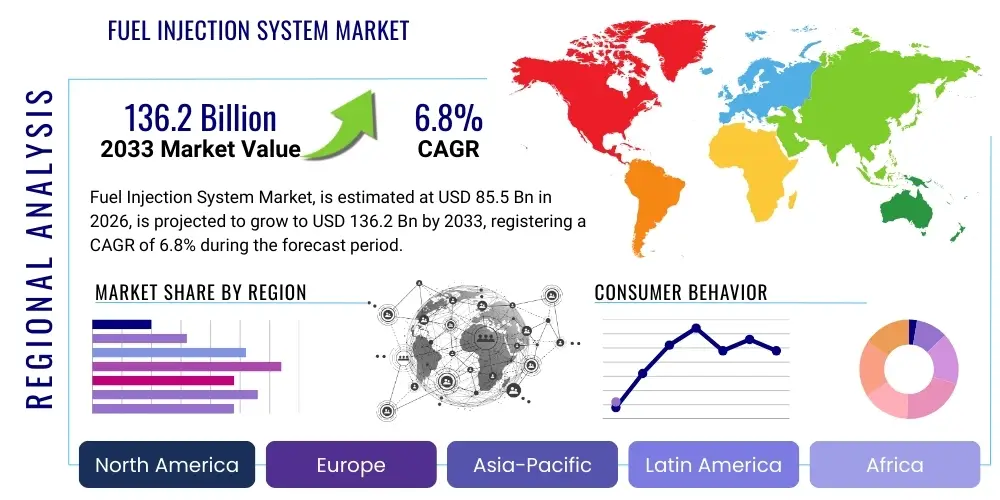

Fuel Injection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438966 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fuel Injection System Market Size

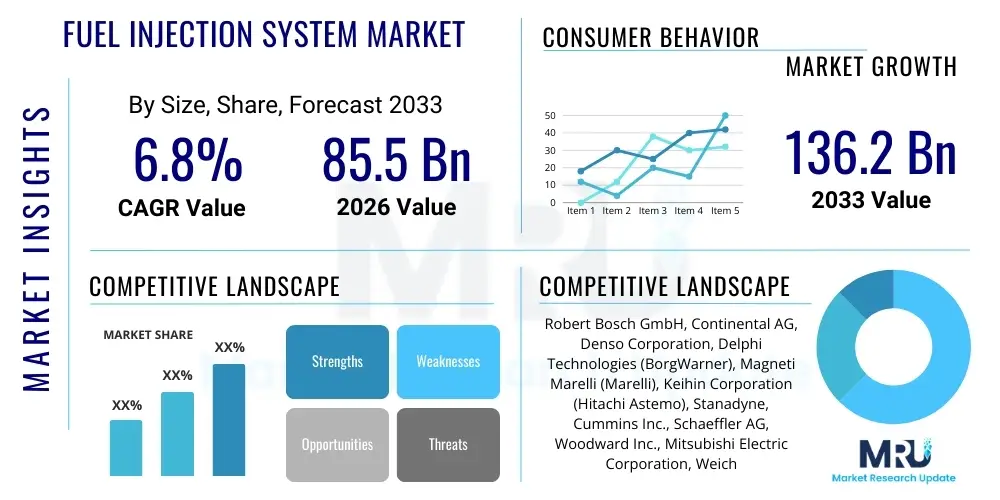

The Fuel Injection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 136.2 Billion by the end of the forecast period in 2033.

Fuel Injection System Market introduction

The Fuel Injection System Market encompasses the design, manufacture, and distribution of components and complete systems responsible for precisely delivering fuel into the internal combustion engine’s combustion chamber. Historically replacing carburetors, fuel injection systems are critical for optimizing engine performance, enhancing fuel economy, and ensuring compliance with stringent global emission standards. These systems utilize advanced electronics, sensors, and mechanical components, categorized primarily into Port Fuel Injection (PFI) and Gasoline Direct Injection (GDI) for gasoline engines, and Common Rail (CR) and Electronic Unit Injector (EUI) systems for diesel applications. The market is fundamentally driven by the continuous demand for powertrain efficiency and the regulatory landscape mandating reduced vehicular pollution worldwide, making it a cornerstone technology in the automotive, marine, and industrial engine sectors.

The product portfolio within this market is highly diversified, ranging from high-pressure pumps, sophisticated injectors (solenoid and piezoelectric), fuel rails, electronic control units (ECUs), and various integrated sensors that monitor parameters such as oxygen levels, throttle position, and manifold pressure. The primary function is to atomize fuel into a fine spray at precisely timed intervals, ensuring optimal air-fuel mixing under varying engine loads and speeds. This precision allows engines to operate leanly while maximizing power output. Major applications are predominantly found in the passenger vehicle segment, followed by commercial vehicles (trucks and buses), and high-performance engines used in motorsports, aerospace, and heavy-duty construction equipment, each requiring tailored system specifications to meet durability and performance metrics.

Key benefits derived from modern fuel injection technology include superior cold-start performance, higher volumetric efficiency leading to increased power density, and crucially, substantial reductions in regulated emissions such as nitrogen oxides (NOx), carbon monoxide (CO), and unburned hydrocarbons (HC). Driving factors for market expansion include the rapid motorization witnessed in developing economies, the global shift towards adopting more complex and efficient engine designs (like turbocharging and downsizing), and legislative mandates such as Euro 7 and CAFE standards, which continuously push manufacturers to integrate the latest generation of fuel delivery systems capable of ultra-fine tuning and adaptability to hybrid powertrains.

Fuel Injection System Market Executive Summary

The global Fuel Injection System Market is characterized by a high degree of technological innovation, intensely focused on balancing high-pressure delivery with miniaturization and durability, largely driven by the tightening grip of environmental regulations. Key business trends indicate a dual approach by major Tier 1 suppliers: aggressively developing highly efficient GDI and Common Rail systems for the short-to-medium term internal combustion engine (ICE) demand, while simultaneously pivoting R&D resources towards supporting hybrid vehicle architectures where fuel injection systems must seamlessly integrate with electric powertrains. Consolidation among suppliers is a notable trend, aimed at achieving economies of scale and pooling expertise to manage the rising complexity and cost associated with advanced precision manufacturing, particularly for piezoelectric injector components and high-integrity ECUs.

Regional trends reveal Asia Pacific (APAC), particularly China and India, as the foremost growth engine, attributable to rising vehicle production, increasing disposable incomes, and the mandatory adoption of BS-VI and China VI equivalent emission standards which necessitate advanced fuel injection technologies in all new vehicles. Conversely, Europe and North America, while mature markets, continue to serve as innovation hubs, focusing heavily on reducing the particle emissions associated with GDI through technologies like dual-injection strategies (PFI combined with GDI) and implementing stricter in-use compliance monitoring. The anticipated decline of diesel engines in European passenger cars is partially offset by the sustained demand for high-efficiency diesel CR systems in the commercial vehicle and off-highway sectors globally.

Segment trends highlight the undisputed growth leadership of the Gasoline Direct Injection (GDI) segment, particularly in North America and Europe, due to its inherent advantage in achieving higher compression ratios and improved thermal efficiency compared to traditional PFI, thus supporting engine downsizing strategies. Within the diesel segment, Common Rail systems continue their dominance across light and heavy commercial vehicles due to their flexibility and capability to achieve multiple injections per combustion cycle, critical for NOx reduction. The challenge remains the transition period: as Battery Electric Vehicles (BEVs) gain traction in premium and urban segments, the fuel injection market must focus on maximizing the lifecycle and efficiency of the remaining ICE and hybrid fleets, pivoting sales and services toward robust aftermarket support and modular system designs.

AI Impact Analysis on Fuel Injection System Market

Common user inquiries regarding AI’s influence on the Fuel Injection System Market often revolve around predictive diagnostics, real-time optimization capabilities, and the potential for AI to manage extremely complex injection parameters to comply with future emissions. Users are highly interested in how AI algorithms can interpret massive streams of sensor data to detect subtle anomalies in injector performance, high-pressure pump wear, or fuel quality, moving maintenance from reactive to predictive. Furthermore, there is significant curiosity about using machine learning (ML) models to dynamically adjust injection timing, pressure, and duration instantaneously based on external factors like weather, altitude, and driving style, exceeding the limits of pre-programmed lookup tables in standard ECUs.

The key themes emerging from user concerns center on cybersecurity risks associated with highly intelligent and connected ECUs, the high initial investment required for integrating AI hardware (like specialized microprocessors) and software, and the need for standardized training data across different engine platforms to ensure reliability. Users expect AI integration to lead directly to unparalleled fuel savings and near-zero tailpipe emissions under real-world driving conditions, differentiating modern systems from older, less adaptive counterparts. This integration fundamentally shifts the value proposition of fuel injection components from being purely mechanical-electronic devices to being critical data-generating and decision-making nodes within the vehicle’s overall performance management system.

AI’s influence is therefore transforming system design, manufacturing, and maintenance. In design, generative AI can optimize fluid dynamics within injector nozzles for superior atomization. In manufacturing, machine vision and ML ensure zero-defect production of highly sensitive components like solenoid valves and piezoelectric stacks. Crucially, on the road, AI enhances the calibration process; instead of relying on fixed engine maps, adaptive algorithms continuously fine-tune the combustion process, leading to engines that maintain their original efficiency standards throughout their service life, a critical factor for complying with stringent regulatory auditing of in-use vehicle performance.

- AI-powered predictive maintenance reduces component failure risk and operational downtime.

- Machine learning algorithms optimize injection parameters (timing, duration, pressure) in real-time based on environmental and operational variables.

- Generative AI accelerates the design and simulation of highly efficient nozzle geometries and flow characteristics.

- Computer vision and automated quality control enhance precision manufacturing of critical, high-tolerance components.

- Adaptive engine control units utilize neural networks for robust closed-loop feedback systems, ensuring sustained emission compliance.

- AI supports the integration of multi-fuel systems (e.g., hydrogen, methanol) by managing complex air-fuel ratios and thermal dynamics.

DRO & Impact Forces Of Fuel Injection System Market

The dynamics of the Fuel Injection System Market are dictated by a powerful combination of legislative pressure and consumer demands for enhanced efficiency, counterbalanced by the disruptive force of electrification. Drivers include relentless global regulatory tightening (e.g., Euro 7, CAFE standards), which necessitates continuous improvements in injection precision to reduce particulate matter and NOx. Furthermore, the global trend towards engine downsizing and turbocharging requires fuel systems capable of handling extremely high pressures (up to 350 bar for GDI and 2,500 bar for Common Rail) to maintain power output while increasing fuel economy. Opportunities lie in developing specialized systems for hybrid electric vehicles (HEVs), which require rapid start-stop cycle robustness, and exploring emerging fuels like hydrogen, synthetic fuels (e-fuels), and methanol, which demand completely re-engineered injection hardware and control software.

However, the market faces significant restraints, most notably the accelerating adoption of Battery Electric Vehicles (BEVs), which threatens the long-term volume growth potential of all ICE-related components, including fuel injection systems. Secondly, the exceptionally high capital expenditure required for R&D, especially for reaching next-generation pressure levels and ultra-low noise operation in premium vehicles, poses a barrier to entry for smaller firms. Environmental groups and governmental bodies worldwide continue to put political pressure on automakers to transition away from fossil fuel dependence, creating market uncertainty and potentially shortening the viable lifespan of newly developed ICE technologies, which can deter long-term investment strategies.

The impact forces within the market are predominantly regulatory and technological. The high impact of regulatory enforcement ensures that non-compliant systems are immediately pulled from the market, forcing constant innovation. Technological impact forces include the fierce competition among Tier 1 suppliers like Bosch, Continental, and Delphi to achieve the highest possible pressure ratings and most reliable piezoelectric actuator technology. These competitive forces drive down unit costs while simultaneously increasing technological sophistication. Overall, the market remains highly competitive yet profoundly sensitive to macroeconomic factors such, as raw material costs (especially specialized alloys for high-pressure components) and geopolitical stability affecting global automotive production volumes.

Segmentation Analysis

The Fuel Injection System Market is segmented based on several critical criteria, including the component type, the fuel used, the technology deployed, and the end-use vehicle category. Understanding these segments is crucial for mapping competitive landscapes and identifying high-growth niches. Segmentation by component separates the market into high-pressure pumps, injectors, fuel rails, and electronic control units (ECUs), with injectors often representing the highest value component due to their complexity and precision manufacturing requirements. Technology segmentation distinguishes between Gasoline Direct Injection (GDI), Port Fuel Injection (PFI), and various Diesel Injection systems such as Common Rail and Unit Injectors, reflecting the differing design priorities and operational complexities of each fuel type.

Segmentation based on fuel type remains foundational, dividing the market between gasoline and diesel systems, with gasoline systems increasingly dominated by GDI to meet efficiency demands in passenger cars, while diesel systems, particularly the Common Rail segment, maintain strong market share in heavy-duty and commercial applications where torque and durability are paramount. The market is also granularly defined by vehicle type, differentiating between passenger vehicles (PV), light commercial vehicles (LCV), and heavy commercial vehicles (HCV), each having unique operational cycles and regulatory requirements that mandate specific fuel injection system designs, ranging from small, lightweight GDI units to robust, high-volume Common Rail setups.

Furthermore, an important layer of segmentation is the aftermarket versus OEM split. While OEM sales are volume-driven and tied to new vehicle production cycles, the aftermarket segment offers significant stability and profit margins, focusing on replacement components, diagnostic tools, and performance-enhancing modifications. The continued longevity of the global ICE fleet, coupled with increasing average vehicle age, ensures that the aftermarket for reliable and certified replacement fuel injection parts remains robust, serving fleet operators and independent repair networks globally, often driven by the need to maintain emission compliance throughout the vehicle's lifespan.

- By Technology:

- Gasoline Direct Injection (GDI)

- Port Fuel Injection (PFI)

- Common Rail System (CRS)

- Unit Injector System (UIS)

- Unit Pump System (UPS)

- By Component:

- Fuel Injectors

- Fuel Pumps (High Pressure and Low Pressure)

- Fuel Rail

- Electronic Control Units (ECUs)

- Pressure Sensors and Regulators

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Highway Vehicles

- By Fuel Type:

- Gasoline

- Diesel

- Alternative Fuels (e.g., CNG, Hydrogen, Methanol)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Fuel Injection System Market

The value chain of the Fuel Injection System Market begins with the upstream procurement of highly specialized raw materials, primarily including corrosion-resistant stainless steel and specific alloys for high-pressure handling, piezoelectric ceramics for sophisticated actuators, and rare earth metals for sensor components. This stage involves specialized raw material processors and component manufacturers who supply critical, high-tolerance parts such as precision machined injector bodies, fuel pump plungers, and solenoid components. Given the extreme operating pressures and temperatures involved, quality control and material science expertise at the upstream level are non-negotiable, directly influencing the final product’s reliability and longevity, particularly in Common Rail and high-pressure GDI systems that operate above 200 bar.

The midstream phase is dominated by Tier 1 suppliers—the primary focus of this market report—who integrate these complex raw components into complete, assembled fuel injection systems (pumps, rails, and injectors) and the corresponding Electronic Control Units (ECUs). This stage requires vast investment in highly automated, clean-room manufacturing facilities, intricate calibration expertise, and deep integration with the intellectual property of the Original Equipment Manufacturers (OEMs). The distribution channel in this stage is predominantly direct, characterized by long-term, highly collaborative contracts between the Tier 1 suppliers (e.g., Bosch, Denso) and the major global automotive OEMs (e.g., Toyota, Volkswagen, Ford) for just-in-time delivery of application-specific systems tailored to engine architecture.

Downstream activities include the integration of the assembled systems into vehicles on the OEM assembly line and subsequent aftermarket servicing. Post-production, the indirect distribution channel becomes crucial, supplying replacement parts through authorized distributors, independent wholesalers, and specialized repair shops. This channel ensures the maintenance and repair of the global vehicle fleet, requiring a robust logistics network for supplying certified OEM or equivalent quality replacement injectors, pumps, and diagnostic tools. The aftermarket is vital for system suppliers as it provides sustained revenue and brand presence even as new ICE vehicle production may eventually slow due to electrification trends, focusing on repair kits and advanced diagnostic support for complex electronic systems.

Fuel Injection System Market Potential Customers

The primary and most significant customers in the Fuel Injection System Market are the Original Equipment Manufacturers (OEMs) across the global automotive sector, encompassing manufacturers of passenger vehicles (PVs), light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs). These major automotive groups require high-volume supply of custom-designed fuel injection systems that meet specific engine performance criteria, durability standards, and, most critically, governmental emission regulations (such as Euro 6/7, US EPA, and China VI). The purchasing decisions of OEMs are driven by factors including system reliability, the supplier's capacity for technological co-development (especially integration into complex hybrid architectures), and cost-effectiveness over the vehicle production lifecycle, making the Tier 1-OEM relationship highly strategic and long-term.

A substantial secondary customer base exists in the non-automotive sector, including manufacturers of industrial equipment, marine engines, aerospace components, and specialized high-performance generators. These customers prioritize robustness, multi-fuel capability, and extreme endurance, often requiring tailored heavy-duty Common Rail systems capable of operating reliably under continuous, high-load conditions far exceeding standard road vehicle demands. For instance, marine diesel engine manufacturers seek systems that can handle varying fuel quality and operate with minimal maintenance in harsh environments, necessitating suppliers capable of providing specialized coatings and enhanced material science applications.

Furthermore, the entire aftermarket ecosystem constitutes a vital customer segment. This includes authorized service centers, independent garages, large fleet operators (e.g., logistics companies, public transport authorities), and specialized performance tuners. These end-users and service providers are the principal buyers of replacement components, service kits, diagnostic software, and high-performance upgrade components. Fleet operators, in particular, are keen customers, as they rely on high-quality aftermarket parts to maintain fuel efficiency and minimize downtime, directly influencing their operational profitability and ensuring their vehicles remain compliant with inspection requirements throughout their operational tenure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 136.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Denso Corporation, Delphi Technologies (BorgWarner), Magneti Marelli (Marelli), Keihin Corporation (Hitachi Astemo), Stanadyne, Cummins Inc., Schaeffler AG, Woodward Inc., Mitsubishi Electric Corporation, Weichai Power, UCAL Fuel Systems, Edelbrock Group, Tula Technology Inc., Pierburg GmbH, Infineon Technologies AG, Texas Instruments, Renesas Electronics Corporation, Zhejiang VIE Science & Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Injection System Market Key Technology Landscape

The technological landscape of the Fuel Injection System Market is defined by the quest for extreme precision, higher operating pressures, and advanced electronic control necessitated by regulatory demands. A key ongoing trend is the move towards ultra-high-pressure injection systems; Gasoline Direct Injection (GDI) pressures are consistently moving beyond 200 bar towards 350 bar and even 500 bar in performance engines, while diesel Common Rail systems are pushing beyond 2,500 bar. This necessitates advancements in material science for pump and injector components to handle the mechanical stresses and ensures superior fuel atomization, which is critical for reducing particulate matter emissions, especially from GDI engines, an area of significant regulatory focus.

Another crucial technological development involves the continuous refinement of injector actuator technology. Piezoelectric injectors, which respond significantly faster than traditional solenoid-based injectors, are becoming standard in premium and high-performance applications. These allow for multi-pulse injection (up to seven or more separate injections per combustion event), providing unprecedented control over the combustion process. This fine control allows engines to optimize performance under diverse conditions, reducing combustion noise, controlling thermal loads, and maximizing the effectiveness of exhaust aftertreatment systems. Furthermore, the electronic control units (ECUs) are evolving into powerful, multi-core processors capable of running complex algorithms, often incorporating machine learning models for adaptive control and diagnostics.

Emerging technologies focus heavily on future-proofing fuel systems against the transition to alternative fuels. This includes developing robust hardware capable of handling hydrogen (H2) and ammonia injection, which presents unique material compatibility and sealing challenges due to the low lubricity and highly volatile nature of these fuels. Furthermore, technologies like Cylinder Deactivation (CDA) and intelligent fuel delivery management—often supported by advanced sensors and software like Tula Technology's Dynamic Skip Fire—require fuel injection systems that can reliably cycle on and off rapidly without compromising cold start or transition performance. The landscape is thus dominated by integration, where mechanical precision meets complex real-time software management.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by high-volume automotive manufacturing, stringent adoption of new emission standards (e.g., China VI, India's BS-VI), and surging demand for personal and commercial vehicles. China and India represent massive installation bases, demanding cost-effective, high-efficiency GDI and robust Common Rail diesel systems for heavy-duty applications, ensuring the region remains the primary market for volume sales.

- Europe: Europe remains a leader in technology adoption, largely due to the most stringent emission standards (Euro 6d and upcoming Euro 7). The region is characterized by high demand for high-pressure GDI systems (often integrated with particulate filters) in passenger cars and advanced Common Rail technology in the premium and heavy-duty segments. However, the regulatory push toward electrification poses a long-term challenge to ICE component volume.

- North America: North America exhibits strong demand, particularly in the light truck and SUV segments, where GDI technology is widely adopted to meet CAFE fuel economy requirements without sacrificing power. The region features a significant and highly profitable aftermarket, driven by the need for maintenance and performance upgrades for a large, aging fleet of gasoline and diesel vehicles.

- Latin America (LATAM): Growth in LATAM is more gradual, dependent on local manufacturing capability and fluctuating economic conditions. Brazil and Mexico are the key markets, where flexible-fuel vehicles (using ethanol blends) require specialized PFI and GDI systems adapted for corrosive fuel types. Regulatory compliance is increasing, pushing local manufacturers toward more modern injection systems.

- Middle East and Africa (MEA): This region is heavily reliant on oil revenue, leading to sustained demand for traditional internal combustion engines. However, the market is characterized by diverse requirements, ranging from basic, robust PFI systems in developing African countries to advanced, high-performance GDI systems in wealthy Gulf nations. System durability against extreme heat and dust is a primary operational requirement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Injection System Market.- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Technologies (A BorgWarner Company)

- Hitachi Astemo, Ltd. (Keihin Corporation)

- Marelli (Magneti Marelli)

- Stanadyne LLC

- Cummins Inc.

- Schaeffler AG

- Woodward, Inc.

- Mitsubishi Electric Corporation

- Weichai Power Co., Ltd.

- UCAL Fuel Systems Ltd.

- Aptiv PLC

- Eaton Corporation plc

- Infineon Technologies AG (ECU components)

- Texas Instruments (ECU components)

- Renesas Electronics Corporation (ECU components)

- BorgWarner Inc.

- Tula Technology Inc.

Frequently Asked Questions

Analyze common user questions about the Fuel Injection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Fuel Injection System Market?

The primary factor driving market growth is the global implementation of increasingly stringent vehicle emission standards, such as Euro 7 and CAFE regulations. These standards mandate superior combustion efficiency, forcing OEMs to adopt high-precision systems like Gasoline Direct Injection (GDI) and high-pressure Common Rail (CR) technology to minimize particulate matter and NOx emissions.

How does the shift towards Electric Vehicles (EVs) impact the long-term viability of the fuel injection market?

While the long-term threat of EV adoption restrains volume growth in certain passenger vehicle segments, the immediate impact is a focus on high-efficiency hybrid vehicles (HEVs) and commercial transport, where ICEs remain essential. Suppliers are pivoting to create robust, fast-cycling injection systems specifically designed for the demanding start-stop cycles of hybrid powertrains, ensuring continued market relevance through the transition phase.

What is the key technological advantage of Gasoline Direct Injection (GDI) over Port Fuel Injection (PFI)?

GDI’s key advantage is the direct injection of fuel into the combustion chamber, allowing for higher compression ratios and more precise air-fuel mixture control. This leads to superior thermal efficiency, significantly improved fuel economy, and higher power density, enabling manufacturers to downsize engines while meeting high performance and emission targets.

Which geographical region holds the highest potential for immediate market growth?

The Asia Pacific (APAC) region, particularly China and India, holds the highest immediate growth potential. This growth is fueled by massive ongoing motorization, rapid adoption of strict environmental regulations equivalent to European standards, and high domestic vehicle production volumes across both passenger and commercial segments.

How are AI and machine learning being integrated into fuel injection systems?

AI is primarily integrated through advanced Electronic Control Units (ECUs) to enable predictive maintenance, anticipating injector wear or pump failures before they occur. Furthermore, machine learning models are used for real-time, dynamic optimization of injection parameters based on environmental conditions, ensuring optimal fuel delivery and sustained low emissions throughout the vehicle's operational life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fuel Injection System Market Size Report By Type (Light Commercial Vehicles, Heavy commercial vehicles, Passenger Vehicles, Hybrid Vehicle, , Diesel, Gasoline, Alternate Fuel, Throttle Body Fuel Injector, Direct Fuel Injector, Sequential Fuel Injector, Port Fuel Injector), By Application (Commercial, Passenger Cruise, Bulk Carrier & Container Ships, Tankers, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Marine Engine Fuel Injection System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (0 HP-2000 HP, 2000 HP-10000 HP, 10000 HP-20000 HP, 20000 HP-50000 HP, 50000 HP-80000 HP, >80000 HP), By Application (Commercial Vessels, Offshore Support Vessels, Inland Waterways Vessels), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Marine Fuel Injection System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Below 2,000 HP, 2,000 To 10,000 HP, 10,000 To 20,000 HP, 20,000 To 50,000 HP, 50,000 To 80,000 HP, Above 80,000 HP), By Application (Commercial Ship, Private Ship), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager