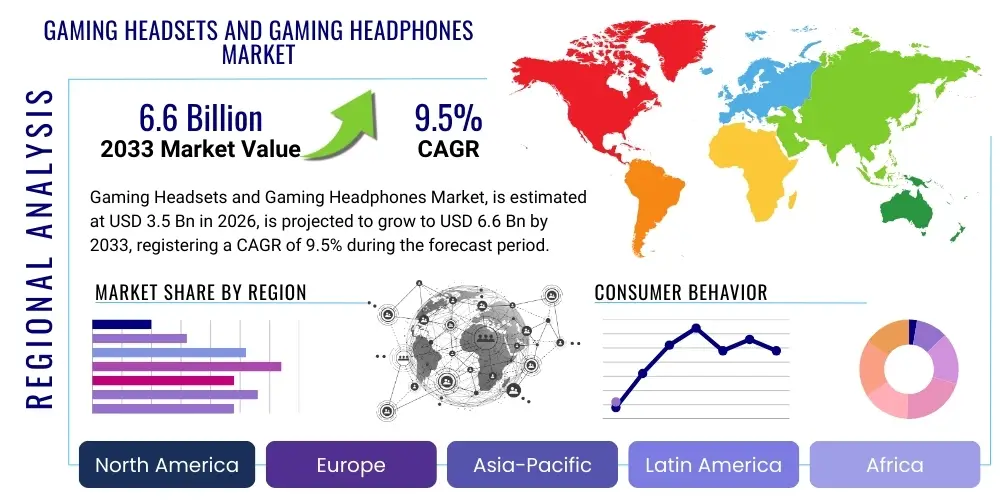

Gaming Headsets and Gaming Headphones Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437032 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Gaming Headsets and Gaming Headphones Market Size

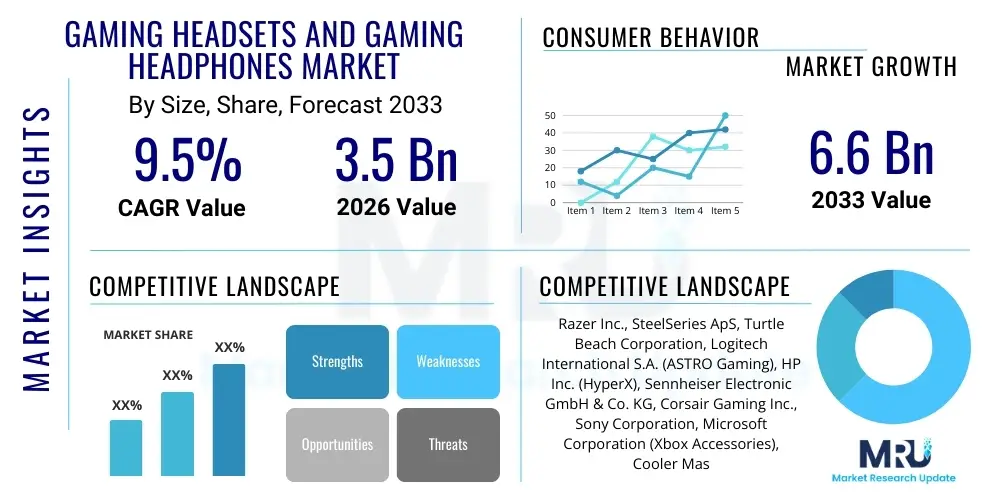

The Gaming Headsets and Gaming Headphones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $6.6 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating adoption of competitive esports, the expansion of the digital gaming distribution landscape across emerging economies, and persistent technological advancements focused on enhancing audio fidelity, positional accuracy, and user comfort. The integration of high-definition audio codecs and sophisticated wireless low-latency technologies is driving premiumization, significantly contributing to the overall market valuation growth over the forecast period.

Gaming Headsets and Gaming Headphones Market introduction

The Gaming Headsets and Gaming Headphones Market encompasses specialized audio equipment designed to meet the rigorous demands of the modern gaming ecosystem, offering critical functionalities such as crystal-clear communication, immersive audio rendering, and robust noise isolation. These devices, ranging from over-ear circumaural designs to high-fidelity earbuds, are crucial peripherals that enhance gameplay by providing positional audio cues necessary for competitive advantage and deep immersion in narrative-driven games. Major applications span across personal computers (PC), dedicated gaming consoles (PlayStation, Xbox, Nintendo Switch), and, increasingly, high-performance mobile gaming platforms. The evolution of the market is characterized by a shift towards lightweight, durable designs featuring long-lasting battery life and universal compatibility across diverse operating systems and hardware configurations, reflecting the convergence of gaming habits across different devices.

The core benefit derived from modern gaming audio solutions is the immediate and accurate transmission of sound data, essential for professional esports players and dedicated enthusiasts. Benefits extend beyond simple sound production, incorporating features like active noise cancellation (ANC) to eliminate environmental distractions, precise microphone arrays for team communication, and customizable equalizers (EQ) tailored for specific game genres, such as FPS or simulation. Driving factors include the continuous rise in consumer disposable income allocated to gaming hardware, the massive global viewership and sponsorship surrounding esports events which legitimizes gaming as a profession, and the widespread availability of high-speed internet infrastructure facilitating online multiplayer experiences. Moreover, the increasing popularity of streaming platforms like Twitch and YouTube requires high-quality audio equipment for content creation, further expanding the market's reach beyond primary gaming use.

Gaming Headsets and Gaming Headphones Market Executive Summary

The global Gaming Headsets and Gaming Headphones market is experiencing significant expansion, driven by accelerating adoption of wireless technologies and a growing demand for premium features such as spatial audio and haptic feedback. Key business trends show major industry players prioritizing the development of ultra-low latency wireless solutions (e.g., utilizing 2.4 GHz proprietary connections) to bridge the performance gap with traditional wired connections, while simultaneously focusing on cross-platform compatibility to capture the fragmented console and mobile gaming demographics. Consolidation efforts and strategic partnerships between hardware manufacturers and professional esports organizations are also prominent, serving to enhance brand visibility and validate product performance under intense competitive conditions. Sustainability in manufacturing and packaging is emerging as a critical secondary trend, influencing purchasing decisions among environmentally conscious consumers in developed markets.

Regionally, Asia Pacific (APAC) stands out as the highest growth potential market, propelled by rapidly increasing internet penetration, a massive population of active mobile gamers, and government support for the development of local esports infrastructure, particularly in countries like China, South Korea, and India. North America and Europe, while already mature, continue to drive innovation in the high-end segment, exhibiting strong demand for luxurious, ergonomic, and technically superior headsets designed for prolonged use by competitive players and content creators. Segment trends indicate a substantial move away from entry-level wired units towards mid-range and premium wireless models that offer enhanced mobility without compromising critical audio performance. Furthermore, the PC peripheral segment maintains its leading revenue share due to the sophisticated requirements for customizable audio profiles and compatibility with advanced sound cards and integrated motherboard audio solutions. This focus on premiumization and technological sophistication is expected to sustain the market’s positive momentum through the forecast period.

AI Impact Analysis on Gaming Headsets and Gaming Headphones Market

User queries regarding the intersection of Artificial Intelligence (AI) and gaming audio predominantly revolve around the tangible improvements AI can deliver in real-time gaming environments, focusing heavily on noise reduction, personalization, and spatial awareness accuracy. Consumers frequently ask how AI can refine microphone performance by eliminating complex background noise (such as keyboard clicks or fan hum) without degrading voice clarity, a crucial factor in team-based online gaming. Another significant theme concerns AI's role in creating highly personalized audio profiles that automatically adapt equalizer settings based on the specific game being played, the listener's unique hearing characteristics, or even the in-game situation (e.g., dynamically prioritizing enemy footsteps over ambient music). Expectations are high for AI to reduce perceived latency and enhance the fidelity of simulated surround sound (spatial audio), making competitive positional cues more reliable and accurate than current hardware-based solutions.

The influence of AI is already evident in sophisticated software solutions embedded within high-end gaming headsets, optimizing both input (microphone) and output (speaker) performance. AI algorithms are crucial for next-generation active noise cancellation (ANC), moving beyond simple frequency filtering to intelligent signal separation, ensuring communication quality remains pristine even in noisy physical environments or chaotic digital battlefields. The future integration of AI suggests systems capable of learning player habits, automatically adjusting volume and sensitivity based on fatigue levels, or even providing AI-driven sound coaching by analyzing audio input patterns and suggesting communication improvements. This shift positions the headset not merely as a passive output device, but as an active, intelligent audio processor integral to the gaming experience, driving demand for chipsets capable of on-device machine learning processing.

- AI-driven real-time noise suppression for enhanced microphone clarity.

- Development of adaptive, personalized sound profiles tailored to individual ear anatomy and game genre.

- Integration of machine learning for improved spatial audio rendering and object detection accuracy.

- AI optimization of latency compensation in wireless transmission protocols.

- Automated sound environment analysis for dynamic equalization adjustments during gameplay.

- Potential for AI-powered audio analytics to offer performance feedback to players.

DRO & Impact Forces Of Gaming Headsets and Gaming Headphones Market

The market dynamics for Gaming Headsets and Gaming Headphones are characterized by a strong interplay between technological innovation and consumer adoption, balanced against the challenges of competitive saturation and price sensitivity in the entry-level segments. The primary drivers include the escalating professionalization and institutionalization of esports globally, which mandates the use of reliable, high-performance peripherals, and the massive proliferation of high-quality gaming content streaming, where clear audio transmission is non-negotiable for creators. Opportunities are significantly expanding through the rise of immersive technologies, particularly Virtual Reality (VR) and Augmented Reality (AR) gaming, which necessitate advanced 3D positional audio capabilities for a convincing experience. These forces collectively push manufacturers toward continuous research and development in areas like driver magnet materials, acoustic chamber design, and proprietary wireless transmission protocols to maintain a competitive edge and drive average selling prices (ASPs) higher.

However, the market faces notable restraints, primarily centered on market saturation in established regions like North America and Western Europe, leading to shorter replacement cycles and difficulty in differentiating products solely on basic features. Another major restraint is the increasing price sensitivity among casual and mobile gamers who may opt for standard consumer headphones or budget alternatives that offer "good enough" performance, limiting the growth potential of the premium segment outside the dedicated enthusiast base. The regulatory landscape around radio frequency (RF) standards and battery safety also imposes constraints on innovation in wireless power and latency reduction. Opportunities, conversely, lie in expanding product offerings integrated with bio-feedback sensors for monitoring user health and fatigue, targeting the rapidly growing mobile esports sector with highly portable, low-latency audio devices, and penetrating underserved emerging markets through localized distribution and strategically priced products.

The key impact forces reshaping the market include technological advancements (low latency, spatial audio), intense competition leading to rapid price erosion in mid-range segments, shifting consumer preferences towards lightweight and comfortable designs suitable for extended gaming sessions, and the overriding influence of major platform holders (Sony, Microsoft) whose console specifications dictate compatibility and technological requirements for peripheral manufacturers. The rapid adoption of USB-C connectivity across devices is simplifying cross-platform usage, forcing manufacturers to adopt universal standards, thereby homogenizing certain aspects of product design while increasing focus on differentiating software ecosystems and proprietary features like advanced virtual surround sound engines.

Segmentation Analysis

The Gaming Headsets and Gaming Headphones market is extensively segmented based on several key criteria, including the physical connection type, the primary platform they support, the specific end-user demographic, and the technological features incorporated. This segmentation allows manufacturers to precisely target distinct consumer needs, ranging from the competitive requirements of professional gamers needing wired reliability and superior isolation, to the comfort and versatility desired by casual console players prioritizing wireless freedom and battery longevity. The underlying structure of market revenue is significantly influenced by the connectivity segment, where the rapid maturation of low-latency wireless technology has shifted consumer preference, although wired connections remain dominant in high-stakes professional esports due to zero latency concerns and robust signal integrity.

Segmentation by product type typically divides the market into over-ear headsets, which dominate the high-performance categories, and in-ear monitors (IEMs) or gaming earbuds, which are gaining traction, especially among mobile gamers due to portability. End-user segmentation distinguishes between amateur/casual users, professional esports players, and content creators/streamers, each demanding specialized feature sets—such as extreme durability for professionals versus extensive customization and aesthetic appeal for streamers. Analyzing these segments provides crucial insights into pricing strategies, distribution channel effectiveness (with e-commerce being particularly strong for specialized gaming gear), and the geographical allocation of marketing resources, highlighting the diverse consumption patterns across different global regions.

- By Product Type:

- Over-Ear Headsets (Circumaural, Supra-aural)

- In-Ear Monitors/Earbuds (IEMs)

- By Connectivity:

- Wired (USB, 3.5mm Jack)

- Wireless (2.4 GHz Proprietary, Bluetooth)

- By Platform Compatibility:

- PC Gaming

- Console Gaming (PS4/PS5, Xbox One/Series X/S)

- Mobile Gaming

- Cross-Platform

- By End-User:

- Casual Gamers

- Professional Esports Athletes

- Content Creators and Streamers

- By Distribution Channel:

- Online Retail (E-commerce)

- Offline Retail (Specialty Stores, Hypermarkets)

Value Chain Analysis For Gaming Headsets and Gaming Headphones Market

The value chain for Gaming Headsets and Gaming Headphones begins with the Upstream Analysis, focusing intensely on the sourcing of specialized raw materials and electronic components critical for audio performance and device functionality. This stage involves procurement of advanced materials for acoustic drivers (e.g., Neodymium magnets, specialized diaphragms), high-grade plastics and metals for robust chassis construction, and crucial electronic components such as Digital-to-Analog Converters (DACs), proprietary System-on-Chips (SoCs) for processing low-latency wireless signals, and high-quality microphone capsules for noise cancellation and voice transmission. Key upstream activities are concentrated in East Asia, particularly in regions specializing in microelectronics and precision manufacturing, where control over component costs and supply chain stability is paramount for maintaining profitability margins in the highly competitive mid-range and budget segments.

Mid-stream activities encompass manufacturing, assembly, quality assurance, and branding. Production often involves complex processes such as acoustic tuning, ensuring driver matching and sound signature consistency across batches, and integrating proprietary software ecosystems. Manufacturers invest heavily in product design and ergonomic research to ensure comfort during extended use—a critical differentiator. Once manufactured, the downstream phase focuses on market access through various distribution channels, encompassing both direct and indirect routes. Direct distribution channels, primarily through company-owned e-commerce platforms, allow manufacturers greater control over branding, pricing, and direct consumer engagement, offering specialized bundles and early access to new releases, which is highly valued by the tech-savvy gaming demographic. This direct approach often provides higher per-unit margins by bypassing traditional retail middlemen.

Indirect distribution remains essential, utilizing established channels such as large multinational retailers (Best Buy, MediaMarkt), specialized gaming peripheral stores, and large e-commerce marketplaces (Amazon, JD.com). This omni-channel approach ensures wide geographical reach and caters to consumers who prefer hands-on experience before purchase. Furthermore, strategic alliances with telecommunication providers, console manufacturers, and system integrators (PC builders) broaden market penetration. The efficiency of the distribution system, particularly fast fulfillment via e-commerce for new product launches, is a key competitive factor, especially considering the rapid obsolescence cycle inherent to gaming technology. Successful integration across the entire value chain—from cost-effective component sourcing to optimized, rapid distribution—determines a company's ability to capture market share and sustain competitive pricing.

Gaming Headsets and Gaming Headphones Market Potential Customers

The potential customer base for Gaming Headsets and Gaming Headphones is broadly categorized into distinct segments based on usage intensity, platform preference, and budget allocation. The most critical segment comprises the Dedicated Esports and Professional Gamers, who require flagship products characterized by zero-latency performance, exceptional directional audio accuracy (crucial for pinpointing enemy positions), extreme durability, and certified noise isolation for tournament environments. These customers prioritize technical specifications over cost and serve as influential brand advocates, validating product quality for the wider market. Their purchasing decisions are often informed by professional endorsements and technical reviews, driving demand for innovative features like custom driver materials and advanced noise-cancelling boom microphones. This high-end segment, while smaller in volume, is vital for driving ASPs and technological advancements within the industry.

The largest volume segment consists of Casual and Enthusiast Gamers, who engage in gaming for recreation across PC, console, and mobile platforms. These consumers seek a balance between performance, comfort, aesthetic appeal, and price. They are the primary drivers of growth in the mid-range and wireless segments, valuing versatility (cross-platform compatibility), comfortable ear cushions for long play sessions, and reliable battery life. Marketing efforts directed towards this group often emphasize immersive audio experiences (e.g., virtual 7.1 surround sound) and ease of use, leading to high adoption rates of plug-and-play wireless models. Their purchase behavior is heavily influenced by online reviews, peer recommendations, and promotional pricing during major shopping events, making effective e-commerce strategy essential for capturing this demographic.

A rapidly expanding customer cohort includes Content Creators, Live Streamers, and Vloggers, whose requirements often overlap with professional gamers but place an additional premium on aesthetic quality, reliable broadcast-quality microphones, and integration with streaming software (e.g., volume mixing capabilities). These users often invest in secondary backup units and prioritize devices that offer high compatibility with mixing boards and audio interfaces. Finally, the growing segment of Remote Workers and Students who also game sporadically represents a significant opportunity for multifunctional headsets. These consumers look for devices that excel both in gaming (low latency) and in professional communication (certified clarity and comfort for video conferencing), favoring sleek, professional aesthetics that transition seamlessly between work and play environments, thus broadening the market reach beyond purely dedicated gaming applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $6.6 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Razer Inc., SteelSeries ApS, Turtle Beach Corporation, Logitech International S.A. (ASTRO Gaming), HP Inc. (HyperX), Sennheiser Electronic GmbH & Co. KG, Corsair Gaming Inc., Sony Corporation, Microsoft Corporation (Xbox Accessories), Cooler Master Technology Inc., Audio-Technica Corporation, EPOS Audio, Beyerdynamic GmbH & Co. KG, Mad Catz Global Limited, ASUS ROG, JBL (Harman International), Xiaomi Corporation, Thrustmaster, Kingston Technology (HyperX), and Plantronics (Poly). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gaming Headsets and Gaming Headphones Market Key Technology Landscape

The technological landscape of the Gaming Headsets and Gaming Headphones Market is dynamically evolving, primarily centered on achieving superior audio performance combined with unparalleled user experience and seamless cross-platform integration. A cornerstone technology is ultra-low latency wireless communication, typically achieved using proprietary 2.4 GHz protocols rather than standard Bluetooth, which minimizes the delay between game audio generation and reproduction. Manufacturers leverage custom chipsets and advanced frequency hopping algorithms to maintain robust, interference-free connections critical for competitive gaming, where even milliseconds of delay can be detrimental. This push towards low-latency wireless is rapidly closing the performance gap that historically favored wired connections, making wireless convenience accessible to the professional tier.

Another crucial innovation driving the market is the development of advanced Spatial Audio technologies, often marketed as virtual 7.1 or 3D audio. These software and hardware solutions utilize sophisticated head-related transfer functions (HRTFs) and digital signal processing (DSP) to create an enveloping sound environment, allowing players to accurately perceive the direction and distance of sound sources. The most advanced systems incorporate proprietary sound engines optimized for specific console or PC platforms, providing precise positional cues that translate directly into competitive advantage in highly detailed acoustic game environments. Furthermore, Active Noise Cancellation (ANC) has moved beyond standard consumer applications; gaming ANC is optimized to block consistent, low-frequency noises (like PC fans or HVAC systems) while often maintaining high sensitivity for critical high-frequency in-game sounds, ensuring concentration without isolation from necessary audio cues.

The market is also witnessing increasing adoption of haptic feedback technology integrated into earcups, designed to translate low-frequency sound effects (explosions, engine rumble) into tangible vibrations, significantly enhancing immersion. Driver technology itself continues to advance, with manufacturers experimenting with planar magnetic drivers or hybrid drivers (combining dynamic and balanced armature components) to achieve wider frequency responses, superior transient clarity, and reduced harmonic distortion compared to traditional dynamic drivers. Finally, the proliferation of high-resolution audio codecs and integrated DACs/AMPs within the headsets ensures that the devices can process and reproduce complex 24-bit/96kHz audio streams, catering to audiophile gamers who demand both competitive performance and musical fidelity, further solidifying the technological sophistication defining the premium segment of the gaming audio market.

Regional Highlights

- Asia Pacific (APAC): APAC represents the most significant growth engine for the gaming audio market globally, driven by the region's vast population, rapidly expanding middle class, and the unparalleled dominance of mobile gaming. Countries like China, India, and Southeast Asian nations are seeing exponential growth in esports participation and viewership, leading to massive demand for affordable yet performance-oriented gaming peripherals. South Korea and Japan continue to be key innovators, driving demand for high-end components and culturally specific product designs (such as gaming IEMs). The regional market is characterized by intense price competition in the entry and mid-levels, but strong brand loyalty exists around established international and local peripheral manufacturers who aggressively sponsor regional esports leagues. The integration of gaming into cultural and academic curricula further sustains long-term demand.

- North America (NA): North America remains the leading market in terms of revenue and early adoption of premium technologies. The region boasts a highly mature gaming ecosystem, characterized by strong spending power, a large population of dedicated PC and console gamers, and a robust professional streaming culture. Consumers in NA prioritize high-fidelity wireless connectivity, superior comfort for extended sessions, and brand-name recognition associated with professional validation (e.g., esports team sponsorships). The market is heavily influenced by console refresh cycles and the continuous demand for cross-platform compatibility, driving manufacturers to focus on innovative features like integrated spatial audio licenses and advanced microphone noise reduction. Average selling prices (ASPs) are typically highest here due to strong demand for feature-rich, high-margin products.

- Europe: The European market exhibits strong regional diversity, with Western Europe showing similar maturation and high demand for quality as North America, particularly in Germany, the UK, and France. Eastern Europe and Russia are emerging markets with high growth potential, fueled by increasing disposable incomes and a burgeoning local esports scene. European consumers place a high value on ergonomic design, build quality, and multi-functional use (blending gaming with music listening). Regulatory pressures, particularly regarding recycling and material safety (e.g., REACH compliance), influence design and manufacturing choices more significantly than in other regions. The market is highly competitive, with strong local brands competing directly with global giants, often differentiating through design aesthetics and software customization capabilities tailored to localized gaming communities.

- Latin America (LATAM) and Middle East & Africa (MEA): While smaller in current volume, these regions offer substantial long-term growth opportunities. LATAM, led by Brazil and Mexico, is seeing increasing internet penetration and smartphone adoption, boosting the mobile gaming segment significantly, thereby driving demand for cost-effective, durable gaming audio solutions. The MEA region, particularly the GCC countries, benefits from high youth engagement in gaming and significant government investment in entertainment infrastructure, supporting the growth of dedicated gaming centers and professional events. Challenges include variable import tariffs and logistics complexities, often necessitating strong local distribution partnerships and strategically localized pricing models to ensure affordability and accessibility for the expanding consumer base in these promising, yet developing, markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gaming Headsets and Gaming Headphones Market.- Razer Inc.

- SteelSeries ApS

- Turtle Beach Corporation

- Logitech International S.A. (ASTRO Gaming)

- HP Inc. (HyperX)

- Sennheiser Electronic GmbH & Co. KG

- Corsair Gaming Inc.

- Sony Corporation

- Microsoft Corporation (Xbox Accessories)

- Cooler Master Technology Inc.

- Audio-Technica Corporation

- EPOS Audio

- Beyerdynamic GmbH & Co. KG

- Mad Catz Global Limited

- ASUS ROG

- JBL (Harman International)

- Xiaomi Corporation

- Thrustmaster

- Kingston Technology (HyperX)

- Plantronics (Poly)

Frequently Asked Questions

Analyze common user questions about the Gaming Headsets and Gaming Headphones market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth rate projection for the Gaming Headsets market?

The Gaming Headsets and Gaming Headphones Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven primarily by technological advancements in wireless fidelity and the expanding global esports infrastructure.

Which factors are driving the shift from wired to wireless gaming headsets?

The shift is primarily driven by advancements in proprietary 2.4 GHz ultra-low latency wireless technology, which offers performance comparable to wired connections while providing greater mobility and comfort, eliminating the constraints associated with physical cables for both console and PC users.

How significant is the impact of AI on modern gaming headset functionality?

AI significantly impacts the market through real-time noise cancellation algorithms for microphones, ensuring crystal-clear team communication by filtering out keyboard clicks and background noise, and through intelligent spatial audio processing that improves positional accuracy.

Which geographic region dominates the demand for premium gaming headsets?

North America currently leads the demand for premium, high-end gaming headsets due to high consumer disposable income, a mature PC and console gaming culture, and the strong influence of professional streamers and esports athletes setting hardware trends.

What are the key technical features differentiating professional esports headsets from casual models?

Professional esports headsets are differentiated by guaranteed zero-latency wired connectivity, superior passive noise isolation, highly sensitive directional audio drivers, and detachable, broadcast-quality boom microphones optimized specifically for tournament communication reliability and rigorous durability requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager