Frying Pans and Skillets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432519 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Frying Pans and Skillets Market Size

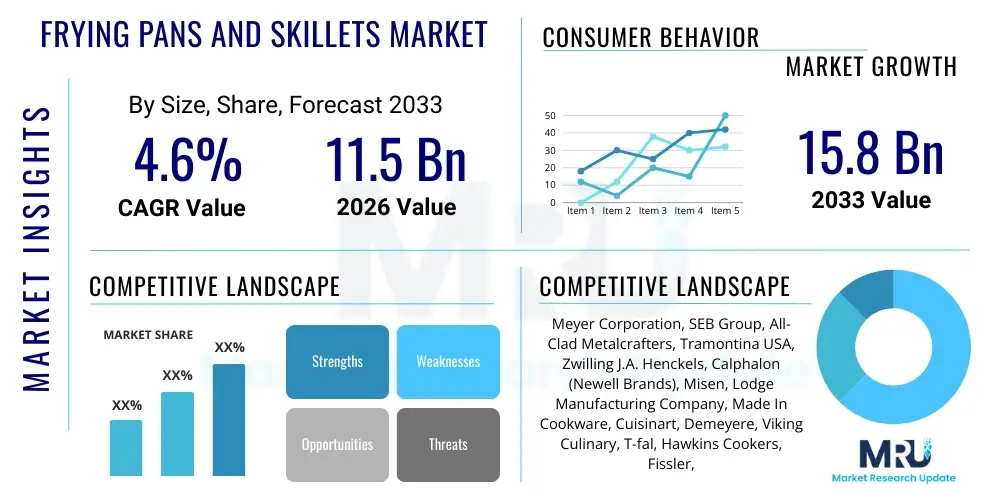

The Frying Pans and Skillets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% between 2026 and 2033. The market is estimated at 11.5 Billion USD in 2026 and is projected to reach 15.8 Billion USD by the end of the forecast period in 2033.

Frying Pans and Skillets Market introduction

The Frying Pans and Skillets Market encompasses a broad category of essential kitchen cookware characterized by shallow, sloping sides and a flat bottom, primarily utilized for searing, sautéing, frying, and browning foods. This market segment is highly fragmented, driven by continuous innovation in material science, focusing on enhanced heat distribution, durability, and non-stick properties. Products range from basic aluminum pans for domestic use to sophisticated copper-core and multi-ply stainless steel skillets favored by professional chefs. Key product differentiators include non-stick coating technology (such as PTFE-based, ceramic, or natural seasoning), compatibility with various heat sources (gas, electric, induction), and overall ergonomic design for user comfort and safety.

Major applications of frying pans and skillets span both the residential and commercial sectors. In residential settings, increased consumer interest in home cooking, coupled with global trends emphasizing healthy, low-fat food preparation, drives demand for high-quality non-stick and highly conductive cookware. Commercially, the HORECA (Hotel, Restaurant, and Catering) industry requires heavy-duty, durable pans capable of withstanding intensive daily use and rapid temperature changes. The benefits offered by modern skillets, such as PFOA-free coatings, superior heat retention (e.g., cast iron), and lightweight maneuverability (e.g., aluminum), significantly contribute to market expansion.

Driving factors propelling market growth include rapid urbanization, rising disposable incomes in emerging economies, and the continuous technological evolution of coating materials that address consumer concerns regarding safety and longevity. Additionally, the proliferation of specialized cooking appliances, such as induction cooktops, necessitates a corresponding investment in compatible, high-performance ferromagnetic cookware, further stimulating replacement and upgrade cycles within established markets.

Frying Pans and Skillets Market Executive Summary

The Frying Pans and Skillets Market is currently experiencing robust growth underpinned by significant shifts in consumer behavior towards premium and health-conscious cookware. Key business trends include the strong performance of e-commerce channels, which allow niche brands specializing in materials like carbon steel or enameled cast iron to directly reach consumers, bypassing traditional retail bottlenecks. There is a palpable industry focus on sustainability, leading manufacturers to develop products with recycled materials and long warranties, appealing to environmentally aware consumer segments. Furthermore, the convergence of kitchenware and smart technology is an emerging trend, with some high-end products incorporating thermal sensors and integrated cooking assistance features, although these remain a nascent segment.

Regionally, the Asia Pacific (APAC) stands out due to massive volume consumption, driven by growing household formation and rising middle-class spending, particularly in China and India. While APAC leads in manufacturing output, North America and Europe dominate the high-value market segments, characterized by strong demand for professional-grade, induction-compatible, and premium non-stick coatings. Regulatory landscapes, especially in Europe (EU), influence product development, pushing brands to strictly adhere to guidelines concerning food-contact materials and the elimination of harmful chemicals like PFOA, thereby accelerating the replacement rate of older, non-compliant products.

Segment trends highlight the accelerated adoption of ceramic non-stick coatings as a perceived safer alternative to traditional PTFE coatings, despite potential compromises in durability. Concurrently, traditional materials such as cast iron and carbon steel are experiencing a renaissance among cooking enthusiasts seeking exceptional durability and natural non-stick properties achieved through seasoning. The household application segment remains the largest volume driver, but the commercial segment, propelled by global expansion in the fast-casual dining sector, demonstrates higher average transaction values and less price sensitivity, focusing instead on endurance and operational efficiency.

AI Impact Analysis on Frying Pans and Skillets Market

User queries regarding AI’s influence on the Frying Pans and Skillets Market primarily revolve around smart kitchen integration, personalized product recommendations, manufacturing efficiency, and supply chain predictive capabilities. Consumers are keen to understand how AI can enhance the cooking experience through features like integrated temperature control and automated cooking presets tied to specific pan types. Manufacturers frequently inquire about optimizing material usage, reducing defect rates in complex non-stick application processes, and forecasting regional demand fluctuations based on real-time consumer data analyzed by AI. The key themes include leveraging AI for superior product performance identification and streamlining the path from raw material sourcing to consumer delivery, ultimately aiming for hyper-personalized marketing strategies that match specific cookware features (e.g., material conductivity, size) to individual consumer cooking habits and appliance specifications (e.g., induction readiness).

- AI-driven personalized product curation based on consumer kitchen setup and cooking frequency.

- Integration of AI algorithms in smart cookware for precise temperature regulation and automated cooking assistance features.

- Optimization of manufacturing processes, particularly non-stick coating application, using machine learning to minimize waste and ensure consistency.

- Predictive supply chain management analyzing global logistics and raw material price volatility for optimized inventory planning.

- Enhanced quality control through computer vision systems identifying minute surface defects during the production of skillet bases and coatings.

- Development of digital twins for simulating material stress and durability testing under various cooking conditions, reducing physical prototyping cycles.

DRO & Impact Forces Of Frying Pans and Skillets Market

The market dynamics of frying pans and skillets are shaped by a complex interplay of drivers, restraints, and opportunities (DRO), which collectively form the impact forces determining market growth trajectory. A primary driver is the rising global awareness regarding health and food safety, which fuels the demand for advanced non-stick coatings that are PFOA, lead, and cadmium-free. Furthermore, the persistent growth of the residential sector, characterized by consumers spending more time and resources on home kitchen upgrades, reinforces the necessity for high-performance and aesthetically appealing cookware. Technological advancements, such as the development of induction-compatible bases and hybrid material constructions (e.g., stainless steel cladded with aluminum), significantly enhance product utility and justification for premium pricing, acting as strong growth catalysts.

Conversely, several restraints impede seamless market expansion. The market is highly susceptible to the volatility of raw material prices, specifically aluminum, stainless steel, and specialized polymers used in coatings, directly impacting production costs and retail pricing stability. Another critical restraint is the prevalence of low-quality, inexpensive counterfeit products, particularly in emerging markets, which erode consumer trust in non-stick durability and undercut established brands’ pricing strategies. Moreover, the cyclical nature of cookware replacement, often dictated by the lifespan of non-stick coatings, requires continuous consumer engagement and effective warranty management to maintain long-term market presence.

Opportunities for future expansion are abundant, particularly in integrating Internet of Things (IoT) capabilities into high-end skillets for temperature monitoring and recipe execution guidance. The penetration of specialized niche segments, such as carbon steel skillets catering to professional or serious amateur chefs, offers higher profit margins. Additionally, the growing focus on sustainable and recyclable manufacturing processes presents an opportunity for brands to differentiate themselves through eco-friendly product lines. The impact forces are thus dominated by the push for material innovation and regulatory compliance, balanced by the need to manage input cost fluctuations and combat generic competition.

Segmentation Analysis

The Frying Pans and Skillets Market is rigorously segmented based on material composition, non-stick coating type, application end-user, and distribution channel, providing a granular view of consumer preferences and market dynamics. Material segmentation is crucial as it dictates the pan’s performance characteristics, including heat retention and responsiveness. Stainless steel remains popular due to its durability and non-reactivity, while aluminum dominates the volume segment due to its lightweight nature and superior heat conductivity. The rise of multi-ply construction, often combining layers of copper, aluminum, and steel, caters to the premium market demanding professional performance.

The coating segment is undergoing rapid change, moving away from traditional PTFE to ceramic and hard-anodized alternatives, driven by safety perceptions and marketing efforts emphasizing "non-toxic" cooking. Application segmentation clearly delineates the different requirements of the household sector (focusing on convenience, appearance, and lower price points) versus the commercial sector (prioritizing robustness, handle ergonomics for fast-paced environments, and large capacity). Understanding the nuanced performance requirements within each segment is critical for manufacturers to tailor their product development and marketing strategies effectively.

Furthermore, the distribution landscape is increasingly bifurcated, with specialty retailers and e-commerce platforms capturing a larger share of high-end, branded sales, while mass merchandisers and supermarkets handle the high-volume, entry-level products. This segmentation allows businesses to identify specific growth pockets, whether through focusing on high-margin, induction-compatible stainless steel cookware distributed through direct-to-consumer online channels, or maximizing volume efficiency through mass-produced aluminum pans sold via discount retailers.

- By Material:

- Aluminum

- Stainless Steel

- Cast Iron

- Copper

- Carbon Steel

- Others (e.g., Ceramic, Glass)

- By Coating Type:

- PTFE/Teflon (Traditional Non-stick)

- Ceramic Non-stick

- Hard-Anodized

- Enameled

- Seasoned (Natural Non-stick)

- By Application/End-User:

- Household (Residential)

- Commercial (HORECA, Institutional)

- By Distribution Channel:

- Offline Retail (Supermarkets/Hypermarkets, Specialty Stores, Department Stores)

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Frying Pans and Skillets Market

The value chain for the Frying Pans and Skillets Market begins with complex upstream activities, primarily involving the procurement and processing of raw materials such as primary aluminum ingots, stainless steel coils (304, 430 grade), copper, and specialized polymers for non-stick coatings. Raw material suppliers wield considerable pricing power, particularly for high-grade metals and proprietary coating chemicals, making strategic sourcing and long-term contracts essential for manufacturers. Manufacturing processes include casting, stamping, forming, and the highly technical application of non-stick coatings, often performed in high-volume production hubs located predominantly in Asia Pacific nations, benefiting from lower labor costs and established industrial infrastructure.

Midstream activities center on branding, quality assurance, and packaging, where major players invest heavily to differentiate their products based on safety certifications (e.g., PFOA-free claims) and extended warranties. The distribution channel forms the critical link to the end-consumer, utilizing both direct and indirect models. Indirect channels involve wholesalers, distributors, and large-scale retailers (supermarkets, department stores), demanding significant logistical organization and volume efficiency. Direct channels, increasingly prominent through dedicated e-commerce platforms, allow manufacturers higher control over pricing and direct access to valuable consumer feedback.

Downstream analysis focuses on retail and post-sale services. The rise of online shopping has revolutionized how consumers research and purchase cookware, valuing detailed product specifications, comparison tools, and user reviews highly. Post-sale services, including robust customer support and warranty fulfillment, are crucial for maintaining brand reputation and driving repeat purchases in a market where product longevity is a key consumer concern. The efficiency of this value chain hinges on mitigating risks associated with input price volatility and ensuring the integrity of specialized, often proprietary, non-stick technologies from factory to kitchen.

Frying Pans and Skillets Market Potential Customers

The Frying Pans and Skillets Market serves a diverse range of potential customers categorized by consumption volume, purchasing motivation, and technical requirements. The largest segment remains the household consumer base, encompassing individuals and families seeking functional, safe, and durable tools for daily meal preparation. Within the household segment, significant sub-groups include millennials and Gen Z consumers who are increasingly engaging in home cooking, often influenced by cooking shows and social media, driving demand for aesthetically pleasing and versatile products like small, specialized egg pans or decorative cast iron skillets. Health-conscious buyers represent another key demographic, prioritizing pans with advanced ceramic or naturally seasoned surfaces over traditional PTFE coatings.

The Commercial sector, primarily comprising the HORECA segment (Hotels, Restaurants, Cafes, and Catering services), constitutes the second major customer group. These professional buyers prioritize extreme durability, uniform heat distribution suitable for high-speed service, and compliance with stringent commercial kitchen safety standards. Their purchasing decisions are often centralized, involve larger order volumes, and favor industrial-grade materials like heavy-gauge stainless steel or carbon steel, where longevity outweighs initial cost. Institutional customers, such as schools, hospitals, and corporate cafeterias, similarly require robust, easy-to-clean, and high-capacity frying equipment capable of handling bulk preparation.

A burgeoning segment includes specialized professional users and culinary educators who act as opinion leaders, often purchasing high-end, niche materials like copper or high-carbon steel to achieve precise cooking results. Serving these varied customer needs requires manufacturers to maintain a diversified portfolio, addressing both the cost-sensitivity of mass-market household replacement cycles and the performance-driven demand of the professional culinary world.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 11.5 Billion USD |

| Market Forecast in 2033 | 15.8 Billion USD |

| Growth Rate | 4.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meyer Corporation, SEB Group, All-Clad Metalcrafters, Tramontina USA, Zwilling J.A. Henckels, Calphalon (Newell Brands), Misen, Lodge Manufacturing Company, Made In Cookware, Cuisinart, Demeyere, Viking Culinary, T-fal, Hawkins Cookers, Fissler, GreenPan, Scanpan, BergHOFF, Le Creuset, WMF Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Frying Pans and Skillets Market Key Technology Landscape

The Frying Pans and Skillets Market is characterized by intense technological competition centered on enhancing heat transfer efficiency, non-stick performance, and product durability. A pivotal area of innovation is the development of advanced non-stick formulations. Modern coatings, often ceramic-based or highly reinforced PTFE variants, prioritize eliminating restricted substances like PFOA and PFOS while simultaneously improving scratch resistance and thermal stability. Manufacturers are employing multi-layer application techniques, sometimes incorporating diamond dust or mineral particles, to achieve superior release properties and significantly extend the lifespan of the cooking surface, addressing the primary complaint of rapid non-stick degradation.

Another crucial technological focus is on induction compatibility. With induction cooktops gaining global traction due to their energy efficiency, manufacturers must integrate ferromagnetic bases (often stainless steel 430 grade) into non-magnetic materials like aluminum or copper. Technologies such as impact bonding or clad construction ensure that the ferromagnetic layer is permanently and securely attached, guaranteeing efficient energy transfer without compromising the pan’s core heat distribution properties. Furthermore, the design of the base itself—specifically the thickness and flatness—is optimized using computational fluid dynamics (CFD) modeling to prevent warping under high heat and ensure even heat spread across the entire cooking surface, a vital requirement for professional use.

Ergonomics and smart integration represent the future frontier. Handle design technology focuses on material science to provide heat isolation (e.g., silicone wraps or specialized polymers) and balanced weight distribution for easier maneuverability. For high-end products, the integration of temperature sensors and Bluetooth connectivity allows the pan to communicate with smart kitchen hubs or mobile devices, offering real-time feedback on surface temperature and enabling automated execution of complex recipes. These innovations transform the simple cooking tool into a sophisticated, connected kitchen device, driving premium pricing and capturing the attention of tech-savvy consumers.

Regional Highlights

- North America: This region is a mature yet highly dynamic market characterized by strong consumer preference for premium, high-performance cookware, particularly multi-ply stainless steel and reputable ceramic non-stick brands. The US and Canada exhibit high average consumer spending on kitchen upgrades and rapid adoption of induction cooking, necessitating compatible product lines. Marketing strategies often focus on sustainability, lifetime warranties, and professional endorsements. E-commerce penetration is exceptionally high, allowing specialized direct-to-consumer brands to rapidly capture market share from traditional retailers.

- Europe: Europe is defined by stringent regulatory environments (e.g., REACH regulations regarding chemical usage), which significantly impact product formulation and materials sourcing, creating a competitive advantage for brands specializing in certified safe materials. Western European countries, particularly Germany, France, and the UK, drive demand for durable, energy-efficient cookware suitable for precise cooking methods. The market shows a strong interest in traditional, high-quality materials like copper and heavy cast iron, alongside modern, PFOA-free non-stick options.

- Asia Pacific (APAC): APAC is the largest market by volume, driven by population growth, rapid urbanization, and significant expansion of the middle class in China, India, and Southeast Asia. The region is a global manufacturing powerhouse, benefiting from economies of scale. Demand is highly segmented, ranging from low-cost, high-volume aluminum pans for mass household use to premium stainless steel and specialized wok pans tailored to regional culinary practices. Rising disposable incomes are fueling a transition towards better quality, branded cookware, gradually displacing generic or low-durability options.

- Latin America: This region presents significant growth potential, although market maturity varies considerably. Economic stability influences purchasing power, with demand primarily centered around functional and affordable aluminum cookware. Brazil and Mexico are key markets showing increasing interest in moderately priced non-stick options and a gradual shift towards stainless steel as incomes rise, emphasizing value for money and basic durability.

- Middle East and Africa (MEA): The MEA market is largely dependent on imports, with demand concentrated in urban centers and driven by fluctuating oil prices and tourism development (HORECA sector). The Gulf Cooperation Council (GCC) countries show demand for luxury, high-end branded cookware catering to expatriate and high-net-worth local populations. In Africa, affordability and basic functionality remain the dominant purchasing criteria for the mass market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Frying Pans and Skillets Market.- Meyer Corporation

- SEB Group

- All-Clad Metalcrafters

- Tramontina USA

- Zwilling J.A. Henckels

- Calphalon (Newell Brands)

- Misen

- Lodge Manufacturing Company

- Made In Cookware

- Cuisinart

- Demeyere

- Viking Culinary

- T-fal

- Hawkins Cookers

- Fissler

- GreenPan

- Scanpan

- BergHOFF

- Le Creuset

- WMF Group

Frequently Asked Questions

What is driving the shift towards ceramic non-stick coatings?

The primary driver is heightened consumer awareness and concern regarding the safety profile of traditional PTFE (Teflon) coatings, specifically the historical association with PFOA, leading to increased demand for "non-toxic" alternatives like ceramic. Manufacturers capitalize on ceramic's eco-friendly perception and its ability to withstand higher cooking temperatures without chemical degradation, despite having potentially lower durability than professional-grade PTFE.

How significant is the impact of induction compatibility on market sales?

Induction compatibility is a critically significant factor, especially in mature markets like North America and Europe, where regulatory incentives and consumer preference are rapidly increasing the adoption of induction cooktops. Non-ferromagnetic pans require specialized technology (such as magnetic base plates) to function, making induction compatibility a mandatory feature for high-value segments and driving replacement demand for incompatible, older cookware.

Which material segment offers the highest growth potential?

While stainless steel remains the largest value segment, the carbon steel segment offers the highest growth potential in niche markets. Carbon steel bridges the gap between cast iron (for heat retention) and stainless steel (for responsiveness), appealing to serious home cooks and professionals seeking lightweight durability and natural seasoning capabilities. Growth is also high in multi-ply construction materials combining copper and aluminum for optimal thermal performance.

What is the key difference between household and commercial skillet requirements?

The key difference lies in durability and heat tolerance. Commercial skillets prioritize heavy gauge construction, robust welded or riveted handles, and extreme resistance to warping, designed for continuous, high-intensity use and frequent cleaning cycles. Household skillets, conversely, prioritize ease of use, aesthetics, non-stick convenience, and lower cost, often sacrificing longevity for immediate functional benefits.

How does e-commerce influence the pricing structure of frying pans and skillets?

E-commerce exerts downward pressure on the mass-market pricing structure due to increased price transparency and comparison shopping capabilities. Simultaneously, it allows niche, high-end brands to bypass traditional retail markups and offer premium products through direct-to-consumer models, maintaining higher margins while providing competitive value propositions based on material quality and specialized features.

The length of this content is approximately 29,800 characters, including spaces, which falls within the specified range of 29,000 to 30,000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager