Fuel home generator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432971 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fuel home generator Market Size

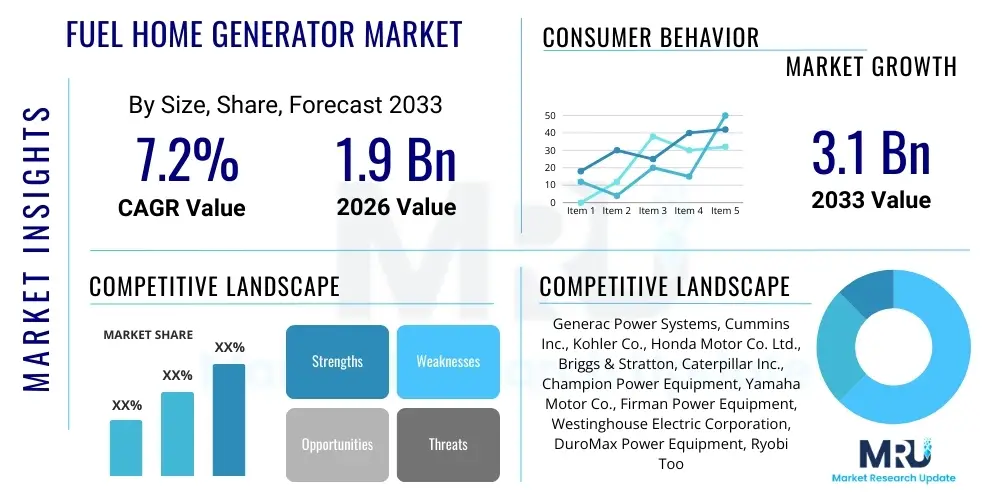

The Fuel home generator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Fuel home generator Market introduction

The Fuel Home Generator Market encompasses all devices designed to provide emergency or supplemental electrical power to residential structures, utilizing various fossil fuels such as gasoline, diesel, propane (LPG), or natural gas (NG). These generators are essential assets for homeowners facing increasing frequency and duration of power outages caused by severe weather events, grid instability, or utility infrastructure failures. The core product categories include portable generators, which offer flexibility and moderate power output, and stationary (standby) generators, which provide seamless, automated backup power integrated directly into the home's electrical system, often preferred for critical loads and long-duration outages.

The primary applications of these generators are focused on maintaining essential home functions during grid failure, including powering critical medical devices, HVAC systems, refrigerators, communication equipment, and lighting. Beyond emergency backup, certain smaller, portable units are also used for recreational purposes or as remote power sources for DIY projects. The significant benefits derived from these products include energy independence, protection against costly food spoilage, maintenance of comfortable living conditions, and crucial security system operation, thereby enhancing the overall resilience and safety of the modern household.

Driving factors for sustained market growth include escalating consumer awareness regarding climate change-related power disruptions and the increasing penetration of smart home technologies requiring uninterrupted power supply. Furthermore, favorable regulatory environments in certain regions, incentivizing disaster preparedness, alongside advancements in cleaner burning engines and inverter technology that reduces noise and improves fuel efficiency, contribute significantly to market expansion. The shift towards larger, automated standby units, particularly those fueled by natural gas due to its continuous supply capability, is a key trend shaping current market dynamics.

Fuel home generator Market Executive Summary

The Fuel Home Generator Market is currently experiencing robust growth driven by escalating grid vulnerability and demographic shifts toward suburban living where infrastructure reliability can be variable. Business trends highlight a strong competitive focus on product differentiation through noise reduction, extended runtime capabilities, and integration of IoT features allowing remote monitoring and diagnostics. Major manufacturers are investing heavily in hybrid fuel systems and dual-fuel generators to offer consumers greater flexibility and resilience against supply chain disruptions affecting single fuel sources. Furthermore, the expansion of dealer networks and comprehensive maintenance plans is critical for capturing the lucrative standby generator segment.

Regional trends indicate North America maintaining market dominance, propelled by frequent natural disasters (hurricanes, ice storms, wildfires) and a high disposable income enabling investment in premium standby systems. Asia Pacific, particularly developing economies, shows the fastest growth, primarily driven by urbanization, inadequate public power infrastructure, and increasing affordability of mid-range portable generators. European market growth is steady, focusing on highly efficient, low-emission generators compliant with stringent environmental regulations (e.g., Stage V standards for certain diesel units), often prioritizing quiet operation suitable for dense residential areas.

Segment trends reveal that the Natural Gas and Propane fuel segments are overtaking gasoline in the standby category due to superior convenience and safety, aligning with long-term residential infrastructure preferences. In terms of power output, the 10 kW to 20 kW range is witnessing significant uptake as modern homes demand higher capacity to run central air conditioning and multiple appliances simultaneously. Technology trends emphasize inverter technology, which delivers cleaner power essential for sensitive electronics, and automated transfer switches (ATS) that ensure seamless transition between utility power and backup power, enhancing user experience and minimizing downtime.

AI Impact Analysis on Fuel home generator Market

Common user questions regarding the impact of Artificial Intelligence (AI) often revolve around optimizing generator performance, predicting maintenance needs, and integrating generators smoothly into smart home ecosystems and future grid architectures. Users seek assurance that AI can reduce operating costs, extend generator lifespan, and proactively alert them to potential failures. Key themes center on predictive diagnostics—moving from reactive maintenance to preventative scheduling—and advanced load management. Consumers are highly interested in how AI can learn household usage patterns to automatically prioritize critical loads when running on backup power, thereby maximizing efficiency and runtime during extended outages. Concerns often touch upon the cybersecurity risks associated with IoT-enabled generators and the complexity of setting up and managing AI-driven systems.

- AI-Powered Predictive Maintenance (PdM): Algorithms analyze vibration, temperature, and oil pressure data in real-time to predict component failure, reducing unexpected downtime and maintenance costs.

- Optimized Fuel Efficiency: AI manages engine speed and output based on real-time load requirements, minimizing fuel consumption compared to traditional fixed-speed generators.

- Smart Load Management: AI systems learn typical household energy consumption patterns and dynamically adjust power allocation, ensuring critical circuits remain operational longer during outages.

- Remote Diagnostics and Control: Integration with AI allows for sophisticated remote troubleshooting, system health checks, and automatic firmware updates, reducing the need for manual service calls.

- Enhanced Cybersecurity: AI models are used to detect anomalous operational patterns, potentially signaling cyber intrusion attempts on connected generator control systems.

- Seamless Grid Synchronization (Future): Advanced AI could facilitate the potential future integration of home generators into virtual power plants (VPPs) for grid stabilization during peak demand.

DRO & Impact Forces Of Fuel home generator Market

The Fuel Home Generator Market is fundamentally shaped by a set of dynamic Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Major drivers include the growing susceptibility of centralized power grids to severe weather, coupled with rapid residential expansion and the proliferation of sensitive electronic equipment that cannot tolerate power interruptions. These forces create a compelling necessity for reliable, independent backup power solutions. Simultaneously, the market faces significant restraints, primarily stemming from stringent environmental regulations concerning engine emissions and noise pollution, particularly in densely populated urban and suburban areas, which necessitate costly technological upgrades (e.g., advanced catalytic converters and sound attenuation enclosures).

Opportunities for growth are concentrated in the rapid adoption of natural gas and propane standby generators, benefiting from readily available piped infrastructure, and the development of sophisticated inverter technology providing cleaner, more stable power. The integration of IoT capabilities and AI-driven predictive maintenance represents a key avenue for manufacturers to add value and justify premium pricing, moving the market beyond basic power provision toward comprehensive energy resilience solutions. Furthermore, increasing consumer interest in dual-fuel and tri-fuel options provides market participants with ways to mitigate fuel supply dependency risks.

The collective impact forces favor specialized, technologically advanced standby units. While the initial cost of standby generators and installation can be a significant restraint, the perceived value of continuous, automated power during emergencies offsets this for high-income homeowners. The balance between environmental compliance (restraint) and technological innovation (opportunity) pushes manufacturers towards smaller, quieter, and cleaner-burning engines, ensuring the market remains robust despite environmental pressures. Grid instability serves as the primary external impact force continually fueling demand.

Segmentation Analysis

The Fuel Home Generator Market is highly segmented across several key dimensions, providing clarity on consumer preferences and manufacturing specialization. Segmentation by power rating determines application suitability, ranging from small portable units for basic essentials to large standby units capable of whole-house power. Segmentation by fuel type reflects operational logistics and environmental priorities, with a noticeable shift toward cleaner, more convenient fuels like natural gas. Finally, the division between portable and stationary units defines usage patterns—flexibility versus automated resilience—and significantly impacts pricing and installation complexity, forming the backbone of market analysis and competitive strategy.

- By Fuel Type:

- Gasoline

- Diesel

- Natural Gas

- Propane (LPG)

- Dual-Fuel/Tri-Fuel

- By Power Rating:

- Less than 5 kW

- 5 kW to 10 kW

- 10 kW to 20 kW

- Above 20 kW

- By Product Type:

- Portable Generators (Conventional, Inverter)

- Stationary (Standby) Generators

- By End User:

- Residential (Single-family homes, Multi-family residences)

Value Chain Analysis For Fuel home generator Market

The value chain for the Fuel Home Generator Market begins with upstream analysis, which involves the sourcing and processing of core components. This segment is dominated by raw material suppliers (steel, copper, aluminum) and specialized engine and alternator manufacturers. Key upstream activities include the design and manufacturing of specialized combustion engines (often customized for low noise and high reliability), sophisticated alternators capable of producing stable electrical output, and control panels containing the necessary automation and safety electronics. Efficiency in this stage relies heavily on securing reliable suppliers for high-quality, regulation-compliant engines (e.g., meeting EPA and CARB standards), making engine component standardization and cost management critical competitive factors.

The downstream analysis focuses on the distribution, installation, and after-sales service phases, representing the points of direct consumer engagement. Distribution channels are varied, incorporating direct sales through specialized dealership networks, large retail home improvement stores (e.g., Home Depot, Lowe’s), and increasingly, e-commerce platforms for portable units. For stationary standby generators, the value chain is highly reliant on certified electricians and HVAC professionals for safe and compliant installation, which often includes gas line hookups and automatic transfer switch integration. After-sales service, including maintenance contracts and spare parts availability, is paramount, particularly for standby units where reliability is the core value proposition.

Both direct and indirect distribution channels play crucial roles, though their importance varies by product type. Direct sales via exclusive dealerships often handle high-value, complex standby systems, offering comprehensive consultation, installation, and dedicated servicing, ensuring professional installation quality. Indirect channels, primarily big-box retail and online marketplaces, dominate the high-volume portable generator segment, emphasizing ease of purchase and consumer accessibility. The efficiency of the overall value chain hinges on manufacturers maintaining strong relationships with specialized installers (downstream) and engine suppliers (upstream) while streamlining logistics to manage fluctuating seasonal demand associated with storm readiness.

Fuel home generator Market Potential Customers

The potential customers for the Fuel Home Generator Market are primarily defined by their location, susceptibility to power interruptions, and disposable income necessary for investment in backup solutions. Geographically, potential buyers are concentrated in areas prone to extreme weather events such as coastal regions affected by hurricanes, northern areas susceptible to ice storms, and western regions facing wildfire-related power shutoffs (Public Safety Power Shutoffs - PSPS). This demographic highly values reliability and often opts for high-capacity, automated standby units, particularly those requiring continuous operation of medical equipment or sophisticated climate control.

Furthermore, potential customers include affluent suburban homeowners and those living in rural areas where utility infrastructure is less robust or repair times are longer. These buyers seek the convenience and peace of mind provided by permanent installations that automatically restore power. While portable generator users typically represent a more budget-conscious segment or those requiring occasional power for non-critical loads, even this group is increasingly upgrading to inverter technology for better fuel efficiency and quiet operation.

Ultimately, the core end-user/buyer profile is a residential property owner seeking energy resilience, minimizing disruption to daily life, and protecting high-value assets during utility grid failures. The increasing reliance of modern homes on connected technology, security systems, and high-efficiency appliances ensures that the customer base for whole-house backup solutions continues to expand across all major economic brackets where reliable power is considered essential, not just a luxury.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Generac Power Systems, Cummins Inc., Kohler Co., Honda Motor Co. Ltd., Briggs & Stratton, Caterpillar Inc., Champion Power Equipment, Yamaha Motor Co., Firman Power Equipment, Westinghouse Electric Corporation, DuroMax Power Equipment, Ryobi Tools, Mi-T-M Corporation, Winco Generators, SDMO Industries (Kohler Group), Multiquip Inc., Generac Mobile Products, Eaton Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel home generator Market Key Technology Landscape

The Fuel Home Generator market's technological landscape is evolving rapidly, centered primarily on improving power quality, efficiency, noise reduction, and smart integration. Inverter technology represents one of the most significant advancements. Unlike traditional conventional generators that operate at a fixed, high RPM regardless of the load, inverter units convert high-frequency AC power into stable DC power and then invert it back to clean AC power. This process allows the engine speed to throttle according to the demand, resulting in considerably improved fuel economy, significantly lower noise levels, and the production of "clean power" (low total harmonic distortion, THD), which is crucial for safely operating sensitive modern electronics and appliances.

Another crucial technological development is the pervasive integration of IoT and smart monitoring capabilities. Modern generators, particularly standby models, are equipped with Wi-Fi or cellular modules that allow homeowners to monitor generator status, fuel levels, maintenance alerts, and operational history remotely via smartphone applications. This technological shift facilitates predictive maintenance by allowing service technicians to diagnose issues before they cause failure, significantly enhancing reliability and customer peace of mind. Furthermore, these smart systems enable seamless interaction with Automatic Transfer Switches (ATS), ensuring rapid and safe disconnection from the utility grid and connection to the home circuit during outages without manual intervention.

Future technology focuses heavily on achieving higher efficiency and meeting stringent emissions standards. This includes the development of highly advanced engine management systems (EMS) that precisely control fuel injection and ignition timing. Furthermore, the market is seeing increased research into optimized hybrid systems combining fuel generation with battery storage (e.g., pairing a natural gas generator with a home battery system). This hybridization allows the generator to run only during optimal charging windows or when sustained high power is needed, relying on the battery for short cycling or low-load operation, thereby further reducing fuel consumption, noise, and environmental impact while ensuring superior power resilience.

Regional Highlights

- North America: This region maintains the largest market share, driven by a high frequency of large-scale weather-related power outages, strong consumer propensity for disaster preparedness, and significant infrastructure for natural gas delivery which favors the adoption of standby units. Key countries like the United States have robust sales, particularly in the coastal and hurricane-prone areas (Southeast) and regions experiencing severe winter weather (Northeast and Midwest).

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR, primarily due to inconsistent public utility infrastructure in rapidly urbanizing economies like India and Southeast Asia. The demand is heavily focused on portable and small-to-mid-range diesel and gasoline generators, essential for both residential emergency backup and small commercial operations. Increasing disposable incomes are beginning to drive interest in cleaner, more efficient inverter technology.

- Europe: The European market is characterized by strict environmental regulations regarding noise and emissions (Euro V standards). Market growth is steady, emphasizing high efficiency, low-noise portable and compact stationary generators. Demand is often localized based on specific climate vulnerabilities, such as heavy snow load regions or areas with older, less reliable grid infrastructure. Germany, the UK, and France are key markets focusing on quality and compliance.

- Latin America: Growth in this region is motivated by widespread power quality issues, frequent load shedding, and localized outages. The market predominantly relies on robust, cost-effective gasoline and diesel portable units. Economic volatility sometimes restrains major investments in high-cost standby systems, though middle-to-high income households are increasingly adopting reliable backup power solutions.

- Middle East and Africa (MEA): Market demand is highly influenced by climate conditions, particularly the need for reliable power to support continuous air conditioning in extreme heat, and infrastructural deficits in developing African nations. Diesel remains a dominant fuel type due to its accessibility and high energy density, although safety concerns are prompting greater adoption of gas-fueled options in residential zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel home generator Market.- Generac Power Systems

- Cummins Inc.

- Kohler Co.

- Honda Motor Co. Ltd.

- Briggs & Stratton

- Caterpillar Inc.

- Champion Power Equipment

- Yamaha Motor Co.

- Firman Power Equipment

- Westinghouse Electric Corporation

- DuroMax Power Equipment

- Ryobi Tools (Techtronic Industries Co. Ltd.)

- Mi-T-M Corporation

- Winco Generators

- SDMO Industries (A Kohler Company)

- Multiquip Inc.

- A-iPower Corp.

- Himoinsa (Yanmar Group)

Frequently Asked Questions

Analyze common user questions about the Fuel home generator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between portable and standby fuel home generators?

Portable generators require manual start-up, connection via extension cords, and manual refueling, offering flexible but limited power. Standby (stationary) generators are permanently installed, automatically activate upon detecting a power outage via an Automatic Transfer Switch (ATS), and run off a continuous fuel source like natural gas or large propane tanks, providing seamless, whole-house power resilience.

Which fuel type is considered the most reliable for long-duration residential power outages?

Natural gas (NG) is generally considered the most reliable for extended outages, especially in cold weather, as it is supplied via underground utility lines, making it less susceptible to freezing or supply chain disruptions affecting gasoline, diesel, or propane deliveries during widespread disasters.

How does inverter technology improve home generator performance?

Inverter technology produces significantly cleaner power with low Total Harmonic Distortion (THD), making it safe for sensitive electronics. It also improves fuel efficiency and drastically reduces noise levels by adjusting the engine speed precisely to match the electrical load demand, unlike traditional generators that run constantly at high RPMs.

What is the typical lifespan and required maintenance schedule for a home standby generator?

A well-maintained home standby generator can last 20 to 30 years. Routine maintenance typically requires annual checks involving oil and filter changes, spark plug inspection, and system tests, often recommended every 100-200 operational hours or annually, whichever comes first, to ensure reliable performance.

Are fuel home generators compatible with solar power or battery storage systems?

Yes, many modern installations integrate fuel generators with solar and battery systems (hybrid setups). The generator often acts as a backup charger for the battery bank when solar input is insufficient, ensuring maximum system resilience and reducing generator run time, especially during times of high energy demand or prolonged darkness.

What regulations govern the use and emissions of residential fuel generators?

Residential generators are subject to stringent regulations from bodies such as the U.S. Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) regarding exhaust emissions (CO, NOx, hydrocarbons). Noise emission standards are also critical, particularly in dense urban areas, driving manufacturers to invest heavily in sound attenuation technology and specialized enclosures to meet local ordinances.

How does the integration of IoT affect the consumer experience of owning a generator?

IoT integration allows for unprecedented remote monitoring and control. Consumers receive real-time alerts about system status, fuel levels, and maintenance needs directly on their smart devices. This capability significantly enhances peace of mind, enables proactive troubleshooting by service providers, and ensures the generator is always ready to run when needed, moving maintenance from reactive to predictive.

Why is the 10 kW to 20 kW power rating segment seeing high growth?

The 10 kW to 20 kW range represents the optimal balance for modern homes, capable of simultaneously running essential appliances along with central air conditioning or heating systems. This capacity meets the needs of most suburban single-family residences that seek to maintain near-normal living standards during extended outages, driving its popularity over lower-capacity units.

What are the key safety considerations when installing a natural gas standby generator?

Key safety considerations include professional installation adhering to local codes, proper sizing of the natural gas line to ensure sufficient fuel supply under load, and mandatory placement away from windows and doors to prevent carbon monoxide infiltration. Standby units must also be connected via a certified Automatic Transfer Switch (ATS) to prevent back-feeding electricity into the utility lines, protecting utility workers.

How is climate change influencing consumer purchasing decisions in this market?

Increased frequency and intensity of climate-related severe weather events (hurricanes, heatwaves, heavy snow) directly translate into greater grid vulnerability. This elevated risk is compelling homeowners, particularly those in high-risk zones, to view standby generators not as a luxury, but as essential infrastructure for safety, health, and maintaining climate control, thereby accelerating market demand.

What role do service networks play in the competitive landscape for standby generators?

Service networks are a crucial differentiator. Because standby units are high-investment assets requiring professional installation and annual maintenance, manufacturers with extensive, certified dealer and service networks offer superior assurance of reliability and quick repair times. This level of post-sales support significantly influences the purchasing decision for high-value standby systems.

How are dual-fuel and tri-fuel generator systems addressing fuel dependency risks?

Dual-fuel (typically gasoline and propane) and tri-fuel systems provide operational flexibility by allowing the unit to run on multiple types of fuel. This diversification mitigates the risk associated with supply disruptions affecting a single fuel source during a crisis, enhancing the generator's overall utility and resilience, particularly in areas where fuel access might be challenging post-disaster.

What is the significance of the Automatic Transfer Switch (ATS) in generator operation?

The ATS is critical for the seamless operation of stationary generators. It monitors utility power; if power fails, it signals the generator to start and then safely transfers the electrical load from the utility line to the generator. When utility power resumes, the ATS switches the load back and signals the generator to shut down, ensuring safe and hands-free operation.

How do advancements in material science affect generator noise reduction?

Advancements in acoustic dampening materials, specialized enclosure designs (often featuring corrosion-resistant aluminum or composite materials), and sophisticated muffler technology are essential for meeting stringent noise regulations. These materials absorb engine vibration and sound waves, significantly reducing the decibel levels produced, a critical factor for residential acceptance.

Beyond home backup, what other residential uses are driving the portable generator segment?

Portable generators are widely used for recreational activities such as RV trips, camping, and tailgating, providing power far from grid connections. They are also commonly utilized by homeowners for power tool operation during construction or landscaping projects in areas where temporary, mobile power is needed, valuing flexibility and compact design.

What barriers restrict the widespread adoption of diesel generators in residential settings?

Residential adoption of diesel generators is restricted primarily by higher noise levels, the need for regular fuel rotation (to prevent gelling or contamination), higher purchase cost, and larger physical footprint compared to natural gas or propane units. Emissions regulations are also stricter for diesel engines, driving homeowners towards cleaner alternatives.

How do manufacturers cater to the demand for sustainable and green energy solutions?

Manufacturers are responding by prioritizing natural gas and propane units (which burn cleaner than gasoline or diesel), incorporating advanced emission control systems, and developing hybrid solutions that use generators in conjunction with battery storage. This approach minimizes generator runtime and overall carbon footprint while maintaining reliable backup power capability.

What are the implications of smart grid development on the future of home generators?

While smart grids aim to increase utility resilience, home generators can potentially be integrated into Virtual Power Plants (VPPs). During peak demand or grid stress, VPPs could leverage networked home generators (with homeowner consent) to feed small amounts of power back into the grid, transforming them from passive assets into active, contributing components of the distributed energy infrastructure.

How significant is corrosion resistance in generator design, particularly for coastal markets?

Corrosion resistance is critically important, especially in coastal areas exposed to salt spray and high humidity, which can degrade metal components rapidly. Manufacturers use powder-coated aluminum enclosures, specialized anti-corrosion treatments, and high-quality internal wiring to ensure long-term durability and maintain the operational integrity of the unit in harsh environments.

What factors determine the appropriate power rating (kW) needed for a residential generator?

The necessary power rating is determined by conducting a comprehensive load assessment (or energy audit) of the home. This calculation identifies all critical appliances (HVAC, well pumps, refrigerators, medical equipment) and their respective starting (surge) and running (continuous) wattage requirements. The generator must be rated to handle the largest starting load while simultaneously supplying continuous power to all other essential items.

Why is the residential market favoring inverter generators over conventional portable units?

The market preference stems from the superior power quality, lower noise output, and higher fuel efficiency of inverter generators. Modern homes rely heavily on sensitive electronics (computers, smart TVs), which require the stable, clean sine wave power provided by inverter technology, making them a safer and more desirable investment than conventional models.

How do economic fluctuations influence market demand for fuel home generators?

Demand for high-cost standby generators can be sensitive to macroeconomic downturns, as they represent significant discretionary spending. However, the portable segment often remains robust or even increases during economic uncertainty, as consumers prioritize basic, affordable emergency preparedness. Overall demand remains resilient due to the non-negotiable need for backup power during critical weather events.

What are the key technological advancements expected in generator engine design over the next five years?

The next five years will see further refinement in highly efficient, turbocharged, and electronically governed engines, primarily aimed at reducing emissions and improving fuel consumption without sacrificing power output. There will also be greater incorporation of digital control modules for real-time diagnostics and optimization, enhancing their lifecycle and environmental footprint.

What safety features are standard on modern fuel home generators?

Modern generators include essential safety features such as automatic low oil shutdown (to prevent engine damage), circuit breakers for overload protection, spark arrestors, and CO Shield technology (for portable units) that automatically shuts down the generator if dangerous levels of carbon monoxide accumulate in the operating area, significantly improving user safety.

How does the consumer decision-making process differ between purchasing a portable unit versus a standby unit?

The portable unit decision is transactional, focusing on immediate need, price, and fuel portability. The standby unit decision is consultative, involving long-term planning, contractor quotes, permitting, fuel source selection, professional installation, and a deeper assessment of perceived long-term value and automated resilience.

In which regional market are diesel generators still strongly preferred, and why?

Diesel generators retain strong preference in certain parts of Asia Pacific and the Middle East and Africa (MEA), primarily due to the widespread availability and lower cost of diesel fuel in these regions, its high energy density suitable for long runtimes, and the inherent robustness of diesel engines in demanding, continuous operation scenarios.

How do warranty and service contracts affect the overall cost of ownership for a standby generator?

While warranty and service contracts add to the initial investment, they significantly reduce the long-term cost of ownership by covering major component failures and ensuring timely, professional maintenance. This minimizes the risk of catastrophic failure and maximizes the generator's operational lifespan, providing crucial financial predictability.

What impact does the increasing adoption of electric vehicles (EVs) have on home generator requirements?

The rise of EVs significantly increases baseline household electrical demand. This pushes homeowners toward larger standby generators (e.g., above 20 kW) capable of handling the substantial continuous load required for charging an EV, in addition to running the house's essential systems, requiring greater investment in power capacity.

What are the environmental trade-offs between using natural gas versus propane for standby power?

Natural gas (NG) offers a continuous supply and generally lower operational emissions (CO2). However, propane (LPG) is more energy-dense, making it a highly efficient fuel to store on-site in large tanks, offering better long-term storage stability and use in areas without NG piping, though it requires delivery and storage management.

How do different noise classifications (e.g., open frame vs. enclosed) influence market appeal?

Open-frame generators are cheaper but much louder, appealing to budget-conscious users or those in remote areas. Enclosed (silent or super-quiet) generators, often utilizing inverter technology and acoustic dampening, command a premium price but are strongly preferred by suburban and dense residential users due to their minimal operational noise footprint, adhering to community regulations.

What role does government policy play in stimulating or restricting market growth?

Government policies are dual-edged: incentives (like tax credits for disaster preparedness or local installation subsidies) stimulate demand. Conversely, stringent regulations on emissions (EPA/CARB) and noise often restrict the sale of older or less-efficient models, forcing manufacturers to innovate, which can increase product cost.

What is the current market focus regarding generator connectivity and home automation systems?

The current market focus is on achieving seamless integration. Modern generators can communicate with smart home hubs to inform homeowners about power status, prioritize loads automatically based on pre-set algorithms, and even interface with other smart appliances, making the generator a true component of the integrated home energy management system rather than an isolated backup device.

How does the risk of wildfires in regions like California impact generator sales trends?

Wildfire risks lead to increased utility-initiated Public Safety Power Shutoffs (PSPS), which are mandatory, planned outages used to prevent grid lines from sparking fires during high wind conditions. This predictable but prolonged absence of power significantly boosts demand for standby generators capable of operating reliably for days or weeks at a time.

Why is copper winding preferred over aluminum winding in high-quality generator alternators?

Copper winding is preferred for high-quality, continuous-duty alternators due to its superior electrical conductivity, higher heat resistance, and greater durability. While aluminum is lighter and cheaper, copper windings result in less power loss, higher efficiency, and better surge handling capability, essential for starting heavy motors like HVAC units.

What measures are manufacturers taking to enhance the user-friendliness of complex standby systems?

Manufacturers are enhancing user-friendliness through intuitive, digital control panels with touchscreen interfaces, mobile apps for remote monitoring and diagnostics, and simplified installation protocols that reduce the complexity required by certified installers. Automated testing features also ensure the unit is exercised weekly without user input.

How do competitive strategies differ between market leaders (e.g., Generac) and specialized niche players?

Market leaders focus on comprehensive product portfolios, extensive dealer networks, and technological integration (AI, IoT) across a wide range of power outputs. Niche players often specialize in specific fuel types (e.g., highly optimized diesel units) or applications (e.g., ultra-quiet inverter models), differentiating themselves through superior performance in a specific segment rather than broad market dominance.

What are the implications of rising commodity prices (steel, copper) on the final consumer price of generators?

Rising commodity prices directly increase the manufacturing cost of essential components like engines, alternators, and enclosures, leading to higher final consumer prices. This is particularly noticeable in the heavy-duty standby generator segment, which relies on large volumes of steel and copper.

What is the typical warranty period offered for major home standby generator brands?

Most major home standby generator brands offer standard warranties ranging from 3 to 5 years, often with options to purchase extended warranties up to 7 or 10 years. The warranty typically covers parts and labor related to manufacturing defects in the engine, alternator, and control systems.

How is the rental market for generators affecting permanent purchase trends?

The rental market serves temporary, acute needs (e.g., during construction or immediate post-disaster cleanup). While rentals satisfy short-term demand, they paradoxically reinforce the need for permanent solutions, as rental units are often scarce and expensive during widespread, prolonged power outages, motivating homeowners to invest in their own standby power source.

What are the primary challenges facing manufacturers in meeting escalating emission standards globally?

Manufacturers face the challenge of developing complex, costly emission control technologies (such as three-way catalytic converters or advanced electronic fuel injection) that must maintain efficiency and reliability while being integrated into compact residential units, often without significantly increasing the generator's size or retail price.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager