Fuel Distribution Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435487 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fuel Distribution Pipe Market Size

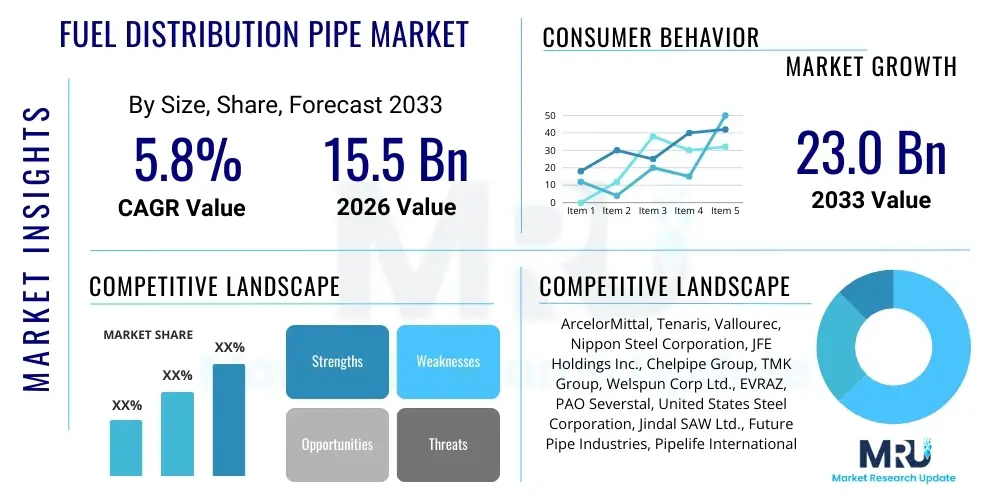

The Fuel Distribution Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Fuel Distribution Pipe Market introduction

The Fuel Distribution Pipe Market encompasses the manufacturing, supply, and installation of piping systems used for the secure and efficient transport of hydrocarbon fuels, including crude oil, refined products (gasoline, diesel, jet fuel), and natural gas, from production sites to storage facilities and final consumption points. These complex infrastructure systems are essential components of the global energy supply chain, operating under diverse environmental and pressure conditions. Key products include line pipes made from steel, high-density polyethylene (HDPE), and composite materials, tailored for specific fluid properties and regulatory standards.

Major applications of these pipes span the midstream and downstream sectors, crucial for connecting oil and gas exploration fields to refineries, and refineries to distribution terminals, fueling stations, and industrial consumers. The integrity and longevity of these piping networks are paramount, necessitating advanced materials science, corrosion protection technologies, and stringent quality control measures. The primary benefits derived from these modern pipe systems include enhanced operational safety, reduced risk of leaks or environmental contamination, and optimized flow efficiency, which directly impacts energy transmission costs and reliability.

Market expansion is principally driven by the continuous global demand for energy, the necessity for replacing aging infrastructure, and increased investment in cross-border pipeline projects, particularly in developing economies. Furthermore, the rising adoption of materials like HDPE for low-pressure gas distribution networks, favored for its corrosion resistance and ease of installation, significantly influences market dynamics. Regulatory frameworks mandating higher safety standards and environmental compliance also compel operators to upgrade existing pipeline infrastructure with state-of-the-art piping solutions and monitoring systems.

Fuel Distribution Pipe Market Executive Summary

The Fuel Distribution Pipe Market is currently undergoing significant transformation driven by dual pressures: the persistent need to maintain and expand traditional fossil fuel infrastructure, and the emerging transition toward cleaner energy vectors like hydrogen and biofuels. Business trends emphasize digitalization in pipeline management, utilizing smart sensors and remote monitoring systems to enhance asset integrity and predictive maintenance capabilities. Key players are strategically focused on diversifying their material portfolio, heavily investing in advanced steel alloys and non-metallic composite pipes (NMCP) to meet demands for high-pressure, corrosive environments, while simultaneously addressing environmental scrutiny regarding methane leakage prevention.

Regionally, the market exhibits robust growth in the Asia Pacific (APAC), primarily fueled by rapid industrialization, urbanization, and large-scale pipeline network expansion, particularly in China and India. North America remains a crucial market due to extensive upstream and midstream activities and mandatory requirements for replacing decades-old transmission lines to comply with heightened safety regulations. Europe, while slowing its investment in oil pipelines, is actively pivoting investment toward gas distribution pipes, and crucially, infrastructure suitable for future hydrogen blending and transport, reflecting the region's strong commitment to energy transition objectives.

Segment-wise, high-strength steel pipes dominate the market value due to their indispensable role in long-distance, high-pressure transmission lines, such as transcontinental oil and gas pipelines. However, the Polymer Pipe segment, notably HDPE, is experiencing the fastest volume growth, driven by its superior performance in lower-pressure municipal gas distribution networks and the relative cost-effectiveness and corrosion resistance it offers over traditional metallic options. The downstream distribution network segment is projected to show accelerated activity, reflecting increasing demand for last-mile connectivity and terminal-to-consumer delivery infrastructure upgrades globally.

AI Impact Analysis on Fuel Distribution Pipe Market

User inquiries concerning AI's role in the Fuel Distribution Pipe Market frequently center on how these technologies can mitigate the substantial risks associated with pipeline failure, reduce operational expenditure (OPEX), and optimize network efficiency. Key themes include the application of machine learning for predictive maintenance scheduling, the use of computer vision and robotics for autonomous inspection, and the integration of large datasets (SCADA, satellite imagery, sensor data) to model corrosion rates and identify anomalous operational behavior. Users are particularly keen on understanding how AI can provide early warning indicators of potential leaks or structural degradation, moving asset management from reactive or time-based schedules to condition-based and proactive intervention strategies.

AI algorithms, leveraging advanced analytics on massive streams of data generated by in-line inspection (ILI) tools and external monitoring systems, are transforming the integrity management of fuel pipelines. By analyzing factors such as material stress, temperature fluctuations, pressure variances, and historical failure data, AI models can accurately predict the remaining useful life of pipe segments. This capability allows pipeline operators to prioritize maintenance activities, allocate resources more efficiently, and minimize costly downtime associated with unexpected failures, thereby ensuring continuous and safe fuel distribution.

Furthermore, AI significantly impacts the planning and security aspects of pipeline operations. Routing optimization algorithms, integrated with geological and environmental data, minimize construction costs and environmental impact during new pipeline installation. For security, AI-powered systems analyze video feeds and acoustic sensor data to detect unauthorized intrusions, potential sabotage, or ground movement impacting the pipeline, providing real-time alerts. This integration of intelligence across the lifecycle—from design and construction to integrity and security—is positioning AI as a critical enabler for maximizing the safety and economic viability of fuel distribution infrastructure worldwide.

- Predictive maintenance scheduling optimization based on real-time sensor data and historical trends.

- Enhanced Leak Detection Systems (LDS) using machine learning to filter noise and rapidly identify subtle pressure anomalies.

- Automated interpretation of In-Line Inspection (ILI) data, accelerating the identification and sizing of defects like cracks or corrosion pits.

- Optimization of flow rate and compressor/pump station operations to minimize energy consumption across the network.

- Improved security monitoring via computer vision and drone surveillance integration for remote pipeline segments.

- Risk scoring and asset prioritization for infrastructure replacement programs using probabilistic modeling.

DRO & Impact Forces Of Fuel Distribution Pipe Market

The Fuel Distribution Pipe Market is fundamentally shaped by the intersection of escalating global energy consumption (Driver), strict governmental regulations on safety and environmental protection (Restraint), and the potential for leveraging existing infrastructure for emerging energy sources (Opportunity). The primary driving force remains the indispensable need to transport vast quantities of energy efficiently, necessitating substantial investment in both new pipeline construction in high-growth regions and the crucial replacement of aging, leak-prone infrastructure in mature markets like North America and Europe. However, these positive growth indicators are countered by significant capital intensity required for mega-projects, volatile raw material prices (especially steel), and increasing public opposition, which often results in project delays or cancellations, acting as critical restraints.

Opportunities in the sector are largely concentrated around technological innovation and energy diversification. The market benefits significantly from the global push toward integrating hydrogen into existing gas grids—a development requiring pipe systems, materials, and coatings compatible with hydrogen transport. Furthermore, the development of smart pipeline technologies, incorporating advanced coatings, fiber optic sensing, and digital twins, provides avenues for market players to offer premium, value-added services focused on lifetime integrity management. These technological leaps help offset the restraints imposed by regulatory bodies demanding higher environmental standards and lower emission rates.

The impact forces analysis reveals a highly competitive landscape dominated by established multinational pipe manufacturers (Threat of New Entrants is moderate due to high capital requirements and stringent certifications). Buyer power is considered high, especially from major oil and gas operators and national utility companies, who demand highly customized, durable, and certified products. Supplier power, particularly for specialized steel alloys and resins, is moderate to high, often dictating production costs. The increasing availability of alternatives, notably rail and marine transport for oil, poses a substitution threat, though pipelines retain superiority for long-distance, high-volume delivery. Overall, the market remains driven by regulatory compliance and safety mandates, which heighten the competitive intensity based on quality and certification rather than just price.

Segmentation Analysis

The Fuel Distribution Pipe Market is segmented based on critical technical and application parameters, providing a detailed understanding of demand patterns across different infrastructure needs. The primary bases for segmentation include the Material Used, which directly impacts corrosion resistance and pressure tolerance; the Type of Fuel Carried, dictating specialized regulatory and handling requirements; and the Application/End-use Sector, reflecting whether the pipes are utilized in high-pressure transmission or lower-pressure distribution networks. Analyzing these segments is vital for manufacturers to tailor their production capabilities and target specific infrastructural upgrade cycles.

Material segmentation reveals the enduring dominance of Steel Pipes (Carbon Steel and Stainless Steel) for high-strength, large-diameter applications, particularly in cross-country transmission. Conversely, the Polymer Pipes segment (dominated by HDPE, PE, and composite materials) is expanding rapidly due to its suitability for corrosive environments, particularly in gas distribution and lower-pressure gathering systems. The choice of material is increasingly influenced by life-cycle cost analysis, where the lower maintenance costs of corrosion-resistant alternatives often outweigh the higher upfront investment.

Furthermore, segmenting by application—Transmission vs. Distribution—highlights the differing market drivers. Transmission lines (high pressure, large diameter, long distance) are subject to geopolitical factors and major infrastructure project cycles, demanding extreme durability and integrity. Distribution lines (lower pressure, smaller diameter, complex networks within urban areas) are driven by residential and commercial expansion and continuous maintenance/replacement cycles necessitated by municipal infrastructure aging. This dual nature requires specialized manufacturing processes and distinct sales strategies targeting different sets of customers.

- By Material:

- Steel Pipes (Carbon Steel, Stainless Steel, Alloy Steel)

- Polymer Pipes (HDPE, PE, PEX)

- Composite Pipes (Fiberglass Reinforced Plastic, Reinforced Thermoplastic Pipes (RTP))

- By Application/End-Use:

- Transmission Lines (Cross-Country, High-Pressure)

- Distribution Networks (Urban Gas Grids, Terminal Delivery)

- Gathering Lines (Upstream Field Connections)

- By Type of Fuel:

- Crude Oil

- Natural Gas

- Refined Petroleum Products (Gasoline, Diesel, Jet Fuel)

- Other (Biofuels, Hydrogen Blends)

- By Diameter:

- Small Diameter Pipes (Below 12 inches)

- Medium Diameter Pipes (12 to 36 inches)

- Large Diameter Pipes (Above 36 inches)

Value Chain Analysis For Fuel Distribution Pipe Market

The value chain of the Fuel Distribution Pipe Market starts with the upstream segment, which involves the sourcing and processing of essential raw materials, primarily steel coil/plates, iron ore, and specialized high-grade resins like polyethylene and polypropylene. The quality and stable supply of these inputs are paramount, as material specifications dictate the final performance characteristics, such as strength, durability, and corrosion resistance, required by strict industry standards (e.g., API specifications). Volatility in commodity prices at this initial stage directly impacts the profitability and final pricing of finished pipe products.

The midstream phase constitutes pipe manufacturing, which includes processes such as seamless rolling, Electric Resistance Welding (ERW), and Submerged Arc Welding (SAW) for steel pipes, or extrusion for polymer pipes. This segment also includes vital value-added activities such as internal and external coating (e.g., fusion-bonded epoxy, 3-layer polyethylene), which drastically enhance the pipeline’s longevity and protection against corrosion and mechanical damage. Significant investment in advanced machinery, quality control testing, and certification (e.g., API 5L) is necessary to operate effectively in this highly specialized manufacturing phase.

The downstream distribution segment involves transporting the finished pipes to the construction site, installation, and post-installation services. Distribution channels are typically a mix of direct sales to major integrated energy companies (IOCs/NOCs) for large-scale transmission projects and indirect sales through specialized distributors and contractors for local distribution networks and maintenance work. Direct channels allow for better quality control and client relationship management for high-value projects, while indirect channels provide wider market reach and localized service capabilities crucial for urban utility projects and routine replacement cycles.

Fuel Distribution Pipe Market Potential Customers

Potential customers for fuel distribution pipes are primarily large-scale energy infrastructure developers and operators whose core business relies on the secure and efficient transportation of hydrocarbon resources. These buyers are highly sophisticated, prioritize safety and regulatory compliance above all, and typically engage in long-term contracts requiring certified materials and rigorous performance guarantees. The procurement process often involves lengthy qualification periods and adherence to international standards set by bodies like the American Petroleum Institute (API) and the International Organization for Standardization (ISO).

The major end-users can be broadly categorized into National Oil Companies (NOCs) and International Oil Companies (IOCs) undertaking large transmission pipeline projects; Municipal and Private Gas Utility Companies responsible for urban gas grid distribution and local service; and Independent Pipeline Operators who specialize purely in midstream transport services. Additionally, engineering, procurement, and construction (EPC) firms act as influential customers, often making material selection decisions on behalf of the asset owners based on project specifications, cost parameters, and execution efficiency.

A growing customer base also includes governmental agencies and regulatory bodies responsible for maintaining essential national energy security and infrastructure integrity. These customers drive demand through mandated replacement programs and upgrades to existing infrastructure, especially in mature regions where corrosion and aging are critical concerns. Future demand growth is anticipated from entities investing in next-generation fuel infrastructure, such as companies building networks for CO2 transport (for Carbon Capture and Storage) or hydrogen blending/distribution, representing a crucial long-term shift in the customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Tenaris, Vallourec, Nippon Steel Corporation, JFE Holdings Inc., Chelpipe Group, TMK Group, Welspun Corp Ltd., EVRAZ, PAO Severstal, United States Steel Corporation, Jindal SAW Ltd., Future Pipe Industries, Pipelife International GmbH, Aliaxis Group, Georg Fischer AG, Plasticon Composites, Saudi Steel Pipe Company, National Oilwell Varco (NOV), Salzgitter AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Distribution Pipe Market Key Technology Landscape

The technological landscape of the Fuel Distribution Pipe Market is centered on enhancing material performance, improving corrosion protection, and integrating advanced monitoring systems to ensure operational safety and regulatory compliance. Material innovation is crucial, with continued development in high-strength low-alloy (HSLA) steel grades, allowing for thinner walls and reduced material use while maintaining pressure integrity for long-distance pipelines. Furthermore, the adoption of Reinforced Thermoplastic Pipes (RTP) and Fiberglass Reinforced Plastic (FRP) is expanding, particularly in corrosive environments and non-metallic pipeline systems, offering superior longevity and resistance to chemical attack compared to traditional metallic options.

Coating technology represents a vital layer of innovation. Three-layer Polyethylene (3LPE) and Fusion Bonded Epoxy (FBE) remain industry standards, but research focuses on advanced internal flow coatings that reduce friction and improve pumping efficiency, thereby lowering energy costs. A significant technological shift involves smart pipeline infrastructure, integrating fiber optic sensing cables directly into the pipe wall or trench. These systems enable real-time detection of temperature changes, seismic activity, third-party intrusion, and strain, providing proactive damage assessment and significantly improving the speed and accuracy of leak detection, a core requirement for modern environmental stewardship.

Digitalization technologies, primarily involving the deployment of SCADA (Supervisory Control and Data Acquisition) systems, digital twins, and advanced In-Line Inspection (ILI) tools (often referred to as 'smart pigs'), are fundamental to the operational technology framework. Modern ILI tools utilize sophisticated magnetic flux leakage (MFL) and ultrasonic testing (UT) capabilities to generate highly accurate maps of pipeline defects. Integrating these inspection results with predictive modeling software (often AI-driven) enables pipeline operators to move from fixed inspection intervals to risk-based inspection strategies, optimizing maintenance expenditure and maximizing asset uptime throughout the pipeline’s engineered lifecycle.

Regional Highlights

The global Fuel Distribution Pipe Market is geographically diverse, with distinct regional dynamics driven by varying levels of infrastructure maturity, specific regulatory mandates, and regional energy demands. North America (NA), comprising the United States and Canada, represents one of the largest and most mature markets. Demand here is characterized not by massive new pipeline expansion, but primarily by mandatory replacement and rehabilitation projects, specifically targeting older, cast iron, and unprotected steel pipes within utility distribution grids. Furthermore, continued strong domestic oil and gas production, particularly from shale plays, necessitates ongoing investment in gathering and transmission infrastructure, regulated by strict governmental safety bodies like the Pipeline and Hazardous Materials Safety Administration (PHMSA).

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This acceleration is attributed to massive industrialization, soaring energy consumption, and significant governmental investment in expanding natural gas distribution networks across densely populated areas, particularly in China, India, and Southeast Asian nations. These countries are building out extensive transmission and distribution networks to shift from coal dependence toward cleaner natural gas and meet rapidly growing industrial and residential needs. Market activity here is characterized by demand for large-diameter, high-capacity pipelines, often financed through state-backed infrastructure initiatives.

Europe demonstrates a complex market dynamic, balancing robust requirements for maintaining existing distribution networks with ambitious decarbonization goals. While investment in traditional crude oil and large-scale gas pipelines is stable but cautious, the region is leading the way in preparing its infrastructure for the energy transition. Significant demand is being generated by projects focused on hydrogen readiness—upgrading or selecting new pipe materials (often HDPE or specialized steel alloys) that can handle hydrogen blending or pure hydrogen transport, crucial for achieving EU climate neutrality targets. Regulatory pressure regarding methane leakage also drives investment in modern, high-integrity distribution pipe systems.

The Middle East and Africa (MEA) region remains a significant global source of market revenue, driven by substantial upstream production and extensive export pipeline networks. Major pipeline projects in this region are often linked to increasing production capacity and enhancing export logistics efficiency. Gulf Cooperation Council (GCC) countries, in particular, continue to invest heavily in modernizing their vast oil and gas infrastructure, demanding high-specification steel pipes designed to withstand harsh desert conditions and corrosive sour gas environments. Africa's market growth is focused on realizing transnational pipeline projects aimed at monetizing untapped natural gas reserves and improving regional energy access.

- North America: Focus on integrity management, mandatory replacement of aging gas distribution lines, and sustained investment in gathering lines for unconventional energy resources.

- Asia Pacific (APAC): Highest volume growth driven by new pipeline construction for natural gas infrastructure expansion and urbanization in major economies.

- Europe: Driven by environmental regulation compliance, infrastructure upgrades for leakage prevention, and the transition toward hydrogen-ready gas networks.

- Middle East & Africa (MEA): Large-scale transmission projects linked to increased crude oil and natural gas production and export capacity enhancement, requiring high-specification materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Distribution Pipe Market.- ArcelorMittal

- Tenaris

- Vallourec

- Nippon Steel Corporation

- JFE Holdings Inc.

- Chelpipe Group (Pipes division)

- TMK Group

- Welspun Corp Ltd.

- EVRAZ

- PAO Severstal

- United States Steel Corporation

- Jindal SAW Ltd.

- Future Pipe Industries

- Pipelife International GmbH

- Aliaxis Group

- Georg Fischer AG

- Plasticon Composites

- Saudi Steel Pipe Company

- National Oilwell Varco (NOV)

- Salzgitter AG

Frequently Asked Questions

Analyze common user questions about the Fuel Distribution Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used in high-pressure fuel distribution pipelines?

The primary materials used in high-pressure, long-distance fuel distribution pipelines are high-strength low-alloy (HSLA) carbon steel and specialized alloy steel, manufactured according to stringent standards like API 5L, ensuring high durability, pressure capacity, and weldability essential for large transmission networks.

How is the market influenced by the global energy transition toward renewable sources?

The energy transition is influencing the market by shifting investment focus towards pipelines suitable for cleaner fuels. This includes increasing demand for pipes compatible with natural gas (as a transition fuel), and specifically for materials and coatings that can safely handle the transport of hydrogen blends or pure hydrogen, driving innovation in polymer and composite pipe segments.

What role does High-Density Polyethylene (HDPE) play in the fuel distribution sector?

HDPE pipes are crucial for municipal and local gas distribution networks (downstream segment) due to their superior resistance to corrosion, low installation costs, and flexibility. HDPE is rapidly replacing aging metallic pipes in urban grids, particularly for natural gas, contributing significantly to market volume growth.

Which geographical region is projected to experience the fastest market growth?

The Asia Pacific (APAC) region is projected to experience the fastest market growth, driven by rapid urbanization, industrial energy demand growth, and large-scale governmental investment in expanding natural gas transmission and city-level distribution infrastructure, notably in economies like China and India.

What are the key technologies implemented to enhance pipeline safety and integrity?

Key integrity technologies include advanced corrosion-resistant coatings (e.g., FBE, 3LPE), highly accurate In-Line Inspection (ILI) tools (smart pigs) utilizing MFL and UT, and integrated digital monitoring systems like fiber optic sensors and SCADA, enabling real-time leak detection and predictive maintenance based on structural modeling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager