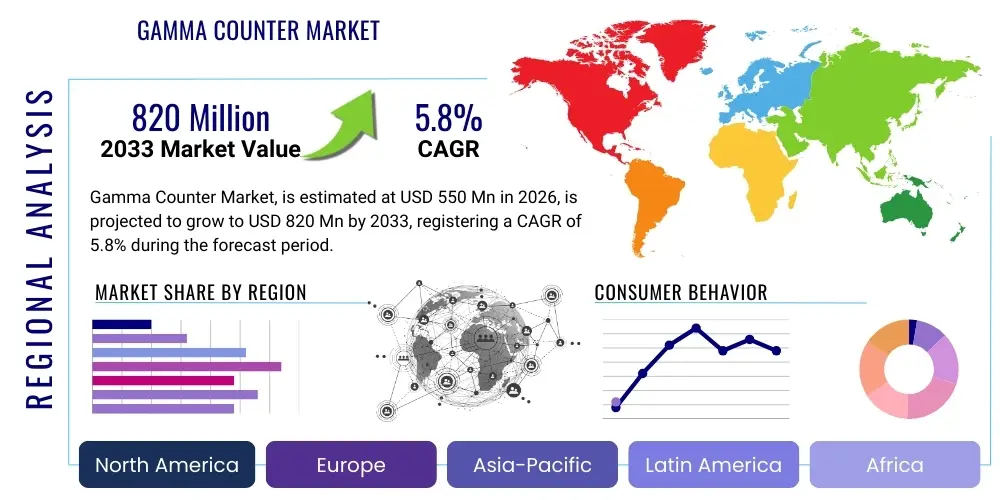

Gamma Counter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438241 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Gamma Counter Market Size

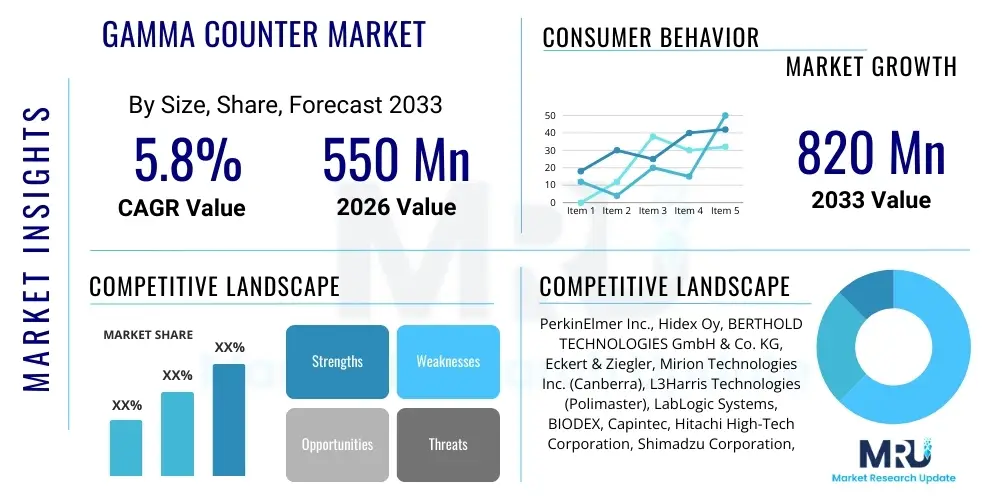

The Gamma Counter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 820 Million by the end of the forecast period in 2033.

Gamma Counter Market introduction

The Gamma Counter Market encompasses specialized analytical instruments essential for measuring radioactivity in biological samples, primarily utilized in nuclear medicine, radiochemistry, and various research applications. These devices quantify gamma radiation emitted by radioisotopes, providing critical data for diagnostic procedures such as radioimmunoassays (RIA), thyroid function tests, and chromium-51 red cell survival studies. The core functionality relies on a detector (often a sodium iodide crystal) that interacts with gamma rays, converting the energy into measurable electrical pulses, thereby enabling precise quantification of radionuclide concentration in the sample.

The increasing global prevalence of chronic diseases, particularly cancer and cardiovascular disorders, is significantly boosting the demand for diagnostic imaging and precise in-vitro testing methods where radioisotopes are key components. Gamma counters offer high sensitivity and throughput, making them indispensable tools in clinical laboratories, pharmaceutical companies conducting drug metabolism studies, and academic institutions involved in tracer kinetic research. Furthermore, the rising awareness and adoption of personalized medicine techniques, which often rely on detailed biochemical analysis using isotopic tracers, are propelling market expansion. The technological evolution toward automation and miniaturization is also enhancing the utility and accessibility of these systems across different healthcare settings.

Key driving factors supporting the sustained growth of this market include substantial investments in nuclear medicine infrastructure, particularly in emerging economies, alongside continuous advancements in radiopharmaceuticals that require accurate measurement instrumentation. Gamma counters provide distinct benefits, such as high efficiency in detecting low levels of gamma emission, crucial for patient safety and accurate diagnosis. However, regulatory frameworks governing radioactive materials and the high initial cost associated with procurement and maintenance present market challenges that stakeholders are actively addressing through strategic pricing and service models.

Gamma Counter Market Executive Summary

The Gamma Counter Market is characterized by steady technological evolution focusing on improving assay throughput, reducing sample preparation time, and enhancing integration capabilities with Laboratory Information Management Systems (LIMS). Current business trends indicate a strong shift towards automated, multi-detector systems capable of simultaneously processing multiple samples, thereby catering to high-volume clinical and research laboratories. Furthermore, manufacturers are increasingly developing benchtop, compact models that are more accessible to smaller hospitals and research institutions. Strategic partnerships between instrument providers and radiopharmaceutical developers are defining the competitive landscape, aiming to create integrated diagnostic solutions. Sustainability and safety in handling radioactive materials remain primary concerns, driving innovation in protective shielding and waste management protocols within new instrument designs.

Regionally, North America maintains market dominance due to robust healthcare spending, established nuclear medicine infrastructure, and the early adoption of advanced diagnostic technologies. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapidly expanding healthcare sectors in countries like China and India, increasing government initiatives supporting nuclear technology, and a growing patient pool requiring radioisotope diagnostics. European markets exhibit maturity but continue to invest in replacing older installations with state-of-the-art automated gamma counters, ensuring compliance with stringent European Union regulatory standards for medical devices and radioactive substance handling. The Middle East and Africa present nascent opportunities driven by new hospital constructions and growing international collaborations in medical research.

Segment trends highlight the dominance of automated gamma counters over manual systems due to their superior efficiency and reduced risk of human error. Within applications, oncology and endocrinology testing, particularly thyroid function assays and tumor marker studies, represent the most significant segments utilizing these instruments. The end-user segment is led by hospitals and diagnostic laboratories, which account for the largest volume of tests performed. Academic and research institutions also form a critical segment, driving demand for specialized, high-resolution gamma counting systems required for intricate research projects involving novel tracers and metabolic pathway analysis. The increasing regulatory pressure for quality control in pharmaceutical research is also boosting demand from biotechnology companies for high-precision validation instruments.

AI Impact Analysis on Gamma Counter Market

Common user questions regarding AI's influence on the Gamma Counter Market frequently revolve around how artificial intelligence and machine learning can enhance data analysis, improve the accuracy of counting measurements, and automate quality control processes. Users are concerned about whether AI can help overcome the inherent challenges associated with background radiation interference and the complex deconvolution of multi-tracer assays. Specifically, inquiries often target the potential for AI algorithms to streamline the labor-intensive aspects of radioimmunoassay data interpretation and to provide predictive maintenance alerts for high-value counting equipment. The synthesis of these concerns points toward a collective expectation that AI will transition gamma counting from a raw data acquisition process to an intelligent, error-corrected, and highly efficient diagnostic tool capable of handling the increasing complexity and volume of nuclear medicine data.

The integration of AI into the gamma counter ecosystem is moving beyond simple statistical analysis towards predictive modeling and autonomous system management. Machine learning algorithms are being trained on vast datasets of historical counting results, background noise fluctuations, and instrument performance metrics to detect anomalies in real-time, significantly improving the reliability of the output. This enhanced data processing capability is particularly vital in research environments where precise quantification of multiple isotopes concurrently (multiplexing) is required. Furthermore, AI tools are expected to aid in dose optimization for patients undergoing radiotracer procedures by modeling the decay kinetics and absorption rates, thereby indirectly increasing the accuracy requirements and reliance on the counter's initial measurement integrity. This shift emphasizes software superiority alongside hardware performance, reshaping future investment priorities for clinical laboratories.

- AI algorithms enable enhanced spectral deconvolution, improving the separation and quantification of multiple radioisotopes counted simultaneously.

- Machine learning facilitates predictive quality control and autonomous calibration procedures, reducing manual intervention and downtime.

- AI optimizes data interpretation in complex assays like RIA, offering faster and more accurate determination of binding kinetics and concentration levels.

- Integration of AI systems allows for real-time monitoring of background radiation, ensuring higher fidelity and reduced measurement uncertainty.

- AI-driven data analytics assist in regulatory compliance documentation and audit trail generation for radioisotope usage and disposal records.

DRO & Impact Forces Of Gamma Counter Market

The dynamics of the Gamma Counter Market are fundamentally shaped by the confluence of technological advancement in nuclear medicine, stringent regulatory oversight, and the economic accessibility of these specialized instruments. Drivers predominantly include the increasing incidence of target diseases requiring radioisotope diagnostics and the continuous development of novel radiopharmaceuticals demanding precise quantification tools. Conversely, the market faces significant restraints, notably the high initial capital expenditure required for purchasing gamma counters, the complex regulatory environment governing radioactive materials, and a shortage of skilled nuclear medicine technicians globally. Opportunities arise from expanding applications in non-traditional areas like environmental monitoring and food safety, alongside rapid infrastructure development in emerging economies. These forces collectively dictate the market trajectory, compelling manufacturers to focus on cost-efficiency, automation, and enhanced usability to maintain competitiveness and expand market penetration.

Key drivers center around the proliferation of diagnostic applications. The expanding use of Positron Emission Tomography (PET) and Single-Photon Emission Computed Tomography (SPECT) technologies indirectly increases the need for accurate in-vitro analysis using gamma counters for calibration and ancillary studies. Specifically, the rising adoption of targeted radioisotope therapies (Theranostics) necessitates rigorous pre-treatment and post-treatment measurement protocols, boosting the demand for high-accuracy, high-throughput gamma counting systems in specialized nuclear pharmacies and hospitals. Technological drivers, such as the shift from traditional photomultiplier tubes (PMTs) to advanced silicon photomultipliers (SiPMs), offer improved energy resolution and reduced footprint, making advanced systems more desirable and driving replacement cycles in established markets.

Restraints are dominated by economic and operational hurdles. The cost of owning and maintaining gamma counting equipment, including specialized consumables and mandatory safety infrastructure (e.g., lead shielding), is substantial, particularly challenging for smaller clinics. Furthermore, the handling and disposal of radioactive waste generated during testing involve strict, costly compliance procedures, which can deter some facilities from adopting these technologies. Opportunities, however, lie in innovative business models such as leasing and centralized testing services, which mitigate the high upfront investment. The most impactful opportunities are geographical, focused on penetrating untapped markets in Latin America and Southeast Asia, where healthcare modernization efforts are accelerating, creating new procurement cycles for essential diagnostic tools.

Segmentation Analysis

The Gamma Counter Market is fundamentally segmented based on factors including the type of instrument technology utilized, the specific applications for which they are deployed, and the end-user setting where the testing is conducted. This structured segmentation allows market participants to tailor their product offerings and strategic focus areas, addressing the distinct needs of diverse laboratory environments, from high-throughput clinical diagnostics to specialized research applications. Understanding these segments is crucial for forecasting growth patterns, as different technologies (like automatic versus manual systems) exhibit varying adoption rates based on regional economic capabilities and regulatory demands. The primary axis of differentiation remains between automated multi-well systems designed for efficiency and single-well systems favored for precision research.

Segmentation by application reflects the core utility of gamma counters in diagnosing and managing various diseases. The dominant segments include endocrinology (especially thyroid disorders and hormonal analysis), oncology (tumor marker assays and therapeutic monitoring), and immunology (radioimmunoassays for antibody detection). This application diversity underscores the instrument's versatility. Technological segmentation differentiates based on throughput capacity and automation level, where the transition from manual, single-detector systems to fully automated, shielded changers (e.g., 10-detector systems) is a key market trend driven by the need for minimizing technician exposure and maximizing laboratory productivity, particularly in high-volume hospital labs.

The end-user segment distribution illustrates where the purchasing power resides, with hospitals and diagnostic laboratories being the cornerstone consumers due to their direct patient service capacity. Academic and research institutions, while smaller in volume, drive demand for the latest high-resolution models necessary for groundbreaking studies and clinical trials. Pharmaceutical and biotechnology companies represent a high-growth end-user segment, driven by the increasing application of radiolabeled compounds in drug discovery, pharmacokinetics, and clinical trial efficacy assessment, demanding instruments that offer both regulatory compliance and extreme measurement accuracy.

- By Product Type:

- Automated Gamma Counters (Multi-well Systems)

- Manual/Single-well Gamma Counters

- Benchtop Gamma Counters

- Floor-standing Gamma Counters

- By Application:

- Clinical Diagnostics (RIA, IRMA, Thyroid Uptake)

- Research and Academic Studies (Tracer Kinetics, Receptor Binding)

- Pharmaceutical and Biotechnology (Drug Metabolism, PK/PD Studies)

- Environmental and Industrial Monitoring

- By End-User:

- Hospitals and Clinics

- Diagnostic and Reference Laboratories

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

Value Chain Analysis For Gamma Counter Market

The value chain for the Gamma Counter Market begins with the upstream suppliers responsible for core components, primarily encompassing specialized detector materials like high-grade Sodium Iodide (NaI) crystals, photomultiplier tubes (or SiPMs), advanced electronics (including high-voltage power supplies and signal processing circuitry), and specialized lead shielding materials. These suppliers must adhere to extremely tight quality control standards, as the purity and consistency of the detector crystal directly impact the instrument's performance and energy resolution. Strategic relationships with niche suppliers of these proprietary components are crucial for ensuring cost efficiency and continuity of supply, especially for maintaining the quality required for accurate nuclear measurements.

The core manufacturing stage involves the precision engineering and assembly of these components into functional gamma counters. This stage includes complex software development for data acquisition, processing, and integration with laboratory systems, which adds significant value to the final product. Manufacturers differentiate themselves through automation capabilities, software interface usability, and the integration of robust safety features, particularly in the handling and containment of radioactive samples. Downstream activities involve distribution channels, which are bifurcated into direct sales teams for major institutional clients (large hospitals, government research labs) and third-party specialized distributors who provide localized sales, technical support, and critical maintenance services, especially in geographically dispersed or emerging markets.

The final crucial steps involve installation, validation, and post-sale support, which are highly specialized given the technical nature and regulatory demands of gamma counters. Training end-users (nuclear medicine technicians and lab personnel) on safe operation, calibration, and routine maintenance is essential. Direct and indirect channels both play a role; direct channels ensure maximum control over the sales and service experience for high-value contracts, while indirect channels provide the necessary regional reach and expertise required for rapid market penetration and localized regulatory adherence. The efficiency of the distribution and service network significantly influences overall customer satisfaction and subsequent purchasing decisions, emphasizing the importance of a robust global service infrastructure.

Gamma Counter Market Potential Customers

The primary consumers and potential customers for Gamma Counters are highly specialized institutions within the healthcare and life sciences sectors that routinely handle radioisotopes for diagnostic, therapeutic, or research purposes. Leading this group are large hospital systems and specialized nuclear medicine departments that require multi-well, automated systems for high-volume clinical testing, particularly thyroid function tests, anemia diagnosis, and various hormonal assays utilizing Radioimmunoassay (RIA) techniques. These organizations prioritize system reliability, speed, and seamless integration with existing Electronic Health Record (EHR) and Laboratory Information Management (LIM) systems, ensuring efficient patient throughput and accurate record keeping.

Diagnostic and reference laboratories constitute another major customer segment. These labs often process samples outsourced by smaller clinics and hospitals, requiring instruments capable of 24/7 high-throughput operation and stringent quality assurance protocols to maintain accreditation. Furthermore, academic and government research institutions, including specialized university laboratories and national institutes of health, are critical customers. They typically purchase the most advanced, high-resolution manual and automated counters for complex basic science research, drug discovery, and method development studies, focusing on performance specifications over sheer volume capacity.

The rapidly growing pharmaceutical and biotechnology industries represent an accelerating customer base. These companies utilize gamma counters extensively in preclinical and clinical drug development stages, specifically for Pharmacokinetic/Pharmacodynamic (PK/PD) studies, measuring drug metabolism, and validating receptor binding affinities using radiolabeled tracers. Regulatory mandates necessitate precise measurements in these fields, driving demand for validated, compliant instruments. Additionally, specialized entities such as nuclear pharmacies and environmental monitoring agencies also constitute niche but stable customer segments requiring customized instrumentation for handling large volumes of environmental or pharmaceutical preparation samples.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 820 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PerkinElmer Inc., Hidex Oy, BERTHOLD TECHNOLOGIES GmbH & Co. KG, Eckert & Ziegler, Mirion Technologies Inc. (Canberra), L3Harris Technologies (Polimaster), LabLogic Systems, BIODEX, Capintec, Hitachi High-Tech Corporation, Shimadzu Corporation, FujiFilm Healthcare, Atomtex, ORTEC, Spectrum Techniques. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gamma Counter Market Key Technology Landscape

The technology landscape of the Gamma Counter Market is characterized by continuous refinement aimed at enhancing efficiency, safety, and data quality. The most significant technological evolution involves the shift from traditional single-detector, manual systems to sophisticated multi-detector, automated instruments. Automated systems, often featuring 10 or more detectors and integrated robotic sample changers, are critical for high-throughput environments, drastically reducing measurement time and minimizing personnel exposure to radioactive materials. Furthermore, advancements in scintillation material purity, particularly in Sodium Iodide (NaI(Tl)) crystals, are leading to improved spectral resolution, which is essential for accurate quantification of samples containing multiple isotopes.

Another crucial area of innovation is in the signal processing electronics. Modern gamma counters increasingly incorporate advanced digital pulse processing (DPP) techniques, replacing older analog circuitry. DPP offers superior energy linearity and stability, allowing for more precise energy windowing and background subtraction. This digital approach enhances the instrument's ability to discriminate between different radioisotopes, crucial for multiplexed assays in research and complex clinical diagnostic panels. The integration of solid-state detectors, while still niche compared to NaI, also represents a growing trend, offering benefits in miniaturization and reduced maintenance requirements, suitable for portable or benchtop units.

Software and connectivity also define the competitive technology landscape. Contemporary gamma counter systems feature LIMS and EHR integration capabilities, enabling seamless data transfer and centralized management, thereby enhancing regulatory compliance and operational efficiency in clinical settings. Furthermore, manufacturers are focusing on user interface design, developing intuitive, touchscreen interfaces that simplify complex setup and calibration procedures. Remote diagnostics and preventative maintenance capabilities, often utilizing cloud-based platforms and data analytics, are becoming standard, ensuring maximum instrument uptime and reducing total cost of ownership for end-users operating high-value equipment globally.

Regional Highlights

- North America (United States and Canada): This region dominates the global Gamma Counter Market, characterized by high adoption rates of advanced nuclear medicine technologies and substantial investment in healthcare infrastructure. The presence of major market players, coupled with favorable government policies supporting clinical research and the widespread use of radioisotopes in diagnostics (particularly in oncology and cardiology), solidifies its leading position. The robust regulatory environment ensures high quality standards for instrumentation, driving demand for automated, compliant systems.

- Europe (Germany, UK, France): Europe represents a mature market with steady growth, driven primarily by the replacement of aging infrastructure and adherence to strict European Union directives regarding medical device performance and radiation safety. Strong research collaboration between academic institutions and pharmaceutical industries, particularly in countries like Germany and the UK, sustains demand for high-precision gamma counting systems for clinical trials and novel radiopharmaceutical development.

- Asia Pacific (China, India, Japan): APAC is projected to be the fastest-growing region, owing to rapidly expanding healthcare expenditure, increasing incidence of lifestyle-related and chronic diseases, and governmental focus on improving diagnostic capabilities. Countries such as China and India are making significant investments in nuclear medicine centers, creating large, untapped markets for both automated clinical counters and benchtop research units.

- Latin America (Brazil, Mexico): The market in Latin America is characterized by emerging opportunities driven by modernization efforts in healthcare facilities and increasing foreign investment in pharmaceutical manufacturing and clinical trials. Economic variability and uneven distribution of advanced medical technology remain challenges, but centralized government tenders for large hospital groups provide key entry points for international manufacturers.

- Middle East and Africa (MEA): This region is experiencing nascent growth, largely concentrated in Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which are heavily investing in medical tourism and building specialized healthcare cities. Demand is focused on state-of-the-art equipment to meet international standards, though widespread adoption is limited by fragmented healthcare access in parts of Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gamma Counter Market.- PerkinElmer Inc.

- Hidex Oy

- BERTHOLD TECHNOLOGIES GmbH & Co. KG

- Eckert & Ziegler

- Mirion Technologies Inc. (Canberra)

- L3Harris Technologies (Polimaster)

- LabLogic Systems

- BIODEX

- Capintec

- Hitachi High-Tech Corporation

- Shimadzu Corporation

- FujiFilm Healthcare

- Atomtex

- ORTEC

- Spectrum Techniques

- General Electric Healthcare

- Philips Healthcare

- Carestream Health

- Mediso Medical Imaging Systems

- Comecer S.p.A.

Frequently Asked Questions

Analyze common user questions about the Gamma Counter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of an automated gamma counter in a clinical setting?

Automated gamma counters are primarily used in clinical diagnostics for high-throughput quantitative analyses, including Radioimmunoassays (RIA), Immunoradiometric Assays (IRMA), testing for thyroid function, measuring hormone levels, and conducting various studies utilizing chromium-51 tracers for red cell survival.

How does AI impact the operational efficiency of modern gamma counting systems?

AI integration improves operational efficiency by automating quality control, enabling real-time background noise correction, and accelerating complex data processing like spectral deconvolution, which is crucial for high-accuracy multi-isotope measurements.

Which geographical region exhibits the fastest growth rate for the Gamma Counter Market?

The Asia Pacific (APAC) region, driven by rapid healthcare infrastructure development, increasing investments in nuclear medicine, and a large patient population, is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period.

What is the main restraint challenging the global adoption of gamma counter technology?

The major restraint is the significant initial capital expenditure required to purchase, install, and shield gamma counter equipment, coupled with the high recurring costs associated with complying with strict regulatory standards for handling and disposing of radioactive waste.

What is the key technological advancement driving the replacement cycle in developed markets?

The key technological advancement is the shift towards advanced multi-detector automated systems utilizing digital pulse processing (DPP) technology, offering enhanced spectral resolution, improved throughput, and seamless integration with LIMS for superior data management.

What is the difference between single-well and multi-well gamma counters?

Single-well gamma counters are typically manual, offering high sensitivity and precision ideal for research or low-volume specialized tests. Multi-well (or automated) systems contain multiple detectors and automated sample changers, providing high throughput for clinical laboratories needing to process numerous samples rapidly.

Which specific radioisotopes are commonly measured using gamma counters in diagnostic labs?

Commonly measured radioisotopes include Iodine-125 (I-125) for RIA, Chromium-51 (Cr-51) for red cell studies, Cobalt-57 (Co-57) used as a source check, and sometimes Technetium-99m (Tc-99m) when measured in peripheral blood samples or specific biological fluids.

How do gamma counters ensure radiation safety for laboratory personnel?

Safety is ensured through robust internal and external lead shielding designed to minimize external radiation exposure, coupled with integrated automated sample handling systems that reduce the need for technicians to manually handle radioactive materials frequently.

What role do gamma counters play in pharmaceutical development?

In pharmaceutical development, gamma counters are crucial for Pharmacokinetic/Pharmacodynamic (PK/PD) studies, measuring the distribution, metabolism, and excretion of radiolabeled drugs, and assessing receptor binding characteristics during preclinical and clinical trials.

Is there a trend toward miniaturization in the gamma counter market?

Yes, there is a distinct trend toward developing smaller, benchtop, and even portable gamma counters, driven by the need for localized testing in smaller clinics, specialized field research, and mobile laboratory settings, often enabled by solid-state detector technology.

What are the primary upstream materials required for manufacturing gamma counters?

Primary upstream materials include high-purity thallium-activated Sodium Iodide (NaI(Tl)) crystals, specialized Photomultiplier Tubes (PMTs) or Silicon Photomultipliers (SiPMs), and dense lead or tungsten alloys used for internal and external radiation shielding.

How significant is the maintenance cost for floor-standing automated gamma counter systems?

Maintenance costs are significant, encompassing routine calibration checks, replacement of high-voltage components, mandatory regulatory inspections of shielding integrity, and software licensing fees, making comprehensive service contracts essential for major institutions.

What specific types of clinical diagnostics rely heavily on gamma counter technology?

Clinical diagnostics heavily reliant on this technology include endocrinology panels (e.g., TSH, free T3/T4 measurement), certain viral marker assays, blood banking quality checks, and monitoring residual activity in samples following therapeutic radioisotope administration.

Why is the integration of LIMS important for modern gamma counter users?

LIMS integration is vital for automating the workflow, reducing manual data entry errors, ensuring seamless patient data management, tracking quality control runs, and maintaining complete, auditable regulatory compliance records for radioisotope usage.

How are environmental monitoring agencies utilizing gamma counter technology?

Environmental agencies use gamma counters to measure low levels of naturally occurring and man-made radioisotopes (e.g., Cesium-137, Iodine-131) in soil, water, and air samples, ensuring public safety and monitoring compliance with radiation protection standards.

What is the role of digital pulse processing (DPP) in enhancing counter performance?

DPP significantly enhances performance by improving signal-to-noise ratio, providing better energy resolution, and ensuring long-term stability in calibration, allowing instruments to accurately quantify radioisotopes even in complex mixtures or samples with high background interference.

Which end-user segment drives the largest volume demand for gamma counters?

Hospitals and large diagnostic laboratories drive the largest volume demand, primarily due to their need for high-throughput automated systems necessary to manage the continuous stream of patient samples requiring routine diagnostic radioimmunoassays and related tests.

What opportunities are driving market growth in emerging economies like India and China?

Opportunities are driven by increasing government investment in public health infrastructure, the construction of new specialized hospitals and nuclear medicine facilities, and the growing accessibility of advanced medical technologies supported by international manufacturers.

How does the regulatory environment influence the market dynamics of gamma counter sales?

Strict regulatory frameworks (e.g., FDA, EU directives) necessitate that new instruments adhere to rigorous safety and performance standards, increasing development costs but also driving demand for high-quality, fully compliant, and traceable automated systems, favoring established manufacturers.

Besides NaI crystals, what other detector technologies are being explored in this market?

Advanced detector technologies being explored include various types of solid-state detectors, such as Silicon Photomultipliers (SiPMs) and Cadmium Zinc Telluride (CZT) detectors, which offer advantages in compactness, energy resolution, and operational simplicity.

What specific challenges does the shortage of skilled personnel pose to the market?

The shortage of skilled nuclear medicine technologists and physicists increases operational strain on labs, driving the market demand for highly automated, user-friendly gamma counters that require minimal specialized training for routine operation and maintenance procedures.

How is the concept of Theranostics influencing the demand for gamma counters?

The increasing use of Theranostics (combining therapy and diagnostics using radioisotopes) is raising the demand for ultra-precise gamma counters needed for dose calibration, quality assurance of therapeutic compounds, and detailed post-therapy bio-sample analysis.

What is the role of distributors in the downstream value chain of gamma counters?

Specialized distributors provide crucial downstream services including localized sales, technical expertise, installation and validation support, and immediate maintenance services, which are critical for supporting complex, high-value equipment in various geographical locations.

How do manufacturers ensure the long-term stability and calibration accuracy of gamma counters?

Manufacturers ensure stability through advanced thermal control systems, robust shielding design, built-in automated calibration routines using reference sources (like Cs-137 or Ba-133), and increasingly, AI-driven predictive maintenance algorithms.

What is the estimated Compound Annual Growth Rate (CAGR) for the forecast period?

The Gamma Counter Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between the years 2026 and 2033, driven by technological advancements and expanding clinical applications globally.

In the context of the supply chain, why are quality control standards critical for detector material suppliers?

Quality control standards are paramount because the performance metrics of the gamma counter, particularly its sensitivity and spectral energy resolution, are directly dependent on the purity, consistency, and structural integrity of the supplied NaI detector crystals.

What market trend is observed concerning the integration of robotic sample handlers?

There is a strong market trend towards integrating sophisticated robotic sample handlers with multi-detector gamma counters to significantly increase throughput, minimize human error, and reduce the occupational radiation exposure risk for laboratory staff.

Which application segment currently holds the largest market share in the Gamma Counter Market?

The Clinical Diagnostics application segment, encompassing routine tests such as radioimmunoassays and thyroid function tests, currently holds the largest share of the Gamma Counter Market due to the high volume of procedures performed globally.

How do gamma counters contribute to quality assurance in blood banking?

Gamma counters are utilized in blood banking for quality assurance checks, particularly in chromium-51 red cell survival studies and sometimes for verifying the sterility or integrity of certain blood components by monitoring trace radioactive markers.

What economic factors primarily restrain market growth in Latin America and MEA?

In Latin America and MEA, market growth is primarily restrained by volatile economic conditions, currency fluctuations affecting import costs, and the lack of widespread specialized medical insurance coverage necessary to support expensive nuclear medicine procedures.

Describe the role of cloud computing in the evolution of gamma counter technology.

Cloud computing facilitates remote monitoring, centralized data storage and backup, secure sharing of large clinical datasets for multi-center studies, and enables manufacturers to deploy software updates and predictive maintenance alerts efficiently to global installations.

What competitive differentiation strategies are key players employing?

Key players are focusing on product differentiation through enhanced automation features, superior software analytics incorporating AI/ML, offering comprehensive service and training packages, and developing compact, cost-effective benchtop models for non-traditional settings.

How is the demand for research-grade gamma counters influenced by academic funding?

Demand for research-grade counters is highly sensitive to academic and government funding cycles for basic science, requiring instruments that offer maximum flexibility, high sensitivity, and specialized features for novel tracer development and complex metabolic studies.

What factors are driving the replacement cycle of older gamma counter models?

The replacement cycle is driven by the need to upgrade to systems offering higher throughput, better energy resolution, improved safety features to meet current standards, and connectivity capabilities (LIMS integration) that older analog systems lack.

In oncology, how are gamma counters used for therapeutic monitoring?

Following radiopharmaceutical therapy (e.g., Iodine-131 therapy), gamma counters are used to measure residual activity in patient bio-samples or waste materials to ensure safe release criteria are met and to monitor the effectiveness of the treatment.

What is the significance of the shift from PMTs to SiPMs in detector technology?

The shift towards Silicon Photomultipliers (SiPMs) allows for detector miniaturization, operates at lower voltages, offers immunity to magnetic fields, and potentially provides better uniformity and stability compared to traditional large Photomultiplier Tubes (PMTs).

How do manufacturers address the challenge of background radiation interference?

Manufacturers address interference through heavy lead shielding (internal and external), implementation of robust software algorithms for background subtraction, and sophisticated energy windowing techniques to isolate the specific gamma emission of interest.

Which economic regions primarily focus on replacing existing equipment rather than new market expansion?

Mature markets, specifically North America and Western Europe, primarily focus on replacing existing, often outdated, gamma counter equipment to adopt current technological advancements and comply with updated regulatory safety mandates.

What role does standardization play in the value proposition of gamma counter systems?

Standardization in measurements and protocols (e.g., NIST traceability) is crucial, providing regulatory confidence, ensuring inter-laboratory comparison accuracy, and validating the reliability of clinical diagnostic results across different institutions.

How do geopolitical factors affect the supply chain for gamma counter components?

Geopolitical tensions can impact the supply chain by affecting the availability and cost of critical rare earth elements used in detector systems and high-purity lead shielding, necessitating diversified sourcing strategies by major manufacturers.

What types of training are essential for end-users of specialized gamma counters?

Essential training includes radiation safety protocols, routine instrument calibration and quality control procedures, advanced assay preparation techniques (e.g., RIA kits), and troubleshooting software and hardware malfunctions unique to nuclear medicine devices.

How do clinical laboratories justify the high capital expenditure for automated gamma counters?

Clinical laboratories justify the high cost through the long-term benefits of increased patient throughput, reduced manual labor costs, minimized risk of human error, and the ability to offer a broader range of high-reimbursement specialized diagnostic tests.

What are the key drivers for the Pharmaceutical and Biotechnology end-user segment?

This segment is driven by the regulatory requirement for detailed radiolabeling studies during drug development, the increasing sophistication of tracer methodologies, and the need for validated, high-accuracy instruments for pharmacokinetic modeling.

Describe the major difference between a gamma counter and a liquid scintillation counter (LSC).

A gamma counter measures gamma rays, typically utilizing NaI crystals, suitable for isotopes like I-125. An LSC measures low-energy beta emissions (like H-3 or C-14) dissolved in a scintillation cocktail, which converts energy into detectable light pulses.

What are the current technological limitations in multi-tracer gamma counting?

Current limitations involve the difficulty in accurately deconvolving the overlapping spectra of multiple gamma-emitting isotopes, especially when their energy peaks are closely spaced, requiring sophisticated software and high-resolution detectors.

How are environmental gamma counters adapted for field use?

Field-adapted environmental counters are often portable, utilize ruggedized materials, sometimes employ solid-state detectors, and are designed with battery power options to perform immediate, on-site quantification of radioactivity in various environmental media.

What emerging market application is showing potential for gamma counter adoption?

An emerging application is in veterinary nuclear medicine, where specialized gamma counters are being adopted by large animal hospitals and research facilities for performing diagnostic procedures and kinetic studies on companion animals and livestock.

What is the expected market valuation of the Gamma Counter Market by 2033?

The Gamma Counter Market is projected to reach an estimated valuation of USD 820 Million by the end of the forecast period in 2033, reflecting steady growth driven by global health investments.

How does the global shortage of medical isotopes affect the gamma counter market?

While not a direct restraint on instrument sales, isotope shortages necessitate maximum efficiency and accuracy in counting procedures, increasing the demand for advanced, highly reliable gamma counters that minimize sample loss and ensure reliable results from limited resources.

Which segment within Product Type holds the dominant market share?

Automated Gamma Counters (Multi-well Systems) hold the dominant market share within the Product Type segment, primarily due to their crucial role in high-throughput clinical diagnostic settings worldwide.

What is the core benefit of utilizing gamma counters over other radioactivity detection methods?

The core benefit is the instrument's high sensitivity and ability to efficiently detect and quantify gamma radiation emitted from samples without the need for complex, messy, and costly scintillation cocktails required by liquid scintillation counters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager