Gable Top Liquid Cartons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438152 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Gable Top Liquid Cartons Market Size

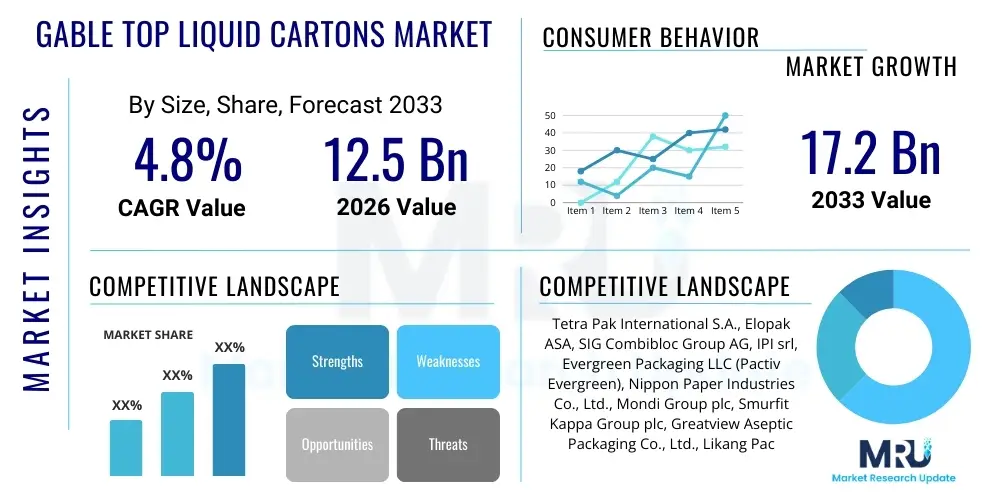

The Gable Top Liquid Cartons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 17.2 Billion by the end of the forecast period in 2033.

Gable Top Liquid Cartons Market introduction

The Gable Top Liquid Cartons Market encompasses the manufacturing, distribution, and utilization of paperboard-based containers primarily used for packaging fresh, perishable, and extended shelf life liquid foods. These cartons, characterized by their distinctive peaked roof or gable, offer a convenient, lightweight, and highly functional packaging solution, particularly favored by the dairy and juice industries. The core structure consists of layers of paperboard, polyethylene, and often a layer of aluminum foil for aseptic applications, ensuring product integrity and barrier properties against light, oxygen, and moisture. Gable top cartons are designed for easy pouring, efficient stacking, and excellent brand visibility, making them a staple in chilled distribution chains globally. They represent a sustainable alternative to traditional plastic and glass containers due to the high proportion of renewable materials utilized in their construction.

Product descriptions typically highlight the carton's structural rigidity, multi-layer protection, and the variety of closures available, ranging from simple crimped seals to advanced screw caps and spouts that enhance convenience and resealability. These features are crucial for maintaining the quality and nutritional value of sensitive liquids like milk, cream, and specialty juices. The standard gable top format is optimized for cold-chain storage (pasteurized products), but advancements in barrier technology have expanded its use into ultra-high temperature (UHT) processed products requiring ambient storage for several months.

Major applications driving market growth include the packaging of fresh milk (whole, skim, flavored), fruit juices, plant-based beverages (almond, soy, oat milk), and liquid food items such as broths and egg substitutes. The primary benefits driving adoption are the environmental profile associated with renewable paper resources, the superior logistical advantages due to their light weight and cube efficiency, and the ample surface area for mandatory labeling and marketing graphics. Key driving factors involve shifting consumer preferences toward portion-controlled, convenient packaging, increasing demand for sustainable and recyclable materials, and the expansion of organized retail and cold chain infrastructure in emerging economies.

Gable Top Liquid Cartons Market Executive Summary

The Gable Top Liquid Cartons Market is experiencing robust growth fueled by the convergence of consumer demand for sustainable packaging and the structural expansion of the global dairy and non-dairy beverage sectors. Current business trends indicate a strong focus on enhancing the barrier performance of cartons to extend shelf life without relying on aluminum foil, driven by cost optimization and recyclability concerns. Furthermore, the integration of advanced digital printing technologies is enabling shorter print runs, rapid customization, and enhanced supply chain responsiveness, particularly critical for seasonal promotions and regional branding initiatives. Companies are heavily investing in aseptic filling technologies compatible with gable top formats to capture the rapidly expanding market for UHT milk and ambient-stored beverages, thereby moving beyond traditional chilled applications. The industry is also facing pressure to develop fully biodegradable or monolayer barrier solutions to meet ambitious circular economy goals set by regulators in Europe and North America.

Regionally, the market dynamics vary significantly. North America and Europe represent mature markets characterized by innovation in closure systems, higher adoption of plant-based milk alternatives, and stringent recycling infrastructure mandates that favor fiber-based packaging. The Asia Pacific (APAC) region, however, is emerging as the primary growth engine, spurred by rapid urbanization, increasing per capita consumption of packaged dairy products, and massive investment in modern processing and cold chain facilities, particularly in India, China, and Southeast Asian nations. Latin America and the Middle East and Africa (MEA) present significant opportunities due to expanding consumer bases and the gradual transition from unpackaged or rudimentary packaging systems to standardized, safe, and hygienic gable top solutions for staples like basic milk and affordable juices. Regional trends emphasize lower cost-to-fill ratios and higher speeds of production machinery to serve these high-volume, price-sensitive markets efficiently.

Segmentation trends highlight the dominance of the milk and dairy segment, which continues to drive volume, while the non-dairy and specialty beverages segment drives value and innovation, particularly concerning premium closures and environmentally certified paperboard. By volume, the standard 1-liter carton remains pervasive, although there is a notable rise in demand for smaller, single-serving cartons (250ml and 500ml) catering to on-the-go consumption and snack culture, especially in developed markets. From a material perspective, the industry is witnessing a shift towards lightweighting the paperboard substrate and using bio-based polyethylene coatings derived from renewable resources rather than fossil fuels. This strategic move aligns with corporate sustainability targets and increasingly strict governmental regulations targeting plastic reduction in packaging formats across major economies.

AI Impact Analysis on Gable Top Liquid Cartons Market

User queries regarding AI's influence on the Gable Top Liquid Cartons Market frequently revolve around topics such as operational efficiency improvement, predictive maintenance of high-speed filling lines, optimization of material sourcing and inventory management, and the potential for AI-driven quality control systems. Users are concerned about how AI can handle the complexity of multi-layered material composition and high-speed aseptic filling environments to minimize material waste and downtime. Key expectations center on AI’s ability to predict demand fluctuations accurately across diverse regional markets and manage the variability introduced by increasing sustainability mandates (e.g., handling recycled content or bio-based polymers). Furthermore, there is significant interest in using machine learning to analyze consumer feedback, optimize carton graphics for maximum shelf impact, and personalize product offerings more effectively than traditional market research methods.

- AI-Powered Predictive Maintenance: Utilizing sensor data from high-speed filling and sealing machines to predict component failures, minimizing unplanned downtime and maximizing throughput (OEE).

- Supply Chain Optimization: Employing machine learning algorithms to forecast demand variability across SKUs, optimizing paperboard and polymer inventory levels, and reducing transportation costs.

- Automated Quality Control: Implementing computer vision and deep learning models to inspect carton integrity, sealing accuracy, and printing quality at ultra-high speeds, ensuring aseptic standards are maintained.

- Material Waste Reduction: Using AI to optimize cutting and creasing processes, minimizing trim waste, and improving material yield during carton sleeve manufacturing.

- Sustainable Sourcing Strategy: Leveraging AI to track and verify the sustainability credentials (e.g., FSC certification) of raw fiber materials in real-time and identifying optimal, low-carbon sourcing routes.

- Enhanced Customization and Design: Using generative AI tools to rapidly prototype new carton structures, closure designs, and marketing graphics tailored to specific demographic insights.

DRO & Impact Forces Of Gable Top Liquid Cartons Market

The Gable Top Liquid Cartons Market is primarily driven by the escalating global focus on food safety, the robust growth of the liquid dairy and plant-based beverage sectors, and the inherent sustainability advantages of paperboard over competing packaging formats like rigid plastics. However, this growth is constrained by the relatively higher cost of aseptic filling machinery compared to standard PET bottle lines and the persistent challenge of recycling multi-layered cartons, especially those incorporating aluminum barrier layers, which complicate material separation. Opportunities lie predominantly in technological innovation aimed at developing mono-material structures for improved recyclability and expanding into high-growth ambient storage applications in developing economies. The primary impact forces shaping the market include strict governmental regulations promoting circular economy principles, intense competition from alternative, cheaper packaging formats (pouches, bottles), and continuous advancements in barrier coating technology essential for extending the shelf life of perishable goods efficiently.

Segmentation Analysis

The Gable Top Liquid Cartons Market is comprehensively segmented based on material structure, filling capacity (volume), end-use application, and closure type. This granular segmentation allows manufacturers to tailor their product offerings precisely to specific consumer needs and regional distribution chain requirements. The structure of the carton—whether standard refrigerated or aseptic—dictates the necessary barrier layers, profoundly influencing production costs and environmental footprint. Volume segmentation is crucial for catering to single-serve convenience versus family-size consumption, with significant market value derived from the increasing trend toward smaller, premium-priced units. Analysis by end-use application confirms the market's reliance on dairy, but also highlights the fastest expansion rates observed within the non-dairy and specialty food sectors, demonstrating market diversification. Finally, the type of closure, from basic fold-and-crimp to sophisticated screw caps with tamper-evident features, adds significant differentiation and value, reflecting consumer prioritization of convenience and hygiene.

Understanding the interplay between these segmentation variables is key to strategic planning. For instance, a medium-volume aseptic carton targeting plant-based milk often necessitates advanced barrier coatings and a high-convenience screw cap, placing it in the high-value segment. Conversely, high-volume fresh milk cartons in developed markets prioritize cost-efficiency and maximum throughput, leaning toward standard barrier materials and simpler closure mechanisms. Regulatory requirements, particularly concerning food contact safety and material traceability, further influence the choice of segment strategy, pushing companies toward bio-based polymers and certified paper sources across all key segments. This detailed breakdown ensures market players can identify niche opportunities and optimize their production capabilities accordingly to meet the diverse global demands for safe, sustainable, and convenient liquid packaging solutions.

- By Material Structure:

- Standard Cartons (Refrigerated)

- Aseptic Cartons (Extended Shelf Life/Ambient)

- By Volume/Capacity:

- Small (Up to 500 ml)

- Medium (500 ml to 1,000 ml)

- Large (Above 1,000 ml)

- By End-Use Application:

- Dairy Products (Milk, Cream, Yogurt Drinks)

- Juices and Nectars

- Plant-Based Beverages (Soy, Almond, Oat, Rice)

- Liquid Food (Soups, Broths, Egg Substitutes)

- Other Beverages (Water, Ready-to-Drink Tea)

- By Closure Type:

- Standard Folded/Crimped Seals

- Screw Caps/Lids

- Spouts and Fitments

Value Chain Analysis For Gable Top Liquid Cartons Market

The value chain for the Gable Top Liquid Cartons Market is fundamentally driven by raw material sourcing, highly specialized manufacturing processes, and intricate distribution networks optimized for speed and cost efficiency. The upstream segment begins with the sustainable sourcing of virgin wood pulp and paperboard, which must adhere to strict forest management standards (e.g., FSC certification). This segment also includes the production of specialized polymer resins (polyethylene, sometimes bio-based) and aluminum foil, which constitute the protective barrier layers. Given the heavy reliance on renewable resources, fluctuations in timber prices and the cost of petrochemical-derived polymers significantly impact the final product cost. Manufacturers of the raw material components must maintain consistently high quality and technical specifications to ensure barrier function and compatibility with high-speed filling lines downstream.

The midstream phase involves the core conversion process, where integrated packaging companies apply barrier coatings, print high-definition graphics onto the paperboard blanks, and precision-cut and score the carton sleeves. This stage requires significant capital investment in advanced printing, lamination, and die-cutting machinery. Innovations at this stage often focus on increasing the number of layers while reducing the overall material thickness (lightweighting) and improving the efficiency of the lamination process to minimize material defects that could compromise asepsis. Furthermore, the fabrication of specialized closures and fitments, often involving injection molding of plastics, is a critical step, as consumer convenience is highly dependent on the quality and functionality of the closure system.

Downstream analysis focuses on the distribution channel, which is dual-layered: direct supply and indirect distribution. Direct supply involves major packaging manufacturers selling carton sleeves directly to large multinational beverage and dairy processors (e.g., Coca-Cola, Danone, Nestle). This channel is dominated by long-term contracts and technical service agreements, where packaging companies often provide or maintain the sophisticated filling machinery. Indirect channels involve distributors or smaller regional packaging converters serving local dairy farms or niche beverage producers. The ultimate success of the carton depends on its seamless integration into the customer's high-speed filling line, requiring technical support and quality assurance throughout the entire supply chain. The high capital expenditure associated with aseptic fillers often creates a strong long-term dependency between the packaging supplier and the end-user, limiting switching costs.

Gable Top Liquid Cartons Market Potential Customers

The primary end-users and buyers of gable top liquid cartons are concentrated within the food and beverage processing industry, specifically entities dealing with high volumes of perishable liquid goods requiring stringent hygiene and cold chain management. Dairy cooperatives and large dairy processing corporations represent the largest customer base, utilizing these cartons extensively for pasteurized and UHT milk, creams, and cultured dairy beverages. These customers prioritize carton integrity, high-speed filling capability, and low operational costs per unit. The growing demand for milk substitutes, driven by dietary trends, has positioned plant-based beverage manufacturers as increasingly vital customers, often seeking premium, environmentally friendly packaging solutions that convey naturalness and sustainability to consumers.

Beyond traditional dairy, significant potential exists among fruit juice and nectar producers, especially those distributing chilled, high-quality, or organic products where flavor preservation is paramount. These producers benefit from the excellent light barrier properties offered by multi-layered cartons. Furthermore, the market is expanding to include niche food manufacturers producing specialized liquid foods such as ready-to-serve liquid eggs, broths, and nutritional supplements. These applications require the superior barrier protection and resealability features characteristic of advanced gable top designs. The focus for all potential customers remains the intersection of food safety compliance, brand differentiation through high-quality printing, and a demonstrably sustainable packaging solution that aligns with corporate social responsibility goals and consumer expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 17.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tetra Pak International S.A., Elopak ASA, SIG Combibloc Group AG, IPI srl, Evergreen Packaging LLC (Pactiv Evergreen), Nippon Paper Industries Co., Ltd., Mondi Group plc, Smurfit Kappa Group plc, Greatview Aseptic Packaging Co., Ltd., Likang Packaging Co., Ltd., Stora Enso Oyj, Weyerhaeuser Company, BillerudKorsnäs AB, Mayr-Melnhof Karton AG, Huhtamaki Oyj |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gable Top Liquid Cartons Market Key Technology Landscape

The technology landscape for the Gable Top Liquid Cartons Market is defined by high-speed processing, aseptic integrity, and material science innovations focused on enhanced barrier properties and sustainability. Central to this market are the sophisticated filling machines, capable of operating at speeds reaching 20,000 units per hour while maintaining absolute sterilization. Aseptic technology, particularly UHT processing combined with hydrogen peroxide sterilization of the carton material before filling, ensures microbial safety for extended ambient storage. Recent technological breakthroughs involve induction sealing systems for closures, ensuring tamper-evidence and minimizing leakage risks, alongside integrated quality control systems utilizing high-resolution sensors and vision inspection to detect micro-leaks or structural defects in real-time. The reliability and efficiency of these filling systems are crucial differentiators among packaging solution providers.

Material innovation represents the second major pillar of the technological landscape. Traditional cartons relied on standard polyethylene (PE) and aluminum foil for barrier performance. However, driven by environmental regulations and consumer pressure, research is concentrated on developing alternative high-barrier films, such as advanced EVOH (ethylene vinyl alcohol) and proprietary polymer blends, capable of replacing the aluminum layer entirely in some applications. This transition facilitates easier recycling processes and reduces the carbon footprint associated with aluminum production. Furthermore, the adoption of bio-based polyethylene, derived from sugarcane or other renewable sources, is a rapidly maturing technology, allowing companies to offer fully renewable packaging solutions, excluding the thin aluminum layer where used. This shift requires significant process adjustments in the lamination and heat-sealing phases to maintain structural integrity.

A third critical area is digital printing and traceability technology. The migration from traditional rotogravure or flexographic printing to advanced digital inkjet printing allows for highly customized, short-run packaging campaigns and the incorporation of dynamic QR codes or serialized barcodes. These technologies enhance supply chain visibility, combat counterfeiting, and enable direct consumer engagement through smart packaging initiatives. The convergence of material science (sustainability), high-speed engineering (efficiency), and digital integration (traceability and marketing) dictates the competitive edge within the gable top cartons market. Companies continually invest in patenting novel closure designs that maximize pouring ease and reclose functionality, responding directly to consumer demand for convenience and minimizing product spoilage after opening.

Regional Highlights

- North America: Characterized by a mature dairy sector and high consumer demand for chilled, single-serve formats and plant-based beverages. Innovation is focused on advanced closures and maximizing the renewable content of packaging materials to meet regional sustainability goals. The US market dominates regional consumption, driven by high per capita packaged beverage consumption.

- Europe: A highly regulated market with aggressive targets for circular economy mandates and plastic reduction. European demand emphasizes fully recyclable or mono-material cartons. Germany, France, and the UK are leading adopters of bio-based PE coatings and advanced aseptic technology for long-life dairy and juice products.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid expansion of the middle class, massive investment in modern dairy processing, and infrastructural development of the cold chain. China and India are the largest volume markets, with growth concentrated in both basic fresh milk and high-value aseptic juice categories. Cost-effectiveness and high-speed filling solutions are critical requirements.

- Latin America: Driven by population growth and the formalization of food distribution networks. Brazil and Mexico are key markets showing increasing adoption of gable top cartons for everyday milk and affordable juices, replacing traditional plastic bottles and pouches due to superior hygiene perception.

- Middle East and Africa (MEA): Significant opportunity for aseptic carton growth due to environmental conditions necessitating ambient storage (UHT milk and juice) and limited cold chain infrastructure in many areas. Saudi Arabia and South Africa are leading importers and manufacturers, prioritizing long shelf life and robustness for difficult logistical environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gable Top Liquid Cartons Market.- Tetra Pak International S.A.

- Elopak ASA

- SIG Combibloc Group AG

- IPI srl

- Evergreen Packaging LLC (Pactiv Evergreen)

- Nippon Paper Industries Co., Ltd.

- Mondi Group plc

- Smurfit Kappa Group plc

- Greatview Aseptic Packaging Co., Ltd.

- Likang Packaging Co., Ltd.

- Stora Enso Oyj

- Weyerhaeuser Company

- BillerudKorsnäs AB

- Mayr-Melnhof Karton AG

- Huhtamaki Oyj

Frequently Asked Questions

Analyze common user questions about the Gable Top Liquid Cartons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Gable Top Liquid Cartons Market?

The primary factor is the increasing global consumer demand for sustainable, fiber-based packaging solutions coupled with the rapid expansion of the chilled and extended shelf life segments for liquid dairy and plant-based milk alternatives, which highly favor the lightweight structure and superior logistical efficiency of gable top designs. AEO optimization emphasizes "sustainable packaging" and "plant-based beverages."

Are gable top cartons truly recyclable, and what challenges exist?

Gable top cartons, especially those without an aluminum layer (standard fresh milk cartons), are highly recyclable where local infrastructure supports fiber recovery. Challenges arise in multi-layer aseptic cartons containing aluminum and specialized polymers, requiring complex separation processes typically available only at specialized hydropulper facilities, impacting overall recycling rates in less developed regions. AEO key term: "multi-layer recycling challenges."

How does aseptic technology impact the application scope of gable top cartons?

Aseptic technology significantly broadens the application scope by sterilizing both the product and the carton materials, allowing perishable liquids (like UHT milk or juice) to be stored safely at ambient temperatures for up to 12 months. This opens up distribution channels in regions lacking robust cold chain logistics and reduces energy consumption in storage. AEO focus: "UHT milk ambient storage" and "cold chain alternatives."

Which geographical region is expected to demonstrate the highest market CAGR through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant population growth, rapid urbanization, rising disposable incomes leading to higher packaged food consumption, and major governmental investments into domestic food processing and hygienic packaging solutions. AEO optimization targets: "APAC market growth drivers" and "emerging economy consumption."

What are the key material science innovations transforming gable top carton barriers?

Key innovations involve the substitution of conventional fossil-fuel-derived polyethylene with bio-based polyethylene (derived from sources like sugarcane) and the development of advanced polymer films (like EVOH) to provide necessary oxygen and moisture barriers, aiming to potentially replace the non-renewable aluminum foil layer for enhanced recyclability and lower environmental impact. AEO terms: "bio-based polyethylene" and "aluminum-free barrier technology."

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager