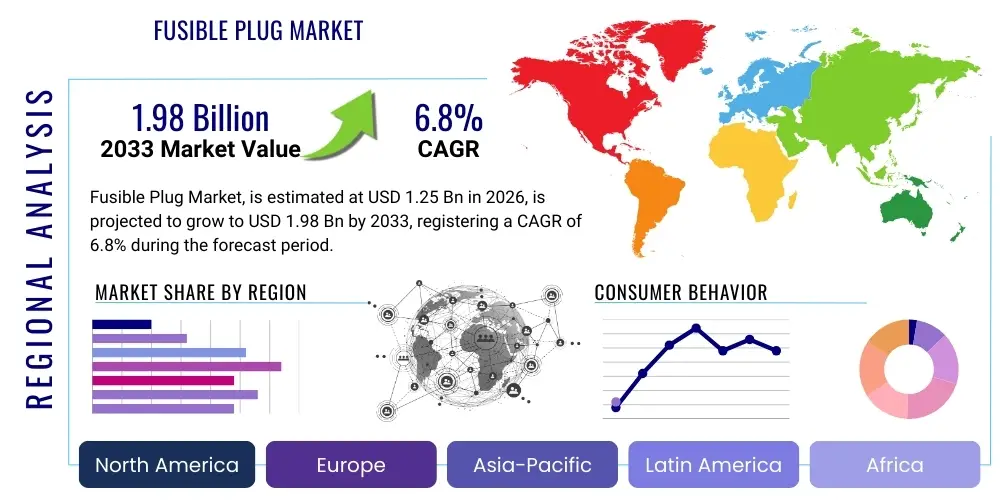

Fusible Plug Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436933 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fusible Plug Market Size

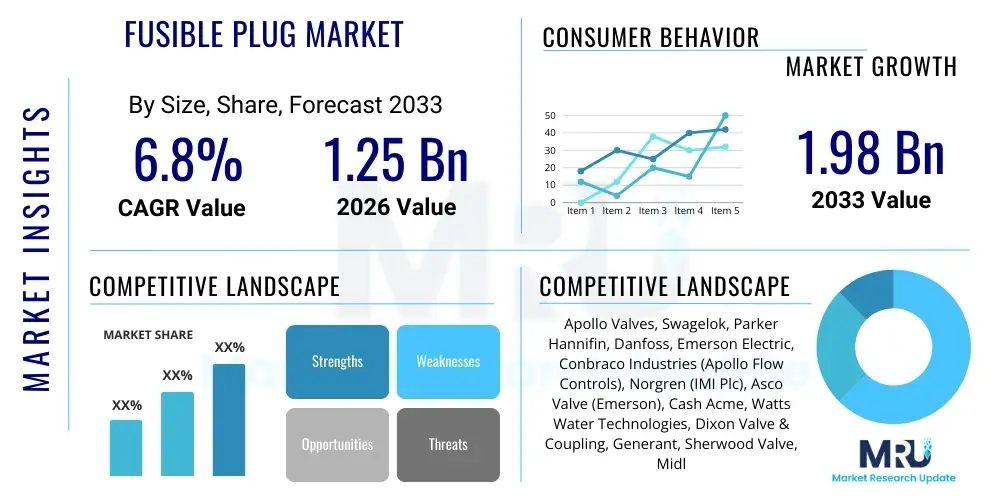

The Fusible Plug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033.

Fusible Plug Market introduction

The Fusible Plug Market encompasses the manufacturing and distribution of specialized safety devices designed to protect pressure vessels, boilers, and gas cylinders from catastrophic failure due to over-temperature conditions. These plugs are characterized by a core of low-melting point alloy, strategically installed in critical equipment. When the internal temperature exceeds a predetermined safe limit—often caused by low water levels in boilers or external heat exposure—the alloy melts, creating a vent for steam or pressure, thereby preventing explosion or rupture. This inherent passive safety mechanism makes fusible plugs indispensable components across numerous heavy and process industries where thermal runaway poses significant risks. Their fundamental purpose is life safety and asset protection, driving consistent demand across regulated sectors globally.

The primary applications of fusible plugs span critical infrastructure, including the automotive, HVAC, power generation, and chemical processing sectors. In automotive applications, particularly in air conditioning systems or specific fuel handling components, these plugs prevent system overpressurization. For industrial boilers and pressure vessels, which operate under extreme conditions, fusible plugs serve as the last line of defense against overheating caused by operational malfunctions. The stringent regulatory frameworks enforced by bodies such as ASME (American Society of Mechanical Engineers) and local safety organizations mandate the use of certified, regularly inspected fusible plugs, ensuring market stability and continuous technological refinement in material composition and failure reliability. The shift towards higher temperature and pressure applications necessitates ongoing innovation in plug materials, moving beyond traditional brass and bronze to include high-grade stainless steel and specialized alloys.

Major driving factors fueling the market growth include the robust expansion of the oil and gas infrastructure, particularly in developing economies, coupled with significant investments in new power generation facilities utilizing thermal processes. Furthermore, the increasing complexity and scale of industrial refrigeration and HVAC systems, which require meticulous pressure and temperature control, contribute substantially to demand. The inherent benefits of fusible plugs—such as their simplicity, cost-effectiveness, and reliability as passive safety devices—ensure their sustained relevance, even amid the rise of sophisticated electronic safety systems. The global focus on workplace safety standards and the increasing liability associated with industrial accidents also pressure operators to maintain and upgrade safety protocols, including the timely replacement of aging fusible plugs, thus stimulating aftermarket growth.

Fusible Plug Market Executive Summary

The Fusible Plug Market is positioned for steady expansion, driven primarily by evolving global safety regulations and increasing infrastructural development across Asia Pacific and the Middle East. Key business trends indicate a heightened focus on material science innovation, particularly the development of plugs using corrosion-resistant materials suitable for demanding chemical and marine environments, thereby extending product lifespan and reliability. Manufacturers are also concentrating on optimizing supply chains to meet the just-in-time inventory demands of large industrial end-users, while strategic mergers and acquisitions among niche safety component providers are leading to market consolidation and expanded product portfolios. The aftermarket segment, driven by mandatory replacement schedules for safety compliance, remains a vital revenue stream for established market players, ensuring consistent business flow irrespective of new equipment installation cycles.

Regional trends reveal Asia Pacific as the fastest-growing market, largely due to rapid industrialization, massive investments in power generation capacity (both conventional and renewable), and the burgeoning manufacturing sector, especially in China and India. North America and Europe, while mature, demonstrate stable demand fueled by stringent safety standards and the ongoing requirement for maintenance, repair, and overhaul (MRO) activities within aging industrial infrastructure. The Middle East and Africa (MEA) are also emerging as critical growth regions, heavily influenced by large-scale oil and gas exploration and processing projects that rely heavily on certified pressure safety devices. Localization of manufacturing capabilities in these regions is becoming a strategic imperative for global vendors seeking to reduce lead times and comply with regional content requirements.

Segmentation trends highlight the increasing preference for high-pressure rated plugs, reflecting the operational demands of modern industrial boilers and large commercial HVAC systems. Material-wise, there is a gradual shift from traditional brass to stainless steel plugs in applications exposed to harsh chemicals or extreme temperatures, valued for their durability and anti-corrosion properties. The application segment growth is robust across the industrial gas cylinder sector, spurred by increased global consumption of medical and industrial gases, necessitating secure pressure management. Overall, the market remains highly compliance-driven, where product performance and regulatory certification are the paramount factors influencing purchasing decisions, overriding minor price variations among competitors.

AI Impact Analysis on Fusible Plug Market

Common user questions regarding AI's impact on the Fusible Plug Market frequently revolve around whether AI-powered predictive maintenance systems will render passive safety devices obsolete, or conversely, how AI can enhance the manufacturing quality and supply chain resilience for these critical components. Users are concerned about the integration of smart sensors into traditional pressure vessels, querying if AI could predict failure points earlier than the melting point of the plug, thus preventing the incident altogether. Furthermore, the industry is keen to understand how AI-driven quality inspection (using computer vision) and optimized material formulation (using machine learning) can lead to zero-defect manufacturing of the specialized alloys utilized in the plugs, ensuring their reliability under extreme conditions. The key theme is the balance between adopting sophisticated digital predictive tools and maintaining the fundamental, proven reliability of mechanical passive safety mechanisms.

While AI will not replace the fundamental mechanical function of the fusible plug—which serves as a non-electronic, last-resort mechanical safeguard—it significantly impacts the surrounding market ecosystem. AI-driven predictive maintenance (PdM) platforms, utilizing sensor data from pressure vessels, can forecast operational anomalies such as internal fouling or suboptimal heating that might lead to an over-temperature event. By predicting and preventing these incidents, AI reduces the rate of actual plug activation, enhancing system uptime. However, regulatory bodies still require the physical plug as a mandatory backup, ensuring its continued market relevance. AI’s true transformative power lies in its application to the manufacturing process, optimizing machining precision and automating sophisticated quality control checks, minimizing human error in the production of these life-critical components.

- AI-driven predictive maintenance systems reduce the frequency of plug activation by mitigating precursor events.

- Machine learning algorithms optimize alloy composition and melting point consistency during the manufacturing process.

- Computer vision systems enhance quality control, enabling rapid, non-destructive testing for micro-fissures and dimensional accuracy.

- AI optimizes supply chain logistics, ensuring timely delivery of replacement plugs for MRO activities, particularly in remote industrial locations.

- Digital twins and simulation platforms utilize AI to model thermal stress behavior, accelerating the design and certification of new high-pressure plugs.

DRO & Impact Forces Of Fusible Plug Market

The Fusible Plug Market is primarily propelled by stringent global safety regulations, especially those mandated by organizations like ASME and various national boiler and pressure vessel codes, which enforce the mandatory installation and periodic replacement of these safety devices. Growth is further accelerated by increased industrial activity, particularly in oil refineries, chemical plants, and the rapidly growing HVAC and industrial refrigeration sectors which rely heavily on effective pressure relief mechanisms. Conversely, the market faces restraints due to the long operational life of industrial equipment, leading to sometimes slower replacement cycles for the plugs themselves, and the increasing trend towards integrated, electronically controlled safety relief valves in certain modern applications, although these rarely fully replace the passive plug requirement. Opportunities lie in developing advanced alloys capable of withstanding harsher, corrosive environments and in expanding into niche applications such as aerospace ground support equipment and specialized medical gas handling systems.

Segmentation Analysis

The Fusible Plug Market is comprehensively segmented based on material type, pressure rating, specific application, and the end-user industry, reflecting the diverse operational environments these critical safety devices are deployed in. Material segmentation is crucial as it dictates the plug's suitability for different operating temperatures, pressures, and corrosive exposures, with brass and bronze dominating general-purpose applications while stainless steel targets high-stress, chemical processing environments. Pressure ratings divide the market into low, medium, and high categories, directly corresponding to the operational parameters of the protected equipment, such as smaller residential boilers versus large industrial steam systems.

Application segmentation categorizes demand drivers across core industrial sectors, with boilers and pressure vessels representing the most traditional and largest segment, followed closely by the rapidly expanding HVAC and refrigeration market where thermal safety is paramount. The End-User Industry perspective provides insight into strategic market focus, identifying the Oil and Gas sector as a primary consumer due to the high risks associated with hydrocarbon processing, alongside robust demand from the Chemical and Power Generation industries. This intricate segmentation allows market players to tailor material science research and manufacturing capacities to meet highly specific regulatory and operational demands across various geographies.

Understanding these segments is essential for strategic planning, particularly in predicting demand shifts driven by industrial capital expenditure cycles. For instance, a boom in LNG infrastructure favors demand for high-pressure, corrosion-resistant plugs suitable for cryogenic environments, while sustained residential construction spurs demand for low-to-medium pressure rated plugs for heating systems. The continuous need for compliance maintenance ensures that all segments, regardless of equipment age, contribute significantly to the MRO aftermarket, providing a resilient revenue baseline for the entire fusible plug supply chain.

- By Material: Brass, Bronze, Copper, Stainless Steel, Others (Specialized Alloys)

- By Pressure Rating: Low Pressure, Medium Pressure, High Pressure

- By Application: Boilers and Pressure Vessels, HVAC and Refrigeration, Industrial Gases, Automotive, Others (Aviation Ground Support, Specialized Heat Exchangers)

- By End-User Industry: Oil and Gas, Chemical, Manufacturing, Transportation, Power Generation, Commercial and Residential

Value Chain Analysis For Fusible Plug Market

The value chain for the Fusible Plug Market begins with the upstream segment involving the procurement and processing of specialized raw materials, primarily high-quality base metals such as brass, bronze, copper, and stainless steel, along with specific low-melting point alloys (e.g., eutectic solders composed of tin, lead, cadmium, or bismuth). Upstream activities are critical, requiring rigorous material certification and metallurgical testing to ensure the alloy's melting point integrity and chemical stability under operational stress. Key suppliers in this phase are specialized metal alloy producers who must meet the exacting standards required for safety-critical components, demanding high reliability and traceability for every batch used in manufacturing.

The core manufacturing stage involves precision casting, forging, and machining processes to produce the plug body and accurately insert the specialized fusible core. Quality assurance is paramount here, utilizing advanced dimensional inspection and material composition analysis. Manufacturers often utilize both direct and indirect distribution channels. Direct channels involve selling high-volume, custom-engineered plugs directly to large original equipment manufacturers (OEMs) in the boiler, HVAC, or industrial gas sectors. Indirect channels involve utilizing a comprehensive network of authorized distributors, industrial supply houses, and specialized MRO component vendors to reach smaller end-users and service providers globally, managing the high volume of replacement and maintenance demand.

Downstream activities center around installation, maintenance, and mandatory replacement. Certified engineers and technicians, often affiliated with boiler or pressure vessel service companies, are responsible for installing and periodically inspecting these plugs according to regulatory requirements, often replacing them on a prescribed schedule (e.g., annually or bi-annually) irrespective of activation status, due to potential material fatigue or contamination. This regulatory requirement drives consistent aftermarket sales. Efficient logistics and reliable distribution partners are essential for the downstream segment to ensure safety components are available exactly when needed for critical maintenance shutdowns across various dispersed industrial locations.

Fusible Plug Market Potential Customers

The primary customers for the Fusible Plug Market are organizations that own and operate pressure-containing equipment where failure could result in severe safety risks or catastrophic equipment loss. This includes original equipment manufacturers (OEMs) that integrate the plugs into their new boilers, industrial compressors, refrigeration units, and gas storage cylinders before market distribution. These OEMs require standardized, high-volume, and certified components tailored to their specific system designs and pressure ratings, making them crucial high-volume buyers at the upstream end of the supply chain.

Equally critical are the large industrial end-users, notably companies within the Oil and Gas sector (refineries, petrochemical plants), Power Generation facilities (coal, gas, nuclear plants utilizing steam cycles), and the Chemical Processing industry. These entities are responsible for the ongoing maintenance and operational integrity of vast amounts of complex, high-pressure equipment. Their purchasing decisions are highly influenced by regulatory compliance, reliability metrics, and supplier certification, leading to recurring high-value MRO contracts for plug replacements and spares.

Furthermore, smaller but highly frequent customers include commercial and residential HVAC service providers, specialized industrial gas distributors managing gas cylinder fleets (e.g., oxygen, nitrogen, acetylene), and independent boiler service companies. These customers typically purchase through indirect distribution channels (industrial supply stores and specialized safety component vendors) but contribute significantly to the aggregated market volume due to the mandatory scheduled replacement of plugs in smaller, decentralized systems. The key driver for all potential customers remains safety compliance and the avoidance of operational downtime and liability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apollo Valves, Swagelok, Parker Hannifin, Danfoss, Emerson Electric, Conbraco Industries (Apollo Flow Controls), Norgren (IMI Plc), Asco Valve (Emerson), Cash Acme, Watts Water Technologies, Dixon Valve & Coupling, Generant, Sherwood Valve, Midland Manufacturing, Wika Group, ZY Fire Protection, Tyco Valves & Controls (Pentair). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fusible Plug Market Key Technology Landscape

The technology landscape of the Fusible Plug Market is fundamentally based on precision metallurgy and advanced manufacturing techniques, despite the product’s core function being purely mechanical and passive. The most significant technological focus is on the formulation and reliable casting of eutectic alloys—the core material responsible for the temperature-triggered failure mechanism. Manufacturers invest heavily in spectral analysis and thermal testing equipment to ensure that the melting point of the alloy is consistent and precisely calibrated to meet stringent international standards (e.g., ASME standards dictate the specific alloy composition and melting characteristics required for certified pressure vessel plugs). This dedication to metallurgical precision ensures that the plug activates only when necessary, preventing false alarms while guaranteeing critical safety intervention.

Recent technological advancements are centered around improving the longevity and operational tolerance of the plug body and threads, moving away from conventional machining methods towards highly automated CNC (Computer Numerical Control) machining centers. This shift minimizes dimensional inaccuracies that could lead to premature failure or leakage under high pressure. Furthermore, surface treatment technologies, such as specialized coatings or passivation techniques, are increasingly being adopted, particularly for stainless steel plugs destined for corrosive environments like marine applications or chemical processing plants. These surface enhancements prevent galvanic corrosion and pitting, which could compromise the mechanical integrity of the plug body over time, independent of the fusible core's function.

Integration technology, though not directly altering the plug itself, is becoming crucial for market competitiveness. This involves designing fusible plugs to be compatible with modern sensor technologies. For instance, some manufacturers now offer plugs with integrated ports or standardized dimensions that allow for the co-installation of pressure and temperature sensors near the plug location. This enables operators to use advanced monitoring systems for predictive diagnostics without compromising the regulatory requirement of having a certified passive plug installed. This blend of simple mechanical safety and digital readiness represents the leading edge of technology adoption in this mature safety device market.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global market growth, driven by massive infrastructure spending in China, India, and Southeast Asian nations. The region's rapid industrialization, characterized by large-scale power plant construction, expansion of oil and gas refining capabilities, and a booming manufacturing sector, dictates high demand for certified safety components. Local regulatory harmonization efforts across countries and increasing enforcement of industrial safety codes further bolster consumption. China, in particular, dominates both consumption and domestic manufacturing, although quality and certification remain critical buying factors.

- North America: This region represents a mature, high-value market defined by extremely rigorous safety standards (e.g., ASME Boiler and Pressure Vessel Code) and a massive installed base of industrial infrastructure. Demand here is stable, largely driven by the mandatory maintenance, repair, and overhaul (MRO) cycle, which mandates periodic replacement of plugs to maintain certification. The US oil and gas industry and the substantial commercial HVAC market are key consumers, prioritizing highly certified, domestically sourced components.

- Europe: Similar to North America, the European market is characterized by maturity, stable demand, and strict adherence to EU directives regarding pressure equipment safety. Germany, the UK, and Italy are significant consumers, driven by advanced manufacturing, chemical processing, and sophisticated district heating systems. Emphasis is placed on material quality, environmental compliance (e.g., RoHS), and traceability, favoring established global suppliers with strong local presence and distribution networks.

- Middle East and Africa (MEA): This region exhibits high growth potential, largely contingent upon upstream and downstream investment in the oil and gas sector, particularly in Saudi Arabia, UAE, and Qatar. The need for robust, high-pressure rated, and corrosion-resistant plugs is paramount due to the harsh operating environments. Government-led diversification efforts promoting industrial zones and power generation projects outside of oil also contribute to long-term market expansion, often requiring international certification standards.

- Latin America: The market here shows moderate but steady growth, heavily influenced by the resource extraction industries (mining, oil, and gas) and localized manufacturing growth in Brazil and Mexico. Economic volatility can sometimes impact major capital expenditure projects, but the essential safety requirements ensure a baseline level of MRO demand. Market penetration is often challenging due to complex local regulations and a reliance on imports, making strong distributor partnerships essential for success.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fusible Plug Market.- Apollo Valves

- Swagelok

- Parker Hannifin

- Danfoss

- Emerson Electric

- Conbraco Industries (Apollo Flow Controls)

- Norgren (IMI Plc)

- Asco Valve (Emerson)

- Cash Acme

- Watts Water Technologies

- Dixon Valve & Coupling

- Generant

- Sherwood Valve

- Midland Manufacturing

- Wika Group

- ZY Fire Protection

- Tyco Valves & Controls (Pentair)

- Velan Inc.

- Leser GmbH & Co. KG

- Farris Engineering

Frequently Asked Questions

Analyze common user questions about the Fusible Plug market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a fusible plug in industrial applications?

The primary function of a fusible plug is to serve as a passive, mechanical safety device designed to protect pressure vessels, boilers, and gas cylinders from catastrophic failure due to over-temperature conditions. It contains a temperature-sensitive alloy that melts at a set point, releasing pressure and preventing rupture.

How often must fusible plugs be replaced according to industry standards?

While specific replacement intervals vary by jurisdiction and application (e.g., boiler vs. gas cylinder), many stringent codes, such as those governing high-pressure industrial boilers, mandate the replacement of fusible plugs annually or biennially, regardless of whether they have been activated, to ensure material integrity and reliability.

Which material segment dominates the Fusible Plug Market and why?

Brass and bronze materials traditionally dominate the market due to their cost-effectiveness, excellent heat conductivity, and sufficient strength for low-to-medium pressure applications, particularly in residential and commercial heating, ventilation, and air conditioning (HVAC) systems.

What is the main driver for market growth in the Asia Pacific region?

The main driver in Asia Pacific is rapid industrialization, coupled with significant governmental and private investments in crucial infrastructure sectors, including power generation, chemical processing, and extensive oil and gas refining capabilities, all of which require mandatory thermal safety components.

Are fusible plugs being replaced by electronic safety systems?

No, fusible plugs are generally not being replaced entirely. While advanced electronic safety systems and predictive maintenance tools reduce the likelihood of incidents, fusible plugs remain mandatory in most high-risk applications as a non-electronic, fail-safe mechanical backup required by major international safety codes (like ASME) for critical asset protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager