Fuel Cell Air Compressor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435685 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fuel Cell Air Compressor Market Size

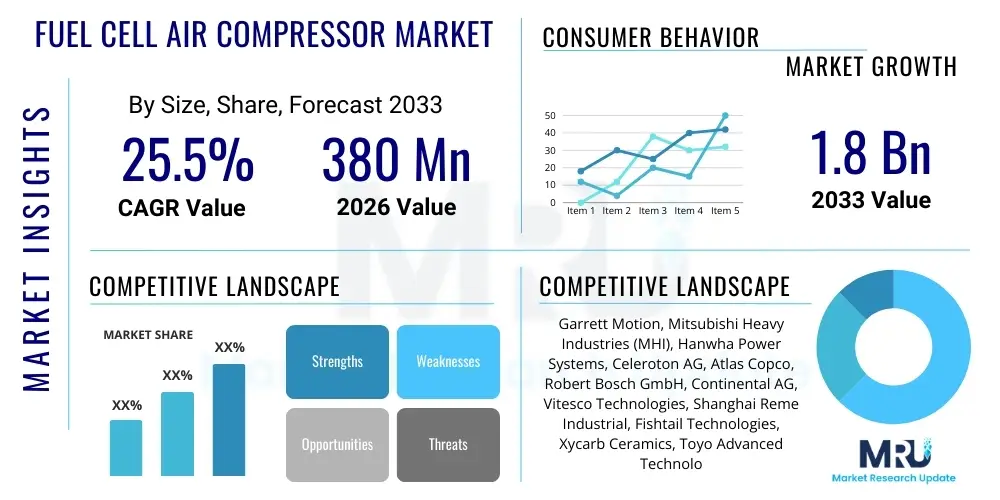

The Fuel Cell Air Compressor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $380 Million in 2026 and is projected to reach $1.8 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily driven by the global pivot towards sustainable transportation solutions, massive investment in hydrogen infrastructure development, and the increasing adoption of Fuel Cell Electric Vehicles (FCEVs), particularly in heavy-duty commercial segments.

Fuel Cell Air Compressor Market introduction

The Fuel Cell Air Compressor (FCAC) is a critical auxiliary component in Proton Exchange Membrane (PEM) fuel cell systems. Its primary function is to supply pressurized, oil-free oxygen (air) to the cathode side of the fuel cell stack, facilitating the electrochemical reaction that generates electricity. High efficiency, reliability, and compact design are paramount characteristics for these compressors, as they significantly influence the overall efficiency and power density of the FCEV or stationary power unit. The market is witnessing rapid technological advancement, moving from traditional screw and scroll compressors to highly efficient, oil-free centrifugal designs driven by high-speed motors, aiming to reduce parasitic power loss and improve operational lifespan.

Major applications of FCACs include hydrogen-powered passenger vehicles, heavy-duty commercial trucks and buses, trains, maritime vessels, and increasingly, stationary power generation units used for grid balancing or backup power. The demand is heavily correlated with FCEV production mandates in major automotive markets like China, South Korea, Japan, Germany, and the United States. These compressors must operate reliably under highly demanding conditions, including rapid start-stop cycles and extreme temperature variations, necessitating robust material selection and advanced thermal management systems.

Key benefits driving the adoption of FCAC technology include enabling zero-emission transportation, high energy efficiency compared to combustion engines, and rapid refueling times for FCEVs. Driving factors encompass stringent global emission regulations, favorable government subsidies and tax incentives for hydrogen vehicles and infrastructure, declining manufacturing costs through economies of scale, and strategic investments by global automotive OEMs and energy companies focused on developing hydrogen economies.

Fuel Cell Air Compressor Market Executive Summary

The Fuel Cell Air Compressor market is characterized by intense technological competition focused on maximizing efficiency and durability while minimizing size, weight, and noise. Business trends indicate a strong move towards centrifugal compressors, particularly for high-power applications (e.g., commercial transport), due to their superior performance envelope and oil-free operation, which prevents contamination of the fuel cell stack. Strategic partnerships between specialized compressor manufacturers and automotive Tier 1 suppliers are dominating the landscape, ensuring integration meets stringent automotive quality standards and scalability requirements for mass production. Furthermore, the market is experiencing consolidation as larger industrial players acquire smaller, specialized technology firms to gain access to proprietary high-speed motor and magnetic bearing technologies, crucial for next-generation compressor design.

Regionally, Asia Pacific maintains its leadership position, primarily fueled by aggressive FCEV deployment targets in China, South Korea, and Japan, which are heavily investing in both commercial FCEV fleets (trucks, buses) and hydrogen refueling infrastructure. Europe is rapidly catching up, driven by the European Green Deal and significant funding for the decarbonization of heavy-duty transport, creating a robust demand for high-power FCAC units. North America, led by Californian regulations and corporate sustainability mandates for large logistics fleets, is accelerating its hydrogen adoption, focusing heavily on long-haul trucking applications where fuel cells offer clear advantages over battery electric vehicles (BEVs) in terms of payload and range.

Segment trends reveal that the commercial vehicle application segment is expected to exhibit the fastest growth rate, surpassing passenger vehicles in terms of required compressor power output and cumulative market value over the forecast period. By technology, the oil-free centrifugal type is rapidly gaining market share over volumetric compressors (screw, scroll), especially in premium and high-performance applications where maximizing system efficiency is crucial. OEMs are increasingly demanding integrated FCAC modules that include the motor, inverter, and thermal management systems pre-packaged, simplifying vehicle integration and reducing overall system complexity and cost.

AI Impact Analysis on Fuel Cell Air Compressor Market

User inquiries regarding AI's influence typically revolve around how artificial intelligence can enhance the operational lifespan, optimize energy consumption, and manage the complex supply chain of FCAC components. Key themes emerging include the potential for AI-driven predictive maintenance to preemptively identify compressor failures in harsh operating environments, the use of machine learning algorithms for real-time control optimization of air flow and pressure to maximize fuel cell stack performance under varying load conditions, and leveraging AI for efficient design optimization, drastically reducing the prototype-to-production cycle for new compressor models. Users are concerned with reliability improvements and cost reduction facilitated by smart technologies integrated directly into the compressor control unit, moving beyond simple programmed logic to adaptive performance management.

- AI-enabled predictive maintenance (PM) algorithms utilizing sensor data (vibration, temperature, current draw) to forecast potential component failure, significantly increasing compressor uptime and reducing maintenance costs, particularly for commercial fleets.

- Real-time flow and pressure optimization through Machine Learning (ML) control systems, ensuring the compressor operates at its peak efficiency point regardless of ambient conditions or load fluctuations, thereby reducing parasitic power consumption.

- Accelerated computational fluid dynamics (CFD) and structural design optimization, where AI identifies optimal impeller geometry and housing designs faster than conventional simulation methods, leading to lighter and more compact units.

- Enhanced supply chain transparency and resilience using AI tools to track the sourcing and quality assurance of highly specialized components, such as high-speed bearings and motor windings.

- Automated fault detection and diagnostics (FDD) integrated into the compressor's electronic control unit (ECU), allowing for instantaneous system adjustments or safe shutdowns in case of anomalies.

DRO & Impact Forces Of Fuel Cell Air Compressor Market

The Fuel Cell Air Compressor market is shaped by powerful factors driving growth alongside significant barriers demanding innovative solutions. The primary driver is the global commitment to achieving net-zero carbon emissions, translating into firm governmental mandates supporting the widespread adoption of FCEVs, especially heavy-duty platforms that require high-power FCACs. Opportunities are substantial in developing high-temperature PEM fuel cells that necessitate new compressor designs capable of handling higher operating temperatures, and in expanding applications beyond road transport, such as drone technology, aerospace, and remote telecommunications infrastructure. The high efficiency and low noise requirements imposed by Original Equipment Manufacturers (OEMs) force continuous technological improvements, particularly concerning high-speed motor integration and bearing reliability.

However, the market faces key restraints. The initial high cost of fuel cell systems, including the FCAC and associated balance-of-plant components, remains a hurdle compared to traditional internal combustion engines and even mature battery electric vehicle systems, although cost parity is expected by the end of the decade. Furthermore, the reliability and long-term durability of the high-speed rotating components, especially the magnetic bearings and oil-free operation mechanisms, present significant engineering challenges requiring continuous validation and testing under extreme conditions. Supply chain fragility for specialized materials (e.g., high-grade titanium or custom motor magnets) can also impact scalability.

The convergence of powerful drivers (decarbonization goals, infrastructure investment) and specific restraints (cost, durability demands) creates dynamic impact forces. The market momentum is currently positive, driven by technological breakthroughs in centrifugal compressor efficiency, which directly reduces the parasitic load—a critical metric for FCEV performance. The key impact force is the regulatory push, particularly from regions like Europe and California, which compels heavy-duty fleets to transition to zero-emission vehicles, ensuring a sustained high demand for robust, high-performance FCAC units over the forecast period.

Segmentation Analysis

The Fuel Cell Air Compressor market is meticulously segmented based on compressor type, technology, operating pressure, and application, reflecting the diverse requirements across various fuel cell platforms. Analyzing these segments provides crucial insights into technological preferences and demand hotspots. The dominance of centrifugal compressors is evident in high-power applications due to their high flow rates and pressure ratios, while screw and scroll compressors maintain relevance in smaller, lower-power stationary or passenger vehicle applications requiring high reliability and simplicity. The segmentation allows manufacturers to target specific performance requirements, such as oil-free operation for PEM stacks or robust construction for industrial environments.

- By Type: Centrifugal Compressor, Screw Compressor, Scroll Compressor, Reciprocating Compressor

- By Technology: Oil-free Compressor, Oil-lubricated Compressor

- By Operating Pressure: Low-pressure (under 1.5 bar), High-pressure (1.5 bar and above)

- By Application: Passenger Vehicles, Commercial Vehicles (Buses, Trucks, Vans), Stationary Power Generation, Other Applications (Marine, Rail, Aerospace)

- By Component: Motor/Drive System, Impeller, Housing/Casing, Control Electronics (ECU/Inverter), Bearings (Magnetic, Air Foil)

Value Chain Analysis For Fuel Cell Air Compressor Market

The value chain for Fuel Cell Air Compressors begins with the upstream suppliers providing highly specialized raw materials and components crucial for performance and durability. This includes suppliers of high-grade aluminum alloys or composite materials for compressor housings, specialized magnetic materials for high-speed permanent magnet motors, and precision bearing manufacturers (especially magnetic or air foil bearings that ensure oil-free operation). Quality control and precision manufacturing tolerances at this stage are critical, as the compressor operates at rotational speeds exceeding 100,000 RPM.

The midstream involves the core FCAC manufacturers who engage in intricate assembly, integration of high-speed electronics (inverters/controllers), and stringent testing procedures. These manufacturers must possess deep expertise in aerodynamics, high-frequency power electronics, and thermal management. Integration with the motor and the inverter is key, as the entire assembly must be compact, robust, and highly efficient. Direct distribution channels are predominantly used for Tier 1 suppliers, who often collaborate closely with the FCAC manufacturers during the design phase to ensure seamless integration into the vehicle’s Balance of Plant (BOP) system.

The downstream segment consists primarily of Original Equipment Manufacturers (OEMs) in the automotive, commercial vehicle, and energy sectors (e.g., manufacturers of fuel cell stacks and system integrators). End-users receive the final FCEV or stationary power unit. Indirect distribution often involves specialized hydrogen system integrators or authorized distributors providing after-sales service and replacement parts, particularly in nascent regional markets where OEM presence is limited. The close relationship between compressor manufacturers and downstream vehicle developers emphasizes the need for customized solutions optimized for specific vehicle platforms and power requirements.

Fuel Cell Air Compressor Market Potential Customers

Potential customers for Fuel Cell Air Compressors are diverse, ranging from large multinational automotive corporations developing FCEV fleets to niche providers of material handling equipment and backup power solutions. The primary and most rapidly growing customer base comprises global automotive and heavy-duty vehicle manufacturers (OEMs) such as Hyundai, Toyota, Honda, Daimler Truck, and Nikola, who require reliable, high-power density compressors for their passenger cars, commercial buses, and long-haul trucks. These customers demand strict adherence to automotive reliability standards (AEC-Q100 equivalent) and large-scale supply capabilities.

Another crucial customer segment involves system integrators and stationary power providers. Companies specializing in decentralized or grid-scale hydrogen power solutions, including those developing Combined Heat and Power (CHP) units or large backup generators for data centers and hospitals, rely on FCACs for sustained, continuous operation. These customers prioritize longevity, maintenance simplicity, and operational cost effectiveness over the life cycle of the system. The marine and rail sectors are also emerging as significant buyers, seeking robust FCACs capable of handling harsh environmental conditions and large power requirements for locomotive and ship propulsion systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $380 Million |

| Market Forecast in 2033 | $1.8 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garrett Motion, Mitsubishi Heavy Industries (MHI), Hanwha Power Systems, Celeroton AG, Atlas Copco, Robert Bosch GmbH, Continental AG, Vitesco Technologies, Shanghai Reme Industrial, Fishtail Technologies, Xycarb Ceramics, Toyo Advanced Technologies, Air Squared, Inc., Compressor Products International (CPI), FusceZ Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Cell Air Compressor Market Key Technology Landscape

The current technology landscape is dominated by the strategic shift toward oil-free compression mechanisms, driven by the absolute necessity to prevent any hydrocarbon contamination of the sensitive PEM fuel cell stack. Centrifugal compressors, specifically single-stage, high-speed turbo compressors, are emerging as the preferred choice for automotive and heavy-duty applications. Their key advantage lies in high efficiency at high flow rates and the potential for direct integration with magnetic bearings or air foil bearings, entirely eliminating the need for oil lubrication. This technology requires extremely precise manufacturing of impellers and relies heavily on advanced power electronics—specifically high-frequency inverters—to drive the electric motor at speeds up to 150,000 RPM, translating electrical energy into kinetic energy with minimal losses.

While centrifugal technology leads, positive displacement compressors, particularly screw and scroll types, still hold a niche. Screw compressors offer high pressure ratios and robust design, making them suitable for certain stationary or heavy-duty applications where system robustness is prioritized over maximum efficiency. Scroll compressors are valued for their low noise and vibration characteristics, often finding applications in passenger vehicles or residential backup power units, although their volumetric efficiency can be a limiting factor compared to modern centrifugal designs. Continuous research is focused on developing lighter materials, such as carbon fiber or advanced polymers, for impellers and housings to reduce inertia and enhance transient response capabilities.

A crucial technological element is the integrated drive system. Modern FCACs are increasingly sold as complete modules encompassing the compressor housing, the high-speed motor, and the motor controller (inverter). The inverter technology is paramount, as it manages the sophisticated control algorithms necessary for precise air flow delivery, thermal management of the motor windings, and protection against overspeed or surge conditions. Advances in wide-bandgap semiconductors like Silicon Carbide (SiC) are enabling smaller, more efficient, and lighter inverters capable of handling the high-frequency switching required by the high-speed motors, thereby significantly improving the overall power density and packaging flexibility of the FCAC module.

Regional Highlights

The global distribution of the Fuel Cell Air Compressor market exhibits distinct regional dynamics driven by local regulatory frameworks, infrastructure development, and industrial focus on hydrogen mobility.

- Asia Pacific (APAC): APAC is the largest market, largely dominated by aggressive national hydrogen strategies in countries like China, South Korea, and Japan. South Korea, through companies like Hyundai, has established a leading position in FCEV passenger cars and expanding commercial fleets, creating a massive, immediate demand for FCACs. China’s focus on decarbonizing heavy transport and urban buses, coupled with supportive local government subsidies, ensures sustained high volume demand for high-power centrifugal units. The region serves as both a manufacturing hub and the largest consumer market for FCACs.

- Europe: Europe is demonstrating the fastest growth trajectory, propelled by the European Green Deal and significant funding via the Clean Hydrogen Alliance. The focus here is primarily on heavy-duty transport (trucks and maritime applications) to meet ambitious decarbonization targets by 2030. Countries like Germany, France, and the Netherlands are leading in hydrogen infrastructure buildout, creating a strong pull for highly efficient, durable FCAC technology compliant with stringent EU quality and sustainability standards. Collaboration between established European industrial giants and specialized clean energy component manufacturers is defining market penetration.

- North America: North America, particularly the US (California) and Canada, represents a high-value market driven by large logistics companies seeking zero-emission solutions for long-haul trucking. Regulatory pressure from states like California and federal initiatives to bolster domestic clean energy manufacturing are fueling demand. The market emphasizes high durability and peak performance suitable for the vast distances and demanding operational cycles characteristic of US commercial transport, necessitating robust, heavy-duty FCAC designs.

- Latin America, Middle East, and Africa (LAMEA): These regions are currently nascent but possess significant long-term potential, particularly in the Middle East due to substantial investments in large-scale "Green Hydrogen" production projects. Initial demand in LAMEA is concentrated in pilot projects for urban buses, mining equipment, and stationary power generation in remote areas, relying on robust and easily serviceable compressor types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Cell Air Compressor Market.- Garrett Motion Inc.

- Mitsubishi Heavy Industries (MHI)

- Hanwha Power Systems

- Celeroton AG

- Atlas Copco AB

- Robert Bosch GmbH

- Continental AG

- Vitesco Technologies GmbH

- Shanghai Reme Industrial Co., Ltd.

- Fishtail Technologies Co., Ltd.

- Toyo Advanced Technologies Co., Ltd.

- Air Squared, Inc.

- Compressor Products International (CPI)

- FusceZ Co., Ltd.

- Howden Group

- Mann+Hummel Group

- Aisin Corporation

- Haskel International, LLC

- GE Aviation

- Powercell Sweden AB

Frequently Asked Questions

Analyze common user questions about the Fuel Cell Air Compressor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Fuel Cell Air Compressor (FCAC) in a vehicle?

The primary function of the FCAC is to deliver pressurized, precisely controlled, and oil-free air (oxygen) to the cathode side of the Proton Exchange Membrane (PEM) fuel cell stack. This pressurized air is essential for the electrochemical reaction that produces electricity, thereby ensuring the fuel cell operates at optimal power and efficiency.

Why are centrifugal compressors becoming the preferred type for FCEVs?

Centrifugal compressors are preferred due to their high efficiency at high flow rates, compact design, and crucial ability to operate oil-free, preventing contamination of the sensitive fuel cell membrane. They offer superior power density and lower parasitic loss compared to traditional volumetric types like screw or scroll compressors, which is critical for maximizing FCEV range and performance.

How does the use of hydrogen impact the design and materials of the air compressor?

While the FCAC compresses air, not hydrogen, the overall system demands ultra-high reliability and zero tolerance for oil contamination to protect the fuel cell stack. This necessitates specialized materials (like advanced coatings and lightweight alloys) and high-precision, oil-free bearing systems (such as magnetic or air foil bearings) to achieve the necessary durability and purity required in a hydrogen ecosystem.

What are the main technological challenges currently facing FCAC manufacturers?

The main challenges involve improving the durability and lifespan of high-speed rotating components (operating above 100,000 RPM), reducing system noise and vibration, and minimizing parasitic power consumption. Integrating highly efficient power electronics (inverters) and achieving compact, cost-effective packaging suitable for mass automotive production remain key hurdles for market maturity.

Which application segment drives the highest demand in the near term?

The Commercial Vehicle segment, particularly heavy-duty trucks and buses, drives the highest demand growth in the near term. This is because fuel cells offer compelling advantages in terms of range and payload capacity over battery electric solutions for long-haul logistics, leading global OEMs to rapidly scale production of high-power fuel cell systems requiring robust, high-output air compressors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager