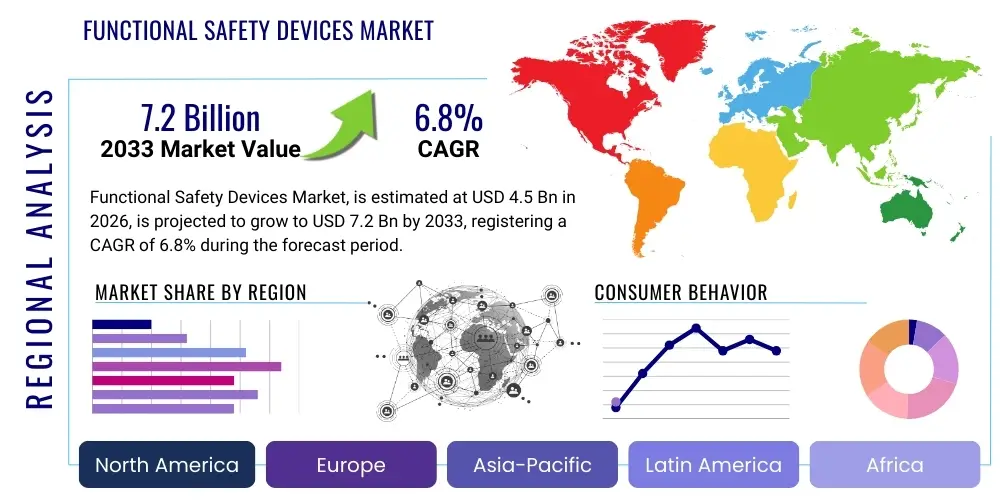

Functional Safety Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439058 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Functional Safety Devices Market Size

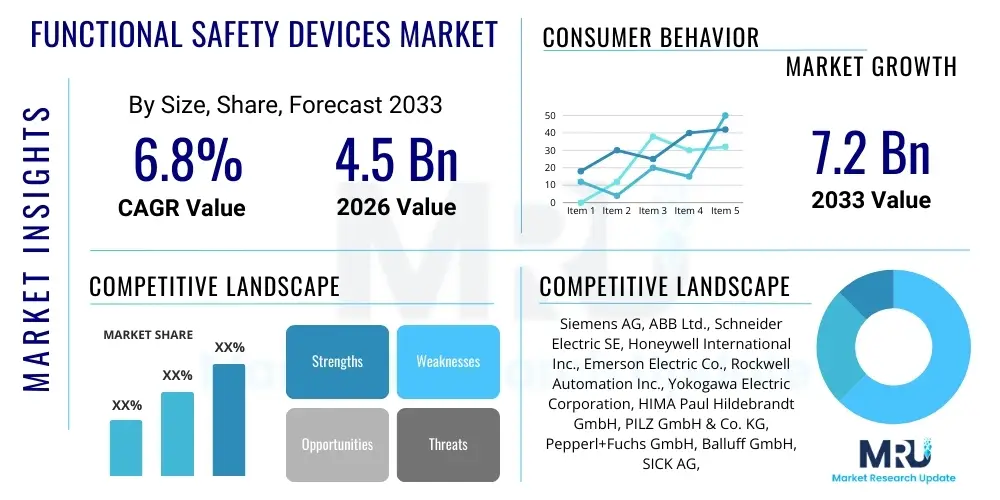

The Functional Safety Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.5 Billion USD in 2026 and is projected to reach $7.2 Billion USD by the end of the forecast period in 2033.

Functional Safety Devices Market introduction

Functional Safety Devices constitute critical hardware and software components engineered to prevent hazards and reduce risks to acceptable levels within industrial processes. These systems are paramount in high-risk environments, ensuring that if a fault or failure occurs, the equipment transitions to a predetermined safe state, thereby protecting personnel, assets, and the environment. The scope of functional safety covers various industries, including oil and gas, chemical processing, power generation, and automotive manufacturing, where operational integrity and adherence to stringent international standards like IEC 61508 and IEC 61511 are mandatory.

The core product offering includes Safety Programmable Logic Controllers (SPLCs), safety sensors (such as pressure, temperature, and level sensors with certified safety integrity levels), safety relays, emergency stop buttons, and associated safeguarding software. These devices work synergistically to form Safety Instrumented Systems (SIS) designed for specific risk reduction tasks. The integration complexity varies significantly depending on the Safety Integrity Level (SIL) required, ranging from basic protection measures to highly redundant and fault-tolerant architectures necessary in the most critical applications.

Key drivers accelerating market growth include increasing regulatory pressure globally, particularly in developed economies emphasizing worker safety and process optimization. Furthermore, the rapid expansion of complex, automated industrial processes (Industry 4.0 initiatives) necessitates equally robust safety frameworks, as machine interaction increases potential hazards. The longevity and reliability benefits offered by certified functional safety devices—which minimize unscheduled downtime and catastrophic failures—provide compelling returns on investment for end-users, fueling sustained demand across sectors undergoing significant capital expenditure upgrades.

Functional Safety Devices Market Executive Summary

The global Functional Safety Devices Market is characterized by robust growth, driven primarily by intensified global regulatory scrutiny regarding industrial safety and the accelerating adoption of automation technologies across manufacturing and processing sectors. Business trends indicate a strong shift towards integrated safety platforms that combine traditional safety logic solvers with secure communication protocols (Safety over Ethernet), facilitating centralized management and real-time diagnostics. This integration reduces wiring complexity and enhances overall system reliability, positioning solution providers capable of offering comprehensive, certified platforms at a competitive advantage. The demand for higher Safety Integrity Levels (SIL 3 and beyond) is particularly pronounced in the oil and gas and chemical industries, where the financial and environmental consequences of failures are extreme, necessitating highly sophisticated and redundant systems.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, spurred by rapid industrialization, massive infrastructure development, and the subsequent implementation of modern safety standards replacing older, less reliable legacy systems, especially in emerging economies like China and India. North America and Europe, while mature, maintain strong market share due to stringent enforcement of existing safety regulations (OSHA, EU directives) and continuous investment in the modernization and expansion of their established industrial base, particularly in pharmaceutical and complex machinery manufacturing. The market penetration of safety devices in Latin America and MEA is also improving, tied closely to major energy sector projects and adherence to international export standards.

Segment trends reveal that Safety PLCs and Safety Controllers dominate the market value due to their central role in the SIS architecture, offering complex logic processing and diagnostic capabilities. However, the Safety Sensor segment is experiencing high volume growth, driven by the proliferation of sensing points required for detailed process monitoring and predictive safety analysis within smart factories. Furthermore, end-users are increasingly demanding certified field devices that offer enhanced diagnostics, facilitating predictive maintenance strategies rather than relying solely on reactive fault detection. The shift towards device-level diagnostics, enabled by technologies like HART and Fieldbus protocols, is a key segment driver, enhancing overall operational efficiency while meeting safety requirements.

AI Impact Analysis on Functional Safety Devices Market

User inquiries regarding AI's influence on Functional Safety Devices frequently center on whether Artificial Intelligence can enhance safety system reliability, accelerate failure detection, and potentially replace traditional hardwired safety logic with predictive algorithms. Key concerns revolve around the certification processes for AI-driven safety systems, regulatory acceptance, and the inherent 'black box' nature of deep learning, which conflicts with the fundamental requirement of transparency and determinism in functional safety (IEC 61508 mandates predictability). Users are keenly interested in how AI can optimize routine safety tasks, such as automated proof testing and predictive maintenance of safety components, without compromising the certified integrity of the Safety Instrumented System. The expectation is that AI will move functional safety from a reactive/preventive paradigm to a proactive/predictive state, improving both safety metrics and operational throughput.

The primary impact of AI is currently observed in the diagnostic and maintenance layers, rather than the core safety logic itself. AI and Machine Learning (ML) algorithms are highly effective in processing vast amounts of operational data gathered from non-safety-related instrumentation and control systems (DCS). By analyzing these complex datasets, AI can identify subtle anomalies and precursor conditions that might lead to failure in safety-critical equipment (e.g., valve stiction, pump vibration drift) long before a traditional safety system alarm threshold is reached. This capability significantly extends the Mean Time To Failure (MTTF) of safety devices and optimizes scheduling for required proof tests, moving away from time-based testing to condition-based testing, which is more resource-efficient.

Furthermore, AI is crucial in supporting cybersecurity aspects of functional safety. As safety systems become more interconnected through industrial IoT, they are exposed to increased cyber threats. AI models can monitor network traffic and system behavior patterns, rapidly identifying unauthorized access attempts or deviations that could compromise the safety function. While regulatory bodies are still cautiously evaluating the use of AI in direct safety loop control due to deterministic concerns, its role in improving the reliability, availability, and diagnostic coverage (DC) of the broader safety infrastructure is already substantial, driving demand for smart, AI-compatible field devices and advanced diagnostic software layers.

- AI enhances predictive maintenance of safety instrumented systems, reducing unplanned shutdowns.

- Machine learning optimizes proof test intervals based on component condition rather than fixed schedules.

- AI algorithms improve diagnostic coverage by identifying subtle, non-obvious failure precursors.

- Integration of AI aids in detecting and mitigating cyber threats targeting critical safety platforms.

- Challenges remain in achieving functional safety certification (IEC 61508) for non-deterministic AI core logic.

DRO & Impact Forces Of Functional Safety Devices Market

The Functional Safety Devices Market is shaped by a confluence of accelerating regulatory requirements, technological innovation focused on system integration, and the inherent constraint of high initial implementation costs and skilled workforce requirements. Drivers include the increasing adoption of complex automation processes (Industry 4.0), which inherently increase operational risks and necessitate robust safety protocols. Global harmonization efforts concerning safety standards, particularly the widespread acceptance of IEC 61508/61511, force multinational companies to upgrade safety infrastructure consistently. Opportunities lie in developing certified solutions for emerging sectors, such as renewable energy (e.g., battery storage systems, advanced wind turbine safety) and the increasing connectivity demands of Industrial IoT (IIoT), pushing vendors toward developing wireless and intrinsically safe communication systems.

Restraints primarily revolve around the significant capital expenditure required for designing, installing, validating, and maintaining Safety Instrumented Systems (SIS), especially achieving higher Safety Integrity Levels (SIL 3 and 4). The lifecycle management of functional safety systems is complex, demanding highly specialized, certified engineers, leading to a shortage of qualified personnel. Furthermore, backward compatibility issues arise when attempting to integrate new, sophisticated safety components with vast, entrenched legacy control systems (DCS/PLC) in older facilities, creating technological and financial friction for modernization projects.

The impact forces are substantial, particularly regulatory impetus, which acts as a powerful non-negotiable driver. The increasing sophistication of threats, both mechanical (due to higher operating parameters) and digital (cybersecurity risks), compels industries to invest continuously in state-of-the-art safety technology. This continuous need for upgrades, combined with the operational efficiency benefits derived from reduced unplanned downtime—a direct consequence of highly reliable safety systems—ensures sustained market momentum, making functional safety investment a prerequisite for maintaining operational licenses and insurance eligibility in high-hazard industries.

Segmentation Analysis

The Functional Safety Devices Market is broadly segmented based on the type of device utilized, the safety integrity level required, the industry served, and the specific application within the industrial process. Understanding these segmentations is crucial as purchasing decisions are highly influenced by the specific risk profile and regulatory landscape of the end-user industry. For instance, the demand profile in the oil and gas sector (requiring high reliability and robustness for hazardous environments) differs significantly from that in the automotive sector (requiring high speed and integrated machine safety functions).

The segmentation by device type reflects the architectural breakdown of a Safety Instrumented System, spanning input elements (sensors, switches), logic solvers (PLCs, controllers), and final elements (valves, actuators). Logic solvers, particularly certified Safety PLCs (SPLCs), represent the highest value segment due to their processing power and software complexity necessary to execute the safety function reliably. Conversely, field devices, like safety sensors, constitute the largest volume segment, driven by the need for extensive monitoring and diagnostic points throughout a facility.

Geographic segmentation is strongly correlated with industrial activity and regulatory maturity. Mature markets like North America and Europe focus on maintenance, upgrades, and high-tech integration, while APAC exhibits higher growth rates driven by Greenfield projects and large-scale industrial build-out. Analyzing these segments provides strategic insights into investment priorities, highlighting the need for specialized, certified solutions tailored to specific regional regulatory interpretations and industry-specific application requirements, such as Emergency Shutdown (ESD) or Fire and Gas (F&G) detection systems.

- Type:

- Safety Sensors (Pressure, Temperature, Level, Flow)

- Safety Switches (Limit, Interlock, Emergency Stop)

- Safety Relays and Modules

- Safety PLCs (Programmable Logic Controllers)

- Safety Controllers and Safety Systems

- Final Elements (Safety Valves, Actuators)

- Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemicals and Petrochemicals

- Power Generation (Thermal, Nuclear, Renewables)

- Automotive and Assembly

- Food & Beverage and Pharmaceuticals

- Machine Manufacturing and Robotics

- Pulp & Paper

- Safety Integrity Level (SIL):

- SIL 1

- SIL 2

- SIL 3

- SIL 4

Value Chain Analysis For Functional Safety Devices Market

The value chain for Functional Safety Devices begins with upstream component manufacturing, involving highly specialized suppliers providing high-reliability microprocessors, certified electronic components, and advanced sensor technologies capable of meeting stringent safety standards (e.g., low failure rates, high diagnostic coverage). This stage is characterized by high barriers to entry due to the necessity of rigorous design standards, material traceability, and adherence to specific semiconductor or material safety specifications (e.g., non-incendive design for hazardous areas). Certifications, such as TÜV or Exida certification for base components, are critical for entry into the subsequent manufacturing stage.

Midstream activities involve the design, assembly, and integration of these components into marketable functional safety products like Safety PLCs, safety relays, and certified sensors. This stage is dominated by large, established automation vendors who possess the necessary intellectual property, software development expertise, and standardized manufacturing processes to achieve IEC 61508 compliance. System integration and software development (firmware, logic solving engines, diagnostic tools) add significant value here. Distribution channels are complex, typically involving a mix of direct sales teams for large capital projects, and indirect specialized safety distributors or certified system integrators (CSIs) who possess the necessary engineering expertise to design and commission Safety Instrumented Systems according to IEC 61511.

Downstream activities center on end-user implementation, installation, validation (Proof Test), and lifecycle maintenance services. The service component of the value chain is increasingly critical and lucrative, covering functional safety assessments (FSAs), verification and validation (V&V), and periodic auditing. Direct distribution is favored for high-value system components and long-term service contracts with major industrial clients, ensuring tight control over quality and specialized support. Indirect channels, mainly system integrators, handle the majority of implementation work, bridging the gap between product manufacturers and diverse end-user applications across various industries, ensuring correct application engineering and regulatory compliance.

Functional Safety Devices Market Potential Customers

Potential customers for Functional Safety Devices are predominantly organizations operating in high-hazard or continuous processing environments where equipment failure poses a substantial risk to life, environment, or asset integrity. This includes major multinational energy companies, petrochemical giants, and chemical producers who rely on Safety Instrumented Systems (SIS) to manage critical process parameters like temperature, pressure, and toxic material containment. Their purchasing decisions are heavily influenced by regulatory mandates (e.g., Seveso Directive compliance in Europe, OSHA in the US) and corporate risk management policies, focusing on achieving optimal SIL levels, reliability, and long-term support guarantees.

Another significant customer segment includes discrete manufacturing industries, specifically automotive, robotics, and complex machinery builders. For these customers, functional safety devices are integral to machine safeguarding (e.g., protecting operators from moving parts, ensuring proper sequencing of hazardous operations), aligning with standards like ISO 13849. These buyers prioritize devices that offer high speed, seamless integration with production PLCs, and simplified commissioning tools, often favoring integrated safety solutions offered by automation suppliers that provide both control and safety components from a single platform.

Furthermore, critical infrastructure operators, such as utility companies (power generation, water treatment), and transportation entities (railways, pipelines), represent consistent long-term demand. Their focus is on extreme reliability, long operational lifespan, and resistance to harsh environmental conditions. The increasing complexity of modern power grids and the necessity for cyber-secure safety mechanisms are driving these end-users towards adopting advanced safety controllers and monitoring systems capable of operating autonomously and providing extensive diagnostic coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion USD |

| Market Forecast in 2033 | $7.2 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Rockwell Automation Inc., Yokogawa Electric Corporation, HIMA Paul Hildebrandt GmbH, PILZ GmbH & Co. KG, Pepperl+Fuchs GmbH, Balluff GmbH, SICK AG, Eaton Corporation, Omron Corporation, Mersen, IDEM Safety Switches, Banner Engineering, General Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Functional Safety Devices Market Key Technology Landscape

The technology landscape in the Functional Safety Devices Market is rapidly evolving, moving away from isolated, hardwired systems toward integrated, software-intensive platforms that leverage advanced digital communication. A primary technological shift involves the widespread adoption of "Safety over Network" protocols, such as PROFIsafe (used predominantly with PROFINET) and CIP Safety (used with EtherNet/IP). These technologies allow safety and standard control data to share the same network infrastructure while maintaining strict separation and certified safety integrity through specialized communication mechanisms, significantly reducing wiring and installation complexity, especially in large, distributed industrial setups.

Another crucial technological development is the enhancement of diagnostic capabilities within field devices. Modern safety sensors and final elements (like smart valves) are increasingly incorporating microprocessor-based intelligence to perform continuous self-diagnostics, often achieving higher Diagnostic Coverage (DC) than previous generations. Protocols like HART and Fieldbus are instrumental here, allowing maintenance personnel to remotely interrogate the health status of a safety device without shutting down the process. This capability aligns perfectly with Industry 4.0 principles, enabling predictive maintenance that improves system reliability and availability, which is a core metric of functional safety performance.

Furthermore, cybersecurity integration has become a non-negotiable part of the technology roadmap. Given the potential for cyberattacks to compromise safety functions (a critical concern articulated in standards like IEC 62443), vendors are embedding secure boot processes, secure communication tunnels (VPNs, TLS), and robust authentication mechanisms directly into Safety PLCs and networked field devices. This dual focus—ensuring protection against random hardware failures (traditional functional safety) and systemic cyber threats (digital security)—defines the current generation of functional safety technology, requiring high levels of cryptographic assurance alongside traditional hardware fault tolerance.

Regional Highlights

The Functional Safety Devices Market exhibits distinct growth trajectories and maturity levels across different geographies, influenced heavily by local industrial density, regulatory stringency, and capital expenditure cycles in the energy sector.

- North America: This region maintains a significant market share, driven by strict regulatory environments enforced by agencies such as OSHA and EPA, particularly within the vast oil and gas, refining, and chemical processing sectors. The market is mature, focusing heavily on modernizing aging infrastructure and adopting high-end integrated safety solutions (e.g., integrated machine safety and complex SIS upgrades) to improve efficiency and reduce compliance risk. The strong presence of global automation giants ensures continuous technological uptake.

- Europe: Europe is characterized by extremely rigorous safety standards (e.g., Machinery Directive, ATEX/Seveso Directives) and high adoption rates of advanced manufacturing techniques. Germany, as a leader in industrial automation (Industry 4.0), drives demand for highly integrated machine safety and robust safety networks (PROFIsafe). The focus is on implementing sustainable safety practices in emerging sectors like offshore wind and battery manufacturing, requiring certified SIL 3 compliant systems.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid industrialization, large-scale construction of new chemical plants and power facilities, and increasing regulatory enforcement, especially in China, India, and Southeast Asia. While price sensitivity remains a factor, the increasing acceptance of international standards (IEC 61508/61511) in new Greenfield projects is rapidly propelling the adoption of complex Safety PLCs and certified field devices.

- Latin America: Growth in this region is volatile but significant, tied primarily to investments in resource extraction (mining, oil and gas). Adoption is often project-driven, necessitating compliance with international safety standards mandated by multinational operators. The market requires robust, reliable, and often explosion-proof certified safety devices due to the harsh operational environments.

- Middle East and Africa (MEA): This region's growth is heavily concentrated in the massive oil and gas and petrochemical sectors, driven by large state-owned enterprises focused on global export standards. There is high demand for high Safety Integrity Level (SIL 3 and 4) systems, particularly for specialized applications like High Integrity Pressure Protection Systems (HIPPS) and Emergency Shutdown (ESD) systems, requiring highly specialized, certified suppliers and maintenance services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Functional Safety Devices Market.- Siemens AG

- ABB Ltd.

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Rockwell Automation Inc.

- Yokogawa Electric Corporation

- HIMA Paul Hildebrandt GmbH

- PILZ GmbH & Co. KG

- Pepperl+Fuchs GmbH

- Balluff GmbH

- SICK AG

- Eaton Corporation

- Omron Corporation

- Mersen

- IDEM Safety Switches

- Banner Engineering

- General Electric

Frequently Asked Questions

Analyze common user questions about the Functional Safety Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary standard governing functional safety devices?

The primary global standard is IEC 61508, which governs the design and manufacture of electrical, electronic, and programmable electronic safety-related systems (E/E/PE systems). This standard forms the basis for industry-specific standards like IEC 61511 (Process Industry) and ISO 13849 (Machinery Safety).

How does Safety Integrity Level (SIL) impact the choice of functional safety devices?

SIL defines the required risk reduction level, ranging from SIL 1 (lowest) to SIL 4 (highest). A higher SIL rating mandates the use of devices with greater fault tolerance, enhanced diagnostic coverage, higher reliability, and often requires component redundancy to meet the probability of failure on demand (PFD) requirements.

What is the difference between functional safety and traditional machinery guarding?

Traditional guarding uses physical barriers (mechanical interlocks, fences) to mitigate risk. Functional safety utilizes active control systems (electronic components, software logic) to detect hazardous conditions and automatically initiate a safe state, primarily focusing on managing systemic and random failures in automated control loops.

How is the integration of wireless technology affecting functional safety systems?

Wireless technology is being cautiously adopted in functional safety for non-critical monitoring and specific applications where wiring is impractical (e.g., remote assets). Adoption requires certified protocols and rigorous validation to ensure the wireless communication link maintains the required safety integrity (e.g., security, latency, and reliability) mandated by IEC 61508.

Which industry segment generates the highest demand for Functional Safety Devices?

The Oil & Gas and Chemical/Petrochemical industries traditionally generate the highest demand due to the extreme hazards involved, necessitating high-cost, high-reliability Safety Instrumented Systems (SIS) across large, complex facilities for applications like Emergency Shutdown (ESD) and Fire and Gas (F&G) detection.

Why are certified system integrators critical in the functional safety market?

Certified system integrators (CSIs) possess the specialized expertise required to design, install, commission, and validate Safety Instrumented Systems (SIS) in accordance with the application-specific standard (IEC 61511). Their certification ensures that the complex safety loop design, implementation, and documentation adhere strictly to regulatory requirements, minimizing end-user liability and maximizing system reliability.

What are the main cybersecurity concerns related to functional safety devices?

The main concerns include unauthorized access to safety logic controllers, malware injection that could compromise safety functions, and denial-of-service attacks targeting safety communications. Modern devices must integrate advanced security features, adhering to standards like IEC 62443, to protect the SIS from both internal and external digital threats while maintaining deterministic operation.

How does the concept of Diagnostic Coverage (DC) relate to device selection?

Diagnostic Coverage (DC) is the measure of a device's ability to detect its own internal faults. Devices with high DC are preferred because they enable the system to quickly identify a failure, leading to a safer state, thereby contributing significantly to achieving the required Safety Integrity Level (SIL) for the overall safety function. Higher SIL targets necessitate higher DC components.

What role does software play in the functional safety market growth?

Software is increasingly vital, moving beyond simple logic solving. It encompasses certified operating systems, advanced diagnostic tools, simulation software for V&V, and lifecycle management suites. These software platforms help engineers manage the entire safety lifecycle efficiently, from hazard identification (HAZOP) through proof testing documentation, driving significant market value.

What is the strategic impact of Industry 4.0 on the functional safety market?

Industry 4.0 increases the interconnectivity and complexity of manufacturing, significantly raising the potential for systemic failures and unauthorized modifications. This trend mandates the adoption of more integrated, networked safety solutions (Safety over Ethernet), higher computational capacity in safety controllers, and strict cybersecurity integration to manage these new, dynamic risks effectively.

Are smaller industrial businesses required to adopt certified functional safety devices?

While compliance requirements vary by jurisdiction and industry, most regulatory bodies mandate adequate risk reduction measures. Even smaller businesses operating hazardous machinery or processes must adhere to applicable national safety laws (e.g., OSHA, Machinery Directive), often necessitating the use of certified safety components, though potentially at lower SIL or Performance Level (PL) ratings compared to large refineries.

How does the certification process for new safety devices typically work?

New devices must undergo rigorous assessment by accredited third-party certification bodies (e.g., TÜV, Exida). This process involves reviewing the device's design, failure data (FMEDA analysis), manufacturing quality procedures, embedded software, and compliance with the relevant sections of IEC 61508, culminating in a certificate specifying the achievable SIL rating and safety parameters.

What is a Safety Instrumented System (SIS)?

A Safety Instrumented System (SIS) is an independent, dedicated system comprising sensors, logic solvers (controllers/PLCs), and final elements designed to bring a process to a safe state when predetermined conditions are violated. It acts as an independent protective layer, separate from the basic process control system (BPCS).

Why is lifecycle management crucial for functional safety systems?

Functional safety is a continuous process, not just a product installation. Lifecycle management, as defined by IEC 61511, ensures the safety system remains effective throughout its operational life, covering periodic proof testing, maintenance, modification management, and re-validation, thus maintaining the required Safety Integrity Level (SIL).

What specific challenges does the automotive sector face regarding functional safety?

The automotive sector, particularly in manufacturing and autonomous driving, faces challenges related to managing high-speed, dynamic risks (ISO 26262), ensuring immediate emergency stops on fast-moving robotic lines, and integrating safety functions seamlessly within complex, flexible manufacturing cells without hindering productivity or adding excessive operational lag.

How do final elements contribute to the overall functional safety loop performance?

Final elements, such as certified safety valves or actuators, are the physical components that execute the safety action (e.g., closing a valve to stop reactant flow). They often represent the element with the highest probability of failure, meaning their reliability, speed of response, and diagnostic capabilities are critical determinants of the safety loop's overall performance and achievable SIL rating.

Is there a trend toward centralized or decentralized safety architecture?

There is a strong trend toward decentralized field I/O combined with centralized logic solving. While logic is often centralized in highly capable Safety PLCs for deterministic control, I/O modules and smart sensors are distributed closer to the process, utilizing high-speed safety communication networks (like PROFIsafe) for efficiency and simplified wiring topology.

What impact do environmental conditions have on device reliability in the market?

Environmental conditions (e.g., extreme temperatures, high vibration, corrosive atmospheres) significantly degrade device reliability, especially in sectors like offshore oil and chemical processing. This necessitates the use of specialized, robust, and often explosion-proof (Ex-certified) devices designed and tested to maintain their safety parameters under harsh operating conditions, increasing the cost and specialization of the devices.

How does the pharmaceutical industry utilize functional safety devices?

The pharmaceutical industry uses functional safety primarily for process containment, clean room air pressure control, temperature regulation of bioreactors, and managing highly potent or hazardous substances. Compliance often involves adhering to GAMP 5 validation practices alongside functional safety standards to ensure both safety and regulatory compliance for production records.

What financial incentives drive companies to invest in high-level functional safety?

Beyond regulatory compliance, key financial drivers include reduction in insurance premiums, minimizing the risk of catastrophic asset loss, avoiding severe regulatory fines, and crucially, minimizing unscheduled downtime (which is far more costly in continuous process industries than the investment in high-reliability safety systems).

Are non-certified commercial-off-the-shelf (COTS) components allowed in SIS?

IEC 61508 generally mandates the use of certified components designed explicitly for safety. While COTS components can sometimes be used, they must undergo extensive and costly prior use justification and assessment (PUJA) to prove they meet the required reliability metrics and safety performance, often making certified safety-specific products the more straightforward and reliable choice.

What is the expected long-term impact of digitalization on safety device diagnostics?

Digitalization will lead to highly advanced, continuous diagnostics throughout the safety loop. This allows safety managers to access real-time performance data (e.g., valve travel time, sensor drift), facilitating condition-based proof testing and reducing the reliance on manual, invasive testing procedures, ultimately lowering operational expenditure and maximizing uptime.

How does the market address obsolete safety devices and systems?

Obsolescence management is a significant challenge. Vendors offer migration strategies, often involving phased replacement programs that utilize modern, certified I/O adapters and logic solvers that can interface with existing field wiring, balancing the need for compliance with the high cost of full system replacement, while gradually transitioning the installed base to modern safety platforms.

What is the significance of the failure mode, effects, and diagnostic analysis (FMEDA) in the market?

FMEDA is a systematic process used to determine the failure rates and diagnostic coverage of a safety device. The resulting data (e.g., Safe Failure Fraction, PFDavg) is essential for end-users to calculate the SIL capability of their specific safety function and is a mandatory requirement for device certification, making it a cornerstone of product design in the functional safety market.

How are Safety PLCs different from standard industrial PLCs?

Safety PLCs (SPLCs) incorporate redundant internal architectures, continuous self-checking diagnostics, specialized certified operating systems, and fault-tolerant communication mechanisms, all designed to ensure that if a component fails, the system transitions reliably to a safe state, preventing unauthorized changes and meeting strict SIL requirements, unlike standard PLCs focused primarily on control efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager