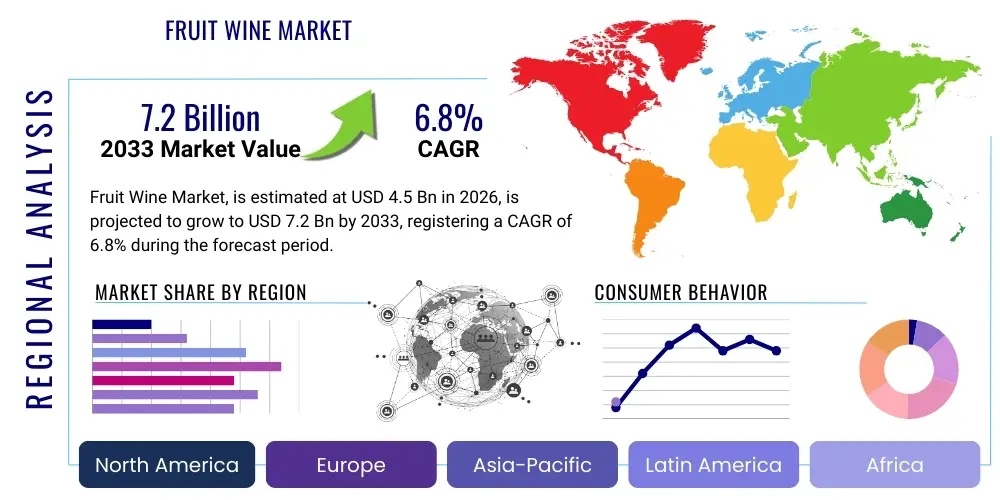

Fruit Wine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436836 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fruit Wine Market Size

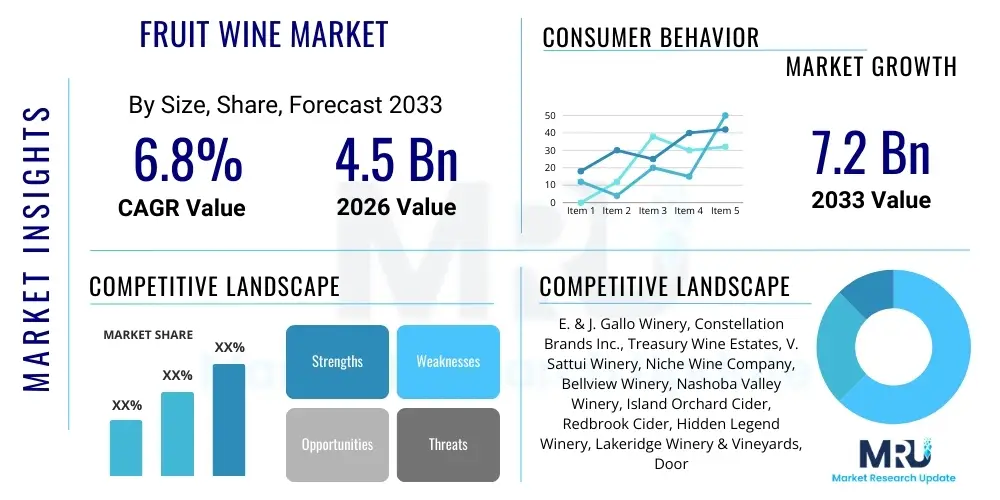

The Fruit Wine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

This robust growth trajectory is primarily fueled by increasing consumer preference for beverages with natural ingredients and lower alcohol content compared to traditional grape wines and spirits. Market expansion is further supported by innovations in flavor profiles, appealing to younger demographics seeking novel and artisanal alcoholic beverages. The rise in health consciousness across developed and developing economies positions fruit wine, particularly those made from superfruits like berries and pomegranates, favorably within the competitive beverage landscape.

Geographical market dynamics indicate strong performance in Asia Pacific, driven by high domestic fruit availability and expanding middle-class consumption patterns. Conversely, established European and North American markets are focusing on premiumization and product diversification, incorporating organic and low-sugar variants. Strategic investments in improved fermentation techniques and sustainable production practices are critical factors ensuring the market's long-term sustainability and projected value appreciation.

Fruit Wine Market introduction

The Fruit Wine Market encompasses alcoholic beverages derived from the fermentation of fruits other than grapes, including but not limited to apples, peaches, cherries, berries, plums, and pomegranates. These wines leverage the natural sugars and flavor compounds present in various fruits, offering diverse taste profiles ranging from dry and tart to intensely sweet. Major applications include direct consumption as a standalone beverage, usage in culinary preparations, and incorporation into cocktails and mixed drinks. Key benefits driving market adoption include their perceived naturalness, often lower alcohol by volume (ABV) compared to traditional wines, and suitability for consumers with sensitivities to grape-based products. The primary driving factors are the burgeoning demand for innovative alcoholic flavors, the global trend towards healthier drinking options, and effective marketing emphasizing regional and artisanal production.

Fruit wines represent a distinct and rapidly evolving category within the global alcoholic beverage industry. Unlike fortified wines or fruit-flavored grape wines, true fruit wines derive their ethanol content solely from the fermentation of non-grape fruit juices. The product diversity is vast, covering everything from crisp ciders (often considered fruit wine in broader contexts) to rich, dessert-style berry wines. Technological advancements in yeast strains and fermentation control are enabling producers to maintain consistent quality and complexity, previously challenging due to the high acidity or low nutrient content inherent in some non-grape fruits. This focus on quality stabilization is crucial for penetrating premium segments of the market.

Consumer engagement with fruit wine is increasingly driven by traceability and provenance. Consumers are prioritizing products that showcase specific regional fruits and traditional production methods. Furthermore, the versatility of fruit wines contributes significantly to their market appeal; they can serve as excellent pairings for various cuisines or act as refreshing, lighter alternatives during casual social settings. The regulatory environment, although sometimes complex due to differing definitions compared to grape wine, is gradually adapting to support the growth and labeling accuracy of these specialized beverages, thereby facilitating global trade and consumption.

Fruit Wine Market Executive Summary

The Fruit Wine Market is characterized by vigorous growth, underpinned by strong consumer interest in flavor diversification and natural ingredients. Current business trends indicate a significant shift towards artisanal and localized production, prioritizing high-quality, regionally sourced fruits, which supports premiumization across North America and Europe. Regional trends highlight the Asia Pacific market as the epicenter of volume growth, leveraging high domestic fruit yields and rapid urbanization leading to increased discretionary spending on alcoholic beverages. Segment trends show that berry wines and apple wines (ciders) dominate consumption by volume, while exotic fruit wines, such as mango and lychee, are capturing niche, high-growth segments, especially in tropical regions. Overall market dynamics reflect an industry successfully balancing tradition with modern flavor innovation and strategic marketing aimed at Millennial and Gen Z consumers.

The core business strategy observed among leading market players involves aggressive portfolio diversification. Companies are not only expanding their fruit wine offerings but are also integrating low-sugar, organic, and preservative-free claims to align with prevailing health and wellness trends. This operational pivot requires enhanced supply chain management capabilities to ensure year-round availability of quality raw materials, often sourced from highly seasonal fruit crops. Furthermore, strategic mergers and acquisitions targeting smaller, specialized producers are common tactics employed by larger corporations to quickly acquire niche expertise and established local brand loyalty, thus consolidating market share.

From a segmentation perspective, the most compelling trend is the rapid expansion of the distribution landscape. While traditional on-trade channels (restaurants, bars) remain important for brand building and premium product placement, the e-commerce sector and specialized retail (off-trade) have become indispensable, particularly following global shifts in purchasing behavior. Digital platforms allow smaller, artisanal producers to reach broader customer bases without massive upfront investment in physical distribution infrastructure. The synergy between digital marketing, which highlights the unique story and provenance of the fruit wine, and streamlined direct-to-consumer sales is a crucial determinant of success in the highly competitive modern market environment.

AI Impact Analysis on Fruit Wine Market

User inquiries regarding AI's influence on the Fruit Wine Market frequently center on three key areas: how AI can optimize fruit yield prediction and sourcing efficiency, its role in standardizing complex fermentation processes to ensure batch consistency, and the potential for AI-driven consumer data analytics to predict flavor trends and personalize marketing campaigns. Users are keen to understand if AI can democratize quality control, allowing smaller producers to compete effectively against large wineries. The general expectation is that AI will primarily serve as a powerful tool for precision viticulture and supply chain optimization, minimizing waste, maximizing raw material utilization, and crucially, accelerating the development of novel flavor combinations that appeal to segmented consumer palates.

Artificial Intelligence applications are transforming the upstream processes of fruit wine production, particularly in agricultural monitoring. AI-powered image recognition and drone surveillance systems are employed to assess fruit ripeness, detect early signs of disease, and predict optimal harvest times with unprecedented accuracy. This precision approach minimizes spoilage and ensures that only peak-quality fruit enters the fermentation stage, which is crucial for maintaining the delicate flavor profiles characteristic of fruit wines. The improved predictability directly influences cost reduction and supply chain stability, addressing the volatility often associated with agricultural commodities.

Downstream, AI is enhancing the crucial fermentation and blending stages. Machine learning algorithms analyze real-time data streams—including temperature, pH levels, and sugar conversion rates—to make instantaneous adjustments to the brewing environment, ensuring consistency across large production batches. Furthermore, predictive modeling analyzes vast datasets of consumer preferences, social media sentiment, and sales figures to identify emerging flavor trends (e.g., specific tropical blends or spiced seasonal variants) far ahead of traditional methods. This capability allows manufacturers to significantly reduce the time-to-market for new fruit wine products, thereby capturing first-mover advantage in niche segments.

- AI-driven precision agriculture for optimal fruit sourcing and harvest scheduling.

- Machine learning applied to fermentation control for enhanced quality and batch consistency.

- Predictive analytics for consumer trend forecasting and personalized flavor development.

- Supply chain optimization through dynamic routing and inventory management based on predicted demand.

- Automated quality control systems utilizing vision technology to detect bottling and labeling defects.

- Enhanced flavor blending algorithms optimizing the balance between sweetness, acidity, and aroma compounds.

DRO & Impact Forces Of Fruit Wine Market

The Fruit Wine Market is significantly influenced by a confluence of accelerating drivers, structural restraints, and emerging opportunities, collectively shaping its impact forces. Primary drivers include the global shift towards low-alcohol beverages and the strong consumer demand for natural, fruit-derived flavor innovations. Restraints predominantly involve the strong dominance of traditional grape wine in established markets and the inherent seasonality and volatility of non-grape fruit supplies, which can disrupt large-scale production consistency. Opportunities lie in penetrating emerging economies, leveraging e-commerce for direct-to-consumer sales, and developing premium, functional fruit wines (e.g., incorporating superfoods). These forces collectively create a dynamic market environment where product innovation and efficient supply chain management are critical levers for overcoming competitive pressures and maximizing growth potential.

The driving force of consumer experimentation is particularly powerful. Younger generations exhibit less brand loyalty to traditional alcoholic categories and are actively seeking unique and authentic beverage experiences, making them highly receptive to the diverse range of fruit wines. This trend is amplified by the widespread perception that fruit wines are often lighter and more refreshing than heavy red or white grape wines, aligning well with casual consumption occasions. Furthermore, technological advancements in preservation and fermentation have successfully extended the shelf life and quality of these products, mitigating historical risks associated with fruit wine instability and boosting consumer confidence.

However, significant constraints persist, particularly regarding regulatory hurdles and consumer education. In many jurisdictions, fruit wines face stringent labeling rules that can confuse consumers or place them at a disadvantage compared to established grape wines. Moreover, the lack of a standardized global classification system for fruit wines (unlike the appellation system for grape wines) complicates international trade and quality perception. To mitigate these restraints, market players must invest heavily in clear labeling, robust quality certification, and targeted educational campaigns that highlight the heritage and sophisticated nature of non-grape fruit fermentation, thereby transforming consumer perceptions from novelty drinks to specialized craft beverages.

Segmentation Analysis

The Fruit Wine Market is segmented primarily based on the type of fruit utilized, the flavor profile of the final product, and the distribution channel through which it reaches the consumer. This multi-dimensional segmentation allows producers to tailor their marketing strategies and product portfolios to specific demographic and geographical requirements. The most significant volume growth is currently observed within the berry wine and apple wine segments due to the robust supply chains and established production technologies associated with these fruits. Analyzing these segments is crucial for identifying areas of future investment and understanding the competitive dynamics defining market leadership and regional dominance.

Segmentation by flavor profile (sweet, semi-sweet, dry) dictates the target audience and consumption occasion. Sweet fruit wines typically capture the attention of younger consumers and those new to the wine category, often marketed as dessert wines or aperitifs. Conversely, dry fruit wines, which require more sophisticated production techniques to balance acidity and tannins, target discerning consumers looking for alternative food-pairing beverages. The increasing demand for low-sugar products is driving innovation within the semi-sweet and dry categories, pushing producers to minimize residual sugar while maintaining complexity and fruit integrity.

Distribution Channel analysis reveals a crucial dual strategy. The off-trade channel (supermarkets, liquor stores, online retail) accounts for the largest sales volume, capitalizing on convenience and price sensitivity. However, the on-trade channel (restaurants, hotels, and specialty bars) remains pivotal for establishing brand image, promoting premium products, and offering tasting experiences that drive long-term consumer loyalty. The rapid expansion of direct-to-consumer (DTC) models, facilitated by e-commerce, is blurring the lines between these traditional channels, offering producers unprecedented control over pricing and customer relationship management.

- By Fruit Type:

- Apple Wine (Cider)

- Berry Wine (Strawberry, Blueberry, Raspberry)

- Stone Fruit Wine (Peach, Cherry, Plum)

- Citrus Wine (Orange, Lemon)

- Exotic Fruit Wine (Mango, Lychee, Pineapple, Pomegranate)

- Other Fruit Wines

- By Flavor Profile:

- Sweet

- Semi-Sweet

- Dry

- By Distribution Channel:

- On-Trade (Restaurants, Bars, Hotels)

- Off-Trade (Supermarkets, Hypermarkets, Liquor Stores, Online Retail)

- By Packaging:

- Bottles (Glass)

- Cans

- Bag-in-Box

Value Chain Analysis For Fruit Wine Market

The value chain for the Fruit Wine Market begins with the highly sensitive upstream component: fruit sourcing and agriculture. This stage involves the cultivation, harvesting, and initial processing of non-grape fruits, which demands rigorous quality control due to the varying sugar and acid content across different fruit types and seasons. Efficiency in this segment is paramount, as the cost and quality of the raw material directly dictate the final product's profitability and market acceptability. Strong integration or contractual relationships between fruit growers and wineries are essential to ensure a reliable and high-quality supply chain, mitigating risks associated with crop failures or price fluctuations.

The midstream segment encompasses the core production processes: crushing, fermentation, aging, blending, and bottling. This stage is marked by significant technological investment in specialized equipment, including stainless steel fermentation tanks, temperature control systems, and advanced filtration technologies. Quality assurance processes, including microbiological testing and sensory analysis, are critical here, particularly for achieving the desired consistency and shelf stability required for global distribution. The strategic decision of whether to age the wine (which increases complexity and cost) or to release it quickly (maximizing inventory turnover) heavily influences the product positioning within the market.

The downstream segment focuses on distribution and sales, covering both direct and indirect channels. Indirect distribution through wholesalers, distributors, and large retail chains dominates volume sales, leveraging established logistics networks. Direct distribution (DTC), especially via dedicated winery websites and specialized tasting rooms, offers higher margins and invaluable customer data. Effective marketing and branding, emphasizing the fruit’s provenance and the wine’s unique flavor story, are crucial in this competitive environment, ensuring the product stands out on crowded retail shelves or digital storefronts.

Fruit Wine Market Potential Customers

The primary end-users and potential buyers of fruit wine span diverse demographic segments, encompassing general consumers seeking lighter alcoholic alternatives, specific demographic groups prioritizing natural and artisanal products, and commercial purchasers like hospitality operators. The largest and fastest-growing segment consists of health-conscious Millennials and Gen Z adults who are actively reducing hard liquor consumption and seeking low-ABV beverages with perceived health benefits (e.g., wines made from antioxidant-rich berries). These consumers prioritize authenticity, environmental sustainability, and unique flavor experiences over traditional brand heritage.

A significant secondary consumer segment includes individuals with dietary restrictions or preferences that exclude grape-based alcohol, finding fruit wine an appealing and sophisticated alternative. This includes consumers interested in specific regional or ethnic food pairings where traditional fruit wines play an integral role. Market penetration in this segment relies heavily on targeted nutritional labeling and clear communication of the ingredient profile. Furthermore, the commercial sector, including upscale restaurants, niche cocktail bars, and boutique hotels, represents a vital B2B customer base, utilizing fruit wines for specialized drink menus and food pairing recommendations, thereby driving premium brand perception.

Targeted marketing efforts should also focus on seasonal buyers and event planners, as fruit wines, particularly ciders and lighter berry wines, are highly popular during warmer months and festive seasons. Expanding the product line to include fortified fruit wines or ice wines also opens doors to the high-end dessert wine market, catering to affluent consumers seeking luxury, after-dinner beverage options. Understanding the psychographic profile—seeking exploration, novelty, and wellness—is more crucial than strict demographic classification in effectively targeting the modern fruit wine consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | E. & J. Gallo Winery, Constellation Brands Inc., Treasury Wine Estates, V. Sattui Winery, Niche Wine Company, Bellview Winery, Nashoba Valley Winery, Island Orchard Cider, Redbrook Cider, Hidden Legend Winery, Lakeridge Winery & Vineyards, Door Peninsula Winery, Bartles & Jaymes, St. Julian Winery, Maine Mead Works, Montezuma Winery, Schloss Wachenheim, Arbor Hill Winery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fruit Wine Market Key Technology Landscape

The technological landscape of the Fruit Wine Market is characterized by continuous innovation aimed at overcoming the production challenges inherent in non-grape fruit substrates, primarily their often higher acidity and lower fermentable sugar content compared to vitis vinifera. Advanced fermentation technology is paramount, involving the selection and deployment of specialized yeast strains (non-Saccharomyces species) capable of tolerating high acidity and enhancing specific fruit aromatics. Modern wineries utilize precise temperature-controlled fermentation vats and inert gas blanketing systems to prevent oxidation, which can rapidly degrade the delicate flavors of fruit wines, ensuring maximum retention of fresh fruit characteristics throughout the process.

Furthermore, technology plays a critical role in stabilization and filtration. Cross-flow filtration and advanced centrifuging techniques are increasingly adopted to achieve microbiological stability without resorting to heavy chemical treatments, meeting the consumer demand for 'clean label' products. Cold stabilization techniques are essential for preventing haze formation and sediment precipitation, which are common issues when dealing with pectin and protein components specific to various fruits. These stabilization technologies are vital for ensuring the visual clarity and shelf-life longevity required for global distribution and consumer acceptance.

Beyond the core brewing process, the industry is leveraging sensor technology and data analytics for quality assurance and process optimization. Near-Infrared (NIR) spectroscopy and electronic nose technology are used to rapidly analyze fruit composition, monitor fermentation kinetics, and confirm the final wine's chemical profile. This high-tech integration allows winemakers to maintain consistency across batches, efficiently manage blending operations for complex flavor matrices, and instantly verify compliance with international labeling standards, thereby securing brand reputation and facilitating market access.

Regional Highlights

- North America: North America represents a mature yet highly dynamic market, dominated by the robust growth of craft cider (apple wine) and niche berry wine categories. The region is characterized by high consumer willingness to pay for premium, artisanal, and locally sourced products. Innovation here is driven by experimentation with unique fruit blends and sustainable packaging solutions, such as canned fruit wines. Regulatory clarity around cider and fruit wine production differs by state and province, but general trends favor product diversification, particularly low-calorie and low-carb variants addressing the strong wellness movement. The U.S. and Canada are major centers for both production and consumption.

- Europe: Europe is the historical powerhouse for traditional fruit fermentation, with countries like the UK (cider and perry) and various Eastern European nations holding established markets for localized fruit wines (e.g., cherry and plum wines). The European market is highly fragmented, necessitating strict adherence to regional quality designations and regulatory frameworks. Current growth is stimulated by the revival of traditional methods combined with modern technology, focusing heavily on organic certification and Geographical Indications (GIs) to enhance market credibility and price points. Germany and the UK remain key consumption hubs, while Eastern Europe provides significant production volume.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and the adoption of Western drinking culture, adapted to local preferences. Domestic fruit abundance (such as mango, lychee, and pineapple) supports high-volume, low-cost production models, particularly in China and Southeast Asia. Consumers in this region often favor sweeter, lighter-bodied wines. The market is primarily volume-driven, but there is an increasing demand for premium, imported fruit wines in metropolitan centers like Shanghai, Tokyo, and Sydney. Supply chain infrastructure development is key to sustaining this rapid expansion.

- Latin America (LATAM): The LATAM market, while smaller than NA or EU, shows significant potential, capitalizing on rich agricultural diversity and regional specialization. Countries like Brazil and Chile possess strong fruit industries that feed local fruit wine production, often targeting mass-market segments. Challenges include economic volatility and fragmented distribution networks. The opportunity lies in exporting unique, regional fruit wines (e.g., wines made from tropical Amazonian fruits) to global markets seeking exotic and novel flavors.

- Middle East and Africa (MEA): The MEA region is characterized by stark contrasts. The Middle Eastern market is heavily constrained by religious and regulatory restrictions on alcohol consumption, focusing consumption almost exclusively on expatriate populations and tourism sectors, favoring high-end, imported products. Conversely, parts of Africa, particularly South Africa, have established local fruit wine and cider industries, often integrated with broader agricultural initiatives. Growth here is tied to tourism recovery and the expansion of the legal retail sector in specific metropolitan areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fruit Wine Market.- E. & J. Gallo Winery

- Constellation Brands Inc.

- Treasury Wine Estates

- V. Sattui Winery

- Niche Wine Company

- Bellview Winery

- Nashoba Valley Winery

- Island Orchard Cider

- Redbrook Cider

- Hidden Legend Winery

- Lakeridge Winery & Vineyards

- Door Peninsula Winery

- Bartles & Jaymes (Gallo subsidiary)

- St. Julian Winery

- Maine Mead Works

- Montezuma Winery

- Schloss Wachenheim

- Arbor Hill Winery

- Oliver Winery

- Chateau Morrisette

Frequently Asked Questions

Analyze common user questions about the Fruit Wine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fruit wine and traditional grape wine?

The defining difference lies in the base ingredient. Fruit wine is fermented solely from non-grape fruits (like berries, apples, or plums), deriving all its alcohol and flavor components from that source, whereas traditional wine uses grapes (Vitis vinifera) exclusively. Fruit wines often present different acidity levels and sugar profiles, necessitating unique fermentation techniques.

Which fruit wine segment is experiencing the fastest growth globally?

The berry wine and exotic fruit wine segments are exhibiting the fastest growth rates. Berry wines, rich in antioxidants, appeal to health-conscious consumers, while exotic fruit wines (e.g., mango, lychee) capitalize on the expanding consumer demand for novel and unique global flavors, particularly across the Asia Pacific region.

How is sustainability impacting production in the Fruit Wine Market?

Sustainability is a major driver, compelling producers to adopt organic farming practices for fruit sourcing, reduce water usage, and utilize sustainable packaging (such as lightweight glass or aluminum cans). Consumers are increasingly scrutinizing supply chains, favoring brands that demonstrate clear environmental stewardship and local sourcing transparency.

What are the main distribution channels driving sales volume in this market?

The off-trade channel, encompassing supermarkets, hypermarkets, and specialized liquor stores, accounts for the majority of sales volume due to consumer convenience and purchasing habits. However, e-commerce and direct-to-consumer (DTC) models are rapidly gaining importance, offering specialized producers wider reach and improved margin control.

Are fruit wines considered a low-alcohol beverage alternative?

Many fruit wines, particularly ciders and certain berry wines, are positioned as low-alcohol beverages (typically 5% to 10% ABV) compared to standard grape wines (12% to 15% ABV). This characteristic is a significant market driver, attracting consumers seeking moderation without sacrificing flavor or complexity.

The strategic deployment of new product development initiatives focusing on low-sugar and functional attributes is expected to redefine consumer expectations within the fruit wine category. Investment in cold-chain logistics, particularly for highly perishable fruit juices used in the wine production, is a critical element of market infrastructure enhancement, ensuring product quality is maintained from the point of harvest to the final consumer purchase. Furthermore, the integration of blockchain technology is beginning to gain traction, offering an immutable record of provenance and processing steps, which significantly boosts consumer trust in premium and artisanal offerings.

The evolving regulatory environment plays a pivotal role in shaping market dynamics, particularly concerning import tariffs, excise taxes, and labeling requirements which vary drastically across major consumption blocs such as the European Union, North America, and Asia. Market players must navigate complex trade agreements and local product definitions to ensure compliance, which often requires significant investment in regulatory affairs teams. Successful companies are those that proactively engage with governing bodies to standardize fruit wine definitions, thereby facilitating smoother cross-border trade and expansion into new geographic territories.

The increasing prominence of alternative packaging formats, notably aluminum cans and bag-in-box options, is revolutionizing consumption patterns. Canned fruit wines cater directly to the outdoor leisure market and younger consumers seeking portable, single-serving options that are recyclable and easier to chill. This packaging innovation helps to dismantle the formal image often associated with bottled grape wine, making fruit wine more accessible and appealing for casual consumption settings. Manufacturers are rapidly retooling production lines to meet the demand for these convenient and environmentally friendly alternatives.

Consumer engagement strategies are increasingly sophisticated, moving beyond traditional advertising to immersive digital storytelling. Brands leverage social media influencers and content marketing to share the unique stories of their fruit sources, the dedication of their growers, and the craft behind the fermentation process. This focus on experiential marketing and authenticity fosters deeper consumer connection and loyalty, especially in the competitive online retail space. Digital analytics also provide crucial feedback loops, allowing manufacturers to quickly adapt flavor profiles and packaging based on real-time market reception.

In terms of competitive landscape, while the market remains fragmented with numerous small, local producers capitalizing on regional fruit specialties, there is a clear trend toward consolidation. Large beverage conglomerates are actively acquiring successful independent fruit wine and cider operations to instantly gain market share and diversify their overall portfolio beyond beer and traditional wine. These acquisitions inject significant capital and professional distribution networks into the acquired brands, accelerating their growth potential and competitive reach both domestically and internationally. This consolidation is likely to standardize certain production best practices across the industry.

The impact of climate change on fruit supply remains a long-term strategic concern for the fruit wine sector. Unpredictable weather patterns, including late frosts and prolonged droughts, directly threaten the stability and quality of non-grape fruit harvests. To mitigate this, producers are investing in climate-resilient fruit varietals, adopting controlled-environment agriculture techniques where feasible, and diversifying their sourcing regions globally. Research into stress-tolerant rootstocks and precision irrigation systems funded by major market players is becoming essential for ensuring the continuity of supply and the overall resilience of the fruit wine value chain.

The rising interest in functional beverages is also transforming the fruit wine space. Producers are experimenting with fermenting fruits that possess high levels of vitamins or probiotics, aiming to market their products as 'better-for-you' alcoholic choices. While regulatory claims regarding health benefits must be managed carefully, the underlying trend suggests a consumer desire for products that offer perceived wellness advantages alongside enjoyment. This market niche, though nascent, holds significant potential for premium pricing and differentiation within the broader alcoholic beverage industry.

Another crucial technological development involves the application of advanced cold aseptic bottling processes. This technology allows producers to bottle heat-sensitive fruit wines without the need for excessive pasteurization, thus preserving the vibrant, fresh fruit characteristics and delicate aromatic compounds that consumers value. Aseptic techniques extend shelf life while maintaining product integrity, a key requirement for exporting delicate fruit wines across long distances and varying climates, particularly to rapidly growing markets in Asia.

The development of yeast genetics is also profoundly influencing flavor complexity. Biotechnological advancements permit the engineering or selection of specialized yeast strains designed to enhance specific fruit esters (aroma compounds) while minimizing unwanted byproducts, such as higher alcohols or sulfur notes. This precision fermentation allows winemakers to exert far greater control over the final sensory profile, enabling the creation of tailored fruit wines that consistently hit highly specific flavor targets for segmented consumer groups, driving product novelty and repeatability.

Finally, the growing popularity of low-alcohol and no-alcohol (NA) versions of fruit wines and ciders presents a lucrative expansion pathway. Using advanced de-alcoholization technologies, such as reverse osmosis or spinning cone columns, producers are able to remove ethanol while retaining the majority of the original fruit flavor and body. The NA fruit wine category caters directly to the burgeoning global trend of mindful drinking and abstention, representing a key strategic investment area for major industry players looking to capture market share among non-traditional consumers of alcoholic beverages.

The global infrastructure for cold storage and expedited transportation remains a challenge, particularly for maintaining the freshness of fruit wines destined for distant markets. Unlike some traditional grape wines which benefit from aging, many fruit wines are best consumed when their youthful fruit notes are most vibrant. This necessity for rapid, temperature-controlled delivery adds to the logistical complexity and cost structure of international trade, especially impacting smaller producers who lack large-scale distribution partnerships. Enhancements in insulated packaging and real-time shipment monitoring are therefore high-priority investments across the value chain.

Economic indicators, such as fluctuating currency exchange rates and varying excise duties imposed on alcoholic beverages, contribute substantial volatility to the market’s pricing structures. Producers exporting fruit wines must strategically hedge against these financial risks to maintain competitive pricing in target markets without compromising profitability. Furthermore, trade wars and geopolitical instability can abruptly impact the availability and cost of packaging materials, notably glass bottles, necessitating flexible sourcing strategies and strong supplier relationships.

The cultural acceptance of fruit wine varies significantly by region. In North America and parts of Europe, fruit wines are largely viewed as a contemporary, often casual, choice. In regions dominated by centuries of grape wine culture, such as France or Italy, fruit wines often face cultural barriers and may be relegated to niche or lower-tier categories. Overcoming these entrenched cultural perceptions requires concerted marketing efforts emphasizing the artisanal quality, regional heritage, and sophisticated food-pairing capabilities of high-quality fruit wines, thereby elevating their status within the fine beverage market.

The rise of micro-breweries and craft cideries operating at a local scale mirrors the craft beer movement, significantly contributing to the innovation pipeline. These small-batch producers frequently experiment with hyper-local fruits, unique wild fermentation processes, and specialized barrel aging, creating highly differentiated products that command premium prices. While their volume share remains small, their influence on trend setting and consumer flavor expectations is substantial, forcing larger manufacturers to respond with their own artisanal or limited-edition lines to maintain relevance among sophisticated consumers.

In the context of the supply chain, the demand for certified organic and non-GMO fruits is creating pressure on upstream agricultural practices. Achieving these certifications requires meticulous compliance, high standards of traceability, and often results in lower yields, translating to higher raw material costs. However, the premiumization trend supports this increase in cost, as consumers globally are increasingly willing to pay a premium for certified ethical and organic consumables, solidifying the market viability of high-quality, specialty fruit wines over cheaper, mass-produced alternatives.

Finally, data privacy regulations, such as GDPR in Europe and similar evolving frameworks globally, impact the marketing and sales strategies of fruit wine companies utilizing e-commerce and DTC channels. The ability to collect and analyze granular consumer data—essential for personalized marketing and flavor preference prediction—must be balanced against strict legal requirements for data protection and transparency. Companies investing in robust, compliant data management systems are better positioned to leverage analytics for strategic decision-making and customer relationship management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager