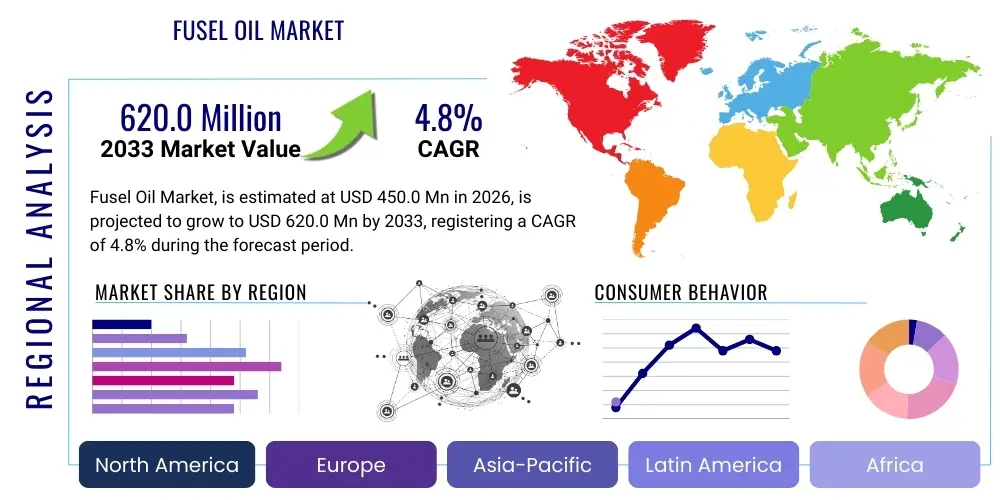

Fusel Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437892 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fusel Oil Market Size

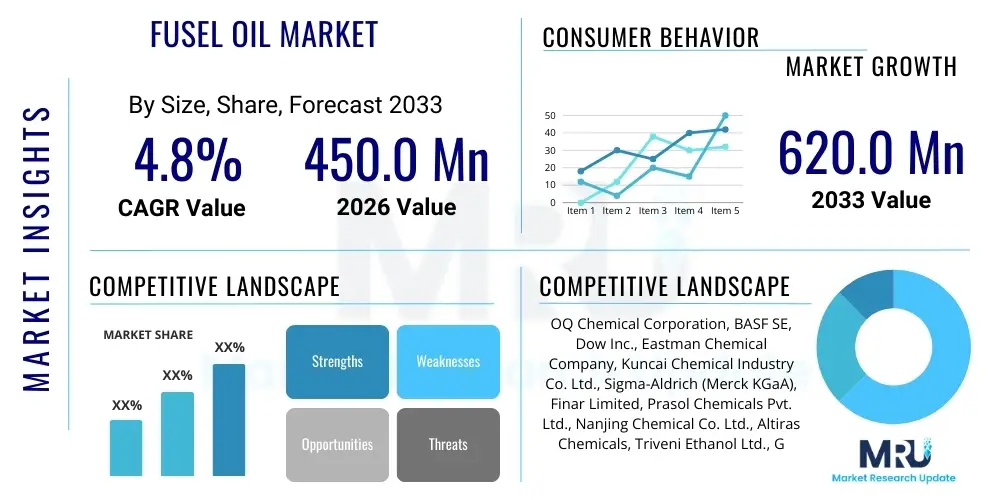

The Fusel Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 620.0 Million by the end of the forecast period in 2033.

Fusel Oil Market introduction

Fusel oil, also known as amyl alcohol or fusel alcohols, is a complex mixture of higher-chain alcohols and esters produced as a byproduct during the fermentation of sugars into ethanol, particularly in the brewing and distilling industries. Chemically, it primarily consists of isoamyl alcohol, active amyl alcohol, isobutyl alcohol, and n-propyl alcohol. While traditionally considered an undesirable residue in beverage production due to its pungent flavor and potential toxicity in high concentrations, its industrial utility has driven significant market demand. The diverse chemical composition makes fusel oil an invaluable precursor in various chemical syntheses, contributing to its transformation from a waste stream into a valuable commodity.

The product's versatility is highlighted by its major applications across multiple high-growth sectors. Key end-use industries include the solvent industry, where its high boiling point and low volatility make it an excellent choice for paints, varnishes, and protective coatings. Furthermore, fusel oil derivatives are crucial in the flavor and fragrance industry, utilized in the synthesis of esters that mimic natural fruit essences. Its emerging role as a sustainable feedstock for advanced biofuels and its application as an intermediate in pharmaceuticals and plasticizers cement its importance in the global chemical landscape. The market expansion is intrinsically linked to growth in the processed food, automotive, and construction sectors, all of which rely heavily on fusel oil derivatives.

Major driving factors include the increasing global demand for environmentally friendly solvents to replace petrochemical-based alternatives, coupled with robust growth in the ethanol production industry globally, which directly increases the supply of the crude product. Benefits associated with fusel oil include its bio-based origin, providing sustainability advantages, and its high solvency power. Additionally, advancements in separation and purification technologies are enhancing the quality and purity of refined fusel oil, broadening its scope of application, particularly in sensitive high-value sectors such as cosmetics and specialized chemical synthesis. These technological improvements are key to unlocking further market potential.

Fusel Oil Market Executive Summary

The Fusel Oil market is experiencing sustained growth driven primarily by its increasing adoption as a bio-based solvent and its role as a key chemical intermediate in the production of high-grade esters for the food and fragrance industries. Business trends indicate a shift towards enhanced valorization of fermentation byproducts, transforming distilleries and ethanol plants into integrated biorefineries that maximize the extraction and purification of fusel oil. Strategic collaborations between ethanol producers and specialized chemical refiners are becoming commonplace, aimed at stabilizing supply chains and ensuring consistent product quality, essential for high-specification applications like pharmaceuticals and specialty coatings. Furthermore, consolidation among key refining players is enabling economies of scale, impacting overall cost structures and competitive pricing strategies across the globe.

Regional trends reveal Asia Pacific as the dominant and fastest-growing market, largely attributable to the massive scale of ethanol production in countries like China and India, driven by fuel blending mandates and burgeoning industrial development. Europe and North America, while mature markets, are focusing on premium, high-purity fusel oil derivatives, capitalizing on stringent environmental regulations that favor bio-based solvents. Latin America, specifically Brazil, remains a crucial source market, given its extensive sugar cane-based ethanol industry. Growth in these established markets is less about volume growth of crude oil and more focused on technological innovation in derivative synthesis, addressing niche demands for advanced coatings and performance chemicals.

Segmentation trends highlight the dominance of Isoamyl Alcohol in terms of volume, attributed to its widespread use as a solvent and flotation agent in the mining industry. However, the segment of Fusel Oil used for bio-fuel applications, particularly in blending agents and advanced alcohol fuels, is forecast to exhibit the highest CAGR due to increasing global emphasis on decarbonization and renewable energy sources. The application segment focused on the manufacturing of fruit flavors and essences shows steady, robust growth, mirroring the continuous expansion of the packaged food and beverage sector. Market participants are increasingly investing in sophisticated fractional distillation techniques to separate and market individual components of fusel oil, optimizing revenue streams across all product types.

AI Impact Analysis on Fusel Oil Market

User queries regarding AI in the Fusel Oil market frequently center on optimizing the complex fermentation and distillation processes, predicting market supply volatility based on ethanol output, and enhancing quality control. Users seek information on how machine learning models can fine-tune fermentation parameters (temperature, pH, yeast strain) to maximize higher alcohol yield without compromising ethanol purity. There is significant interest in predictive analytics for feedstock sourcing and inventory management, given that fusel oil supply is inherently tied to the highly seasonal and volatile agricultural cycles of sugar cane and corn. Furthermore, concerns revolve around the integration cost of AI-driven sensors and control systems into legacy distillery infrastructure and the necessity of specialized data science skills for operational teams to effectively utilize these sophisticated tools for yield maximization and purification efficiency.

AI’s primary influence is seen in the optimization of the upstream supply chain. By analyzing historical production data, yeast performance metrics, and real-time sensor readings within the fermentation vats, AI algorithms can dynamically adjust processing variables to ensure maximum yield of higher alcohols, improving the economic viability of fusel oil extraction. This precision fermentation minimizes waste and energy consumption during the initial production phase. Moreover, AI-driven predictive maintenance schedules for distillation equipment can reduce costly downtime, a critical factor in capital-intensive chemical refining operations, ensuring a consistent and uninterrupted supply of refined fusel oil to end-use markets.

In the downstream market, AI is poised to revolutionize demand forecasting and pricing strategies. Machine learning models integrate global ethanol production forecasts, regulatory changes concerning bio-solvents, and regional economic indicators to provide highly accurate demand projections for specific fusel oil derivatives (e.g., isoamyl acetate). This capability allows manufacturers to optimize production mix and inventory levels, reducing spoilage and storage costs. For end-users, especially in the fine chemical and pharmaceutical synthesis sectors, AI-assisted quality control through spectroscopic analysis and pattern recognition ensures that highly purified fusel oil meets strict specifications, guaranteeing reliability for sensitive chemical reactions.

- AI optimizes real-time fermentation parameters to maximize higher alcohol yield.

- Predictive analytics stabilize supply chain logistics based on ethanol market volatility.

- Machine learning models enhance fractional distillation efficiency, reducing energy consumption.

- AI-driven sensors improve quality control for high-purity solvent grades.

- Predictive maintenance minimizes operational downtime in refinery processes.

- Automated market analysis assists in dynamic pricing and inventory management for derivatives.

DRO & Impact Forces Of Fusel Oil Market

The Fusel Oil market is shaped by a confluence of strong drivers related to sustainability and industrial demand, balanced against inherent restraints tied to its source dependence, while significant opportunities emerge from technological advancements in chemical applications. The primary driving force is the global push for bio-based and sustainable solvents, positioning fusel oil and its derivatives as direct replacements for less environmentally friendly petrochemical products in coatings, cosmetics, and cleaners. However, the market’s inherent dependence on the ethanol industry means that supply volume and pricing are inextricably linked to volatile agricultural cycles (corn, sugar cane) and governmental fuel blending policies, creating a critical restraint. The major opportunity lies in the burgeoning market for specialized chemical intermediates and advanced second-generation biofuel applications, which require high purity but offer substantial profit margins. These forces create a dynamic landscape where market growth is robust but subject to periodic supply chain disruptions.

Key drivers include the stringent environmental regulations in North America and Europe mandating lower Volatile Organic Compound (VOC) content in industrial coatings and adhesives. Since fusel oil derivatives offer excellent performance characteristics while complying with these rules, their market penetration is accelerating. Another significant driver is the increasing use of fusel oil in flotation agents within the rapidly expanding mining industry, especially in emerging economies. Conversely, the main restraint, apart from supply volatility, is the competitive pressure from synthetic alcohol substitutes. Although bio-based alternatives are favored, mass-produced synthetic solvents sometimes offer greater price stability and consistency, particularly for low-value applications, challenging the market expansion of crude fusel oil grades. Furthermore, complex purification processes required for high-grade fusel oil derivatives involve significant capital investment, posing a barrier to entry for smaller refining operations.

Opportunities for growth are heavily concentrated in the development of novel applications, particularly in specialty chemicals. The use of isoamyl alcohol derivatives in the production of flavors (like isoamyl acetate, mimicking banana flavor) and fragrances provides a high-margin avenue for growth, independent of the volatile fuel sector. Moreover, ongoing research into utilizing fusel oil as a platform chemical for producing high-octane gasoline components or sustainable jet fuels represents a massive, untapped market potential. The impact forces show that regulatory pressure acts as a positive reinforcement (driver) for bio-solvent adoption, while agricultural commodity pricing remains a destabilizing external factor. The balance of these forces suggests a continued upward trajectory for refined fusel oil segments, despite inherent challenges in managing crude material procurement.

Segmentation Analysis

Segmentation of the Fusel Oil market allows for a granular understanding of its diverse applications and product types, reflecting the varying purity requirements and end-use characteristics across industrial sectors. The market is primarily segmented based on the type of alcohol component extracted (e.g., Isoamyl Alcohol, Isobutyl Alcohol), the application area (Solvents, Flavor & Fragrance, Biofuels, Chemical Intermediates), and the source material used for fermentation (Sugar Cane, Corn, Grains, etc.). This multifaceted segmentation is essential because the required purity level—ranging from crude technical grade used in flotation to highly refined pharmaceutical grade esters—fundamentally dictates pricing and market accessibility.

The segmentation by product type is critical as different components possess distinct chemical properties; for instance, Isoamyl Alcohol dominates due to its use in diverse industrial solvents and as a flotation agent, whereas n-Propyl Alcohol is often used in specialized industrial cleaning formulations. In terms of application, the solvent segment currently holds the largest market share owing to high-volume usage in protective coatings, printing inks, and lacquers. However, the rapidly expanding biofuel and chemical intermediate segments are expected to drive the highest revenue growth during the forecast period, reflecting a global pivot toward advanced bio-derived components.

Source-based segmentation is increasingly important, particularly in regulated markets. Fusel oil derived from sugar cane fermentation (prevalent in Brazil) often exhibits slightly different impurity profiles compared to corn-derived fusel oil (common in the U.S.), impacting the subsequent refining processes and suitability for highly sensitive applications like flavorings. Understanding these segment dynamics enables manufacturers to tailor their production capabilities and marketing strategies to target high-value, niche markets that demand specific source-related attributes or high purity standards, thereby optimizing their overall profitability.

- By Product Type:

- Isoamyl Alcohol (Primary Component)

- Isobutyl Alcohol

- n-Propyl Alcohol

- Active Amyl Alcohol

- Other Higher Alcohols

- By Application:

- Solvents (Coatings, Inks, Adhesives)

- Flavor and Fragrance Agents (Ester Synthesis)

- Chemical Intermediates (Plasticizers, Pharmaceuticals)

- Flotation Agents (Mining Industry)

- Biofuels and Additives

- By Source:

- Sugar Cane

- Corn

- Grains (Wheat, Barley, etc.)

- Others (Molasses, Agro-residues)

- By Purity/Grade:

- Technical Grade (Crude)

- Refined Grade (98%+)

- High Purity/Pharmaceutical Grade

Value Chain Analysis For Fusel Oil Market

The Fusel Oil market value chain initiates with upstream analysis focused on feedstock cultivation and initial fermentation processes, encompassing everything from corn and sugar cane farming to the ethanol distillery operations where crude fusel oil is generated as a byproduct. This stage is highly dependent on agricultural yields, commodity prices, and bio-fuel policy mandates, which directly dictate the volume and cost of the primary raw material. Effective upstream management involves optimizing fermentation to maximize the co-production of higher alcohols, ensuring efficient collection and preliminary separation from the bulk ethanol stream. High-efficiency ethanol production is essential, as fusel oil revenue often serves as a crucial economic balancer for volatile ethanol margins.

The midstream involves the critical steps of purification, refining, and derivative manufacturing. Crude fusel oil is transported from distilleries to specialized chemical processing plants where fractional distillation and other separation techniques are employed to yield purified components like isoamyl alcohol or isobutyl alcohol. Further down the midstream, these pure alcohols are utilized in chemical synthesis to produce high-value esters (e.g., acetates, butyrates) that find application in the flavor, fragrance, and polymer industries. This refining stage adds significant value and requires advanced technological expertise and substantial capital expenditure, transforming a low-value byproduct into a specialized chemical commodity.

Downstream analysis focuses on distribution channels and end-user consumption. Direct distribution channels are prevalent for high-volume customers, such as major industrial solvent manufacturers and large coating companies, allowing for customized specifications and bulk delivery efficiency. Indirect channels, utilizing specialized chemical distributors and regional traders, serve smaller, niche end-users like cosmetic formulators, small-batch flavor houses, and specialty chemical labs. Effective distribution involves specialized handling and storage (due to flammability and specific purity requirements), ensuring the refined product reaches diverse geographical markets reliably and quickly, thus maximizing market penetration across critical sectors like construction, mining, and food processing.

Fusel Oil Market Potential Customers

Potential customers for the Fusel Oil market span a diverse range of industrial users who require high-performance, bio-derived solvents, chemical intermediates, or specific flavoring agents. The primary buyer segment comprises manufacturers of paints, lacquers, varnishes, and printing inks, who rely on the excellent solvency power and low VOC characteristics of fusel oil derivatives (such as isoamyl alcohol) to formulate compliant and effective coating solutions. This segment often purchases technical or refined grades in bulk, driven primarily by price stability and regulatory compliance related to environmental standards.

A second major customer category includes specialty chemical manufacturers and pharmaceutical companies. These buyers use highly purified fusel oil components as intermediates in the synthesis of high-value products, including certain plasticizers, pharmaceutical excipients, and specialized lubricants. For this segment, the consistency of purity, certification, and traceability are paramount, often justifying a premium price for pharmaceutical or high-purity grades. The demand here is driven by innovation in new material sciences and the expansion of the global healthcare and fine chemical sectors.

Finally, the flavor and fragrance industry represents a high-growth segment of potential customers. Manufacturers in this sector utilize fusel oil derivatives, especially their acetate esters (like isoamyl acetate), to create synthetic fruit flavors and complex fragrance notes for consumer products ranging from processed foods and confectionery to cosmetics and household cleaners. These customers demand extremely high purity and consistent odor profiles, making supply chain reliability and adherence to strict food safety standards key purchasing criteria. Additionally, the mining industry is a steady buyer, utilizing fusel oil as a frothing agent in mineral flotation processes, requiring technical-grade, high-volume supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 620.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OQ Chemical Corporation, BASF SE, Dow Inc., Eastman Chemical Company, Kuncai Chemical Industry Co. Ltd., Sigma-Aldrich (Merck KGaA), Finar Limited, Prasol Chemicals Pvt. Ltd., Nanjing Chemical Co. Ltd., Altiras Chemicals, Triveni Ethanol Ltd., Green Biologics Ltd., Gevo Inc., Advanced Biofuels USA, Cargill Incorporated, Poet LLC, Tereos, Virent, Inc., BioAmber, Inc., Global Bio-Chem Technology Group Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fusel Oil Market Key Technology Landscape

The key technology landscape of the Fusel Oil market is dominated by advancements in separation science, particularly high-efficiency fractional distillation and extraction technologies, which are essential for purifying the crude mixture into marketable components. The primary technological challenge is the effective separation of high-boiling-point alcohols from ethanol and water with minimal energy input. Modern multi-stage fractional distillation columns utilizing advanced packing materials and precise temperature control are crucial for achieving the ultra-high purity (>99%) required for flavor, fragrance, and pharmaceutical applications. Furthermore, the integration of vacuum distillation techniques helps lower operating temperatures, thereby reducing energy costs and preventing thermal degradation of certain sensitive components during the refining process.

Beyond traditional distillation, solvent extraction methods and membrane separation technologies are gaining prominence, particularly for initial dewatering and preliminary separation of the fusel oil stream at the distillery site. Solvent extraction, using appropriate non-polar solvents, offers a robust method for concentrating the higher alcohols before sending them for final distillation, improving overall process efficiency. Membrane technologies, though still emerging in this specific application, offer the potential for highly selective separation based on molecular size and polarity, promising lower energy consumption and a smaller environmental footprint compared to energy-intensive thermal methods. These technologies are integral to the valorization strategies adopted by modern integrated biorefineries.

Another critical area of technological innovation involves chemical synthesis processes for converting purified fusel oil components into high-value derivatives. Esterification technology, particularly using reactive distillation processes, is vital for producing acetates (like isoamyl acetate) and other flavor compounds efficiently. Catalytic processes are also continuously being optimized to enhance conversion rates and selectivity for specific chemical intermediates, such as plasticizers or bio-jet fuel precursors derived from fusel alcohols. The effective integration of these refining and synthesis technologies is paramount for manufacturers seeking to maximize the value extracted from the fusel oil byproduct stream and maintain a competitive edge in specialty chemical markets.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Fusel Oil, largely driven by massive ethanol production capacities in China and India, necessitated by their governmental bio-fuel mandates. The rapid expansion of the construction, coatings, and manufacturing sectors across Southeast Asia generates substantial demand for industrial solvents and chemical intermediates. Furthermore, the region’s expansive mining activities utilize large volumes of technical-grade fusel oil derivatives as flotation agents. Market growth is further fueled by lower production costs compared to Western economies and continuous investment in new distillation and refining infrastructure to meet stringent local quality standards. The focus is currently on high-volume, technical-grade product consumption, although demand for high-purity flavor esters is rising significantly due to the expanding urban middle-class population.

- North America: North America is characterized by high demand for high-purity, premium-grade fusel oil, particularly for regulated sectors like pharmaceuticals, cosmetics, and low-VOC architectural coatings. The U.S. ethanol industry, predominantly corn-based, provides a stable, though volatile, crude supply. Stringent environmental regulations in states like California drive innovation and adoption of bio-based solvents, reinforcing the position of refined fusel oil as a preferred alternative. Key growth factors include robust R&D activities focused on advanced bio-fuel technologies utilizing fusel alcohols and consistent demand from the specialty chemical manufacturing base. Pricing in this region is typically higher, reflecting the advanced purity requirements and rigorous certification processes.

- Europe: The European market is highly mature and innovation-focused, driven primarily by strict EU directives promoting bio-economy and sustainability. While ethanol production capacity is moderate compared to the U.S. or Brazil, the region excels in the consumption of high-value fusel oil derivatives in the flavor and fragrance industry, where high quality and consistency are non-negotiable. Furthermore, European chemical companies are leaders in developing advanced chemical intermediates and plasticizers based on fusel alcohols. The market is defined by high technological standards, sophisticated refining processes, and a strong preference for certified, sustainable-sourced products, often leading to collaboration between European chemical refiners and Latin American/Asian crude suppliers to secure reliable supply.

- Latin America: Latin America, dominated by Brazil, is a critical source market for crude fusel oil due to its vast sugar cane-based ethanol industry. The region benefits from highly efficient, large-scale fermentation facilities, providing the lowest-cost feedstock globally. While much of the crude oil is exported for refinement in other regions, internal demand is growing, particularly in the domestic coatings, mining, and agricultural chemical sectors. Opportunities lie in developing local refining capabilities to capture more value-added revenue domestically, reducing reliance on the export of crude materials. Governmental support for bio-fuels and renewable chemicals continues to underpin the foundational supply strength of this region.

- Middle East and Africa (MEA): The MEA market is currently small in terms of consumption but offers significant growth potential, particularly in the Middle East due to ongoing infrastructure development requiring large volumes of industrial coatings and solvents. Fusel oil adoption is tied to construction booms and the emerging chemical manufacturing sector. In Africa, the growth is more gradual, linked to localized agricultural processing and the introduction of ethanol blending mandates. Supply is primarily met through imports of refined products from Asia and Europe, making logistics and import tariffs crucial competitive factors. Future growth will be stimulated by localizing refining capacity as ethanol production increases across certain African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fusel Oil Market.- OQ Chemical Corporation

- BASF SE

- Dow Inc.

- Eastman Chemical Company

- Kuncai Chemical Industry Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Finar Limited

- Prasol Chemicals Pvt. Ltd.

- Nanjing Chemical Co. Ltd.

- Altiras Chemicals

- Triveni Ethanol Ltd.

- Green Biologics Ltd.

- Gevo Inc.

- Advanced Biofuels USA

- Cargill Incorporated

- Poet LLC

- Tereos

- Virent, Inc.

- BioAmber, Inc.

- Global Bio-Chem Technology Group Co. Ltd.

- Huntsman Corporation

- Celanese Corporation

- Mitsui Chemicals, Inc.

- Solvay S.A.

- ExxonMobil Chemical Company

- Shell plc (Chemicals Division)

- Sasol Limited

- LyondellBasell Industries N.V.

- Ashland Global Holdings Inc.

- INEOS Group Holdings S.A.

- Air Products and Chemicals, Inc.

- Shin-Etsu Chemical Co. Ltd.

- Wanhua Chemical Group Co. Ltd.

- Lotte Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- TCI Chemicals (India) Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Acros Organics (Thermo Fisher Scientific)

- Spectrochem Pvt. Ltd.

- Otto Chemie Pvt. Ltd.

- Sisco Research Laboratories Pvt. Ltd. (SRL)

- Central Drug House (P) Ltd.

- Fisher Scientific International Inc.

- Avantor, Inc.

- Thermo Scientific

- VWR International, LLC

- MilliporeSigma

- Honeywell International Inc. (Research Chemicals)

- Arkema S.A.

- DIC Corporation

- Kaneka Corporation

- Nippon Shokubai Co. Ltd.

- Evonik Industries AG

- Clariant AG

- Lonza Group AG

- Novozymes A/S

- DSM N.V.

- Associated British Foods plc (ABF)

- Bunge Limited

- Archer Daniels Midland Company (ADM)

- Wilmar International Limited

- Louis Dreyfus Company B.V.

- Glencore plc (Agriculture)

- COFCO Corporation

- Aemetis, Inc.

- Pacific Ethanol, Inc.

- Alto Ingredients, Inc.

- Valero Energy Corporation (Renewable Fuels)

- Marathon Petroleum Corporation (Renewable Fuels)

- Phillips 66 (Renewable Fuels)

- BP plc (Biofuels Division)

- TotalEnergies SE (Biofuels)

- RENOVA, Inc.

- SunPower Corporation

- First Solar, Inc.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Co. Ltd.

- Canadian Solar Inc.

- Hanwha Q CELLS Co. Ltd.

- REC Silicon ASA

- Polysilicon Technology Co. Ltd.

- Wacker Chemie AG

- Hemlock Semiconductor Operations LLC

- Tokuyama Corporation

- OSRAM GmbH (LED materials)

- Nichia Corporation

- Cree LED (Sensus)

- Samsung SDI Co. Ltd.

- LG Chem Ltd.

- Contemporary Amperex Technology Co. Ltd. (CATL)

- BYD Co. Ltd.

- Panasonic Corporation (Automotive Battery)

- SK Innovation Co. Ltd.

- Toda Kogyo Corp.

- Umicore N.V.

- 3M Company (Advanced Materials)

- DuPont de Nemours, Inc.

- Avery Dennison Corporation

- CCL Industries Inc.

- Mondi Group

- Smurfit Kappa Group plc

- International Paper Company

- Domtar Corporation

- Resolute Forest Products Inc.

- WestRock Company

- Stora Enso Oyj

- Svenska Cellulosa Aktiebolaget (SCA)

- Kimberly-Clark Corporation

- Procter & Gamble Co. (P&G)

- Unilever plc

- Colgate-Palmolive Company

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- The Clorox Company

- SC Johnson & Son, Inc.

- Ecolab Inc.

Frequently Asked Questions

Analyze common user questions about the Fusel Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary commercial applications of Fusel Oil derivatives?

The primary commercial applications include high-performance industrial solvents for coatings, inks, and adhesives; chemical intermediates for producing plasticizers and specialty chemicals; and the synthesis of esters crucial for the food and fragrance industries, such as isoamyl acetate (banana flavor). Fusel oil is also used extensively as a flotation agent in the mining sector.

How does the Fusel Oil supply chain affect market pricing?

Fusel Oil supply is a byproduct directly tied to global ethanol production volumes, meaning its availability and subsequent market pricing are heavily influenced by the volatility of agricultural feedstocks (corn, sugar cane) and governmental mandates concerning bio-fuel blending. High ethanol production generally increases fusel oil supply, potentially stabilizing prices, while crop failures or policy shifts can introduce price spikes due to constrained supply.

Which geographical region dominates the production and consumption of Fusel Oil?

Asia Pacific (APAC), particularly China and India, dominates both the production and consumption of crude and technical-grade Fusel Oil due to vast domestic ethanol production capacities and rapidly growing industrial sectors (coatings, manufacturing, and mining). However, refinement and consumption of premium, high-ppurity grades are concentrated in North America and Europe.

What technological advancements are driving growth in the refined Fusel Oil segment?

Growth is significantly driven by advancements in separation technologies, including multi-stage high-efficiency fractional distillation, solvent extraction, and emerging membrane technologies. These innovations enable refiners to economically achieve the high purity levels (>99%) required for lucrative flavor, fragrance, and pharmaceutical grade applications, maximizing the value of the byproduct stream.

Is Fusel Oil considered a sustainable or bio-based chemical?

Yes, Fusel Oil is inherently sustainable as it is entirely derived as a byproduct of natural fermentation processes utilizing renewable agricultural feedstocks (sugar cane, corn). Its classification as a bio-based solvent positions it favorably within global regulatory frameworks that mandate the reduction of petroleum-derived volatile organic compounds (VOCs) in industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager