Functional Glass Coating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434947 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Functional Glass Coating Market Size

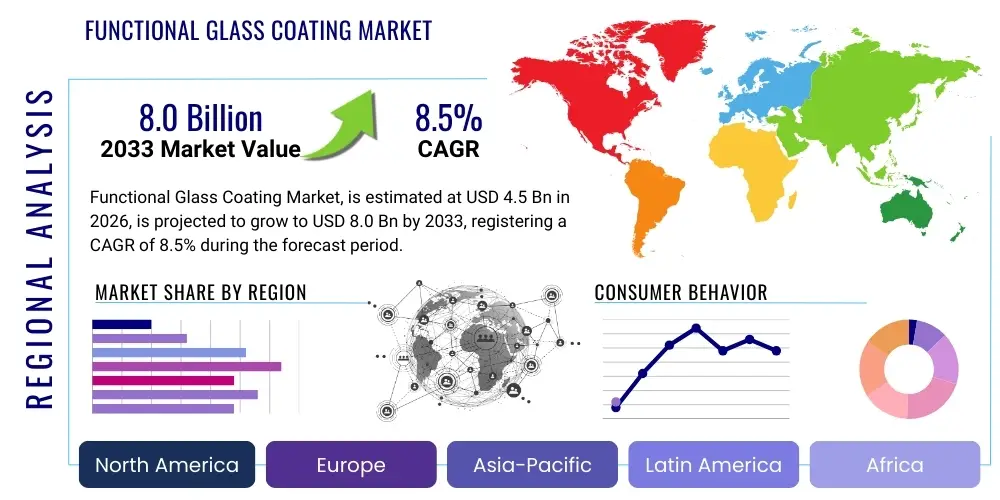

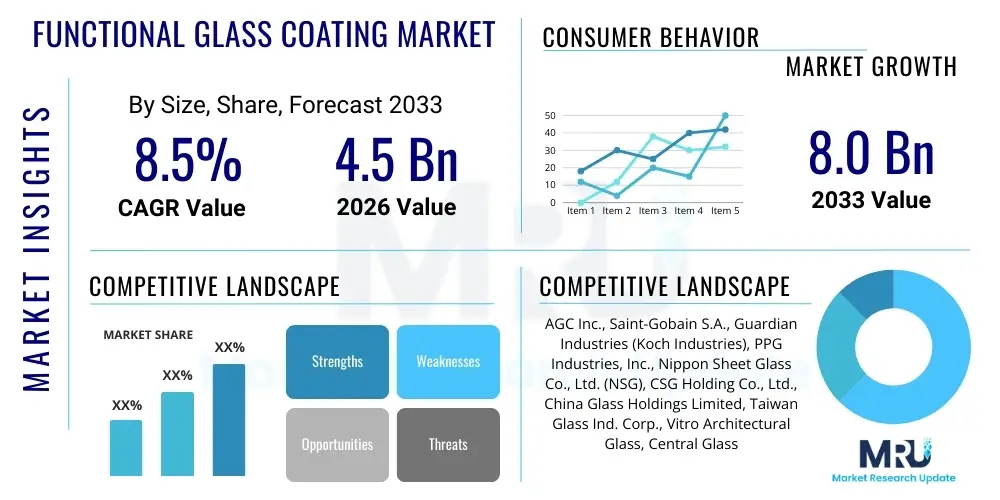

The Functional Glass Coating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Functional Glass Coating Market introduction

The Functional Glass Coating Market encompasses specialized surface treatments applied to glass substrates to impart enhanced performance characteristics beyond basic transparency and durability. These coatings utilize advanced materials, including metallic oxides, nitrides, and specialized polymers, engineered at the nanoscale to optimize properties such as thermal insulation, solar control, anti-reflection, self-cleaning, and electrical conductivity. The fundamental purpose of these coatings is to transform standard architectural, automotive, or specialized glass into a high-performance component, significantly contributing to energy efficiency in buildings and vehicles, improving optical clarity in displays, and enabling photovoltaic energy generation. This technological evolution is primarily driven by stringent global energy efficiency regulations and the burgeoning demand for smart, high-performance building materials that minimize environmental impact while maximizing occupant comfort. The application methods range from sophisticated vacuum deposition techniques, such as magnetron sputtering (MSVD), to chemical vapor deposition (CVD) methods like pyrolytic coating, each tailored to specific functional requirements and production volumes, ensuring high adherence and long-term durability of the functional layer.

Functional glass coatings are categorized based on their primary function. Low-emissivity (Low-E) coatings dominate the market in architectural applications, designed to reflect radiant infrared energy, thereby reducing heat transfer and minimizing heating and cooling loads in structures, making them essential components of insulated glazing units (IGUs). Similarly, solar control coatings are critical in regions with high solar exposure, selectively filtering out specific wavelengths of solar radiation, reducing solar heat gain coefficients (SHGC) without severely compromising visible light transmission. Beyond energy management, the market includes advanced functionalities such as anti-reflective coatings necessary for solar panels and electronic displays to maximize light penetration, anti-fog coatings utilized in refrigeration and transportation, and self-cleaning (photocatalytic) coatings that use UV light to decompose organic contaminants, requiring less manual maintenance. The diversity in application highlights the market's intrinsic connection to sustainable development goals, particularly in reducing energy consumption and optimizing material performance across multiple industry verticals.

The market expansion is underpinned by several key drivers, including the rapid urbanization across emerging economies necessitating large-scale construction projects that incorporate energy-efficient materials, coupled with significant technological advancements in thin-film deposition technologies that allow for precise control over coating thickness and uniformity, thereby enhancing overall functional performance. Furthermore, the increasing adoption of photovoltaic (PV) modules globally relies heavily on high-transparency, anti-reflective functional coatings to maximize energy yield, positioning the renewable energy sector as a major consumer. The benefits derived from these coatings—lower energy bills, increased structural comfort, enhanced safety, and improved aesthetic quality—strongly support their growing integration into modern infrastructure. While initial costs for high-performance coated glass may be higher than traditional glass, the superior long-term return on investment driven by energy savings and reduced maintenance validates the robust growth trajectory projected for the Functional Glass Coating Market throughout the forecast period.

Functional Glass Coating Market Executive Summary

The Functional Glass Coating Market is experiencing robust growth fueled by converging business trends, specifically the global push for sustainable construction and the rapid deployment of solar energy infrastructure. Key business dynamics include strategic mergers and acquisitions among major glass manufacturers and coating technology providers aimed at vertically integrating the value chain and capturing advanced intellectual property related to complex multi-layer coatings. Manufacturers are increasingly focusing on developing switchable or smart coatings (electrochromic, thermochromic) that dynamically adjust their properties in response to external stimuli, catering to the high-end architectural and automotive sectors seeking adaptive performance solutions. Supply chain resilience, particularly regarding precursor materials like indium tin oxide (ITO) and silver, remains a critical focus area, driving investment in diversification and localized production capabilities, primarily within high-growth regions like Asia Pacific. Furthermore, collaborative partnerships between coating specialists and major original equipment manufacturers (OEMs) in the automotive industry are intensifying, driving the adoption of specialized coatings for heads-up displays, enhanced durability, and UV protection in modern vehicles, reflecting a major shift toward high-value, customized coating solutions.

Regionally, the market exhibits varied maturity levels and growth accelerators. Asia Pacific (APAC) leads the global market in terms of volume and growth potential, primarily due to large-scale infrastructure projects in China and India, coupled with massive government investments in solar energy capacity expansion. European markets, characterized by highly stringent building energy performance directives (EPBD), exhibit high adoption rates of premium Low-E and triple-glazing units, making them leaders in value-based penetration, focusing on minimizing thermal bridging and maximizing insulation performance. North America is experiencing steady growth driven by renewed focus on energy retrofitting of commercial buildings and increasing demand for customized, high-performance glass in luxury and institutional construction. Middle East and Africa (MEA) presents significant opportunities, particularly for advanced solar control coatings, mandated by the intense climatic conditions requiring maximum reduction of solar heat gain in commercial and residential structures. The regional variations necessitate localized product strategies, focusing on optimal solar heat gain coefficient (SHGC) and visible light transmission (VLT) targets tailored to specific regional climatic zones and regulatory landscapes.

Segment trends indicate that the Low-E segment, particularly for insulating glass units (IGUs), remains the largest revenue generator within the functional glass coatings market, driven by universal adoption in residential and commercial construction globally. However, the Photovoltaic (PV) glass coating segment, including anti-reflective (AR) and anti-soiling (AS) coatings, is projected to record the highest growth rate, directly correlated with the accelerating global energy transition and the installation of large-scale solar farms. In terms of technology, the shift is trending towards sophisticated offline coating methods (MSVD) which offer greater versatility in applying complex, multi-functional layers post-glass production, enabling higher performance customization compared to online (pyrolytic) methods, which are typically restricted to basic functionalities. End-use application segmentation reveals that the construction sector holds the dominant share, emphasizing energy efficiency and aesthetic integration, while the automotive sector is rapidly increasing its market share, driven by the shift towards electric vehicles (EVs) that utilize specialized coated glass for weight reduction, thermal management of interiors, and integration of sensor technologies required for advanced driver-assistance systems (ADAS).

AI Impact Analysis on Functional Glass Coating Market

User inquiries regarding AI's influence in the Functional Glass Coating Market typically revolve around optimizing coating formulation processes, improving manufacturing throughput, and enhancing quality control precision. Common themes include the potential for AI-driven material discovery to identify novel, high-performance coating materials with superior properties like durability or specific optical characteristics, replacing traditional trial-and-error R&D methods. Users are highly interested in how machine learning algorithms can analyze vast datasets from sputtering targets, deposition parameters, and post-coating performance metrics (e.g., emissivity, transparency, adherence) to fine-tune production lines autonomously, thereby minimizing material waste and ensuring near-perfect uniformity across large production batches. Furthermore, there is significant curiosity regarding AI’s role in predictive maintenance within the coating machinery (e.g., monitoring magnetron performance or vacuum levels) to prevent unplanned downtime, and in demand forecasting tailored specifically to the fluctuating needs of the solar and smart building sectors, reflecting a general expectation that AI will deliver substantial improvements in efficiency and advanced product capabilities.

The deployment of Artificial Intelligence and machine learning models in functional glass coating production represents a paradigm shift from empirical methods to data-driven engineering. In the formulation stage, AI excels at simulating the performance of thousands of potential multi-layer coating stacks instantaneously, considering factors like refractive indices, layer thickness variations, and material compatibility under diverse environmental conditions. This accelerated material informatics capability drastically reduces the R&D cycle time for launching new products, such as ultra-durable low-e coatings or highly selective solar films. Specifically, reinforcement learning models can be trained using historical operational data to dynamically adjust deposition rates and power settings within magnetron sputtering chambers in real-time, compensating for minor environmental fluctuations or material degradation, thus ensuring the final product consistently meets the narrow tolerance specifications required by high-performance applications like aerospace or high-precision display covers. This predictive control optimization is crucial for maintaining both the functional performance and the cost-effectiveness of complex coating structures.

Beyond the manufacturing floor, AI algorithms are profoundly impacting the market structure by optimizing the entire supply chain and enhancing customer interaction. Predictive analytics are being utilized to forecast the demand for specific coating types (e.g., self-cleaning coatings in residential vs. solar control coatings in commercial) based on real-time construction activity data, climate trends, and regional regulatory shifts, allowing manufacturers to optimize inventory and raw material procurement, particularly for scarce elements. In quality assurance, AI-powered computer vision systems are performing rapid, high-resolution defect detection on finished coated glass panels, identifying microscopic irregularities invisible to the human eye, ensuring maximum product quality before shipment. Moreover, the integration of AI-enabled design tools allows architectural firms to specify optimal coated glass parameters based on a building’s location, orientation, and desired energy performance targets, streamlining the specification process and further driving the adoption of advanced functional coatings in customized building envelopes.

- AI optimizes multi-layer coating formulation, accelerating the discovery of novel materials (Material Informatics).

- Machine learning models enable real-time, dynamic control of sputtering and deposition parameters, enhancing coating uniformity and yield.

- Predictive maintenance systems utilize AI to monitor coating equipment health, minimizing operational downtime in high-volume production lines.

- AI-powered computer vision facilitates high-speed, high-precision defect detection and quality control on finished glass substrates.

- Predictive analytics enhance supply chain efficiency by forecasting regional demand for specific functional coating types based on construction activity and climate data.

- Generative AI tools assist architects and engineers in selecting and modeling the optimal functional glass specifications for energy efficiency projects.

DRO & Impact Forces Of Functional Glass Coating Market

The Functional Glass Coating Market is propelled by significant drivers, anchored by global mandates for energy efficiency, while facing constraints related to high initial investment costs and technological complexities; substantial opportunities lie in leveraging emerging smart glass technologies and expanding solar market infrastructure. The primary driving force is the escalating requirement for reduced energy consumption in buildings, enforced by international agreements and national energy codes, which makes high-performance Low-E and solar control coatings essential components of modern construction design. Constraints primarily stem from the capital-intensive nature of advanced coating equipment, particularly Magnetron Sputtering Vacuum Deposition (MSVD) systems, and the inherent technical challenges associated with scaling up production while maintaining ultra-precise coating tolerances and material consistency. Impact forces, such as the increasing price volatility of critical raw materials (silver, indium, rare earth elements) and the rapid pace of technological obsolescence in thin-film deposition, significantly influence market profitability and competitive dynamics, compelling players to continuously innovate and diversify their supply chains to mitigate risk and sustain competitive advantage.

Key drivers extend beyond mandated energy standards to encompass the rapidly expanding solar photovoltaic (PV) industry, which requires extensive use of anti-reflective (AR) and anti-soiling (AS) coatings to maximize light capture and minimize maintenance costs, directly correlating PV capacity additions with coating market growth. Consumer preference is also shifting towards aesthetics and functionality, driving demand for multi-functional coatings that combine solar control with self-cleaning capabilities or enhanced safety features, particularly in luxury architectural and automotive applications. However, significant restraints include the challenge of recycling coated glass, where the separation of the functional layers from the glass substrate remains technologically and economically challenging, slowing the adoption of circular economy practices within the industry. Moreover, market penetration in developing economies is hampered by the perceived high cost barrier of premium coated glass compared to standard glass, requiring extensive educational efforts and government incentives to demonstrate the long-term cost-benefit analysis based on energy savings and lifecycle assessment.

Opportunities for market growth are abundant, particularly in the development and commercialization of next-generation smart coatings, such as electrochromic devices, which allow users to dynamically adjust the tint and light transmission properties of windows, offering superior environmental control and privacy. The integration of functional coatings onto flexible substrates or plastic films (used in displays or specialty applications) also represents a high-growth area, moving beyond traditional rigid glass panels. Furthermore, continuous R&D focus on improving coating durability, enabling scratch resistance, and enhancing chemical inertness opens new applications in harsh environments, such as marine or industrial settings. The dynamic interplay of these forces—where mandatory regulatory drivers push innovation, high costs constrain speed of adoption, and technological opportunities pave the way for premium product offerings—defines the strategic landscape, compelling manufacturers to invest heavily in advanced manufacturing techniques and sustainable material alternatives to capture future market share effectively.

- Drivers:

- Stringent global energy efficiency regulations (e.g., EPBD in Europe, updated building codes globally).

- Exponential growth and capacity additions in the solar photovoltaic (PV) energy sector requiring specialized AR/AS coatings.

- Increasing adoption of smart glass and customized aesthetic architecture demanding advanced thermal and optical control.

- Growing need for weight reduction and thermal management in electric vehicle (EV) glazing and sunroofs.

- Restraints:

- High capital expenditure required for establishing advanced coating production facilities (MSVD technology).

- Technological difficulty and high cost associated with recycling functional coated glass (demetallization challenge).

- Price volatility and supply chain concentration risk of critical raw materials (e.g., silver, indium, titanium dioxide).

- Relatively higher initial cost of coated glass compared to standard glass, impacting adoption in price-sensitive markets.

- Opportunity:

- Development and commercialization of dynamic smart coatings (electrochromic, thermochromic) for high-value applications.

- Expansion of coating applications into non-traditional markets like flexible displays, specialty electronics, and biomedical devices.

- Focus on developing sustainable, non-toxic, and bio-friendly coating materials to replace hazardous compounds.

- Retrofitting existing commercial and residential building stock with high-performance Low-E coating films or windows.

- Impact Forces:

- Technological innovation pace in thin-film deposition techniques (e.g., Atomic Layer Deposition – ALD).

- Geopolitical instability affecting the supply and price of precursor materials and energy costs for vacuum processes.

- Evolving consumer demand for multi-functional products (e.g., integrated heating/privacy functions).

Segmentation Analysis

The Functional Glass Coating Market is highly diversified, segmented comprehensively based on function, technology, material type, and critical end-use applications, allowing for precise market targeting and strategic development. The segmentation by function, which includes Low-E, solar control, self-cleaning, and anti-reflective, dictates the performance characteristics and primary market vertical, with energy-saving coatings dominating revenue share. Technological segmentation distinguishes between online (pyrolytic) and offline (vacuum deposition) methods, reflecting differences in capital cost, scalability, and the complexity of the achievable coating structure. Material segmentation covers metallic oxides, metals, and specialized ceramics, each offering distinct optical and thermal properties. The end-use application split highlights the construction sector as the primary consumer, followed by high-growth areas like automotive and solar power generation, necessitating highly customized coating solutions tailored to environmental and operational requirements.

- By Functionality:

- Low-E (Low Emissivity) Coatings

- Solar Control Coatings

- Anti-Reflective Coatings

- Self-Cleaning (Photocatalytic) Coatings

- Anti-Fog Coatings

- Electrochromic/Theromochromic (Smart) Coatings

- By Technology:

- Pyrolytic (Online) Coating

- Sputtering (Offline) Coating (e.g., MSVD)

- Sol-Gel Coating

- By Material Type:

- Metallic Oxides (e.g., TiO2, SnO2, ZnO)

- Metals (e.g., Silver, Gold)

- Ceramics/Nitrides

- By End-Use Application:

- Construction (Residential, Commercial, Institutional)

- Automotive (Windshields, Sunroofs, Side Windows)

- Solar Power (PV Modules, Solar Thermal Collectors)

- Displays and Electronics

- Aerospace and Defense

Value Chain Analysis For Functional Glass Coating Market

The value chain for the Functional Glass Coating Market initiates with the upstream procurement and processing of specialized raw materials, including high-purity glass substrates, noble metals (silver, platinum), and metallic oxide targets (titanium, zinc, silicon) required for deposition processes. This stage is characterized by high technical barriers and reliance on specialized chemical and mining industries. Midstream activities involve the highly sophisticated manufacturing processes: glass substrate production (float glass) followed by the application of functional coatings, utilizing advanced techniques like MSVD or pyrolytic deposition, which require substantial capital investment, stringent quality control, and deep material science expertise. The efficiency and quality of the finished coated glass, which often involves multiple ultra-thin layers, directly depend on the precision achieved at this manufacturing stage. Downstream activities focus on the fabrication and integration of the coated glass, involving cutting, tempering, laminating, and assembly into final products such as Insulated Glazing Units (IGUs), automotive windshields, or PV panels, before distribution to the end-users.

Distribution channels for functional coated glass are predominantly indirect, leveraging established networks due to the bulk and fragile nature of the product. Manufacturers typically sell the coated glass directly to glass fabricators and processors who then perform the final assembly, or to large-scale construction material distributors. The distribution network is highly centralized for architectural applications, relying on specialized construction suppliers and glass wholesalers who manage complex logistics tailored to large-format, fragile components. For the automotive sector, distribution often flows directly from specialized coater/processor firms to Tier 1 automotive suppliers or vehicle assembly plants, adhering to rigorous just-in-time (JIT) delivery protocols. The direct channel is less common but exists for highly specialized, high-margin projects, such as large institutional buildings or high-security applications, where custom-coated glass specifications necessitate direct consultation and supply from the primary manufacturer to ensure exact performance requirements are met.

Upstream analysis reveals that technological sourcing and material purity are paramount competitive factors. Key challenges include securing a stable supply of high-purity sputtering targets, particularly for silver (essential for high-performance Low-E coatings) and indium (used in ITO for conductivity). Price volatility in these raw material markets significantly impacts midstream manufacturing costs. The downstream value is heavily influenced by energy performance compliance and aesthetic integration. Fabricators must ensure that cutting and processing (like edge deletion necessary for IGUs) does not compromise the integrity of the functional coating. The market structure dictates that integrated players, who control both float glass production and advanced coating processes, often possess superior cost advantages and quality control, whereas non-integrated specialized coaters rely heavily on technological differentiation and niche product specialization to maintain market competitiveness and premium pricing structures.

Functional Glass Coating Market Potential Customers

The Functional Glass Coating Market serves a diverse range of high-value industrial and commercial clients whose core operations demand enhanced glass performance related to energy efficiency, optical clarity, and durability. The primary and largest end-user segment is the global construction industry, including developers of residential, commercial, and institutional buildings (e.g., hospitals, schools, corporate headquarters). These customers require high-performance glazing solutions, primarily Low-E and solar control coatings, to meet stringent green building certifications (like LEED or BREEAM) and drastically reduce operational heating and cooling energy expenditures. Given the increasing focus on net-zero energy buildings, this segment’s demand is driven by lifecycle cost analysis and regulatory compliance, making energy performance the deciding purchasing criterion for architects and contractors, often resulting in complex specifications for insulated and laminated glass products tailored to specific climate zones.

Another major consuming sector is the automotive industry, which utilizes functional coatings not only for passenger comfort and safety but increasingly for technological integration. Automotive OEMs require coatings for superior thermal management (reducing interior heat load in hot climates and improving efficiency in electric vehicles), anti-fog and hydrophobic treatments for enhanced visibility, and specialized anti-reflective layers for complex heads-up displays (HUDs). The shift toward EVs also drives demand for lightweight, high-performance laminated glass incorporating coatings, minimizing vehicle mass while maximizing thermal insulation of the cabin to conserve battery power. These customers demand highly durable, aesthetically neutral coatings that meet rigorous automotive safety standards and integrate seamlessly with sensor technologies essential for ADAS functionality.

The third critical segment comprises the solar energy industry, encompassing manufacturers of photovoltaic (PV) modules and solar thermal collectors. For PV customers, anti-reflective (AR) coatings are crucial for maximizing the efficiency of light transmission into the silicon cells, thereby increasing overall energy yield per panel. Anti-soiling (AS) coatings are essential in arid regions to minimize dust accumulation and reduce the frequency and cost of panel cleaning, ensuring sustained performance over the panel’s decades-long lifespan. These customers prioritize coatings that offer maximum light transmission, excellent durability against weathering and abrasion, and long-term stability under continuous high UV exposure. Other high-value customers include electronics manufacturers (for display glass and touchscreens requiring anti-glare and conductive coatings) and aerospace companies (for specialized thermal and optical management in aircraft windows and instrumentation).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain S.A., Guardian Industries (Koch Industries), PPG Industries, Inc., Nippon Sheet Glass Co., Ltd. (NSG), CSG Holding Co., Ltd., China Glass Holdings Limited, Taiwan Glass Ind. Corp., Vitro Architectural Glass, Central Glass Co., Ltd., Ferroglobe, Ferro Corporation, Balzers (Oerlikon), Bühler AG, Quanex Building Products Corporation, Viridian Glass, Xinyi Glass Holdings Limited, Solutia Inc. (Eastman Chemical Company), Schott AG, Corning Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Functional Glass Coating Market Key Technology Landscape

The technological landscape of the Functional Glass Coating Market is dominated by two primary deposition methods: Pyrolytic (Online) Coating and Magnetron Sputtering Vacuum Deposition (MSVD), often referred to as Offline Coating, alongside emerging techniques like Sol-Gel and Atomic Layer Deposition (ALD). Pyrolytic coating involves spraying chemical precursors onto the glass ribbon while it is still hot on the float line, resulting in a durable, hard-coat that is highly resistant to abrasion and environmental wear, making it suitable for basic Low-E and safety glass applications, though its optical performance is generally limited to simpler, single-layer functionalities. In contrast, MSVD, which occurs after the glass has cooled, uses a vacuum chamber to precisely deposit multiple, ultra-thin layers of metals and metallic oxides, offering significantly superior thermal and solar control performance, enabling the creation of complex, high-performance, multi-functional coating stacks essential for premium products like triple silver Low-E glass and sophisticated electrochromic layers. The choice between these two methods dictates the achievable performance characteristics, production costs, and final product application.

Technological advancement is heavily centered on refining the MSVD process to improve uniformity across increasingly larger glass substrates and to reduce the reliance on expensive target materials like silver and indium. Current R&D efforts focus on developing highly selective coatings—those that maximize visible light transmission while aggressively blocking solar heat (near-infrared radiation)—critical for tropical and high-sun regions. Furthermore, significant progress is being made in developing self-cleaning coatings, which primarily utilize titanium dioxide (TiO2) applied via chemical methods or specialized sputtering, activating photocatalytic and hydrophilic properties upon exposure to UV light to break down organic dirt and wash it away with rain. The integration of advanced diagnostics and control systems, often leveraging AI, is key to managing the vacuum environment, plasma characteristics, and layer thickness uniformity during the sputtering process, which operates under extremely tight tolerances, often measured in nanometers.

The emerging technologies are positioning themselves to capture niche, high-value segments. Sol-Gel processing offers a low-cost alternative for applying coatings like anti-fog or simple anti-reflective layers using chemical baths, though achieving the durability and complexity of vacuum-deposited coatings remains challenging. Atomic Layer Deposition (ALD) is gaining traction, particularly for highly precise, ultra-thin layers required in display electronics and biomedical applications, due to its ability to deposit conformal layers with atomic-level control, though it is currently restricted by slow deposition rates and higher operational costs compared to MSVD. The future technological landscape is trending towards hybridization, combining the durability of online pyrolytic bases with the superior optical performance of offline MSVD functional stacks, ultimately aiming for multi-functional glass that is simultaneously energy-efficient, self-cleaning, durable, and capable of integrating smart functionalities.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, driven primarily by expansive urbanization, massive infrastructure development projects, and unparalleled investment in photovoltaic (PV) solar energy infrastructure, particularly in China, India, and Southeast Asia. The region’s focus is dual: high-volume production of basic Low-E and tempered glass coatings for mass residential markets, and specialized anti-reflective/anti-soiling coatings for utility-scale solar farms. Stringent energy codes are beginning to take root, especially in Tier 1 cities, accelerating the shift towards premium, multi-layer coatings, positioning the region as a global manufacturing hub and consumer market. The demand for glass in high-tech displays and electronics also contributes significantly to regional coating consumption, emphasizing demand for conductive and anti-glare functionalities.

- Europe: Europe is characterized by high maturity and deep market penetration, particularly for high-performance Low-E coatings, largely due to some of the world’s most demanding building energy performance directives (EPBD and related national standards). The European market focuses heavily on superior thermal insulation (often requiring triple-silver Low-E stacks and triple-glazed units) to combat cold climates and minimize heating costs. Growth here is primarily driven by energy retrofitting existing commercial and residential buildings, rather than new construction volume, and a strong preference for sustainable and certified green building materials. Europe is also a significant innovation hub for smart glass technologies, leading the commercialization of dynamic coatings.

- North America: The North American market exhibits steady growth, influenced by varied climate zones requiring tailored coating solutions—heavy thermal performance needs in the North and intense solar control requirements in the South and Southwest. Market growth is stimulated by the rising adoption of green building standards (e.g., LEED certification) in commercial construction and increasing consumer awareness regarding energy savings. The automotive sector, especially in vehicle manufacturing, is a significant driver, with a strong demand for specialized coatings integrated into advanced vehicle models, emphasizing safety, UV protection, and aesthetics. Legislative incentives for energy-efficient homes and commercial properties further bolster market adoption.

- Middle East & Africa (MEA): MEA presents a high-potential market, particularly driven by large-scale, prestige construction projects in the Gulf Cooperation Council (GCC) countries. The critical demand is for superior solar control coatings (high reflectivity, low solar heat gain coefficient) to mitigate extreme desert heat, alongside self-cleaning properties to manage dust and sand accumulation. Government initiatives focused on diversifying economies and developing sustainable cities (like NEOM) necessitate large quantities of high-performance architectural glass. The region’s growth is concentrated in commercial centers but is rapidly expanding into residential high-rises and utility infrastructure development.

- Latin America (LATAM): The LATAM market is emerging, with adoption rates varying significantly by country. Growth is primarily concentrated in urban centers (Brazil, Mexico, Chile) where new commercial developments are increasingly incorporating energy-efficient glazing solutions, often influenced by international design standards. Demand is currently shifting from basic monolithic glass to Low-E and solar control insulated units, driven by cost-benefit analysis related to air conditioning expenses and gradual tightening of local building efficiency codes. The market is sensitive to economic fluctuations and requires greater governmental support and standardization to accelerate widespread adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Functional Glass Coating Market.- AGC Inc. (Asahi Glass Company)

- Saint-Gobain S.A.

- Guardian Industries (Koch Industries)

- PPG Industries, Inc.

- Nippon Sheet Glass Co., Ltd. (NSG)

- CSG Holding Co., Ltd.

- China Glass Holdings Limited

- Taiwan Glass Ind. Corp.

- Vitro Architectural Glass

- Central Glass Co., Ltd.

- Ferroglobe

- Ferro Corporation

- Balzers (Oerlikon Group)

- Bühler AG

- Quanex Building Products Corporation

- Viridian Glass

- Xinyi Glass Holdings Limited

- Solutia Inc. (Eastman Chemical Company)

- Schott AG

- Corning Inc.

Frequently Asked Questions

Analyze common user questions about the Functional Glass Coating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Low-E coatings and how do they save energy?

Low-E (Low Emissivity) coatings are microscopically thin, nearly invisible metallic oxide layers applied to glass surfaces. Their primary function is to reflect long-wave infrared radiation (heat energy) back into the building during cold periods and reflect external heat away during warm periods, effectively minimizing heat transfer across the glass. This dual action significantly reduces the reliance on HVAC systems, leading to substantial energy savings and improved indoor thermal comfort.

What is the main difference between pyrolytic (online) and sputtered (offline) functional coatings?

Pyrolytic coatings are applied during the glass manufacturing process while the glass is hot (online), resulting in a hard, durable, single-layer coating. Sputtered coatings, known as Magnetron Sputtering Vacuum Deposition (MSVD), are applied after the glass is cooled (offline) in a vacuum chamber, allowing for the precise deposition of multiple, complex metallic layers, offering far superior and more selective thermal and solar performance, but requiring protection within an Insulated Glazing Unit (IGU).

How significant is the solar power sector as an end-user for functional glass coatings?

The solar power sector is critically significant and the fastest-growing end-user segment. Solar panels rely extensively on Anti-Reflective (AR) coatings to maximize light transmission into the photovoltaic cells, increasing energy yield, and Anti-Soiling (AS) coatings to maintain performance efficiency in dusty environments by reducing the frequency and cost of manual cleaning. Global PV deployment drives substantial demand for specialized functional glass.

Which geographical region leads the global demand for functional glass coatings and why?

Asia Pacific (APAC) currently leads the global demand for functional glass coatings. This is primarily attributed to unprecedented urbanization rates, large-scale infrastructural development across countries like China and India, and leading government investments in both commercial construction and vast photovoltaic energy projects, requiring high volumes of energy-efficient and specialized coated glass products.

What role do smart coatings play in the future of the Functional Glass Coating Market?

Smart coatings, such as electrochromic and thermochromic materials, represent a major growth opportunity. These coatings allow the user or the environment to dynamically control the glass properties (tint, transparency, light transmission) via electrical stimulus or temperature change, offering superior adaptive thermal management, improved privacy, and greater aesthetic control in high-end architectural and automotive applications, moving beyond static performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager