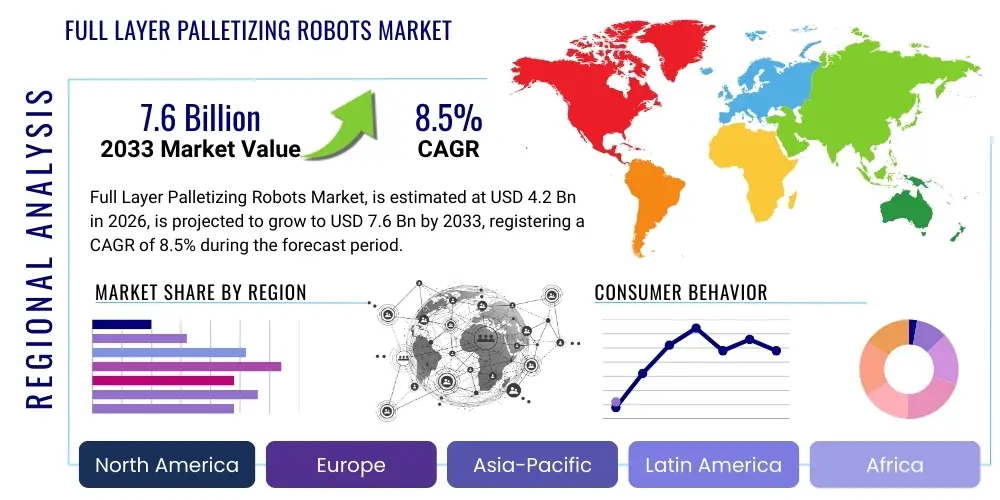

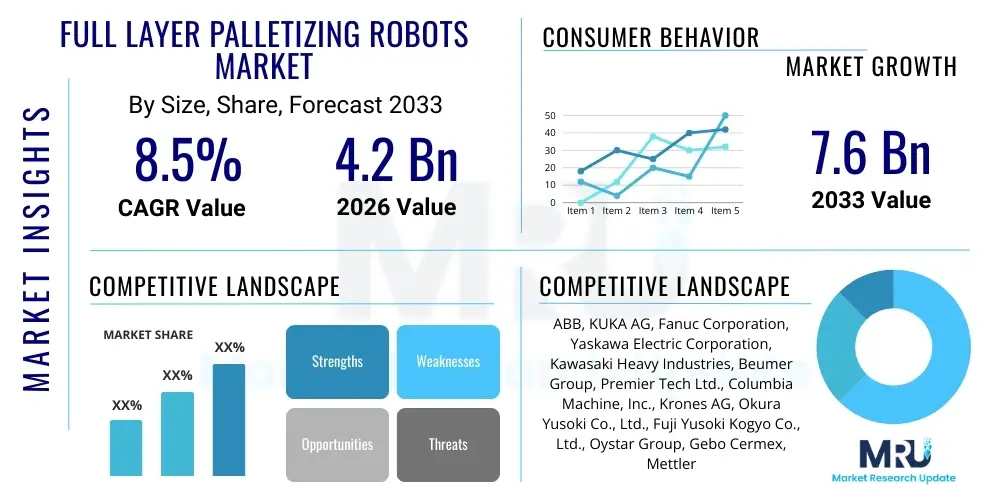

Full Layer Palletizing Robots Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435897 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Full Layer Palletizing Robots Market Size

The Full Layer Palletizing Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for high-speed, automated end-of-line packaging solutions across various high-volume industries. The shift towards large-scale production facilities and the imperative to reduce manual labor dependency, particularly in demanding physical tasks like full layer stacking, underpin this significant financial forecast.

Full Layer Palletizing Robots Market introduction

The Full Layer Palletizing Robots Market encompasses advanced automated machinery designed to stack complete layers of packaged products (such as boxes, bags, or cartons) onto pallets at extremely high speeds, ensuring stability and uniformity. These robotic systems utilize sophisticated gripping technologies and programming to handle an entire horizontal layer simultaneously, offering significant throughput advantages over conventional or single-product palletizers. The core product involves heavy-duty articulated or gantry robots integrated with specialized end-of-arm tooling (EOAT) engineered for swift and precise layer placement. Major applications span the Food and Beverage industry, where high-speed case packing is critical, Consumer Packaged Goods (CPG) manufacturing, and bulk logistics operations.

The primary benefit derived from the adoption of full layer palletizing robots is the unparalleled speed and efficiency they bring to end-of-line processes. By handling multiple items simultaneously, these robots drastically reduce cycle times, enabling manufacturing facilities to meet the escalating demands of modern supply chains, which are characterized by high volume and quick turnaround requirements. Furthermore, these systems enhance workplace safety by automating repetitive and physically strenuous tasks, mitigating risks associated with manual labor and reducing operational inconsistencies that often lead to damaged goods or unstable pallets. Their precision ensures optimal pallet stacking patterns, maximizing shipping density and minimizing transport costs.

Driving factors for this market include the pervasive global shortage of skilled labor willing to undertake repetitive packaging tasks, the continuous expansion of e-commerce necessitating rapid and efficient distribution centers, and stringent quality control standards requiring uniform stacking. As industries move toward complete manufacturing automation (Industry 4.0), the seamless integration capability of these robots with existing enterprise resource planning (ERP) systems and supervisory control and data acquisition (SCADA) platforms further accelerates their adoption. The ongoing technological advancements in vision systems, sensor technologies, and collaborative features also make these robots more versatile and easier to deploy in dynamic production environments.

Full Layer Palletizing Robots Market Executive Summary

The Full Layer Palletizing Robots Market is currently experiencing a phase of accelerated growth, spearheaded by robust investment in smart factory initiatives and digitalization across major manufacturing hubs. Business trends indicate a strong move toward highly customized, flexible robotic solutions capable of handling diverse product sizes and packaging materials without extensive retooling, thereby maximizing operational uptime. Key industry players are focusing on developing faster cycle times and enhanced payload capacities to cater to the increasing scale of modern logistics and warehousing operations. Furthermore, the push for sustainable operations is influencing product development, with manufacturers exploring energy-efficient servo drives and lighter, more durable construction materials to reduce the environmental footprint of these heavy industrial assets. Strategic collaborations between robot manufacturers and specialized system integrators are becoming critical for penetrating niche applications and providing turn-key automation solutions.

Regionally, the Asia Pacific (APAC) region, driven primarily by China, Japan, and India, maintains its position as the largest and fastest-growing market segment. This dominance is attributed to massive investments in manufacturing infrastructure, rapid urbanization, and the necessity for scalable automation solutions to serve large domestic consumer bases. North America and Europe, while mature markets, show steady growth, focusing less on initial adoption volume and more on replacing older, slower equipment with cutting-edge, interconnected robotic systems that align with strict regulatory standards regarding worker safety and efficiency. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, characterized by gradual industrialization and the establishment of local production facilities, particularly within the food and beverage and construction materials sectors where full layer handling is prevalent.

Segment-wise, the high-payload capacity robots (those exceeding 300 kg) are witnessing significant demand, reflecting the trend towards handling larger, more complex full layers in industries like bulk chemicals and construction. In terms of end-users, the Food and Beverage segment remains the undisputed leader due to the high volume, repetitive nature, and standardized packaging requirements inherent in the industry. However, the E-commerce and Logistics segment is projected to show the highest CAGR, propelled by the need for automated order fulfillment and rapid pallet creation in fulfillment centers. Software and services associated with robot integration, predictive maintenance, and simulation tools are also growing faster than hardware sales, indicating a market maturation where optimization and lifecycle management are gaining prominence over initial equipment purchase.

AI Impact Analysis on Full Layer Palletizing Robots Market

Common user questions regarding AI's influence often revolve around how AI can enhance the robot's ability to handle highly variable or damaged products, how it contributes to zero-downtime operations, and whether the complexity of AI integration justifies the cost increase. Users are particularly keen on understanding AI’s role in optimizing stacking patterns in real-time to maximize pallet density and stability, especially when dealing with mixed SKU layers (mixed-case palletizing), which is a significant challenge for traditional programming. The central theme emerging is the expectation for AI to transform reactive maintenance into predictive fault management and to introduce true flexibility, moving beyond rigid, pre-programmed routines. There is also an underlying concern about the data security implications and the necessity for specialized IT infrastructure to support machine learning algorithms running on the edge devices of the palletizing system.

- AI-driven vision systems enable robots to instantly recognize variations in product orientation, damage levels, and packaging dimensions, allowing for adaptive gripping and placement corrections without stopping the line.

- Predictive maintenance analytics, powered by machine learning, analyze sensor data (vibration, motor load, temperature) to forecast potential component failures, significantly maximizing uptime and minimizing unplanned production halts.

- AI algorithms optimize complex stacking logic in real-time, dynamically generating the most stable and space-efficient pallet patterns for mixed-SKU loads, a critical factor for efficient e-commerce fulfillment.

- Reinforcement learning facilitates faster robot commissioning and reduced programming time by allowing the robot to "learn" optimal motion paths and grip forces through iterative trial-and-error, improving speed and energy efficiency.

- Enhanced Human-Robot Collaboration (HRC) via AI allows full layer palletizers to safely operate in closer proximity to human workers, managing safety zones and adjusting speeds based on real-time environmental inputs.

- Integration of AI with upstream production scheduling software enables the palletizing system to anticipate incoming product flows, manage buffers proactively, and align output with immediate logistics requirements.

DRO & Impact Forces Of Full Layer Palletizing Robots Market

The market trajectory for full layer palletizing robots is shaped by a compelling set of drivers, high barriers to entry acting as restraints, and evolving opportunities defined by technological advancements. The primary driver is the pervasive need for efficiency gains and labor cost reduction in high-throughput manufacturing, exacerbated by global supply chain pressures demanding faster fulfillment cycles. However, this growth is significantly restrained by the substantial initial capital investment required for these heavy-duty systems, the complexity associated with integrating them into legacy manufacturing execution systems (MES), and the ongoing requirement for highly specialized technicians for maintenance and optimization. The greatest opportunities lie in the integration of advanced sensors and software that enable flexibility—specifically addressing the challenge of mixed-pallet creation for diversified retail and e-commerce orders, alongside geographical expansion into rapidly industrializing regions where automation penetration is still low.

Impact forces currently influencing the market dynamics include the rapidly declining cost of industrial sensors and computing power, making advanced features like real-time quality inspection and AI integration more financially viable. Furthermore, stringent global safety regulations, particularly in North America and Europe, are indirectly driving the adoption of automated systems, as robots inherently offer a safer working environment compared to manual handling. The competitive landscape is characterized by established global robotics giants leveraging their brand reputation and existing distribution networks, alongside smaller, specialized integrators who excel in providing highly customized, application-specific solutions. The continuous evolution of packaging materials, including lighter and more complex corrugated structures, demands ongoing innovation in end-of-arm tooling design, posing both a challenge for R&D departments and an opportunity for specialized component suppliers.

The interdependence of the supply chain—where delays in procuring high-precision servo motors or proprietary controller components can halt robot production—acts as a continuous impact force, particularly relevant post-2020 global disruptions. Government incentives promoting industrial automation and smart manufacturing (such as those seen in Germany's Industry 4.0 initiatives or China's Made in 2025) provide a strong positive external push. Conversely, the market remains vulnerable to economic downturns, which can lead major end-users to defer significant capital expenditure decisions, temporarily restraining short-term growth prospects. The ultimate commercial success hinges on vendors’ ability to deliver modular, scalable, and user-friendly robotic solutions that minimize the total cost of ownership (TCO) over the system's operational lifetime, overcoming the initial financial hurdle that often deters smaller and medium-sized enterprises (SMEs).

Segmentation Analysis

The Full Layer Palletizing Robots Market is comprehensively segmented based on several critical factors, including the robot type, payload capacity, end-user industry, and geographical distribution, providing granular insights into market dynamics. Segmentation by robot type primarily distinguishes between gantry-style, articulated, and hybrid systems, each offering unique trade-offs between speed, reach, and footprint suitability for different factory layouts. Payload capacity segmentation is vital, reflecting the physical demands of the products being handled, separating high-payload (over 300 kg) systems often used for bulk goods from mid-payload systems popular in standard CPG applications. The market structure reveals a growing preference for modular design across all segments, allowing customers to scale automation efforts according to production peaks and valleys, a feature highly valued in the volatile consumer goods sector.

Analysis of the end-user landscape confirms the dominant role of the Food and Beverage sector, covering everything from canned goods and bottled beverages to frozen foods, all requiring reliable, high-speed stacking. However, rapid growth is anticipated in emerging segments like Pharmaceutical and Chemical industries, which demand high-precision and sterile handling capabilities that layered robotics can provide. Furthermore, the segmentation by application highlights the growing importance of integration services, recognizing that the efficiency of a full layer palletizing robot is often dictated by the seamlessness of its integration with conveyors, wrapping systems, and warehouse management systems (WMS). This reliance on integration expertise is driving market growth for specialized system integrators who operate as key intermediaries between robot manufacturers and the end-user. Understanding these segmentation nuances is crucial for strategic business planning, allowing vendors to tailor their technology offerings and pricing models to address the specific throughput and complexity requirements of diverse industrial applications.

- By Robot Type:

- Articulated Robots

- Gantry Robots

- SCARA Robots (Less common for full layer, but used in hybrid systems)

- Collaborative Layer Palletizers (Emerging)

- By Payload Capacity:

- Up to 150 Kg

- 151 Kg to 300 Kg (Mid-Payload)

- Above 300 Kg (High-Payload/Heavy Duty)

- By Application:

- Case and Carton Palletizing

- Bag and Sack Palletizing

- Crate and Tray Palletizing

- By End-User Industry:

- Food and Beverage

- Consumer Packaged Goods (CPG)

- Pharmaceutical and Healthcare

- Chemicals and Petrochemicals

- Logistics and E-commerce Fulfillment

- Building Materials (Cement, Aggregates)

Value Chain Analysis For Full Layer Palletizing Robots Market

The value chain for the Full Layer Palletizing Robots Market begins with the upstream suppliers responsible for providing highly specialized core components. This segment includes manufacturers of precision hardware such as servo motors, high-reliability controllers (PLCs), sophisticated sensor arrays (vision systems, force sensors), and specialized materials for the robot structure and end-of-arm tooling (EOAT). The quality and technological sophistication of these components are paramount, as they directly influence the robot’s speed, repeatability, and payload capacity. Key market players often rely on a limited number of global suppliers for proprietary components, leading to potential supply chain vulnerabilities but also ensuring high standardization of parts. Research and Development (R&D) activities, focused on AI integration and robust simulation software, also form a critical, value-adding component in this upstream stage.

The midstream involves the core activities of robot manufacturing, system integration, and software development. Robot original equipment manufacturers (OEMs) assemble the components, focusing on mechanical design, advanced programming, and rigorous quality testing. Critically, a significant portion of the value is added by system integrators—often independent third parties—who customize the standard robot platform to fit the specific constraints of the end-user’s factory layout, product mix, and existing machinery (conveyors, wrappers, labelers). The efficiency of the final installation heavily depends on the integrator's expertise in designing complex layer patterns and ensuring seamless data exchange between the robot cell and the factory’s central control system. Successful integration minimizes downtime and maximizes the robot's return on investment (ROI).

Downstream activities include distribution, installation, post-sales services, and continuous optimization. Distribution channels are typically a mix of direct sales teams for large, global accounts (especially for major OEMs like Fanuc or ABB) and indirect distribution through a network of certified system integrators and specialized distributors who handle localized sales, installation, and technical support. Post-sales service—covering maintenance contracts, spare parts supply, and software updates—is a crucial revenue stream and a major determinant of customer satisfaction and retention. The shift towards connected robots (IIoT) is enabling remote diagnostics and predictive maintenance services, further cementing the value derived from long-term service agreements and digital offerings.

Full Layer Palletizing Robots Market Potential Customers

The primary consumers, or potential customers, of full layer palletizing robots are large-scale manufacturing and logistics facilities that require consistent, high-volume throughput in their end-of-line packaging and distribution operations. These buyers are typically characterized by having standardized product packaging (e.g., cases of uniform size) and demanding extremely fast pallet cycle times, often exceeding what traditional conventional or manual systems can achieve. The Food and Beverage sector stands out, encompassing breweries, soft drink bottling plants, dairy operations, and packaged food manufacturers, where rapid production rates and often refrigerated or temperature-sensitive handling mandate the reliability and precision of automated layer stacking. These customers prioritize speed and hygienic design, requiring stainless steel or washdown-capable robots.

Another major segment includes the fast-moving Consumer Packaged Goods (CPG) industry, covering household items, personal care products, and retail goods. CPG manufacturers are constant buyers due to intense competition and the need to manage diverse packaging formats efficiently. The growing e-commerce and logistics sector, particularly large third-party logistics (3PL) providers and major retail fulfillment centers, represents a rapidly expanding customer base. These entities seek full layer palletizers to handle inbound bulk materials, create outbound mixed-SKU store pallets, and improve the speed of container loading, directly addressing the pressure for same-day or next-day delivery promises that define modern retail logistics.

Finally, industrial sectors dealing with heavy or bulky products, such as the Building Materials industry (e.g., cement, tiles, roofing materials) and certain Chemical operations (e.g., large containers, bags), represent customers focused on payload capacity and robustness. For these buyers, the robot’s ability to safely handle layers exceeding 300 kg and operate reliably in dusty or harsh environments is a non-negotiable requirement. While initial cost is always a factor, the ultimate purchasing decision across all these customer segments is heavily weighted toward calculating the long-term Return on Investment (ROI) derived from reduced labor costs, minimized product damage, and maximized facility throughput over a five to ten-year operational period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB, KUKA AG, Fanuc Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Beumer Group, Premier Tech Ltd., Columbia Machine, Inc., Krones AG, Okura Yusoki Co., Ltd., Fuji Yusoki Kogyo Co., Ltd., Oystar Group, Gebo Cermex, Mettler-Toledo International Inc., Concetti S.p.A., Universal Robots (in collaborative segment), Motion Controls Robotics, Schneider Packaging Equipment Co., Intralox, Bosch Packaging Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Full Layer Palletizing Robots Market Key Technology Landscape

The technological evolution of the Full Layer Palletizing Robots Market is centered on enhancing speed, precision, and operational flexibility through advanced integrated systems. A pivotal development is the proliferation of sophisticated 3D vision systems and LiDAR technology, which enable robots to accurately identify the precise location and orientation of incoming product layers, even when products are slightly shifted or irregularly stacked. This high-level perception drastically reduces product rejection rates and allows for non-contact quality checks during the stacking process, ensuring that damaged goods are excluded. Furthermore, the integration of high-resolution force-sensing technology within the end-of-arm tooling (EOAT) is crucial, allowing the robot to apply precisely the necessary pressure to grip different product weights and materials (such as fragile cartons versus plastic crates) without causing damage, thereby optimizing handling performance across a diverse product mix.

Software advancements are equally critical, notably the increasing reliance on digital twin technology and simulation platforms. These tools allow system integrators and end-users to model the entire palletizing cell, test various robot layouts, and optimize stacking patterns virtually before physical installation. This capability significantly reduces commissioning time and minimizes expensive on-site modifications. Moreover, modern robotic controllers are designed with open architecture and enhanced connectivity (IIoT standards like OPC UA), enabling seamless integration with facility-wide MES (Manufacturing Execution Systems) and WMS (Warehouse Management Systems). This connectivity facilitates real-time data exchange, providing valuable metrics on throughput, cycle time, and energy consumption, which is essential for continuous process improvement and compliance reporting.

A burgeoning area of innovation involves modular End-of-Arm Tooling (EOAT) equipped with quick-change mechanisms. Traditional full layer palletizing often required extensive manual retooling when switching between different product layers or packaging types (e.g., switching from vacuum suction cups for boxes to pneumatic clamps for bags). Modern EOAT systems utilize automated docking mechanisms and standardized interfaces, allowing the robot to switch tooling types in seconds, dramatically enhancing overall line flexibility and reducing changeover downtime. This technological focus on modularity directly addresses the market's demand for versatile systems capable of handling the increasing product variability characteristic of modern, demand-driven manufacturing environments, especially those engaged in short-run production cycles or multi-product operations.

Regional Highlights

The market dynamics of the Full Layer Palletizing Robots Market exhibit significant regional variation influenced by industrial maturity, labor costs, and governmental policies regarding automation investment. The Asia Pacific (APAC) region currently dominates the market share and is projected to register the highest growth rate during the forecast period. This strong performance is underpinned by the massive scale of manufacturing operations in countries like China and India, coupled with substantial governmental support and tax incentives aimed at upgrading factory automation to meet booming domestic and international consumer demands. Furthermore, the region is characterized by large, densely populated consumer markets necessitating high-volume throughput in the Food & Beverage and CPG sectors, making full layer palletizing solutions an economic necessity rather than a technological luxury.

North America (NA), driven by the United States and Canada, represents a mature market focused on productivity optimization and mitigating escalating labor costs. Adoption in this region is less about building new capacity and more about replacing outdated, slower machinery with high-speed, flexible robotic systems that comply with stringent safety standards (e.g., OSHA regulations). The robust growth in the e-commerce and logistics sector in North America is a critical driver, with fulfillment centers heavily investing in full layer and mixed-case palletizing solutions to streamline their complex distribution networks. European demand is equally strong, particularly in Western Europe (Germany, Italy, France), emphasizing high precision, energy efficiency, and adherence to Industry 4.0 principles, favoring interconnected and highly reliable systems that integrate seamlessly with sophisticated factory automation environments.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets that offer substantial long-term growth potential, albeit from a smaller base. LATAM’s growth is spurred by the modernization of its food processing and pharmaceutical industries, particularly in countries like Brazil and Mexico, which are increasingly serving as regional manufacturing hubs. The MEA region, fueled by infrastructure investment in the Gulf Cooperation Council (GCC) countries and industrialization in South Africa, shows steady adoption, primarily targeting large-scale construction materials and petrochemicals segments where the handling of heavy, stable loads is essential. However, these regions face challenges related to higher importation costs, complex regulatory environments, and the lack of readily available skilled integration and maintenance talent, which necessitates turnkey solutions from established global vendors.

- Asia Pacific (APAC): Market leader due to high volume manufacturing, rapid industrialization, and significant government support for automation in China and India; focuses heavily on Food & Beverage and CPG capacity expansion.

- North America (NA): Mature market driven by labor cost reduction, e-commerce fulfillment demands, and modernization of existing facilities; high demand for flexible and intelligent robotic solutions.

- Europe: Focuses on Industry 4.0 integration, energy efficiency, and adherence to strict safety and quality standards; strong demand in pharmaceutical and complex logistics applications.

- Latin America (LATAM): Emerging market growth led by modernization efforts in Brazil and Mexico's Food Processing and Chemical sectors.

- Middle East & Africa (MEA): Gradually adopting automation in construction materials and petrochemicals, driven by large infrastructure projects and regional industrial goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Full Layer Palletizing Robots Market.- ABB Ltd.

- KUKA AG (Midea Group)

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Beumer Group GmbH & Co. KG

- Premier Tech Ltd.

- Krones AG

- Columbia Machine, Inc.

- Okura Yusoki Co., Ltd.

- Fuji Yusoki Kogyo Co., Ltd.

- Gebo Cermex (Sidel Group)

- Schneider Packaging Equipment Co. Inc.

- Mettler-Toledo International Inc. (Through integration systems)

- Universal Robots (Collaborative Palletizing Solutions)

- Concetti S.p.A.

- Motion Controls Robotics

- A-B-C Packaging Machine Corp.

- Intralox (Conveying integration)

- Bosch Packaging Technology (Syntegon Technology)

Frequently Asked Questions

What is the projected growth rate (CAGR) for the Full Layer Palletizing Robots Market?

The Full Layer Palletizing Robots Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033, driven by continuous demand for high-speed end-of-line automation in global manufacturing and logistics sectors.

Which end-user industry is the largest consumer of full layer palletizing robots?

The Food and Beverage industry currently holds the largest market share due to its high-volume production, standardized packaging formats, and critical need for fast, consistent, and hygienic end-of-line handling processes globally.

How does AI impact the performance and flexibility of full layer palletizers?

AI significantly enhances performance by enabling real-time optimal stacking pattern generation for mixed-SKU pallets, driving predictive maintenance to maximize uptime, and improving the robot’s ability to handle product variability using advanced vision systems.

What are the key technological advancements driving market adoption?

Key technological drivers include sophisticated 3D vision systems for product recognition, force-sensing EOAT for delicate handling, modular tooling for quick changeovers, and the integration of digital twin and simulation software for reduced commissioning time.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region is forecasted to achieve the highest growth, fueled by substantial government investment in smart manufacturing infrastructure and the rapid expansion of manufacturing capacity in economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager