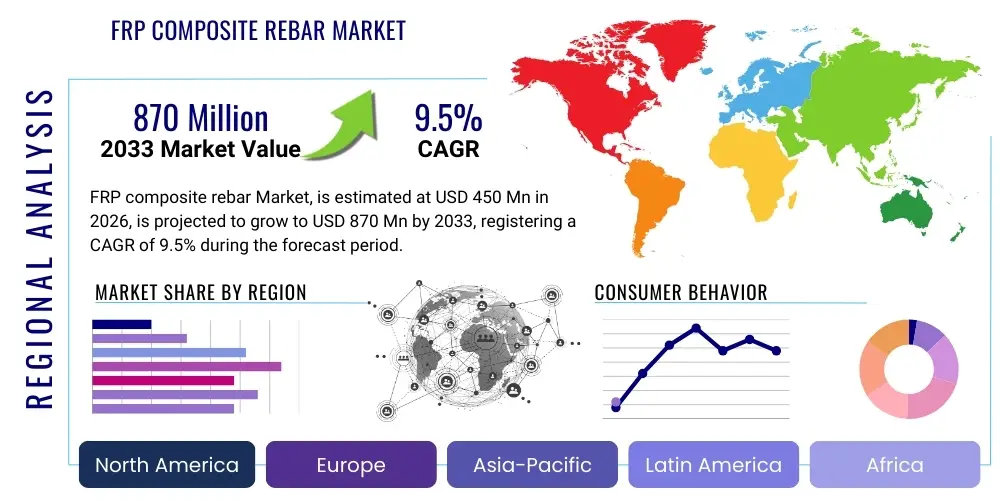

FRP composite rebar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435569 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

FRP composite rebar Market Size

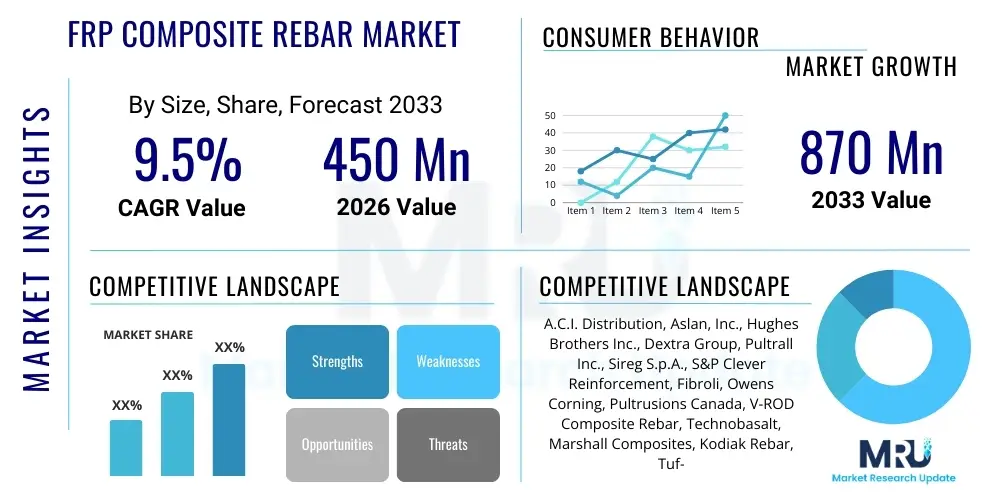

The FRP composite rebar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 870 million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global need for durable and corrosion-resistant construction materials, particularly within critical infrastructure projects that face harsh environmental exposure, such as marine environments, coastal roads, and wastewater treatment facilities. The inherent limitations of traditional steel reinforcement, especially concerning susceptibility to chloride and carbonation-induced corrosion, significantly propel the adoption of advanced materials like Fiber Reinforced Polymer (FRP) rebar, positioning the market for robust, sustained growth throughout the forecast period.

FRP composite rebar Market introduction

The FRP composite rebar market encompasses the manufacturing, distribution, and application of non-corrosive reinforcing bars made from high-strength fibers embedded in a polymer resin matrix. These materials, typically composed of glass fibers (GFRP), carbon fibers (CFRP), or aramid fibers (AFRP), offer exceptional resistance to chemical degradation, electromagnetic neutrality, and superior tensile strength-to-weight ratios compared to conventional steel reinforcement. This technical superiority addresses critical longevity issues in reinforced concrete structures, especially those exposed to high moisture, de-icing salts, or acidic industrial environments, making FRP rebar an indispensable component for modern, resilient infrastructure development worldwide. The product's lightweight nature also dramatically reduces logistical costs and simplifies on-site handling, providing significant operational advantages to construction firms globally.

Major applications of FRP composite rebar span across critical sectors, including transportation infrastructure (bridges, highways, tunnels), maritime construction (docks, jetties, seawalls), specialty construction (MRI rooms, power generation facilities, magnetically sensitive laboratories), and industrial structures (chemical plants, cooling towers, wastewater treatment tanks). The primary benefit FRP rebar offers is its complete immunity to corrosion, which translates directly into lower maintenance costs and substantially extended service life for concrete structures, often exceeding 100 years without major repairs due to reinforcement degradation. Furthermore, the material’s high tensile strength ensures structural integrity even in highly stressed applications, while its non-conductive properties are crucial for structures requiring electromagnetic transparency.

Key driving factors accelerating market expansion include stringent government regulations mandating the use of durable materials in public infrastructure projects, particularly in regions prone to seismic activity or coastal corrosion. The increasing focus on sustainability and life cycle assessment in construction heavily favors FRP composites due to their longevity and reduced requirement for maintenance over time. Technological advancements in pultrusion manufacturing techniques are leading to more cost-effective and scalable production of high-quality FRP rebar, making it a viable alternative to steel in a wider range of mainstream construction applications. Moreover, successful demonstration projects globally are building confidence among engineers and contractors, further institutionalizing the use of composite reinforcement.

FRP composite rebar Market Executive Summary

The global FRP composite rebar market is characterized by robust business trends centered on material innovation and strategic partnerships aimed at broadening application scope. Manufacturers are heavily investing in research and development to optimize resin chemistry and fiber composition, striving to improve fire resistance and shear strength, which have historically been areas of focus for improvement compared to steel. A significant business trend involves the establishment of localized manufacturing facilities, especially in high-growth regions like Asia Pacific and the Middle East, to circumvent logistics challenges associated with shipping bulky composite materials and to comply with local content regulations. Furthermore, standardization efforts by international bodies are contributing to increased market acceptance and easier specification by design engineers, fostering business continuity and predictable supply chain growth.

Regionally, North America and Europe currently dominate the market due to early adoption driven by comprehensive infrastructure upgrade initiatives and severe corrosion issues related to widespread use of de-icing salts. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by massive urbanization projects, extensive development of coastal infrastructure, and significant government spending on new rail and highway networks. The Middle East and Africa (MEA) are also showing strong potential, particularly in marine and wastewater infrastructure projects where high salinity and aggressive chemical environments necessitate non-corroding materials. These regional trends underscore a global shift towards resilient construction practices, moving away from short-term cost savings in materials towards long-term life cycle value.

Segment trends reveal that Glass Fiber Reinforced Polymer (GFRP) rebar holds the largest market share due to its optimal balance of performance, affordability, and ease of manufacturing. While Carbon Fiber Reinforced Polymer (CFRP) rebar commands a premium segment, its superior tensile strength and fatigue resistance make it indispensable for highly critical, load-bearing structures like long-span bridges and specialized applications in aerospace-related construction. Application-wise, the Infrastructure segment, encompassing roads, bridges, and rail, remains the primary consumer, although the Water & Wastewater segment is exhibiting the highest growth rate, reflecting the urgent global need to replace or rehabilitate aging, corrosion-prone concrete assets in treatment plants and piping systems. The increasing complexity and scale of modern construction necessitate these segment-specific material optimizations.

AI Impact Analysis on FRP composite rebar Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the FRP composite rebar market primarily revolve around optimizing the complex pultrusion manufacturing process, predicting material performance under varied environmental stresses, and enhancing supply chain efficiency. Users are keenly interested in how machine learning algorithms can analyze real-time production data—such as temperature, tension, curing speed, and resin flow—to minimize defects, maintain tight quality control, and reduce waste in the highly specialized composite manufacturing environment. A major concern is leveraging AI for predictive modeling of long-term durability, helping engineers specify the correct fiber and resin matrix for specific geographic or structural requirements, thereby validating the material's superior lifespan claims to skeptical stakeholders. Furthermore, integrating AI into inventory and logistics management is a key focus for users aiming to manage the global supply of specialized fibers and resins efficiently.

The implementation of AI algorithms is expected to revolutionize quality assurance processes within FRP rebar manufacturing. By employing computer vision and sensor data analytics, AI systems can monitor the continuous pultrusion process, instantly identifying anomalies in fiber alignment or resin saturation that manual inspection might miss. This proactive quality control ensures product consistency, a crucial factor for gaining broader regulatory acceptance. Moreover, AI is instrumental in accelerating material science research; machine learning models can simulate millions of combinations of fiber types, sizing agents, and polymer matrix compositions to discover novel, high-performance, cost-effective composite formulations faster than traditional experimental methods. This accelerated material development is vital for driving down production costs and expanding the material's structural capabilities.

In the application phase, AI contributes significantly to structural design and maintenance planning. Building Information Modeling (BIM) software, increasingly augmented with AI, can simulate the corrosion resistance and thermal properties of FRP rebar within a proposed structure under various stress scenarios, ensuring optimal design placement and material sizing. Post-construction, AI-driven digital twins and predictive maintenance platforms utilize data collected from embedded sensors (if applicable) to monitor the structural health of concrete reinforced with FRP. This capability further validates the long-term economic advantages of using composites by providing verifiable data on reduced degradation rates, reinforcing the value proposition of FRP rebar against traditional steel alternatives in large-scale infrastructure investments.

- AI optimizes pultrusion manufacturing parameters for defect reduction and increased throughput.

- Machine learning models predict long-term durability and fatigue life of FRP rebar under aggressive environmental loads.

- AI-driven supply chain management improves inventory tracking and global logistics for specialized fibers and resins.

- Computer vision systems enhance quality control by monitoring fiber saturation and alignment in real time.

- AI accelerates material innovation by simulating novel composite formulations for improved fire and shear resistance.

DRO & Impact Forces Of FRP composite rebar Market

The FRP composite rebar market is fundamentally shaped by a dynamic interplay of potent drivers (D), significant restraints (R), and compelling opportunities (O), creating powerful impact forces that dictate market direction and growth trajectory. The primary driver is the pervasive issue of steel corrosion in aging infrastructure worldwide, particularly in coastal regions and areas utilizing de-icing chemicals, leading asset owners to seek sustainable, long-life alternatives. Coupled with this is the increasing body of successful case studies and the gradual revision of building codes to explicitly include FRP materials, institutionalizing their use. However, the market faces constraints, most notably the higher initial cost relative to commodity steel and a lack of universal awareness and reluctance among some traditional contractors and design engineers who are accustomed to decades of steel use. These forces create tension between the clear long-term value proposition and the immediate financial constraints of major construction projects.

Restraints are continuously being addressed through technological innovation and market education. The historical constraint regarding FRP's lower elastic modulus and shear strength compared to steel is being mitigated by introducing advanced hybrid fiber compositions and specialized resin modifications. The market penetration is also slowed by the capital-intensive nature of establishing new pultrusion lines, which presents a barrier to entry for smaller manufacturers. Opportunities, nevertheless, abound, driven by emerging economies requiring substantial, resilient infrastructure build-out and the exponential growth of non-traditional construction sectors, such as high-speed rail, data centers (requiring non-magnetic structures), and specialized chemical storage facilities. These niche, high-value applications often prioritize durability and specialized material properties over initial material cost, providing premium growth avenues for FRP suppliers.

The collective impact forces are strongly positive, signaling a structural shift rather than a temporary trend. Drivers such as infrastructural longevity requirements and regulatory mandates exert continuous upward pressure on demand. While restraints temporarily temper the adoption rate in cost-sensitive segments, the overwhelming opportunity presented by global infrastructure renewal and the technological advancements making FRP more cost-competitive ensures acceleration. Specifically, the impact force of global climate change driving higher severity of corrosion environments (e.g., rising sea levels, increased exposure to extreme weather) acts as a powerful catalyst, making non-corrosive materials like FRP rebar essential for future proofing vital assets. This results in a market environment where long-term value creation strongly overrides short-term procurement costs, sustaining high CAGR throughout the forecast period.

Segmentation Analysis

The FRP composite rebar market is meticulously segmented based on material type, fiber orientation, application, and end-use sector, providing a granular view of market dynamics and catering to specific structural requirements. Segmentation by material type—Glass, Carbon, and Aramid—reflects distinct performance characteristics, cost structures, and intended application environments. Application segmentation highlights the material's critical role in infrastructure, marine, and specialized construction, each demanding unique structural properties. This detailed segmentation allows manufacturers to tailor their production capabilities and marketing strategies to address highly specific needs within the global construction landscape, ensuring maximum efficacy and market penetration across diverse civil engineering projects.

- By Fiber Type:

- Glass Fiber Reinforced Polymer (GFRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- Aramid Fiber Reinforced Polymer (AFRP)

- Basalt Fiber Reinforced Polymer (BFRP)

- By Resin Type:

- Vinyl Ester

- Epoxy

- Polyester

- By Application:

- Bridges and Highways

- Marine Structures and Coastal Applications

- Tunnels and Mining

- Water and Wastewater Treatment Plants

- Industrial and Chemical Facilities

- Specialty Applications (e.g., MRI facilities, magnetic research labs)

- By End-Use Sector:

- Infrastructure

- Building and Construction (Residential and Commercial)

- Industrial

Value Chain Analysis For FRP composite rebar Market

The value chain for FRP composite rebar begins with the upstream procurement of highly specialized raw materials, primarily high-strength fibers (such as E-glass, T-glass, carbon fibers) and polymer resins (vinyl ester, epoxy). Upstream dynamics are critical, as the cost and supply stability of these components directly impact the final product pricing and manufacturing margins. Suppliers of resins often focus on formulating specialized matrices that enhance the rebar’s chemical resistance and thermal properties, while fiber suppliers are crucial for delivering consistency in tensile strength and sizing required for the pultrusion process. The intense competitive landscape among chemical and fiber manufacturers necessitates robust long-term contracts to ensure stable pricing and supply security for rebar producers.

The core of the value chain is the manufacturing process, dominated by the pultrusion technique, where FRP composite rebar producers transform raw materials into finished products. Manufacturers focus heavily on process optimization, quality control (driven by standards like ASTM and CSA), and achieving economies of scale. Direct distribution channels involve rebar manufacturers selling directly to large infrastructure developers, major governmental bodies (e.g., transportation departments), or specialized engineering procurement and construction (EPC) firms handling mega-projects. This channel emphasizes deep technical consultancy, customized sizing, and large-volume contracts, requiring a dedicated sales and engineering support team from the manufacturer.

Indirect distribution relies on a network of construction material distributors, specialized composite suppliers, and regional building material retailers. This channel is vital for reaching smaller contractors, localized construction projects, and addressing immediate, smaller-scale demand. Downstream activities involve the final application and integration of the FRP rebar into concrete structures, requiring specialized training for concrete placement and finishing crews to handle the material correctly (e.g., non-shear cutting methods). The downstream success is heavily reliant on engineering specification and designer acceptance, underscoring the importance of continuous technical education and successful reference projects to drive widespread adoption among end-users and ensure market liquidity.

FRP composite rebar Market Potential Customers

The primary potential customers and buyers of FRP composite rebar are large-scale infrastructure owners and managing authorities who prioritize asset longevity and minimal maintenance expenditure over the material's upfront cost. This includes state and federal Departments of Transportation (DOTs) responsible for maintaining bridges, highways, and tunnels, especially those subjected to high levels of de-icing salt application or frequent freezing-thaw cycles. Municipal water authorities and wastewater treatment companies are also critical buyers, as FRP rebar provides the only cost-effective solution for reinforcement in chemically aggressive tanks and clarifiers where steel rapidly degrades, leading to catastrophic structural failure and high replacement costs. These customers seek materials that ensure a service life exceeding 75 to 100 years.

Another significant customer segment includes construction companies and specialized marine contractors operating in coastal and offshore environments, where traditional steel corrosion is accelerated by chloride intrusion. Projects such as seawalls, port facilities, jetties, and deep-water pilings require the non-corrosive properties of FRP composites to withstand constant exposure to saltwater spray and submersion. Furthermore, highly specialized industrial clients, particularly those in the magnetic resonance imaging (MRI) and high-voltage electrical transmission sectors, form a valuable niche customer base. These buyers are driven not just by durability but by the non-conductive and non-magnetic characteristics of FRP rebar, which are essential for maintaining the operational integrity of sensitive equipment and avoiding electromagnetic interference.

Finally, general building contractors involved in specialized high-rise and commercial construction, particularly in seismic zones or structures designed for extreme performance, represent growing potential customers. While residential construction lags, specialized commercial projects—like data centers, chemical storage facilities, and heavy industrial slabs—are increasingly specifying FRP composites to meet stringent performance criteria. The purchasing decision for all these customers is intrinsically linked to engineering specifications, life-cycle cost analysis (LCCA), and compliance with increasing regulatory pressures demanding resilient, sustainable building practices, making the material's long-term economic superiority the core selling point.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 million |

| Market Forecast in 2033 | USD 870 million |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A.C.I. Distribution, Aslan, Inc., Hughes Brothers Inc., Dextra Group, Pultrall Inc., Sireg S.p.A., S&P Clever Reinforcement, Fibroli, Owens Corning, Pultrusions Canada, V-ROD Composite Rebar, Technobasalt, Marshall Composites, Kodiak Rebar, Tuf-Bar, Composite Rebar Technologies, Fibrex Construction Group, Fujian Strait New Material, Nanjing KTK Technology, Schoeck Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FRP composite rebar Market Key Technology Landscape

The core technology underpinning the FRP composite rebar market is continuous pultrusion, a high-efficiency manufacturing process that pulls reinforcement fibers through a resin bath and then through a heated die to cure the polymer matrix into a final, continuous profile. Advancements in pultrusion technology are focused on increasing production speed, reducing energy consumption, and achieving higher precision in fiber volume fraction, which directly correlates to the rebar's structural performance. Innovations include closed-mold systems that minimize volatile organic compound (VOC) emissions and automated tensioning systems that ensure consistent fiber alignment throughout the process, crucial for maximizing the tensile strength of the finished product. The efficiency of pultrusion dictates the overall cost-competitiveness of FRP rebar against steel.

Beyond the manufacturing process, significant technological efforts are concentrated on material science, particularly optimizing the fiber and resin systems. In the fiber landscape, while traditional E-glass dominates, there is increasing interest and technological maturity in Basalt Fiber Reinforced Polymer (BFRP) rebar, which offers higher temperature resistance and improved environmental sustainability due to the natural origin of the basalt rock. Resin technology is evolving rapidly, with next-generation vinyl ester and epoxy systems being developed to enhance chemical resistance against strong acids and alkalis, and to improve bond strength between the rebar surface and the surrounding concrete, often through integrated sand coating or proprietary surface texturing applied during the pultrusion process.

Digital technologies are also becoming integral to the FRP rebar landscape. Advanced Non-Destructive Testing (NDT) techniques, often employing ultrasound or electromagnetic methods, are used for stringent quality checks post-pultrusion to ensure the absence of voids or discontinuities within the composite structure. Furthermore, the integration of specialized corrosion modeling software, which incorporates FRP material properties, is crucial for assisting engineers in design specification, especially in complex, high-exposure structures. The continued focus on developing fire-resistant resin additives and coatings is also a significant technological trend, addressing one of the material’s key limitations in certain structural fire scenarios and aiming to achieve broader building code acceptance globally.

Regional Highlights

The FRP composite rebar market exhibits significant regional variations in adoption rates, regulatory support, and primary application focus, driven by local infrastructure needs and environmental conditions.

- North America (U.S. and Canada): This region is a mature and leading market, characterized by comprehensive federal infrastructure spending and severe problems related to steel corrosion from extensive road salt usage. The U.S. Federal Highway Administration (FHWA) and various State DOTs have actively promoted the use of GFRP rebar in bridge decks and coastal structures, establishing strong technical guidelines and driving steady market demand.

- Europe: Europe is a highly innovative market, focusing on sustainable and circular economy principles. Countries like Germany, the Netherlands, and Scandinavia are adopting FRP rebar not only for bridges and tunnels but also for highly specialized applications in magnetically sensitive medical and research facilities. Strict EU regulations regarding material durability and life cycle assessment accelerate composite adoption.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization and massive investments in new transportation networks, including high-speed rail and extensive coastal development in countries like China, India, and Japan. The region’s aggressive construction schedule and need for earthquake-resistant structures are key demand drivers.

- Middle East and Africa (MEA): This region shows significant potential, primarily driven by massive capital projects in the GCC states (Saudi Arabia, UAE). High temperatures, extreme salinity in coastal areas, and the large-scale development of desalination and wastewater infrastructure necessitate high-performance, corrosion-proof reinforcement materials like FRP rebar, particularly BFRP and high-grade GFRP.

- Latin America: Market adoption is still nascent but gaining momentum, particularly in countries facing critical infrastructure repair needs and high maintenance burdens on existing assets. Projects focusing on port expansions and chemical industry facilities are leading the initial demand, seeking durable, long-term reinforcement solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FRP composite rebar Market.- A.C.I. Distribution

- Aslan, Inc. (An industry leader specializing in GFRP and hybrid solutions)

- Hughes Brothers Inc.

- Dextra Group (Known for providing comprehensive FRP solutions and technical support)

- Pultrall Inc.

- Sireg S.p.A.

- S&P Clever Reinforcement (Focusing on advanced composite strengthening systems)

- Fibroli (Key regional player in GFRP production)

- Owens Corning (Major upstream fiber supplier influencing the market)

- Pultrusions Canada

- V-ROD Composite Rebar

- Technobasalt (Specializing in Basalt Fiber Reinforced Polymer solutions)

- Marshall Composites

- Kodiak Rebar

- Tuf-Bar (A prominent supplier of specialized GFRP rebar)

- Composite Rebar Technologies

- Fibrex Construction Group

- Fujian Strait New Material

- Nanjing KTK Technology

- Schoeck Group (Focusing on thermal breaks using FRP technology)

Frequently Asked Questions

Analyze common user questions about the FRP composite rebar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of FRP composite rebar over traditional steel rebar?

The primary advantage is its complete immunity to electrochemical corrosion, which is the leading cause of premature failure in concrete structures reinforced with steel, especially in environments exposed to chlorides (like de-icing salts or marine air). FRP rebar significantly extends the service life of structures, reducing life-cycle maintenance costs dramatically.

Is FRP rebar more expensive than steel, and how is the cost justified?

FRP rebar generally has a higher initial material cost (unit price) compared to commodity steel. However, the cost is justified through a comprehensive Life Cycle Cost Analysis (LCCA). FRP structures require minimal maintenance over 75-100 years, avoiding expensive corrosion-related repairs, thereby offering substantial long-term economic savings and higher asset value.

What are the main types of FRP rebar materials used in construction?

The main types are Glass Fiber Reinforced Polymer (GFRP), which is the most common and cost-effective, Carbon Fiber Reinforced Polymer (CFRP), used for high-tensile, specialized applications, and Basalt Fiber Reinforced Polymer (BFRP), which offers good performance with high-temperature resistance and environmental benefits.

Can standard construction workers handle and install FRP rebar?

Yes, installation methods for FRP rebar are similar to steel, requiring tying and placement. However, special care must be taken as it cannot be bent on site; all bends must be pre-fabricated. It is significantly lighter, simplifying handling, but it must be cut using abrasion tools (like saws or grinding discs) rather than standard metal shears.

Where is FRP rebar most commonly used globally?

FRP rebar is most commonly utilized in critical infrastructure projects exposed to high corrosion risk. Leading applications include bridge decks, highway pavements, marine structures (docks, bulkheads), seawalls, airport runways, and highly corrosive industrial environments such as chemical plants and municipal wastewater treatment facilities worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager