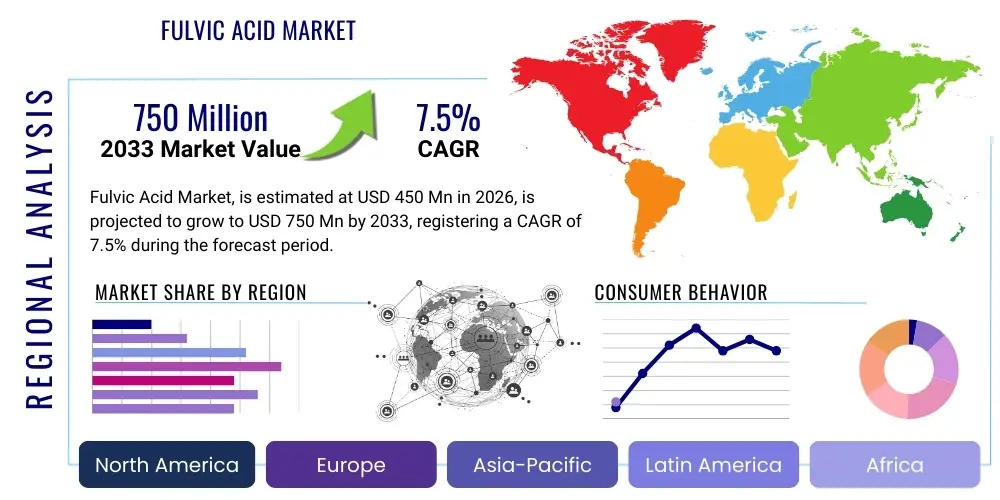

Fulvic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432102 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fulvic Acid Market Size

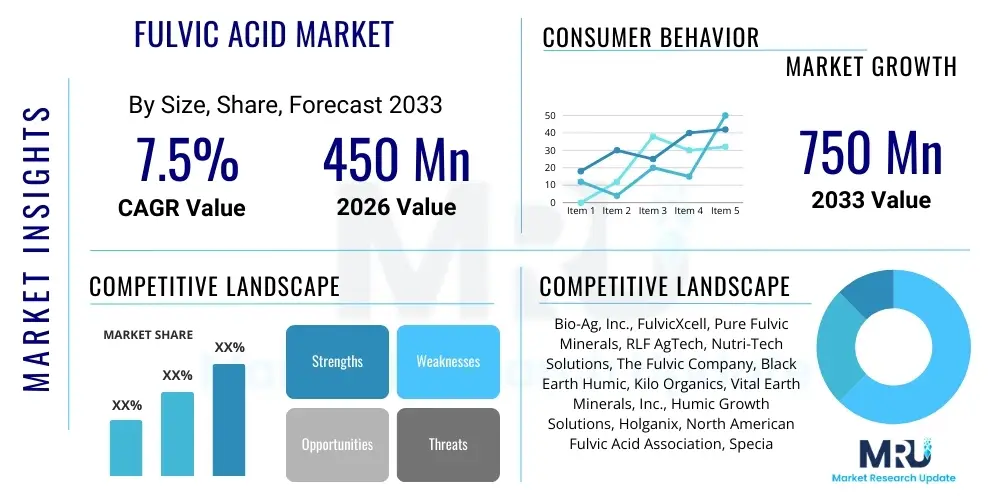

The Fulvic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Fulvic Acid Market introduction

The Fulvic Acid Market encompasses the production, distribution, and utilization of fulvic acid, a potent humic substance derived primarily from decomposed organic matter, typically found in soils, peat, and shilajit. As a low molecular weight organic acid, fulvic acid is highly valued across multiple industries due to its exceptional chelating capabilities, which allow it to bind with minerals and enhance their bioavailability and absorption. It acts as a powerful natural electrolyte, vital for maintaining cellular balance and promoting efficient nutrient transport both in plant systems and human physiology. The increasing global focus on sustainable agriculture and natural health supplements is propelling the market forward, establishing fulvic acid as a critical component in biostimulants, functional foods, and advanced cosmetic formulations. The market trajectory is heavily influenced by innovations in extraction purity and formulation stability.

Major applications of fulvic acid span agriculture, where it dramatically improves soil health, enhances crop yield, and boosts nutrient uptake efficiency by chelation, reducing the required quantity of synthetic fertilizers. In the dietary supplements sector, it is marketed for its detoxifying properties, immune system support, and anti-inflammatory benefits, often consumed in liquid or powder form. Furthermore, its antioxidant properties make it increasingly valuable in the cosmeceutical industry, integrated into anti-aging and skin health products. The versatile nature of this compound, combined with a rising consumer preference for natural, organic ingredients over synthetic chemical alternatives, solidifies its critical role in modern bio-based industries.

The primary driving factors for market growth include the robust expansion of the organic and sustainable farming movement globally, necessitated by growing environmental concerns regarding excessive chemical fertilizer use. Simultaneously, heightened consumer awareness regarding gut health, immunity, and natural detoxification processes fuels demand within the nutraceutical space. Advancements in extraction and purification technologies, leading to higher quality and consistent fulvic acid products, further encourage its integration across diverse end-use sectors. These combined factors underscore the promising and rapidly evolving landscape of the global fulvic acid industry.

Fulvic Acid Market Executive Summary

The Fulvic Acid Market exhibits strong momentum, driven primarily by the synergistic demand emanating from the agricultural and nutraceutical sectors. Key business trends indicate a definitive shift toward premium, highly purified liquid fulvic acid concentrates, which offer superior bioavailability and ease of use compared to traditional powder formulations. Strategic collaborations between fulvic acid producers and biostimulant manufacturers are becoming prevalent, aiming to create integrated crop performance solutions that cater to the exacting standards of precision agriculture. Investment in patented extraction technologies, particularly those utilizing environmentally benign processes such as advanced membrane filtration, is a crucial area of competitive differentiation. Furthermore, companies are focused on clinical validation and rigorous quality control to address regulatory scrutiny and enhance consumer trust in dietary supplement applications, ensuring product stability and efficacy throughout the supply chain.

Regionally, the Asia Pacific (APAC) stands out as a dominant growth region, largely attributable to its massive agricultural base and the rapid adoption of biostimulants in countries like China and India to maximize crop output on limited land resources. North America and Europe maintain high market values, characterized by mature nutraceutical industries and stringent quality standards, driving demand for high-grade fulvic acid in functional beverages and supplements. However, growth in Europe is moderated slightly by complex regulatory classifications regarding fulvic acid's status as a novel food or supplement ingredient. The Middle East and Africa (MEA) are emerging markets, primarily focusing on using fulvic acid to improve water retention and soil quality in arid environments, indicating future untapped potential.

Segmentation trends highlight the increasing importance of the application segment, with agriculture maintaining the largest market share, but the dietary supplement segment demonstrating the highest Compound Annual Growth Rate (CAGR). Within the source segment, leonardite and shilajit sources are heavily utilized, though shilajit commands a premium due to its traditional acceptance and perception of superior health benefits. The market is consolidating around a few key players who possess strong intellectual property regarding extraction methods and possess the vertical integration capabilities necessary to control raw material sourcing and end-product quality, setting higher barriers to entry for smaller competitors.

AI Impact Analysis on Fulvic Acid Market

User inquiries regarding AI's influence on the Fulvic Acid market predominantly revolve around optimizing agricultural application efficiency, improving complex extraction yields, and ensuring supply chain transparency. Common questions probe how Artificial Intelligence can facilitate precision farming techniques by correlating soil microbiome data with optimal fulvic acid dosage recommendations, thereby maximizing crop benefit while minimizing waste. Furthermore, users frequently express interest in AI-driven predictive maintenance for sophisticated extraction machinery and the use of machine learning algorithms to analyze spectral data for verifying the purity and concentration of finished fulvic acid products. The key themes summarized from user concerns focus on leveraging AI to reduce costs associated with raw material variability, achieving higher standards of product quality assurance, and developing smarter, personalized dosage protocols for nutraceutical consumption based on individual health profiles and genetic markers, moving the industry toward data-driven decision-making.

- AI-powered soil analysis systems predict optimal fulvic acid application rates, enhancing nutrient use efficiency in precision agriculture.

- Machine learning algorithms optimize complex multi-stage fulvic acid extraction processes, increasing yield and minimizing energy consumption.

- AI integration in quality control utilizes spectral analysis to rapidly verify product purity, concentration, and absence of heavy metals.

- Predictive supply chain analytics improve raw material sourcing (peat, shilajit) and optimize logistics for time-sensitive ingredient delivery.

- Personalized nutraceutical dosage recommendations generated by AI based on user health data and fulvic acid efficacy studies.

- Automation of large-scale fermentation processes for synthetic or bio-engineered fulvic acid alternatives, ensuring consistency and scalability.

DRO & Impact Forces Of Fulvic Acid Market

The market dynamics are governed by a complex interplay of strong drivers related to global health and agricultural sustainability, significant restraints concerning regulatory consistency and sourcing challenges, and emerging opportunities in new application areas. A major driver is the accelerating shift towards organic and regenerative agriculture, where fulvic acid is indispensable as a natural biostimulant that improves fertilizer efficacy and mitigates environmental impact. Coupled with this is the surging consumer interest in functional foods and natural health supplements, particularly post-pandemic, where immune support and detoxification benefits attributed to fulvic acid drive retail sales. The impact force of these drivers is high, translating into sustained investment in production capacity and research focusing on formulation stability.

Conversely, significant restraints hinder maximal market expansion. The high capital expenditure required for advanced, proprietary extraction and purification technologies, necessary to meet stringent purity standards, acts as a barrier, particularly for smaller producers. Furthermore, regulatory ambiguity across different geographic regions regarding the classification of fulvic acid—whether as a fertilizer additive, dietary ingredient, or novel food—creates market fragmentation and increases compliance costs, especially in the European Union and parts of Asia. Concerns over heavy metal contamination, naturally present in raw source materials like shilajit and specific forms of peat, necessitate exhaustive and costly purification steps, placing downward pressure on profit margins and posing a persistent constraint on widespread acceptance.

Opportunities for growth are abundant, notably in the cosmeceutical and specialty chemical sectors. Fulvic acid's proven anti-inflammatory, antioxidant, and tissue penetration-enhancing properties position it ideally for incorporation into high-end dermatological products and targeted topical treatments. Furthermore, its application in environmental remediation, particularly in water purification and soil detoxification, represents a burgeoning, though currently smaller, market segment that aligns perfectly with global sustainability initiatives. These emerging applications, paired with ongoing R&D focused on standardizing production methods and achieving consistent compositional purity, are expected to provide significant long-term market expansion and diversification beyond core agricultural usage.

Segmentation Analysis

The Fulvic Acid Market is comprehensively segmented based on its Source, Application, and Form, allowing for precise tracking of demand patterns and value chain distribution across diverse end-use sectors. The segmentation highlights the intrinsic links between raw material availability and the suitability of the resulting product for highly regulated sectors such as human consumption, which demands exceptional purity. Analyzing these segments is critical for manufacturers to tailor their production technologies and marketing strategies, ensuring compliance with varied regulatory landscapes inherent to the agricultural and nutraceutical industries, which represent the largest consumption pools globally.

Segmentation by Source differentiates products based on their origin, primarily focusing on naturally derived materials like leonardite (a soft, brown, coal-like mineraloid), shilajit (a sticky substance found primarily in the Himalayas), and peat. This segment dictates the initial compositional complexity and impurity profile of the fulvic acid extract, directly influencing the required downstream purification efforts. The Application segmentation is crucial as it dictates volume consumption and price sensitivity, with agriculture requiring large volumes at moderate prices, whereas dietary supplements demand lower volumes but accept premium pricing due to stringent quality control requirements and consumer health benefits. The Form segmentation, primarily liquid versus powder, reflects market preference for ease of use and formulation stability, with liquids gaining traction for rapid absorption in both human and plant applications.

The nuanced understanding of these market segments allows for strategic market entry and product positioning. For instance, producers targeting the premium nutraceutical market must prioritize high-purity shilajit-derived fulvic acid in stable liquid concentrate form, whereas companies focusing on large-scale agricultural biostimulants are more likely to utilize cost-effective leonardite sources in both liquid and soluble powder forms. The increasing demand for standardized, measurable quality across all segments underscores the need for continuous technological innovation in standardization and compositional verification, crucial elements for unlocking new growth vectors in specialty applications.

- Source

- Leonardite

- Shilajit

- Peat

- Other Sources (e.g., oxidized coal, humates)

- Application

- Agriculture (Soil amendment, Biostimulant, Foliar spray)

- Dietary Supplements and Nutraceuticals

- Cosmetics and Personal Care

- Pharmaceuticals

- Environmental (Water treatment, Remediation)

- Form

- Liquid

- Powder (Crystalline/Soluble)

- Purity Level

- Standard Grade (Agricultural)

- High Purity Grade (Nutraceutical/Cosmetic)

Value Chain Analysis For Fulvic Acid Market

The value chain for the Fulvic Acid Market begins with the upstream sourcing and extraction of raw materials, primarily leonardite, specialized peat deposits, or shilajit, which are geographically concentrated and require specific mining or harvesting operations. This upstream phase is highly capital intensive and determines the initial cost base and impurity profile of the product. Key upstream challenges include securing consistent, high-quality deposits and managing the environmental impact associated with extraction. Companies with proprietary access to superior source material possess a significant competitive advantage, allowing them better control over the subsequent purification processes necessary for high-value applications.

The midstream segment involves the critical processing stages, including physical pre-treatment, chemical extraction (often alkali-based), and meticulous purification, increasingly utilizing advanced techniques such as ultrafiltration, reverse osmosis, and chromatographic separation to remove contaminants, heavy metals, and residual solvents. This phase adds the most value, transforming raw humic substances into stable, standardized fulvic acid concentrate or powder. Efficiency and technological sophistication in the midstream directly correlate with the final product's grade and marketability, especially in nutraceutical and cosmetic applications where purity is paramount. Quality testing and certification processes are integrated into this stage to ensure regulatory compliance before distribution.

The downstream segment focuses on formulation, packaging, and distribution. Products are formulated into various forms—liquid concentrates, ready-to-use solutions, or soluble powders—tailored to specific end-user requirements. Distribution channels are highly fragmented: agriculture utilizes large-scale B2B sales through fertilizer distributors and agronomist networks (indirect channel), while nutraceuticals rely on a mix of direct-to-consumer sales, e-commerce platforms, and specialized health food stores. Direct channels are becoming increasingly important for premium brands seeking to control brand messaging and customer relationships, especially in the supplement sector, ensuring the final product reaches the consumer with maintained efficacy and guaranteed traceability.

Fulvic Acid Market Potential Customers

The primary end-user segment for fulvic acid is the agricultural sector, encompassing large-scale commercial farming operations, specialized horticultural enterprises, and organic producers. These customers procure fulvic acid, often in bulk and in standard-grade formulations, for use as highly effective soil amendments, biostimulants, and foliar feeds. They are driven by the need to enhance nutrient uptake efficiency, mitigate soil degradation caused by synthetic chemical overuse, and boost overall crop resilience and yield. The chelating action of fulvic acid is highly valued here as it makes essential micronutrients readily available to plants, leading to healthier growth cycles and reduced reliance on costly synthetic fertilizers, addressing modern demands for sustainable resource management.

Another significant customer base resides within the nutraceutical and dietary supplement industry, consisting of supplement manufacturers, functional food and beverage companies, and pharmaceutical firms specializing in natural products. These customers require high-purity, often shilajit-derived, fulvic acid for encapsulation, tablet formulation, or incorporation into liquid supplements targeting digestive health, immune function, and anti-aging properties. This segment is characterized by demanding specification requirements, robust quality assurance protocols, and a willingness to pay premium prices for clinically validated, heavy metal-free products. The direct buyers here are typically R&D departments and procurement managers seeking specific biological activity profiles.

Emerging, yet rapidly growing, customer groups include cosmetic formulators and environmental engineering firms. The cosmetic sector integrates high-purity fulvic acid into serums, creams, and masks due to its antioxidant and anti-inflammatory properties, aiming to appeal to the clean beauty and premium skincare segments. Environmental firms utilize fulvic acid solutions for specific applications in bioremediation, particularly in chelating and immobilizing heavy metals in contaminated water sources or soil, addressing complex pollution challenges. These diverse end-users confirm the broad applicability of fulvic acid across critical industrial and health domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bio-Ag, Inc., FulvicXcell, Pure Fulvic Minerals, RLF AgTech, Nutri-Tech Solutions, The Fulvic Company, Black Earth Humic, Kilo Organics, Vital Earth Minerals, Inc., Humic Growth Solutions, Holganix, North American Fulvic Acid Association, Specialty Humics, Ag Concepts, Minelco Fulvic. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fulvic Acid Market Key Technology Landscape

The technological landscape of the Fulvic Acid market is primarily defined by advanced extraction, purification, and standardization methodologies, crucial for separating the valuable fulvic acid component from its complex source matrix while ensuring the removal of undesirable heavy metals and contaminants. The dominant extraction technology involves alkali treatment (e.g., potassium hydroxide or sodium hydroxide) followed by acid precipitation, a historically established method for separating humic acids from fulvic acid based on differential solubility. However, modern technological advancements focus on refining this process to minimize chemical residues and increase selectivity. New generation techniques are moving toward greener chemistry, employing bio-based solvents or pressurized liquid extraction to mitigate environmental impact and enhance the organic credential of the final product.

Purification represents the most technologically intensive stage, particularly for nutraceutical-grade fulvic acid. Key purification technologies include membrane separation techniques such as ultrafiltration (UF) and nanofiltration (NF). UF is employed to remove high molecular weight humic substances and colloidal materials, while NF is effective at concentrating the lower molecular weight fulvic acid fraction and removing multivalent ions and residual salts. Furthermore, ion exchange chromatography is increasingly utilized to polish the extract, ensuring exceptional purity and consistency, which is mandatory for human consumption. This high-tech approach enables manufacturers to achieve industry-leading purity levels, often exceeding 95%, thereby justifying premium pricing in specialty markets and adhering to stringent food and drug administration guidelines globally.

Standardization technology is equally vital. Given that fulvic acid is not a single chemical entity but rather a complex mixture of organic acids, standardization involves employing advanced analytical techniques, such as High-Performance Liquid Chromatography (HPLC), Gel Permeation Chromatography (GPC), and Fourier-Transform Infrared Spectroscopy (FTIR). These tools are used to define a consistent "fingerprint" of the fulvic acid content, molecular weight distribution, and functional group activity. This standardization ensures batch-to-batch consistency and allows manufacturers to substantiate marketing claims regarding chelation capacity and biological activity, crucial for building long-term customer confidence and addressing the scientific community's demand for rigorous, replicable data.

Regional Highlights

- North America (NA): The North American market, particularly the United States, holds a significant market share, driven primarily by robust demand in the dietary supplements and functional food sectors. Consumers are highly focused on wellness, natural detoxification, and immune support, leading to high adoption rates of premium fulvic acid supplements. The region also exhibits advanced agricultural practices where fulvic acid biostimulants are integral to high-value crop production, such as fruits and specialized vegetables. Strict regulatory standards, enforced by agencies like the FDA, necessitate high investment in product quality and purity, favoring major players with established extraction technologies and substantial R&D capabilities.

- Europe: Europe represents a high-value, quality-driven market, though growth is tempered by complex regulatory structures, especially the Novel Food Regulation which scrutinizes new ingredients entering the dietary supplement space. Agricultural use is strong, spurred by the Common Agricultural Policy (CAP) promoting environmentally friendly farming and reduced synthetic fertilizer input. Germany, France, and the UK are key markets, characterized by consumer demand for sustainability and traceability. The region's stringent standards push producers toward sophisticated membrane filtration techniques to ensure products are free from heavy metals and meet strict purity thresholds.

- Asia Pacific (APAC): APAC is forecast to exhibit the highest growth rate, fueled by its immense agricultural sector and rapidly expanding population. Countries like China, India, and Australia utilize fulvic acid extensively as a soil enhancer and yield booster to improve productivity and manage soil salinity, especially in large-scale farming. Furthermore, traditional use of shilajit in Ayurvedic medicine drives the nutraceutical segment, particularly in South Asia. Infrastructure investments in extraction facilities and increasing consumer disposable income dedicated to health and wellness products are accelerating market penetration across the region.

- Latin America (LATAM): The LATAM market, led by Brazil and Argentina, is dominated by agricultural applications, largely servicing the extensive soybean, corn, and sugarcane farming industries. Fulvic acid is valued for improving nutrient efficiency in expansive crop areas and mitigating environmental stress. Market expansion is dependent on improving logistics infrastructure and overcoming economic volatilities, though the fundamental demand driver of enhancing crop productivity remains consistently high across the continent.

- Middle East and Africa (MEA): This region is an emerging market, where fulvic acid's primary utility lies in combating challenging agricultural conditions such as soil alkalinity, drought stress, and poor water retention capabilities. Countries in the Gulf Cooperation Council (GCC) invest in biostimulants to improve domestic food security. Demand remains concentrated within the agricultural sector, though early adoption in niche cosmetic applications is beginning to emerge in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fulvic Acid Market.- Bio-Ag, Inc.

- FulvicXcell

- Pure Fulvic Minerals

- RLF AgTech

- Nutri-Tech Solutions

- The Fulvic Company

- Black Earth Humic

- Kilo Organics

- Vital Earth Minerals, Inc.

- Humic Growth Solutions

- Holganix

- North American Fulvic Acid Association

- Specialty Humics

- Ag Concepts

- Minelco Fulvic

- Desert Mountain Corporation

- Fuxian (Fujian) Humic Acid Technology Co., Ltd.

- International Humic Substances Society

- Fulvic Health (Pty) Ltd.

- Humatech, Inc.

Frequently Asked Questions

Analyze common user questions about the Fulvic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of fulvic acid in agriculture?

Fulvic acid acts primarily as a powerful biostimulant and chelating agent in agriculture, enhancing the uptake of essential minerals and micronutrients by plants, improving soil structure, and boosting overall crop health and yield efficiency.

Is there a regulatory standard for fulvic acid in dietary supplements?

While specific global regulations vary (e.g., FDA recognition versus EFSA Novel Food classification), manufacturers are required to adhere to strict purity standards, particularly concerning heavy metal contamination, often demanding high-grade, documented purification processes for consumer safety.

How does the source material (e.g., shilajit vs. leonardite) affect the final product?

The source material significantly impacts the chemical composition and purity profile. Shilajit-derived fulvic acid is often considered premium due to traditional medicinal use, while leonardite provides high-volume, cost-effective material primarily used in agricultural applications, requiring rigorous purification for human consumption.

What is the market potential for fulvic acid in the cosmeceutical sector?

The cosmeceutical sector shows high potential, driven by fulvic acid's antioxidant, anti-inflammatory, and potential transdermal absorption enhancing properties, making it valuable for anti-aging, skin repair, and topical treatments in the premium skincare segment.

Which technology is crucial for achieving high-purity fulvic acid?

Advanced membrane separation technologies, specifically Ultrafiltration (UF) and Nanofiltration (NF), are crucial for high-purity applications, as they effectively remove unwanted contaminants, high molecular weight humic acids, and heavy metals, ensuring the product is safe and consistent for nutraceutical use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fulvic Acid Market Size Report By Type (Industrial Grade, Pharmaceutical Grade), By Application (Medicine, Fertilizer, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fulvic Acid Market Statistics 2025 Analysis By Application (Medicine, Fertilizer), By Type (Industrial Grade, Pharmaceutical Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pharmaceutical Grade Fulvic Acid Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High Purity Pharmaceutical Grade Fulvic Acid, Low Purity Pharmaceutical Grade Fulvic Acid), By Application (Medicine, Health Care Products, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager