pacific (APAC) is the leading region in the global market, both in terms of consumption volume and growth rate. This is largely driven by mass urbanization, burgeoning middle-class populations, and the strong cultural acceptance and proliferation of fried chicken as a staple convenience food across countries like China, India, and South Korea.

What role does technology play in flavor consistency and shelf life?

Technology, particularly flavor encapsulation techniques and advanced milling, is crucial for maintaining flavor consistency and extending shelf life. Encapsulation protects volatile spice notes from heat and oxidation, while high-barrier packaging and aseptic processing ensure product integrity and stability over long distribution periods, essential for global supply chains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager