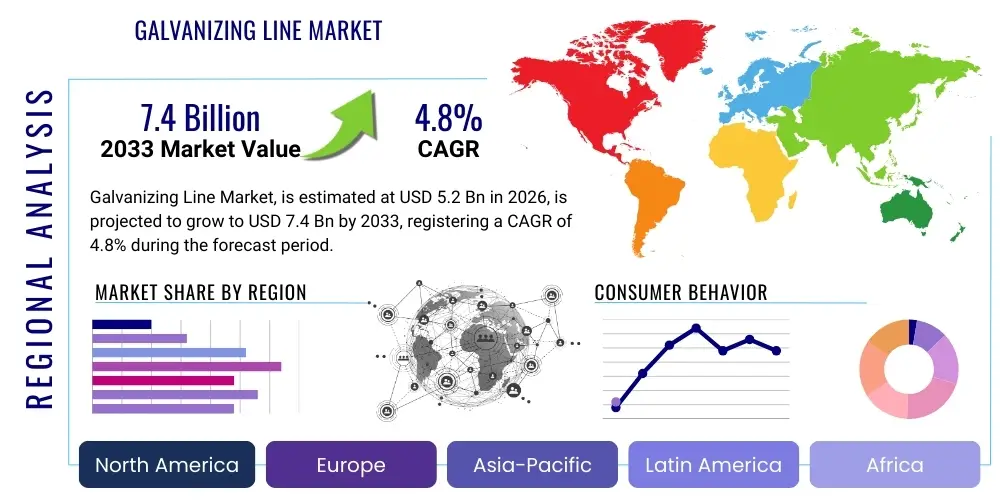

Galvanizing Line Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438881 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Galvanizing Line Market Size

The Galvanizing Line Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Galvanizing Line Market introduction

The Galvanizing Line Market encompasses the industrial machinery and systems used for applying protective zinc coatings to ferrous materials, primarily steel sheets, strips, wires, and tubes, to prevent corrosion and extend material lifespan. These specialized processing lines, particularly Continuous Hot-Dip Galvanizing Lines (CHDGLs) and Electro-Galvanizing Lines (EGLs), are integral to high-volume manufacturing across crucial sectors. The core product involves complex systems featuring cleaning sections, annealing furnaces, zinc pots, air knife systems for coating thickness control, and post-treatment sections. Galvanizing lines are essential for producing corrosion-resistant materials demanded by the automotive, construction, and infrastructure industries.

Major applications of galvanized products include automotive body panels, structural components for commercial and residential buildings, HVAC systems, agricultural machinery, and various forms of transportation infrastructure such as guardrails and bridges. The primary benefit derived from these lines is the superior corrosion resistance imparted by the zinc layer, which acts as a physical barrier and offers cathodic protection to the underlying steel. This extended durability translates directly into reduced maintenance costs and enhanced safety standards across end-use applications, solidifying the market's fundamental importance in modern industrial manufacturing.

Driving factors for market growth are intrinsically linked to global industrialization and rapid urbanization, particularly across emerging economies in Asia Pacific. Increased government spending on large-scale infrastructure projects, stringent regulatory standards requiring enhanced material durability (especially in high-salinity or harsh environments), and the continuous innovation within the automotive sector, focusing on lightweight and durable steel alloys, collectively propel the demand for high-capacity, efficient galvanizing lines. Technological advancements in line speed and coating uniformity further stimulate investment in modernizing existing production facilities.

Galvanizing Line Market Executive Summary

The Galvanizing Line Market is currently characterized by intense technological evolution focusing on energy efficiency and automated quality control, driving significant business trends toward turnkey solutions and integrated maintenance contracts offered by major equipment manufacturers. Key business trends include the shift towards sophisticated processing lines capable of handling advanced high-strength steels (AHSS), crucial for the automotive industry's pursuit of crash safety and lightweighting. Manufacturers are increasingly integrating IoT and digital twin technologies into new line constructions to offer predictive maintenance capabilities and optimize operational throughput. Furthermore, sustainability is a rising trend, compelling line operators to adopt low-emission heating technologies and efficient zinc management systems to comply with tightening environmental mandates, influencing capital expenditure decisions across established and emerging industrial geographies.

Regionally, the Asia Pacific (APAC) stands as the dominant force, driven overwhelmingly by the sheer scale of infrastructural development and housing construction across nations such as China, India, and Southeast Asian economies. These regions necessitate vast quantities of galvanized steel for long-term urban projects and industrial expansion, fueling consistent demand for both new installations and capacity expansions. Europe and North America, while mature markets, focus heavily on modernization and replacement cycles, emphasizing the integration of high-speed lines capable of superior coating performance, catering primarily to high-specification automotive and specialized construction sectors where material quality and traceability are paramount regulatory requirements.

Segment trends indicate that the Continuous Hot-Dip Galvanizing Line (CHDGL) segment maintains market supremacy due to its cost-effectiveness, high throughput, and versatility in handling various strip widths and thicknesses suitable for construction and general industry applications. Conversely, the Electro-Galvanizing segment, though smaller in volume, is experiencing robust growth fueled by demand from premium automotive manufacturers requiring ultra-precise, thinner zinc coatings for demanding aesthetic and structural applications where dimensional accuracy is critical. Moreover, there is a distinct trend toward automated lines equipped with advanced sensing technologies (e.g., optical inspection systems) that minimize human error and ensure adherence to increasingly strict international coating standards (e.g., ASTM and EN norms).

AI Impact Analysis on Galvanizing Line Market

Common user questions regarding AI's impact on the Galvanizing Line Market frequently revolve around optimizing line throughput, enhancing coating quality predictability, and reducing energy consumption during the annealing and zinc pot operations. Users are keen to understand how AI-driven predictive maintenance can minimize costly unplanned downtime, a critical concern given the high CapEx and continuous nature of these operations. Furthermore, there is strong interest in using machine learning algorithms to fine-tune complex variables—such as air knife pressure, strip speed, and bath temperature—to achieve perfect coating uniformity consistently, thereby reducing scrap rates. Concerns often center on the initial investment required for sensor infrastructure and data processing capabilities, along with the need for specialized personnel to manage these complex AI systems and ensure data integrity within harsh industrial environments. Users expect AI to fundamentally transform quality control from reactive inspection to proactive process adjustment.

- AI-driven Predictive Maintenance: Anticipates equipment failure (e.g., furnaces, rolls, air knives) by analyzing vibration and temperature data, minimizing unplanned shutdowns.

- Optimized Coating Weight Control: Machine learning models analyze strip speed and bath chemistry in real-time to precisely adjust air knife settings, ensuring uniform zinc layer thickness (AEO optimization).

- Energy Consumption Reduction: AI algorithms manage furnace temperature profiles and preheating cycles based on production schedules and steel grade, significantly lowering gas and electricity usage.

- Automated Defect Detection: Computer vision systems powered by AI analyze high-speed video feeds to instantaneously identify surface defects (e.g., bare spots, non-uniform spangle), improving overall product quality assurance.

- Process Parameter Optimization: Utilizing deep learning to identify the optimal combination of line tension, annealing conditions, and cooling rates for specific high-strength steel grades.

- Digital Twin Implementation: Creation of virtual models for real-time simulation and testing of process changes before implementation on the physical line, reducing commissioning time.

DRO & Impact Forces Of Galvanizing Line Market

The market is fundamentally driven by robust global infrastructure spending and the non-negotiable requirement for corrosion protection in construction and automotive industries, establishing a high baseline demand for galvanized products. Restraints primarily involve the substantial capital investment required for constructing or upgrading continuous galvanizing lines, creating high barriers to entry, alongside the volatility in raw material pricing, particularly zinc, which directly impacts operational costs and market profitability. Opportunities are abundant in the growing demand for specialized advanced high-strength steel (AHSS) galvanizing capabilities, especially in emerging Asian and Latin American automotive markets, alongside technological advancements focused on energy recuperation and waste minimization. The overall impact forces dictate a moderate to high growth trajectory, propelled by necessity and technological innovation, yet constrained by significant financial and regulatory hurdles associated with heavy industry manufacturing.

Drivers include the accelerating pace of global urbanization, which mandates high volumes of structural and durable steel in urban centers, and strict mandates from automotive original equipment manufacturers (OEMs) demanding galvanized AHSS for lighter, safer vehicles. The long operational lifespan and high depreciation rates associated with galvanizing line equipment also necessitate consistent upgrades and capacity expansion, driving continued investment in new systems. Restraints are further compounded by stringent environmental regulations regarding emissions from annealing furnaces and wastewater treatment for cleaning sections, often necessitating costly compliance upgrades. Furthermore, the specialized skillset required for operating and maintaining these complex lines poses a continuous challenge in labor acquisition.

Key opportunities revolve around the development of next-generation galvanizing technologies, such as advanced fluxing agents and specialized post-treatment passivation techniques, which cater to niche applications requiring unique surface properties or colors. The ongoing trend of Industry 4.0 integration—incorporating highly automated, closed-loop process controls—offers manufacturers a significant pathway to operational efficiency and competitive advantage. Overall, the market remains highly strategic, where investment is justified by the guaranteed longevity and superior performance galvanized steel offers over unprotected alternatives, ensuring that demand growth, while cyclical with economic conditions, remains structurally sound over the long term, pushing manufacturers towards high-efficiency, environmentally compliant systems.

Segmentation Analysis

The Galvanizing Line Market segmentation is primarily defined by the type of process utilized, the material format being processed, the speed and capacity of the line, and the end-user application demanding the galvanized product. Process segmentation differentiates between continuous hot-dip galvanizing (CHDGL), which accounts for the largest market share due to its versatility and high throughput for construction materials, and electro-galvanizing (EGL), which is favored for precise, thin coatings crucial for high-end automotive applications. Further differentiation occurs based on the type of steel processed, such as cold-rolled steel versus hot-rolled steel, each requiring distinct cleaning and annealing protocols. Understanding these segments is vital for equipment manufacturers to tailor system specifications, from furnace size to air knife configuration, meeting the diverse demands of global industrial clientele.

- By Process Type:

- Continuous Hot-Dip Galvanizing Lines (CHDGL)

- Electro-Galvanizing Lines (EGL)

- Batch Hot-Dip Galvanizing Lines (BHDGL)

- Continuous Annealing and Processing Lines (CAPL) with galvanizing capabilities

- By Product Type:

- Strip and Sheet Galvanizing Lines

- Wire Galvanizing Lines

- Tube and Pipe Galvanizing Lines

- Structural Component Galvanizing Facilities

- By Application:

- Automotive (Body in White, Structural Components)

- Construction and Infrastructure (Roofing, Siding, Guardrails, Structural Steel)

- General Manufacturing and Consumer Goods

- HVAC and Appliances

- By Coating Type:

- Pure Zinc (GI)

- Zinc-Aluminum (Galvalume / Galfan)

- Zinc-Magnesium Alloys

Value Chain Analysis For Galvanizing Line Market

The value chain for the Galvanizing Line Market begins significantly upstream with the suppliers of primary raw materials, specifically high-quality steel feedstock (coils) and zinc ingots, alongside essential consumables like fluxing chemicals and heating gases. Volatility in the global steel and zinc commodity markets critically influences the procurement costs for the end-product manufacturers operating these lines. Midstream activities involve the specialized engineering, manufacturing, and installation of the galvanizing line equipment itself, dominated by a few global technology providers who design and deliver complex, integrated systems (e.g., annealing furnaces, chemical treatment sections, and precision coating machinery). These companies are responsible for integrating advanced technologies like thermal modeling and sophisticated control systems, representing the highest value-add stage.

Downstream, the immediate customers are large-scale steel producers and specialized coil coating centers who utilize the installed lines to produce galvanized steel products (coils, sheets, wire). The output from these lines is then channeled through various distribution networks, which include direct sales channels to major end-users like automotive OEMs and large construction firms, as well as indirect distribution via service centers and metal distributors who process and cut the galvanized material to specific client requirements. The effectiveness of the distribution channel hinges on logistics efficiency, inventory management, and the ability to provide value-added services such as slitting and packaging customized for different industrial standards.

The direct channel, typically involving sales of specialized galvanized steel grades (e.g., for high-end automotive use) directly from the producer to the OEM, emphasizes high quality, consistent supply, and strong technical partnership. The indirect channel serves the broader construction and general manufacturing sectors, prioritizing cost-effectiveness, rapid availability, and a wide variety of product specifications. The sustained success of the value chain is increasingly reliant on vertical integration and strong partnerships between equipment manufacturers and steel producers to ensure that line technology continually evolves to meet the increasingly strict quality and environmental standards demanded by the ultimate end-users in major global industries.

Galvanizing Line Market Potential Customers

The primary customers and end-users of galvanized products, and consequently the investors in galvanizing line technology, are large integrated steel manufacturers and specialized coil coating companies globally. These entities require high-capacity, continuous lines to meet bulk demand for corrosion-resistant steel. Integrated steel mills invest in these lines to add a high-value coating process to their primary steel production stream, offering a complete product portfolio from raw slab to finished galvanized coil. Coil coating centers, often operating independently, specialize purely in applying coatings and rely on the efficiency and precision of the line to differentiate their offering in competitive markets.

Further down the value chain, the ultimate buyers whose consumption drives the necessity for these manufacturing lines fall predominantly into two major categories: the global automotive industry and the construction and infrastructure sector. Automotive OEMs require galvanized steel for Body-in-White applications, emphasizing precise coating uniformity and compatibility with welding and painting processes. This segment demands lines capable of handling sophisticated, thin-gauge AHSS alloys. The construction sector, conversely, demands high volumes of heavily coated steel for long-term structural integrity in framing, roofing, and general outdoor applications, necessitating high-speed, robust continuous hot-dip lines.

Secondary but significant potential customers include manufacturers of HVAC systems, consumer appliances (like washing machine casings and refrigerators), and various general fabrication companies involved in producing electrical conduits, agricultural equipment, and specialized industrial components. These users prioritize durability and cost efficiency. The demand from these diverse end-users necessitates that equipment providers offer customizable galvanizing line solutions, ranging from high-capacity continuous lines for major steel producers to smaller, more flexible batch lines catering to specialized component galvanizers serving regional markets or specific niche industrial requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMS Group, Danieli, Fives Group, Primetals Technologies, CMI Industry, ISIK, Nippon Steel Engineering, Posco E&C, ANDRITZ Metals, TENOVA, AMECO, JFE Engineering, ArcelorMittal, BlueScope Steel, Voestalpine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Galvanizing Line Market Key Technology Landscape

The key technological landscape within the Galvanizing Line Market is centered on achieving higher production speeds, superior coating adhesion, and optimal energy efficiency. A pivotal technology is the development of advanced non-oxidizing furnaces (NOF) and radiant tube furnaces (RTF), crucial for the thermal treatment (annealing) of advanced high-strength steels (AHSS) prior to galvanizing. These furnaces must precisely control temperature profiles and atmosphere composition (e.g., hydrogen-nitrogen mixtures) to prepare the strip surface optimally for zinc adhesion without compromising the steel's metallurgical properties, a technical challenge critical for lightweight automotive applications. Furthermore, the integration of high-speed air knife technology, utilizing precision nozzles and pressure regulation systems, is essential for accurately controlling the zinc coating weight at operational speeds exceeding 200 meters per minute, directly impacting product quality and resource usage.

Another significant area of technological advancement involves the development of specialized zinc bath compositions, moving beyond pure zinc (GI) to include metallic alloys such as Zinc-Aluminum (Galvalume or Galfan) and Zinc-Magnesium (Zn-Mg). These advanced coatings offer superior corrosion resistance and enhanced formability, meeting the increased durability requirements of the construction sector and the complex forming demands of automotive manufacturing. Equipment manufacturers are continuously innovating the geometry and materials used in the ceramic or induction heating zinc pots and associated submerged hardware (rolls, bearings) to handle these reactive alloys effectively, maximizing bath life and reducing maintenance downtime associated with dross formation.

In terms of process control and digitalization, the deployment of sophisticated automation systems (Level 2 and Level 3 automation) is transforming operational efficiency. This includes closed-loop control systems utilizing sophisticated sensors for continuous monitoring of strip temperature, zinc bath chemistry, and air knife pressure. Furthermore, the rising integration of machine learning and Artificial Intelligence (AI) for predictive defect detection and overall process optimization represents the cutting edge. These digital technologies allow operators to move toward autonomous control, ensuring quality consistency, minimizing energy waste in the extensive heating sections, and maximizing overall equipment effectiveness (OEE) across complex, high-speed continuous lines, making the technology landscape increasingly characterized by intelligent manufacturing solutions.

Regional Highlights

- Asia Pacific (APAC): APAC represents the undisputed largest market for galvanizing lines, fueled by massive ongoing and planned investments in infrastructure, residential, and commercial construction, particularly in China, India, and Southeast Asia (e.g., Vietnam, Indonesia). The region's automotive production expansion further stimulates demand for both new continuous hot-dip galvanizing lines and capacity upgrades. The market here is characterized by the requirement for both high-volume, standard galvanized products and increasingly specialized AHSS-compatible lines to serve the rapidly modernizing domestic automotive supply chains.

- North America: This region is a mature market focused less on new capacity addition and more on modernization and technological replacement. Strict safety and material durability standards in the U.S. and Canada drive demand for high-specification galvanized steel, especially Zn-Al and Zn-Mg coated products. Investment is concentrated on automating existing lines, integrating advanced AI-driven quality control, and ensuring lines are capable of processing the latest generation of ultra-high-strength steels used by domestic automotive giants.

- Europe: The European market is highly regulated, placing intense pressure on manufacturers regarding environmental compliance (e.g., EU Green Deal mandates) and energy consumption. Demand is stable, driven by the strong premium automotive sector and sophisticated construction standards. Key market activities include retrofitting existing galvanizing lines with advanced energy recuperation systems (e.g., waste heat recovery from furnaces) and adopting closed-loop systems to minimize chemical waste and emissions, emphasizing sustainability alongside product quality.

- Latin America: This region, while smaller, offers significant growth potential, driven by infrastructure bottlenecks and cyclical recovery in the construction and mining sectors, particularly in Brazil and Mexico. Investment tends to be strategic, often targeting the establishment of domestic production capabilities to reduce reliance on imports, leading to planned acquisitions of medium-capacity, flexible galvanizing lines capable of serving multiple industrial applications efficiently.

- Middle East and Africa (MEA): Growth in MEA is highly localized, dominated by mega infrastructure projects and the necessity for durable, anti-corrosive materials due to harsh environmental conditions (high heat, humidity, and salinity). The Gulf Cooperation Council (GCC) countries drive demand for construction-grade galvanized steel. The market is primarily served by imported galvanized products, but local capacity addition is increasing, focused on establishing modern, low-operational-cost lines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Galvanizing Line Market.- SMS Group

- Danieli

- Fives Group (formerly CMI Industry)

- Primetals Technologies

- ANDRITZ Metals

- TENOVA

- Ishikawajima-Harima Heavy Industries (IHI)

- Nippon Steel Engineering

- POSCO Engineering & Construction

- Amecon (Amecco)

- JFE Engineering Corporation

- Voestalpine Group

- ArcelorMittal

- BlueScope Steel

- Messer Group

- Air Liquide

- Daehwa E&C

- Zhiye Mechanical & Electrical Technology

- Wuxi Taihu Special Equipment

- BaoSteel Engineering & Technology

Frequently Asked Questions

Analyze common user questions about the Galvanizing Line market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Continuous Hot-Dip Galvanizing Lines (CHDGL) globally?

The primary driver is the accelerating global investment in civil infrastructure and commercial construction, particularly in the Asia Pacific region. CHDGLs offer the high throughput and cost-efficiency required to produce the vast volumes of corrosion-resistant steel necessary for long-term structural applications and roofing materials.

How does the shift towards Advanced High-Strength Steels (AHSS) impact the design of modern galvanizing lines?

AHSS requires significantly more complex and precise thermal processing. Modern lines must incorporate advanced non-oxidizing furnaces (NOF) and rapid cooling technologies to ensure the steel achieves optimal surface chemistry for zinc adhesion without compromising the superior strength properties developed during rolling, demanding stricter atmosphere control and faster process speeds.

What role does Artificial Intelligence play in optimizing galvanizing line operations?

AI is crucial for enhancing operational efficiency through predictive maintenance, minimizing costly unplanned downtime. Furthermore, machine learning models optimize key variables like air knife settings and strip tension in real-time, drastically improving coating weight uniformity and thickness precision while reducing energy consumption in the annealing section.

Which regions are leading in the procurement of new galvanizing line installations?

Asia Pacific, especially China, India, and rapidly industrializing Southeast Asian nations, leads in new line installations. This is directly correlated with massive regional urbanization, domestic manufacturing expansion, and governmental initiatives focusing on modernizing outdated industrial capacity to meet international product standards.

What are the main technological challenges related to advanced zinc alloy coatings like Zn-Mg?

The primary challenges include managing the higher reactivity of zinc-magnesium alloys, which demands specialized high-performance refractory materials and submerged rolls within the zinc pot to resist corrosion and dross formation. Maintaining the precise chemical composition of the molten bath and ensuring optimal coating adhesion at high speeds are persistent technical hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager