Fuel Cell DC-DC Converter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436716 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Fuel Cell DC-DC Converter Market Size

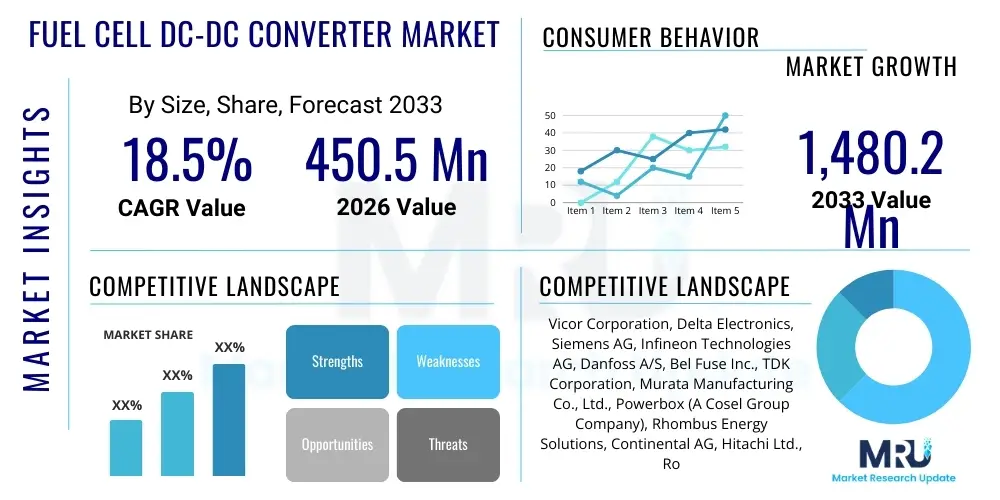

The Fuel Cell DC-DC Converter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 1,480.2 Million by the end of the forecast period in 2033.

Fuel Cell DC-DC Converter Market introduction

The Fuel Cell DC-DC Converter Market encompasses specialized power electronic devices essential for managing the variable output voltage generated by hydrogen fuel cells and conditioning it to a stable, usable DC voltage required by the system load, such as traction motors in electric vehicles or grid inverters in stationary power systems. These converters are critical components that ensure high efficiency, reliability, and optimal power delivery, bridging the electrochemical energy conversion process of the fuel cell stack with the electrical requirements of the application. High-efficiency conversion is paramount to maximizing the energy density benefits of hydrogen fuel, making the converter technology a focal point of innovation in the burgeoning hydrogen economy. The increasing global focus on decarbonization and sustainable energy solutions directly fuels the demand for these sophisticated power management units across multiple sectors.

Fuel cell DC-DC converters typically utilize advanced switching topologies, including isolated and non-isolated designs, depending on the application’s safety and voltage level requirements. Key applications span transportation (heavy-duty trucks, buses, passenger vehicles, and maritime vessels), stationary power generation (backup power systems, microgrids), and portable devices. The inherent benefits of using fuel cells—zero tailpipe emissions, high energy density, and rapid refueling—make them attractive alternatives to traditional internal combustion engines and standard battery systems in demanding scenarios. DC-DC converters must handle wide input voltage variations resulting from the fuel cell stack operating across different power demands, maintaining robust regulation and minimizing power losses, often employing SiC or GaN semiconductor technologies for enhanced performance.

The primary driving factors accelerating market expansion include stringent global emissions regulations pushing for zero-emission vehicles, massive public and private investments in hydrogen infrastructure development (including refueling stations and production facilities), and technological advancements leading to smaller, lighter, and more efficient converter modules. Furthermore, the commercialization of large-scale fuel cell electric vehicles (FCEVs), particularly in the heavy-duty and logistics sectors, where range and payload are critical, necessitates reliable and powerful DC-DC conversion systems capable of handling high kilowatt ratings. This technological push is supported by ongoing research into advanced cooling techniques and control algorithms to optimize power flow under dynamic operating conditions.

Fuel Cell DC-DC Converter Market Executive Summary

The Fuel Cell DC-DC Converter Market is characterized by robust growth driven by the pivotal role these converters play in enhancing the efficiency and commercial viability of fuel cell systems across mobility and stationary power applications. Business trends indicate a strong shift towards high-voltage systems (800V and above) to support heavy-duty transportation and rapid charging infrastructure, prompting manufacturers to invest heavily in Silicon Carbide (SiC) and Gallium Nitride (GaN) based power electronics, which offer superior switching speeds and lower energy losses compared to conventional silicon-based components. This material transition is a core competitive differentiator, focusing on improving power density and reducing the overall footprint and weight of the power train components. Furthermore, strategic partnerships between fuel cell stack producers, automotive OEMs, and power electronics specialists are becoming commonplace to ensure seamless system integration and standardization of interface protocols.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, primarily fueled by aggressive government mandates in China, Japan, and South Korea supporting hydrogen transportation and large-scale deployment of FCEVs, particularly heavy-duty trucks and public buses. Europe is witnessing significant growth, driven by the implementation of the European Green Deal and substantial investments in the hydrogen valley concept, focusing heavily on stationary power and maritime applications. North America, led by initiatives in California and the broader push for long-haul trucking decarbonization, shows steady adoption, particularly in integrating fuel cells into off-grid and auxiliary power units (APUs) in remote areas. The global trend is decentralized manufacturing and supply chain localization to mitigate risks associated with geopolitical instabilities and transportation costs, ensuring regional market resilience.

Segmentation trends confirm that the high-power segment (above 50 kW) is the largest and most rapidly expanding category due to increasing deployment in commercial transportation (buses and trucks) and industrial machinery, which require significant instantaneous power delivery. By product type, the Non-Isolated DC-DC converter segment holds a strong position due to its simplicity, cost-effectiveness, and adequate performance for lower-voltage vehicle applications, though the Isolated converter segment is gaining traction, driven by stringent safety requirements in high-voltage passenger and stationary applications demanding galvanic isolation between the fuel cell and the load. Application-wise, the Automotive segment, particularly Heavy-Duty Vehicles (HDVs), remains the core revenue generator, reflecting the high energy demand and mission-critical nature of these commercial fleets, closely followed by the rapidly emerging stationary power sector.

AI Impact Analysis on Fuel Cell DC-DC Converter Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fuel Cell DC-DC Converter Market primarily revolve around optimizing efficiency, enhancing predictive maintenance capabilities, and accelerating the design phase. Users are keenly interested in how machine learning algorithms can manage the complex, non-linear dynamics of fuel cell systems, particularly the optimization of converter control strategies to adapt instantaneously to fluctuating load demands and varying fuel cell degradation states. Key concerns also focus on utilizing AI for fault detection and diagnostics, which is critical in extending the lifespan and ensuring the safety of high-voltage fuel cell systems. There is a clear expectation that AI will transition converter control from pre-programmed, static parameters to real-time, self-learning algorithms, thereby maximizing fuel utilization and overall system performance.

- AI-driven control optimization minimizes switching losses and enhances overall converter efficiency by dynamically adjusting pulse width modulation (PWM) strategies in real-time based on temperature, voltage, and load conditions.

- Predictive maintenance using machine learning monitors component health (e.g., capacitors, semiconductors) to forecast potential failures, significantly reducing downtime and extending the operational lifespan of the converter unit.

- Accelerated design and simulation through generative AI tools allow engineers to rapidly iterate and optimize converter topologies, magnetics, and cooling systems for maximum power density and thermal performance.

- Anomaly detection in fuel cell stacks is improved by AI analyzing subtle voltage ripples and current fluctuations fed through the converter, providing early warnings of stack degradation or poisoning.

- Enhanced thermal management systems leverage AI to optimize cooling fan speeds and fluid flow based on predicted hot spots, preventing overheating of high-power SiC/GaN switches.

DRO & Impact Forces Of Fuel Cell DC-DC Converter Market

The market for Fuel Cell DC-DC Converters is shaped by a powerful confluence of enabling drivers, significant technical restraints, and compelling future opportunities, which collectively determine the growth trajectory and competitive landscape. The primary drivers stem from global regulatory pressures promoting zero-emission solutions and substantial government subsidies directed toward developing the hydrogen value chain, directly increasing the deployment rate of FCEVs and stationary fuel cell installations. Key restraints include the high initial cost of fuel cell systems, often exacerbated by the expense of advanced power semiconductors (SiC/GaN) required for high-efficiency converters, and technical challenges associated with thermal management in densely packed, high-power density modules. Opportunities lie in developing modular, scalable converter designs for standardized applications, integrating vehicle-to-grid (V2G) capabilities, and the potential expansion into marine, rail, and aviation sectors. These forces, when synthesized, create a dynamic competitive environment where technological superiority and cost reduction are paramount.

Impact forces currently favoring market growth include the decreasing cost curve of renewable hydrogen production (green hydrogen), which makes the operating expense of fuel cell systems more competitive, and continuous advancements in wide-bandgap semiconductor technology, which is resolving historic issues related to efficiency and thermal stress. Conversely, a major restraining impact force is the relative lack of standardized refueling infrastructure globally, which creates range anxiety and limits widespread consumer adoption of FCEVs, particularly in regions outside of established hydrogen hubs. The primary opportunity impact force is the global commitment to hydrogen as a cornerstone of industrial decarbonization, which guarantees long-term public and private funding streams for research and commercialization efforts in power electronics specifically tailored for hydrogen applications. Addressing the cost and infrastructure gaps remains the most critical pivot point for sustained exponential market expansion.

Segmentation Analysis

The Fuel Cell DC-DC Converter market is meticulously segmented based on key operational and technical parameters to accurately reflect variations in application requirements, power handling capabilities, and underlying conversion topology. This structural analysis is crucial for stakeholders to identify specific high-growth niches. The major segmentation criteria include Power Output (Low, Medium, High), which correlates directly with the application size, ranging from portable electronics to heavy-duty industrial vehicles. Further segmentation by Product Type (Isolated and Non-Isolated) reflects different safety and voltage management needs, where isolation is critical for high-voltage integrity and passenger safety. Finally, segmentation by Application (Automotive, Stationary Power, Portable) delineates the end-use sectors, with Automotive currently being the revenue powerhouse, followed by the emerging Stationary Power segment focused on microgrids and uninterruptible power supplies (UPS).

- By Power Output

- Low Power (up to 10 kW)

- Medium Power (10 kW to 50 kW)

- High Power (Above 50 kW)

- By Product Type

- Isolated DC-DC Converters

- Non-Isolated DC-DC Converters

- By Component

- Semiconductors (SiC, GaN, Si)

- Capacitors

- Magnetics (Inductors, Transformers)

- Cooling Systems

- By Application

- Automotive (Passenger Vehicles, Buses, Trucks, Forklifts)

- Stationary Power (Primary Power, Backup Power, Combined Heat and Power - CHP)

- Portable Power (Drones, Auxiliary Power Units - APUs)

- By Voltage Level

- Below 400V

- 400V to 800V

- Above 800V

Value Chain Analysis For Fuel Cell DC-DC Converter Market

The value chain for the Fuel Cell DC-DC Converter Market begins with upstream activities centered on the procurement and fabrication of highly specialized raw materials and components, particularly advanced semiconductor substrates (Silicon Carbide and Gallium Nitride wafers), high-performance magnetic materials (ferrites, amorphous metals), and specialized high-temperature capacitors. This upstream segment is highly concentrated, relying on a few specialized suppliers globally. Manufacturers then design and assemble the converters, leveraging advanced packaging, thermal management solutions, and proprietary control software. Efficiency and reliability are created at this stage, focusing on maximizing power density and minimizing heat generation.

The midstream phase involves the integration and testing of the finalized DC-DC converter unit into the complete fuel cell power system (Fuel Cell Stack + Balance of Plant). This stage often involves rigorous standardization tests and certification processes to ensure compatibility with high-voltage battery banks and traction motors. Direct distribution channels are predominantly used for key automotive Original Equipment Manufacturers (OEMs) and large stationary power integrators, where customized specifications and direct technical support are required. Indirect channels, involving specialized power electronics distributors, are occasionally utilized for smaller volume orders or portable application manufacturers, but the complexity of the product typically favors direct relationships.

Downstream activities are dominated by end-user installation, operation, and subsequent maintenance and servicing. For FCEVs, the DC-DC converter must interact flawlessly with the vehicle's electronic control unit (ECU) and the entire driveline. The aftermarket service segment, though nascent, is crucial, focusing on diagnostics, software updates, and potential replacement of high-wear components like cooling pumps or high-voltage capacitors. Given the long lifespan expectation of fuel cell systems, managing the service life and potential re-use or recycling of the power electronics components presents a growing segment of the downstream value chain, emphasizing sustainability and resource management.

Fuel Cell DC-DC Converter Market Potential Customers

The potential customer base for Fuel Cell DC-DC Converters spans several distinct high-value sectors, primarily defined by their need for clean, high-density, and continuous power. The largest group consists of global Automotive Original Equipment Manufacturers (OEMs), specifically those focused on heavy-duty commercial vehicles (Class 7 and 8 trucks), transit buses, and specialized delivery vans, as these segments require robust, high-power DC-DC solutions to manage 100+ kW fuel cell stacks and interface with high-voltage traction batteries. Energy and utility companies represent another critical customer segment, purchasing converters for stationary power installations, including backup power for data centers, telecommunications infrastructure, and localized microgrid applications utilizing multi-megawatt fuel cell farms. These customers prioritize reliability, long operational life, and seamless integration with grid infrastructure protocols.

Additionally, specialized industrial equipment manufacturers, particularly those producing forklifts, material handling systems, and off-highway construction vehicles, constitute a strong niche market. These applications benefit immensely from the zero-emission operation and extended runtime offered by fuel cells over traditional battery systems, demanding converters optimized for rugged industrial environments and frequent stop-start cycles. Military and defense sectors are also emerging customers, utilizing fuel cell power electronics for silent surveillance, remote base power, and field-deployable APUs, where size, weight, and operational resilience under extreme conditions are critical purchasing criteria. The diversification of fuel cell applications ensures a broad and resilient demand base for DC-DC converter technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 1,480.2 Million |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vicor Corporation, Delta Electronics, Siemens AG, Infineon Technologies AG, Danfoss A/S, Bel Fuse Inc., TDK Corporation, Murata Manufacturing Co., Ltd., Powerbox (A Cosel Group Company), Rhombus Energy Solutions, Continental AG, Hitachi Ltd., Robert Bosch GmbH, Ballard Power Systems (Power Electronics Division), Nidec Corporation, Eaton Corporation, TT Electronics, Fuji Electric Co., Ltd., Semikron Danfoss, TTM Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Cell DC-DC Converter Market Key Technology Landscape

The technological landscape of the Fuel Cell DC-DC Converter market is rapidly evolving, driven primarily by the need for higher power density, increased efficiency, and reduced size/weight, which are crucial for mobility applications. The cornerstone of current innovation is the widespread adoption of Wide-Bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and, increasingly, Gallium Nitride (GaN) components. SiC MOSFETs are favored for high-power (above 50 kW) automotive and stationary applications due to their ability to operate at much higher switching frequencies and temperatures than traditional Silicon (Si) IGBTs or MOSFETs, drastically reducing losses and decreasing the size requirements for passive components like inductors and capacitors. GaN transistors are gaining traction in lower to medium power segments, particularly portable and drone applications, where ultra-high frequency operation provides unparalleled power density gains, albeit with higher design complexity in control and thermal management.

In terms of topology, the market is shifting towards advanced soft-switching techniques to minimize switching losses, a major source of inefficiency and heat generation. Resonant and quasi-resonant converters, such as the Dual Active Bridge (DAB) converter, are becoming standard, especially in isolated, high-power fuel cell systems connecting to a high-voltage battery bus. The DAB topology offers bidirectional power flow capability, which is essential for regenerative braking in FCEVs and for enabling V2G (Vehicle-to-Grid) functionalities, allowing the fuel cell system to manage energy flow effectively between the stack, the battery, and the traction system. Additionally, modularity and interleaving are crucial design principles; interleaving multiple lower-power converter phases reduces the current ripple seen by the fuel cell stack, improving its longevity and allowing for the use of smaller input/output filters, further contributing to power density.

Another significant technological focus is the advancement in magnetic component design and integrated cooling solutions. Planar magnetics, which use layered PCB traces instead of bulky wound wires, are being utilized to miniaturize transformers and inductors, enabling flatter, more compact converter designs suitable for tight packaging constraints in vehicle chassis. Sophisticated thermal management, often involving integrated liquid cooling channels directly coupled to the semiconductor modules (e.g., cold plates), is mandatory to manage the high heat flux generated by SiC switches operating at high power. The implementation of digital control utilizing high-speed digital signal processors (DSPs) and Field-Programmable Gate Arrays (FPGAs) is also paramount, providing the necessary computational speed to execute complex, adaptive control algorithms that ensure optimal performance across the fuel cell's extremely wide operating voltage range.

Regional Highlights

The geographical analysis of the Fuel Cell DC-DC Converter Market reveals distinct growth patterns and maturity levels across major global regions, reflecting variances in hydrogen policy, infrastructure readiness, and industrial focus. Asia Pacific (APAC) currently holds the dominant market share and exhibits the highest growth trajectory, primarily driven by large-scale government initiatives in China, Japan, and South Korea aimed at establishing hydrogen as a major energy carrier. China’s focus on electrifying heavy-duty fleet transportation using FCEVs translates to immense demand for high-power DC-DC converters (50 kW+). Japan and South Korea, with established commitments to fuel cell technology, are investing heavily in both mobility and residential stationary power solutions, requiring specialized isolated and non-isolated converters.

Europe represents the second-largest market and is characterized by strong regulatory support, notably through the EU Hydrogen Strategy and the implementation of massive hydrogen-related IPCEI (Important Projects of Common European Interest) funding. Market growth is particularly robust in Germany, France, and the Nordic countries, focusing on niche, high-value applications such as maritime transport, rail, and industrial logistics vehicles. European demand leans towards highly efficient, certified converter solutions compatible with strict safety and grid compliance standards, fostering innovation in modular and multi-port converter designs capable of handling various energy inputs (fuel cell, battery, grid).

North America, particularly the United States, is poised for accelerated growth, supported by the Inflation Reduction Act (IRA), which provides significant tax credits and incentives for clean hydrogen production and fuel cell deployment. The region’s market is heavily concentrated on long-haul trucking and port operations (drayage trucks), demanding rugged, reliable, and high-voltage (800V) DC-DC converters suitable for challenging operational environments. The region also shows strong adoption of fuel cell systems for backup power in critical infrastructure, driving demand for specialized stationary converters. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by pilot projects and resource exploration (mining) applications requiring off-grid, reliable fuel cell power systems, though growth rates are comparatively slower, pending larger infrastructure investment.

- Asia Pacific (APAC): Market leader and fastest growth; dominance driven by government hydrogen mandates in China, South Korea, and Japan, focusing heavily on FCEV buses and trucks (High Power segment).

- Europe: Strong regulatory backing (EU Green Deal); high adoption in Germany, France, and Nordic countries for marine, rail, and stationary microgrids; emphasis on modular and V2G-capable converters.

- North America: Accelerating growth supported by the IRA; primary focus on high-voltage (800V) heavy-duty trucking and critical infrastructure backup power; emphasis on high reliability and ruggedization.

- Latin America & MEA: Emerging markets with potential in mining, off-grid power, and selective regional transportation pilot programs; growth dependent on future infrastructure build-out and regional clean energy policies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Cell DC-DC Converter Market.- Vicor Corporation

- Delta Electronics

- Siemens AG

- Infineon Technologies AG

- Danfoss A/S

- Bel Fuse Inc.

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- Powerbox (A Cosel Group Company)

- Rhombus Energy Solutions

- Continental AG

- Hitachi Ltd.

- Robert Bosch GmbH

- Ballard Power Systems (Power Electronics Division)

- Nidec Corporation

- Eaton Corporation

- TT Electronics

- Fuji Electric Co., Ltd.

- Semikron Danfoss

- TTM Technologies

Frequently Asked Questions

Analyze common user questions about the Fuel Cell DC-DC Converter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a DC-DC converter in a fuel cell system?

The primary function is to condition the variable DC voltage output from the fuel cell stack into a stable, regulated DC voltage required by the system load, such as the traction motor, battery bank, or grid inverter, ensuring optimal efficiency and power delivery.

Why are SiC and GaN semiconductors critical for fuel cell DC-DC converters?

Silicon Carbide (SiC) and Gallium Nitride (GaN) are Wide-Bandgap semiconductors that allow converters to operate at significantly higher switching frequencies and temperatures. This capability reduces power losses, enhances overall efficiency, and enables the design of smaller, lighter, and higher power-density modules essential for FCEVs.

What is the difference between isolated and non-isolated DC-DC converters in this market?

Isolated converters utilize a transformer to provide galvanic isolation between the fuel cell stack and the load (e.g., high-voltage battery), fulfilling stringent safety requirements, particularly in passenger and high-voltage stationary applications. Non-isolated converters are simpler, more cost-effective, and typically used in lower-voltage systems where isolation is not strictly mandated.

Which application segment drives the highest demand for these converters?

The Automotive application segment, specifically the Heavy-Duty Vehicle (HDV) sub-segment (trucks and buses), drives the highest demand. These vehicles utilize high-power fuel cell stacks (50 kW+) requiring robust, high-efficiency converters to manage power flow to the high-voltage electric driveline.

How does technological advancement in thermal management affect converter performance?

Advanced thermal management, such as integrated liquid cooling systems, is vital because high-power SiC/GaN switches generate substantial heat. Effective cooling prevents overheating, which is crucial for maintaining component reliability, maximizing power throughput, and extending the operational lifespan of the converter unit.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager