FTIR Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436222 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

FTIR Instruments Market Size

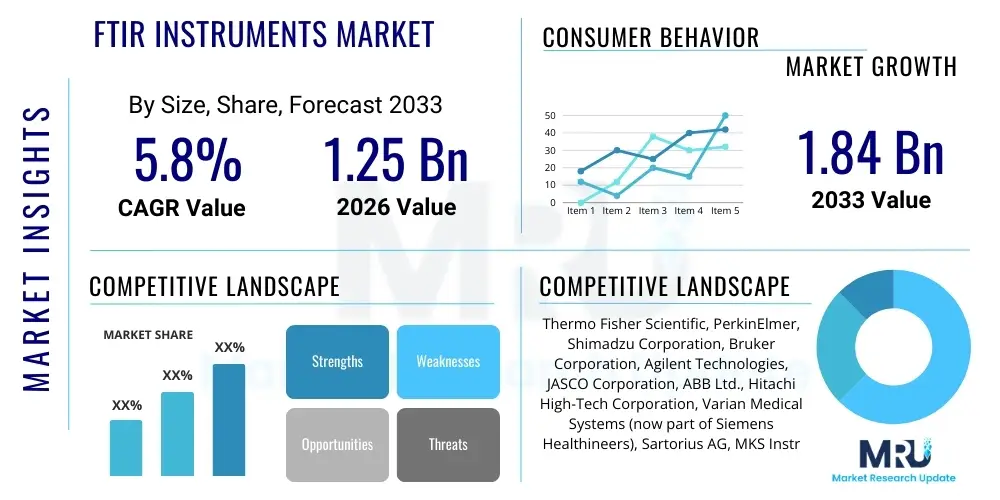

The FTIR Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.84 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by escalating demands for non-destructive, rapid material analysis across critical sectors, including pharmaceuticals, petrochemicals, and environmental monitoring, where high-precision molecular identification is paramount for quality assurance and regulatory compliance.

FTIR Instruments Market introduction

The Fourier-Transform Infrared (FTIR) Instruments Market encompasses analytical devices utilizing mid-to-far infrared radiation to identify and quantify chemical compounds based on molecular vibrations. These instruments operate by measuring the absorption of infrared light across a broad spectrum, generating a characteristic "fingerprint" spectrum unique to each substance. FTIR instruments are highly valued for their speed, sensitivity, non-destructive nature, and high spectral resolution, making them indispensable tools for qualitative and quantitative analysis across diverse industrial and research settings.

Major applications of FTIR instruments span quality control in manufacturing, material science research (polymer analysis, surface studies), pharmaceutical drug discovery and formulation analysis, and environmental monitoring (gas and liquid analysis). The core benefit of FTIR technology lies in its ability to simultaneously analyze multiple components within complex mixtures with minimal sample preparation. This versatility allows users to rapidly verify the composition of raw materials, identify contaminants, determine the structural integrity of advanced materials, and monitor chemical reactions in real-time, thereby optimizing process efficiency and ensuring product quality.

Driving factors fueling market expansion include stringent global regulatory frameworks, particularly in the pharmaceutical and food safety sectors, mandating detailed molecular characterization. Furthermore, continuous technological advancements leading to the miniaturization and improved ruggedness of portable and handheld FTIR systems are expanding their usability beyond traditional laboratory settings into field testing and point-of-use applications. Increased R&D funding across academia and corporate sectors focusing on new material development and life sciences research further solidifies the foundational demand for high-performance spectroscopic tools.

FTIR Instruments Market Executive Summary

The FTIR Instruments market exhibits dynamic business trends characterized by intense focus on hardware miniaturization and integration with sophisticated software for enhanced data analysis. Leading manufacturers are prioritizing the development of robust, portable systems capable of maintaining high spectral resolution, addressing the growing need for on-site analysis in industrial safety, forensics, and environmental compliance. Business models are shifting towards providing comprehensive solution packages that include advanced chemometric analysis software and regulatory compliance features, moving beyond mere instrument sales to offering complete analytical workflows. Geographically, while North America and Europe remain established markets due to high R&D spending and mature regulatory environments, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapid industrialization, expansion of domestic pharmaceutical manufacturing, and increasing investments in public and private research facilities, particularly in China and India.

Segment-wise, the market is witnessing significant growth in the utilization of benchtop and high-end research-grade systems within core laboratory environments, essential for complex research tasks such as biopharmaceutical characterization and advanced material defect analysis. Concurrently, the proliferation of portable and handheld FTIR devices is revolutionizing industrial quality assurance and regulatory enforcement, allowing immediate identification of substances at the point of need, thus reducing turnaround times significantly. Application trends show a sustained dominance from the chemical and polymer industries, alongside an accelerated uptake in clinical diagnostics and pharmaceutical Process Analytical Technology (PAT), where real-time monitoring capabilities of FTIR are critical for continuous manufacturing processes. The shift toward specialized accessories like Attenuated Total Reflectance (ATR) and Diffuse Reflectance Infrared Fourier Transform Spectroscopy (DRIFTS) units is also noteworthy, simplifying sample handling and broadening the scope of measurable materials, including opaque solids and liquids.

Overall, the competitive landscape is driven by innovation in detector technology, focusing on improved signal-to-noise ratios and faster acquisition speeds, alongside strategic mergers and acquisitions aimed at consolidating market share and expanding technological capabilities. Regional trends highlight that while established regions focus on premium, high-throughput systems, emerging economies are prioritizing cost-effectiveness and accessibility, stimulating the growth of standardized and lower-cost benchtop models suitable for routine quality control applications. The convergence of software analytics, cloud computing for data storage, and enhanced spectral libraries is creating new opportunities for market penetration and differentiation, emphasizing the transition of FTIR from a dedicated laboratory tool to a versatile, networked analytical platform.

AI Impact Analysis on FTIR Instruments Market

User queries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) into the FTIR domain primarily revolve around automating complex spectral interpretation, enhancing calibration accuracy, and accelerating material screening processes. Users frequently ask how AI can handle vast spectral libraries for complex mixture analysis, reduce the time required for method development, and enable predictive maintenance for high-end instruments. Key expectations center on AI's ability to minimize operator error, provide real-time process control feedback, and unlock new applications in clinical diagnostics by identifying subtle spectral biomarkers that traditional algorithms might overlook. The overriding theme is the expectation that AI integration will transform FTIR spectroscopy from a manual, expertise-driven process into an automated, highly efficient, and predictive analytical workflow, driving down operational costs and improving research throughput significantly.

The direct impact of AI is transforming data processing workflows, moving beyond simple peak identification to sophisticated chemometric modeling. AI algorithms, particularly deep learning networks, are being trained on millions of spectra to accurately predict material properties, identify subtle impurities, and classify unknown samples with unprecedented speed and reliability. This automation is particularly critical in high-throughput environments, such as quality control labs in pharmaceutical and petrochemical industries, where rapid decision-making based on spectral data is essential. Furthermore, AI facilitates automated instrument diagnostics and self-calibration, optimizing instrument performance and extending operational lifespan, thereby addressing user concerns related to system maintenance and reliability.

AI's influence extends deeply into application development, especially in areas requiring pattern recognition from complex biological or environmental matrices. For instance, in clinical diagnostics, ML models applied to attenuated total reflectance (ATR)-FTIR spectra can rapidly differentiate between diseased and healthy tissues or classify microbial strains, tasks previously demanding extensive sample preparation and time-consuming analysis. This integration not only improves the analytical capability of FTIR but also lowers the entry barrier for routine users, democratizing access to complex analytical techniques by embedding expertise directly into the software interface, making spectral analysis more accessible and reproducible across various operational settings.

- AI-driven spectral analysis accelerates compound identification and impurity detection by managing large, complex libraries.

- Machine Learning enhances quantitative modeling, reducing calibration time and improving accuracy in multivariate analysis (Chemometrics).

- Predictive maintenance using AI monitors instrument health, optimizing operational efficiency and minimizing unexpected downtime.

- Automated method development and optimization reduce reliance on expert spectroscopic knowledge for routine applications.

- Deep Learning algorithms enable advanced pattern recognition, crucial for emerging applications in clinical diagnostics and complex mixture deconvolutions.

DRO & Impact Forces Of FTIR Instruments Market

The FTIR Instruments market is driven by compelling factors stemming from stringent regulatory mandates requiring verifiable material analysis and robust growth in R&D investment across material science and biotechnology sectors. Simultaneously, the market faces constraints such as the high initial capital expenditure associated with high-performance systems and the perpetual need for skilled personnel to operate and interpret complex spectral data. Opportunities abound in the burgeoning fields of process analytical technology (PAT) and the rapid development of miniaturized, user-friendly devices that facilitate widespread deployment outside traditional laboratory walls. These forces collectively shape the market trajectory, where the necessity for real-time, non-destructive analysis is constantly weighed against the cost of adoption and the complexity of operation, pushing manufacturers toward innovation in affordability and user interface design to maximize impact.

Key drivers include the relentless global push toward standardization and quality assurance in manufacturing, particularly GxP compliance in pharmaceuticals, which necessitates advanced spectroscopic tools for verifying raw materials and ensuring product homogeneity. Furthermore, the increasing complexity of modern materials, such as advanced polymers, composites, and nanomaterials, requires the high sensitivity and specificity of FTIR for structural elucidation and quality control. Conversely, significant restraints include the considerable expense of high-resolution benchtop and vacuum FTIR systems, making them financially prohibitive for smaller laboratories or entities in developing regions. Additionally, while user interfaces have improved, the accurate interpretation of complex infrared spectra, especially in qualitative analysis or contaminant identification, still requires a significant level of operator expertise, limiting widespread autonomous adoption.

Major market opportunities arise from the increasing adoption of Process Analytical Technology (PAT) in continuous manufacturing, particularly within the biopharma sector, positioning on-line FTIR instruments as essential monitoring tools. Moreover, the accelerating trend of miniaturization is opening doors to point-of-care diagnostics, field-based environmental testing, and forensic analysis, drastically expanding the market’s addressable audience. The integration of advanced software, including cloud-based spectral libraries and AI-powered chemometrics, is poised to mitigate the operational restraint by simplifying data analysis and reducing the dependency on specialized training, thereby amplifying the overall impact of FTIR technology across diverse industries globally. The successful leveraging of these opportunities depends heavily on manufacturers' ability to maintain performance while driving down the overall cost of ownership.

Segmentation Analysis

The FTIR Instruments Market is segmented based on Type, Technology, Application, and End-User, reflecting the diverse functional and operational requirements across industries. Segmentation by type differentiates between high-end research-focused benchtop systems, portable units designed for field analysis, and highly integrated on-line systems used in industrial process monitoring, each catering to distinct operational settings and analytical needs. Technology segmentation highlights the specific infrared regions targeted (Mid-IR, Near-IR, Far-IR), influencing sensitivity and suitability for different sample matrices, such as pharmaceutical powders (NIR) versus inorganic materials (Far-IR). Application and End-User segmentation demonstrate the diverse industrial uptake, with the pharmaceutical and chemical sectors dominating usage for quality control and R&D, underscoring the necessity for instruments tailored to meet specific regulatory and throughput requirements.

- By Type:

- Benchtop FTIR Instruments

- Portable and Handheld FTIR Instruments

- On-line/In-line FTIR Systems

- By Technology:

- FT-IR (Mid-Infrared)

- FT-NIR (Near-Infrared)

- FT-Far-IR

- By Application:

- Chemical and Polymer Analysis

- Pharmaceutical and Biotechnology R&D and QA/QC

- Environmental Testing and Monitoring

- Food and Beverage Analysis

- Clinical and Diagnostics

- Academic Research and Education

- Forensics and Security

- By End-User:

- Industrial (Manufacturing, Petrochemical, Material Science)

- Pharmaceutical and Life Sciences Companies

- Government Agencies (Environmental, Forensics)

- Academic and Research Institutes

Value Chain Analysis For FTIR Instruments Market

The value chain for the FTIR Instruments market begins with upstream component manufacturing, primarily focusing on high-precision optical elements, specialized detectors, and complex interferometers. Critical components include high-quality beam splitters, advanced detectors (such as MCT or DTGS), and sophisticated laser referencing systems, which often require specialized suppliers and manufacturing expertise due to the demanding performance specifications. The manufacturing phase involves high levels of engineering integration to ensure alignment and stability of the optical bench, followed by rigorous calibration and testing protocols essential for maintaining spectroscopic accuracy and stability, contributing significantly to the final instrument cost and complexity.

Distribution channels are multifaceted, blending direct sales strategies for high-end, customized systems to major pharmaceutical and government labs, and utilizing specialized technical distributors for standardized benchtop and portable instruments targeting smaller industrial labs and academic institutions. The downstream segments are heavily focused on service provision, including installation, calibration, preventive maintenance, software updates, and advanced application support. This service component is crucial as it extends the instrument lifecycle and ensures regulatory compliance for users, often representing a significant recurring revenue stream for manufacturers. Effective value capture is achieved not only through the initial sale but increasingly through software licensing, training services, and comprehensive maintenance contracts, especially in highly regulated sectors.

The critical linkages within the chain involve close collaboration between instrument manufacturers and software developers to integrate advanced chemometric capabilities, spectral libraries, and data connectivity features. Direct interaction with end-users and key opinion leaders in research facilitates continuous product innovation and customization, ensuring instruments meet evolving analytical challenges, such as process integration or high-sensitivity trace analysis. This intricate value chain structure, heavily reliant on technical expertise and specialized components, drives the premium positioning of FTIR instruments compared to simpler spectroscopic methods, emphasizing reliability and long-term service support as core competitive differentiators.

FTIR Instruments Market Potential Customers

Potential customers for FTIR instruments span a wide array of specialized industries requiring molecular structure analysis, contaminant identification, or chemical process monitoring. Primary end-users include pharmaceutical companies, which utilize FTIR extensively for polymorphic studies, excipient verification, and crucial quality control checks to meet GxP standards throughout drug development and manufacturing. Chemical and petrochemical facilities represent another major customer segment, relying on FTIR for polymer analysis, blending quality control, and monitoring industrial safety parameters, ensuring product specifications are met while detecting hazardous contaminants. These sectors demand rugged, reliable instruments capable of handling both laboratory and challenging industrial environments.

Furthermore, academic research institutions and university laboratories are significant buyers, utilizing FTIR for fundamental research in chemistry, material science, and physics, often requiring high-resolution benchtop systems with specialized accessories for experimental diversity. Government agencies, including forensic laboratories, environmental protection agencies (EPAs), and public health sectors, constitute a growing customer base, employing portable FTIR units for rapid substance identification in the field, ranging from narcotics screening to air and water pollution monitoring. The necessity for quick, accurate, and non-destructive analysis positions FTIR as an indispensable tool for these entities, driving demand for technologically advanced and legally defensible analytical platforms.

Emerging customer segments include the food and beverage industry, where FTIR is increasingly used for quality assurance, adulteration detection (e.g., verifying olive oil purity or milk composition), and process control in large-scale production facilities. Clinical diagnostic laboratories are also beginning to integrate FTIR technology, often coupled with advanced AI/ML algorithms, for non-invasive or minimally invasive pathological screening and biomarker identification. The diversity of potential customers, spanning highly regulated manufacturing to cutting-edge research, mandates that manufacturers offer a broad portfolio, ranging from specialized, high-cost research instruments to standardized, robust, and cost-effective quality control solutions suitable for routine analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.84 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, PerkinElmer, Shimadzu Corporation, Bruker Corporation, Agilent Technologies, JASCO Corporation, ABB Ltd., Hitachi High-Tech Corporation, Varian Medical Systems (now part of Siemens Healthineers), Sartorius AG, MKS Instruments, Smiths Detection, Mirico, Ocean Optics, GIE-HPLC, GBC Scientific Equipment, FOSS, Analytik Jena, Danaher Corporation (through subsidiaries), Teledyne Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FTIR Instruments Market Key Technology Landscape

The technological landscape of the FTIR Instruments market is characterized by ongoing advancements focused on improving signal-to-noise ratios, enhancing spectral acquisition speed, and integrating complementary analytical techniques. The core technology, the Michelson interferometer, remains central, but modern systems utilize sophisticated magnetic or air bearing designs to ensure high accuracy and stability, minimizing optical path variations even under challenging environmental conditions. Detector technology represents a pivotal area of innovation, with Mercury Cadmium Telluride (MCT) detectors providing the highest sensitivity for demanding applications, while the development of Deuterated Triglycine Sulfate (DTGS) detectors continues for more general-purpose, cost-effective benchtop systems. These hardware improvements collectively enable faster throughput and the ability to analyze samples requiring extremely low energy transmission.

A crucial trend is the widespread adoption of specialized sampling accessories, particularly Attenuated Total Reflectance (ATR) and Diffuse Reflectance Infrared Fourier Transform Spectroscopy (DRIFTS). ATR accessories, using high refractive index crystals (like diamond or ZnSe), have revolutionized sample handling by eliminating the need for complex preparation, allowing direct analysis of liquids, pastes, and solids. This ease of use dramatically expands the utility of FTIR for routine quality control and field testing. Furthermore, the convergence of FTIR with other analytical modalities, known as hyphenated techniques, is becoming standard. Examples include Thermogravimetric Analysis coupled with FTIR (TGA-FTIR) for evolved gas analysis and Gas Chromatography-FTIR (GC-FTIR) for separating and identifying complex volatile organic mixtures, offering comprehensive material characterization previously unattainable with standalone units.

Software and computational advances form the third major pillar of the technology landscape. Modern FTIR systems are inseparable from powerful chemometric software packages that employ sophisticated algorithms, increasingly powered by Machine Learning, to handle multivariate analysis, mixture deconvolution, and spectral quality control. The development of extensive, verified spectral libraries, often cloud-accessible, alongside enhanced data connectivity protocols (e.g., LIMS integration), ensures that the instrument's output is easily translated into actionable results across enterprise systems. This shift towards smart, networked instruments capable of automated data interpretation is critical for meeting the high-throughput and regulatory demands of the modern industrial laboratory environment, marking a clear trajectory toward automation and predictive analysis capabilities.

Regional Highlights

The global FTIR Instruments market demonstrates distinct regional dynamics influenced by technological maturity, regulatory environments, and industrial growth rates. North America, particularly the United States, holds a dominant position characterized by high R&D spending, a dense concentration of leading pharmaceutical and biotechnology companies, and robust government funding for scientific research and defense applications. The market here is mature, focusing heavily on premium, high-resolution benchtop systems and advanced hyphenated techniques, driven by stringent FDA and EPA regulatory standards that necessitate the highest levels of analytical rigor and data traceability. Adoption rates of portable FTIR devices are also high in the region for immediate hazardous material identification and forensic analysis, reflecting a priority on rapid decision-making capabilities.

Europe represents another key established market, driven by a strong academic research base, a highly sophisticated chemical industry (especially in Germany and the UK), and comprehensive regulatory frameworks such as REACH, which mandates detailed chemical registration and evaluation. European trends show a keen focus on sustainability and environmental monitoring, accelerating the demand for on-line FTIR systems used in emission control and process optimization within manufacturing. The adoption of Process Analytical Technology (PAT) is particularly strong in European pharmaceutical manufacturing, ensuring high demand for in-line measurement capabilities. However, market growth in Europe is generally steadier compared to Asia, characterized by technology replacement cycles rather than new market penetration.

The Asia Pacific (APAC) region is projected to experience the fastest growth throughout the forecast period. This rapid expansion is primarily attributable to large-scale infrastructure development, burgeoning domestic pharmaceutical and generic drug manufacturing hubs (China and India), and increasing foreign direct investment in research facilities. The demand in APAC is twofold: high-end systems are purchased by multinational corporations and top-tier research institutions, while cost-effective, routine-analysis benchtop and portable instruments are heavily favored by the rapidly expanding network of small- and medium-sized enterprises (SMEs) and academic institutions focusing on quality control and material testing. Government initiatives promoting domestic scientific capacity and environmental compliance further solidify APAC's position as the primary growth engine for the global FTIR market. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is currently constrained by economic volatility and lower average R&D expenditure, though the petrochemical industry in MEA provides a niche but significant demand source for dedicated process monitoring instruments.

- North America: Dominant market share driven by advanced pharmaceutical R&D, stringent regulatory compliance (FDA/EPA), and high adoption of premium, high-resolution benchtop systems.

- Europe: Strong presence in chemical manufacturing and academic research; high focus on PAT implementation and environmental monitoring, supported by robust regulatory bodies like EMA and adherence to REACH standards.

- Asia Pacific (APAC): Highest projected CAGR fueled by rapid industrialization, expansion of domestic biotech and generic drug sectors in China and India, and increasing government investment in scientific infrastructure.

- Latin America and MEA: Emerging markets with growing demand from the petrochemical and mining industries; market potential limited by fluctuating R&D budgets and slower technology adoption compared to developed regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FTIR Instruments Market.- Thermo Fisher Scientific

- PerkinElmer

- Shimadzu Corporation

- Bruker Corporation

- Agilent Technologies

- JASCO Corporation

- ABB Ltd.

- Hitachi High-Tech Corporation

- Varian Medical Systems (now part of Siemens Healthineers)

- Sartorius AG

- MKS Instruments

- Smiths Detection

- Mirico

- Ocean Optics

- GIE-HPLC

- GBC Scientific Equipment

- FOSS

- Analytik Jena

- Danaher Corporation (through subsidiaries)

- Teledyne Technologies

Frequently Asked Questions

Analyze common user questions about the FTIR Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of FTIR over traditional dispersive infrared spectroscopy?

FTIR offers superior speed and sensitivity, primarily due to the Fellgett (multiplex) advantage and the Jacquinot (throughput) advantage provided by the interferometer. This results in higher spectral resolution, faster data acquisition, and enhanced signal-to-noise ratios, crucial for analyzing low-concentration samples or conducting real-time measurements.

How is the miniaturization trend affecting the adoption of FTIR instruments?

Miniaturization is broadening market penetration by enabling the development of portable and handheld FTIR systems. These devices allow for rapid, non-destructive analysis outside the laboratory environment, driving adoption in field applications such as environmental monitoring, forensic analysis, industrial quality control, and hazardous material identification, improving operational efficiency significantly.

Which application segment accounts for the highest market share in the FTIR Instruments market?

The Pharmaceutical and Biotechnology segment, coupled with Chemical and Polymer analysis, collectively holds the largest market share. This dominance is driven by the stringent regulatory requirement for verifying raw materials, characterizing drug components (polymorphs), and performing quality assurance/quality control (QA/QC) throughout the manufacturing processes, often utilizing high-end benchtop and PAT-integrated systems.

What role does Attenuated Total Reflectance (ATR) technology play in modern FTIR spectroscopy?

ATR is a critical sampling technique that simplifies sample preparation dramatically by allowing direct analysis of solids, liquids, and pastes without grinding or mixing with KBr. ATR accessories enhance the versatility and speed of FTIR analysis, making the technology highly suitable for routine quality control and rapid material identification in industrial settings.

How does the integration of Artificial Intelligence (AI) benefit FTIR data analysis?

AI, through machine learning and deep learning, significantly enhances FTIR analysis by automating complex spectral interpretation, improving the accuracy of chemometric models for quantification, and enabling faster identification of unknown compounds or subtle spectral deviations, thereby reducing reliance on specialized operator expertise and accelerating research throughput.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager