Galvanometer Scanner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432713 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Galvanometer Scanner Market Size

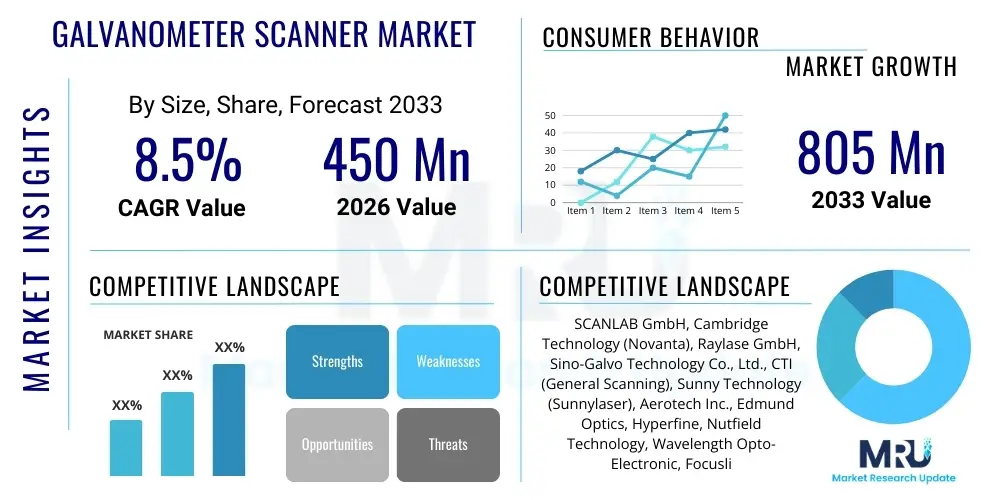

The Galvanometer Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing adoption of high-precision laser systems across advanced manufacturing processes, particularly in the automotive, semiconductor, and medical device sectors. The growing demand for rapid, accurate, and scalable laser processing solutions, such as laser marking, welding, and additive manufacturing, significantly contributes to the market’s upward trajectory.

Galvanometer Scanner Market introduction

The Galvanometer Scanner Market encompasses high-speed, high-precision laser beam steering and positioning systems crucial for modern material processing and imaging applications. These systems utilize mirrored rotors driven by electromagnetic coils (galvanometers) to rapidly redirect a laser beam across a target surface with micro-radian accuracy and repeatability. Galvanometer scanners are fundamental components in two-dimensional (2D) and three-dimensional (3D) laser systems, offering superior speed and precision compared to traditional mechanical stages, thereby enhancing throughput and quality in critical industrial operations.

Major applications of galvanometer scanners span a wide spectrum, ranging from intricate industrial uses such as micro-machining, semiconductor wafer inspection, and complex laser welding in electric vehicle (EV) battery manufacturing, to advanced medical procedures like ophthalmology (LASIK), medical imaging (OCT), and aesthetic dermatology. The primary benefits derived from integrating galvanometric scanning technology include enhanced production speed, minimal thermal distortion, superior pattern flexibility, and reliable long-term operational stability. Furthermore, the ability to execute complex vector and raster patterns with extremely high dynamic response makes them indispensable in environments requiring fast switching and high resolution.

Key driving factors accelerating the market include the global push toward Industry 4.0 and smart factories, which necessitates automated, highly efficient processing tools. The proliferation of fiber laser technology and ultrafast pulsed lasers (pico- and femtosecond) requires sophisticated beam steering mechanisms capable of handling high peak power densities and maintaining spatial resolution across large fields of view. Additionally, significant investments in the development of next-generation display technologies (OLED/Micro-LED) and semiconductor fabrication processes are creating substantial opportunities for advanced, specialized galvanometer scanning solutions designed for micron-level precision.

Galvanometer Scanner Market Executive Summary

The Galvanometer Scanner Market is characterized by intense technological competition and strategic growth driven by global industrial digitalization and the rising requirement for sub-micron precision in manufacturing. Business trends indicate a strong move toward system integration, where manufacturers offer complete optical solutions rather than just components, focusing heavily on proprietary servo control algorithms and advanced thermal management to maximize scanning speed and long-term stability. Furthermore, there is a distinct market shift towards 3D scanning systems, utilizing dynamic focus elements and advanced software correction for processing non-planar surfaces, catering directly to complex additive manufacturing and large-format material processing applications. Successful companies are those investing heavily in developing high-performance digital servo drivers that can minimize lag and optimize the tracking accuracy of the mirrors, crucial for high-speed laser processing.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption volume, primarily due to the massive presence of electronics manufacturing, automotive production, and consumer goods assembly lines in countries like China, Japan, and South Korea, which heavily rely on laser marking and cutting technologies. North America and Europe, while smaller in volume, lead in value-driven segments, characterized by stringent quality requirements in aerospace, defense, and high-end medical device manufacturing. These regions are primary centers for research and development (R&D) focused on ultra-fast laser processing and advanced ophthalmological applications, driving demand for the most technologically advanced and customized scanning systems.

Segment trends reveal that the 2-Axis segment remains foundational, widely used for standard 2D laser marking and engraving; however, the 3-Axis segment is experiencing the fastest growth, propelled by the surge in 3D printing and complex surface welding applications, particularly in the e-mobility sector. In terms of application, the industrial sector maintains the largest market share, driven by demand from automotive component traceability and semiconductor packaging. Nonetheless, the medical and aesthetic applications segment is projected to exhibit the highest CAGR, supported by advancements in minimally invasive surgeries and high-resolution diagnostic imaging techniques that require extremely precise beam placement and synchronization.

AI Impact Analysis on Galvanometer Scanner Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Galvanometer Scanner Market typically center on how AI enhances processing speed, improves defect detection, and enables adaptive laser control in real-time. Users frequently ask if AI-driven optimization reduces manual setup time and increases the lifespan of scanner components through predictive maintenance. A major theme is the potential for AI algorithms to dynamically adjust scan parameters (such as speed, power, and focus) based on immediate feedback from in-situ quality monitoring systems, moving beyond pre-programmed paths to truly adaptive processing. Users are highly interested in the capability of machine learning models to analyze complex material reactions during processing, ensuring optimal energy delivery and preventing material damage, especially in micro-processing and sensitive semiconductor applications.

The integration of AI, particularly through machine vision and deep learning models, is revolutionizing the efficiency and repeatability of galvanometric systems. AI enables real-time calibration and drift compensation, automatically adjusting for thermal variations or mechanical wear, thereby sustaining micron-level accuracy over extended operational periods. This capability is paramount in high-volume manufacturing environments where any deviation in laser placement translates into significant waste. Moreover, AI facilitates complex path planning in 3D scanning, where algorithms calculate the most efficient scan vectors and focus adjustments for highly intricate geometries, significantly reducing processing cycle times that were previously limited by human calculation or simplistic software heuristics.

Ultimately, AI is transforming galvanometer scanners from deterministic motion control devices into intelligent, adaptive laser tooling platforms. This transition involves AI driving superior quality control by integrating non-destructive testing results directly into the scanning process loop. For instance, in laser welding of battery cells, AI models analyze spectroscopic data captured during the scan, instantly adjusting scan speed or power to ensure weld homogeneity and integrity, a capability far exceeding traditional proportional–integral–derivative (PID) controllers. This trend is pushing scanner manufacturers to develop open architectures and software development kits (SDKs) compatible with modern machine learning frameworks, embedding intelligence closer to the beam steering mechanism.

- AI-driven real-time thermal drift compensation, enhancing long-term positional accuracy.

- Predictive maintenance algorithms using operational data to forecast scanner failure and optimize maintenance schedules.

- Machine Vision integration for instant defect detection and adaptive scan parameter adjustment (Vision-Guided Laser Processing).

- Optimization of complex 3D scanning paths and dynamic focus adjustments using deep reinforcement learning.

- Automated quality assurance and process control, reducing human intervention in critical laser micro-machining.

- Enhanced processing flexibility allowing rapid reconfiguration for various material types and geometries without manual recalibration.

- Improved energy efficiency by ensuring optimal laser power delivery based on real-time material feedback.

DRO & Impact Forces Of Galvanometer Scanner Market

The Galvanometer Scanner Market dynamics are defined by powerful growth drivers stemming from industrial automation and technological advancements, counterbalanced by significant restraints related to cost and complexity, yet underpinned by substantial future opportunities. The primary driver is the pervasive adoption of laser technology in key high-growth industries, such as the electric vehicle (EV) sector for battery welding and component marking, and the semiconductor industry for advanced lithography and packaging. These applications require the high speed, repeatability, and precision inherent to galvanometer systems. However, the high initial investment cost associated with advanced digital galvanometer systems, coupled with the need for specialized expertise for system integration and maintenance, poses a considerable restraint, particularly for small and medium-sized enterprises (SMEs) looking to automate their processes. Nevertheless, the burgeoning fields of 3D printing (Selective Laser Sintering/Melting) and specialized medical procedures, such as retinal surgery and advanced diagnostics, represent crucial opportunities for market expansion, driving demand for specialized, high-bandwidth scanning solutions.

The key drivers propelling market growth include the relentless miniaturization trend in electronics, necessitating micro-processing capabilities that only high-speed, accurate galvanometer systems can deliver, particularly in flex circuit manufacturing and display repair. Furthermore, regulatory requirements for traceability and serialization in industries like pharmaceuticals and food and beverage mandate permanent, high-contrast laser marking, boosting the demand for reliable 2-Axis scanners. A secondary, but highly influential, impact force is the competition from alternative beam steering technologies, such as advanced MEMS mirrors and spatial light modulators (SLMs). While these alternatives offer higher frequencies or greater pixel density, galvanometer scanners maintain dominance in applications requiring high optical power handling and large deflection angles, creating a strategic barrier to entry for competing technologies in heavy industrial applications.

The overall impact force of these factors is decisively positive, pushing the market towards higher performance specifications, especially concerning dynamic response and thermal stability. Opportunities in advanced laser techniques, such as laser-induced forward transfer (LIFT) and sophisticated ophthalmology equipment requiring sub-millisecond beam control, compel manufacturers to innovate in mirror design (e.g., lightweight ceramics) and servo control electronics. The industry is also seeing an opportunity in retrofit and modernization projects, where older, analog galvanometers are replaced with newer digital models offering faster settling times and superior linearity, ensuring sustained market relevance through performance upgrade cycles. These dynamics confirm a long-term shift toward precision-intensive applications where performance justifies the higher cost.

Segmentation Analysis

The Galvanometer Scanner Market is comprehensively segmented based on the configuration of the scanning system, the core application requiring beam manipulation, and the geographic region driving demand. Understanding these segments is crucial for strategic planning, as distinct product types cater to specialized performance requirements. The market is primarily divided by the number of axes, differentiating between standard 2-Axis systems essential for planar marking and highly complex 3-Axis systems used for volume processing and dynamic focus correction. Further segmentation based on technology, separating analog from advanced digital control systems, reflects varying demands for precision and ease of integration. The application segmentation clearly delineates high-volume industrial uses from high-precision medical and research applications, each requiring vastly different specifications in terms of mirror size, resonant frequency, and aperture.

The segmentation by Type, specifically focusing on the axis configuration, reveals that 2-Axis scanners hold a larger volume share due to their widespread use in standard laser marking, welding, and cutting tasks across diverse industries. However, 3-Axis systems, which incorporate a third axis for dynamic focus adjustment along the Z-axis, are rapidly gaining prominence. This growth is directly linked to the increased market penetration of 3D printing, advanced selective laser melting (SLM) for complex geometries, and laser texture creation on contoured parts, necessitating precise focus control across large working volumes. Manufacturers are increasingly prioritizing the development of compact and thermally stable 3D scanning heads to meet this escalating industrial requirement.

Application-based segmentation highlights the dual nature of the market. The Industrial segment, which includes automotive, semiconductor, and electronics sectors, demands systems optimized for high throughput and harsh operating environments, prioritizing durability and mean time between failures (MTBF). Conversely, the Medical & Aesthetic segment requires extreme precision, superior beam quality preservation (low wavefront error), and tight regulatory compliance, focusing on specialized coatings and miniaturized scanning heads suitable for integration into sophisticated diagnostic and surgical instruments. The continuous technological overlap between micro-machining and medical procedures is blurring traditional application lines, fostering innovation in ultra-precise, small-aperture scanning systems.

- By Axis Type:

- 2-Axis Galvanometer Scanners (X-Y Plane)

- 3-Axis Galvanometer Scanners (X-Y-Z Dynamic Focus)

- By Technology:

- Analog Galvanometer Systems

- Digital Galvanometer Systems (DSP controlled)

- By Aperture Size:

- Small Aperture (<= 10 mm)

- Medium Aperture (10 mm - 30 mm)

- Large Aperture (> 30 mm)

- By Application:

- Industrial Manufacturing (Laser Marking, Welding, Cutting, Drilling)

- Medical & Aesthetic (Ophthalmology, Dermatology, Diagnostic Imaging)

- Research & Defense

- Semiconductor & Electronics (Repair, Lithography, Wafer Processing)

- Additive Manufacturing (3D Printing - SLM/SLS)

- By End-User Industry:

- Automotive & Aerospace

- Electronics & Display

- Healthcare & Pharma

- Textile & Packaging

Value Chain Analysis For Galvanometer Scanner Market

The value chain for the Galvanometer Scanner Market begins with upstream suppliers providing critical raw materials and specialized components. This stage involves manufacturers of high-performance magnets (neodymium-iron-boron), specialized low-inertia mirror substrates (silicon carbide, beryllium, fused silica), and precision coil windings. The quality and purity of these materials directly impact the scanner’s dynamic response, thermal stability, and overall optical performance. Success in this upstream segment hinges on material science innovation and stringent quality control, as failures here cascade into system performance issues for the final product. Strong partnerships with specialized material suppliers are vital for maintaining a competitive edge, particularly when developing scanners for high-power, ultra-fast laser applications.

The midstream focuses on the core manufacturing and integration process, where specialized companies assemble the electromagnetic motors, integrate highly sensitive positional feedback sensors (e.g., capacitive or optical), and develop the complex servo drivers and control boards. This manufacturing step is highly proprietary, relying heavily on sophisticated calibration techniques and algorithms to linearize the angular response and minimize cross-axis coupling. Downstream activities involve system integrators, Original Equipment Manufacturers (OEMs), and specialized distributors. System integrators customize the scanners by adding focusing optics, F-theta lenses, and sophisticated control software to create turn-key laser processing workstations. OEMs embed these scanning heads directly into larger machinery, such as 3D printing systems or advanced medical diagnostic platforms, leveraging their technical compatibility and operational reliability.

Distribution channels are bifurcated into direct sales to major OEMs and specialized indirect distribution through technical sales representatives and value-added resellers (VARs). Direct sales are predominant for high-volume or highly customized orders, ensuring deep technical support and collaboration during the design phase. Indirect channels are crucial for reaching a diverse base of smaller end-users and research institutions globally, relying on distributors who possess localized expertise in laser safety, application-specific optimization, and rapid technical service. The overall profitability within the value chain is increasingly shifting towards the control software and system integration stages, as advanced digital scanning solutions require sophisticated programming and seamless integration into the factory network (Industry 4.0 platforms) to unlock their full potential.

Galvanometer Scanner Market Potential Customers

Potential customers, or end-users, of galvanometer scanners are highly diversified across industries prioritizing precision, speed, and automation in material processing or imaging. The largest segment of buyers consists of Original Equipment Manufacturers (OEMs) specializing in laser material processing systems. These customers purchase scanning subsystems in bulk to integrate into their final products, such as industrial laser marking stations, sophisticated high-speed cutting machines used in electronics manufacturing, and advanced welding robots utilized in automotive assembly lines. The purchasing decision for OEMs is heavily weighted by factors such as system reliability, dynamic performance specifications (e.g., settling time, tracking error), and the availability of robust digital interface protocols for seamless machine integration.

Another crucial group of buyers includes advanced manufacturing facilities, particularly those in the automotive and aerospace sectors. Automotive manufacturers utilize these scanners extensively for component traceability (VIN marking, part serialization), precision welding of complex battery geometries for electric vehicles, and interior aesthetic processing (laser texturing). Aerospace companies rely on high-power, large-aperture scanners for precise material ablation, surface treatment, and micro-drilling of specialized alloys, where component integrity and zero-defect manufacturing are non-negotiable requirements. These end-users demand scanners capable of handling high-power laser sources while maintaining thermal stability and long-term calibration, often necessitating customized cooling solutions and large mirror sizes.

Furthermore, the medical device and pharmaceutical industries represent high-value potential customers. Hospitals, specialized ophthalmology clinics, and medical device manufacturers purchase scanning systems for integrating into advanced surgical lasers (e.g., LASIK systems requiring sub-millisecond control), diagnostic equipment (Optical Coherence Tomography - OCT), and precise marking of medical instruments and packaging for sterile traceability. These applications emphasize accuracy, beam quality preservation, and strict adherence to regulatory standards. Research institutions and universities also constitute consistent buyers, utilizing high-end galvanometer systems for experimental setups in optics, physics, and advanced material science research, often requiring specialized coatings and ultra-high-speed performance for non-linear optics experiments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCANLAB GmbH, Cambridge Technology (Novanta), Raylase GmbH, Sino-Galvo Technology Co., Ltd., CTI (General Scanning), Sunny Technology (Sunnylaser), Aerotech Inc., Edmund Optics, Hyperfine, Nutfield Technology, Wavelength Opto-Electronic, Focuslight Technologies, Aomen Optoelectronics, Precision Scanning Systems, 4D Technology, Optotune AG, Scansonic MI GmbH, Thorlabs, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Galvanometer Scanner Market Key Technology Landscape

The technological landscape of the Galvanometer Scanner Market is rapidly evolving, driven primarily by the shift from analog to high-performance digital servo drivers. Digital systems, often leveraging Digital Signal Processors (DSPs), offer significant advantages over traditional analog control, including superior linearity, reduced thermal drift, faster settling times, and enhanced noise immunity. This digital control allows for the implementation of advanced proprietary algorithms for trajectory control and dynamic distortion correction, which are essential for high-throughput, high-quality laser processing. Furthermore, digital interfaces facilitate easier integration into modern networked manufacturing environments (e.g., EtherCAT or proprietary industrial protocols), enabling remote diagnostics and integrated quality monitoring, aligning perfectly with Industry 4.0 standards.

A major focus of innovation lies in improving mirror technology and dynamic focus mechanisms. Manufacturers are actively developing lightweight, high-stiffness mirror materials, such as single-crystal silicon, ceramic composites, or specialized coated beryllium, to minimize inertia and maximize the achievable scan speed and resonant frequency without compromising surface flatness or optical quality. The integration of high-resolution position feedback sensors (often utilizing non-contact capacitive or highly accurate linear encoders) is critical to ensure micro-radian angular resolution and repeatability, particularly for complex micro-machining tasks. The trend toward 3D scanning solutions involves the technological advancement of dynamic focusing elements, such as highly optimized focusing lenses driven by specialized actuators, which must synchronize perfectly with the 2-Axis mirrors to maintain uniform spot size and intensity throughout the working volume.

Another influential technological segment involves resonant scanning and Micro-Electro-Mechanical Systems (MEMS) mirrors, which are competing with traditional galvanometer technology, especially in high-frequency, small-aperture applications like biomedical imaging and handheld devices. While traditional galvanometers maintain their dominance in high-power, large-area industrial processing due to superior torque and deflection angle, the cross-pollination of ideas, such as improved thermal management systems (liquid and forced-air cooling integrated into the housing) and modular design, is enhancing the flexibility and power handling capabilities of standard scanners. The increasing need for sophisticated software tools that include complex geometrical transformation, distortion mapping, and seamless integration with Computer-Aided Design (CAD) files is transforming the scanner from a hardware component into a part of a unified, intelligent laser processing platform.

Regional Highlights

- Asia Pacific (APAC): Dominance in Manufacturing and Volume Consumption

The APAC region holds the largest market share in terms of volume and is projected to exhibit the highest growth rate due to its position as the global hub for electronics, automotive component, and semiconductor manufacturing. Countries like China, South Korea, and Taiwan drive massive demand for 2-Axis and 3-Axis scanners used in high-volume laser marking, cutting of display panels (OLED/Micro-LED), and advanced packaging processes. Government initiatives supporting industrial automation and the proliferation of low-cost fiber laser systems further accelerate the adoption of galvanometer technology across diverse manufacturing environments. Investment in domestic high-tech manufacturing, particularly in China's rapidly expanding electric vehicle battery sector, necessitates vast numbers of precision laser welding and marking systems, securing APAC's market leadership.

- North America: Focus on High-Value and Research Applications

North America is a pivotal region for technological innovation and high-value applications, including aerospace, defense, and specialized medical device manufacturing. The market here is characterized by a demand for premium, customized galvanometer systems featuring high spectral purity, low drift, and exceptional thermal stability, particularly for use with ultrafast lasers in micro-machining and specialized lithography. The strong presence of leading academic and private research institutions, coupled with significant venture capital funding in advanced manufacturing and biomedical engineering, sustains robust demand for cutting-edge scanning solutions. The region is a leader in implementing AI and machine learning into laser systems, driving the adoption of the latest digital scanning technology.

- Europe: Precision Engineering and Medical Technology Leadership

Europe, particularly Germany, Switzerland, and the UK, is renowned for its excellence in precision engineering and high-quality industrial machinery, making it a critical market for galvanometer scanners. The region has strong demand from the premium automotive sector, requiring high-precision laser systems for component welding and surface finishing. Furthermore, Europe is a global leader in medical technology, driving continuous uptake of advanced scanners for ophthalmology (e.g., excimer laser systems for vision correction) and clinical diagnostics. European companies often prioritize energy efficiency, long-term operational stability, and adherence to stringent quality and environmental standards, influencing product development toward robust, highly durable digital systems.

- Latin America, Middle East, and Africa (LAMEA): Emerging Growth Centers

LAMEA currently represents a smaller portion of the global market but is exhibiting high growth potential, driven by industrial diversification and increasing foreign direct investment in manufacturing, oil and gas, and infrastructural development. Countries like Brazil and Mexico are expanding their automotive and packaging industries, leading to increased adoption of entry-level and medium-performance 2-Axis marking systems for traceability and quality control. The Middle East is showing localized growth tied to aerospace maintenance and repair (MRO) facilities and investments in localized high-tech manufacturing hubs, demanding specialized, robust scanning systems capable of operating reliably in challenging environments. Market maturity in these regions is growing, creating opportunities for distributors offering integrated solutions and local support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Galvanometer Scanner Market.- SCANLAB GmbH

- Cambridge Technology (Novanta)

- Raylase GmbH

- Sino-Galvo Technology Co., Ltd.

- CTI (General Scanning)

- Sunny Technology (Sunnylaser)

- Aerotech Inc.

- Edmund Optics

- Hyperfine

- Nutfield Technology

- Wavelength Opto-Electronic

- Focuslight Technologies

- Aomen Optoelectronics

- Precision Scanning Systems

- 4D Technology

- Optotune AG

- Scansonic MI GmbH

- Thorlabs, Inc.

- PicoLAS GmbH

- Laser Mechanisms, Inc.

Frequently Asked Questions

Analyze common user questions about the Galvanometer Scanner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between 2-Axis and 3-Axis galvanometer scanners?

2-Axis scanners control the laser beam position in the X and Y plane for 2D processing like flat marking. 3-Axis scanners add a third axis, typically a dynamic focusing mechanism (Z-axis), allowing for precise beam manipulation and consistent spot quality across curved surfaces and large working volumes, crucial for 3D printing and deep engraving applications.

Which industries are the primary drivers of demand for high-speed digital galvanometer systems?

The primary drivers are the semiconductor manufacturing sector, requiring high-precision processing for wafer repair and lithography, and the electric vehicle (EV) industry, which needs ultra-fast, reliable welding and marking systems for battery cell production and component traceability.

How does the integration of AI benefit galvanometer scanner performance in manufacturing?

AI integration significantly enhances performance by enabling real-time adaptive process control, compensating for thermal drift, optimizing complex scan paths instantly, and conducting automated quality assurance through integrated machine vision, leading to higher throughput and reduced defects.

What are the typical mirror materials used in high-power laser applications?

For high-power applications, mirrors must exhibit low thermal expansion and high stiffness. Common materials include silicon carbide (SiC), beryllium (Be), and lightweight fused silica, often requiring specialized dielectric coatings optimized for the specific laser wavelength and power density.

What is the Compound Annual Growth Rate (CAGR) projected for the Galvanometer Scanner Market?

The Galvanometer Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between the years 2026 and 2033, driven by continuous advancements in laser processing technology and industrial automation requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager