Full Synthetic Motorcycle Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432683 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Full Synthetic Motorcycle Oil Market Size

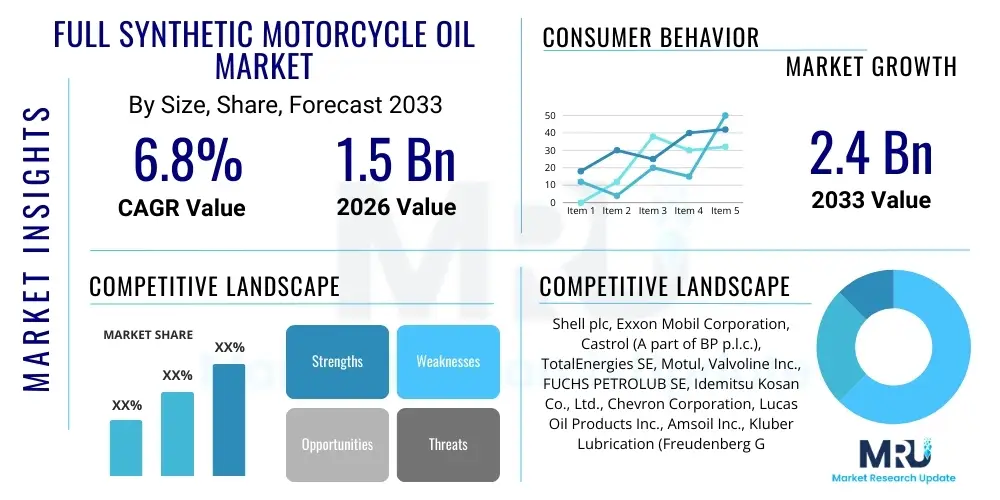

The Full Synthetic Motorcycle Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for high-performance motorcycles and scooters, particularly in emerging economies where two-wheelers are a primary mode of transport. Full synthetic oils offer superior engine protection, reduced friction, and enhanced thermal stability compared to mineral or semi-synthetic alternatives, making them essential for modern, high-revving motorcycle engines that operate under extreme conditions.

The transition toward stricter emission standards, such as Euro 5 and Bharat Stage VI, necessitates the use of advanced lubricants that can maintain engine cleanliness and efficiency over longer drain intervals. Full synthetic formulations, often utilizing advanced Polyalphaolefin (PAO) or ester basestocks, are engineered to meet these rigorous demands. Furthermore, the growing popularity of premium and sports motorcycles, which inherently require lubricants capable of handling high horsepower and torque outputs, significantly contributes to the market size increase. Manufacturers are continuously investing in research and development to formulate oils that enhance clutch performance and gearbox durability, solidifying the market's trajectory towards the projected valuation.

Full Synthetic Motorcycle Oil Market introduction

The Full Synthetic Motorcycle Oil Market encompasses lubricants meticulously engineered from high-quality base oils (typically Group IV PAO and Group V Esters) and specialized additive packages designed for two- and four-stroke motorcycle engines. These advanced oils are critical for maintaining peak performance, superior thermal stability, and maximum wear protection, especially in high-stress applications characteristic of modern motorcycles, including racing and extensive touring. Major applications span high-performance superbikes, adventure motorcycles, touring bikes, and premium scooters. Key benefits include extended engine life, improved fuel economy, enhanced wet-clutch operation, and stable viscosity across a wide temperature range. The market growth is fundamentally driven by rising motorcycle production, increasing disposable income in Asia Pacific, stringent emission regulations demanding cleaner combustion, and a consumer preference for premium, long-lasting engine protection.

Full Synthetic Motorcycle Oil Market Executive Summary

The Full Synthetic Motorcycle Oil market is characterized by strong fundamental business trends centered on technological innovation and premiumization, particularly the shift toward high-viscosity-index basestocks and optimized additive chemistry for integrated gearbox lubrication. Regional trends highlight the Asia Pacific region as the dominant consumer and production hub, driven by massive two-wheeler fleets in countries like India, China, and Southeast Asia, although North America and Europe demonstrate higher adoption rates for ultra-premium, high-specification products (e.g., racing formulations). Segment trends underscore the dominance of the four-stroke engine segment, owing to its widespread global application and the complex lubrication requirements of modern overhead cam designs, while the rapid adoption of higher viscosity grades (e.g., 10W-40, 5W-40) remains crucial for balance between performance and cold start protection, positioning the market for sustained high-value growth.

AI Impact Analysis on Full Synthetic Motorcycle Oil Market

Common user questions regarding AI's influence in the synthetic lubricant market often center on predictive maintenance, formulation optimization, and supply chain efficiency. Users frequently inquire if AI can personalize oil change intervals based on individual riding styles or how machine learning algorithms are accelerating the development of new, highly specialized additive chemistries for next-generation engines. The key themes revolve around how AI enhances the precision of lubricant design (predicting interactions between basestocks and additives), streamlines manufacturing processes (optimizing blend times and reducing waste), and revolutionizes consumer interaction through smart diagnostics and customized service recommendations integrated into advanced motorcycle telemetry systems. The expectation is that AI will move synthetic oil from a reactive maintenance product to a proactive component of engine management, particularly concerning thermal management and reducing sheer degradation under specific operating loads, leading to higher product reliability and customization.

- AI-driven optimization of chemical synthesis pathways for novel ester and PAO basestocks, accelerating R&D cycles.

- Predictive modeling of oil lifespan and degradation curves based on real-time engine operating data (telemetry integration).

- Supply chain and inventory management optimization using machine learning to forecast regional demand fluctuations accurately.

- Enhanced quality control in blending plants through AI vision systems detecting contaminants or inconsistencies instantaneously.

- Personalized lubricant recommendations for end-users based on specific bike model, climate, and average duty cycle data analysis.

- Development of smart lubricant sensors compatible with Internet of Things (IoT) systems for continuous condition monitoring.

DRO & Impact Forces Of Full Synthetic Motorcycle Oil Market

The market is fundamentally driven by the escalating demand for high-performance and premium motorcycles requiring superior lubrication properties, coupled with increasingly stringent environmental regulations that necessitate cleaner, more durable engine oils to optimize catalytic converter lifespan and reduce emissions. Restraints primarily include the high initial cost of full synthetic oils compared to mineral alternatives, which can deter price-sensitive consumers, particularly in emerging markets, alongside challenges related to the complex recycling and disposal processes required for spent synthetic lubricants. Significant opportunities lie in the expansion of niche segments such as electric motorcycle gear oils and specialized racing formulations, alongside geographical market penetration in untapped rural areas of developing countries and strategic partnerships with OEM motorcycle manufacturers for first-fill oil contracts, collectively influencing market trajectory towards higher performance and premiumization.

Segmentation Analysis

The Full Synthetic Motorcycle Oil market is comprehensively segmented based on engine type, viscosity grade, application, and distribution channel, providing a refined view of market dynamics and targeted consumer groups. Engine type segmentation clearly distinguishes between the requirements of two-stroke and four-stroke engines, with the latter dominating due to its widespread adoption globally and greater complexity in lubrication requirements (engine, gearbox, and clutch integrated). Viscosity grade segmentation reflects regional climate requirements and specific engine design needs, focusing heavily on multi-grade oils that ensure efficient performance across diverse temperature extremes. Application segmentation differentiates between on-road use (standard commute and touring) and off-road use (motocross, dirt biking), while specialized racing applications represent a high-value niche demanding ultra-premium formulations for extreme thermal and shear conditions.

- By Engine Type:

- Four-Stroke Engine Oil

- Two-Stroke Engine Oil

- By Viscosity Grade:

- 0W-XX (e.g., 0W-30, 0W-40)

- 5W-XX (e.g., 5W-40, 5W-50)

- 10W-XX (e.g., 10W-30, 10W-40, 10W-50)

- 15W-XX and Above (e.g., 15W-50, 20W-50)

- By Application:

- On-Road Motorcycles (Commuting, Touring, Sport Bikes)

- Off-Road Motorcycles (Dirt Bikes, ATVs)

- Racing and High-Performance

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retail Stores, Garages, Online Sales)

Value Chain Analysis For Full Synthetic Motorcycle Oil Market

The value chain begins with upstream activities, dominated by major chemical companies and refineries that produce the highly specialized Group IV (PAO) and Group V (Ester) basestocks, which are the fundamental and most costly components of full synthetic oils. Additive manufacturers then play a critical role, developing complex packages (Detergents, Dispersants, Anti-wear agents, Viscosity Index Improvers) tailored specifically for motorcycle engine characteristics, such as wet clutch compatibility and high-shear stability. Midstream activities involve the blending and formulation by lubricant companies, requiring rigorous quality control and certification (API, JASO, ACEA standards). Downstream distribution channels are bifurcated into Direct (OEM supply for first-fill) and Indirect (Aftermarket sales), utilizing extensive networks of distributors, authorized dealers, auto parts stores, and increasingly, direct-to-consumer e-commerce platforms to reach the vast and fragmented global motorcycle user base, ensuring product availability and technical support.

Full Synthetic Motorcycle Oil Market Potential Customers

Potential customers for full synthetic motorcycle oils are primarily defined by their ownership of high-performance, premium, or late-model motorcycles that demand optimal engine protection and performance stability. This customer base includes owners of sport bikes, adventure touring motorcycles, and high-end cruisers who prioritize thermal stability, extended drain intervals, and reduced wear under extreme operating conditions. Additionally, a significant segment comprises professional and amateur motorsports teams, demanding specialized racing-grade synthetics formulated for maximum power output and shear resistance in competitive environments. Geographically, key customers are concentrated in regions with high disposable incomes (North America, Western Europe) and areas with rapidly growing premium motorcycle ownership (major metropolitan centers in Asia Pacific), alongside independent motorcycle repair shops and franchise service centers that require certified, high-quality lubricants for scheduled maintenance and service.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell plc, Exxon Mobil Corporation, Castrol (A part of BP p.l.c.), TotalEnergies SE, Motul, Valvoline Inc., FUCHS PETROLUB SE, Idemitsu Kosan Co., Ltd., Chevron Corporation, Lucas Oil Products Inc., Amsoil Inc., Kluber Lubrication (Freudenberg Group), Liqui Moly GmbH, Gulf Oil International, Repsol S.A., Indian Oil Corporation Ltd., Petronas Lubricants International, Sinopec Corporation, Eneos Corporation, Bel-Ray Company LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Full Synthetic Motorcycle Oil Market Key Technology Landscape

The technological landscape of full synthetic motorcycle oil is primarily defined by advancements in basestock synthesis and additive chemistry tailored for demanding applications. Key technologies revolve around the use of high-performance Group IV Polyalphaolefin (PAO) basestocks, prized for their excellent oxidative stability and high viscosity index, and Group V Esters, known for superior thermal resilience and solvency, crucial for keeping internal engine components clean. A fundamental technological requirement is the incorporation of sophisticated friction modifiers and anti-wear agents, specifically engineered to ensure compliance with the Japanese Automotive Standards Organization (JASO) MA or MB specifications, which govern wet clutch performance. Continuous technological innovation focuses on developing low-volatility formulations to minimize oil consumption and specialized shear-stable polymers to maintain viscosity integrity under high stress, directly addressing the operational characteristics of high-revving motorcycle engines.

Regional Highlights

The Asia Pacific (APAC) region commands the largest share of the Full Synthetic Motorcycle Oil Market, a dominance driven by the sheer volume of two-wheelers used for daily transportation in countries such as India, China, Indonesia, and Vietnam. While mineral oil remains prevalent in the lower-end segments, the rapid proliferation of premium and sport motorcycles, coupled with rising middle-class disposable incomes, accelerates the adoption of full synthetic alternatives. Government initiatives mandating adherence to higher emission standards (e.g., BS VI in India) compel motorcycle manufacturers to use superior lubricants, thus boosting demand for performance-enhancing synthetics in the OEM segment, cementing APAC's pivotal role in market volume and growth trajectory over the forecast period.

Conversely, North America and Europe represent mature markets characterized by higher average consumption of premium synthetic oils, driven by a strong culture of recreational riding, high-performance motorsports, and robust regulatory frameworks prioritizing environmental sustainability. In these regions, consumers are less price-sensitive and show a greater willingness to invest in specialized formulations (e.g., racing synthetics, specific brand affiliations) that promise extended engine lifespan and maximum performance output. Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting moderate growth, largely influenced by urbanization and increasing motorcycle fleet modernization, presenting future opportunities, especially as major international lubricant manufacturers establish local blending and distribution partnerships to capitalize on developing infrastructural improvements and rising vehicle ownership rates.

- Asia Pacific (APAC): Market leader due to high volume of two-wheeler sales, rapid industrialization, and increasing adoption of premium bikes.

- North America: High per capita consumption of specialized synthetic oils, driven by sports and touring bike enthusiasts and demanding performance specifications.

- Europe: Characterized by stringent environmental regulations (Euro standards) pushing demand for low-ash, high-efficiency synthetic formulations.

- Latin America (LATAM): Emerging market potential driven by expanding urban populations and growing motorcycle fleet modernization efforts.

- Middle East & Africa (MEA): Moderate growth linked to infrastructure development and rising presence of international lubricant brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Full Synthetic Motorcycle Oil Market.- Shell plc

- Exxon Mobil Corporation

- Castrol (A part of BP p.l.c.)

- TotalEnergies SE

- Motul

- Valvoline Inc.

- FUCHS PETROLUB SE

- Idemitsu Kosan Co., Ltd.

- Chevron Corporation

- Lucas Oil Products Inc.

- Amsoil Inc.

- Kluber Lubrication (Freudenberg Group)

- Liqui Moly GmbH

- Gulf Oil International

- Repsol S.A.

- Indian Oil Corporation Ltd.

- Petronas Lubricants International

- Sinopec Corporation

- Eneos Corporation

- Bel-Ray Company LLC

Frequently Asked Questions

Analyze common user questions about the Full Synthetic Motorcycle Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes full synthetic motorcycle oil from semi-synthetic or conventional oil?

Full synthetic oil is entirely formulated using high-performance base oils (Group IV PAO or Group V Esters) that are chemically manufactured to achieve uniform molecular structure. This provides superior thermal and oxidative stability, lower volatility, and higher resistance to sheer breakdown compared to mineral or semi-synthetic blends, resulting in enhanced engine protection and extended drain intervals, especially in high-temperature, high-revving motorcycle operations.

Is full synthetic oil safe for motorcycle wet clutch systems?

Yes, all reputable full synthetic motorcycle oils are specifically engineered with additive packages that exclude excessive friction modifiers, ensuring compatibility with wet clutch systems. Users must verify the oil meets the relevant JASO MA or JASO MA2 specification, which explicitly certifies the lubricant for optimum wet clutch performance, preventing slippage and maximizing torque transfer without compromising engine wear protection.

How do temperature extremes affect the performance of synthetic motorcycle oils?

Full synthetic oils excel in temperature extremes due to their high viscosity index (VI), meaning their viscosity changes minimally with temperature fluctuation. They provide rapid lubrication during cold starts (critical for minimizing wear) and maintain a stable, strong protective film at the extreme high temperatures typical of high-performance motorcycle engines, offering consistent protection across diverse riding conditions.

Which viscosity grades are most common in the full synthetic motorcycle oil market?

The most commonly adopted viscosity grades globally are 10W-40 and 5W-40, offering an ideal balance between cold-start efficiency and high-temperature protection suitable for a broad range of motorcycle designs. However, high-performance racing applications often utilize higher grades like 10W-50 or 15W-50 for increased shear stability under maximum thermal load, while some modern bikes may specify lighter 0W grades.

What are the key drivers for the demand of full synthetic motorcycle oil in the Asia Pacific region?

The demand in Asia Pacific is driven by three primary factors: the massive and growing population of two-wheelers; the increasing trend toward premiumization, where riders upgrade to higher-displacement, performance-oriented bikes; and the implementation of stringent government emission standards (such as BS VI and equivalent regional norms) requiring cleaner, higher-specification lubricants to ensure compliance and catalytic converter longevity.

Detailed Market Dynamics and Competitive Landscape

The competitive landscape of the Full Synthetic Motorcycle Oil Market is highly concentrated among a few global multinational energy and chemical corporations, such as Shell, Exxon Mobil, and BP (Castrol), which leverage their extensive supply chain networks, proprietary basestock technologies, and deep pockets for continuous R&D. These major players utilize strong brand recognition and strategic partnerships with Original Equipment Manufacturers (OEMs) like Honda, Yamaha, and Kawasaki to secure first-fill contracts, establishing brand loyalty early in the vehicle lifecycle. The market also includes specialist lubricant producers like Motul and Amsoil, which focus heavily on high-performance and niche racing segments, differentiating themselves through specialized ester-based formulations and superior technical service tailored specifically for enthusiast riders and motorsports teams.

Pricing strategy is a crucial dynamic, as full synthetics command a significant premium over conventional oils. Manufacturers justify this price through documented performance benefits, extended drain intervals, and superior engine longevity. However, regional pricing varies considerably, influenced by local taxation, distribution costs, and the level of consumer price sensitivity, particularly in developing economies where counterfeit products pose a persistent threat to established brands. Product differentiation often hinges on additive technologies, such as advanced anti-wear packages containing Zinc Dialkyldithiophosphates (ZDDP) and sophisticated detergents designed to minimize sludge and varnish buildup in integrated gearboxes and clutches, pushing continuous innovation across the entire product line.

Technological advancement is intensely focused on achieving optimal balance between lubricity, thermal resilience, and environmental compliance. Key innovations include the development of low-SAPS (Sulfated Ash, Phosphorus, Sulfur) formulations to protect advanced exhaust after-treatment systems, and specialized fluids for motorcycles equipped with start-stop technology or hybrid powertrains. Furthermore, digitalization is beginning to influence purchasing decisions, with online reviews, technical forums, and direct-to-consumer digital channels playing an increasing role in market communication and sales, forcing traditional manufacturers to adopt robust e-commerce and digital marketing strategies to maintain market visibility against agile, digitally native competitors.

Product Analysis: Four-Stroke vs. Two-Stroke Synthetics

The four-stroke synthetic motorcycle oil segment dominates the market due to the overwhelming global prevalence of four-stroke engines in both commuting and recreational motorcycles. These oils are typically complex multi-functional fluids designed to lubricate the engine, gearbox, and clutch simultaneously (common in shared sump designs). Key performance requirements include maintaining viscosity under extreme shear stress encountered in the gearbox and preventing clutch slippage, necessitating adherence to rigorous standards like JASO MA2. Innovations in this segment focus on extended drain intervals and improved fuel economy without sacrificing vital protection layers, particularly in high-temperature operation associated with air-cooled designs.

Conversely, the two-stroke synthetic oil segment addresses the requirements of engines that mix oil directly with fuel. Although the overall volume is smaller due to decreasing production of two-stroke road bikes, this segment remains vital for scooters, off-road applications, and niche racing. Full synthetic two-stroke oils utilize specialized, low-ash, clean-burning formulations, often containing ester base oils, to minimize carbon deposits on pistons, ports, and spark plugs, ensuring efficient combustion and preventing ring sticking. The focus here is on maximizing combustion efficiency and minimizing harmful exhaust smoke and residue accumulation, driving demand specifically among performance enthusiasts who require maximum power output and reliability from their two-stroke machines.

The distinction between these two product categories highlights the need for highly specialized manufacturing processes. Four-stroke synthetics demand intricate additive packages balancing disparate requirements (engine protection and clutch friction), while two-stroke synthetics prioritize clean burning and deposit control. As regulatory pressures increase globally, both segments are seeing a transition towards higher-quality synthetic basestocks that inherently offer cleaner performance and better long-term stability, ensuring the motorcycle oil market continues its trajectory toward premium, environmentally conscious solutions.

- Four-Stroke Characteristics: Shared sump compatibility, high shear stability (gearbox), JASO MA2 certification mandatory, focus on long drain intervals.

- Two-Stroke Characteristics: Clean burning, low ash content, ester-based typically, required for mix with fuel, focus on deposit control and minimal smoke.

Distribution Channel Dynamics

The distribution landscape for full synthetic motorcycle oil is heavily influenced by the split between OEM channels and the independent aftermarket. OEM distribution involves supplying lubricants directly to motorcycle assembly plants for initial factory fill and providing authorized dealers with branded oil for scheduled warranty services. This channel is crucial for brand validation and capturing consumers early in the vehicle ownership cycle. OEMs typically specify high-grade synthetic oils to ensure new engines meet performance and emissions standards, creating a stable, high-volume demand stream for key suppliers.

The aftermarket, however, represents the largest revenue driver for synthetic oil sales, encompassing independent repair shops, quick-lube facilities, retail auto parts stores, and online e-commerce platforms. The aftermarket is highly competitive, characterized by intense brand promotion and price variation. Online sales channels are gaining significant traction, allowing consumers access to specialist international brands and providing convenience, particularly for high-volume purchasers and motorsports enthusiasts seeking specific, high-end synthetic grades not readily available in local retail outlets. E-commerce platforms also serve as vital conduits for technical information and peer reviews, influencing consumer choices significantly.

Effective management of the distribution network requires manufacturers to maintain robust inventory levels and efficient logistics to prevent stockouts across diverse geographical regions. In Asia Pacific, for example, distribution often relies on complex networks of small regional distributors and wholesalers to reach remote workshops and service centers. In contrast, North American and European markets rely more on centralized distribution centers and large retail chains. The successful market participant must therefore balance high-volume OEM contracts with aggressive aftermarket marketing and seamless integration across traditional retail and burgeoning digital sales channels.

- OEM Channel: Factory fill, warranty service, high-specification products, stability, brand validation.

- Aftermarket Channel: Largest revenue stream, retail stores, independent garages, growing e-commerce penetration, driven by consumer choice and price.

- E-commerce: Increased convenience, access to niche racing formulations, transparent pricing, vital for brand communication.

Sustainability and Regulatory Impact

Sustainability is rapidly becoming a defining factor in the synthetic lubricant market. Regulatory bodies globally are tightening restrictions on engine emissions and mandating improvements in fuel efficiency, directly influencing the required chemistry of motorcycle oils. The move towards lower-viscosity synthetic grades (e.g., 0W and 5W series) is supported by their ability to reduce internal engine friction, contributing significantly to better fuel economy and lower carbon dioxide emissions. Furthermore, the industry is seeing heightened focus on the environmental impact of the lubricants themselves, driving R&D toward bio-synthetic and readily biodegradable basestocks that minimize ecological harm upon disposal.

The implementation of stricter standards, notably the Euro 5 standards in Europe and BS VI standards in India, mandates the use of highly stable oils capable of protecting sophisticated exhaust after-treatment systems, such as catalytic converters. Poor quality oils can poison these systems, reducing their effectiveness and increasing overall emissions. Full synthetic low-SAPS (Sulfated Ash, Phosphorus, Sulfur) formulations are essential for meeting these requirements, pushing manufacturers to invest heavily in additive chemistry that provides robust engine protection while minimizing harmful byproducts. Compliance with these standards is not optional and acts as a significant entry barrier for lower-quality product manufacturers.

Waste oil management also contributes to the sustainability profile. As synthetic oils have longer drain intervals, they reduce the overall volume of used oil generated, easing the burden on recycling and disposal infrastructure. However, the complex chemical nature of synthetic lubricants requires specialized recycling processes compared to conventional mineral oils. Industry players are actively collaborating with recyclers and governmental agencies to establish effective closed-loop systems, emphasizing responsible product stewardship from production to end-of-life management, ensuring that the market's growth aligns with global environmental targets.

- Emission Standards: Driving demand for low-SAPS, high-efficiency synthetics (Euro 5, BS VI compliance).

- Viscosity Reduction: Shift to lower W-grades (e.g., 0W, 5W) to improve fuel economy and reduce CO2 emissions through lower friction.

- Biodegradability: Increasing research into bio-synthetic basestocks to improve environmental compatibility.

- Waste Management: Focus on extended drain intervals and specialized recycling programs for synthetic waste oil.

Emerging Market Opportunities and Future Outlook

A significant emerging opportunity lies in the lubrication requirements of electric motorcycles and scooters. While fully electric vehicles do not require traditional engine oil, they necessitate specialized electric drive fluids (EDFs) or e-fluids for the gearbox, motor cooling, and battery thermal management systems. These synthetic fluids demand excellent thermal conductivity, dielectric properties, and corrosion protection. As global electric two-wheeler adoption accelerates, the market for high-performance synthetic e-fluids presents a substantial diversification opportunity for incumbent lubricant manufacturers, allowing them to leverage their expertise in advanced basestock chemistry for a new generation of mobility.

Furthermore, the growth of the motorcycle customization and high-end niche segments, such as vintage restoration and extreme performance modifications, creates demand for ultra-specialized synthetic formulations. Riders in these segments require lubricants tailored to unique engine architectures or extreme racing conditions not covered by standard OEM specifications. Manufacturers are capitalizing on this by offering hyper-premium products marketed through performance tuning shops and direct enthusiast channels, characterized by superior ester content and specialized anti-foaming agents, delivering higher margins and greater brand cachet.

Geographically, while Asia Pacific currently dominates volume, Sub-Saharan Africa and certain parts of Latin America offer long-term growth potential due to rapid urbanization, infrastructure development, and increasing personal mobility needs, fueling motorcycle sales. Establishing effective local blending facilities and localized distribution networks in these emerging frontiers will be crucial for capturing future market share. The combination of technological pivot towards e-mobility and geographical expansion into untapped developing markets ensures a dynamic and growth-oriented future for the full synthetic motorcycle oil industry.

- Electric Drive Fluids (EDFs): New market segment for synthetic fluids in electric motorcycle gearboxes and cooling systems.

- Niche Customization: Demand for ultra-specialized synthetics for high-performance tuning, racing, and classic restoration.

- Geographical Expansion: Untapped potential in Sub-Saharan Africa and high-growth urban centers in Latin America.

- Service Integration: Opportunities in integrating oil monitoring sensors (IoT) with digital service platforms for predictive maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager