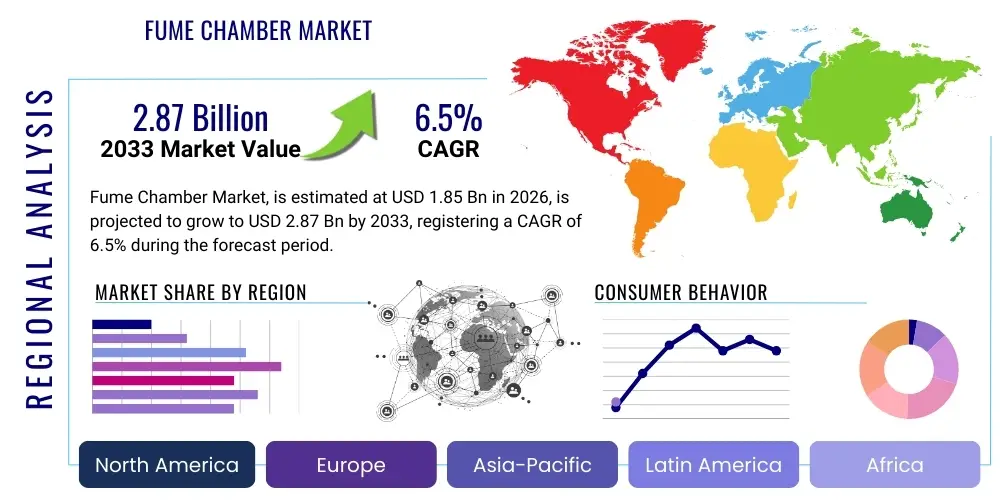

Fume Chamber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438941 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fume Chamber Market Size

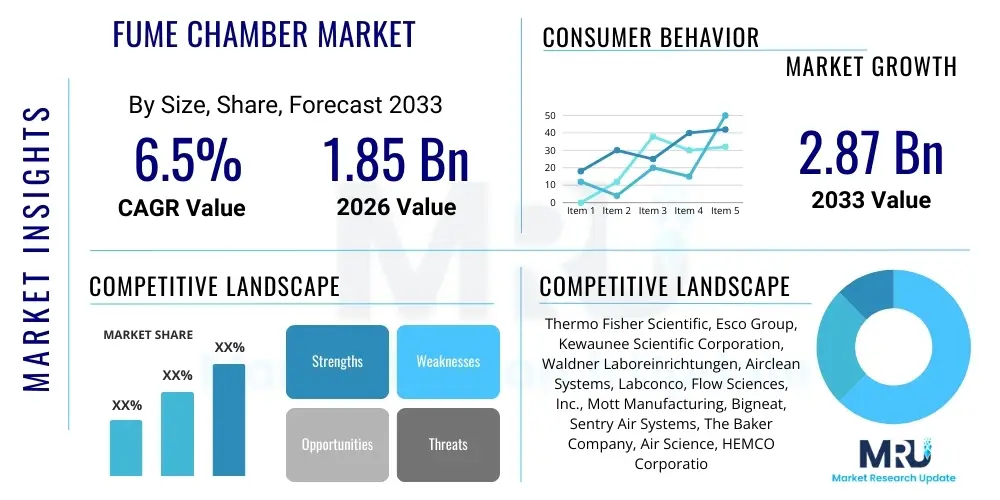

The Fume Chamber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.87 Billion by the end of the forecast period in 2033.

Fume Chamber Market introduction

The Fume Chamber Market encompasses the manufacturing, distribution, and utilization of enclosed, ventilated workspaces designed to effectively capture, contain, and exhaust hazardous fumes, vapors, and airborne particulates generated during laboratory processes. These critical safety devices, often referred to as fume hoods, serve as the primary engineering control in laboratories across diverse industries, safeguarding personnel from toxic or flammable substances. The market is characterized by stringent regulatory oversight, particularly from bodies like OSHA and ANSI, which mandate specific airflow performance and containment standards, driving continuous innovation in energy efficiency and safety features.

Fume chambers are indispensable across major applications, including synthetic organic chemistry, analysis of potent compounds in pharmaceutical R&D, material testing, and forensic investigations. The product’s core function is to maintain a negative pressure barrier, ensuring that contaminants are channeled away from the operator and safely filtered or exhausted outside the building. Key benefits derived from adopting high-quality fume chambers include enhanced laboratory safety, compliance with health regulations, reduced risk of cross-contamination, and the ability to handle highly volatile and dangerous reagents, thereby accelerating complex research and manufacturing operations.

The market growth is primarily driven by the expansion of the global pharmaceutical and biotechnology sectors, coupled with increasing investments in academic research infrastructure and strict adherence to workplace safety regulations. Furthermore, technological advancements leading to the development of sophisticated ductless systems—which offer flexibility and reduced installation costs—and chambers optimized for high-performance low-flow (HPLF) operations are key driving factors fostering market expansion. The necessity for these containment solutions in emerging fields such as gene therapy and advanced material science further reinforces the sustained demand throughout the forecast period.

Fume Chamber Market Executive Summary

The Fume Chamber Market is experiencing steady growth, propelled by robust regulatory frameworks governing laboratory safety and significant capital expenditures in life sciences R&D, particularly in North America and Asia Pacific. Business trends indicate a shift toward environmentally friendly and energy-efficient designs, with manufacturers focusing heavily on variable air volume (VAV) systems that dramatically reduce HVAC operating costs. The ductless segment is witnessing accelerated adoption due to its modularity, ease of installation, and effectiveness in handling specific chemical loads, although traditional ducted systems remain dominant in high-hazard applications requiring significant air exchange capacity. Strategic alliances focusing on integrating smart features, such as remote monitoring and predictive maintenance, are defining competitive differentiation.

Regionally, North America continues to hold the largest market share, driven by a mature pharmaceutical industry, extensive government funding for basic research, and rigorous enforcement of safety standards. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapidly expanding biomanufacturing hubs in China and India, coupled with increasing foreign direct investment in localized research facilities. Europe maintains a strong presence, emphasizing standardization and compliance with stringent environmental directives. Segment trends highlight that the Pharmaceutical & Biotechnology end-user segment is the largest consumer, necessitated by the complexity and toxicity of compounds synthesized during drug discovery and development phases. Simultaneously, the academic and institutional sector remains a foundational pillar of demand, driven by ongoing infrastructure upgrades.

The market structure is moderately fragmented, with large multinational corporations maintaining dominance through comprehensive product portfolios and global distribution networks, while specialized regional players focus on niche application requirements or custom engineering solutions. A key trend impacting the entire ecosystem is the move towards digital integration; modern fume chambers are increasingly incorporating advanced sensor technology and sophisticated control algorithms to optimize sash positioning, monitor face velocity in real-time, and log performance data for audit purposes, thereby enhancing both safety and operational efficiency. This focus on data-driven compliance and energy efficiency is reshaping product development cycles across all material types, including epoxy resin, stainless steel, and polypropylene, ensuring long-term sustainability for high-volume lab operations.

AI Impact Analysis on Fume Chamber Market

User inquiries regarding AI's impact on the Fume Chamber Market commonly revolve around themes of predictive maintenance, optimization of airflow mechanics, and integration with wider laboratory automation ecosystems. Users are primarily concerned with how AI can enhance safety margins, reduce energy consumption in VAV systems, and facilitate automatic compliance reporting. Specifically, questions often address the potential for AI algorithms to anticipate filter saturation in ductless systems or predict mechanical failure in exhaust blowers before critical safety limits are breached. This analysis summarizes key expectations: users foresee AI transforming fume chambers from passive containment units into integrated, intelligent safety systems capable of self-diagnostics and dynamic operational adjustments, minimizing human error and maximizing system uptime while rigorously maintaining containment standards.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data (vibration, temperature, current draw) from blowers and fans, predicting component failure and scheduling maintenance proactively, significantly reducing unplanned downtime.

- Real-time Airflow Optimization: Employing AI to dynamically adjust variable air volume (VAV) settings based on sensed operator presence, chemical usage profiles, and external ambient conditions, ensuring optimal face velocity (containment) while minimizing energy expenditure.

- Smart Compliance and Reporting: Automated generation of audit trails and compliance reports by correlating usage patterns, maintenance logs, and real-time performance metrics, simplifying regulatory adherence and reducing manual documentation burdens.

- Enhanced Filter Management (Ductless Chambers): Implementing AI to analyze the spectrum of chemicals handled and correlating this with adsorption rates to predict the remaining lifespan of carbon filters accurately, moving beyond simple pressure drop measurements.

- Integration with Lab Automation Systems: Allowing fume chambers to communicate containment status and chemical inventory data directly with Laboratory Information Management Systems (LIMS) or robotic platforms, enabling automated shutdown or process modifications in case of anomalies.

- Personalized Safety Alerts: Developing adaptive algorithms that learn specific user behaviors and laboratory workflows, providing tailored, real-time safety warnings if operations deviate from safe operating parameters within the chamber.

DRO & Impact Forces Of Fume Chamber Market

The dynamics of the Fume Chamber Market are governed by a complex interplay of stringent safety regulations, relentless technological innovation focused on sustainability, and the capital-intensive nature of advanced research infrastructure. Drivers for market expansion include escalating global investments in biopharma research, mandated regulatory compliance (OSHA, EH&S), and the increasing construction of advanced BSL/C-GMP facilities worldwide. Conversely, restraints involve the high initial investment cost associated with VAV ducted systems and the significant energy consumption tied to maintaining high air exchange rates, which can deter adoption in budget-constrained settings. Opportunities lie in the rapid proliferation of high-efficiency ductless technology, modular lab designs, and leveraging digital twins for optimizing lab airflow dynamics. These market forces collectively necessitate continuous improvement in safety metrics and energy performance, exerting sustained upward pressure on product quality and compliance standards across the industry.

Key drivers center around regulatory environments that continually tighten permissible exposure limits (PELs) for hazardous substances, forcing laboratories to upgrade older, less efficient chambers. The global focus on personalized medicine and advanced therapeutics, such as cell and gene therapies, mandates the use of highly controlled, validated containment equipment during complex synthesis and processing steps. Furthermore, academic institutions, receiving increased government funding for specialized research, are systematically replacing outdated infrastructure, contributing substantially to new demand. These institutional upgrades often prioritize systems that offer low-maintenance operational profiles and documented energy savings, favoring state-of-the-art VAV and ductless solutions.

Restraints are primarily economic and logistical. While ductless options address some cost issues, high-volume chemistry operations still require robust ducted systems, imposing substantial construction and operational expenses due to necessary HVAC modifications and energy usage. Moreover, the complexity involved in retrofitting existing laboratory spaces often presents a significant logistical hurdle, delaying or limiting the installation of new, larger containment units. The opportunity landscape is expanding dramatically due to the demand for application-specific chambers (e.g., radioisotope handling, perchloric acid chambers) and the integration of IoT technologies, which transforms standard fume chambers into crucial nodes within the interconnected smart lab environment. The overall impact forces compel manufacturers to prioritize energy efficiency, safety validation, and ergonomic design simultaneously to maintain competitive relevance and address the diverging needs of both emerging and established research markets.

Segmentation Analysis

The Fume Chamber Market is broadly segmented based on Type, End-User, and Material, reflecting the diverse applications and regulatory requirements across the global laboratory landscape. Segmentation by type differentiates between traditional ducted systems, which vent chemicals outside the facility, and ductless systems, which use activated carbon or HEPA/ULPA filtration to recirculate filtered air back into the lab. End-user segmentation captures the primary consuming sectors, with major demand emanating from heavily regulated industries like pharmaceuticals and government research institutions. Finally, material segmentation highlights construction differences based on required chemical resistance and durability, critical factors influencing the chamber's longevity and suitability for specific chemical exposures. This granular segmentation allows manufacturers and stakeholders to accurately target product development and marketing efforts towards high-growth, application-specific sub-markets.

- By Type:

- Ducted Fume Chambers (Constant Air Volume (CAV) and Variable Air Volume (VAV))

- Ductless Fume Chambers (Recirculating Fume Hoods)

- Walk-in Fume Chambers

- Specialty Fume Chambers (e.g., Perchloric Acid Fume Chambers, Radioisotope Hoods)

- By End-User:

- Pharmaceutical & Biotechnology Companies (R&D and Manufacturing)

- Academic & Research Institutions (Universities and Government Labs)

- Chemical & Petrochemical Industry

- Food & Beverage Testing Laboratories

- Clinical & Diagnostic Laboratories

- Forensic and Government Agencies

- By Material:

- Stainless Steel

- Polypropylene (PP)

- Epoxy Resin

- Phenolic Resin

Value Chain Analysis For Fume Chamber Market

The value chain for the Fume Chamber Market starts with the upstream sourcing of specialized materials, including high-grade stainless steel, chemically inert polymers like polypropylene and epoxy resin, and sophisticated filtration media (activated carbon, HEPA filters). Key upstream activities involve quality assurance on raw material chemical resistance and the manufacturing of precision components like blowers, VAV controllers, and monitoring sensors. Efficiency and stability in the supply of these specialized components are paramount, as they directly influence the final product’s performance validation and compliance. Suppliers that can provide certified, traceable materials and components gain a competitive edge in serving manufacturers committed to international safety standards such as ASHRAE 110.

The core midstream segment involves the design, fabrication, assembly, and testing of the fume chambers. Manufacturers dedicate significant resources to R&D to develop ergonomic, energy-efficient designs (especially VAV and low-flow models) and ensure rigorous testing (e.g., tracer gas containment testing) is performed before distribution. The downstream segment involves complex distribution channels, often blending direct sales for highly customized institutional projects with indirect distribution through specialized laboratory equipment dealers and regional resellers. Direct sales allow manufacturers to offer comprehensive installation, commissioning, and validation services, crucial for complex lab build-outs in the pharmaceutical sector. Indirect channels facilitate broader market penetration into smaller clinical labs and academic departments.

Both direct and indirect distribution channels are heavily reliant on skilled technical support staff capable of advising clients on appropriate chamber selection based on chemical risk assessments and ventilation requirements. Post-sale services, including maintenance contracts, performance re-validation, and filter replacement (critical for ductless systems), represent a significant recurring revenue stream and are essential components of customer retention. The effectiveness of the value chain is ultimately measured by the ability to deliver validated containment solutions promptly and support ongoing compliance, ensuring long-term partnerships with research-intensive end-users across all geographic regions.

Fume Chamber Market Potential Customers

The primary customers for fume chambers are institutional entities that routinely handle hazardous, volatile, or highly potent substances requiring effective isolation and containment to ensure operator safety and environmental protection. The largest end-user group comprises pharmaceutical and biotechnology companies, specifically their R&D divisions involved in drug synthesis, screening, and toxicology testing, where precision containment is non-negotiable for handling APIs (Active Pharmaceutical Ingredients) and potent compounds. These customers frequently require specialized chambers like walk-in hoods or high-performance, low-flow VAV systems to manage high throughput and energy consumption in large-scale facilities.

Academic and government research institutions, including major universities and national laboratories, constitute another critical customer base. These entities purchase fume chambers for chemistry teaching labs, advanced materials research, and specialized projects (e.g., nuclear physics or environmental analysis). Their purchasing decisions are often influenced by grant funding cycles, institutional safety mandates, and the need for durable, multi-user accessible equipment. Demand from this sector often favors reliable ducted systems for general chemistry and cost-effective ductless solutions for teaching environments involving less volatile chemicals or where facility renovation is impractical.

Other significant buyers include quality control and testing laboratories across various industries, such as the chemical, petrochemical, and food & beverage sectors, where routine sample preparation often generates fumes. Furthermore, forensic laboratories and public health agencies rely on fume chambers for evidence processing, chemical analysis, and containment of biohazards. Essentially, any facility where manipulation of hazardous chemical or biological agents occurs, driven by increasingly strict safety regulations and corporate responsibility mandates, represents a core potential customer for advanced fume containment technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.87 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Esco Group, Kewaunee Scientific Corporation, Waldner Laboreinrichtungen, Airclean Systems, Labconco, Flow Sciences, Inc., Mott Manufacturing, Bigneat, Sentry Air Systems, The Baker Company, Air Science, HEMCO Corporation, Mystaire Inc., Sheldon Manufacturing, Inc., Kottermann, Yamato Scientific Co., Ltd., ZAP Group, Teclab, Total Lab Solutions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fume Chamber Market Key Technology Landscape

The technological landscape of the Fume Chamber Market is defined by continuous advancements aimed at improving safety, enhancing energy efficiency, and integrating the containment unit into the broader smart laboratory infrastructure. A pivotal technology is the Variable Air Volume (VAV) system, which automatically adjusts the exhaust volume based on sash position, significantly reducing conditioned air usage compared to older Constant Air Volume (CAV) systems. Modern VAV chambers employ sophisticated sensors and digital controllers to maintain a consistent face velocity regardless of operational changes, ensuring containment integrity while drastically lowering the laboratory's overall HVAC energy footprint. This shift towards intelligent VAV control has become a standard requirement in new construction and major renovation projects due to compelling return-on-investment calculations based on energy savings.

Another dominant technological trend involves the refinement of ductless fume chamber technology. These systems utilize advanced multi-stage filtration—often featuring high-efficiency activated carbon filters and HEPA filters—to capture contaminants and recirculate clean air, eliminating the need for external ductwork. Recent innovations in ductless technology focus on developing smarter filter saturation monitoring using chemical sensors and algorithms to precisely predict filter lifespan based on the actual chemical load rather than relying solely on pressure drop. This enhances safety and optimizes replacement cycles. Furthermore, the modularity and portability of ductless chambers make them increasingly attractive for temporary labs, academic teaching environments, and facilities handling non-trace quantities of specific chemicals, driving rapid technological adoption in niche markets.

The emergence of IoT and integrated lab management systems (LIMS) is defining the next generation of fume chamber technology. New chambers are equipped with networked interfaces that allow real-time performance monitoring, remote diagnostics, and data logging capabilities, crucial for compliance reporting. Technologies such as automated sash closing mechanisms, visual and auditory alarm systems for face velocity deviations, and ergonomic enhancements like integrated LED lighting and specialized internal baffling designs, collectively improve user interaction and operational safety. This technological convergence transforms the fume chamber from a simple ventilation device into a high-tech safety appliance optimized for the demands of modern, automated research environments.

Regional Highlights

- North America: Dominates the global Fume Chamber Market, driven by the presence of major pharmaceutical giants, world-class research universities, and robust governmental funding (NIH, NSF). Stringent regulatory enforcement by agencies like OSHA and ANSI mandates the use of certified containment equipment. The region is a primary adopter of advanced VAV systems and high-performance low-flow hoods, focusing heavily on energy efficiency and compliance validation protocols (ASHRAE 110).

- Europe: Represents a mature market characterized by rigorous safety standards (EN 14175 series) and a strong emphasis on sustainability and energy consumption reduction. Western European countries, particularly Germany, the UK, and Switzerland, are centers for specialized chemical and pharmaceutical manufacturing, requiring customized and high-quality fume chambers. The market is steadily transitioning towards smart VAV and integrated lab solutions to meet ambitious carbon footprint reduction goals.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. Growth is stimulated by massive infrastructural investments in biomanufacturing, contract research organizations (CROs), and academic expansion in China, India, and South Korea. While historically utilizing simpler designs, the APAC market is rapidly upgrading to international safety standards, favoring both cost-effective ductless solutions for quick deployment and large-scale ducted systems for new R&D parks. Regulatory convergence with Western standards is a major market accelerator.

- Latin America (LATAM): Growth is moderate but steady, concentrated in economic centers like Brazil and Mexico. Market expansion is dependent on governmental investment in public health and university infrastructure improvements, coupled with increased foreign investment in localized drug production. Price sensitivity often leads to slower adoption of high-end VAV technology, but demand for reliable, basic ducted systems remains constant.

- Middle East and Africa (MEA): This region is an emerging market primarily driven by diversification efforts in the Gulf Cooperation Council (GCC) nations, focusing on establishing indigenous research capabilities in petrochemicals, pharmaceuticals, and environmental science. Major infrastructure projects necessitate the installation of certified fume chambers, often imported from established European and North American manufacturers, emphasizing highly durable materials like stainless steel for demanding conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fume Chamber Market.- Thermo Fisher Scientific

- Esco Group

- Kewaunee Scientific Corporation

- Waldner Laboreinrichtungen

- Airclean Systems

- Labconco

- Flow Sciences, Inc.

- Mott Manufacturing

- Bigneat

- Sentry Air Systems

- The Baker Company

- Air Science

- HEMCO Corporation

- Mystaire Inc.

- Sheldon Manufacturing, Inc.

- Kottermann

- Yamato Scientific Co., Ltd.

- ZAP Group

- Teclab

- Total Lab Solutions

Frequently Asked Questions

Analyze common user questions about the Fume Chamber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ducted (VAV) and Ductless Fume Chambers?

The primary difference lies in air handling and exhaust. Ducted Fume Chambers (especially VAV) connect to the building’s HVAC system to exhaust contaminated air outside, handling a wide range of chemicals. Ductless Fume Chambers use internal activated carbon and HEPA filters to clean the air and recirculate it back into the laboratory, offering greater installation flexibility but requiring strict filter management based on the specific chemicals used.

Why is Variable Air Volume (VAV) technology crucial for modern fume chambers?

VAV technology is crucial because it significantly enhances energy efficiency. By automatically adjusting the exhausted air volume based on the sash height, VAV systems ensure optimal containment face velocity while minimizing the volume of conditioned air removed from the laboratory, leading to substantial reductions in long-term HVAC operating costs.

Which end-user segment dominates the demand for Fume Chamber equipment?

The Pharmaceutical and Biotechnology end-user segment dominates the demand. This is due to the intensive research, synthesis, and quality control processes involving highly potent and volatile chemical compounds, necessitating stringent containment solutions to comply with Good Manufacturing Practices (GMP) and workplace safety regulations.

How does IoT integration enhance the safety of fume chambers?

IoT integration enhances safety by enabling continuous, real-time monitoring of critical operational parameters, such as face velocity, sash position, and filter saturation. This allows for immediate digital alerts and automated data logging for compliance, ensuring that any deviation from safe operating conditions is instantly flagged and recorded, minimizing risk to the operator.

What are the key materials used in Fume Chamber construction, and why are they selected?

Key materials include stainless steel, polypropylene (PP), and epoxy resin. Stainless steel is chosen for its durability and fire resistance, essential for high-heat or specific chemical applications. Polypropylene and epoxy resin are favored for their excellent chemical resistance to acids and harsh solvents, crucial for preventing degradation and ensuring the longevity of the containment structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager