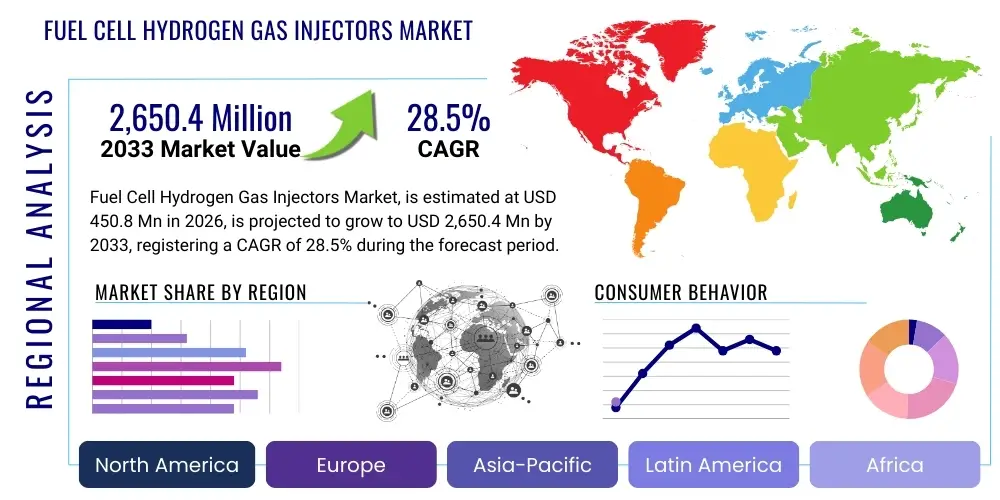

Fuel Cell Hydrogen Gas Injectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437516 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Fuel Cell Hydrogen Gas Injectors Market Size

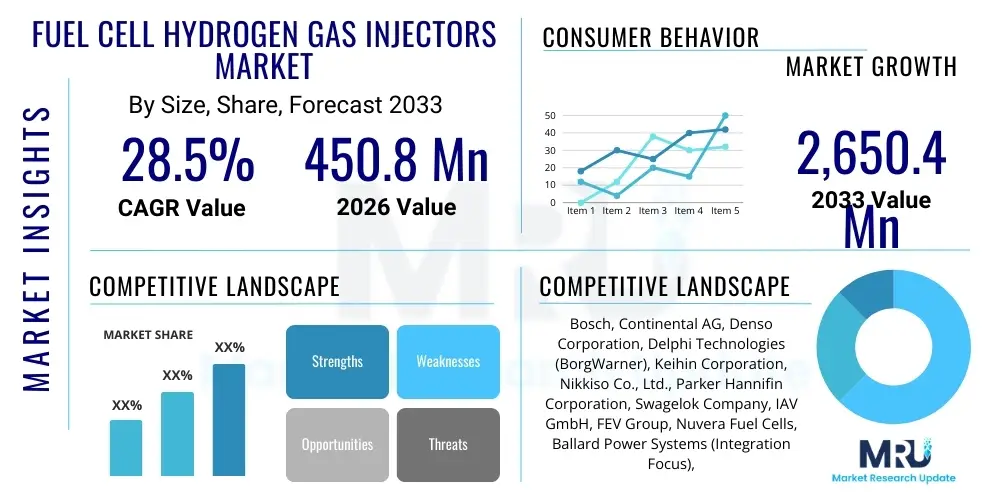

The Fuel Cell Hydrogen Gas Injectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 450.8 Million in 2026 and is projected to reach USD 2,650.4 Million by the end of the forecast period in 2033.

Fuel Cell Hydrogen Gas Injectors Market introduction

The Fuel Cell Hydrogen Gas Injectors Market encompasses the global production and distribution of precision devices crucial for regulating the flow and injection of hydrogen gas into Proton Exchange Membrane (PEM) fuel cells. These injectors, which operate under extreme pressure and require exceptional durability and leak tightness, are fundamental components in hydrogen fuel cell systems, directly impacting the efficiency, power output, and longevity of the entire stack. As governments and major corporations globally commit substantial investments toward decarbonization and sustainable energy infrastructure, the demand for high-performance hydrogen delivery systems, particularly in the transportation sector, is accelerating the adoption of these specialized injectors. Their sophisticated design allows for precise dosing and rapid cycling, vital for maintaining optimal stoichiometry and dynamic response in demanding automotive and stationary power applications.

Fuel cell hydrogen gas injectors are primarily applied in mobile applications, specifically fuel cell electric vehicles (FCEVs), including passenger cars, heavy-duty trucks, and buses. These injectors must manage hydrogen flow rates ranging from minimal idling requirements to high-demand acceleration phases while maintaining nanosecond-level precision. Secondary, yet rapidly growing, applications include backup power systems for critical infrastructure, maritime vessels, and specialized material handling equipment like forklifts. The technological complexity resides in handling highly flammable, low-density hydrogen gas at pressures typically exceeding 700 bar (in high-pressure systems), requiring materials resistant to hydrogen embrittlement and thermal cycling stresses.

The major benefits driving the market include the superior energy density of hydrogen compared to batteries, resulting in extended range and rapid refueling times for FCEVs, which directly appeals to the commercial fleet sector. Furthermore, the zero-emission nature of fuel cell technology aligns perfectly with global regulatory mandates aimed at reducing greenhouse gas emissions. Key driving factors involve supportive government policies promoting hydrogen infrastructure development (e.g., European Green Deal, U.S. Infrastructure Law), the declining cost of renewable hydrogen production (green hydrogen), and aggressive research and development efforts by automotive original equipment manufacturers (OEMs) to commercialize second and third-generation FCEVs. These collective forces solidify the market's trajectory toward rapid expansion through the forecast period.

Fuel Cell Hydrogen Gas Injectors Market Executive Summary

The Fuel Cell Hydrogen Gas Injectors Market is positioned for robust, double-digit growth, primarily fueled by global commitments to achieving net-zero emissions and significant breakthroughs in fuel cell durability and cost reduction. Business trends indicate a strong move towards strategic partnerships between traditional automotive suppliers and specialized hydrogen technology firms, focusing on modular component design to reduce manufacturing costs and accelerate scalability. Manufacturers are heavily investing in proprietary valve technology, such as solenoid and piezoelectric systems, to enhance injector speed and precision, crucial for maximizing fuel efficiency under transient operating conditions. The supply chain is increasingly globalized but is currently consolidating around key technology providers capable of meeting stringent automotive quality standards (IATF 16949).

Geographically, Asia Pacific (APAC), particularly China, Japan, and South Korea, dominates the market due to massive governmental incentives supporting FCEV deployment and establishing extensive hydrogen refueling networks. Europe is emerging as the fastest-growing region, driven by the rollout of the EU Hydrogen Strategy and strict mandates targeting heavy-duty vehicle decarbonization. North America maintains strong R&D leadership, with significant focus on long-haul trucking and stationary power solutions. Segment trends highlight that high-pressure direct injectors are the technological standard for modern FCEVs, optimizing power output and minimizing hydrogen consumption per kilometer. The Automotive application segment, particularly commercial vehicles, remains the largest revenue generator, although the Stationary Power segment is projected to exhibit elevated growth rates as grid stabilization and remote power solutions become more prevalent.

In summary, the market outlook is overwhelmingly positive, characterized by technological maturity, favorable legislative backing, and increasing consumer acceptance in key application areas. Key challenges, such as the initial high cost of FCEVs and the slow buildout of comprehensive refueling infrastructure, are being systematically addressed through joint industry-government initiatives. The strategic focus for market participants must center on maximizing production efficiency, ensuring component reliability over long duty cycles, and standardizing injector interfaces to facilitate broader integration across diverse fuel cell platforms.

AI Impact Analysis on Fuel Cell Hydrogen Gas Injectors Market

Users frequently inquire how artificial intelligence (AI) and machine learning (ML) are enhancing the performance and reliability of fuel cell components, particularly hydrogen gas injectors. Common questions revolve around predictive maintenance schedules, optimizing injector control parameters in real-time based on environmental conditions, and using generative AI for accelerated material design to combat hydrogen embrittlement. The primary concerns center on the integration complexity of advanced sensors and computational algorithms into high-pressure systems and ensuring data integrity in critical safety applications. Expectations are high regarding AI's ability to minimize downtime, extend the lifespan of costly components, and fine-tune injection strategies to achieve unprecedented efficiency levels, thereby lowering the overall Total Cost of Ownership (TCO) for fuel cell systems. This shift transforms injectors from simple mechanical components into smart, data-driven subsystems.

- AI-Driven Predictive Maintenance: Machine learning algorithms analyze vibrational data, temperature fluctuations, and operational cycles of injectors to predict potential failures, allowing for proactive replacement and minimizing costly system downtime.

- Real-Time Flow Optimization: AI models dynamically adjust injector pulse widths and timing based on immediate power demands, ambient temperature, humidity levels, and stack pressure, maximizing fuel efficiency and transient response speed.

- Generative Design for Material Science: AI accelerates the discovery and testing of novel alloys and coatings highly resistant to hydrogen induced cracking and pressure degradation, enhancing injector longevity and safety features.

- Manufacturing Process Control: Integration of machine vision and deep learning models into assembly lines ensures micron-level precision and quality control for injector components, reducing manufacturing defects and improving yield rates.

- Digital Twin Simulation: Creation of high-fidelity digital models allows engineers to simulate injector performance under extreme and rare operating conditions, accelerating R&D cycles and verifying safety protocols before physical prototyping.

DRO & Impact Forces Of Fuel Cell Hydrogen Gas Injectors Market

The Fuel Cell Hydrogen Gas Injectors market is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver is the global regulatory push towards zero-emission mobility, particularly the push by major economies to replace diesel engines in heavy-duty commercial transport with FCEVs. This regulatory pressure is amplified by substantial public and private investment into the 'Hydrogen Economy,' which necessitates high-quality, reliable injection technology. However, the market faces significant restraints, primarily the high initial cost of FCEV deployment compared to traditional vehicles and the inherent technical challenges associated with handling high-pressure hydrogen, demanding extremely tight manufacturing tolerances and expensive materials.

Opportunities in the market center around technological advancements, specifically the shift from solenoid injectors to advanced piezo injectors which offer faster response times and higher precision, thereby improving overall fuel cell stack performance. Furthermore, the rapid expansion of non-automotive applications, such as large-scale drone delivery, backup grid power, and material handling, offers diversified revenue streams outside the cyclical automotive industry. These opportunities are contingent upon continuous cost reductions achieved through mass production scaling and supply chain optimization. Successfully navigating the high capital expenditure required for R&D in materials science and precision engineering is critical for capitalizing on these growth vectors.

The impact forces within this ecosystem are substantial. Government policy (e.g., subsidies and tax credits for FCEVs) acts as a high-impact external driver, accelerating demand significantly. Technological substitution risk, primarily from rapidly improving battery electric vehicle (BEV) technology, represents a moderate to high internal restraint, particularly for passenger vehicles where range anxiety is being mitigated. Supplier power is currently high due to the limited number of companies possessing the required precision manufacturing capability for hydrogen service, pushing up component costs. However, as more suppliers enter the segment, the intensity of competitive rivalry is expected to increase, ultimately benefiting the OEMs through reduced component pricing.

Segmentation Analysis

The Fuel Cell Hydrogen Gas Injectors Market segmentation provides a detailed structural breakdown of market revenue based on technology type, operational pressure, primary application, and geographical region. This analysis is crucial for understanding specific areas of innovation and concentrated demand. The division by injector type, mainly between Direct Injectors and Port Injectors, reflects efficiency requirements, with direct injection systems dominating high-performance applications like automotive, offering superior fuel utilization and response speed. Furthermore, segmentation by pressure range—low, medium, and high pressure—directly corresponds to the type of storage tank technology utilized, with 700 bar (high pressure) systems being the standard for maximizing vehicle range.

The application landscape is fragmented but led predominantly by the mobility sector. While commercial vehicles currently represent the largest segment due to the economic benefits of long-range, rapid refueling, passenger vehicles are expected to recover as infrastructure improves. The Stationary Power generation segment, including micro-grids and uninterruptible power supplies (UPS), presents a niche but high-growth area where reliability and extended run-time are prioritized over cost per unit. The convergence of these segment variables dictates specialized design requirements for gas injectors, ranging from large-flow, continuous-duty injectors for power plants to compact, high-speed units for FCEVs.

- By Type:

- Direct Injectors

- Port Injectors

- By Pressure Range:

- Low Pressure (e.g., for specialized industrial processes or smaller systems)

- Medium Pressure (e.g., for initial stages of commercial vehicle testing)

- High Pressure (700 Bar Systems, dominating FCEV market)

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles, Buses)

- Stationary Power Generation (Backup Power, Microgrids)

- Portable Devices (Drones, Auxiliary Power Units)

- Other Applications (Maritime, Rail, Material Handling)

- By Component Material:

- Stainless Steel Alloys

- Polymer Composites and Ceramics

Value Chain Analysis For Fuel Cell Hydrogen Gas Injectors Market

The value chain for Fuel Cell Hydrogen Gas Injectors is complex, starting with highly specialized upstream activities focused on material selection and precision component manufacturing. Upstream analysis involves raw material suppliers providing specialized stainless steel alloys (316L, Duplex), ceramics, and high-performance polymers capable of resisting hydrogen embrittlement and operating safely under cryogenic and high-pressure conditions. Precision machining companies convert these raw materials into critical components such as solenoid bodies, nozzle tips, and valve seats, demanding zero-defect tolerance levels. These highly specialized suppliers form the foundation of the market, wielding significant leverage due to their unique expertise and limited global availability.

The midstream stage involves the core injector assembly, calibration, and final quality assurance by Tier 1 suppliers. These major component manufacturers integrate the various subcomponents and apply proprietary sealing and actuation technology (e.g., piezo or solenoid drivers) to produce the complete injector module. The distribution channel predominantly favors direct sales and technical collaboration, driven by the critical safety nature of the product. Major OEMs (Fuel Cell Stack Manufacturers and Automotive Tier 0.5 Integrators) prefer direct relationships with injector producers (Direct Channel) to ensure strict adherence to performance specifications and facilitate rapid iteration during development phases. Indirect distribution through specialized technical distributors exists, but it is less common for high-volume, mission-critical automotive applications.

Downstream analysis focuses on the integration of these injectors into the final fuel cell system and its end applications. The injectors are supplied to fuel cell stack integrators (like Ballard, Nuvera, Plug Power) who incorporate them into the Balance of Plant (BOP) systems. These completed fuel cell modules are then delivered to vehicle manufacturers (OEMs like Toyota, Hyundai, Daimler) for final assembly into FCEVs. Post-sale, the downstream includes specialized maintenance providers who require training and certification for servicing high-pressure hydrogen systems. The performance data generated downstream feeds back into the upstream R&D cycle, emphasizing the closed-loop nature of innovation in this sector.

Fuel Cell Hydrogen Gas Injectors Market Potential Customers

The potential customers for Fuel Cell Hydrogen Gas Injectors are sophisticated industrial entities operating within the energy, mobility, and heavy manufacturing sectors that require high-efficiency, clean power generation solutions. The primary and largest cohort comprises global Automotive Original Equipment Manufacturers (OEMs), particularly those focused on heavy-duty commercial vehicles (Class 8 trucks, buses) where the weight and refueling speed advantages of hydrogen outweigh those of battery power. These customers demand high-volume production capability, exceptional durability guarantees (often 15,000+ operating hours), and seamless integration compatibility with proprietary engine control units (ECUs). Their purchasing decisions are highly influenced by total system cost reduction targets and reliability metrics.

A rapidly expanding customer base includes specialized Fuel Cell System Integrators and Stack Manufacturers. These companies, such as Plug Power and Ceres Power, purchase injectors as critical components for their module builds, which are then sold into diverse markets including logistics (forklifts), grid stabilization, and maritime applications. This segment values technical partnership, customization capability for different power outputs, and stringent quality control protocols. They often procure large volumes under long-term supply agreements to ensure component security and predictable pricing.

Additionally, emerging niche customers include developers of unmanned aerial vehicles (UAVs) and specialized portable power equipment for remote industrial sites. These buyers prioritize lightweight design and operational efficiency under extreme environmental conditions. Government and defense entities also represent a stable, high-value customer group, seeking resilient and reliable power solutions for military applications where fuel logistics and noise reduction are paramount concerns. Successful penetration into these diverse customer segments requires suppliers to maintain highly flexible manufacturing platforms and robust technical support infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 Million |

| Market Forecast in 2033 | USD 2,650.4 Million |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner), Keihin Corporation, Nikkiso Co., Ltd., Parker Hannifin Corporation, Swagelok Company, IAV GmbH, FEV Group, Nuvera Fuel Cells, Ballard Power Systems (Integration Focus), Cummins Inc. (New Power), Eaton Corporation, Symbio (Faurecia & Michelin Joint Venture), Weichai Power, Mahle GmbH, Mikuni Corporation, Liebherr-Aerospace, GCE Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Cell Hydrogen Gas Injectors Market Key Technology Landscape

The technological landscape of the Fuel Cell Hydrogen Gas Injectors market is dominated by advancements in actuation methods and material science engineered to meet the stringent demands of high-pressure hydrogen environments. The current standard involves high-speed solenoid injectors, which offer a reliable balance of cost and performance. However, the industry is increasingly transitioning toward Piezoelectric (Piezo) actuation technology. Piezo injectors leverage the rapid expansion and contraction of piezoelectric materials to achieve significantly shorter response times (measured in microseconds) and superior dosing accuracy compared to solenoids. This precision is vital for optimizing fuel cell stack performance during dynamic load changes and cold start conditions, enabling the development of more efficient and durable FCEVs.

Material innovation is equally critical. Due to the propensity of hydrogen to cause embrittlement and degradation in standard metals, specialized materials are mandatory. This includes the use of high-grade stainless steel alloys (specifically those with high nickel content) for the injector body and advanced ceramic or polymer composites for critical sealing components (like O-rings and seats). Furthermore, precision surface treatments and coatings are utilized to prevent friction wear and ensure gas tightness over the product's lifespan, typically requiring millions of operational cycles. Research is heavily focused on developing cheaper, yet equally resilient, composite materials to reduce the overall manufacturing cost without compromising safety or integrity.

A key supporting technology involves the integration of sophisticated control electronics and sensor technology. Modern hydrogen injectors are often paired with dedicated Electronic Control Units (ECUs) capable of running complex algorithms for closed-loop control, managing injector timing based on real-time feedback from stack pressure and temperature sensors. This integration allows for diagnostics and monitoring, facilitating AI-driven predictive maintenance and ensuring compliance with rapidly evolving safety standards (such as ISO 19880). The overall technological trend emphasizes modularity, high reliability, miniaturization, and seamless data connectivity across the fuel cell Balance of Plant (BOP).

Regional Highlights

The market growth dynamics are highly dependent on regional policy and infrastructure maturity. Asia Pacific (APAC) currently holds the dominant market share, driven primarily by government mandates and industrial commitments in countries like China, South Korea, and Japan. These nations have established aggressive hydrogen roadmaps, heavily subsidizing both FCEV manufacturing and the build-out of 700 bar refueling stations. China's massive push towards commercial FCEVs (buses and heavy trucks) makes it the single largest consumer market for injectors. South Korea and Japan, leaders in FCEV passenger vehicle technology, continue to focus on high-performance injector systems for global export.

Europe is poised for the most rapid growth through the forecast period. The European Union's Hydrogen Strategy and initiatives like the Clean Hydrogen Alliance are driving substantial investment, particularly in Germany, France, and the Netherlands. The regional focus is heavily skewed toward decarbonizing medium- and heavy-duty transport and utilizing fuel cells for maritime and rail applications. Strict emissions standards necessitate the immediate adoption of reliable hydrogen components, accelerating demand for high-end injectors.

North America, led by the United States, is gaining momentum, fueled by federal funding (e.g., Department of Energy initiatives and infrastructure bills) aimed at establishing hydrogen hubs across the nation. The market here is concentrated on long-haul trucking applications, stationary power generation for remote locations, and specialized industrial fleets. While infrastructure buildout trails APAC and parts of Europe, significant domestic R&D activity in injector technology ensures strong future domestic production capabilities.

- Asia Pacific (APAC): Dominates the market due to robust government support, mass production of FCEV buses and trucks (China), and mature technology integration (Japan, South Korea). Highest volume consumer.

- Europe: Fastest-growing region, driven by the EU Hydrogen Strategy, stringent heavy-duty vehicle mandates, and significant investment in cross-border hydrogen corridors. Strong focus on high-precision Piezo injectors.

- North America: Focuses on long-haul freight and strategic hydrogen hubs. High investment in R&D and materials science to enhance injector reliability under diverse climatic conditions.

- Middle East & Africa (MEA): Emerging market linked to planned large-scale green hydrogen production projects (e.g., NEOM in Saudi Arabia). Initial demand concentrated in stationary power and specialized logistics.

- Latin America: Slow but steady adoption, mainly centered on pilot programs for mining trucks and logistics fleets in major economies like Brazil and Chile, leveraging hydro power for clean hydrogen production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Cell Hydrogen Gas Injectors Market.- Bosch (Robert Bosch GmbH)

- Continental AG

- Denso Corporation

- Delphi Technologies (a BorgWarner company)

- Keihin Corporation

- Nikkiso Co., Ltd.

- Parker Hannifin Corporation

- Swagelok Company

- IAV GmbH

- FEV Group

- Nuvera Fuel Cells (Integration focus)

- Ballard Power Systems (Integration focus)

- Cummins Inc. (New Power Segment)

- Eaton Corporation

- Symbio (Faurecia & Michelin Joint Venture)

- Weichai Power

- Mahle GmbH

- Mikuni Corporation

- Liebherr-Aerospace

- GCE Group

Frequently Asked Questions

What is the primary function of a hydrogen gas injector in a fuel cell system?

The hydrogen gas injector precisely controls and regulates the high-pressure flow of hydrogen gas into the anode side of the fuel cell stack. Its main function is to ensure optimal hydrogen dosing, rapid response to load changes, and leak-tight sealing, which are critical for maximizing the stack’s efficiency, power output, and operational lifespan.

How do high-pressure (700 bar) injectors differ from standard gas injectors?

High-pressure injectors (700 bar) are designed with specialized materials and advanced sealing mechanisms to withstand extreme operational pressures common in modern FCEV storage systems. They require enhanced material resistance against hydrogen embrittlement and must maintain nanosecond-level precision in flow control to prevent damage to the stack while ensuring high energy utilization.

Which technological innovation is most impacting fuel cell injector performance?

The transition from traditional solenoid valve technology to Piezoelectric (Piezo) actuation is the most impactful innovation. Piezo injectors offer significantly faster response times and superior accuracy in hydrogen dosing, enabling better transient performance and contributing directly to higher overall fuel economy and stack durability in dynamic driving cycles.

What are the key restraint factors limiting the growth of the gas injectors market?

Key restraints include the high manufacturing cost associated with precision components capable of handling high-pressure hydrogen, the currently underdeveloped global hydrogen refueling infrastructure, and intense competition from rapidly advancing battery electric vehicle (BEV) technologies, particularly in the passenger vehicle segment.

Which application segment currently drives the highest demand for hydrogen gas injectors?

The Automotive application segment, specifically commercial vehicles (heavy-duty trucks and buses), currently drives the highest demand. FCEVs provide superior range and quick refueling capabilities essential for logistics and long-haul transport, making them a commercially viable alternative to conventional diesel vehicles in this sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager