Fully Automatic Plate Rolling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435767 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fully Automatic Plate Rolling Machine Market Size

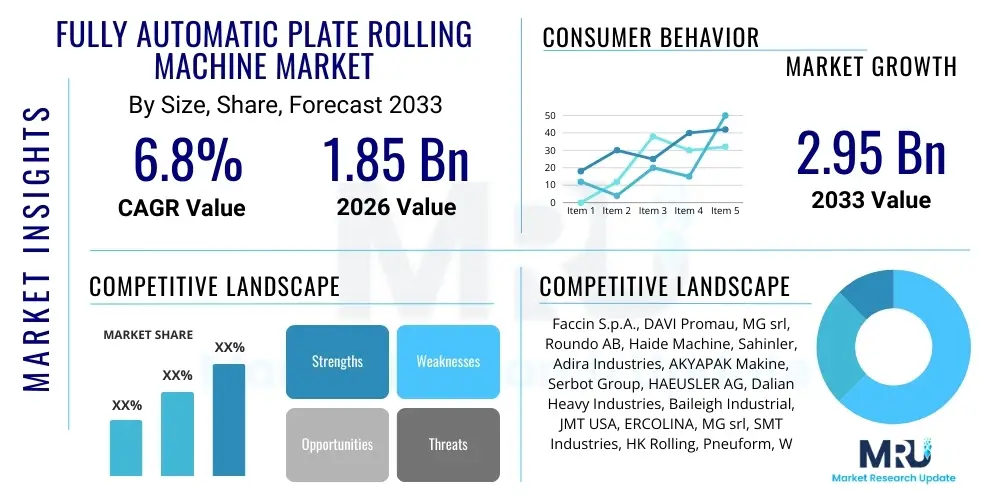

The Fully Automatic Plate Rolling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033.

Fully Automatic Plate Rolling Machine Market introduction

The Fully Automatic Plate Rolling Machine Market encompasses specialized heavy machinery designed for bending flat metal plates into cylindrical, conical, or elliptical shapes with minimal human intervention. These machines utilize advanced computerized numerical control (CNC) systems, hydraulic or electric drives, and integrated sensor technology to achieve high precision, repeatability, and speed in complex rolling operations. Unlike conventional manual or semi-automatic rollers, fully automatic systems manage material feeding, positioning, rolling sequence, and unloading autonomously, making them critical assets in high-volume production environments across heavy industry sectors. The integration of advanced features such as automatic material thickness detection, adaptive rolling speed, and immediate error correction distinguishes these high-end machines, driving their adoption in mission-critical applications where dimensional accuracy is paramount.

Product descriptions typically focus on the configuration type, such as three-roll or four-roll designs, with four-roll models generally dominating the fully automatic segment due to their superior capability in pre-bending and handling thin sheets efficiently. Major applications span several capital-intensive industries including shipbuilding (for hull sections), pressure vessel manufacturing (for boilers and reactors), aerospace (for large airframe components), and infrastructure projects (such as large diameter pipelines and storage tanks). The versatility in handling diverse materials, including carbon steel, stainless steel, aluminum, and high-strength alloys, further solidifies their market position. The sophistication of the control software allows for seamless integration into existing fabrication lines, often utilizing robotic loading and unloading systems to create a completely automated production cell, thereby maximizing throughput.

Key benefits driving market expansion include substantial reduction in cycle time, significant decrease in material waste due to enhanced precision, and improved worker safety by minimizing manual interaction with heavy plates. The demand for increasingly complex geometric shapes and higher quality standards in sectors like oil and gas processing necessitates the accuracy provided by fully automatic systems. Furthermore, factors such as the global focus on energy transition infrastructure, which requires large-scale rolling of thick plates for wind towers and cryogenic tanks, alongside general industrial modernization in emerging economies, are primary forces propelling the adoption of these automated plate rolling solutions globally. The continuous innovation in sensor technology and predictive maintenance capabilities is also making these machines more reliable and cost-effective over their operational lifespan.

Fully Automatic Plate Rolling Machine Market Executive Summary

The Fully Automatic Plate Rolling Machine Market is experiencing robust growth driven primarily by global industrial automation trends, stringent quality requirements in critical manufacturing sectors, and massive infrastructure investment, particularly in Asia Pacific and the Middle East. Business trends highlight a strong shift toward four-roll fully automatic configurations due to their operational efficiency and enhanced pre-bending capabilities compared to traditional three-roll systems. Key manufacturers are focusing heavily on integrating Industry 4.0 concepts, including real-time monitoring, cloud connectivity, and sophisticated diagnostic tools, to offer competitive advantages centered on uptime and precision. The competitive landscape is characterized by established European and North American companies known for high-precision, heavy-duty machines, increasingly facing competition from technologically advanced manufacturers in China and South Korea who offer cost-effective solutions tailored for rapidly expanding domestic infrastructure markets. Strategic collaborations between machinery manufacturers and specialized software providers are becoming common to enhance machine intelligence and adaptive process control.

Regional trends indicate that the Asia Pacific region, led by China, India, and Southeast Asian nations, is the dominant market due to unparalleled growth in shipbuilding, construction, and oil and gas infrastructure development. North America and Europe, while mature markets, maintain high demand for next-generation automated rollers, focusing on replacing legacy equipment with highly efficient, sustainable, and cyber-physical systems compliant with strict regional manufacturing standards. The Middle East and Africa (MEA) are also emerging as crucial growth hubs, fueled by large-scale energy projects, including renewable energy initiatives and expansion of downstream petrochemical processing facilities, requiring heavy plate rolling capabilities. Segment trends show that the end-user segment of shipbuilding and marine structures remains a core revenue generator, but the pressure vessel and boiler manufacturing segment is projected to exhibit the fastest growth, driven by global demand for cleaner energy technologies and associated storage solutions. Furthermore, systems capable of handling extremely thick plates (over 150mm) command premium pricing and represent a high-value niche segment, catering to the specialized needs of nuclear and heavy chemical processing industries.

In terms of technology, the Hydraulic Fully Automatic Plate Rolling Machine segment currently holds the largest market share owing to its superior power and robustness for handling thick materials, though Electric Fully Automatic Plate Rolling Machines are gaining traction in applications requiring higher energy efficiency and positional accuracy for thinner plates. The market faces constraints related to the high initial capital investment and the requirement for highly skilled technical personnel to operate and maintain these complex systems. However, the opportunity landscape is vast, centered on customized automation solutions for complex geometries and leveraging predictive maintenance technologies to minimize downtime. Successful market players are those that can effectively manage the balance between high machine quality, advanced digital integration, and competitive pricing strategies tailored to diverse regional procurement capabilities.

AI Impact Analysis on Fully Automatic Plate Rolling Machine Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) will transform the operational efficiency and quality control of plate rolling. Common concerns revolve around AI's ability to handle material variability, predict machine failures, and automate complex, non-standard bending sequences that traditionally rely on operator experience. Expectations are high regarding AI integration for predictive maintenance, optimizing energy consumption during rolling, and achieving zero-defect production runs. Users seek clarity on specific AI applications, such as real-time simulation based on material spring-back characteristics, dynamic adjustment of roll geometry, and the development of self-correcting feedback loops. The key themes summarized across user queries emphasize the transition from static, pre-programmed rolling processes to dynamic, adaptive manufacturing workflows enabled by AI, thereby unlocking significant improvements in material utilization and overall fabrication speed.

- AI-Powered Process Optimization: Utilizing ML algorithms to analyze sensor data (stress, temperature, pressure) during rolling, automatically adjusting speed and pressure settings in real-time to compensate for material inconsistencies and minimize spring-back effect, leading to higher dimensional accuracy.

- Predictive Maintenance and Diagnostics: Implementing AI models to monitor vibration, motor load, and hydraulic pressure signatures, predicting potential component failures (e.g., bearings, seals, gears) hundreds of hours in advance, thereby maximizing machine uptime and reducing unexpected maintenance costs.

- Automated Geometry Recognition and Setup: Employing computer vision and AI to automatically measure plate dimensions, material type, and initial flatness deviation, instantly generating the optimal rolling sequence program without manual input or iterative trial runs.

- Energy Efficiency Management: AI systems learn optimal rolling torque and speed profiles for specific materials and thicknesses, minimizing wasted energy and reducing operational costs compared to standardized operational envelopes.

- Operator Assistance and Training: AI-driven augmented reality interfaces and sophisticated simulation tools provide real-time guidance to operators for complex setups and troubleshooting, enhancing skill transfer and speeding up process qualification.

- Defect Detection and Quality Assurance: Integrating deep learning models with ultrasonic testing (UT) and eddy current (EC) sensors to detect subsurface material defects or imperfections during the rolling process, ensuring immediate material segregation or process adjustment.

DRO & Impact Forces Of Fully Automatic Plate Rolling Machine Market

The market dynamics for Fully Automatic Plate Rolling Machines are dictated by a confluence of technological drivers, significant capital investment constraints, burgeoning global infrastructure opportunities, and the pervasive impact of automation demands. The primary drivers include the escalating need for high-precision, large-diameter rolled components in the energy and aerospace sectors, coupled with global regulatory pressures demanding safer and more consistent manufacturing processes. Restraints often stem from the exceptionally high initial investment cost required for these sophisticated machines, which limits adoption among smaller fabrication shops, alongside the persistent shortage of qualified technicians capable of servicing and programming advanced CNC rolling systems. Opportunities are clearly delineated within the scope of leveraging Industry 4.0 integration, specifically through subscription-based models for advanced software features and strategic expansion into rapidly developing economies with large-scale projects, such as offshore wind farms and Liquefied Natural Gas (LNG) processing plants. These forces collectively shape the competitive environment, prioritizing manufacturers who can offer a strong balance of high performance, connectivity, and lifecycle service support.

Impact forces in the market are particularly strong regarding the demand side; for example, the global transition to renewable energy requires immense quantities of specialized steel fabrication, creating a sustained demand for automated plate rolling solutions suitable for wind tower shells and large steel foundations. Conversely, geopolitical instability affecting global steel prices and trade tariffs acts as a significant restraint, introducing volatility into both raw material procurement and the final machinery cost. The increasing automation penetration in high-wage economies acts as a powerful driver, as companies seek to offset labor costs and variability with machine consistency. Furthermore, the development of new high-strength, lightweight materials necessitates next-generation rolling machines that can handle these complex materials without cracking or distortion, driving technology upgrade cycles and creating specific market opportunities for specialized machine builders. The necessity for reduced scrap rates in expensive materials like titanium or specialized stainless steels further amplifies the appeal of fully automatic, precision-driven rolling technologies, influencing purchasing decisions significantly.

The cumulative impact of these drivers, restraints, and opportunities suggests a polarized market trajectory. High-end, technologically superior machines will capture significant market share in critical sectors (aerospace, nuclear, high-pressure vessels), capitalizing on precision and safety requirements, while mid-range automated machines will dominate general construction and standard fabrication, driven by throughput requirements and competitive pricing. The ability of manufacturers to overcome the initial capital expenditure hurdle through flexible financing options or by integrating advanced simulation software that reduces setup time will be crucial for sustained growth. The market's resilience is tied directly to global capital spending on large infrastructure and industrial capacity expansion, meaning that economic sentiment in APAC and MEA holds disproportionate weight in the overall market trajectory through 2033.

Segmentation Analysis

The Fully Automatic Plate Rolling Machine Market is systematically segmented based on technological configuration, application, and plate thickness capacity, providing granular insights into demand patterns across various industrial end-users. Technological segmentation primarily distinguishes between hydraulic and electric drive systems, with hydraulic variants dominating heavy-duty applications requiring high torque and pressure consistency, while electric variants are recognized for superior precision and energy efficiency in lighter gauge materials. Application segmentation focuses on the major end-user industries such as shipbuilding, pressure vessels and heat exchangers, oil and gas piping, and construction, each presenting unique demands regarding machine capacity and automation level. Furthermore, the market is differentiated by the maximum plate thickness capacity (e.g., up to 50mm, 50mm-100mm, and above 100mm), which is a critical factor determining the machine’s utility and price point within heavy fabrication sectors.

- By Product Type (Configuration):

- Three-Roll Fully Automatic Plate Rolling Machines

- Four-Roll Fully Automatic Plate Rolling Machines

- By Driving Mechanism:

- Hydraulic Fully Automatic Plate Rolling Machines

- Electric (Electromechanical) Fully Automatic Plate Rolling Machines

- By Application (End-User Industry):

- Shipbuilding and Marine Structures

- Pressure Vessels, Boilers, and Heat Exchangers

- Oil and Gas Pipelines and Storage Tanks

- Aerospace and Defense Components

- Construction and Infrastructure (e.g., Wind Towers, Silos)

- General Fabrication and Metalworking

- By Plate Thickness Capacity:

- Light Duty (Up to 30mm)

- Medium Duty (30mm to 80mm)

- Heavy Duty (Above 80mm)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Fully Automatic Plate Rolling Machine Market

The value chain for the Fully Automatic Plate Rolling Machine Market is complex, beginning with the upstream supply of high-quality components and culminating in the highly specialized downstream installation and maintenance services. Upstream analysis involves sourcing critical components such as high-tolerance steel for machine frames, advanced hydraulic systems (pumps, valves, cylinders), precision-ground rolls, and sophisticated CNC control units (hardware and software). Suppliers of these components, particularly high-precision bearing manufacturers and specialized servo drive system companies, wield significant influence over the final product quality and cost. Strategic relationships with key component providers are essential for mitigating supply chain risks and ensuring the integration of cutting-edge technology, such as specialized sensors for real-time process control.

The manufacturing and assembly phase involves sophisticated engineering design, precision machining, and integration of the automatic control software. Direct distribution channels, often utilized for major industrial clients in the shipbuilding and energy sectors, typically involve direct sales teams or highly specialized regional representatives who can offer deep technical consultation and customization services. Indirect distribution, though less common for high-value automatic machinery, might involve industrial distributors or agents focusing on smaller fabrication companies or specific geographical niches. The efficiency of the distribution channel is heavily dependent on logistical infrastructure due to the sheer size and weight of these machines, necessitating specialized heavy-haul transport and installation teams. Aftermarket services, including routine maintenance, recalibration, software updates, and the supply of replacement rolls and components, constitute a high-margin segment of the downstream value chain, often determining customer loyalty and long-term profitability for the manufacturer.

Downstream analysis highlights the role of system integrators and application engineers who tailor the machine specifications to the client's specific production requirements, such as material type, required radius, and cycle time targets. End-users evaluate potential suppliers based not only on machine performance but also on the robustness of the after-sales support and the manufacturer's ability to provide comprehensive training for programming and operation. The shift towards connected machinery has further integrated the value chain, allowing manufacturers to offer remote diagnostics and predictive servicing contracts, creating a continuous revenue stream beyond the initial sale. This integration ensures that the machine operates at peak efficiency throughout its operational life, directly addressing the end-user concern regarding return on investment (ROI) for such substantial capital equipment.

Fully Automatic Plate Rolling Machine Market Potential Customers

The primary customers for Fully Automatic Plate Rolling Machines are large-scale industrial fabricators and manufacturers engaged in projects that require high-precision, repetitive bending of thick or large metal plates. These end-users, or buyers, operate in capital-intensive sectors where quality standards are regulated and failure tolerance is minimal. The shipbuilding industry is a major consumer, utilizing these machines extensively for rolling large hull sections and curved superstructures, requiring machines capable of handling high-strength marine-grade steel accurately and quickly. Similarly, manufacturers of pressure vessels, including those used in chemical processing, petrochemical refining, and nuclear power generation, are crucial customers, demanding specialized rolling equipment to meet stringent ASME and ISO standards for cylindrical and conical vessel shells where integrity is non-negotiable.

Other significant buyer groups include engineering procurement and construction (EPC) companies involved in large infrastructure projects, particularly those constructing massive storage tanks (e.g., LNG, crude oil) or high-capacity wind turbine towers, which necessitate rolling extremely thick plates up to 150mm or more. The oil and gas sector requires automated rolling for large-diameter, high-pressure pipeline components and offshore platform construction. Defense contractors and aerospace firms also represent a high-value niche, purchasing these machines for rolling specialized alloys used in aircraft structures or military vehicle components, where geometric precision and repeatability must be absolute. These customers often seek integrated solutions that can communicate seamlessly with their existing manufacturing execution systems (MES) and enterprise resource planning (ERP) platforms, emphasizing the importance of digital connectivity in the procurement process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Faccin S.p.A., DAVI Promau, MG srl, Roundo AB, Haide Machine, Sahinler, Adira Industries, AKYAPAK Makine, Serbot Group, HAEUSLER AG, Dalian Heavy Industries, Baileigh Industrial, JMT USA, ERCOLINA, MG srl, SMT Industries, HK Rolling, Pneuform, Wuxi Shenchong, Hefei Metalforming |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fully Automatic Plate Rolling Machine Market Key Technology Landscape

The technology landscape of the Fully Automatic Plate Rolling Machine Market is dominated by advanced CNC (Computerized Numerical Control) systems and sophisticated sensor technology designed to maximize precision and process repeatability. Modern machines rely heavily on proprietary software interfaces that allow operators to simulate complex rolling sequences, predict material behavior (like spring-back), and automatically compensate for variations in plate thickness or yield strength. Key technological advancements include the deployment of proportional hydraulic valve systems that offer fine-tuned control over roll pressure and positioning, significantly enhancing the accuracy of the pre-bending process, which is critical for minimizing flat ends on the rolled component. The integration of laser measurement systems and ultrasonic sensors allows for continuous, in-process monitoring of the evolving geometry, feeding data back to the CNC controller for dynamic adjustments, a feature crucial for handling high-value exotic alloys.

Furthermore, connectivity and digital integration, aligned with Industry 4.0 principles, define the cutting edge of this market. New machines are equipped with Industrial Internet of Things (IIoT) capabilities, facilitating remote diagnostics, real-time performance monitoring, and secure data logging to cloud-based platforms. This technology enables predictive maintenance schedules, reducing catastrophic failures and maximizing operational efficiency. The transition towards fully electric rolling machines, while slower in heavy-duty applications, represents an emerging technological trend focused on achieving higher energy efficiency and positional accuracy through precise servo motor controls, often preferred for thin-plate rolling in the aerospace sector where extremely tight tolerances are required. The development of specialized software for conical rolling and elliptical bending, automating previously time-consuming manual calculations, further accelerates production cycles and broadens the application scope of these automatic systems.

Another pivotal technological area involves the material handling systems integrated with the rolling machines. Fully automatic setups incorporate motorized roller conveyors, side supports, and overhead support carriages controlled by the main CNC unit, ensuring seamless loading and unloading of heavy plates without manual intervention, which enhances both safety and speed. Manufacturers are also experimenting with additive manufacturing techniques for producing customized or wear-resistant roll tooling, although traditional forging and hardening processes remain standard. The focus is increasingly on user-friendly human-machine interfaces (HMIs) that simplify complex programming tasks, reducing the dependency on highly experienced veteran operators. This democratization of the control interface is a key technological driver for broader market adoption, especially in regions facing skilled labor shortages, allowing for more intuitive control over the entire automated fabrication process.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC is the largest and fastest-growing market, primarily fueled by massive infrastructure investments in China, India, and Southeast Asia, focusing on shipbuilding expansion, high-capacity pipeline projects, and urbanization-driven construction. The region benefits from robust government support for local manufacturing automation and a continuous demand for heavy-duty plate fabrication for energy projects.

- North America (NA) Advanced Adoption: North America exhibits high adoption rates of the latest, most advanced fully automatic machines, driven by stringent quality standards in aerospace, defense, and oil & gas sectors. The market here is characterized by replacement demand, prioritizing machines with superior AI integration, connectivity (IIoT), and energy efficiency to optimize high labor cost structures.

- Europe's Precision Focus: Europe remains a stronghold for premium, high-precision rolling machine manufacturers (e.g., Italy, Germany, Sweden). Demand is stable, focused on specialized applications like offshore wind turbine fabrication, nuclear components, and high-quality pressure vessels. Sustainability and compliance with strict EU industrial directives heavily influence purchasing decisions, favoring electric and energy-efficient hydraulic systems.

- Middle East and Africa (MEA) Energy Growth: MEA is experiencing significant demand acceleration, driven by large-scale capital projects in the energy sector, including refinery expansion, LNG plant construction, and diversification into renewable energy. Saudi Arabia and the UAE are key demand centers, requiring heavy-duty, robust automated machines capable of handling extreme operational conditions and large material dimensions.

- Latin America (LA) Stabilization: The Latin American market shows moderate, selective growth, tied predominantly to commodity price stability impacting mining and oil and gas investment in countries like Brazil and Mexico. Procurement often focuses on achieving an optimal balance between automation features and initial capital expenditure, making cost-competitive, high-performance machines particularly appealing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fully Automatic Plate Rolling Machine Market.- DAVI Promau S.p.A.

- Faccin S.p.A.

- HAEUSLER AG

- MG srl

- Roundo AB

- Sahinler Metal Makina San. Ve Tic. A.S.

- AKYAPAK Makine San. Tic. A.S.

- Adira Industries

- JMT USA (Joint Machine Tools)

- Baileigh Industrial Holdings LLC

- Wuxi Shenchong Forging Machine Tool Co., Ltd.

- Dalian Heavy Industries Co., Ltd.

- Hefei Metalforming Machine Co., Ltd.

- Serbot Group (Stierli-Bieger)

- ERCOLINA

- Pneuform Bending Technology

- HK Rolling Machine Manufacturer

- SMT Industries

- Timesavers LLC

- YSD Sheet Metal Processing Equipment

Frequently Asked Questions

Analyze common user questions about the Fully Automatic Plate Rolling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key advantage of a four-roll fully automatic machine over a three-roll configuration?

Four-roll fully automatic machines offer superior efficiency, primarily through dedicated top and bottom pinch rolls and two side rolls. This configuration allows for the entire pre-bending and rolling sequence to be performed in a single pass without removing or flipping the plate, drastically reducing cycle time and ensuring greater precision in the flat end reduction.

How does AI contribute to optimizing plate rolling machine performance?

AI integrates machine learning to analyze real-time operational data, automatically compensating for material characteristics (spring-back) and machine wear. This results in optimized rolling paths, minimal material waste, enhanced positional accuracy, and supports predictive maintenance by flagging potential component failures early.

Which industry drives the highest demand for heavy-duty (100mm+ capacity) automatic plate rollers?

The pressure vessel, boiler, and heavy infrastructure sectors, particularly related to the energy industry (nuclear power, high-pressure oil/gas facilities, large wind turbine towers), drive the highest demand for heavy-duty automatic plate rollers due to the critical nature and thickness requirements of these structural components.

What are the main factors restraining market growth in emerging economies?

The primary restraint is the significant initial capital expenditure required for fully automatic CNC rolling systems. Additionally, the lack of a sufficient pool of highly specialized technicians for complex programming, diagnostics, and maintenance poses a challenge to widespread adoption in developing regions.

Is the market moving towards hydraulic or electric driving mechanisms for automation?

The market utilizes both. Hydraulic systems maintain dominance for heavy-duty applications due to their power and robustness. However, electric (electromechanical) systems are gaining traction in medium-to-light duty segments, favored for their higher energy efficiency, reduced noise, and superior positional accuracy achieved through advanced servo controls.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager