Game Publisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432304 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Game Publisher Market Size

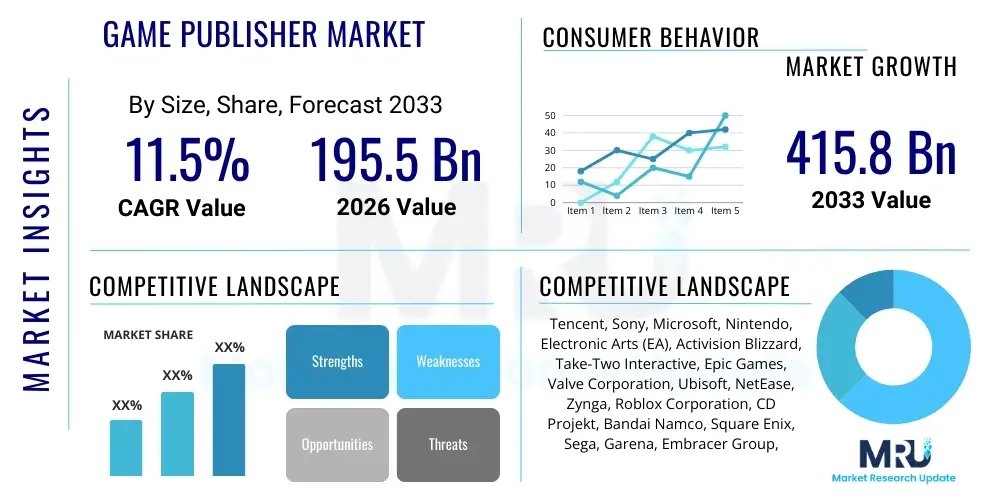

The Game Publisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 415.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerated globalization of digital entertainment, particularly the massive uptake of mobile gaming in emerging economies and the continuous innovation in console and PC platforms. The transition toward free-to-play (F2P) models supported by live service content and microtransactions has fundamentally altered monetization strategies, expanding the addressable market size significantly beyond traditional retail sales.

The market expansion is further buoyed by strategic investments in cloud gaming infrastructure, which lowers the barrier to entry for high-fidelity gaming across varied devices, thereby attracting a broader, more geographically diverse consumer base. Publishers are prioritizing intellectual property (IP) expansion, leveraging successful franchises across media formats—including film, television, and merchandise—to create comprehensive entertainment ecosystems. This multi-platform and cross-media strategy ensures sustained revenue streams and deepens consumer loyalty, cementing the market’s trajectory toward reaching the forecasted valuation by 2033.

Game Publisher Market introduction

The Game Publisher Market encompasses all entities responsible for financing, marketing, and distributing video games developed by internal or external studios. This sector acts as the critical bridge between game development and consumer accessibility, managing risks associated with large-scale production and ensuring successful market penetration across diverse platforms such as PC, consoles (Sony PlayStation, Microsoft Xbox, Nintendo Switch), mobile devices, and cloud services. Key product offerings include packaged software, digital downloads, in-game purchases, and subscription services, which collectively define the modern gaming revenue landscape. The core market function involves identifying viable intellectual property (IP), securing funding, overseeing development milestones, and executing global marketing campaigns, particularly leveraging social media and streaming platforms.

Major applications of published games span beyond pure entertainment, increasingly including educational simulations, corporate training modules, and significant contributions to the rapidly growing professional eSports ecosystem. The primary benefits derived from successful game publishing include robust intellectual property monetization, predictable long-term revenue through live services, and extensive brand recognition capable of supporting cross-industry ventures. The global nature of digital distribution facilitates immediate market access, reducing geographical limitations that previously constrained growth, making scale a fundamental advantage for leading publishers.

Driving factors propelling this market include the relentless global expansion of internet penetration, especially in the Asia Pacific and Latin American regions, making high-quality gaming accessible to billions. Furthermore, generational leaps in hardware capabilities, the continuous evolution of immersive technologies like Virtual Reality (VR) and Augmented Reality (AR), and the cultural normalization of gaming as a mainstream entertainment choice are critical catalysts. The sustained consumer appetite for dynamic, ongoing content updates through GaaS (Games as a Service) models reinforces long-term engagement and recurring spending, solidifying the market's robust growth foundation.

Game Publisher Market Executive Summary

The Game Publisher Market is currently defined by intense consolidation, driven by massive merger and acquisition activities, as major technology conglomerates seek to secure valuable content libraries and development talent to fuel their nascent cloud and metaverse initiatives. Business trends indicate a persistent shift toward the Games as a Service (GaaS) model, emphasizing high-retention strategies, personalized content delivery, and sophisticated engagement tools that maximize the lifetime value of the player. Publishers are heavily investing in proprietary distribution platforms and ecosystem locking, aiming to control the player journey from discovery to ongoing monetization, thereby mitigating reliance on third-party app stores or console manufacturers where possible. This competitive environment necessitates continuous innovation in both content quality and monetization mechanics, with success hinging on the ability to cultivate large, loyal communities capable of sustaining long-term revenue streams.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, primarily fueled by massive mobile gaming adoption in China, India, and Southeast Asia, representing both the largest volume of players and the highest concentration of high-spending users. North America and Europe remain crucial centers for high Average Revenue Per User (ARPU) console and PC segments, driving innovation in AAA titles and eSports infrastructure. However, Latin America and the Middle East & Africa (MEA) are emerging as high-growth potential markets, characterized by rapid mobile internet adoption and increasing disposable income, attracting significant targeted investment from global publishers seeking new player bases and market diversification.

Segment trends underscore the phenomenal rise of mobile gaming, which now accounts for the largest share of market revenue, propelled by accessibility and diverse monetization options like hybrid casual games. The traditional console segment remains resilient, driven by the current hardware generation cycle and the demand for graphically intense, narrative-driven experiences, often funded via fixed price purchases. Crucially, the Cloud Gaming segment is poised for transformative growth, promising platform independence and lower upfront costs for consumers, forcing publishers to adapt their delivery infrastructure and licensing agreements to support streaming models effectively across fragmented device landscapes.

AI Impact Analysis on Game Publisher Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Game Publisher Market primarily center on efficiency gains in game development, the ethics of using AI-generated content (AIGC), and the anticipated shifts in player experience and personalization. Users frequently question how AI can expedite asset creation (3D models, textures, animations) to reduce production cycles, thereby potentially lowering the monumental development costs associated with AAA titles. A significant area of concern revolves around job displacement for creative and testing roles, coupled with questions about intellectual property ownership and the authenticity of AI-driven narratives. Furthermore, users are keenly interested in AI’s role in optimizing player retention and monetization through advanced predictive analytics, personalized difficulty scaling, and dynamic content generation that ensures every player receives a unique and continually engaging experience, driving higher lifetime value.

The integration of sophisticated AI models is fundamentally restructuring the internal operations of game publishing houses, moving beyond simple non-player character (NPC) behavior to systemic design tools. Publishers are leveraging machine learning for exhaustive quality assurance and bug testing, drastically shrinking the time required for pre-release validation and post-launch patching, which improves game stability and user perception. On the business intelligence side, AI is paramount in analyzing vast datasets related to player behavior, enabling granular segmentation and targeted marketing campaigns, ensuring promotional spend is optimized for conversion and maximizing return on investment (ROI) across various geographic and demographic segments. This operational efficiency is becoming a core competitive differentiator.

From a consumer interaction perspective, AI dramatically enhances the player experience by enabling truly adaptive gameplay and hyper-personalized content feeds within live service environments. AI algorithms manage in-game economies, predict churn risk, and dynamically adjust difficulty or introduce new challenges to maintain optimal flow and engagement. However, publishers must navigate the delicate balance between personalization and privacy, ensuring AI-driven data collection remains transparent and compliant with global regulations. The successful deployment of AI is therefore not just a matter of technological capability but also requires robust governance and ethical frameworks to maintain player trust and long-term brand equity.

- AI accelerates content creation (AIGC) for assets, environments, and dialogue generation.

- Predictive analytics driven by AI optimizes microtransaction timing and personalized offers, maximizing monetization.

- Machine learning enhances quality assurance, rapidly identifying and fixing complex bugs and exploits before public release.

- AI-driven procedural content generation supports massive open worlds and endless replayability, fulfilling GaaS demands.

- Advanced AI systems facilitate sophisticated anti-cheat measures and fraud detection within online competitive environments.

- AI models are used for real-time localization and translation, significantly aiding global market expansion efforts.

DRO & Impact Forces Of Game Publisher Market

The Game Publisher Market dynamics are shaped by a complex interplay of powerful growth drivers, inherent operational restraints, and substantial market opportunities, collectively defining the impact forces. Key drivers include the exponential rise of eSports as a global professional sport, attracting massive viewership and corporate sponsorships, thereby increasing the value proposition of competitive titles. Simultaneously, the proliferation of affordable high-speed mobile internet globally, coupled with the increasing accessibility of budget-friendly smartphones, has unlocked vast consumer bases in previously underserved emerging markets. The cultural acceptance and mainstream adoption of gaming across all age groups further accelerates consumer spending and commitment to digital entertainment ecosystems, fueling consistent revenue growth for major publishers.

Restraints, however, pose significant challenges to sustained growth and profitability. The cost of developing AAA titles continues to escalate dramatically due to rising fidelity expectations and the complexity of modern game engines, leading to fewer, but larger, investment risks. Furthermore, market saturation across both mobile and PC platforms results in intense competition for consumer attention, driving up customer acquisition costs (CAC) significantly. Regulatory scrutiny is increasing globally, particularly concerning loot box mechanics, child protection, and data privacy (like GDPR and CCPA), forcing publishers to overhaul monetization practices and compliance frameworks, adding operational overhead and potential legal risk.

Opportunities for publishers lie predominantly in technological innovation and strategic market expansion. The ongoing rollout of high-performance cloud gaming platforms (like Xbox Cloud Gaming and PlayStation Now) represents a paradigm shift, eliminating the need for expensive hardware barriers and allowing high-fidelity titles to reach virtually any screen. Additionally, the exploration of Web3 technologies, including blockchain integration, NFTs, and play-to-earn models, offers potential new avenues for digital asset ownership and community-driven monetization, although this area remains nascent and volatile. Expanding strategic partnerships with major tech giants for exclusive content and exploring untapped regional markets like Africa further amplify the potential for long-term profitable expansion.

Segmentation Analysis

The Game Publisher Market is fundamentally segmented based on the platforms utilized by consumers, the monetization strategies employed by publishers, and the core genre of the content offered, reflecting the diverse consumer preferences and varied investment landscapes globally. Understanding these segments is crucial for strategic resource allocation, allowing publishers to tailor marketing, development, and distribution efforts precisely. The platform segmentation, encompassing mobile, console, and PC, dictates the necessary technological infrastructure and content fidelity requirements, while the revenue model—ranging from F2P to subscription—defines the publisher’s financial lifecycle and risk profile. Genre segmentation allows for targeted content creation aimed at specific demographic niches, ensuring maximized engagement within specialized communities.

- By Platform

- PC Gaming

- Console Gaming (Dedicated Consoles, Handheld Consoles)

- Mobile Gaming (Smartphones, Tablets)

- Cloud Gaming (Streaming Services)

- Virtual Reality (VR) and Augmented Reality (AR)

- By Revenue Model

- Free-to-Play (F2P) - Supported by In-Game Purchases (Microtransactions, DLC)

- Pay-to-Play (P2P) - Upfront Purchase (Retail, Digital Download)

- Subscription Services (e.g., Xbox Game Pass, PlayStation Plus)

- Advertising (In-Game Ads, Ad-Supported F2P)

- By Genre

- Action and Adventure

- Role-Playing Games (RPG)

- Strategy and Simulation

- Sports and Racing

- Casual and Hypercasual

- Massively Multiplayer Online (MMO)

- By Target Audience

- Core Gamers

- Casual Gamers

- Professional eSports Athletes

Value Chain Analysis For Game Publisher Market

The Game Publisher market value chain is highly complex and multi-layered, beginning with upstream intellectual property creation and ending with downstream consumer engagement and retention. Upstream activities involve concept generation, rigorous market feasibility assessment, and the development process itself, typically executed by internal studios or outsourced to independent developers. Critical upstream partners include technology providers offering game engines (Unity, Unreal Engine), development tools, and high-end hardware necessary for content creation. The effective management of this initial phase, including securing necessary licensing and talent, directly determines the quality and eventual market potential of the product.

The core midstream segment involves the publishing function, which focuses on financing, quality assurance (QA), localization, certification (especially for consoles), and global marketing. Distribution channels form a critical part of this segment, categorized broadly into direct and indirect methods. Direct distribution involves proprietary platforms owned and operated by the publisher (e.g., Steam, Epic Games Store, or publisher-specific mobile clients), offering higher margins and direct consumer data access. Indirect distribution relies on major third-party platforms like console manufacturer stores (Sony PS Store, Microsoft Store) or mobile marketplaces (Apple App Store, Google Play), which provide massive reach but require significant revenue sharing.

Downstream analysis focuses on customer acquisition, community management, and maintaining the live operations of the game, particularly crucial in the GaaS era. This phase is heavily influenced by external forces, including marketing agencies, influencers, and streaming platforms (Twitch, YouTube), which serve as crucial conduits for consumer discovery and sustained engagement. Success in the downstream hinges on effective post-launch content updates, server stability, and utilizing feedback loops for continuous product improvement, directly influencing player retention and the success of subsequent in-game monetization efforts.

Game Publisher Market Potential Customers

Potential customers for the Game Publisher Market are vast and diverse, spanning globally across multiple age groups and socio-economic classes, segmented primarily by platform preference and engagement level. The core target demographic includes dedicated console and PC gamers (typically aged 18-35) who prioritize high-fidelity, competitive, and narrative-driven experiences, representing the highest spenders in premium and microtransaction segments. These buyers look for deep, continuous content updates and strong community features, often driving the success of eSports titles and major AAA franchises. Their purchase decisions are heavily influenced by critical reviews, community reputation, and continuous developer support post-launch.

A second, and rapidly growing, customer segment is the mobile-first user base, particularly prevalent in APAC and LATAM, often characterized by casual to mid-core engagement with Free-to-Play titles. These customers seek accessible, time-efficient entertainment and contribute significantly to revenue through large volumes of low-value, frequent microtransactions (e.g., cosmetic items, time savers, energy recharges). Publishers targeting this segment emphasize hyper-optimization for diverse mobile hardware and rely on sophisticated behavioral analytics to personalize advertising and in-app offers, focusing heavily on lifetime value maximization over immediate high expenditure.

Institutional customers and adjacent market buyers also represent a growing potential. This includes professional eSports organizations, tournament operators, and streaming platforms that require licensing and access rights to popular titles, contributing significant revenue through media rights and strategic partnerships. Furthermore, companies increasingly utilize gaming technology for non-entertainment purposes, such as simulation training for industries like defense, healthcare, and architecture, where customized, high-fidelity game environments are utilized, creating niche but high-value B2B opportunities for specialized publishers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 415.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tencent, Sony, Microsoft, Nintendo, Electronic Arts (EA), Activision Blizzard, Take-Two Interactive, Epic Games, Valve Corporation, Ubisoft, NetEase, Zynga, Roblox Corporation, CD Projekt, Bandai Namco, Square Enix, Sega, Garena, Embracer Group, Krafton. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Game Publisher Market Key Technology Landscape

The Game Publisher Market is underpinned by sophisticated technological infrastructures designed to support high fidelity, massive concurrent user counts, and complex real-time interactivity across a global network. Core technologies involve advanced game engines like Unreal Engine and Unity, which provide the foundational rendering, physics, and scripting tools necessary for modern content creation, often integrating state-of-the-art features such as ray tracing and complex destruction mechanics. Furthermore, robust cloud computing services (e.g., AWS, Azure, Google Cloud) are indispensable, serving as the backbone for hosting massive multiplayer online games, managing player data, and providing the scaling capability essential for handling peak traffic during major game launches or live events. These cloud infrastructures also drive the emerging segment of true cloud gaming by enabling remote rendering and streaming.

A critical technological area for publishers is the implementation of proprietary or third-party digital distribution and security platforms. Effective Digital Rights Management (DRM) and sophisticated anti-cheat systems are mandatory investments to protect intellectual property and maintain fair play, ensuring community integrity, particularly in competitive titles. Publishers utilize machine learning algorithms embedded within their live operation platforms to analyze in-game activity, identify fraudulent behavior, and manage content moderation at scale. The integration of advanced networking protocols, optimized for low latency, is crucial for maintaining competitive parity and a seamless experience for players spread across continents, requiring significant investment in edge computing and global content delivery networks (CDNs).

Looking forward, the technology landscape is being rapidly shaped by immersive technologies and decentralized systems. Virtual Reality (VR) and Augmented Reality (AR) frameworks require specialized SDKs and publishing workflows to optimize interactive experiences for head-mounted displays and mobile cameras, respectively. The nascent integration of blockchain technology is focused on creating secure, verifiable digital assets (NFTs) and decentralized finance (DeFi) mechanisms within games, although widespread adoption still faces hurdles related to scalability and regulatory acceptance. Publishers must consistently evaluate and integrate these emerging technologies to maintain a competitive edge and secure future monetization streams by offering cutting-edge player experiences.

Regional Highlights

Regional dynamics play a paramount role in shaping the Game Publisher Market, with each major geographic area exhibiting distinct consumer behaviors, preferred platforms, and revenue models that publishers must strategically address. The diversity in internet penetration rates, regulatory environments, and consumer disposable income necessitates highly localized content and monetization strategies to achieve optimum market penetration and profitability across the globe. Publishers often establish specialized regional teams dedicated to cultural adaptation, marketing localization, and managing regional distribution partnerships.

- Asia Pacific (APAC): Dominates the global market, primarily driven by the massive scale of mobile gaming adoption in countries like China, India, and Southeast Asia. The region is characterized by a strong preference for Free-to-Play models supported by high-frequency microtransactions and the rapid growth of large-scale competitive eSports events. Regulatory shifts in major markets like China significantly impact global publisher strategies and revenue streams, making regulatory compliance a high priority. South Korea and Japan remain strongholds for high-ARPU console and PC gaming, showcasing a demand for narrative-driven RPGs and established IP franchises.

- North America: Represents the largest segment for high-budget, graphically intensive Console and PC gaming (AAA titles). This region shows strong engagement with subscription services (Game Pass, PS Plus) and a high willingness to pay for premium content, downloadable content (DLC), and collector editions. North America is a crucial hub for technological innovation and is the primary testing ground for advanced concepts like cloud gaming and metaverse integration, often setting global trends in consumer hardware adoption and high-end streaming infrastructure.

- Europe: A mature market characterized by robust PC and Console segment strength, similar to North America, but with greater cultural fragmentation requiring extensive localization efforts across numerous languages and regulatory frameworks (e.g., GDPR data protection and specific national laws on loot boxes). Western Europe drives high ARPU, while Eastern Europe is growing rapidly, fueled by increasing internet access and a strong tradition of PC gaming, particularly strategy and competitive titles.

- Latin America (LATAM): Identified as a major high-growth opportunity, characterized by soaring mobile adoption and increasing purchasing power. The market faces challenges related to digital payment infrastructure and piracy, but the sheer size of the emerging youth population and rapid internet expansion make it a focus area for global F2P publishers. Brazil and Mexico are the largest markets, driving local content creation and establishing regional eSports infrastructure.

- Middle East and Africa (MEA): The fastest-growing emerging market, particularly the Gulf Cooperation Council (GCC) countries, which boast some of the highest ARPU globally due to significant disposable income and high-end broadband penetration. Mobile gaming is dominant across Africa, though infrastructure challenges persist. Publishers target the MEA region with culturally sensitive content and localized payment methods, recognizing its long-term potential for massive scale and high-value player acquisition in key urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Game Publisher Market.- Tencent Holdings Ltd.

- Sony Corporation

- Microsoft Corporation

- Nintendo Co., Ltd.

- Electronic Arts (EA)

- Activision Blizzard (Part of Microsoft)

- Take-Two Interactive Software, Inc.

- Epic Games, Inc.

- Valve Corporation

- Ubisoft Entertainment SA

- NetEase, Inc.

- Zynga Inc. (Part of Take-Two Interactive)

- Roblox Corporation

- CD Projekt S.A.

- Bandai Namco Holdings Inc.

- Square Enix Holdings Co., Ltd.

- Sega Sammy Holdings Inc.

- Garena (Sea Ltd.)

- Embracer Group AB

- Krafton Inc.

Frequently Asked Questions

Analyze common user questions about the Game Publisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Game Publisher Market?

Growth is primarily driven by the mass adoption of mobile gaming globally, particularly in Asia Pacific, the rapid expansion of professional eSports, continuous advancements in cloud gaming technology, and the widespread consumer adoption of the Games as a Service (GaaS) monetization model.

How is AI impacting game development costs and timelines?

AI integration is significantly reducing development costs and accelerating timelines by automating tedious tasks such as asset creation (AIGC), streamlining quality assurance and bug detection, and optimizing live service content delivery and personalization based on predictive player analytics.

Which segment holds the largest share in the Game Publisher Market revenue?

The Mobile Gaming segment currently holds the largest revenue share globally, attributed to its low barrier to entry, widespread accessibility through smartphones, and the highly effective Free-to-Play monetization models utilized by major publishers in this category.

What are the primary regulatory challenges faced by game publishers?

Key regulatory challenges include compliance with global data privacy laws (like GDPR), increasing scrutiny over controversial monetization methods such as loot boxes, and adhering to strict governmental regulations concerning content censorship and platform licensing in large markets like China.

What role does cloud gaming play in the market's future?

Cloud gaming is foundational to the market's future, as it democratizes access to high-fidelity titles by removing the need for expensive dedicated hardware. It enables publishers to reach billions of potential customers on diverse screens, transforming distribution models and licensing opportunities through streaming subscriptions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager