Fully Threaded Rod Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432427 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fully Threaded Rod Market Size

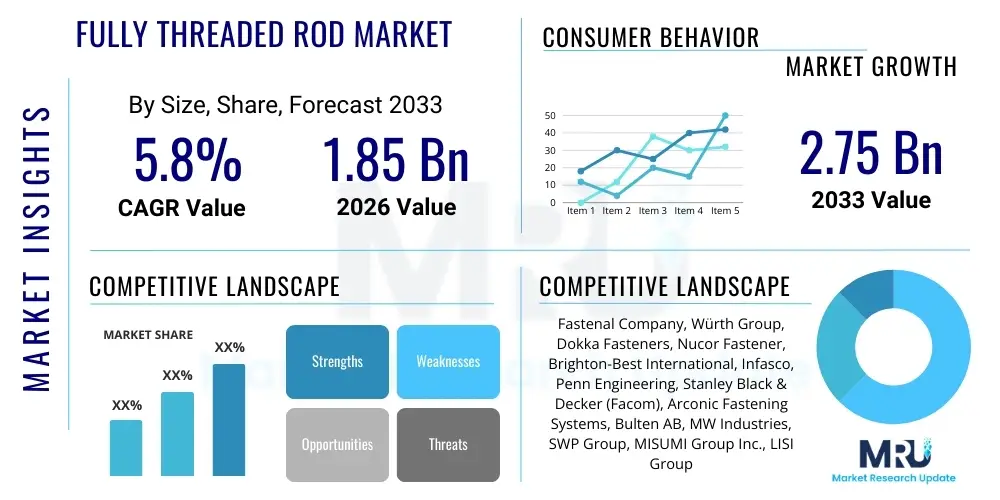

The Fully Threaded Rod Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Fully Threaded Rod Market introduction

The Fully Threaded Rod Market encompasses the production and distribution of cylindrical metal bars that feature continuous external threading along their entire length. These components, often referred to as all-thread, continuous thread, or threaded bar stock, are foundational elements in various heavy-duty and light-duty fastening, anchoring, and suspension applications across diverse industrial sectors. The primary function of fully threaded rods is to secure objects together or into supporting structures, offering a robust and adaptable connection point when used in conjunction with nuts, couplers, and washers. Due to their simple design and high load-bearing capacity, they are indispensable in environments demanding high tensile strength and reliable structural integrity.

Key applications span massive infrastructure development projects, including commercial and residential construction, bridges, tunnels, and renewable energy installations, particularly solar mounting systems and wind turbine assembly. Beyond construction, these rods are heavily utilized in industrial machinery manufacturing, shipbuilding, petrochemical facilities, and plumbing systems where pipe hanging and support are critical. The versatile nature of these products, allowing them to be cut to specific lengths on-site and easily coupled for longer runs, significantly contributes to their widespread adoption, driving steady market growth globally.

Major market driving factors include the escalating pace of urbanization and infrastructure investment, particularly in emerging economies of the Asia Pacific region. Furthermore, stringent safety regulations governing structural integrity in seismic zones and high-stress environments necessitate the use of certified, high-quality fastening solutions, directly benefiting specialized and high-strength threaded rods. Continuous innovation in corrosion-resistant coatings and advanced material alloys ensures that these rods meet the demanding performance criteria of modern industrial and construction applications, solidifying their status as essential engineering components.

Fully Threaded Rod Market Executive Summary

The Fully Threaded Rod Market is characterized by robust growth, primarily propelled by global infrastructural spending, particularly in the APAC region, which is witnessing rapid urbanization and industrialization. Business trends indicate a rising demand for specialized materials, such as stainless steel and high-tensile alloy steel rods, driven by the requirement for enhanced durability and corrosion resistance in challenging environments like marine, oil and gas, and chemical processing facilities. Manufacturers are increasingly focusing on automation in threading processes and advanced coating technologies (e.g., hot-dip galvanizing and fluoropolymer coatings) to enhance product lifespan and meet specific industry compliance standards, thereby optimizing production efficiency and minimizing material waste.

Regionally, the market exhibits dynamic expansion. North America and Europe maintain a mature market status, characterized by high adoption of premium, standardized products adhering to strict international norms (e.g., ASTM, DIN). Conversely, Asia Pacific is the fastest-growing region, fueled by massive government investments in transportation networks, utility expansion, and commercial construction. Latin America and the Middle East & Africa (MEA) are also showing significant potential, linked to expanding energy projects and diversification initiatives, requiring large volumes of reliable fastening components for structural support and mechanical assembly.

Segmentation trends highlight the dominance of carbon steel rods due to their cost-effectiveness and broad utility in standard construction. However, the fastest growth is observed in the stainless steel segment, driven by applications requiring superior chemical resistance, such as food processing and healthcare infrastructure. Furthermore, the construction and MRO (Maintenance, Repair, and Operations) segments remain the largest application areas, consistently demanding high volumes of readily available threaded rods for various anchoring, bracing, and suspension tasks across civil engineering projects and manufacturing plant maintenance.

AI Impact Analysis on Fully Threaded Rod Market

Common user questions regarding AI's impact on the Fully Threaded Rod Market typically revolve around operational efficiency, material wastage reduction, quality control, and supply chain predictability. Users are frequently interested in how machine learning algorithms can optimize material yield during the initial cutting and rolling processes, minimizing scrap metal which significantly impacts cost. Another key concern is the application of computer vision systems for automated, high-speed inspection of threading consistency, pitch accuracy, and defect detection (such as hairline fractures or incomplete threading) to ensure compliance with precise tolerance specifications. Furthermore, inquiries focus on leveraging predictive analytics to forecast demand fluctuations based on complex construction cycles and geopolitical factors, enabling manufacturers to optimize inventory levels and procurement strategies for raw materials like steel and specialty alloys, which are subject to high price volatility.

The implementation of Artificial Intelligence and associated technologies, such as Industrial Internet of Things (IIoT), is fundamentally transforming the manufacturing landscape of fully threaded rods. AI-driven predictive maintenance models analyze sensor data from threading and rolling machines to anticipate equipment failures, reducing unplanned downtime and enhancing overall equipment effectiveness (OEE). This move towards intelligent manufacturing processes ensures higher throughput and consistent product quality across massive production runs, critical for supplying large-scale infrastructure projects. The ability of AI to process vast datasets relating to historical performance and operational parameters allows for continuous process refinement, moving the industry closer to zero-defect manufacturing.

Supply chain integration is another major area benefiting from AI adoption. Advanced algorithms facilitate better routing and logistics planning, particularly relevant given the weight and volume of threaded rod shipments. AI tools are used to monitor raw material procurement strategies, identifying optimal sourcing times and suppliers based on global commodity price trends and historical reliability data. This intelligence layer enhances resilience against supply chain disruptions, allowing manufacturers to maintain competitive pricing and ensure timely delivery, thereby strengthening relationships with major construction contractors and industrial distributors.

- Enhanced Manufacturing Precision: AI-powered computer vision systems ensure rapid, highly accurate inspection of thread profiles and dimensions, significantly reducing quality deviations.

- Optimized Material Utilization: Machine learning algorithms analyze cutting patterns and rolling pressures to maximize metal yield and minimize costly scrap generation during production.

- Predictive Maintenance: IIoT sensors and AI models forecast equipment wear and potential breakdowns in threading machines, reducing downtime and maintenance costs by enabling proactive servicing.

- Demand Forecasting: Advanced analytics predict material requirements based on macro-economic indicators and construction pipeline data, optimizing inventory levels and reducing warehousing costs.

- Smart Supply Chain Logistics: AI algorithms improve transportation planning, minimizing freight costs and ensuring the timely delivery of heavy, bulk products to distributed construction sites.

DRO & Impact Forces Of Fully Threaded Rod Market

The dynamics of the Fully Threaded Rod Market are dictated by a compelling balance of growth drivers, inherent industry restraints, and untapped opportunities, which collectively define the impact forces shaping its trajectory. Key drivers include massive global infrastructure investments and the growth of the renewable energy sector, demanding reliable structural fasteners. Restraints primarily involve the significant volatility in raw material prices (steel and alloying elements) and the competitive threat posed by alternative fastening solutions like chemical anchors in specific applications. However, opportunities abound in developing specialized, high-performance threaded rods with niche anti-corrosion coatings and advanced material grades tailored for extreme environmental conditions, creating premium market segments. These forces interact to push manufacturers toward greater efficiency, product differentiation, and supply chain robustness, making resilience a crucial competitive factor.

The primary driving force remains the increasing global emphasis on structural integrity and longevity in both new construction and MRO activities. Regulations demanding seismic resistance and higher fire protection in public infrastructure necessitate the use of certified, high-strength threaded rods, particularly those made from alloy steel. Furthermore, the ongoing transition toward sustainable energy sources requires extensive fastening solutions for solar panel arrays, ground mounts, and wind tower foundations, providing a consistent and accelerating demand base. Manufacturers who invest in rigorous quality assurance and international certifications are positioned to capitalize on these high-specification project requirements globally.

Conversely, significant restraints hinder optimal market growth. The production of fully threaded rods is highly dependent on commodities markets, especially steel. Sudden or sustained spikes in steel prices can compress profit margins, especially for standardized, commodity-grade products. Moreover, the long lifecycle of infrastructure projects means that initial investment decisions are highly sensitive to price, leading to intense competition based on cost. Opportunities lie in expanding into additive manufacturing applications (though currently limited) and focusing on market gaps for customized, small-batch, and highly specialized threaded rods required for advanced aerospace or critical manufacturing machinery, moving beyond bulk commodity supply.

Segmentation Analysis

The Fully Threaded Rod Market is comprehensively segmented based on material, diameter, finish type, and application, reflecting the diverse end-user requirements across industrial and construction sectors. Material segmentation is critical, ranging from high-volume, cost-effective carbon steel to specialized stainless steel and alloy grades offering enhanced performance characteristics like corrosion resistance and superior tensile strength. Diameter segmentation addresses the varying load-bearing requirements, from smaller diameters used for lightweight suspensions to large diameters essential for heavy-duty structural anchoring. The geographical segmentation emphasizes regional economic activities and infrastructure development trends, highlighting differential growth rates across established and emerging markets.

The fastest-growing segment often revolves around specialized finishes, such as hot-dip galvanizing (HDG) or zinc-nickel plating, as demand for components that can withstand harsh outdoor, chemical, or marine environments increases. Application analysis shows that while commercial and residential construction constitutes the bulk of the market volume, specialized industrial segments like petrochemical, power generation, and automotive are driving demand for high-value, specification-heavy products. Understanding these granular segmentation dynamics is vital for market players to tailor their production, inventory management, and marketing strategies effectively.

- Material Type:

- Carbon Steel (Grade 2, Grade 5, Grade 8)

- Stainless Steel (304, 316, 410)

- Alloy Steel (B7/L7, B8/B8M)

- Non-Ferrous Metals (Brass, Aluminum, others)

- Diameter:

- M6 to M16 (1/4 inch to 5/8 inch)

- M16 to M30 (5/8 inch to 1 1/4 inch)

- Above M30 (Above 1 1/4 inch)

- Finish Type:

- Plain/Self-Color

- Zinc Plated (Clear, Yellow)

- Hot-Dip Galvanized (HDG)

- Specialty Coatings (Xylan, PTFE, Fluoropolymer)

- Application:

- Construction (Commercial, Residential, Infrastructure)

- Industrial Machinery and Equipment

- Oil, Gas, and Petrochemical

- Power Generation and Renewable Energy

- Automotive and Transportation

- HVAC and Plumbing Systems

Value Chain Analysis For Fully Threaded Rod Market

The value chain for the Fully Threaded Rod Market begins with the upstream sourcing of raw materials, predominantly steel billets or coils, which are high-volume commodity inputs. The stability of the supply chain is heavily dependent on global steel producers and market price fluctuations. Manufacturers often engage in long-term contracts or vertical integration strategies to mitigate volatility. The transformation process involves wire drawing (reducing the diameter), cold heading or hot forging, and specialized threading techniques (primarily cold rolling or cut threading). Efficiency in this phase—focusing on minimizing material waste and energy consumption—is crucial for cost control, particularly for high-volume standard rods.

Midstream activities involve secondary processing, including heat treating for specific strength grades (e.g., B7/L7) and applying anti-corrosion finishes like zinc plating or hot-dip galvanizing. Quality control, testing, and certification (meeting standards like ASTM, ISO, or DIN) are integrated at this stage to ensure product reliability, which is paramount for structural applications. Distribution channels form the critical link to the downstream market. Due to the wide variety of sizes, materials, and volumes required, distribution is highly fragmented, utilizing a mix of direct and indirect methods.

Downstream sales are executed primarily through large industrial distributors, specialized fastener wholesalers, and MRO suppliers, who stock and provide cut-to-length services to meet immediate project needs. Direct sales channels are often employed for very large, customized, or highly specialized infrastructure projects requiring direct consultation between the manufacturer and the engineering firm or contractor. End-users, ranging from small-to-medium contractors to multinational EPC (Engineering, Procurement, and Construction) firms, drive demand based on project timelines and specific structural requirements. The final value capture often depends on the ability of the distributor or manufacturer to provide rapid logistics and specialized technical support.

Fully Threaded Rod Market Potential Customers

Potential customers for fully threaded rods are diverse, spanning virtually every sector involved in construction, manufacturing, and long-term asset maintenance. The primary end-users are large civil and infrastructure contractors involved in building bridges, highways, and commercial high-rises, where these rods serve as essential components for anchoring structural steel, bracing walls, and connecting heavy equipment. Mechanical, Electrical, and Plumbing (MEP) contractors represent another significant buyer segment, utilizing rods extensively for hanging ductwork, piping systems, and cable trays, particularly in large industrial and commercial buildings.

Beyond construction, industrial manufacturing sectors, including automotive assembly, heavy machinery production, and shipbuilding, rely on high-grade threaded rods for equipment assembly and mounting. The specialized needs of the Oil & Gas and Power Generation industries, demanding rods resistant to extreme temperatures, high pressure, and corrosive chemicals, represent a high-value customer segment, often purchasing alloy steel rods with advanced protective coatings. Additionally, facility maintenance and repair departments (MRO) across all industrial facilities are consistent purchasers, requiring replacements and adjustments for existing infrastructure supports and fixtures.

The customer base is heavily influenced by the product specification; standard carbon steel rods appeal broadly to general construction, while high-tensile, stainless steel, or coated rods are targeted specifically towards demanding environments such as marine engineering, chemical plants, and cleanroom applications. EPC companies, managing complex, multi-year projects, often procure rods in massive bulk quantities, making them critical anchor customers for major manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal Company, Würth Group, Dokka Fasteners, Nucor Fastener, Brighton-Best International, Infasco, Penn Engineering, Stanley Black & Decker (Facom), Arconic Fastening Systems, Bulten AB, MW Industries, SWP Group, MISUMI Group Inc., LISI Group, Fontana Gruppo, A&F Fastener, TR Fastenings, EJOT Group, Bossard Group, Atlas Bolt & Screw. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fully Threaded Rod Market Key Technology Landscape

The technological landscape of the Fully Threaded Rod Market is centered on optimizing the manufacturing process for efficiency, precision, and enhancing product durability through advanced material treatment and coating. A core technology is cold rolling (or roll threading), which is highly favored over traditional cut threading. Cold rolling uses dies to displace and form the metal, resulting in threads that are stronger, smoother, and exhibit superior fatigue resistance compared to cut threads, as the process increases the material's density in the thread root. Automation in cold rolling machinery, often integrated with sensor technology and PLC (Programmable Logic Controller) systems, allows for high-volume, continuous production with minimal human intervention and precise dimensional control, meeting stringent quality standards for high-stress applications.

A second crucial area involves surface finish and anti-corrosion technology. Standard zinc plating remains prevalent for indoor and less aggressive environments. However, for outdoor infrastructure and marine applications, hot-dip galvanizing (HDG) technology, which provides a thick, robust layer of zinc alloy, is essential. Furthermore, specialized polymer coatings, such as Xylan or PTFE, are increasingly used, particularly in the oil and gas industry and chemical processing plants, where resistance to aggressive chemical agents and high temperatures is mandatory. Research and development efforts are focused on improving the adhesion and longevity of these protective layers while reducing the environmental impact of the application processes.

Digitalization and data integration are also playing a significant role. Manufacturers are implementing advanced Enterprise Resource Planning (ERP) systems coupled with real-time quality monitoring to track batches from raw material input through final inspection. This provides unparalleled traceability, which is critical for complying with construction regulations and liability standards, especially in safety-critical applications. Furthermore, the use of specialized, high-tensile alloy steels, often requiring carefully controlled heat treatment processes facilitated by modern furnace technology, allows the production of rods meeting the most demanding strength requirements (e.g., A490 equivalent strength grades for structural use), ensuring product differentiation in a highly competitive market.

Regional Highlights

- North America (U.S., Canada, Mexico): This region represents a mature market characterized by robust regulatory frameworks (e.g., ASTM standards) and a high demand for premium, high-specification rods, particularly in the energy (oil and gas) and transportation infrastructure sectors. The US market is dominated by large, established distributors and manufacturers focusing on quality assurance and supply chain efficiency. Significant investment in industrial retrofitting and seismic upgrades drives consistent demand for high-performance fastening solutions.

- Europe (Germany, UK, France, Italy): Europe exhibits stable growth, driven by stringent Eurocodes and environmental regulations promoting sustainable and durable building practices. Germany and the UK are key demand centers due to large automotive and manufacturing industries requiring precision fasteners. The emphasis here is often on environmentally friendly coating technologies and stainless steel products for longevity in varied climates and chemical environments.

- Asia Pacific (China, India, Japan, Southeast Asia): APAC is the fastest-growing market globally, primarily due to unprecedented investment in infrastructure development, rapid urbanization, and massive manufacturing output, particularly in China and India. Lower production costs and escalating construction activity, including massive railway and power generation projects, make this region a crucial hub for both consumption and low-to-mid specification production.

- Latin America (Brazil, Argentina): Growth in Latin America is tied to renewed investment in oil, mining, and public infrastructure projects. While price sensitivity is high, the need for reliable fasteners in large-scale energy developments provides strong growth pockets. Brazil's recovering construction sector is a major consumer, focusing on both domestic and imported specialized threaded rods.

- Middle East and Africa (MEA): This region’s demand is heavily concentrated in the Gulf Cooperation Council (GCC) countries, fueled by mega-projects (e.g., NEOM, EXPO sites) and substantial investments in the oil and gas infrastructure. The extreme environmental conditions (high heat, high salinity) mandate the use of highly corrosion-resistant materials and specialized coatings, driving up the average selling price and market value per unit.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fully Threaded Rod Market.- Fastenal Company

- Würth Group

- Dokka Fasteners

- Nucor Fastener

- Brighton-Best International

- Infasco

- Penn Engineering

- Stanley Black & Decker (Facom)

- Arconic Fastening Systems

- Bulten AB

- MW Industries

- SWP Group

- MISUMI Group Inc.

- LISI Group

- Fontana Gruppo

- A&F Fastener

- TR Fastenings

- EJOT Group

- Bossard Group

- Atlas Bolt & Screw

Frequently Asked Questions

Analyze common user questions about the Fully Threaded Rod market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Fully Threaded Rod Market?

The primary driver is sustained global investment in infrastructure development, particularly large-scale projects in transportation, utilities, and commercial construction, which require high volumes of reliable, standardized fastening and anchoring solutions.

Which material segment is projected to show the highest growth rate?

The stainless steel segment (e.g., 304 and 316 grades) is expected to exhibit the highest growth rate, driven by increasing regulatory requirements for corrosion resistance in chemical processing, food manufacturing, and challenging marine environments.

How does the cold rolling process benefit the quality of threaded rods?

Cold rolling creates threads by reforming the metal rather than cutting it, which strengthens the material structure at the thread root, resulting in superior tensile strength, improved fatigue resistance, and smoother surface finish compared to cut threading.

What are the key technological challenges in the manufacturing process?

Key challenges include managing the high environmental impact of traditional metal finishing (plating/galvanizing), maintaining ultra-high threading precision across diverse material grades, and mitigating material waste caused by volatility in raw steel input quality.

Which geographical region holds the largest market share for fully threaded rods?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by massive government-backed infrastructure development programs, rapid industrial expansion, and high construction activity, especially in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager