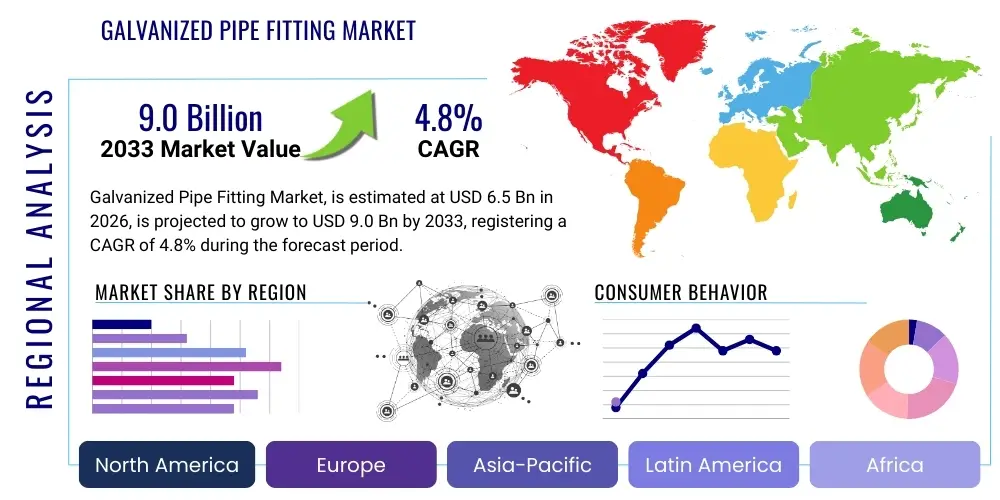

Galvanized Pipe Fitting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431448 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Galvanized Pipe Fitting Market Size

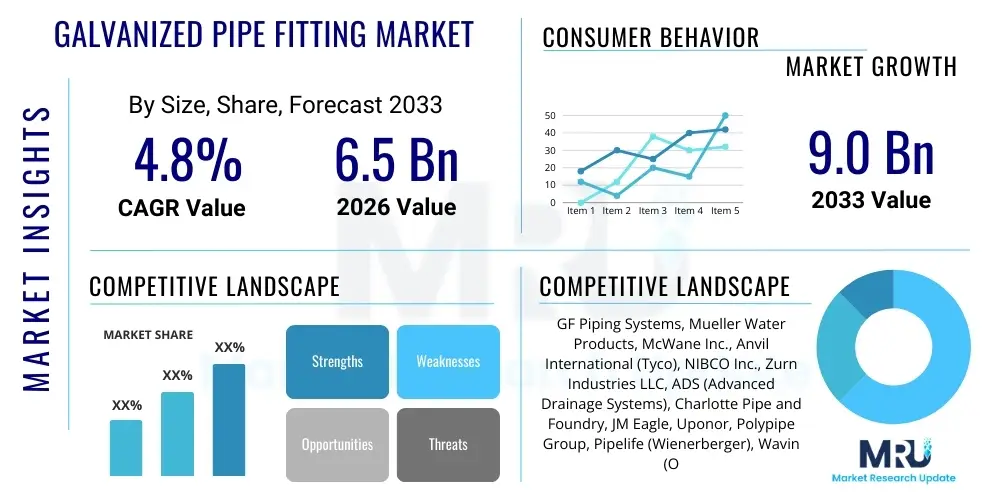

The Galvanized Pipe Fitting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Galvanized Pipe Fitting Market introduction

The Galvanized Pipe Fitting Market encompasses the manufacturing, distribution, and utilization of components used to connect pipe sections, change direction, terminate lines, or provide branch connections within fluid transfer systems, primarily employing zinc-coated steel for corrosion resistance. These fittings are critical elements in piping networks across various industrial, commercial, and residential applications where longevity and protection against rust are paramount. The galvanization process, typically hot-dip galvanizing, imparts superior durability compared to standard steel fittings, making them suitable for harsh or exterior environments.

Galvanized pipe fittings, which include elbows, tees, couplings, unions, reducers, and caps, are widely utilized due to their cost-effectiveness and robustness. They are particularly essential in applications involving water supply, drainage systems, natural gas distribution, and fire suppression systems where maintaining internal integrity and preventing system failure due to corrosion is non-negotiable. The inherent strength of steel combined with the sacrificial protection offered by the zinc coating ensures a prolonged operational lifespan, reducing maintenance frequency and associated costs, thus cementing their status as a preferred solution in infrastructure projects globally.

Major applications driving market expansion include municipal water infrastructure upgrades, substantial growth in residential and commercial construction in emerging economies, and the continuous need for reliable plumbing systems in industrial settings such as chemical processing and oil refineries. The market growth is fundamentally propelled by stringent governmental regulations concerning water quality and safety, alongside increasing investments in smart city development and sustainable infrastructure that necessitate durable, long-term piping solutions resistant to environmental degradation.

Galvanized Pipe Fitting Market Executive Summary

The Galvanized Pipe Fitting Market is characterized by stable demand driven primarily by global infrastructure spending and robust residential construction sectors, particularly across the Asia Pacific region. Key business trends involve the increasing adoption of automated manufacturing processes to enhance fitting precision and uniformity, coupled with a growing emphasis on high-pressure galvanized fittings suitable for specialized industrial applications. Companies are focusing on product standardization (adhering to ASME and ASTM standards) and improving supply chain efficiency to mitigate material cost volatility, which remains a consistent challenge in the metal fittings industry. Furthermore, sustainable galvanization techniques, minimizing environmental impact, are emerging as a competitive differentiator among leading manufacturers.

Regionally, the market dynamics are highly concentrated in areas undergoing rapid urbanization and industrialization. Asia Pacific dominates the market due to massive infrastructure projects in China, India, and Southeast Asian nations focused on expanding utility networks. North America and Europe demonstrate mature market characteristics, emphasizing replacement and upgrade cycles in aging water infrastructure, and demanding premium, certified fittings for specialized applications like fire protection systems. Regulatory compliance related to material quality and traceability is significantly influencing procurement decisions across all developed regions, favoring established suppliers with rigorous quality control mechanisms.

In terms of segmentation, the Malleable Iron galvanized fittings segment maintains a substantial market share owing to its excellent mechanical properties and widespread use in high-pressure plumbing and general pipe installation. The Application segment is heavily weighted towards the Construction and Water Treatment sectors, reflecting the foundational need for durable fluid conveyance. Future segment trends indicate a gradual shift towards standardized, easy-to-install fittings (such as grooved fittings) that reduce labor costs and installation time, offering a higher total value proposition to contractors and project developers globally.

AI Impact Analysis on Galvanized Pipe Fitting Market

User inquiries regarding AI in the Galvanized Pipe Fitting Market commonly revolve around improving operational efficiency, enhancing quality control during the galvanization process, and optimizing complex supply chain logistics. Users are concerned about how predictive maintenance algorithms can prolong equipment life in manufacturing plants and how machine learning can interpret real-time sensor data from the galvanizing baths to ensure optimal zinc coating thickness and uniformity, thereby reducing defect rates. Key expectations center on AI’s capability to move beyond traditional automation towards smart, adaptive manufacturing environments that minimize waste and energy consumption while maintaining stringent regulatory compliance for product standards.

The application of Artificial Intelligence (AI) and Machine Learning (ML) primarily manifests in two critical areas: smart manufacturing and demand forecasting. In the manufacturing workflow, AI-powered vision systems are being deployed for rapid, non-destructive inspection of finished fittings, capable of identifying microscopic surface defects or inconsistencies in the galvanization layer far more accurately and rapidly than human inspectors. This significantly increases throughput and ensures adherence to precise specifications required for high-stakes applications like oil and gas pipelines. Furthermore, ML models are analyzing historical production data (temperature, chemical composition, time submerged) to dynamically adjust galvanization parameters, minimizing material usage and energy costs.

From a strategic and logistical standpoint, AI algorithms are revolutionizing inventory management and procurement strategies within the galvanized pipe fitting supply chain. Given the volatility in steel and zinc prices, predictive analytics help manufacturers forecast material requirements and purchasing timelines to lock in favorable pricing, thereby stabilizing production costs. Additionally, AI optimizes warehousing layouts and distribution routes, responding dynamically to fluctuations in regional construction demand. This enhanced responsiveness ensures that the right fittings are available at construction sites exactly when needed, reducing project delays and improving customer satisfaction across the highly dispersed global market.

- AI-driven Quality Control: Implementing machine vision for automated detection of coating flaws and dimensional inaccuracies, ensuring compliance with ISO and ASTM standards.

- Predictive Maintenance: Utilizing sensor data within manufacturing equipment (molding, threading, galvanizing tanks) to forecast potential failures, maximizing operational uptime.

- Supply Chain Optimization: ML algorithms for forecasting demand for specific fitting types (e.g., Tees vs. Elbows) based on regional construction indices and commodity price prediction.

- Energy Efficiency Management: AI optimizing heating cycles and process timing in galvanizing baths to minimize energy consumption while achieving optimal coating adhesion.

- Process Automation: Enhancing robotics in handling high-temperature fittings immediately post-galvanization, improving worker safety and speed.

DRO & Impact Forces Of Galvanized Pipe Fitting Market

The Galvanized Pipe Fitting Market is fundamentally influenced by infrastructural development and corrosion resistance requirements, creating strong drivers for growth, countered by restraints related to material pricing volatility and alternative piping solutions. The primary driver is the global need for durable, anti-corrosive fluid transmission systems in rapidly urbanizing areas, particularly where climate conditions accelerate rust formation. However, the reliance on volatile commodity markets for both steel and zinc acts as a major restraint, leading to fluctuating manufacturing costs and unpredictable pricing structures for end-users. Opportunities arise from technological advancements in specialized corrosion-resistant alloys and smart infrastructure projects requiring integrated monitoring systems. The overall market dynamics are shaped by the critical impact forces of regulatory standards promoting quality and the competitive pressure exerted by non-metallic alternatives like PVC and PEX in certain low-pressure applications.

Key drivers include substantial investment in municipal water and wastewater infrastructure upgrades in both developed and developing economies, necessitated by aging pipeline networks reaching the end of their operational lifecycles. Furthermore, the stringent safety requirements in the oil and gas sector and the fire protection industry mandate the use of robust, non-flammable metal fittings, ensuring sustained demand for galvanized products. Conversely, the market faces headwinds from the environmental constraints associated with the galvanization process itself, particularly regulations related to zinc disposal and chemical effluent, which increases operational overhead for manufacturers and drives the necessity for cleaner production methods.

The most compelling opportunities lie in the integration of galvanized fittings into emerging fields such as modular construction and pre-fabricated piping solutions, where high standardization and quick installation are paramount. The development of advanced galvanizing methods, such as continuous galvanizing or specialized duplex coatings, offers competitive advantages by further enhancing durability beyond standard hot-dip methods. The impact forces determining long-term success are predominantly focused on the economic viability of galvanized fittings versus plastic substitutes in non-industrial settings, and the constant regulatory evolution demanding certified, traceable products that meet specific structural integrity and health standards.

Segmentation Analysis

The Galvanized Pipe Fitting Market is comprehensively segmented based on the material composition, the specific type of fitting, the size/diameter, and the diverse applications across end-user industries. Understanding these segments is crucial as they reflect varying demand patterns influenced by pressure requirements, operational environment severity, and installation standards specific to each industry. The malleable iron segment, known for its ease of machining and excellent strength-to-weight ratio, continues to hold a dominant share, while the application segment is heavily reliant on the pace of global construction and energy sector projects. Market stakeholders continually innovate within these segments, focusing on dimensional precision and coating quality to meet specialized requirements, particularly for fittings used in extreme temperature or high-vibration environments.

- By Material: Malleable Iron, Carbon Steel, Stainless Steel (Galvanized), Copper (Galvanized), Others (Ductile Iron, Aluminum).

- By Type: Elbows, Tees, Couplings, Reducers, Caps/Plugs, Unions, Flanges, Nipples, Crosses.

- By Pipe Size: Up to 2 Inches, 2 to 4 Inches, 4 to 8 Inches, Above 8 Inches.

- By Application: Oil and Gas, Construction (Residential and Commercial), Infrastructure (Water and Wastewater), Chemical Processing, HVAC Systems, Fire Protection Systems, Mining.

Value Chain Analysis For Galvanized Pipe Fitting Market

The value chain for the Galvanized Pipe Fitting Market begins with the upstream procurement of raw materials, primarily steel (in various forms like billets or strips) and high-grade zinc used for the coating process. Upstream activities involve complex negotiations with major commodity suppliers, where pricing volatility dictates production costs. Efficiency at this stage is achieved through long-term supply contracts and effective inventory management to hedge against market fluctuations. Manufacturers focus heavily on precision casting, forging, and threading processes, followed by the rigorous hot-dip galvanization treatment, which requires specialized facilities and strict adherence to process control standards to ensure uniform coating thickness and adhesion.

The midstream phase involves manufacturing and distribution, where finished fittings are bundled, quality-checked, and transported. Distribution is bifurcated into direct channels (selling large volumes directly to major construction contractors or utility companies) and indirect channels (utilizing wholesalers, regional distributors, and retailers). The efficiency of the distribution network is crucial for meeting localized demand spikes and ensuring timely delivery to geographically dispersed construction sites. Furthermore, midstream actors often handle inventory management for standard, high-turnover products like couplings and elbows, requiring sophisticated logistics planning.

The downstream analysis focuses on the end-user application and installation. Potential customers, including engineering, procurement, and construction (EPC) firms, industrial maintenance operators, and plumbing contractors, select fittings based on technical specifications, pressure ratings, and compliance certificates. The final value addition comes from installation services, where skilled labor integrates the fittings into the complete piping system. Direct sales are often preferred for customized or specialized fittings (e.g., large diameter flanges for industrial plants), while common fittings are typically acquired through indirect, retail-heavy channels, highlighting the importance of brand recognition and availability across diverse distribution points.

Galvanized Pipe Fitting Market Potential Customers

The potential customers for galvanized pipe fittings span a wide spectrum of industries, primarily driven by the need for reliable fluid or gas conveyance systems that resist environmental degradation and require high structural integrity. The primary buyers are large-scale Engineering, Procurement, and Construction (EPC) companies involved in substantial infrastructure projects such as water treatment plants, urban drainage networks, and commercial building complexes. These customers prioritize compliance with national safety codes and the guaranteed longevity provided by the zinc coating. Additionally, the industrial sector, encompassing chemical processing facilities, refineries, and power generation plants, represents a crucial segment, often requiring specialized, high-pressure fittings tailored to demanding operational environments.

Beyond the major construction and industrial users, a significant portion of the market relies on maintenance and repair operations (MRO), where residential and commercial plumbing contractors regularly purchase standardized galvanized fittings for renovation, repair, and smaller installation jobs. Utility companies, responsible for municipal water and gas distribution, also represent consistent, high-volume buyers, especially during system expansion or replacement phases. These buyers demand fittings that adhere strictly to local utility standards and provide decades of maintenance-free service under varied soil and atmospheric conditions, making durability the chief purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GF Piping Systems, Mueller Water Products, McWane Inc., Anvil International (Tyco), NIBCO Inc., Zurn Industries LLC, ADS (Advanced Drainage Systems), Charlotte Pipe and Foundry, JM Eagle, Uponor, Polypipe Group, Pipelife (Wienerberger), Wavin (Orbia), Victaulic, Aliaxis Group, Precision Castparts Corp., Swagelok Company, Parker Hannifin Corporation, Grinnell Mechanical Products, TATA Steel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Galvanized Pipe Fitting Market Key Technology Landscape

The manufacturing technology for galvanized pipe fittings is highly sophisticated, focusing on achieving precise dimensions, superior thread integrity, and uniform, long-lasting zinc coating. Key technological advancements center around optimizing the hot-dip galvanizing process. Modern galvanizing lines utilize advanced flux chemistries and automated pre-treatment stages to ensure exceptional surface preparation, which is critical for strong zinc adhesion and minimum porosity. Furthermore, induction heating and precise temperature control systems are employed to manage the metallurgical reaction between the steel substrate and the molten zinc, guaranteeing a consistent, high-quality, and structurally sound protective layer that meets stringent industry standards like ASTM A153/A123. Robotics are increasingly integrated for handling fittings during the dipping and cooling stages, improving consistency and worker safety.

In the realm of metallurgy and fabrication, computer numerical control (CNC) machining and automated threading processes are standard, ensuring that all fittings meet exact dimensional tolerances necessary for leak-proof connections. Specialized pressure testing equipment, often integrated with smart sensors and data logging capabilities, verifies the structural integrity of the fittings before galvanization, minimizing waste. A growing technology trend is the adoption of duplex systems, combining galvanization with a subsequent powder coating or painting layer. This advanced technology offers enhanced protection in highly corrosive environments (e.g., coastal infrastructure), extending the lifespan of the fittings significantly beyond traditional single-layer galvanized products and opening new application avenues.

Digitalization also plays a pivotal role, with manufacturers utilizing 3D modeling and finite element analysis (FEA) software to simulate stress distribution and optimize the design of complex fittings (like crosses or reducers) for specific pressure and temperature requirements prior to production. Moreover, traceability technologies, such as laser etching of QR codes or unique serial numbers, are being implemented directly onto the fittings. This enables end-users and regulators to instantly access material provenance, date of manufacture, and quality certification data, bolstering product confidence and meeting strict regulatory demands for construction and oil and gas projects globally. This shift toward smart, traceable manufacturing is a core element of modernizing the pipe fitting industry.

Regional Highlights

- North America (USA, Canada): This region exhibits a mature market characterized by stringent safety standards (especially for fire protection and natural gas lines) and a strong focus on infrastructure replacement. Demand is stable, driven by the need to upgrade aging water distribution systems and sustained commercial construction activity. The USA's adherence to "Buy American" provisions sometimes influences material sourcing, promoting domestic manufacturing excellence and highly certified products.

- Europe (Germany, UK, France): European demand is heavily influenced by strict environmental regulations regarding material sourcing and manufacturing waste. The market is defined by a consistent need for replacement fittings in historical and industrial infrastructure, alongside strong growth in renewable energy projects requiring specialized piping solutions. Western European countries prioritize fittings with verifiable sustainability credentials and high energy efficiency ratings, pushing manufacturers towards cleaner production technologies.

- Asia Pacific (China, India, Japan): APAC is the fastest-growing market, primarily fueled by massive government investments in new infrastructure, rapid urbanization, and expansion of industrial corridors. China and India are major consumers due to large-scale residential housing projects and the build-out of new municipal water and sewage networks. The sheer volume of construction activities makes this region the largest demand center, although price sensitivity remains a significant factor influencing procurement decisions.

- Latin America (Brazil, Mexico, Argentina): Market growth in Latin America is moderate but increasing, strongly tied to national economic stability and investments in oil and gas infrastructure and mining operations. Brazil and Mexico lead regional demand, driven by expansion in their petrochemical sectors and necessary improvements to existing, often underdeveloped, municipal water systems. Economic variability often leads to cyclical demand patterns, but the long-term outlook remains positive due to necessary infrastructure gaps.

- Middle East and Africa (MEA): This region is characterized by high-value projects, particularly in the GCC states (Saudi Arabia, UAE) focused on ambitious urban development, desalination plants, and extensive oil and gas exploration. Demand for robust, anti-corrosive galvanized fittings is exceptionally high due to the harsh desert environment and high salinity, necessitating premium, heavy-duty products that guarantee operational integrity under extreme stress. African markets, while nascent, show rising potential linked to localized infrastructure development and utility expansion projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Galvanized Pipe Fitting Market.- GF Piping Systems

- Mueller Water Products

- McWane Inc.

- Anvil International (Tyco)

- NIBCO Inc.

- Zurn Industries LLC

- Advanced Drainage Systems (ADS)

- Charlotte Pipe and Foundry

- JM Eagle

- Uponor Corporation

- Polypipe Group PLC

- Pipelife (Wienerberger AG)

- Wavin (Orbia Group)

- Victaulic Company

- Aliaxis Group S.A.

- Precision Castparts Corp.

- Swagelok Company

- Parker Hannifin Corporation

- Grinnell Mechanical Products

- TATA Steel Ltd.

Frequently Asked Questions

Analyze common user questions about the Galvanized Pipe Fitting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Galvanized Pipe Fitting Market?

The primary factor driving market growth is the global imperative for infrastructure modernization, particularly the replacement and expansion of aging municipal water supply and wastewater treatment systems in both developed and rapidly urbanizing nations, coupled with stringent anti-corrosion requirements in construction.

How do galvanized pipe fittings compare in cost and lifespan to alternatives like PVC or stainless steel?

Galvanized steel fittings typically offer superior longevity and structural strength compared to PVC, especially in high-pressure or high-temperature industrial applications, though they are generally priced lower than stainless steel. Their cost-effectiveness over a multi-decade lifecycle, minimizing replacement needs, is a key selling point.

Which geographical region holds the largest market share for galvanized pipe fittings and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to extensive government-led infrastructure investment, rapid urban development, and massive ongoing residential and commercial construction projects, particularly in countries such as China and India, generating high-volume demand.

What is the impact of commodity price volatility (steel and zinc) on market profitability?

The volatility in the prices of raw materials, specifically steel and zinc, significantly impacts the profitability of manufacturers. Fluctuating commodity costs often lead to necessary price adjustments for finished fittings, posing challenges for long-term project budgeting and potentially shifting demand toward substitutes if pricing remains unstable.

What role does advanced technology, such as AI, play in the manufacturing of galvanized fittings?

Advanced technologies like Artificial Intelligence (AI) are primarily used for enhancing quality control, implementing automated non-destructive inspection systems to verify coating uniformity, and optimizing the hot-dip galvanizing process parameters for reduced waste and improved material efficiency in smart manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager