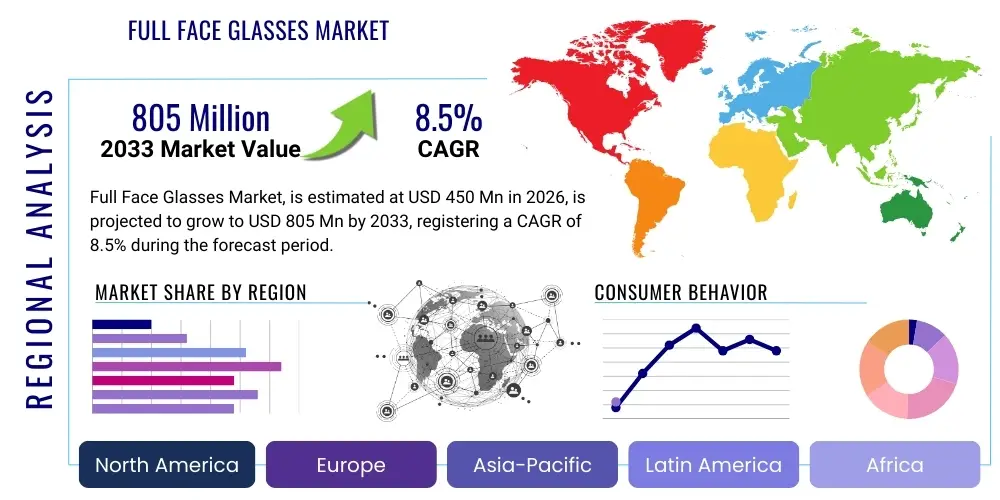

Full Face Glasses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435589 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Full Face Glasses Market Size

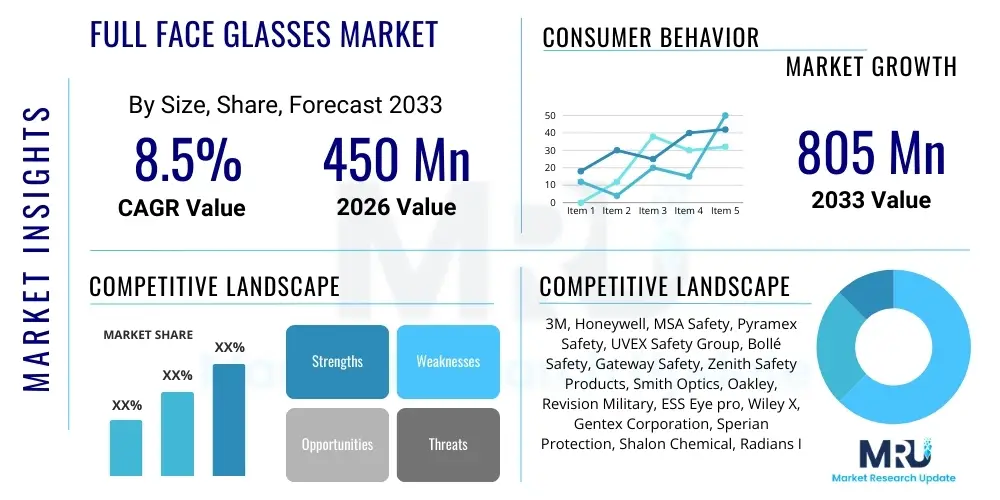

The Full Face Glasses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global industrial safety standards, coupled with technological advancements integrating augmented reality and sophisticated optics into protective eyewear. The rising awareness regarding occupational hazards in manufacturing, construction, and healthcare sectors worldwide is the primary catalyst driving demand for comprehensive facial and ocular protection solutions.

Full Face Glasses Market introduction

The Full Face Glasses Market encompasses specialized protective eyewear designed to shield the eyes, face, and often portions of the lateral head from external hazards, including impact debris, chemical splashes, intense light, and thermal exposure. These products range from high-impact safety goggles and face shields used in heavy industry to advanced medical visors and integrated smart glasses utilizing transparent display technology for augmented reality applications. The core product description centers on high-durability materials like polycarbonate and Trivex, offering exceptional clarity and resistance to abrasion and shattering, adhering strictly to international safety certifications such as ANSI Z87.1 and EN 166.

Major applications for full face glasses are highly diverse, spanning sectors where superior personal protective equipment (PPE) is mandatory. Key areas include industrial safety (welding, grinding, machining), military and tactical operations, healthcare (surgical procedures, pathogen protection), and emerging consumer markets such as high-end sports and recreational activities requiring enhanced visibility and protection. The primary benefits driving market adoption include superior peripheral vision compared to traditional goggles, comprehensive physical barrier protection against contaminants, and reduced risk of severe facial injury in dynamic work environments. Furthermore, modern designs increasingly incorporate ergonomic features and anti-fog coatings, enhancing user compliance and comfort during prolonged usage.

The primary driving factors propelling the market expansion are stringent governmental regulations mandating the use of specific PPE in hazardous occupations, particularly in rapidly industrializing economies across the Asia Pacific region. Technological integration, specifically the incorporation of micro-displays, sensors, and connectivity features into smart safety glasses, is opening new revenue streams within the industrial automation and remote assistance domains. Moreover, the long-term structural shift towards workplace safety culture, incentivizing employers to invest proactively in advanced protective gear, ensures sustained demand throughout the forecast period, positioning full face glasses as an indispensable safety item rather than a discretionary expenditure.

Full Face Glasses Market Executive Summary

The global Full Face Glasses Market demonstrates a robust and accelerating growth profile, characterized by significant innovation focused on material science and digital integration. Current business trends indicate a strong focus among leading manufacturers on developing lighter, more ergonomic designs that minimize user fatigue while maximizing protective capabilities. Strategic mergers and acquisitions are prevalent, aimed at consolidating specialized technology—such as advanced anti-scratch and anti-fog coatings—and expanding geographic distribution, particularly into emerging markets with rapidly evolving regulatory frameworks. The transition towards sustainable manufacturing practices and the use of eco-friendly materials are also becoming critical competitive differentiators, aligning with broader corporate social responsibility goals and procurement mandates from large industrial customers.

Regionally, North America and Europe currently dominate the market in terms of value, primarily due to well-established, strict occupational safety administrations (like OSHA in the US and EU-OSHA) that rigorously enforce PPE compliance. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion in APAC is fueled by massive infrastructure projects, burgeoning manufacturing capabilities, and an increasing adoption of Western safety standards by local enterprises, particularly in countries like China, India, and South Korea. These regional trends necessitate localized product customization, addressing specific climatic conditions (e.g., humidity affecting fogging) and varying economic procurement scales.

In terms of segment trends, the Application segment focusing on Industrial Safety holds the largest market share, driven by high volume use in construction, mining, and chemical processing. Nevertheless, the Medical/Healthcare segment is experiencing accelerated growth, largely attributed to heightened global awareness regarding viral transmission and the critical need for barrier protection, a trend significantly amplified by recent global health crises. Material science innovations are favoring advanced Polycarbonate and Trivex materials over traditional glass, given their superior impact resistance and lighter weight, thereby influencing pricing and distribution strategies across all vertical segments. The premiumization of smart full face glasses integrating AR/VR capabilities is a developing segment trend, offering higher margins and targeting highly specialized industrial and military applications.

AI Impact Analysis on Full Face Glasses Market

Analysis of common user questions regarding AI's impact reveals three core themes: personalized design optimization, predictive maintenance and safety, and the enhancement of smart glasses functionality. Users are keenly interested in how Artificial Intelligence can move beyond simple automation to create truly customized, high-performing eyewear. Key concerns revolve around the ethical implications of data collection via smart glasses (e.g., tracking worker movements or productivity) and the reliability of AI-driven material failure prediction systems in high-stakes safety environments. Expectations center on AI significantly reducing design flaws, accelerating the R&D cycle for new materials, and delivering highly ergonomic products that maximize user compliance and comfort.

The application of AI in the Full Face Glasses market is transforming product development from a reactive process to a predictive one. Machine learning algorithms are now utilized in computational fluid dynamics (CFD) simulations to optimize ventilation systems within the glasses, virtually eliminating fogging—a major user complaint—before a physical prototype is even built. Furthermore, AI-driven analysis of facial geometry data collected via 3D scanning allows manufacturers to produce custom-fit safety glasses and visors quickly and cost-effectively, drastically improving the seal and overall protection level for specialized industrial and medical personnel. This shift towards hyper-personalization, powered by generative design models, is becoming a significant competitive advantage.

In the context of smart full face glasses, AI serves as the core processing engine, enabling advanced features crucial for industrial applications. Computer vision algorithms deployed via embedded cameras can monitor workplace hazards in real-time, providing immediate visual or audio alerts to the wearer regarding proximity to dangerous machinery or unauthorized zones. Additionally, predictive maintenance software utilizes data collected by integrated sensors (temperature, vibration, light exposure) on the glasses to forecast potential equipment failure or fatigue in the surrounding environment, enhancing overall operational safety. This integration positions full face glasses not merely as protective gear, but as sophisticated, connected industrial safety hubs.

- AI-driven Generative Design Optimization for superior fit and aerodynamics.

- Machine Learning algorithms predict optimal anti-fog and anti-scratch coating formulations.

- Computer Vision integration enables real-time hazard detection and situational awareness.

- Predictive Analytics enhance maintenance protocols for both the eyewear and surrounding machinery.

- Automated Quality Control (AQC) systems utilize AI for defect identification during manufacturing.

- Personalized 3D Printing strategies enabled by AI analysis of specific facial metrics.

DRO & Impact Forces Of Full Face Glasses Market

The Full Face Glasses Market dynamics are fundamentally shaped by a delicate interplay between rigorous regulatory drivers and inherent product limitations, counterbalanced by transformative technological opportunities. The primary driver is the non-negotiable requirement for robust occupational safety compliance across heavy industries globally, reinforced by increasingly punitive measures for non-compliance. Restraints often revolve around user adoption challenges, specifically the discomfort associated with prolonged wear, issues related to field-of-vision distortion in lower-quality products, and the initial capital outlay required for high-specification, technologically integrated eyewear. Opportunities are highly concentrated in the nexus of safety and digital transformation, particularly in developing specialized optics for advanced AR/VR interfaces and medical applications requiring sterile, disposable, or rapidly sanitizable options. These forces collectively dictate the innovation roadmap and competitive landscape.

Key drivers include the rapid expansion of global infrastructure and construction sectors, particularly in emerging economies, necessitating high volumes of standard safety gear. Concurrently, the increasing complexity of industrial processes, involving hazardous chemicals, high-speed machinery, and intense heat, demands continuous improvement in material performance and protective ratings. Furthermore, the COVID-19 pandemic permanently elevated the demand for comprehensive facial barrier protection in healthcare and public-facing roles, solidifying the market for certain disposable and reusable full face glasses. These macro trends ensure a sustained foundational demand, prioritizing durability and certified protection over merely cost-effectiveness in procurement decisions by large organizations.

Significant restraints challenging market growth include the inherent design challenges of balancing maximum protection with minimal weight and maximum airflow, which directly impacts user tolerance and compliance. Economic downturns or supply chain volatility can restrain growth by increasing the cost of specialty materials (like Trivex), thus impacting the affordability for small and medium-sized enterprises (SMEs). However, the major opportunities lie in the commercialization of smart full face glasses that offer value-added functionalities beyond mere protection, such as heads-up displays for manufacturing data, guided assembly instructions, and integrated biometric monitoring. The shift toward specialized, high-performance materials capable of simultaneously offering high clarity, chemical resistance, and ballistic protection presents lucrative avenues for market differentiation and growth, particularly targeting defense and high-risk industrial environments.

Segmentation Analysis

The Full Face Glasses Market is comprehensively segmented based on three critical parameters: Material, Application, and End-User Industry. Segmentation by Material dictates the level of protection, clarity, and cost, with Polycarbonate dominating due to its excellent impact resistance, followed by Trivex for premium, lightweight, and high-optical clarity applications, and specialized glass for certain high-heat or chemical-resistant environments. Application segmentation divides the market based on the primary usage context, distinguishing between high-volume, standardized industrial needs and low-volume, high-specification medical or military requirements. End-User segmentation provides insight into procurement patterns and regulatory adherence across major vertical industries, highlighting the difference in safety standards and buying cycles between sectors such as Manufacturing and Healthcare Providers.

- By Material

- Polycarbonate

- Trivex

- Glass

- Acrylic and Other Polymers

- By Application

- Industrial Safety (Construction, Mining, Welding)

- Medical and Healthcare (Surgical, Laboratory, Epidemic Control)

- Sports and Recreation (Motorcycling, Skiing, Racing)

- Military and Defense

- AR/VR and Smart Display Integration

- By End-User Industry

- Manufacturing and Production

- Construction and Infrastructure

- Healthcare Providers and Pharmaceuticals

- Chemical and Petrochemical

- Oil and Gas

- Utilities and Energy

- By Protection Type

- High-Impact Resistance

- Chemical Splash Protection

- UV/IR Radiation Filtering

Value Chain Analysis For Full Face Glasses Market

The value chain for the Full Face Glasses Market initiates with the upstream segment, which involves the sourcing and production of specialized raw materials. This primarily includes the polymerization of high-grade plastics like polycarbonate resins, trivex monomers, and specialty optical coatings (anti-fog, anti-scratch, UV filtering agents). Innovation at this stage is crucial, as the performance characteristics of the final product are heavily dependent on the quality and formulation of these upstream inputs. Key relationships are established between eyewear manufacturers and specialized chemical or plastics producers, demanding stringent quality control and certification to meet international safety standards, often leading to proprietary material compositions.

The midstream phase involves the core manufacturing process, encompassing injection molding, lens fabrication, assembly of frames and straps, and the critical application of performance coatings. This stage is characterized by high capital investment in precision machinery and advanced quality assurance protocols, especially for optical clarity testing. Distribution channels, forming the downstream segment, play a pivotal role in market reach. Direct distribution is favored for large B2B contracts, particularly to major industrial corporations, government agencies, and military procurement bodies, allowing for customized orders and direct technical support. Indirect distribution utilizes specialized industrial safety distributors, wholesale retailers, and increasingly, e-commerce platforms to reach smaller enterprises and individual consumers.

The efficiency of the distribution network is crucial for maintaining competitive pricing and ensuring rapid deployment of essential PPE. Direct sales offer higher margins and tighter control over branding and service quality, while indirect channels provide wider market penetration and logistical scalability. The healthcare sector often relies on specialized medical supply distributors who adhere to strict sterilization and regulatory requirements. Overall value creation is maximized by manufacturers who successfully integrate technological capabilities (such as 3D printing for customization) with robust supply chain management, mitigating risks associated with sole-source material dependencies and ensuring swift compliance with evolving global safety mandates.

Full Face Glasses Market Potential Customers

The Full Face Glasses Market targets a broad spectrum of end-users who necessitate certified ocular and facial protection, spanning highly regulated industrial environments to advanced surgical settings. Primary end-users, or buyers, are institutional procurement managers in large manufacturing facilities, construction firms, and oil and gas operations, who purchase in bulk based on company-wide safety mandates and regulatory requirements. These buyers prioritize compliance certificates (ANSI, EN standards), durability, compatibility with other PPE (e.g., helmets, respirators), and total cost of ownership (TCO) over the lifespan of the product, often favoring reusable, high-performance models that offer ergonomic comfort to enhance worker compliance.

A rapidly expanding customer base resides within the Healthcare and Pharmaceutical sector, encompassing surgeons, nurses, laboratory technicians, and emergency medical service (EMS) personnel. For this segment, the buying criteria emphasize fluid and pathogen barrier protection, anti-fog performance, and the ease of sterilization or disposability, particularly in environments susceptible to biological contaminants. The purchasing decisions are often centralized through hospital networks or government health agencies, demanding specialized products that can withstand harsh chemical sanitization protocols while maintaining optical integrity.

Emerging potential customers include specialized military and law enforcement agencies requiring ballistic-rated full face protection, and technology companies developing advanced industrial Augmented Reality (AR) solutions. These high-specification customers demand cutting-edge technology, including integrated heads-up displays, extreme environmental resistance, and customized fitting solutions enabled by digital scanning and 3D printing. The procurement cycle in these specialized segments is typically longer, involving extensive testing and validation, but yields higher revenue per unit due to the complexity and integration of advanced features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Honeywell, MSA Safety, Pyramex Safety, UVEX Safety Group, Bollé Safety, Gateway Safety, Zenith Safety Products, Smith Optics, Oakley, Revision Military, ESS Eye pro, Wiley X, Gentex Corporation, Sperian Protection, Shalon Chemical, Radians Inc., Hellberg Safety, Kimberly-Clark Professional, Dräger |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Full Face Glasses Market Key Technology Landscape

The technological landscape of the Full Face Glasses Market is undergoing rapid evolution, shifting from basic protective gear to sophisticated smart safety solutions. A critical area of development is advanced coating technology, focusing heavily on durable anti-fog and anti-scratch treatments. Manufacturers are employing nanoscale surface engineering to create hydrophilic or hydrophobic layers that actively manage condensation and resist abrasions, significantly enhancing the longevity and clarity of the lenses. Furthermore, specialized light filtering technologies, including photochromic lenses that adjust automatically to varying light conditions and precise IR/UV shielding coatings, are becoming standard requirements in professional-grade products, particularly for welding and outdoor industrial applications.

The advent of connectivity and miniaturization has led to the rise of smart full face glasses. This segment integrates micro-displays, small high-definition cameras, and various environmental sensors (e.g., temperature, air quality, motion trackers) directly into the frame. Key technologies enabling this include waveguide optics for non-intrusive heads-up displays and high-efficiency micro-batteries. These devices leverage Bluetooth, Wi-Fi, and 5G connectivity to transmit real-time data back to central safety management systems, facilitating remote assistance, guided workflows, and improved incident reporting, thereby moving the product from passive protection to active safety augmentation.

Manufacturing techniques, particularly 3D printing (additive manufacturing), are fundamentally changing product customization. 3D printing allows for the rapid prototyping and production of customized frames and specialized fittings based on individual biometric data, ensuring optimal ergonomics and seal integrity—a crucial factor in chemical and biological protection. This technology reduces lead times and material waste, making high-level personalization economically viable. Additionally, material science continues to focus on composite structures and advanced polymers like Trivex, aiming to achieve ballistic-level protection while maintaining extremely low density and superior optical quality, addressing the demand for high-performance, lightweight military and industrial safety gear.

Regional Highlights

Geographical market dynamics are highly reflective of industrial density, regulatory stringency, and technological adoption rates. North America (NA) represents a mature yet highly valuable market segment, characterized by stringent occupational safety standards enforced by bodies such as OSHA and ANSI. The region exhibits high adoption rates for premium and smart safety glasses, driven by technological readiness in the manufacturing and oil and gas sectors, and a strong culture of litigation risk mitigation, compelling employers to invest in certified, high-quality PPE. The US and Canada are leaders in integrating AR technology into industrial eyewear for maintenance and training purposes.

Europe, particularly Western Europe (Germany, UK, France), maintains strong market demand, underpinned by high manufacturing standards and comprehensive EU regulatory directives (e.g., EN standards). The focus here is often on ergonomic design, sustainability in material sourcing, and comprehensive chemical and heat protection. Southern and Eastern Europe are experiencing steady growth, driven by infrastructure investment and harmonization with stricter EU safety protocols. The European market is highly fragmented, with strong regional players alongside major global brands, emphasizing compliance and standardized product certification.

Asia Pacific (APAC) is the fastest-growing region globally for Full Face Glasses. This trajectory is fueled by massive industrial expansion, rapid urbanization, and significant government-led investments in infrastructure and manufacturing hubs (especially in China, India, and Southeast Asia). While price sensitivity is a factor, the increasing adoption of global safety practices by multinational corporations operating in the region is elevating the demand for certified, high-impact protective wear. This region presents substantial opportunities for manufacturers who can successfully balance affordability with international safety compliance, especially concerning industrial construction and large-scale electronics manufacturing.

- North America (USA, Canada): High adoption of smart glasses and premium, certified PPE; market driven by strict OSHA regulations and advanced industrial automation.

- Europe (Germany, UK, France): Strong focus on ergonomic design, sustainable materials, and adherence to rigorous EN safety standards; mature market with high penetration rates.

- Asia Pacific (China, India, Japan): Highest growth rate driven by industrialization, infrastructure development, and growing acceptance of global safety protocols; cost-effectiveness and volume demand are critical factors.

- Latin America (Brazil, Mexico): Market growth tied to mining, energy, and construction sectors; increasing regulatory oversight, though often lagged by economic instability.

- Middle East & Africa (MEA): Significant demand from the oil and gas sector and large construction projects (Saudi Arabia, UAE); requirements often centered on heat resistance and specialty protection against sand/dust.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Full Face Glasses Market.- 3M

- Honeywell

- MSA Safety

- Pyramex Safety

- UVEX Safety Group

- Bollé Safety

- Gateway Safety

- Zenith Safety Products

- Smith Optics

- Oakley

- Revision Military

- ESS Eye pro

- Wiley X

- Gentex Corporation

- Sperian Protection

- Shalon Chemical

- Radians Inc.

- Hellberg Safety

- Kimberly-Clark Professional

- Dräger

Frequently Asked Questions

Analyze common user questions about the Full Face Glasses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between polycarbonate and Trivex materials in full face glasses?

Polycarbonate is highly impact-resistant and widely used due to its cost-effectiveness. Trivex is a premium, newer material known for being lighter, offering superior optical clarity (less distortion), and having similar impact resistance, making it ideal for precision tasks and prolonged wear.

Which industry currently represents the largest demand segment for full face glasses?

The Industrial Safety segment, encompassing construction, manufacturing, and mining, holds the largest market share due to global regulatory mandates and high volume usage for protecting against debris, particulates, and chemical splash hazards.

How do smart full face glasses enhance industrial safety beyond physical protection?

Smart glasses integrate features like heads-up displays (HUDs) for real-time data, computer vision for hazard detection, and sensor integration for environmental monitoring, transitioning the product from passive protective gear to an active safety and workflow augmentation tool.

What are the primary factors influencing the longevity and replacement cycle of industrial full face glasses?

Longevity is primarily influenced by the durability of anti-scratch coatings, resistance to chemical degradation, and structural integrity following repeated impacts or harsh cleaning. Compliance standards often dictate mandatory replacement schedules irrespective of visible damage, ensuring sustained protection levels.

What regulatory certifications are crucial for ensuring the quality of full face protective eyewear?

Key global certifications include ANSI Z87.1 (North America), which specifies criteria for impact, coverage, and optical quality, and the European standard EN 166, which sets comprehensive specifications for various types of personal eye protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager