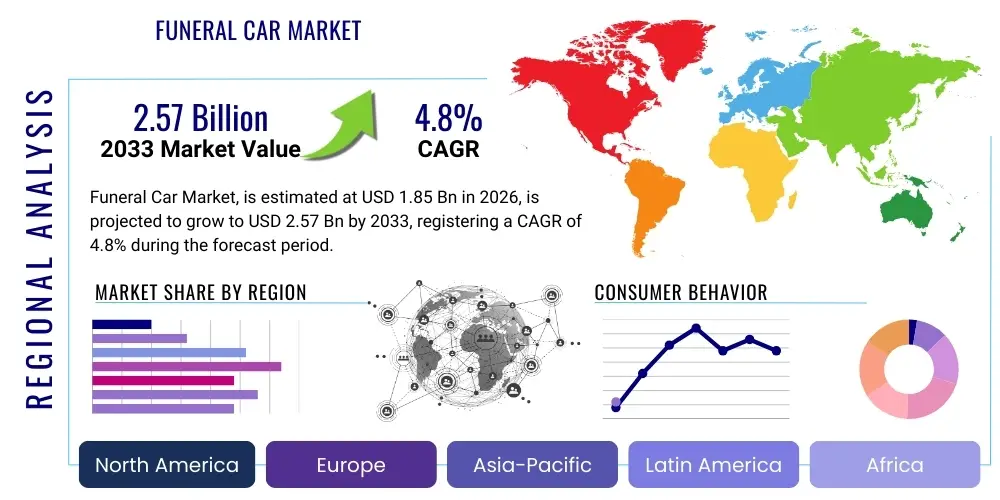

Funeral Car Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439066 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Funeral Car Market Size

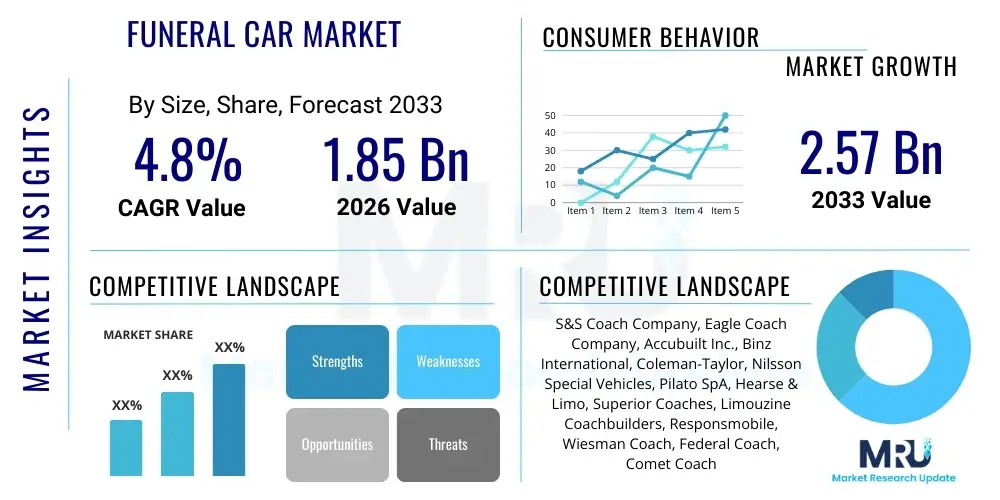

The Funeral Car Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.57 Billion by the end of the forecast period in 2033.

Funeral Car Market introduction

The Funeral Car Market encompasses the specialized segment of automotive manufacturing dedicated to producing vehicles tailored for ceremonial use in funeral services. These vehicles primarily include hearses—designed specifically to carry the deceased in a casket—and accompanying funeral limousines, which transport close family members and official mourners. These products are fundamentally defined by their necessary modifications to standard automotive chassis, focusing on extended length, enhanced load-bearing capacity, specialized cabin design for dignity and solemnity, and highly reliable performance given the critical nature of their function. The aesthetics are crucial, emphasizing tradition, formality, and respect, often utilizing dark, subdued color palettes and customized interior fittings that prioritize quiet operation and spaciousness. Modern vehicles are increasingly incorporating advanced safety features and technological enhancements while maintaining the traditional visual standards expected by clientele.

Major applications of funeral cars are overwhelmingly centered within licensed funeral homes, burial societies, and institutional entities, including government and military organizations that require state-standard vehicles for official functions. Beyond the traditional hearse, the market also includes niche applications such as specialized flower cars, which follow the procession carrying floral tributes, and customized transport for specific religious or cultural rites that require unique vehicle configurations. The primary benefits driving the steady demand in this market are the need to uphold cultural and social dignity during the final passage, the requirement for reliable transportation logistics for large ceremonies, and the professional projection of compassion and competence that modern, well-maintained fleets afford service providers. As populations age globally, and as average life spans increase, the consistent, albeit slow, turnover rate in funeral car fleets ensures stable demand for manufacturers specializing in body conversion and high-end chassis adaptation.

Driving factors supporting the stable growth of the Funeral Car Market include consistent demographic trends, particularly the aging populations in major economies across North America and Europe, which guarantees a sustained need for end-of-life services. Furthermore, there is a growing trend towards customization and personalization of funeral services, pushing funeral homes to invest in modern, high-specification vehicles that reflect quality and offer specialized features such as advanced climate control and enhanced cabin comfort for mourners. Regulatory stability concerning vehicle dimensions and operational standards also provides a predictable environment for manufacturers. Increasingly, replacement cycles are driven by technological obsolescence, especially regarding engine efficiency, emissions standards, and the rising demand for Electric Vehicle (EV) alternatives, which promise silent operation, a feature highly valued in ceremonial settings.

Funeral Car Market Executive Summary

The Funeral Car Market is navigating a period of subtle yet significant transformation, largely characterized by the convergence of traditional aesthetics with modern automotive technologies, particularly powertrain electrification. Business trends indicate a robust demand for highly customized, luxury-segment vehicles, driven by the willingness of large funeral chains and high-net-worth individuals to invest in bespoke models that project exclusivity and status. Key manufacturers are focusing heavily on developing robust chassis platforms sourced from luxury marques, ensuring longevity, prestige, and minimal operational noise. The customization aspect extends to materials science, where lightweight, durable composites are being used in body conversion to enhance fuel efficiency or battery range, coupled with sophisticated interior fittings that enhance the ceremonial atmosphere. Operational efficiency remains a crucial purchasing criterion, prompting funeral homes to adopt fleet management technologies integrated into their vehicles.

Regional trends exhibit stark contrasts between mature and emerging markets. North America and Europe dominate the revenue share due to well-established funeral service industries, high disposable incomes supporting expensive fleet upgrades, and stringent safety and emissions regulations pushing mandatory replacement cycles. European markets show a strong preference for refined, coach-built designs, often utilizing premium European chassis. Conversely, the Asia Pacific (APAC) region, while exhibiting rapid urbanization and demographic growth, presents varied market acceptance; while mature markets like Japan maintain high standards, emerging economies are often serviced by more standardized or locally converted vehicles, though demand for Western luxury imports is increasing in metropolitan centers. The Middle East and Africa (MEA) market demonstrates high demand for luxury specifications, often imported directly, reflecting cultural emphasis on grandeur and formality in ceremonies.

Segment trends highlight the growing divergence between standard bearers and premium luxury hearses. The standard segment focuses on efficiency, low maintenance costs, and reliability, often utilizing established commercial vehicle platforms. In contrast, the luxury segment is witnessing intensive development in electric vehicle (EV) hearse technology, offering silent, zero-emission operation, which is a significant competitive differentiator. Furthermore, the accompanying limousine segment is trending towards larger, SUV-based or specialized multi-passenger vehicles to accommodate larger family groups comfortably. Powertrain segmentation clearly indicates a shift away from purely Internal Combustion Engines (ICE) towards hybrid and battery electric vehicles (BEV), particularly in environmentally conscious jurisdictions, signaling a major transition period for traditional coachbuilders who must rapidly acquire expertise in EV conversion and certification.

AI Impact Analysis on Funeral Car Market

User queries regarding the impact of Artificial Intelligence (AI) on the Funeral Car Market frequently revolve around optimizing complex ceremonial logistics, enhancing client service personalization without losing the human touch, and leveraging predictive maintenance to ensure vehicle uptime. Common questions explore how AI-driven routing algorithms can minimize procession travel time and mitigate urban traffic disruptions, thereby improving punctuality and reducing stress for mourners. Furthermore, users are keen to understand the potential role of AI in managing specialized vehicle inventory, such as matching specific car models or historical vehicles to client preferences derived from memorial service data. A core concern remains the balance: leveraging efficiency gains from AI, such as automated scheduling and diagnostic systems, while maintaining the requisite dignity and human empathy inherent in funeral services, ensuring that technology serves the ceremony rather than dominating it.

The primary area where AI is already exerting influence is in back-office operational management, which, while not directly impacting the vehicle's function, significantly affects its deployment and utilization rate. AI-powered diagnostic systems are increasingly integrated into modern funeral car chassis, allowing for predictive maintenance scheduling based on real-time component wear and usage patterns, rather than fixed mileage intervals. This capability is critical because vehicle failure during a procession is catastrophic for reputation and service delivery, making preventative measures highly valuable. AI algorithms can analyze driving behavior, route complexity, and environmental conditions to provide precise maintenance recommendations, ensuring the high-reliability standard demanded by this industry is consistently met, optimizing total cost of ownership (TCO) for fleet managers.

Looking ahead, the integration of advanced navigational AI will revolutionize procession management, especially in densely populated urban areas. AI systems can dynamically adjust route plans based on real-time traffic data, local events, and unexpected obstacles, communicating these changes instantly and discretely to all vehicles in the convoy, thereby ensuring smooth and respectful transit. Furthermore, specialized AI-driven client relationship management (CRM) tools, when coupled with historical service data, can assist funeral directors in making highly personalized recommendations regarding vehicle style, interior specifications, and even procession music synchronization systems, subtle enhancements that contribute significantly to the perceived quality of service and client satisfaction during a sensitive time. However, full vehicle autonomy, while technically feasible, faces significant public acceptance and regulatory hurdles given the specific, emotional context of a funeral procession.

- AI-driven predictive maintenance optimizes fleet reliability and minimizes critical downtime.

- Advanced route optimization algorithms ensure dignified and punctual ceremonial processions.

- AI-enhanced CRM tools personalize vehicle selection and service elements based on client preferences.

- Automated inventory management assists funeral homes in efficient allocation of specialized assets.

- Real-time vehicle diagnostics improve safety profiles and reduce long-term operating costs.

DRO & Impact Forces Of Funeral Car Market

The dynamics of the Funeral Car Market are governed by a unique interplay of cultural sensitivities, regulatory requirements, and technological innovation. Drivers are fundamentally rooted in demographics, specifically the consistent, non-cyclical demand generated by mortality rates globally, ensuring a stable baseline for vehicle requirements. Cultural significance dictates the necessity of formal ceremonial transport, maintaining the market for specialized, high-dignity vehicles despite economic fluctuations. Technological drivers include the pervasive push towards fleet electrification and the adoption of modern safety standards, compelling replacement cycles even for well-maintained older vehicles. Restraints primarily center on the high capital expenditure required for acquiring specialized, coach-built vehicles, which are significantly more expensive than standard commercial equivalents. Furthermore, the highly specialized nature of manufacturing and limited sales volume result in high R&D costs that are passed on to the consumer. Regulatory restraints involve stringent certification processes for heavily modified vehicles, especially concerning passenger safety and structural integrity after extensive chassis lengthening and body conversion.

Opportunities for growth are strongly concentrated in the rapidly expanding Electric Vehicle (EV) segment. The inherent quietness and zero-emission status of BEVs align perfectly with the core values of solemnity and environmental responsibility increasingly demanded by modern consumers. This transition provides incumbent manufacturers with a chance to redefine the market standard and offers new entrants a pathway to specialization. Another significant opportunity lies in market penetration into high-growth urban centers in developing economies, where rising middle classes are beginning to demand higher-quality, professionally managed funeral services, often replicating Western standards of formality and luxury. The market also benefits from the potential for bespoke, ultra-luxury conversions catering to state funerals or affluent private clients, where cost is secondary to prestige and customization, providing high-margin revenue streams for specialist coachbuilders.

Impact forces within this market are shaped by consumer perception and legislative changes. The powerful influence of public opinion regarding the dignity and appearance of funeral services acts as a continuous pressure point, forcing funeral homes to maintain fleets that appear modern, pristine, and highly respectful. Legislative impact forces, particularly those relating to environmental mandates (e.g., city-wide zero-emission zones), are accelerating the shift toward EV platforms, profoundly affecting manufacturing strategies. Competitive dynamics are specialized, involving intense rivalry among a few niche coachbuilders who possess the proprietary knowledge and regulatory certifications necessary for deep chassis modification. Substitution threat is extremely low, as no viable alternative exists for the symbolic and practical function of the specialized hearse and accompanying processional limousine, cementing the necessity of the funeral car within the end-of-life service ecosystem.

Segmentation Analysis

The Funeral Car Market is segmented based on critical characteristics including vehicle type, powertrain technology, end-user application, and chassis sourcing. This segmentation allows manufacturers and service providers to target specific market niches, ranging from high-volume, standard service fleets to ultra-low-volume, bespoke luxury ceremonial vehicles. The key differentiation factors include the extent of customization (coach-built versus factory-modified), the propulsion system (ICE, Hybrid, or Battery Electric), and the primary function (hearse for transport of the deceased versus specialized limousine for mourners). The underlying trend across all segments is the increasing demand for high-specification interiors, enhanced safety features, and systems optimized for silent and discreet operation, regardless of the chassis base.

- By Vehicle Type:

- Hearses (Traditional and Modern Designs)

- Funeral Limousines (6-door, 8-door configurations)

- Specialty Vehicles (Flower Cars, Service Vans)

- By Powertrain:

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Battery Electric Vehicle (BEV)

- By Chassis Source:

- Luxury/Premium Chassis (e.g., Mercedes-Benz, Cadillac, Rolls-Royce)

- Standard/Commercial Chassis (e.g., Ford, Chevrolet, Chrysler)

- By End-User:

- Funeral Home Chains

- Independent Funeral Directors

- Government & State Agencies

- Military Organizations

Value Chain Analysis For Funeral Car Market

The value chain for the Funeral Car Market begins at the upstream level with the sourcing of core chassis and base vehicles, typically from established Original Equipment Manufacturers (OEMs) within the premium or luxury segments. Unlike standard vehicles, these chassis are often purchased specifically for conversion, requiring close coordination between the OEM and the coachbuilder to ensure the base platform can withstand extensive structural modification, including cutting, lengthening, and reinforcing the frame. Key upstream activities involve securing high-quality, durable materials—such as specialized sheet metal, lightweight composites, and high-end interior textiles—that meet both regulatory standards for vehicular safety and the high aesthetic requirements for ceremonial use. Relationships at this stage are critical, as coachbuilders rely on consistent supply chains for compatible, reliable platforms that carry a recognized brand prestige.

The midstream section, dominated by specialized coachbuilders and conversion companies, represents the highest value-add activity. This stage involves meticulous engineering, structural fabrication (often extending the wheelbase by several feet), installing specialized mechanisms (such as casket rollers and locking systems), and fitting custom body panels. Certification and compliance testing are integral here, ensuring that the heavily modified vehicles meet national and international safety standards without compromising structural integrity or handling characteristics. Distribution is highly niche; sales are primarily direct from the coachbuilder or through a limited network of specialized dealers who focus exclusively on the funeral services industry. This direct model allows for high customization levels and specialized consultation regarding fleet requirements and maintenance protocols.

Downstream activities center around the end-users—funeral home operators, both large national chains and smaller independent businesses—who are responsible for the ongoing operation, maintenance, and eventual retirement of the vehicles. Aftermarket services, including routine maintenance, accident repair, and specialized bodywork, are crucial, often necessitating parts and expertise unique to the conversion process, which can only be provided by certified specialists or the original coachbuilder. The overall value chain is characterized by low volume, high customization, and substantial barriers to entry due to the specialized engineering knowledge and regulatory hurdles required to legally and safely modify primary automotive chassis for funeral duties, ensuring that profit margins are often concentrated at the conversion stage.

Funeral Car Market Potential Customers

The primary and most consistent customers for the Funeral Car Market are professional organizations operating within the funeral service industry. This includes large, vertically integrated funeral home chains, which often operate regionally or nationally and maintain sizable, modern fleets. These chains prioritize fleet standardization, operational efficiency, and negotiating volume discounts. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO), reliability, and the projected lifespan and residual value of the specialized vehicles. They typically seek a blend of high-end hearses for premium services and dependable, mid-range limousines for general transport, driving demand for both standard and luxury segments of the market.

A second major customer group consists of independent, often family-owned, funeral director businesses. These operators frequently require less standardized, sometimes more bespoke vehicles that reflect their local community identity or traditional service offerings. While they purchase fewer units, they often demand higher levels of personalization and customization, sometimes opting for coach-built models based on classic luxury chassis to project a timeless sense of quality and established prestige. Their decisions are often driven by reputation and local brand image, and they rely heavily on specialized dealer relationships for financing, service, and sourcing vehicles that offer low perceived maintenance complexity and high reliability, given their limited in-house fleet maintenance capabilities.

A third, specialized customer segment includes governmental entities, military branches, and state protocol departments. These bodies require vehicles, often hearses, designed to meet specific ceremonial or state requirements, typically demanding the highest level of build quality, security features, and formal appearance. These purchases are usually non-cyclical, tied to official mandates or replacement policies for aging protocol fleets, and often involve highly bespoke specifications that exceed commercial standards. Furthermore, small, niche customer groups, such as specialist historical vehicle renters or certain religious orders, occasionally procure unique vehicles, demonstrating the market's capacity for ultra-low volume, high-value, tailored sales outside of the mainstream commercial funeral sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.57 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S&S Coach Company, Eagle Coach Company, Accubuilt Inc., Binz International, Coleman-Taylor, Nilsson Special Vehicles, Pilato SpA, Hearse & Limo, Superior Coaches, Limouzine Coachbuilders, Responsmobile, Wiesman Coach, Federal Coach, Comet Coach Company, K2 Vehicles, Platinum Coach, Xtreme Customs, Lenco Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Funeral Car Market Key Technology Landscape

The technology landscape for the Funeral Car Market is fundamentally defined by specialized modification engineering and integration of advanced automotive systems that support quiet, dignified operation. The critical technological focus remains on chassis modification techniques, utilizing advanced welding, bonding agents, and lightweight, high-strength materials (such as carbon fiber composites) to ensure that the structurally extended vehicle maintains rigidity, safety, and stability, often exceeding original OEM specifications for torsional stiffness. This engineering must be coupled with specialized suspension tuning to provide an extremely smooth and level ride, mitigating movement for the cargo and ensuring passenger comfort. Furthermore, the development of sophisticated casket retention and roller systems that operate silently and reliably is a proprietary technology held by leading coachbuilders, crucial for efficient service delivery.

A significant area of technological evolution is powertrain adaptation, driven by the global transition to sustainable mobility. While conventional ICE powertrains are still common, especially in markets with limited EV charging infrastructure, the innovation thrust is centered on integrating hybrid and, increasingly, full battery-electric drivetrains into stretched chassis. This requires complex battery management system (BMS) integration, thermal management solutions for the extended structure, and careful weight distribution to compensate for the significant mass of the battery packs without compromising the ceremonial appearance or driving dynamics. Electric hearses, valued specifically for their near-silent operation, are utilizing advanced noise dampening and acoustic insulation materials to further enhance the tranquility of the ceremonial setting, offering a clear technological advantage over even the quietest combustion engines.

Beyond structural and powertrain technologies, modern funeral cars incorporate advanced connectivity and internal comfort systems. This includes sophisticated, multi-zone climate control systems to maintain optimal temperatures for both passengers and often temperature-sensitive floral arrangements, high-grade interior acoustic materials to isolate the cabin from external noise, and discreet integration of advanced driver-assistance systems (ADAS). Logistics technology, such as specialized GPS tracking and integrated fleet management software that communicates seamlessly between the hearse and accompanying support vehicles, is becoming standard. These subtle technological enhancements allow funeral directors to manage complex processions efficiently, professionally, and with minimal intrusion into the solemnity of the event, reinforcing the vehicle's role as a technological facilitator of tradition and dignity.

Regional Highlights

- North America: This region represents one of the most mature and significant markets, characterized by a high demand for premium and large-scale vehicles, primarily utilizing luxury domestic and imported chassis (e.g., Cadillac, Lincoln, Mercedes-Benz). The market is dominated by large funeral service chains that prioritize fleet standardization, high reliability, and technologically advanced features, including integrated logistics systems. The US and Canada are experiencing a gradual but steady adoption of hybrid and electric funeral cars, particularly in coastal, environmentally progressive urban areas, driven by municipal green initiatives and favorable consumer sentiment towards silent services. Replacement cycles are robust, often driven by the desire to project modernity and avoid high maintenance costs associated with extremely old specialized vehicles.

- Europe: The European market is highly fragmented, reflecting diverse national regulatory and aesthetic preferences, with a strong tradition of specialized, artisan coachbuilding, particularly in Italy, Germany, and the UK. European customers typically favor chassis from premium brands like Mercedes-Benz, Volvo, and Jaguar, often resulting in sleek, highly customized, and structurally sophisticated conversions. Europe is a global leader in the adoption of electric hearses, driven by stringent EU emissions targets, the proliferation of urban Low Emission Zones (LEZs), and strong consumer awareness of sustainability. Demand is high for compact, high-performance vehicles suitable for narrow city streets, contrasting with the larger vehicle preference in North America.

- Asia Pacific (APAC): APAC is an emerging yet rapidly growing market, driven by urbanization and the rise of professional funeral services in countries like China, India, and Southeast Asia. While cost-sensitivity remains in many areas, countries such as Japan and Australia maintain very high standards, demanding imported luxury vehicles. The expansion in this region is marked by a dual strategy: imported high-end hearses for major metropolitan and expatriate services, and locally modified, more cost-effective vehicles for broader regional penetration. Infrastructure challenges, particularly the lack of EV charging networks, mean that ICE and hybrid vehicles currently dominate, though interest in silent electric options is increasing rapidly in tech-forward nations like South Korea and Singapore.

- Latin America (LATAM): The LATAM market is characterized by sensitivity to economic volatility and currency fluctuations, which impacts the ability of funeral homes to invest in new, imported, high-capital vehicles. The market primarily relies on established chassis conversions (often using American or European legacy models) or focuses on highly reliable, mid-range vehicles. Demand often spikes in larger economic centers like Brazil and Mexico, where formal ceremonies maintain high social importance. Opportunities exist as economic stability improves and local conversion specialists begin to offer more modernized designs and better access to financing, catering to the aesthetic demands for dignity and prestige that are culturally significant in the region.

- Middle East and Africa (MEA): The MEA region shows a distinct preference for large, highly luxurious, and often ostentatious vehicles, particularly in the Gulf Cooperation Council (GCC) states, where the projection of status and wealth in all aspects of life is paramount. Vehicles are almost exclusively imported, utilizing ultra-premium chassis like Rolls-Royce or high-end models from Mercedes-Benz and Cadillac, often requiring specialized modifications tailored to regional climatic conditions (e.g., enhanced cooling systems). The African segment is varied, with South Africa showing maturity and demand for reliable imported vehicles, while other areas rely on imported used vehicles due to cost constraints. Security and robust construction are key considerations in parts of the MEA market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Funeral Car Market.- S&S Coach Company

- Eagle Coach Company

- Accubuilt Inc.

- Binz International

- Coleman-Taylor

- Nilsson Special Vehicles AB

- Pilato S.p.A.

- Hearse & Limo

- Superior Coaches

- Limouzine Coachbuilders

- Responsmobile

- Wiesman Coach

- Federal Coach

- Comet Coach Company

- K2 Vehicles

- Platinum Coach

- Xtreme Customs

- Lenco Industries

- Silver Spur Limousine

- Woodall-Nicholson

Frequently Asked Questions

Analyze common user questions about the Funeral Car market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market shift towards Electric Vehicle (EV) hearses?

The primary driver is the desire for silent operation, which enhances the solemnity and dignity of the funeral procession. Additionally, strict environmental regulations in urban areas, zero-emission zone mandates, and fleet managers' desire to align with corporate sustainability goals are accelerating EV adoption.

How do specialized funeral car manufacturers ensure the structural integrity of a stretched vehicle?

Manufacturers utilize advanced coachbuilding techniques including chassis lengthening, reinforced frame rails, high-strength welding, and strategic use of lightweight composite materials. Every design must undergo rigorous safety testing and regulatory certification to ensure the vehicle maintains stability and crash resistance.

What are the key differences between a commercial chassis and a luxury chassis conversion?

Luxury chassis conversions start with premium platforms (e.g., Mercedes-Benz, Rolls-Royce) offering higher base prestige, sophisticated suspensions, and high-end interiors. Commercial chassis conversions focus on durability, lower TCO, and standardization, often using more economical, heavy-duty base platforms designed for continuous commercial service.

What role does technology play in modern funeral car fleet management?

Technology facilitates logistics, using specialized GPS and AI-powered route optimization for efficient processions. Modern fleets also employ integrated diagnostic systems for predictive maintenance, ensuring high reliability and minimal downtime, which is crucial for critical service delivery.

Which geographic region currently leads the innovation in funeral car design and adoption?

Europe, particularly Western European nations, leads in design innovation and the adoption of cutting-edge powertrain technologies, especially Battery Electric Vehicle (BEV) hearses. This is driven by strict environmental policies and a strong tradition of specialized, high-quality coachbuilding artistry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager