Fuel Filler Pipes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433934 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fuel Filler Pipes Market Size

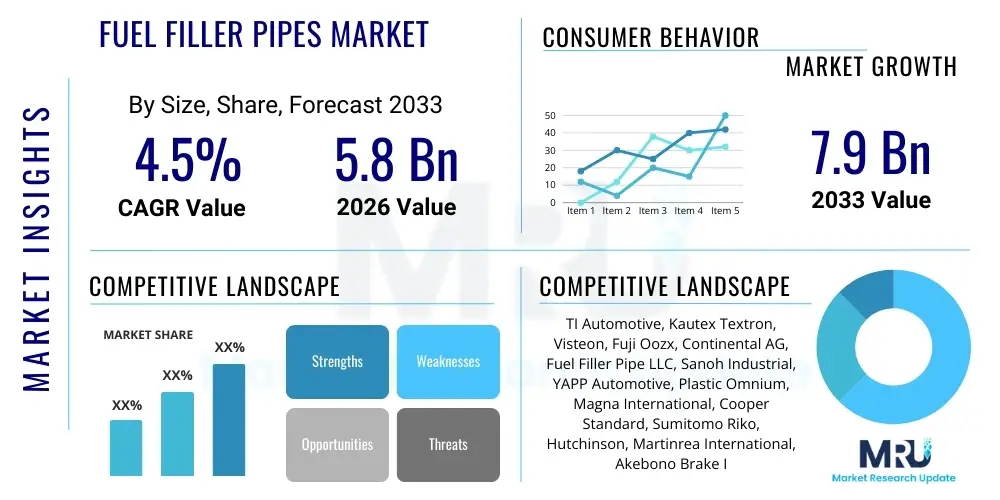

The Fuel Filler Pipes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% (CAGR) between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global production of automobiles, particularly in emerging economies, coupled with stringent environmental regulations focusing on evaporative emissions control, which necessitate advanced sealing and material technology in fuel systems.

Fuel Filler Pipes Market introduction

The Fuel Filler Pipes Market encompasses the design, manufacturing, and distribution of components that connect the fuel inlet cap to the fuel tank, facilitating safe and efficient refueling while minimizing the escape of hydrocarbon vapors. These critical automotive components have evolved significantly from basic metal tubes to sophisticated, multi-layered plastic assemblies, predominantly High-Density Polyethylene (HDPE), designed to meet rigorous standards for safety, durability, and most importantly, evaporative emission control. The primary function involves managing fuel flow dynamics, preventing splash-back, and integrating sensors and valves required for modern onboard diagnostics and emission systems (like ORVR - Onboard Refueling Vapor Recovery).

The transition from traditional steel filler neck pipes to plastic alternatives is a dominant theme in this market. Plastic fuel filler pipes offer substantial benefits in terms of weight reduction, corrosion resistance, and greater design flexibility, allowing automakers to optimize packaging space and comply with increasingly demanding fuel efficiency standards. Furthermore, the ability to co-extrude plastic pipes with barrier layers (such as EVOH or Nylon) significantly enhances their capacity to meet Zero Evaporative Emissions (ZEV) mandates, especially relevant in jurisdictions like California and Europe. This material substitution trend is a key driver underpinning market dynamics and technological investment.

Major applications of fuel filler pipes span the entire spectrum of vehicular transportation, including passenger cars, light commercial vehicles, heavy-duty trucks, and specialized off-road vehicles. Beyond basic functionality, the modern fuel filler pipe assembly often incorporates complex integrated systems, such as anti-siphoning mechanisms, fuel quality sensors, and capless refueling systems, enhancing user convenience and security. The market’s resilience is closely tied to global vehicle production volumes, regulatory frameworks governing vehicle safety and emissions, and the continuous push by OEMs for component lightweighting to improve overall vehicle performance and reduce carbon footprint.

- Product Description: Components connecting the external refueling port to the internal fuel storage tank, designed for safe fuel transfer and evaporative emissions containment.

- Major Applications: Passenger vehicles (sedans, SUVs, hatchbacks), Light commercial vehicles (LCVs), Heavy-duty vehicles (HDVs).

- Key Benefits: Enhanced safety (anti-siphoning), weight reduction (plastic assemblies), corrosion resistance, and compliance with strict evaporative emission standards (ORVR systems).

- Driving Factors: Global rise in vehicle manufacturing, stringent EPA and EU emission regulations (especially Tier 3 and Euro 6/7), and automaker focus on component lightweighting.

Fuel Filler Pipes Market Executive Summary

The Fuel Filler Pipes market is experiencing transformative growth, driven primarily by the global shift towards lighter materials and advanced compliance mechanisms necessitated by increasingly strict evaporative emission regulations across North America, Europe, and Asia Pacific. Business trends indicate a consolidation among Tier 1 suppliers who possess proprietary blow molding and co-extrusion technologies required for producing multi-layered plastic pipes with superior barrier properties. Key automotive OEMs are favoring standardized, modular designs that can be rapidly adapted across different vehicle platforms, thereby streamlining supply chains and reducing component complexity. Furthermore, the impending electrification trend is causing suppliers to rapidly pivot R&D efforts toward compatible filler necks for hybrid electric vehicles (HEVs) and preparing for eventual phase-out in Battery Electric Vehicles (BEVs), leading to strategic acquisitions focused on specialized production capabilities.

Regionally, Asia Pacific, particularly China and India, remains the dominant growth engine due to high volume production and escalating consumer demand for new vehicles, coupled with the introduction of stringent local emission standards (e.g., China 6, Bharat Stage VI). North America and Europe, while representing mature markets, are driving innovation through regulatory requirements like ORVR and demands for higher thermal stability and enhanced chemical compatibility required by biofuels and new fuel formulations. This duality in regional market focus—volume in APAC and technology in North America/Europe—necessitates distinct supply chain strategies, favoring localized manufacturing and rapid adaptation of material specifications based on regional fuel characteristics and climatic conditions. The competitive landscape is intensely focused on achieving zero-defect manufacturing capabilities and securing long-term contracts with major global OEM platforms.

Segment trends highlight the dominance of plastic (HDPE) materials over steel, accounting for the largest market share and exhibiting the highest CAGR, primarily due to cost-effectiveness and weight advantages crucial for meeting CAFÉ standards. The Passenger Vehicle segment maintains supremacy in volume, although the Commercial Vehicle segment is showing robust growth driven by replacement cycles and fleet modernization programs globally. In terms of sales channel, the OEM segment accounts for the vast majority of revenue, reflecting the critical integration and safety requirements of these components during initial vehicle assembly, although the aftermarket segment provides stable revenue streams driven by repair and accident replacement demands across an aging vehicle fleet base.

AI Impact Analysis on Fuel Filler Pipes Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fuel Filler Pipes Market frequently center on themes such as optimization of complex material blends, enhancing manufacturing quality control, and predicting supply chain disruptions. Users are particularly concerned with how AI can assist in the structural design of plastic components to minimize stress points and potential leak paths, especially when integrating multiple sensors and anti-siphoning valves within confined spaces. Furthermore, there is significant interest in leveraging machine learning algorithms for predictive maintenance of highly automated blow molding machinery, reducing downtime, and ensuring the tight tolerances required for vapor sealing mechanisms. The core expectation is that AI will significantly shorten design cycles and minimize waste material usage, thereby improving overall cost efficiency and quality compliance in high-volume production environments.

The application of AI in material science is revolutionizing the development of next-generation fuel filler pipes. Machine learning models can process vast datasets related to material compatibility with various fuels (including high-ethanol blends), thermal stress performance, and long-term degradation under dynamic vehicular conditions. This capability allows manufacturers to swiftly identify optimal plastic formulations (e.g., multilayered co-extrusions) that provide superior barrier properties against fuel vapor permeation while ensuring structural integrity over the vehicle’s lifespan. This optimization is crucial for meeting increasingly strict evaporative emission requirements without incurring excessive costs or adding unnecessary weight, effectively accelerating the transition from traditional, heavy materials.

In the manufacturing phase, AI-powered computer vision systems are deployed to conduct rapid, high-precision quality checks on every produced pipe. These systems can instantly detect microscopic flaws, inconsistent wall thickness, or welding defects that are virtually invisible to the human eye, ensuring zero-defect output essential for safety-critical fuel system components. Furthermore, AI optimizes production scheduling, managing complex tool changeovers and material inputs in multi-cavity molding processes, dramatically improving operational efficiency. By integrating AI across the design-to-manufacture spectrum, suppliers are not only achieving higher yields but are also gaining a competitive edge by offering demonstrably safer and more regulatory-compliant products.

- Design Optimization: AI algorithms used to simulate fluid dynamics and structural integrity of new pipe geometries, reducing iteration cycles and optimizing wall thickness for lightweighting.

- Material Informatics: Machine learning employed to identify optimal polymer blends (e.g., HDPE, EVOH barriers) for enhanced chemical resistance and vapor barrier performance.

- Quality Control: AI-driven vision systems perform real-time, non-destructive testing and defect detection in injection and blow molding processes, ensuring stringent safety standards.

- Predictive Maintenance: AI monitors molding machine parameters (temperature, pressure, cycle time) to forecast component failure, minimizing production downtime and maximizing throughput.

- Supply Chain Efficiency: AI tools predict demand fluctuations and optimize logistics for raw polymer resins and specialized additives, mitigating risks associated with commodity price volatility.

DRO & Impact Forces Of Fuel Filler Pipes Market

The dynamics of the Fuel Filler Pipes market are profoundly shaped by a combination of technological drivers, structural restraints, strategic opportunities, and powerful external impact forces originating primarily from regulatory bodies and the global push toward sustainability. The primary driver is the pervasive and tightening global emission control legislation, particularly the enforcement of ORVR (Onboard Refueling Vapor Recovery) systems which mandates the integration of complex vapor management components into the filler neck assembly, favoring suppliers with high-precision manufacturing capabilities. Simultaneously, the persistent industry-wide focus on vehicle lightweighting serves as a powerful accelerator, compelling OEMs to adopt lighter plastic systems over traditional steel, thereby driving innovation in multi-layer co-extrusion technology and composite materials.

However, the market faces significant restraints that temper its growth rate. The foremost structural impediment is the inherent complexity and high initial investment required for sophisticated plastic processing technologies, particularly those needed to ensure necessary barrier properties against fuel permeation, which raises the entry barrier for new competitors. Furthermore, the long-term uncertainty posed by the accelerating global transition towards Battery Electric Vehicles (BEVs) represents a substantial long-term threat, as BEVs completely eliminate the need for fuel filler pipes. While the current market for internal combustion engine (ICE) and hybrid vehicles remains robust, suppliers must manage the eventual decline in core product demand by diversifying technological expertise towards EV components or seeking opportunities in the expanding biofuel/alternative fuel vehicle sectors.

Opportunities for growth are abundant, particularly in emerging markets where rapid motorization is ongoing and local manufacturing is expanding. Specifically, the development and commercialization of capless refueling systems and highly integrated filler assemblies present opportunities for value addition and differentiation. Furthermore, the push for sustainable manufacturing practices, including the use of recycled or bio-based plastics in non-critical layers of the filler pipe, opens new avenues for market positioning and compliance with environmental goals. The combined impact forces—regulatory stringency, raw material price volatility, and the disruptive shift toward electrification—demand continuous innovation, forcing manufacturers to adopt agile R&D strategies and secure resilient global supply chains.

- Drivers: Stringent evaporative emission regulations (ORVR compliance), mandated vehicle lightweighting goals (CAFÉ standards), and increasing global vehicle production volumes, particularly in Asia.

- Restraints: High capital investment required for advanced plastic manufacturing and specialized tooling, performance reliability concerns related to plastic under extreme temperature fluctuations, and the long-term threat of BEV market penetration.

- Opportunities: Development of advanced capless refueling systems, expansion into high-growth emerging economies, and adoption of sustainable/recycled polymer materials in production.

- Impact Forces: Regulatory pressure (high), Technological obsolescence risk (medium-high), Raw material price fluctuation (high).

Segmentation Analysis

The Fuel Filler Pipes Market is meticulously segmented based on material type, vehicle type, and sales channel, providing a clear structural view of the industry landscape and underlying demand patterns. Material segmentation is arguably the most dynamic area, showcasing a definitive shift from traditional metal components to advanced polymer solutions. The functionality of the fuel filler pipe, intrinsically linked to vehicle safety and environmental compliance, dictates high barriers to entry and favors suppliers capable of meeting precise dimensional and chemical resistance specifications, regardless of the segment served. Understanding these segments is critical for manufacturers to tailor their production capabilities and material sourcing strategies.

The segmentation by material type reflects the industry’s continuous pursuit of weight reduction and enhanced corrosion resistance. While steel (often coated or galvanized) remains utilized in certain heavy-duty applications or specific regulatory environments, the plastic segment, dominated by High-Density Polyethylene (HDPE) and multi-layer co-extrusions, commands the highest growth rate. These advanced plastic pipes offer superior resistance to chemical degradation caused by modern fuels (especially E10/E85) and are essential for achieving the extremely low permeation rates required by current emission standards. The evolution within the plastic segment focuses on incorporating better barrier materials, such as EVOH or fluoropolymers, into the pipe structure.

In terms of vehicle application, the Passenger Vehicle segment represents the largest volume market globally, driven by mass production and shorter replacement cycles, leading to high-volume contracts for standardized components. Conversely, the Commercial Vehicle segment, encompassing buses and heavy trucks, typically requires larger, more robust, and often customized filler pipes, prioritizing durability and resistance to harsh operating conditions over marginal weight savings. The segmentation by sales channel underlines the market's structure: OEM sales dominate due to mandatory integration during assembly, whereas the aftermarket provides predictable, though smaller, revenue through replacement parts necessitated by collision damage, wear, or regulatory recalls.

- By Material Type:

- Steel/Metal (Galvanized Steel, Stainless Steel)

- Plastic/Polymer (HDPE, Co-extruded Multi-layer Pipes, Nylon)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Commercial Vehicles (CV)

- Heavy Duty Trucks (HDT)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (AM)

Value Chain Analysis For Fuel Filler Pipes Market

The value chain for the Fuel Filler Pipes Market is characterized by a sophisticated, tiered structure spanning from specialized raw material suppliers to final vehicle assembly plants. Upstream analysis focuses heavily on the procurement of specialized raw materials, primarily high-grade polymer resins (HDPE, PA, EVOH for barrier layers) and high-quality steel alloys. Price volatility and supply stability of these materials, which are largely dictated by the global petrochemical and steel industries, directly impact the profitability and pricing strategies of component manufacturers. Tier 2 suppliers are critical here, often specializing in compounding and supplying the specific polymer blends and additives required for achieving the high heat resistance and chemical compatibility mandated by automotive specifications.

The core manufacturing process, conducted by Tier 1 suppliers, involves complex transformation techniques such as blow molding, injection molding, and welding, followed by rigorous testing (pressure testing, permeation testing). This midstream phase demands significant capital expenditure on precision machinery and automation. Direct and indirect distribution channels define how these components reach the final buyer. Direct channels overwhelmingly involve Just-In-Time (JIT) delivery to major automotive OEM assembly lines globally, requiring highly efficient logistics and inventory management, often governed by long-term, fixed-price contracts. Product differentiation at this stage hinges on quality, weight reduction, and the ability to integrate sophisticated sensors and vapor management components.

Downstream analysis includes the integration of the filler pipe assembly into the overall fuel system during vehicle manufacturing and subsequent sales into the aftermarket. The aftermarket segment relies on indirect distribution through large independent repair garages, specialized distributors, and online parts retailers. For the aftermarket, inventory management, quick availability, and competitive pricing are the key competitive factors, often dealing with simpler, replacement-grade versions of the OEM components. The value capture is highest in the midstream, where proprietary manufacturing technology for multi-layer plastic pipes provides a substantial competitive advantage and margin opportunity.

Fuel Filler Pipes Market Potential Customers

The primary customer base for fuel filler pipes consists predominantly of Original Equipment Manufacturers (OEMs), who incorporate these components into newly manufactured vehicles. These OEMs, including global automotive giants such as Volkswagen Group, Toyota Motor Corporation, General Motors, and Ford Motor Company, represent the highest volume demand and are the most stringent regarding technical specifications, safety standards, and logistical adherence (JIT delivery). Their purchasing decisions are driven by long-term cost of ownership, compliance with global environmental regulations (like EPA and Euro standards), and the supplier’s capability to integrate complex sub-assemblies (e.g., ORVR components and capless systems) seamlessly into the vehicle platform architecture.

The secondary customer group comprises Tier 1 suppliers, who often purchase individual components (like specialized valves, sensors, or metal sub-assemblies) to integrate into their final fuel filler pipe systems before delivering the complete module to the OEM. While Tier 1 suppliers are often the manufacturers themselves, they also act as buyers for specialized, high-tech inputs. Furthermore, the Aftermarket segment represents a crucial, albeit smaller, revenue stream. Buyers in this segment include independent distributors, large retail auto parts chains, insurance companies, and repair workshops, seeking replacement parts for vehicles damaged in collisions or experiencing failures due to age or corrosion. Demand here is less sensitive to technological innovation and more focused on availability, cost-effectiveness, and compatibility with older vehicle models.

In the evolving landscape of mobility, emerging potential customers include specialist vehicle manufacturers focusing on niche markets, such as high-performance vehicles, agricultural machinery, and marine applications, all of which require customized fuel handling solutions. Furthermore, suppliers engaging in proprietary material development may also target raw material procurement teams within smaller OEMs or contract manufacturers looking for advanced, sustainable material solutions for their next-generation fuel systems. Meeting the diverse needs of these customer groups requires a highly flexible manufacturing setup capable of handling both high-volume standardized production and low-volume, high-specification customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TI Automotive, Kautex Textron, Visteon, Fuji Oozx, Continental AG, Fuel Filler Pipe LLC, Sanoh Industrial, YAPP Automotive, Plastic Omnium, Magna International, Cooper Standard, Sumitomo Riko, Hutchinson, Martinrea International, Akebono Brake Industry, Aisin Seiki Co., Tenneco Inc., Mann+Hummel, Delphi Technologies, Robert Bosch GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Filler Pipes Market Key Technology Landscape

The technological landscape of the Fuel Filler Pipes Market is dominated by advanced plastic processing techniques that enable the production of complex geometries with superior barrier properties. Key to this is the evolution of blow molding and co-extrusion processes. Modern blow molding technology allows manufacturers to create intricate, single-piece plastic filler necks that incorporate mounting brackets, vent tubes, and sensor ports, significantly reducing the number of potential leak points compared to traditional welded metal assemblies. The adoption of co-extrusion is critical for meeting stringent evaporative emission standards, enabling the creation of multi-layered structures where internal layers provide the necessary fuel vapor barrier (e.g., using EVOH or Nylon 6), while external layers provide structural strength and UV resistance. Continuous R&D focuses on optimizing these layers to maximize barrier efficiency while minimizing overall component weight.

A secondary, yet crucial, area of technological focus involves the integration of smart systems, particularly those related to vapor management and refueling automation. The rise of capless refueling systems (such as Ford’s Easy Fuel system) utilizes complex mechanisms integrated directly into the filler neck assembly, requiring precision engineering, advanced plastics, and sophisticated sealing technology to ensure hermetic closure and compliance with ORVR mandates. Furthermore, incorporating pressure sensors and fuel quality sensors into the filler pipe assembly is becoming standard practice, necessitating expertise in micro-electronics and reliable plastic-to-metal bonding techniques to maintain durability and functionality under extreme conditions. The successful implementation of these integrated systems defines the technological leadership within the market.

Material science innovation also plays a vital role. Suppliers are actively exploring high-performance composites and specialized polymer formulations that offer improved thermal stability and enhanced resistance to new-generation fuels, including high-octane racing fuels, biofuels (like B20 biodiesel), and future synthetic fuels. Welding technology has also advanced, particularly vibration and hot-plate welding methods, which are essential for securely joining different plastic components without compromising the internal barrier layers. Manufacturers that invest in precise, automated welding and assembly processes demonstrate superior quality control, which is paramount given the safety-critical nature of fuel system components. This holistic technological approach—combining advanced molding, integrated electronics, and specialized materials—is essential for sustained competitive advantage.

Regional Highlights

Regional dynamics in the Fuel Filler Pipes Market are highly differentiated, reflecting varying levels of vehicle production, emission regulations, and technological adoption rates across continents. Asia Pacific (APAC) dominates the market in terms of volume due to the immense scale of vehicle manufacturing in countries like China, India, Japan, and South Korea. This region is rapidly adopting global emission standards (e.g., China 6, BS VI), driving substantial investment in plastic filler pipe manufacturing capabilities to meet required evaporative controls. Growth is accelerating as local OEMs prioritize lightweighting and sophisticated fuel management systems.

North America and Europe represent mature markets characterized by innovation leadership and stringent regulatory demands. These regions were early adopters of ORVR standards, forcing a quick transition to advanced plastic multi-layer pipes. North America, driven by EPA and CARB regulations, emphasizes barrier performance and the integration of sophisticated diagnostic components. Europe, influenced by Euro 6/7 standards and a strong focus on fleet efficiency, drives demand for maximum lightweighting and modular, customizable filler assemblies suitable for hybrid and alternative fuel vehicles. The competitive intensity is high, focusing on securing supply contracts for high-value, integrated systems.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering moderate growth potential. LATAM markets are slowly tightening emission controls, creating demand for cost-effective, durable plastic solutions. MEA remains highly dependent on vehicle imports and localized assembly, leading to demand for replacement parts and basic OEM components, though increasing urbanization and economic development suggest future adoption of more advanced standards, particularly in GCC countries.

- Asia Pacific (APAC): Market volume leader; driven by high vehicle production (China, India) and accelerating adoption of stringent emissions standards (e.g., China 6 and BS VI implementation). Focus on mass production of plastic filler necks.

- North America: Technology leader; driven by strict EPA and California Air Resources Board (CARB) regulations, especially those related to Onboard Refueling Vapor Recovery (ORVR). High demand for integrated, complex assemblies.

- Europe: Innovation hub; strong regulatory push (Euro 6/7) favoring lightweight materials and modular systems for compliance with fuel efficiency mandates and the integration of components for hybrid vehicles.

- Latin America (LATAM): Growth market; increasing vehicle parc and gradual tightening of emission standards create demand for reliable, cost-effective plastic and durable metal filler pipes.

- Middle East & Africa (MEA): Emerging market; growth tied to vehicle imports and localized assembly operations; increasing infrastructure development expected to slowly accelerate demand for modern fuel systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Filler Pipes Market.- TI Automotive

- Kautex Textron

- Visteon

- Fuji Oozx

- Continental AG

- Fuel Filler Pipe LLC

- Sanoh Industrial

- YAPP Automotive

- Plastic Omnium

- Magna International

- Cooper Standard

- Sumitomo Riko

- Hutchinson

- Martinrea International

- Akebono Brake Industry

- Aisin Seiki Co.

- Tenneco Inc.

- Mann+Hummel

- Delphi Technologies

- Robert Bosch GmbH

Frequently Asked Questions

Analyze common user questions about the Fuel Filler Pipes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced fuel filler pipes?

The most significant driver is the implementation of global evaporative emission regulations, specifically Onboard Refueling Vapor Recovery (ORVR) standards, which necessitate multi-layered, low-permeation plastic pipes to minimize hydrocarbon vapor leakage during and after refueling operations.

How does the shift from steel to plastic impact the market?

The transition to High-Density Polyethylene (HDPE) and co-extruded plastic pipes significantly reduces vehicle weight, improves corrosion resistance, offers greater design flexibility, and enables compliance with stringent emission standards due to superior vapor barrier properties, ultimately supporting fuel efficiency goals.

Which material segment holds the highest growth potential in the forecast period?

The Plastic/Polymer material segment is projected to exhibit the highest CAGR, primarily because plastic assemblies are essential for meeting current regulatory requirements for evaporative emissions and addressing the automotive industry's continuous need for lightweighting across passenger and commercial vehicle platforms.

What is the major long-term threat facing manufacturers in this market?

The primary long-term threat is the accelerated global adoption of Battery Electric Vehicles (BEVs), which require no fuel systems, leading to eventual market contraction for traditional fuel filler pipe manufacturers, forcing suppliers to diversify into high-voltage battery components or fluid management systems for HEVs.

What role does technology play in modern fuel filler pipe design?

Technology focuses on integrated systems, including capless refueling mechanisms and the incorporation of sensors for fuel monitoring and vapor pressure management, utilizing advanced manufacturing processes like precision blow molding and AI-enhanced quality control to ensure flawless, sealed assemblies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager