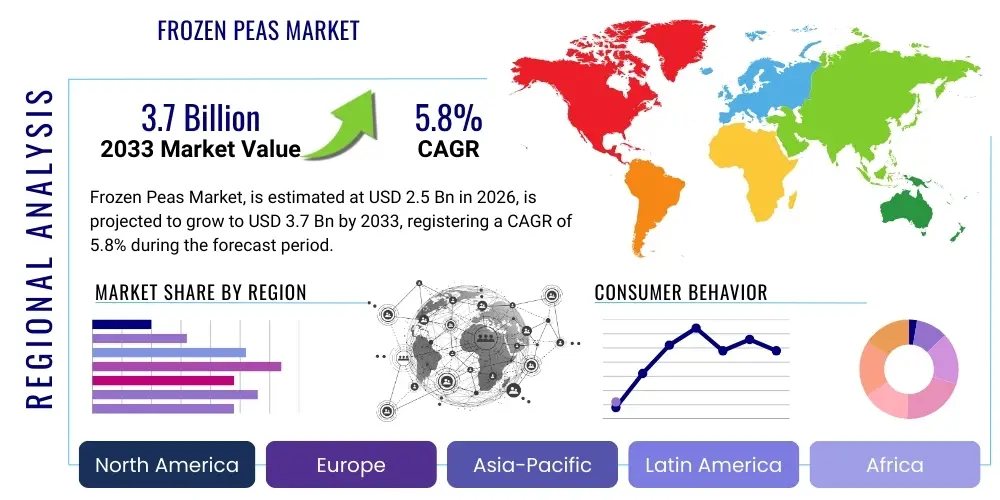

Frozen Peas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436229 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Frozen Peas Market Size

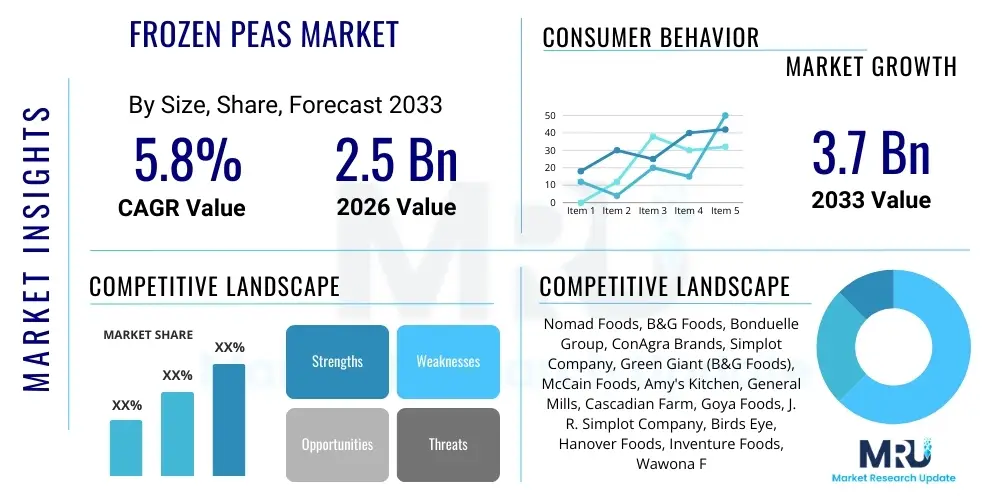

The Frozen Peas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033.

Frozen Peas Market introduction

The Frozen Peas Market encompasses the global production, distribution, and consumption of peas preserved through freezing processes, primarily standard garden peas (green peas), but also including specialty varieties like snow peas and snap peas. This preservation method allows the product to retain maximum nutritional value, color, and flavor, catering to increasing consumer demand for convenient, long-shelf-life vegetable options that minimize food waste. The market is fundamentally driven by the rising globalization of food supply chains, coupled with shifting demographics characterized by busier lifestyles and higher disposable incomes in developing economies. Frozen peas serve as a staple ingredient in both household cooking and large-scale food service operations, offering year-round availability regardless of seasonal harvest limitations. Key applications range from ready-to-eat meals, soups, stews, and side dishes, making them essential components in modern culinary preparation.

Product descriptions within the market emphasize quick freezing technology, such as Individual Quick Freezing (IQF), which ensures that each pea is frozen separately, preventing clumping and maintaining texture integrity upon thawing. The primary benefits of frozen peas include their exceptional nutritional profile, similar to fresh peas, notably high in vitamins C and K, and dietary fiber. Furthermore, the convenience factor, eliminating washing and shelling preparation time, significantly drives consumer adoption. The major applications span across retail sales, catering, institutional food supply (hospitals, schools), and industrial use in processed food manufacturing. The market's stability is underpinned by its versatility and cost-effectiveness compared to fresh produce that requires fast handling and refrigeration during transit.

Driving factors for sustained growth include the global trend towards plant-based and flexitarian diets, where vegetables play a central role, positioning frozen peas as an accessible protein and nutrient source. Additionally, advancements in cold chain logistics and improved freezer storage technology in homes and commercial settings have significantly expanded the market reach, particularly in regions previously constrained by infrastructural limitations. Continuous innovation in sustainable packaging solutions and organic farming practices further bolsters consumer confidence and market expansion. The convenience offered by pre-portioned, readily available frozen vegetables aligns perfectly with the demands of modern urban living, solidifying the market’s positive growth trajectory across major geographies.

Frozen Peas Market Executive Summary

The Frozen Peas Market is currently experiencing robust growth, primarily fueled by significant shifts in consumer behavior towards health-conscious and time-saving food solutions. Business trends indicate a strong focus on supply chain resilience, necessitated by volatile weather patterns impacting fresh produce supply, positioning frozen alternatives as reliable backups. Major market players are heavily investing in automation, particularly IQF technology, to enhance product quality and scaling efficiency. Strategic initiatives include mergers and acquisitions aimed at vertically integrating production, from farm sourcing to retail distribution, ensuring consistent quality and cost control. Furthermore, private label brands are rapidly gaining traction, offering competitive pricing that challenges established national brands, leading to increased market fragmentation and competitive pricing pressures globally.

Regionally, the market shows diversified growth dynamics. North America and Europe maintain maturity, characterized by high per capita consumption and sophisticated cold chain infrastructure, focusing primarily on premium, organic, and non-GMO varieties. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment. This accelerated growth is attributed to rapid urbanization, expanding modern retail formats (supermarkets and hypermarkets), and increasing adoption of frozen foods among middle-class households who value convenience. Latin America and the Middle East and Africa (MEA) are also showing promising potential, driven by improvements in household freezer penetration and foreign investment in local processing facilities, enhancing local availability and affordability of frozen vegetable products.

Segment-wise, the retail channel dominates the market due to the high volume of direct consumer purchases for home consumption. However, the food service segment is projected to exhibit the highest CAGR, propelled by the recovery of the restaurant industry and the growing demand from quick-service restaurants (QSRs) and catering services for consistent, pre-prepped ingredients. In terms of product type, standard green peas remain the dominant segment, though specialty peas like snap peas and snow peas are witnessing increased demand, reflecting consumer interest in diverse textures and gourmet applications. Trends also point towards higher demand for sustainable and recyclable packaging solutions, influencing manufacturers’ material choices and operational expenditures across all key segments.

AI Impact Analysis on Frozen Peas Market

User inquiries regarding AI's influence in the Frozen Peas Market often center on optimizing complex agricultural processes, improving predictive quality assurance, and streamlining the cold supply chain to reduce waste. Key themes include how Artificial Intelligence and Machine Learning (ML) algorithms can enhance yield forecasting and timing of harvest to maximize sweetness and quality (since timing is critical for freezing). Consumers and businesses are also concerned with AI’s role in automating sorting and defect detection on production lines, ensuring uniform product quality before freezing. Furthermore, significant interest lies in utilizing AI for dynamic pricing strategies, personalized marketing campaigns based on regional consumption patterns, and predictive maintenance of critical refrigeration equipment, which is vital for maintaining product integrity throughout distribution.

- AI-driven demand forecasting optimizes production schedules, minimizing overstocking and reducing energy usage related to prolonged storage.

- Machine Vision systems powered by AI automate high-speed sorting, accurately identifying and removing sub-standard peas based on color, size, and blemishes, significantly improving quality control.

- Predictive analytics in agriculture assist farmers in optimizing irrigation, fertilization, and pest control timing, leading to higher yields and superior quality raw material for freezing.

- AI-enhanced cold chain management uses sensors and algorithms to monitor and adjust transit temperatures dynamically, reducing spoilage risk during long-distance distribution.

- Generative AI models are employed in developing innovative packaging designs that appeal to specific consumer demographics and communicate sustainability credentials effectively.

DRO & Impact Forces Of Frozen Peas Market

The Frozen Peas Market is strongly influenced by a combination of inherent drivers, structural restraints, and emerging opportunities that dictate its growth trajectory and competitive intensity. The primary driver is the unparalleled consumer convenience offered by frozen vegetables, aligning with the fast-paced, urbanized lifestyle prevalent globally. Consumers seek quick, reliable ingredients that require minimal preparation, and frozen peas fulfill this need perfectly. Coupled with this is the growing awareness regarding food safety and nutritional retention; flash-freezing processes are perceived positively as they lock in nutrients at peak freshness, often surpassing the nutritional content of "fresh" produce that has traveled long distances. The increasing acceptance of frozen foods as a healthy dietary component, supported by dietary recommendations promoting higher vegetable intake, acts as a perpetual tailwind, driving consistent volume growth across all geographical markets.

However, significant restraints temper the market’s full potential. The high initial capital investment required for establishing and maintaining a sophisticated cold chain infrastructure—including specialized warehousing, refrigerated transport fleets, and high-efficiency freezing equipment—poses a major barrier to entry, especially in developing economies. Furthermore, consumer perception challenges, though diminishing, still exist; some segments of the population erroneously believe frozen vegetables are nutritionally inferior or less palatable than fresh alternatives, requiring continuous marketing and education efforts to counter this belief. The market is also vulnerable to fluctuations in the prices of raw materials, energy costs (critical for refrigeration), and packaging materials, potentially compressing profit margins for manufacturers and leading to price volatility for the end consumer.

Opportunities for expansion are abundant, particularly through strategic product differentiation and market penetration into underserved regions. Development of specialized, value-added products, such as frozen peas mixed with spices, herbs, or sauces (ready-to-cook mixes), addresses the demand for convenience and culinary innovation. Geographical expansion into emerging APAC markets, leveraging improved retail infrastructure, represents a significant growth vector. Moreover, the industry can capitalize on sustainability trends by promoting frozen peas as a solution for food waste reduction—a powerful narrative given that frozen products significantly extend shelf life compared to highly perishable fresh vegetables. Successful leveraging of these opportunities, alongside managing logistical complexities, will determine the market leaders in the coming decade, creating a dynamic competitive landscape influenced profoundly by external economic and climate factors.

Segmentation Analysis

The Frozen Peas Market segmentation provides a granular view of consumer preferences, product types, and dominant distribution channels, essential for tailoring strategic market approaches. The market is primarily segmented based on product type (Green Peas, Snow Peas, Snap Peas), application (Retail/Household and Food Service/Industrial), and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Traditional Groceries). Analyzing these segments helps stakeholders understand where demand concentration lies and how evolving consumption patterns are reshaping the value chain. For instance, while green peas dominate due to their ubiquitous use, specialty varieties are commanding premium prices, indicating a trend toward diversification and higher-value product offerings driven by culinary experimentation and gourmet food demands, particularly in developed Western markets.

The distinction between the Retail segment and the Food Service segment is critical for manufacturers. The Retail segment emphasizes consumer-friendly packaging, branding, and smaller, convenient portions, where brand loyalty and marketing expenditure play a significant role. Conversely, the Food Service segment (comprising restaurants, catering, and industrial processors) prioritizes bulk packaging, consistent quality specifications, and competitive contractual pricing. The rapid growth of the Food Service segment post-pandemic highlights its importance, driven by increasing out-of-home eating and the reliance of commercial kitchens on pre-prepped, zero-waste ingredients to manage labor costs and ensure menu consistency across multiple locations, thereby increasing the market's industrial reliance on frozen commodities.

Distribution channel analysis reveals the growing power of organized retail and e-commerce platforms. Supermarkets and hypermarkets remain the primary sales outlet, offering high visibility and optimized cold storage facilities. However, the online retail channel is rapidly gaining ground, particularly accelerated by global lockdowns, offering the convenience of doorstep delivery of frozen goods, which previously faced significant logistical hurdles. Investing in robust e-commerce cold chain delivery systems is now essential for market players seeking to capture the younger, digitally native consumer base. This shift necessitates specialized logistics partnerships and investment in smart packaging solutions designed to maintain freezing temperatures throughout the 'last mile' delivery process, altering traditional distribution models significantly.

- By Product Type:

- Green Peas (Garden Peas)

- Snow Peas

- Snap Peas

- By Application:

- Retail/Household

- Food Service/Industrial

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Traditional Groceries and Wet Markets

Value Chain Analysis For Frozen Peas Market

The value chain for the Frozen Peas Market begins with the upstream segment, which involves agricultural planning, seed selection, cultivation, and harvesting. Pea cultivation requires precise timing, as the sugar-to-starch conversion happens rapidly after picking; thus, growers utilize specialized harvesters to ensure the peas are picked at peak sweetness and rapidly transported to the processing plant. Upstream activities are critical for determining the final product quality and involve strong collaboration between processors and contracted farmers, often utilizing sophisticated yield monitoring and quality testing technologies immediately after harvest. Investment in high-quality seeds and sustainable farming practices are key differentiators at this stage, setting the foundation for the premiumization trend observed in developed markets.

The midstream section involves processing, which is the most capital-intensive phase. Upon arrival, peas are shelled, blanched (briefly immersed in hot water to inactivate enzymes), and then flash-frozen, typically using Individual Quick Freezing (IQF) technology. This step is crucial for microbial safety, enzyme stabilization, and preserving color and texture. Following freezing, the peas are sorted, weighed, and packaged. Distribution channels constitute the downstream segment, involving the movement of packaged frozen peas from the manufacturing plant to retail outlets, food service distributors, and, increasingly, directly to consumers via e-commerce fulfillment centers. Maintaining the cold chain integrity (a continuous temperature of -18°C or lower) is paramount across all logistical steps—from storage to transportation—to prevent thawing and subsequent quality degradation.

The distribution of frozen peas utilizes both direct and indirect channels. Direct distribution is common for large-volume sales to industrial clients or major national retail chains that have centralized distribution centers, allowing manufacturers greater control over product handling and shelf placement. Indirect distribution leverages third-party logistics (3PL) providers and specialized cold storage wholesalers who manage regional inventory and fragmented deliveries to smaller retailers, local food service operations, and institutional buyers. The growing prominence of online retail has introduced complex distribution dynamics, requiring specialized refrigerated vehicles and partnerships for efficient last-mile delivery. The ability to manage these complex, capital-intensive logistics across multiple channels is a core competitive advantage in the frozen peas industry.

Frozen Peas Market Potential Customers

The primary end-users and buyers of frozen peas are segmented into two major categories: Retail/Household Consumers and Commercial/Food Service Entities. Household consumers represent the largest volume segment, valuing convenience, extended shelf life, and the nutritional benefits of easily incorporated vegetables. This segment includes busy working professionals, families seeking easy meal preparation, and health-conscious individuals who rely on frozen ingredients for balanced diets. These consumers typically purchase through supermarkets and online grocery platforms, driven by factors such as pricing, brand trust, and ease of storage in standard home freezers, with a growing preference for organic and sustainably sourced options.

The commercial segment encompasses a wide array of high-volume buyers. Food Service entities, such as restaurants, hotels, institutional catering (schools, hospitals, corporate cafeterias), and quick-service restaurants (QSRs), rely heavily on frozen peas for consistent quality, portion control, and minimizing labor costs associated with vegetable preparation. Industrial food processors form another crucial sub-segment, utilizing frozen peas as a key ingredient in manufacturing ready-to-eat meals, frozen dinners, canned soups, and vegetable mixes. For these large buyers, supply reliability, bulk pricing, and adherence to stringent quality specifications are the critical purchasing criteria, often secured through long-term contractual agreements to ensure stable supply year-round, regardless of seasonal harvest limitations.

A rapidly expanding segment of potential customers includes specialized diet consumers and value-added manufacturers. Plant-based food producers use frozen peas as a foundational ingredient for alternative protein products, vegan meat substitutes, and purees. Furthermore, buyers focused on sustainability and minimizing environmental impact are increasingly influential; they specifically seek products from companies that demonstrate reduced water usage, minimal waste, and certified sustainable sourcing practices. Targeting these specialized customers requires nuanced product certifications and transparent supply chain documentation, moving beyond basic commodity offerings towards value-driven, ethical purchasing relationships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nomad Foods, B&G Foods, Bonduelle Group, ConAgra Brands, Simplot Company, Green Giant (B&G Foods), McCain Foods, Amy's Kitchen, General Mills, Cascadian Farm, Goya Foods, J. R. Simplot Company, Birds Eye, Hanover Foods, Inventure Foods, Wawona Frozen Foods, Arctic Gardens, Pinnacle Foods, Ajinomoto Co., Inc., Findus Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frozen Peas Market Key Technology Landscape

The technological landscape of the Frozen Peas Market is defined by continuous advancements in processing efficiency, quality assurance, and cold chain logistics, primarily aimed at preserving the organoleptic properties and nutritional integrity of the product. Individual Quick Freezing (IQF) remains the foundational technology, utilizing fluidized bed freezers to rapidly freeze individual pea spheres, preventing cell wall damage and maintaining superior texture upon thawing. Modern IQF systems integrate energy-efficient compressors and advanced heat exchange mechanisms to minimize operational electricity consumption, a critical factor given the energy intensity of freezing operations. Furthermore, sophisticated blanching technology utilizes precise temperature and time controls to deactivate undesirable enzymes without overcooking the peas, thereby preserving their vibrant green color and maximizing vitamin retention, essential for appealing to health-conscious consumers.

Beyond freezing, critical technologies include advanced optical sorting and grading systems. These systems employ high-resolution cameras and spectrophotometers, often enhanced by AI and Machine Vision, to meticulously scan peas for defects, foreign materials, and size inconsistencies at high throughput speeds. This level of automated quality control far surpasses manual inspection capabilities, ensuring that only premium, uniformly sized products are packaged. The integration of these sorting technologies directly into the production line has significantly reduced product recalls and enhanced consumer trust in packaged frozen vegetables, which is vital for brand reputation in a highly competitive retail environment. Continuous technological upgrades in this area are central to maintaining compliance with stringent international food safety standards, particularly in export-focused operations.

In the downstream segment, the use of advanced packaging technology is crucial. Barrier packaging materials, including multilayer films and vacuum-sealed pouches, are utilized to minimize oxidation, prevent freezer burn, and extend shelf stability, ensuring product quality is maintained during extended storage periods. Furthermore, the adoption of smart packaging, which may include time-temperature indicators (TTIs) or RFID tags, provides real-time monitoring of product conditions throughout the cold chain journey. These smart solutions are invaluable for logistics managers, offering instant alerts regarding temperature excursions, thereby mitigating risks and proving due diligence in maintaining the required freezing standards. The convergence of IoT (Internet of Things) devices and robust cold chain management systems is transforming logistics from a cost center into a source of competitive differentiation.

Regional Highlights

- North America: The North American market, comprising the US and Canada, is characterized by high consumer awareness, developed cold chain infrastructure, and a strong preference for convenience foods. Growth here is primarily driven by the demand for organic, non-GMO, and value-added frozen pea products, such as steam-in-bag varieties. The US dominates regional consumption, heavily influenced by large retail chains and institutional buyers (schools, hospitals). The market is mature but highly competitive, with established brands focusing on sustainability claims and clean label ingredients to attract discerning consumers. Innovation often centers on specialized packaging designed for faster cooking or smaller portions tailored to single-person households.

- Europe: Europe represents a significant market share, distinguished by stringent food quality and environmental regulations. Countries like the UK, Germany, and France are key consumers. Consumer trends are strongly aligned with health, environmental sustainability, and local sourcing initiatives, even for frozen products. The European frozen food sector is highly sophisticated, focusing heavily on reducing energy consumption in processing and distribution. Strong demand is seen in the institutional catering and ready-meal sectors. Legislative pressures often dictate the adoption of recyclable packaging and transparent sourcing methodologies, making certification (like organic or Fair Trade) a crucial market entry requirement.

- Asia Pacific (APAC): The APAC region, including China, India, and Southeast Asia, is projected to witness the highest growth rate during the forecast period. This acceleration is fueled by rapid economic expansion, increasing urbanization, the proliferation of modern retail infrastructure (supermarkets), and rising household income levels, making freezer ownership more common. While cold chain infrastructure is less developed in some sub-regions, investment is accelerating to meet demand. Frozen peas are increasingly popular due to their versatility in local cuisines and their cost-effectiveness compared to seasonal fresh produce, driving substantial adoption in both retail and emerging food service markets, particularly in rapidly growing metropolitan areas.

- Latin America: This region, particularly Brazil and Mexico, offers untapped potential. Market expansion is currently constrained by varying degrees of cold chain quality and consumer purchasing power. However, as disposable incomes rise and major international retailers expand their presence, the accessibility and acceptance of frozen vegetables are improving. The market generally focuses on affordability and shelf stability. Local manufacturers are focusing on adapting global freezing and packaging standards to meet domestic demands, often focusing on basic, unflavored frozen pea varieties for traditional cooking applications.

- Middle East and Africa (MEA): The MEA market is small but exhibiting steady growth, largely driven by increasing reliance on imported frozen products in the Gulf Cooperation Council (GCC) countries due to limited local agricultural capacity. In Africa, urbanization and the growth of modern supermarkets are slowly driving adoption, especially in South Africa. The market faces challenges related to extreme climate and infrastructural limitations, making robust, temperature-stable cold logistics essential. Demand is often concentrated in metropolitan hubs and expatriate communities, highlighting a need for further localized product development and better infrastructural investment to serve broader populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frozen Peas Market.- Nomad Foods

- B&G Foods

- Bonduelle Group

- ConAgra Brands

- Simplot Company

- Green Giant (B&G Foods)

- McCain Foods

- Amy's Kitchen

- General Mills

- Cascadian Farm

- Goya Foods

- J. R. Simplot Company

- Birds Eye

- Hanover Foods

- Inventure Foods

- Wawona Frozen Foods

- Arctic Gardens

- Pinnacle Foods

- Ajinomoto Co., Inc.

- Findus Group

Frequently Asked Questions

Analyze common user questions about the Frozen Peas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth rate projection for the Frozen Peas Market?

The Frozen Peas Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by increasing consumer demand for convenient, long-shelf-life vegetable products and advancements in cold chain logistics globally.

Are frozen peas nutritionally comparable to fresh peas?

Yes, frozen peas are generally considered nutritionally comparable to, and sometimes superior to, fresh peas because they are flash-frozen immediately after harvest, locking in peak vitamins and nutrients, whereas "fresh" peas may lose nutritional value during long transit times.

Which region is expected to lead market growth in the near future?

The Asia Pacific (APAC) region is anticipated to record the fastest market growth, fueled by rapid urbanization, expanding modern retail presence, and increasing adoption of frozen convenience foods among the growing middle-class populations in countries like China and India.

What are the primary distribution channels for frozen peas?

The primary distribution channels include Supermarkets and Hypermarkets, which dominate retail sales. However, Online Retail is the fastest-growing channel due to enhanced cold chain last-mile delivery capabilities and increased consumer preference for grocery e-commerce.

How does AI technology impact the frozen peas value chain?

AI technology significantly impacts the value chain by optimizing farming yields through predictive analytics, enhancing quality assurance via automated optical sorting systems, and streamlining logistics through AI-driven demand forecasting and cold chain temperature monitoring, minimizing waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager