Gambling Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437216 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Gambling Machines Market Size

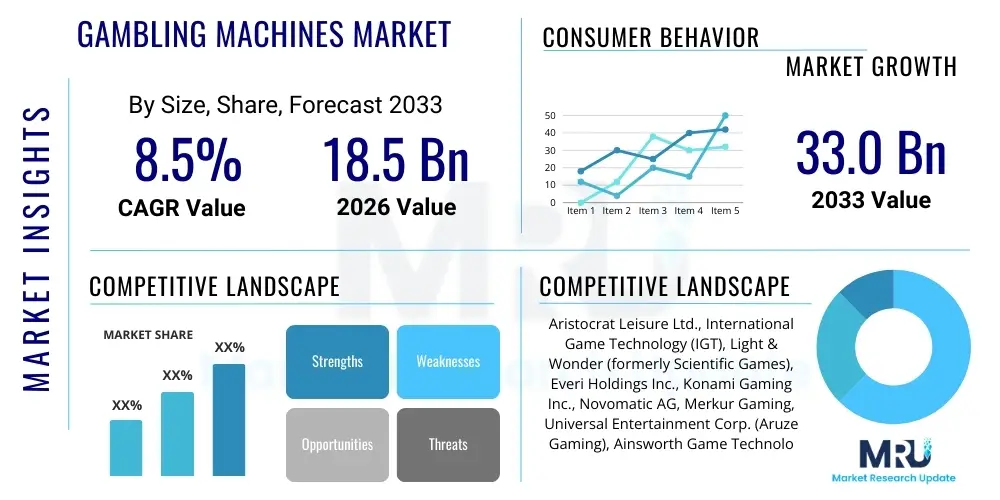

The Gambling Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 33.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the continuous technological advancements in gaming mechanics, particularly the integration of high-definition displays, augmented reality (AR) features, and sophisticated network systems that enhance user engagement and operational efficiency for casino operators worldwide. The shift towards server-based gaming (SBG) and the proliferation of legalized gambling jurisdictions contribute significantly to the overall market expansion.

Gambling Machines Market introduction

The Gambling Machines Market encompasses the manufacturing, distribution, and operation of automated electronic and mechanical devices designed for wagering activities, predominantly found in land-based casinos, arcades, and licensed gaming venues. These machines, ranging from traditional mechanical reel slots to modern video lottery terminals (VLTs) and sophisticated electronic table games (ETGs), serve as primary revenue generators for the global gaming industry. Key products include slot machines, video poker machines, and multi-game terminals, all optimized for high throughput and immersive player experiences. The market’s evolution is characterized by the increasing adoption of cashless payment systems and networked progressive jackpots, moving away from purely mechanical or electro-mechanical designs towards fully integrated digital platforms.

Major applications of gambling machines are concentrated in large integrated resorts and dedicated casino establishments, where they form the backbone of the gaming floor, offering diverse themes and volatility levels to attract a wide demographic of players. The inherent benefits of these machines include providing standardized, auditable gaming outcomes, high operational uptime, and the ability to offer massive linked jackpots which act as significant marketing drawcards. Furthermore, modern machines offer advanced responsible gaming features and tailored player interfaces, enhancing both security and regulatory compliance for operators. The convergence of physical machines with online gaming infrastructure, often through cross-platform loyalty programs, further solidifies their importance.

Driving factors propelling market growth include the steady deregulation and expansion of legalized gambling across developing regions, particularly in Asia Pacific and parts of Latin America, leading to new casino construction and the mandatory replacement of older machine inventories. Technological drivers such as the implementation of advanced graphics processors, better sound design, and the integration of sophisticated analytics software—enabling dynamic game configuration and personalized player rewards—are crucial. Economic recovery in major gaming hubs like Las Vegas and Macau, alongside the rising consumer disposable income allocated towards entertainment, further stimulates demand for innovative and high-stakes gambling machine experiences.

Gambling Machines Market Executive Summary

The Gambling Machines Market is undergoing a rapid transition driven by digital convergence and evolving regulatory landscapes. Business trends indicate a strong move toward hardware virtualization, with server-based gaming (SBG) allowing operators unparalleled flexibility in game deployment and rapid inventory rotation, significantly reducing capital expenditure volatility associated with physical machine replacements. Furthermore, strategic mergers and acquisitions among leading manufacturers are concentrating technological expertise, focusing on developing cross-channel products that link the land-based experience seamlessly with regulated online platforms. The focus remains heavily on creating highly engaging, cinematic content that appeals to younger demographics accustomed to complex video game narratives, thereby modernizing the traditional casino floor appeal and safeguarding future revenue streams.

Regionally, North America remains the largest revenue generator, characterized by a highly mature market and high Average Daily Win (ADW) per machine, coupled with continuous investment in technological retrofitting and expanding sports betting integration features on physical terminals. Asia Pacific, particularly driven by emerging markets and the expansion of integrated resorts in countries like Japan, represents the fastest-growing region, underpinned by massive infrastructure projects and a strong cultural affinity for high-limit gaming. European markets demonstrate stable growth, primarily focused on regulatory compliance, responsible gaming features, and the shift towards VLTs in localized betting shops and arcades, requiring manufacturers to tailor hardware and software to strict national standards.

Segmentation trends highlight the dominance of the video slot machine category due to its versatility and high engagement potential, alongside the increasing market penetration of electronic table games (ETGs). ETGs are becoming popular as they offer the excitement of traditional table games while minimizing operational labor costs and increasing the number of hands played per hour. The rise of multi-game machines offering diverse portfolios on a single cabinet is optimizing floor space utilization for operators. Key challenges revolve around regulatory compliance concerning game fairness and combating problem gambling, which necessitate ongoing investment in sophisticated auditing and monitoring systems integrated directly into the machine hardware and software architecture.

AI Impact Analysis on Gambling Machines Market

User queries regarding AI's influence in the Gambling Machines Market frequently center on personalization, security, and responsible gaming protocols. Users are keen to understand how AI can tailor game volatility, themes, and bonus structures in real-time to individual players, enhancing engagement while maximizing yield for operators. A significant concern revolves around the potential for AI-driven optimization to inadvertently increase the risk of problem gambling, thus prompting questions about regulatory oversight and mandated AI transparency. Furthermore, queries often focus on AI's role in predictive maintenance, advanced fraud detection systems, and automating surveillance and security operations on the casino floor, transforming operational efficiency and minimizing revenue leakage.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally reshaping the operational and experiential facets of gambling machines. AI algorithms are being employed to analyze vast datasets of player behavior, including bet size, time on device, and preferred game mechanics. This data-driven approach enables the development of hyper-personalized gaming experiences, where the machine dynamically adjusts content, pay tables, and reward cycles to maintain optimal engagement levels for specific player profiles. This level of customization allows operators to improve player loyalty and increase lifetime value (LTV), moving beyond simple random number generation (RNG) to intelligent, adaptive system management.

Beyond the user interface, AI significantly impacts the back-end infrastructure. Predictive maintenance models analyze sensor data from the machines to forecast hardware failures, allowing for proactive servicing and dramatically increasing the machine's uptime, a critical metric for profitability. In security and regulatory compliance, sophisticated AI models detect complex patterns indicative of fraud, money laundering, or irregular wagering activities far quicker than traditional methods. Crucially, AI is being deployed within mandated responsible gaming frameworks, using behavioral indicators to identify at-risk players in real-time and trigger automated interventions, ensuring compliance with increasingly stringent global gaming regulations and promoting a sustainable gaming environment.

- Real-time Personalized Gaming: AI tailors game themes, volatility, and bonuses to individual player profiles, maximizing engagement.

- Predictive Maintenance: ML algorithms analyze machine performance data to forecast component failure, minimizing downtime and optimizing maintenance schedules.

- Advanced Fraud Detection: AI identifies complex patterns of collusion, chip dumping, or money laundering attempts far more effectively than manual monitoring.

- Enhanced Responsible Gaming: Behavioral analytics powered by AI detects early signs of problem gambling and triggers immediate, automated player support interventions.

- Dynamic Pricing and Yield Management: AI optimizes floor configuration and machine placement based on real-time foot traffic and utilization data.

- Automated Security Surveillance: Computer vision and AI analyze video feeds to ensure floor security and detect unauthorized tampering or regulatory breaches.

DRO & Impact Forces Of Gambling Machines Market

The Gambling Machines Market is propelled by strong Drivers such as technological innovation in hardware and software, the expansion of regulated gaming markets globally, and the consumer demand for immersive entertainment experiences. Restraints predominantly include rigorous and often disparate governmental regulations across various jurisdictions, high initial capital investment requirements for advanced gaming terminals, and increasing societal concerns regarding problem gambling, which lead to restrictive legislative measures. Opportunities lie significantly in emerging markets, the further integration of skill-based and social gaming elements into traditional terminals, and the potential revenue streams generated by the cross-platform linkage between land-based machines and online/mobile applications. These forces are fundamentally impacted by global macroeconomic stability and the continuous evolution of data privacy laws, which dictate how player tracking and personalized services can be implemented.

Key drivers include the continuous push by manufacturers to integrate advanced technologies like 4K graphics, haptic feedback systems, and motion sensing capabilities, transforming traditional slot cabinets into interactive entertainment centers that justify higher average bet sizes. Furthermore, the global trend towards replacing aging inventories with server-based architecture accelerates demand, as SBG systems offer greater operational flexibility, remote content updates, and improved regulatory reporting capabilities. The geographical expansion into new, populous jurisdictions, particularly in Asia, presents massive untapped markets ready for modern gaming equipment installation, compensating for maturation in established Western markets.

Conversely, significant restraints hinder uniform growth. Regulatory fragmentation poses a major hurdle; manufacturers must meet distinct and often conflicting standards for randomness testing, pay-out percentages, and player identification across different states or countries, leading to high compliance costs and delayed product launches. Additionally, heightened scrutiny on Responsible Gambling (RG) practices leads to imposed limitations on maximum betting amounts, mandatory breaks, and detailed data logging, which can sometimes dampen revenue potential. The high procurement cost of premium hardware, coupled with competitive pressure from the burgeoning unregulated or lightly regulated online betting sector, necessitates operators to carefully balance investment returns against regulatory risks. These constraints mandate continuous lobbying and harmonization efforts across the industry.

Segmentation Analysis

The Gambling Machines Market is systematically segmented based on the type of machine, the end-user application, and the geographical region of operation. This structure allows for granular analysis of market dynamics, revealing that the market diversity stems primarily from the technological sophistication and the specific regulatory environment governing game mechanics. Segmentation by product highlights the shift from purely electro-mechanical devices to fully digital video terminals, reflecting evolving consumer preferences for complex, video game-like content. Analyzing end-user segments indicates that large integrated resorts and commercial casinos remain the foundational drivers of high-volume sales, while smaller localized venues focus on cost-effective VLT installations.

The core segmentation criteria are essential for manufacturers to tailor their product development pipelines and sales strategies. By identifying the highest growth rate within specific segments, such as Electronic Table Games (ETGs) adoption in Asian markets or the replacement cycles of Video Slot Terminals (VSTs) in mature markets like North America, companies can optimize resource allocation. Furthermore, the segmentation by technology—distinguishing between standalone machines and networked, server-based gaming (SBG) systems—is increasingly critical as operators prioritize scalability, remote management capabilities, and the seamless deployment of content updates across their entire gaming floor footprint. The performance of these distinct segments is heavily correlated with regional economic health and local legislative decisions on gaming expansion.

- By Product Type:

- Video Slot Machines (VSTs)

- Video Poker Machines

- Electronic Table Games (ETGs) (e.g., Roulette, Blackjack, Baccarat)

- Multi-Game Machines

- Other Gaming Terminals (e.g., Keno, VLTs)

- By Technology:

- Standalone Machines

- Server-Based Gaming (SBG) Systems

- Networked Progressive Systems

- By End User:

- Commercial Casinos

- Tribal Casinos

- Integrated Resorts

- Arcades and Gaming Centers

- Hotels and Bars (VLT locations)

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain)

- Asia Pacific (Macau, Singapore, Australia, Japan)

- Latin America (Brazil, Argentina, Peru)

- Middle East and Africa (South Africa, UAE)

Value Chain Analysis For Gambling Machines Market

The value chain for the Gambling Machines Market begins with the upstream sourcing of high-technology components, including specialized graphic processing units (GPUs), high-resolution touchscreens, secure Random Number Generators (RNGs), and proprietary cabinet materials. Key upstream activities involve R&D and intellectual property development, where leading manufacturers invest heavily in creating unique game themes and mathematical models protected by patents. The midstream involves the core manufacturing, assembly, and rigorous testing processes, ensuring the machines meet complex regulatory standards (e.g., GLI certifications) for fairness, security, and durability. Specialized component suppliers often operate within highly regulated supply chains, demanding strict quality control to maintain the integrity of the final gaming product, particularly regarding regulatory compliance hardware.

Downstream activities center around the distribution, installation, operation, and maintenance of the machines on the casino floor. The distribution channel is often highly centralized, primarily involving direct sales models where major manufacturers lease or sell machines directly to large casino operators or licensed regional distributors who manage smaller venues. Direct sales are preferred due to the high value and customization requirements of the products. Furthermore, the downstream includes critical operational services such as server management for networked systems, remote monitoring, technical support, and periodic hardware upgrades. The lifecycle management of gaming content—updating game libraries and managing progressive jackpot networks—is a crucial downstream service that maintains machine relevance and player engagement over time.

The interaction between the upstream technology providers (e.g., semiconductor manufacturers) and the core gambling machine manufacturers defines innovation speed. The subsequent link to casino operators is primarily direct, ensuring controlled installation and maintenance environments compliant with jurisdictional laws. Indirect channels, such as specialized distributors, cater mainly to smaller gaming venues or arcades outside major casino hubs. The profitability across the chain is concentrated at the manufacturing stage (IP creation and assembly) and the operational stage (revenue share agreements or recurring maintenance contracts), emphasizing the market's reliance on both technological differentiation and robust, reliable field service capabilities provided directly by the original equipment manufacturers (OEMs).

Gambling Machines Market Potential Customers

The primary end-users and buyers of gambling machines are large, integrated resort operators and established commercial casinos globally. These entities require high volumes of diverse gaming content, state-of-the-art cabinet technology, and networked progressive jackpot systems to attract high-value tourists and local patrons. Their purchasing decisions are heavily influenced by the machine's proven performance metrics, specifically the Average Daily Win (ADW), durability, and the manufacturer’s ability to provide swift technical support and compliance certifications. These customers invest in high-end, technologically sophisticated machines that integrate seamlessly with their proprietary casino management systems and player loyalty programs.

A secondary, yet rapidly expanding, customer base includes tribal casinos, particularly prominent in North America, which focus on maximizing revenue from local demographics while adhering to specific governmental regulations regarding gaming compacts. Additionally, government-operated lottery corporations and licensed VLT (Video Lottery Terminal) operators constitute a significant segment. These customers often purchase standardized, reliable terminals for deployment in distributed, non-casino environments such as bars, pubs, and dedicated arcades. Their priority is regulatory compliance, operational simplicity, and scalability across numerous small locations, often favoring revenue-sharing models over outright purchase.

The expansion into new geographical territories, such as emerging Asian markets or newly liberalized Latin American jurisdictions, creates demand for initial installation and large-scale infrastructure deployment. Potential customers in these regions often prioritize machines that are culturally tailored to local gaming preferences, requiring manufacturers to rapidly localize game themes and language interfaces. As the convergence with sports betting grows, sports bars and dedicated betting shops also become potential customers for hybrid gaming/betting terminals, seeking machines that combine traditional casino games with integrated sports wagering capabilities, thus diversifying the potential customer matrix significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 33.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aristocrat Leisure Ltd., International Game Technology (IGT), Light & Wonder (formerly Scientific Games), Everi Holdings Inc., Konami Gaming Inc., Novomatic AG, Merkur Gaming, Universal Entertainment Corp. (Aruze Gaming), Ainsworth Game Technology Ltd., Zitro International S.à r.l., Incredible Technologies Inc., Gaming Arts LLC, Galaxy Gaming Inc., AGS (Applied Gaming Solutions), Inspired Entertainment Inc., EGT Interactive (Euro Games Technology), Interblock d.d., Kambi Group plc, Playtech plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gambling Machines Market Key Technology Landscape

The technological evolution of the Gambling Machines Market is defined by the transition from electro-mechanical devices to highly sophisticated digital computing platforms, fundamentally driven by advances in graphical processing power and network infrastructure. Key technologies include the widespread adoption of 4K and curved ultra-HD displays, often incorporating gesture control and high-fidelity haptic feedback systems to maximize player immersion and interaction. Crucially, the move toward Server-Based Gaming (SBG) architecture is central; SBG allows game logic and content to reside on centralized servers, enabling instant game changes, real-time auditing, and highly efficient network management across thousands of terminals, which vastly improves operational flexibility compared to older, individual-machine setups.

Security technology remains paramount, utilizing advanced encryption standards, biometric authentication for high-limit players and staff access, and robust hardware-based Random Number Generators (RNGs) that meet stringent global regulatory standards like those set by GLI (Gaming Laboratories International). Furthermore, cashless gaming systems are rapidly gaining traction, utilizing RFID, NFC, and QR code technologies to integrate machine play with digital wallets and TITO (Ticket-In, Ticket-Out) systems. This technological shift addresses consumer demand for seamless payment solutions and aids operators in complying with anti-money laundering (AML) regulations by improving transaction traceability and reducing the dependency on handling large volumes of cash on the gaming floor.

The rising prevalence of Electronic Table Games (ETGs) leverages technology to provide a digitized version of traditional table games. These systems use high-speed video capture and advanced sensor technology to track betting positions and card outcomes, offering faster play and lower overhead costs than live dealer games. Moreover, the integration of connectivity technologies such as 5G allows for faster data transmission between machines and cloud-based analytical platforms, facilitating real-time marketing, personalized bonus delivery, and sophisticated predictive maintenance alerts. The future landscape is moving toward integrated augmented reality (AR) overlays and sophisticated AI components embedded directly into the gaming software, enhancing realism and data-driven personalization.

Regional Highlights

North America, led by the highly developed casino markets in the United States, represents the largest and most technologically advanced regional market for gambling machines. The region is characterized by high replacement rates of older inventory, robust capital investment in the latest SBG systems, and a strong presence of major global manufacturers. Growth is further accelerated by the expansion of tribal gaming operations and the rapid regulatory acceptance of newer entertainment concepts like skill-based gaming terminals and integrated sports betting kiosks. The U.S. market, particularly jurisdictions like Nevada and New Jersey, serves as the global benchmark for innovation in cabinet design, progressive jackpot technology, and operational data analytics.

Asia Pacific (APAC) is projected to be the fastest-growing market, primarily fueled by massive infrastructure investments in integrated resorts, notably in Macau, Singapore, and the impending legalization and expansion in Japan. The APAC market shows a strong demand for high-limit and premium gaming terminals, favoring products that emphasize cultural themes, high volatility, and opulent design aesthetics suited for VIP clientele. While regulatory environments can be complex and restrictive in some countries, the sheer size of the potential consumer base and increasing disposable incomes dedicated to entertainment ensure sustained high growth rates, prompting major manufacturers to establish localized R&D and manufacturing bases within the region.

Europe holds a mature yet fragmented market, heavily influenced by varying national regulations regarding maximum bets, payout percentages, and mandatory responsible gaming features. The European market sees significant demand for Video Lottery Terminals (VLTs) utilized in localized betting shops, bars, and arcades, requiring rugged, reliable, and cost-effective machines tailored to specific country standards (e.g., German, Italian, or UK regulations). Regulatory emphasis on player protection drives innovation in biometric identification and mandatory break prompts, making compliance technology a critical component of machine design. Growth in Eastern Europe is notable, though generally slower than in APAC or the U.S., focusing on modernizing existing casino infrastructure following regulatory shifts.

- North America: Dominant market share; High adoption of SBG and premium video slots; Focus on convergence with online platforms and sports betting.

- Asia Pacific (APAC): Highest growth rate; Driven by new integrated resorts in Japan and Southeast Asia; Strong demand for high-denomination and themed games.

- Europe: Highly regulated market; Strong demand for VLTs and compliance-focused technology; Fragmentation necessitates localized product variants.

- Latin America: Emerging market potential; Driven by regulatory liberalization (e.g., Brazil, Argentina); Demand for flexible, multi-currency enabled machines.

- Middle East and Africa (MEA): Niche market focused mainly on tourist destinations (e.g., South Africa); Limited growth due to religious and cultural restrictions in many countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gambling Machines Market.- Aristocrat Leisure Ltd.

- International Game Technology (IGT)

- Light & Wonder (formerly Scientific Games)

- Everi Holdings Inc.

- Konami Gaming Inc.

- Novomatic AG

- Merkur Gaming

- Universal Entertainment Corp. (Aruze Gaming)

- Ainsworth Game Technology Ltd.

- Zitro International S.à r.l.

- Incredible Technologies Inc.

- Gaming Arts LLC

- Galaxy Gaming Inc.

- AGS (Applied Gaming Solutions)

- Inspired Entertainment Inc.

- EGT Interactive (Euro Games Technology)

- Interblock d.d.

- Kambi Group plc

- Playtech plc

- Scientific Games Corporation (SGC)

- TransAct Technologies Incorporated

Frequently Asked Questions

Analyze common user questions about the Gambling Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Server-Based Gaming (SBG) and how is it transforming casino operations?

Server-Based Gaming (SBG) is a technology where the core game logic and content reside on centralized servers rather than within individual machine cabinets. This transformation allows casino operators to remotely change games, adjust denominations, and update software across the entire floor instantly, reducing operational friction, inventory costs, and maximizing floor yield through real-time content management and dynamic configuration.

How is AI being utilized to enhance security and prevent fraud in modern gambling machines?

AI utilizes machine learning models to continuously analyze player behavior, transaction patterns, and sensor data from the machines. This enables the system to rapidly identify statistical anomalies, detect attempts at physical tampering, or flag complex coordinated fraud schemes, significantly improving overall security, compliance with anti-money laundering (AML) protocols, and safeguarding revenue integrity for the operator.

What are Electronic Table Games (ETGs) and why are they becoming increasingly popular in the market?

Electronic Table Games (ETGs) are automated or semi-automated terminals offering digital versions of classic casino games like roulette, blackjack, and baccarat. They are popular because they offer faster play rates, lower labor costs compared to live dealers, high throughput capacity, and eliminate opportunities for dealer error or collusion, appealing both to operators seeking efficiency and players seeking standardized, rapid gaming action.

Which geographical region exhibits the highest growth potential for gambling machine deployment?

The Asia Pacific (APAC) region, particularly driven by large-scale integrated resort developments in areas such as Japan and Southeast Asia, demonstrates the highest growth potential. This growth is supported by favorable demographics, increasing consumer wealth, and the planned expansion into high-stakes, premium gaming infrastructure that requires significant investment in new, state-of-the-art gambling equipment and technology.

What regulatory challenges face manufacturers when developing new gambling machine hardware and software?

Manufacturers must navigate highly fragmented global regulatory environments, requiring products to undergo costly and time-consuming certification processes (e.g., GLI testing) for specific payout percentages, technical integrity, security features, and increasingly stringent responsible gaming mandates. Compliance with these diverse local standards requires substantial investment in localized product variants and continuous regulatory oversight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager