Front Loaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434919 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Front Loaders Market Size

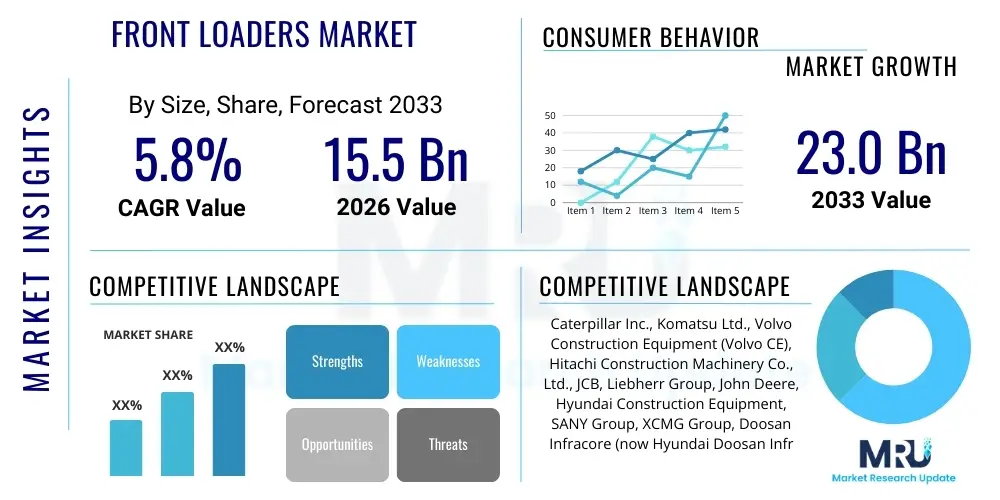

The Front Loaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Front Loaders Market introduction

The Front Loaders Market encompasses the global trade of heavy construction and agricultural equipment designed primarily for scooping, lifting, and moving materials such as soil, gravel, sand, asphalt, demolition debris, and agricultural feed. These machines, characterized by a large bucket mounted on linkages attached to the front, are indispensable across numerous heavy industries due to their high maneuverability and operational efficiency in bulk material handling. The market is defined by continuous innovation focused on enhancing fuel efficiency, incorporating advanced telematics, and improving operator comfort and safety standards, directly addressing strict emission regulations prevalent in developed economies. Adoption rates are strongly correlated with global infrastructure spending and the overall health of the construction, mining, and waste management sectors.

Product differentiation within the Front Loaders segment is primarily driven by operational capacity, engine horsepower, and the type of locomotion, categorized broadly into compact, medium, and large loaders, and further segmented by wheeled or tracked mechanisms. Wheeled front loaders dominate the market share owing to their speed and versatility on paved surfaces and stable grounds, making them the preferred choice for municipal work, highway construction, and industrial logistics. Conversely, tracked loaders, or compact track loaders (CTLs), offer superior traction and stability on uneven, soft, or muddy terrains, proving essential in heavy-duty mining, forestry, and agricultural land preparation applications. Manufacturers are increasingly focusing on modular designs that allow for easy attachment swapping, transforming these primary machines into multi-functional utility vehicles capable of performing diverse tasks ranging from trench digging to snow removal.

The core benefits driving sustained market growth include their exceptional cost-effectiveness in material transport over short distances, reduction in manual labor dependence, and the increased pace of project completion they facilitate. Key applications span public works, large-scale commercial real estate development, resource extraction processes, and modern agricultural operations requiring high-volume feed and fertilizer handling. The primary driving factors sustaining demand are rapid urbanization, especially in emerging economies, government investment in smart city infrastructure, and the global push toward sustainable construction methods requiring efficient site management and waste processing capabilities. These factors collectively establish Front Loaders as critical assets in the machinery ecosystem, promising consistent demand throughout the forecast period.

Front Loaders Market Executive Summary

The Front Loaders Market is experiencing robust growth fueled by cyclical upswings in the global construction and mining sectors, alongside transformative technological advancements such as electrification and digital integration. Current business trends indicate a strong regional shift in manufacturing and demand, with Asia Pacific solidifying its position as the largest consumer market, primarily due to large-scale infrastructure projects in India, China, and Southeast Asian nations. Companies are increasingly moving away from purely diesel-powered models towards hybrid and fully electric front loaders, driven by stringent carbon emission goals and localized noise reduction mandates, particularly in urban construction sites. Furthermore, the emphasis on predictive maintenance through embedded IoT sensors and telematics is enhancing operational uptime and minimizing total cost of ownership (TCO), providing a substantial competitive edge for manufacturers offering these digital services.

Regional trends highlight divergence in market maturity and regulatory environments. North America and Europe, characterized by mature markets, exhibit high demand for premium, technologically advanced, and specialized equipment, including autonomous operation capabilities, focusing intensely on efficiency and safety compliance (e.g., EU Stage V emissions standards). The demand here is often replacement-driven, focusing on upgrading fleets to lower-emission models. Conversely, regions such as Latin America and the Middle East and Africa (MEA) are seeing high volume growth, characterized by initial fleet acquisition for new infrastructure development, often prioritizing robust, cost-effective machinery over highly sophisticated digital features, though sustainability requirements are slowly gaining traction due to international financing standards.

Segmentation trends reveal significant growth in the compact and medium loader segments, primarily catering to the increasing complexity and confined spaces of urban construction and landscaping projects. In terms of technology, the adoption rate of specialized attachments, such as quick couplers, high-tip buckets, and optimized fork attachments, is rising, transforming standard loaders into versatile pieces of equipment and driving aftermarket revenue streams. The dominance of hydraulic mechanisms remains unchallenged, but manufacturers are integrating advanced electro-hydraulic controls to improve precision, reduce energy wastage, and enable better integration with remote diagnostic systems. This strategic pivot towards versatility and sustainability underscores the market’s responsiveness to evolving operational demands across diverse end-use applications.

AI Impact Analysis on Front Loaders Market

Common user inquiries concerning AI in the Front Loaders Market revolve around how automation will affect job roles, the reliability of AI-driven material recognition systems, the safety implications of autonomous operations, and the integration costs associated with retrofitting existing fleets. Users frequently seek reassurance regarding the cybersecurity of connected machinery and the tangible return on investment (ROI) derived from AI-enhanced predictive maintenance. The overarching theme is centered on the transition from operator-dependent machinery to semi-autonomous or fully autonomous fleet management. Users expect AI to dramatically improve site efficiency and worker safety but are wary of the initial capital expenditure and the complexity of maintaining sophisticated software-hardware ecosystems in harsh operational environments.

The deployment of Artificial Intelligence is fundamentally transforming the operational paradigm of front loaders, moving them toward intelligent job execution and dynamic resource allocation. AI algorithms are crucial for optimizing fuel consumption by analyzing real-time load profiles and adjusting engine parameters accordingly, leading to significant reductions in operational expenditure and carbon footprint. Furthermore, computer vision and machine learning models enable precise material handling, automating tasks such as bucket filling to optimal capacity (load-weighing systems), thereby minimizing spillage and maximizing payload efficiency per cycle. This is particularly valuable in high-volume environments like mining or quarrying, where marginal efficiency gains translate into substantial operational savings.

Beyond operational optimization, AI integration is paramount in enhancing safety and predictive maintenance. AI-powered diagnostic systems analyze telematics data streams—including vibration, temperature, and fluid pressures—to predict component failures days or weeks in advance, minimizing unscheduled downtime and catastrophic damage. In terms of safety, AI supports proximity detection and collision avoidance systems, autonomously intervening when an operator fails to react to dangerous site conditions or obstacles. The eventual evolution towards fully autonomous front loaders, coordinated by AI fleet management platforms, promises 24/7 operation and higher precision, especially in hazardous or remote environments, solidifying AI as a critical enabler of future heavy equipment technology.

- AI-driven optimization of duty cycles and fuel consumption based on real-time operational data.

- Implementation of autonomous bucket control systems using computer vision for precise loading and reduced material loss.

- Enhanced predictive maintenance (PdM) through machine learning analysis of telematics data, minimizing unexpected mechanical failure.

- Integration of advanced collision avoidance and object detection systems, drastically improving site safety for both personnel and assets.

- Development of fully autonomous front loader operation capabilities for deployment in mining and high-risk environments.

- Streamlined fleet management and coordination through centralized AI platforms optimizing job sequencing and resource allocation.

DRO & Impact Forces Of Front Loaders Market

The Front Loaders Market dynamics are dictated by a delicate balance of strong macroeconomic tailwinds, regulatory hurdles, and technological opportunities, forming the core DRO (Drivers, Restraints, Opportunities) framework. The primary drivers revolve around the accelerated pace of global infrastructure development, especially in emerging nations where massive governmental spending is directed toward transportation networks, utilities, and commercial structures. This demand is compounded by the necessity of replacing aging fleets in mature markets, driven by strict mandates concerning emissions and operational efficiency. However, the market faces significant restraints, most notably the high initial acquisition cost of advanced machinery, particularly those featuring Tier 4 Final/Stage V compliant engines or electric powertrains, making them inaccessible to smaller contractors. Furthermore, the volatility in raw material costs, such as steel and aluminum, directly impacts manufacturing costs and, consequently, final equipment pricing, creating market instability.

Opportunities for growth are abundant, primarily centered on technological innovation and market penetration into niche applications. The accelerating trend towards machine electrification presents a major opportunity, allowing manufacturers to cater to urban job sites with zero-emission, low-noise equipment. Furthermore, the expansion of telematics and data analytics services offers substantial aftermarket potential, providing recurring revenue streams through software subscriptions, predictive maintenance packages, and remote diagnostic services. Another significant opportunity lies in developing robust, specialized attachments for waste management and recycling industries, which require machinery capable of handling unconventional and varying material types, increasing the utility and market reach of standard front loaders beyond traditional construction applications.

These drivers, restraints, and opportunities combine to generate distinct impact forces shaping strategic decisions across the industry. The force of regulatory pressure (emission standards) pushes manufacturers toward innovation (Opportunity/Driver), while the force of high initial investment (Restraint) tempers rapid adoption. The cyclical nature of the construction and mining industries acts as a powerful external impact force, subjecting market demand to global economic fluctuations. Companies mitigating these forces successfully are those that invest strategically in modular design for cost control, localize manufacturing to reduce supply chain complexity, and prioritize R&D into electric and autonomous technologies to comply with future regulatory landscapes and capture high-value contracts demanding cutting-edge technology.

- Drivers: Rising global infrastructure investment, stringent emission control regulations (Tier 4/Stage V), increasing adoption of mechanized material handling in agriculture.

- Restraints: High capital expenditure for advanced machinery, shortage of skilled operators and maintenance technicians, fluctuating raw material prices and supply chain bottlenecks.

- Opportunities: Electrification and development of zero-emission models, expansion of telematics and data-driven aftermarket services, demand for specialized attachments in waste and recycling sectors.

- Impact Forces: Regulatory push for sustainability, economic cyclicity of construction sector, technological disruption from autonomy and digitalization.

Segmentation Analysis

The Front Loaders Market is comprehensively segmented based on Type, Operating Mechanism, Application, and Propulsion System, allowing for detailed analysis of demand patterns and strategic focus areas. The Type segmentation (Compact, Medium, Large) dictates the primary end-user base; Compact loaders serve landscaping and residential construction, while Large loaders are crucial for mining and heavy infrastructure. The critical insight derived from segmentation is the sustained pivot toward compact equipment, necessitated by increasing urban density and restrictions on heavy machinery movement in city centers, driving innovation in power-to-weight ratios and maneuverability. This granular categorization enables manufacturers to tailor their product offerings precisely to regional operational constraints and customer affordability thresholds.

Segmentation by Operating Mechanism (Wheeled vs. Tracked) reflects terrain suitability and performance requirements. Wheeled loaders currently hold the larger market share due to their speed and versatility on prepared surfaces, remaining the workhorse for standard construction tasks. However, tracked loaders (CTLs) are demonstrating faster growth rates due to their superior performance in specialized applications like forestry, agricultural soil preparation, and highly adverse ground conditions typical of utility installation or pipeline projects. This growth is driven by advancements in track durability and suspension systems, making them viable alternatives to traditional skid-steer loaders while offering increased stability and lift capacity, optimizing performance in challenging environments.

Further analysis by Application (Construction, Mining, Agriculture, Waste Management) highlights diverse market penetration strategies. Construction remains the dominant application, intrinsically linked to global GDP growth. However, the fastest growth is anticipated in the Waste Management sector, driven by increasing regulatory focus on recycling and efficient landfill operations which require high-capacity, durable loaders with specialized protective features. The segmentation by Propulsion System (Diesel, Electric/Hybrid) is perhaps the most dynamic area, with Diesel retaining current market share but Electric/Hybrid rapidly gaining traction, propelled by massive R&D investments and favorable government incentives aimed at decarbonizing the construction industry, signaling a fundamental, long-term shift in technology preference across all end-use segments.

- By Type:

- Compact Front Loaders (Under 100 HP)

- Medium Front Loaders (100 HP to 250 HP)

- Large Front Loaders (Over 250 HP)

- By Operating Mechanism:

- Wheeled Front Loaders

- Tracked Front Loaders (Compact Track Loaders - CTLs)

- By Application:

- Construction (Residential, Commercial, Infrastructure)

- Mining and Quarrying

- Agriculture and Forestry

- Waste Management and Recycling

- Industrial and Logistics

- By Propulsion System:

- Diesel

- Electric and Hybrid

Value Chain Analysis For Front Loaders Market

The value chain for the Front Loaders Market begins with Upstream activities, focused on the sourcing and processing of core raw materials such as high-grade steel alloys for chassis and buckets, engine components (from major suppliers like Cummins or Deutz), and advanced hydraulic systems. This phase is highly capital intensive and sensitive to commodity price fluctuations, which necessitates robust supplier relationship management and diversification to mitigate risks. Key upstream differentiators include the adoption of lightweight, high-strength materials (e.g., advanced composites) to improve fuel efficiency and increase payload capacity, and the strategic integration of major subsystem suppliers into the design process for optimized component synergy and reduced assembly time, ensuring streamlined manufacturing protocols.

Midstream activities involve the core manufacturing, assembly, and testing processes. Modern manufacturing facilities utilize advanced automation, robotic welding, and stringent quality control protocols to ensure durability and precision. This stage includes the integration of complex technologies such as telematics units, electronic control units (ECUs), and increasingly, sophisticated battery management systems (BMS) for hybrid and electric models. Downstream activities involve distribution, sales, and comprehensive after-sales support. The distribution channel is bifurcated into Direct Sales (often used for large, global mining contracts) and Indirect Sales through a vast network of authorized dealers and third-party distributors who provide local sales, financing, spare parts inventory, and essential maintenance services, acting as the primary point of contact for end-users.

The Aftermarket segment—a critical component of the value chain—generates substantial, high-margin revenue through the supply of spare parts, servicing contracts, fluid analysis, and software updates (e.g., firmware for autonomy features). Dealers play a crucial role in maintaining machine longevity and ensuring operational compliance. The trend toward digitalization is transforming the downstream process, with manufacturers leveraging digital platforms for direct engagement, personalized service offerings, and centralized fleet monitoring. The efficiency of the indirect channel, specifically the geographic reach and technical expertise of the dealer network, often determines a manufacturer’s market success, as prompt servicing and readily available parts inventory are critical factors in minimizing customer downtime and enhancing brand loyalty.

Front Loaders Market Potential Customers

Potential customers for front loaders are diverse, spanning both government entities and private enterprises across multiple heavy industries. In the construction sector, the primary buyers are large-scale civil engineering firms, residential developers, and general contractors who rely on these machines for site preparation, material movement, and loading tasks across commercial and public infrastructure projects. These customers prioritize reliability, operational efficiency (low fuel consumption), and robust telematics capabilities to manage large fleets across geographically dispersed sites. For this segment, the Total Cost of Ownership (TCO) over the machine’s lifecycle, including anticipated maintenance costs and resale value, is the principal determinant in purchasing decisions, favoring established brands with strong service networks.

The mining and quarrying industries represent another major customer segment, demanding highly durable, high-capacity, and often specialized loaders capable of continuous operation in extremely harsh environments. These end-users, typically large multinational mining corporations, often engage in direct procurement of specialized, large-class loaders, increasingly requesting customized or autonomous models to enhance safety and efficiency in deep pit or underground operations. The focus here is on maximum payload, machine power, and advanced safety features, where downtime is financially catastrophic. Furthermore, the agricultural sector, ranging from large commercial farms to cooperatives, constitutes a growing customer base, utilizing compact and medium loaders for feed handling, fertilizer application, and general farm utility work, prioritizing versatility through quick-attach systems.

Beyond traditional heavy industries, municipal corporations and waste management service providers are emerging as high-growth customers. Municipalities acquire loaders for snow removal, road maintenance, and public works projects, focusing on compact and maneuverable models suitable for urban conditions. Waste management companies require highly protected, heavy-duty loaders for sorting, compacting, and transporting refuse and recycled materials at transfer stations and landfills. These buyers require specific machine reinforcements, such as specialized guarding against debris and protection for hydraulic lines, demanding tailored solutions that withstand the corrosive and abrasive nature of waste handling, signifying a profitable and expanding niche for specialized equipment sales and leasing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment (Volvo CE), Hitachi Construction Machinery Co., Ltd., JCB, Liebherr Group, John Deere, Hyundai Construction Equipment, SANY Group, XCMG Group, Doosan Infracore (now Hyundai Doosan Infracore), CNH Industrial N.V., Kubota Corporation, Terex Corporation, Wacker Neuson SE, LiuGong Machinery Co. Ltd., Bell Equipment Ltd., Atlas Copco, CASE Construction Equipment, Zoomlion Heavy Industry Science and Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Front Loaders Market Key Technology Landscape

The Front Loaders Market is undergoing rapid technological evolution driven by regulatory compliance, the pursuit of operational efficiency, and the growing mandate for sustainability. Central to this transformation is the advanced powertrain technology, particularly the shift towards hybrid and electric propulsion systems. Electric loaders, utilizing high-density lithium-ion battery packs and sophisticated battery thermal management systems (BTMS), offer zero tailpipe emissions and significantly reduced noise pollution, making them ideal for sensitive urban and indoor industrial environments. Hybrid models combine smaller, efficient diesel engines with electric assistance, primarily focusing on regenerative braking energy capture and reduced idling consumption. Furthermore, the integration of intelligent engine management systems (EMS) in conventional diesel loaders ensures compliance with the strict Tier 4 Final/Stage V emission standards, relying on technologies like Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF) to minimize environmental impact.

Digitalization forms the second major pillar of technological innovation, centered around sophisticated telematics and machine control systems. Modern front loaders are equipped with comprehensive IoT sensor suites that monitor hundreds of parameters, transmitting critical data (location, fuel consumption, load cycles, diagnostic codes) via integrated telematics units to cloud-based fleet management platforms. This technology facilitates predictive maintenance, improves asset utilization through real-time monitoring of operational status, and enhances job site productivity through data-driven performance benchmarking. Key advancements include advanced load-weighing systems (A-LWS) that provide high-accuracy payload measurement directly in the cab, crucial for optimizing truck loading and preventing overloading penalties, thereby ensuring strict contractual compliance and operational profitability.

A third, critical technological shift is the increasing deployment of automation and semi-autonomous features, laying the groundwork for future fully autonomous fleets. Technologies such as high-precision GPS (RTK), lidar, radar, and stereoscopic vision systems enable features like automated digging cycles, obstacle avoidance, and perimeter safety zones. While fully autonomous front loaders are predominantly restricted to highly controlled environments like large mines (e.g., using AHS – Autonomous Haulage Systems), semi-autonomous functionality aids the operator by automating repetitive or complex functions, reducing fatigue, and standardizing operational quality across shifts. This gradual introduction of AI and robotic controls is fundamentally changing the skill set required of operators and is driving the demand for advanced digital interfaces and human-machine interaction (HMI) solutions, ensuring seamless and intuitive control of complex machine functions.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for front loader demand, driven by massive public and private investment in infrastructure, including new railway lines, expressways, and residential megaprojects in countries like China, India, and Indonesia. This region is characterized by high-volume sales, with a growing demand for medium-sized and compact loaders, though large mining vehicles remain critical in resource-rich sub-regions. Manufacturers are focused on establishing localized production facilities to reduce costs and cater specifically to regional emission standards (which often lag European or North American standards, thus allowing for a diverse product mix).

- North America: This market is mature, stable, and highly focused on replacement demand and technological upgrades. Strong drivers include residential construction recovery and significant governmental investment in infrastructure renewal programs (e.g., the U.S. Infrastructure Investment and Jobs Act). The region exhibits high demand for premium features, robust telematics, and early adoption of electric and hybrid models, driven by strong safety standards and the TCO reduction benefits offered by advanced fuel efficiency and predictive maintenance systems.

- Europe: Europe represents a technologically leading market, strictly regulated by EU Stage V emissions standards, which mandates high levels of investment in engine technology and alternative powertrains. Demand is heavily skewed toward high-efficiency, sustainable, and noise-reducing equipment, particularly for urban construction. Germany, the UK, and France are key markets, showing a rapid shift toward smaller, more versatile compact loaders and strong market penetration of electric models due to green public procurement policies and carbon neutrality goals.

- Latin America: This region's market dynamics are closely tied to commodity prices, particularly mining and agriculture exports (e.g., in Brazil, Chile, and Peru). While the market size is substantial, it is prone to economic volatility and currency fluctuations. Buyers often prioritize ruggedness and ease of maintenance over highly sophisticated digital features, though infrastructure spending in major cities is slowly increasing the adoption of medium-sized, modern equipment.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) states (due to massive construction projects tied to economic diversification) and resource extraction activities across Africa. The demand spectrum is wide, from basic, cost-effective machinery for developing African markets to cutting-edge, high-capacity equipment for major Saudi and Emirati smart city initiatives. Market growth is strong but depends heavily on geopolitical stability and fluctuations in oil and gas revenues that fund infrastructure spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Front Loaders Market.- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment (Volvo CE)

- Hitachi Construction Machinery Co., Ltd.

- JCB

- Liebherr Group

- John Deere

- Hyundai Construction Equipment

- SANY Group

- XCMG Group

- Hyundai Doosan Infracore

- CNH Industrial N.V.

- Kubota Corporation

- Terex Corporation

- Wacker Neuson SE

- LiuGong Machinery Co. Ltd.

- Bell Equipment Ltd.

- Atlas Copco

- CASE Construction Equipment

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Front Loaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the electrification of the Front Loaders Market?

The primary factor driving electrification is the global imposition of stringent environmental regulations, such as EU Stage V and upcoming zero-emission mandates in urban centers. Electric front loaders offer significant operational benefits, including zero tailpipe emissions and substantially reduced noise pollution, which is essential for projects operating in residential or sensitive environments, alongside long-term reductions in fuel and maintenance costs.

How do telematics systems improve the profitability of using a front loader?

Telematics systems enhance profitability by providing real-time data on machine utilization, health, and location. This data facilitates advanced predictive maintenance, minimizing unscheduled downtime, optimizing route planning and loading cycles, and ultimately reducing the Total Cost of Ownership (TCO) through improved fuel efficiency and maximized operational hours.

What is the difference in market demand between Wheeled and Tracked Front Loaders?

Wheeled Front Loaders dominate the overall market volume due to their speed and versatility on prepared construction sites and industrial surfaces. Tracked Front Loaders (CTLs) represent a faster-growing segment, favored for specialized tasks requiring superior traction, lower ground pressure, and enhanced stability in adverse, soft, or muddy terrains prevalent in forestry and specific agricultural applications.

Which geographical region holds the largest market share for Front Loaders, and why?

The Asia Pacific (APAC) region holds the largest market share, predominantly driven by massive governmental investments in infrastructure development, rapid urbanization, and high-volume demand from the booming construction and mining sectors, particularly in nations like China and India, which are undergoing extensive industrial expansion.

How is Artificial Intelligence (AI) being utilized to enhance front loader operations?

AI is utilized primarily for operational optimization, enabling semi-autonomous features such as automated bucket filling and precise load-weighing for maximizing payload efficiency. AI also powers advanced predictive diagnostics using machine learning on telematics data, significantly improving maintenance scheduling and overall machine reliability by foreseeing component failures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager