Fume Cupboard Worktop Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435645 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Fume Cupboard Worktop Market Size

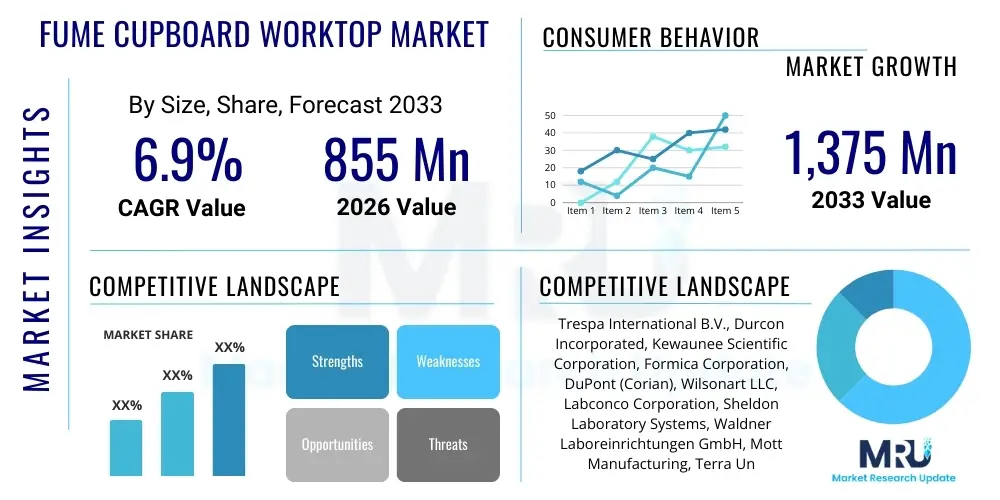

The Fume Cupboard Worktop Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.85% between 2026 and 2033. The market is estimated at $855 Million USD in 2026 and is projected to reach $1,375 Million USD by the end of the forecast period in 2033.

Fume Cupboard Worktop Market introduction

The Fume Cupboard Worktop Market encompasses the specialized surfaces utilized within laboratory fume hoods designed to contain hazardous fumes, vapors, and particulate matter. These worktops are critical components of laboratory safety infrastructure, providing a chemically resistant, heat-tolerant, and easy-to-clean platform for conducting sensitive or dangerous experiments. The materials used, such as epoxy resin, phenolic resin, and stainless steel, are selected based on their specific resistance profiles against a wide range of corrosive agents, high temperatures, and mechanical stress, ensuring the longevity and safety compliance of the research environment. The functional integrity of the worktop directly correlates with the overall protective capability of the fume cupboard system, making material selection a stringent process driven by regulatory standards like ASHRAE 110 and SEFA guidelines.

Fume cupboard worktops find major applications across diverse sectors, including chemical processing, pharmaceutical R&D, academic research institutions, clinical diagnostics, and petrochemical laboratories. In the pharmaceutical sector, worktops must withstand frequent exposure to highly concentrated solvents and sterilizing agents, while in chemical laboratories, resistance to strong acids and bases is paramount. The primary benefits driving market demand include enhanced laboratory safety by preventing spills from penetrating the substrate and protecting the structural integrity of the hood; superior chemical containment capability; and improved operational efficiency due to reduced maintenance time. Furthermore, regulatory mandates concerning laboratory safety and occupational health worldwide continually emphasize the need for certified, high-performance work surfaces, sustaining a robust demand trajectory.

Key driving factors propelling the growth of this specialized market include the escalating investment in global life sciences and biotechnology research, particularly post-pandemic, leading to the establishment of new, sophisticated laboratory facilities. Additionally, the replacement and refurbishment of outdated laboratory infrastructure, especially in developed economies, contributes significantly to market expansion. The increasing complexity of chemical synthesis and analysis requiring specialized protective environments, coupled with the stringent enforcement of international safety standards, compels institutions to adopt high-grade, durable worktop materials. Innovation in material science, focusing on antimicrobial properties and sustainable manufacturing processes, further acts as a positive market catalyst, addressing evolving user demands for hygiene and environmental responsibility.

Fume Cupboard Worktop Market Executive Summary

The Fume Cupboard Worktop Market demonstrates strong momentum, characterized by continuous investment in research infrastructure and rigorous regulatory compliance mandates globally. Business trends indicate a pronounced shift towards high-performance materials like solid epoxy resin and compact phenolic laminate due to their superior chemical resistance and durability compared to traditional materials. Market consolidation is observed through strategic partnerships between raw material suppliers and specialized laboratory furniture manufacturers, aiming to optimize supply chain efficiency and offer integrated laboratory solutions. Furthermore, the burgeoning demand for specialized containment solutions for highly potent active pharmaceutical ingredients (HPAPIs) is driving innovation in seamless and non-porous work surface design, ensuring maximum cleanability and minimizing cross-contamination risks.

Regionally, the market exhibits differential growth patterns. North America, driven by substantial government funding for biomedical research and the presence of major pharmaceutical and academic research hubs, remains the largest revenue contributor. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid industrialization, the establishment of numerous R&D centers in countries like China and India, and increasing foreign direct investment in local pharmaceutical manufacturing. European market stability is maintained through strict adherence to EU safety directives (e.g., REACH regulations) and high standards for occupational safety, necessitating regular upgrades of existing laboratory facilities to comply with modern specifications.

Segment trends reveal that the Epoxy Resin material segment currently holds the dominant market share due to its unparalleled thermal and chemical resistance, making it the preferred choice for high-intensity chemical environments. However, the Phenolic Resin segment is experiencing accelerated growth, particularly in educational and light-duty laboratories, owing to its cost-effectiveness, lighter weight, and good balance of chemical resistance. Application-wise, the Pharmaceutical and Biotechnology segment leads the market, driven by intense drug discovery pipelines and increasing focus on quality control and specialized manufacturing processes. The shift toward modular and flexible laboratory designs is also influencing material procurement, favoring surfaces that can be easily integrated into reconfigurable laboratory layouts.

AI Impact Analysis on Fume Cupboard Worktop Market

Common user questions regarding AI's influence on the Fume Cupboard Worktop Market primarily revolve around how automation affects laboratory footprint, whether AI can predict worktop wear and tear, and if smart monitoring systems will replace manual safety checks. Users are concerned about optimizing laboratory design efficiency and achieving predictive maintenance. Based on this analysis, AI is primarily expected to impact the operational efficiency and predictive maintenance cycles of the associated fume cupboard systems, rather than the worktop material itself. Key themes summarize that AI-driven data analytics will optimize resource allocation and enhance regulatory reporting, focusing on extending the lifecycle of high-value laboratory assets, including specialized worktops, through intelligent usage monitoring and proactive safety warnings.

- AI integration enables predictive maintenance routines for fume cupboard systems, indirectly extending the lifespan and ensuring the integrity of the worktop by maintaining optimal airflow and temperature control.

- Advanced image recognition and machine learning algorithms can analyze high-resolution sensor data (e.g., thermal imaging, chemical sensing) to detect early signs of material degradation or chemical corrosion on the worktop surface.

- AI-powered lab management systems optimize experimental workflows, potentially leading to less material abuse and fewer unexpected chemical spills, reducing worktop replacement frequency.

- The adoption of automated, high-throughput screening (HTS) processes, often managed by AI, drives demand for standardized, precision-engineered worktops that seamlessly integrate with robotic equipment and automated liquid handling systems.

- AI assists in generating complex compliance documentation by logging exposure history and temperature fluctuations experienced by the worktop, thereby simplifying regulatory audits related to material resilience.

- Virtual reality (VR) and augmented reality (AR) guided by AI facilitate faster, more accurate installation and repair training for specialized worktops, reducing downtime and installation errors.

DRO & Impact Forces Of Fume Cupboard Worktop Market

The Fume Cupboard Worktop Market is fundamentally influenced by the interplay of stringent safety regulations and burgeoning investment in scientific research infrastructure globally. Drivers include mandatory occupational safety standards, escalating complexity in chemical research necessitating specialized containment, and the expansion of the life sciences sector. Restraints largely center on the high initial investment required for premium worktop materials (like solid epoxy resin) and the long replacement cycles inherent in durable laboratory equipment, which can slow immediate market churn. Opportunities arise from developing sustainable and antimicrobial surface technologies and tapping into emerging markets in Asia and Latin America where new laboratory construction is accelerating. These factors, combined with technological shifts toward modular design, exert significant impact forces on material innovation, pricing strategies, and regional market penetration.

Key drivers include the global expansion of high-level biosafety laboratories (BSL-3 and BSL-4) which mandate the use of seamless, non-porous, and exceptionally durable worktops to ensure sterility and containment. Government funding initiatives supporting R&D, particularly in biotechnology and public health, directly translate into capital expenditure on laboratory build-outs and retrofits, boosting demand for high-quality fume cupboard components. Furthermore, heightened environmental consciousness is driving manufacturers to innovate worktops that are compliant with low volatile organic compound (VOC) emission standards and are potentially recyclable, meeting the criteria for green building certifications in laboratory construction.

Conversely, significant restraints hinder market growth. The complexity associated with adhering to varied international safety standards (e.g., ANSI/AIHA Z9.5 in the US, EN 14175 in Europe) can create barriers for standardized product deployment across different regions. Moreover, the raw material cost volatility, particularly for petroleum-derived resins, poses a perpetual challenge to maintaining stable pricing structures. However, these challenges are mitigated by robust opportunities, such as the increasing utilization of advanced digital tools (BIM modeling) in laboratory design, which allows for precise customization and specification of worktops, ensuring optimal fit and function for highly specific research protocols. The continuous demand for corrosion-proof surfaces in harsh industrial environments, such as electroplating and chemical refining, provides a specialized, high-margin niche for premium material providers.

Segmentation Analysis

The Fume Cupboard Worktop Market is comprehensively segmented based on material type, application, and end-user, reflecting the diverse requirements of the global laboratory landscape. Material type is the most critical differentiator, as performance specifications—such as chemical resistance, heat tolerance, and load-bearing capacity—are dictated entirely by the base substance. Epoxy resin and phenolic resin dominate the market structure, catering to high-intensity chemical and moderately intense research environments, respectively. The application segmentation demonstrates the varied industry needs, with pharmaceuticals demanding the highest specifications due to stringent validation protocols. End-user categorization reveals a stable demand foundation from academic institutions alongside volatile, but high-value, projects originating from commercial R&D laboratories and government defense or health agencies.

- By Material Type:

- Epoxy Resin

- Phenolic Resin/Compact Laminate

- Stainless Steel

- Ceramic

- High-Density Polyethylene (HDPE)

- By Application:

- Chemical Laboratories

- Pharmaceutical and Biotechnology R&D

- Academic and Research Institutions

- Clinical Diagnostics

- Industrial/Petrochemical Testing

- By End-User:

- Universities and Colleges

- Pharmaceutical and Biotechnology Companies

- Government and Public Sector Laboratories

- Hospitals and Private Diagnostic Centers

- Industrial Manufacturing Facilities

Value Chain Analysis For Fume Cupboard Worktop Market

The value chain for fume cupboard worktops is highly specialized, beginning with the sourcing and manufacturing of raw materials, primarily specialized resins (epoxies, phenolics) and alloys (stainless steel). Upstream analysis involves chemical processing firms that produce these high-grade materials, focusing on consistent quality control to meet strict industry standards for purity and resistance. Material manufacturers then process these raw chemicals into large sheets or slabs through casting, molding, or compression techniques, requiring significant capital investment in specialized fabrication equipment. Efficiency at this stage is crucial, as material defects translate directly into reduced performance and increased failure rates in the laboratory environment. Vertical integration, where raw material suppliers also offer fabrication services, is becoming increasingly common to control quality and reduce material waste.

Midstream activities involve secondary fabrication and integration. Specialized laboratory furniture manufacturers procure these finished material slabs and customize them—cutting, routing, polishing, and installing specific features such as sink bowls, drain troughs, and service fixtures (e.g., gas taps, electrical outlets). This stage requires precision machining to ensure seamless installation into the fume cupboard chassis, complying with precise dimensional tolerances necessary for proper airflow dynamics. Distribution channels are bifurcated: direct channels involve large laboratory design-build contractors working directly with manufacturers for major construction or renovation projects. Indirect channels utilize specialized laboratory equipment distributors who manage smaller projects, retrofits, and supply maintenance spares.

Downstream analysis focuses on installation and end-user interaction. Certified installers are required to ensure the worktop is level, sealed correctly (using chemically resistant sealants), and integrated without compromising the overall fume cupboard’s containment performance. Potential customers, spanning academic, corporate, and governmental entities, rely heavily on post-sale services, including warranty fulfillment, cleaning protocol advice, and replacement services. The lifespan of the worktop, often exceeding 15–20 years for premium materials, means that brand reputation and reliable long-term support are key factors influencing procurement decisions. The value chain emphasizes quality assurance at every stage, given the life safety implications associated with product failure.

Fume Cupboard Worktop Market Potential Customers

Potential customers for Fume Cupboard Worktops are diverse but heavily concentrated within regulated sectors requiring high-level chemical handling and containment. The primary end-users/buyers of these specialized products are categorized into three main groups: institutional, corporate, and governmental. Institutional buyers, particularly universities and major academic research centers, represent a stable segment driven by consistent cyclical funding for research infrastructure updates and expansion of scientific curriculum facilities. They prioritize durability, cost-effectiveness (especially phenolic resins for teaching labs), and compliance with educational safety protocols.

The corporate segment, dominated by pharmaceutical, biotechnology, and chemical manufacturing companies, is the most lucrative segment, demanding premium materials like solid epoxy resin and stainless steel. These customers require worktops capable of withstanding extreme conditions related to drug synthesis, quality control testing, and high-throughput screening. Their purchasing decisions are primarily influenced by performance specifications, validation documentation, seamless integration with automation, and minimization of surface contamination risks, justifying higher capital outlay for specialized, customized solutions.

Governmental and public sector laboratories, including public health agencies, military research facilities, and environmental testing centers, form the third significant customer base. These entities prioritize regulatory compliance above all, often adhering to strict federal procurement guidelines which favor vendors with established track records and comprehensive safety certifications. Demand here is stable, often tied to multi-year national research agendas or public health initiatives, such as the ongoing global need for advanced facilities capable of handling biological and chemical threats, which drives the specification of chemically inert and highly durable work surfaces for maximum operational safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $855 Million USD |

| Market Forecast in 2033 | $1,375 Million USD |

| Growth Rate | 6.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trespa International B.V., Durcon Incorporated, Kewaunee Scientific Corporation, Formica Corporation, DuPont (Corian), Wilsonart LLC, Labconco Corporation, Sheldon Laboratory Systems, Waldner Laboreinrichtungen GmbH, Mott Manufacturing, Terra Universal, Inc., Diversified Woodcrafts Inc., HWS Scientific, CI-FME Group, HEMCO Corporation, PSA Laboratory Furniture, Bedrock Scientific, Gopher Scientific, Custom-Crafted Lab Counters, Laboratory Design and Supply Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fume Cupboard Worktop Market Key Technology Landscape

The technological landscape of the Fume Cupboard Worktop Market is centered less on radical invention and more on material science refinement, manufacturing process optimization, and integration with modern smart lab infrastructure. The core technologies involve specialized high-pressure and thermal curing processes utilized in the creation of epoxy and phenolic resins, ensuring superior cross-linking for maximum chemical and heat resistance. Recent advancements focus on incorporating nano-technology to enhance surface impermeability and introduce self-cleaning or antimicrobial properties, crucial for high-containment biomedical research environments. Precision CNC machining and edge-banding technologies are also critical, enabling the fabrication of seamless worktops and integral sink units, minimizing joints where hazardous materials might accumulate or compromise containment integrity.

A significant technological driver is the increasing demand for seamless integration between the worktop and associated monitoring systems. Modern fume cupboards utilize sophisticated airflow sensors (often incorporating hot-wire anemometry or pressure transducers) and digital controllers to maintain optimal face velocity. The worktop's material and mounting mechanism must not interfere with these sensitive air dynamics. Therefore, advanced CAD/CAM software is used to design worktops that facilitate easy, flush mounting of sensors and utility access points, contributing to AEO by ensuring the entire system meets energy efficiency standards (e.g., Variable Air Volume - VAV systems). The technological focus is moving towards composite materials that offer a lighter weight profile while maintaining the structural integrity required for heavy scientific apparatus.

Furthermore, sustainable manufacturing techniques are gaining traction as a key technological differentiator. This includes low-emission resin formulations that minimize VOC release during production and installation, appealing to LEED-certified laboratory projects. The adoption of robust quality control technologies, such as advanced spectroscopic analysis to verify surface composition and chemical resistance profiles before shipment, is standard practice among leading manufacturers. The interplay between physical material science and digital design methodologies defines the contemporary technology landscape, ensuring that worktops meet increasingly complex criteria for safety, longevity, and smart lab functionality.

Regional Highlights

- North America: Dominance Driven by R&D Investment

North America maintains market dominance, primarily attributable to the substantial financial backing received by the pharmaceutical, biotechnology, and academic sectors from both private and federal sources (e.g., NIH funding). The United States, in particular, has a dense concentration of high-tier research universities and major corporate R&D centers, which consistently demand premium, high-specification worktops, predominantly solid epoxy resin, due to stringent occupational safety regulations (OSHA, ANSI/AIHA Z9.5). The market here is mature, characterized by high replacement demand for aging facilities and continuous demand for customized solutions for specialized containment needs. Canada also contributes significantly, focusing heavily on university research expansion and leveraging cross-border collaborations which standardize equipment procurement practices. The region’s focus on energy efficiency in VAV fume cupboard systems mandates worktops that support sophisticated airflow dynamics, further consolidating the high-value segment.

The regulatory framework within North America is arguably the most demanding globally, driving innovation in material traceability and certification. Laboratories frequently undergo rigorous third-party audits, necessitating documentation proving the chemical resistance and fire safety of installed worktops. This regulatory pressure sustains a market preference for certified materials like Durcon and Trespa. Market competition is intense, favoring manufacturers capable of offering comprehensive design consultation, installation, and long-term maintenance contracts, moving beyond simple product supply to integrated service provision.

- Europe: Focus on Standardization and Sustainability

The European market is robust and highly regulated, guided by directives such as EN 14175 (Fume Cupboards) and REACH (chemical regulation). Germany, the UK, and France are the major revenue contributors, driven by strong domestic chemical and automotive industries requiring R&D facilities. Europe places a strong emphasis on standardization and environmental responsibility. This translates into increased adoption of phenolic resin composites and other sustainable materials that offer favorable environmental profiles without compromising safety. The prevalence of modular laboratory design in European facilities supports the use of standardized worktop components that facilitate easy reconfiguration and expansion.

Central and Eastern European countries are experiencing rapid growth as multinational corporations establish new manufacturing and testing centers to leverage favorable economic conditions. This expansion represents a greenfield opportunity for worktop suppliers. The European market exhibits a slightly higher uptake of specialized materials like ceramic worktops for extreme temperature or highly abrasive applications compared to North America. Competition is characterized by strong regional manufacturers focusing on bespoke, high-quality fabrication and adherence to precise European Union quality marks, ensuring long-term product viability and low lifecycle costs for public sector clients.

- Asia Pacific (APAC): Fastest Growth Trajectory

APAC is projected to be the fastest-growing market, primarily fueled by massive infrastructure investment in China, India, South Korea, and Southeast Asian nations. Governments are prioritizing the establishment of domestic pharmaceutical manufacturing capabilities and world-class academic research centers. This high-growth environment translates into significant demand for new installations. While initial price sensitivity remains a factor, driving demand for cost-effective phenolic resins in emerging educational and industrial sectors, the demand for high-end epoxy worktops is rapidly accelerating in major biotechnology clusters (e.g., Shanghai, Bangalore).

The growth dynamics are driven by two main factors: regulatory modernization and foreign investment. As APAC countries align their safety and quality standards closer to international norms, the demand for certified, high-performance materials increases. Local manufacturers are rapidly upgrading their fabrication technologies to compete with international suppliers. Japan and South Korea lead in adopting advanced material technologies and smart laboratory integration, whereas China and India represent the largest volume markets driven by sheer scale of construction, creating an urgent need for reliable supply chain logistics and installation expertise.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging Opportunities

The LATAM and MEA regions offer considerable opportunity, albeit from a lower base, primarily driven by investments in the oil and gas sector (petrochemical testing labs) and national healthcare expansion projects. Countries like Brazil, Mexico, Saudi Arabia, and the UAE are investing heavily in diversifying their economies, leading to the construction of advanced research facilities. The demand profile in MEA is often focused on high chemical and heat resistance, suitable for specialized oil and gas testing environments, favoring epoxy resins and stainless steel. LATAM growth is more segmented, with stronger demand coming from academic institutions in major economic hubs.

Market penetration requires navigating complex procurement processes and establishing reliable distribution networks due to logistical challenges. The focus in these regions is increasingly on establishing high-quality, international-standard facilities, ensuring that suppliers who can offer turn-key solutions, including certified installation and maintenance, are favorably positioned to capture these emerging government and corporate contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fume Cupboard Worktop Market.- Trespa International B.V.

- Durcon Incorporated

- Kewaunee Scientific Corporation

- Formica Corporation

- DuPont (Corian)

- Wilsonart LLC

- Labconco Corporation

- Sheldon Laboratory Systems

- Waldner Laboreinrichtungen GmbH

- Mott Manufacturing

- Terra Universal, Inc.

- Diversified Woodcrafts Inc.

- HWS Scientific

- CI-FME Group

- HEMCO Corporation

- PSA Laboratory Furniture

- Bedrock Scientific

- Gopher Scientific

- Custom-Crafted Lab Counters

- Laboratory Design and Supply Inc.

Frequently Asked Questions

Analyze common user questions about the Fume Cupboard Worktop market and generate a concise list of summarized FAQs reflecting key topics and concerns.Which material offers the best chemical resistance for extreme laboratory environments?

Solid Epoxy Resin provides the highest level of chemical and heat resistance, making it the industry standard for extreme laboratory environments involving concentrated acids, solvents, and high-temperature reactions. Its monolithic, non-porous structure ensures superior chemical containment and longevity.

What is the typical lifespan of a fume cupboard worktop?

High-quality epoxy and phenolic resin worktops are engineered for durability, typically offering a lifespan exceeding 15 to 20 years with proper maintenance. Lifespan is highly dependent on the intensity of chemical exposure and adherence to cleaning protocols.

How do safety regulations influence material selection in the Fume Cupboard Worktop Market?

Strict safety regulations, such as those set by SEFA and OSHA, mandate the use of materials with certified chemical and fire resistance properties. Regulatory compliance is the primary driver compelling institutions to select certified, non-flammable, and chemically inert materials like epoxy and phenolic compact laminates.

What role does sustainability play in the worktop procurement process?

Sustainability is an increasing priority, particularly in Europe and North America. Buyers are seeking materials with low VOC emissions, certified under environmental standards (e.g., LEED), and manufactured using sustainable processes. Phenolic resins often align well with these green building certifications.

Are stainless steel worktops suitable for general chemistry labs?

Stainless steel worktops (typically Type 304 or 316) are highly durable and non-porous, making them excellent for environments requiring sterility, such as biological or radioisotope labs. However, they are generally not recommended for handling high concentrations of strong acids or chlorine-based solvents, which can cause corrosion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager