Gamma Radioactive Sources Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438398 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Gamma Radioactive Sources Market Size

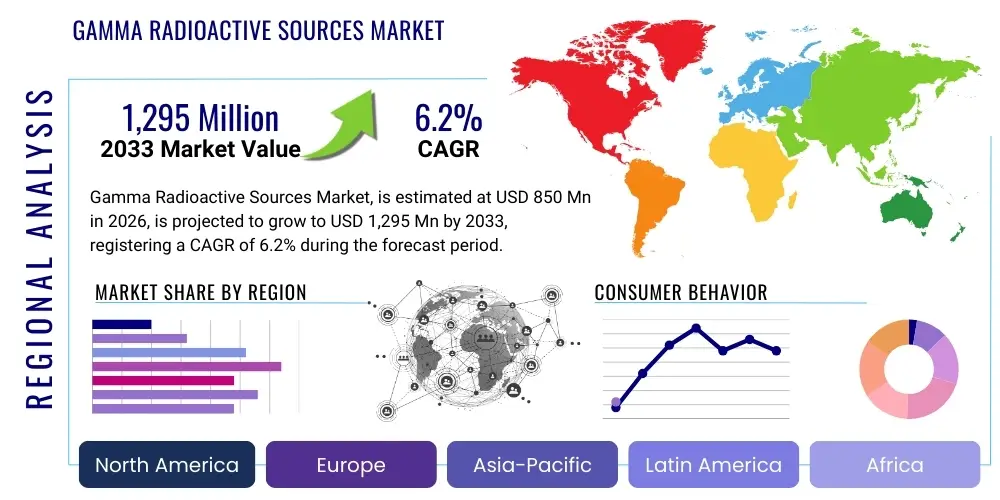

The Gamma Radioactive Sources Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,295 Million by the end of the forecast period in 2033. This growth is primarily driven by expanding applications in industrial automation, heightened global security concerns necessitating advanced inspection techniques, and the continued deployment of nuclear medicine procedures requiring reliable, high-integrity gamma emitters. The market size reflects the increasing demand for isotopes such as Cobalt-60 (Co-60), Iridium-192 (Ir-192), and Cesium-137 (Cs-137) across various critical sectors globally.

Gamma Radioactive Sources Market introduction

The Gamma Radioactive Sources Market encompasses the production, encapsulation, distribution, and disposal of sealed radioactive sources that emit gamma radiation. These sources are engineered components containing radioactive material securely encased in durable, non-radioactive containers, preventing leakage and ensuring safe handling while allowing the penetration of gamma rays for their intended application. Gamma sources are indispensable in numerous high-reliability fields due to their high penetrating power, stability, and predictable decay rates, which provide consistent performance over extended periods. Applications range critically from industrial radiography used for non-destructive testing (NDT) of welds and structures in aerospace and oil pipelines, to large-scale sterilization of medical devices and food products, and depth measurements in the geophysical logging sector. The stringent safety regulations surrounding their transport and usage necessitate sophisticated material science and rigorous quality control in manufacturing.

Key products within this market include isotopes utilized for calibration standards, thickness gauging, level sensing, and moisture density measurement, alongside major industrial applications like sterilization (using high-activity Co-60 sources) and cancer therapy (brachytherapy and external beam therapy using specific gamma emitters). The inherent benefits of gamma sources, such as their long service life, high energy output, and robust design, make them superior alternatives in environments where X-ray systems are impractical or cost-prohibitive. Furthermore, the stability of gamma radiation allows for precise measurement and control in automated industrial processes, driving efficiency and reliability in critical manufacturing and infrastructure projects. The market growth is intrinsically linked to global industrial expansion, particularly in emerging economies where infrastructure development requires extensive quality assurance measures.

Driving factors for the market include increasing infrastructure spending, leading to greater demand for NDT services; the rapid growth of the healthcare industry, necessitating sterilization of single-use medical equipment; and stricter global safety standards in the oil and gas sector requiring regular structural integrity assessments. The shift towards automated production processes also favors reliable, continuous-monitoring technologies like gamma gauges. However, market dynamics are heavily influenced by the high initial cost of sources, the complex regulatory burden associated with radioactive materials management, and the substantial costs related to eventual source disposal and recycling, which necessitates continuous innovation in source management and longevity.

Gamma Radioactive Sources Market Executive Summary

The Gamma Radioactive Sources Market is characterized by moderate but stable growth, underpinned by non-discretionary demand from critical infrastructure and healthcare sectors. Business trends highlight a consolidation among major source manufacturers focused on vertical integration to control the entire lifecycle, from isotope production (often subsidized by national nuclear programs) to final disposal services. A key technological trend is the development of smaller, higher-activity sources utilizing advanced encapsulation techniques (e.g., double encapsulation using inert metals like Hastelloy or stainless steel) to enhance safety and durability. Furthermore, there is a growing emphasis on minimizing regulatory risk through specialized logistics and source tracking systems, driven by international security protocols and IAEA guidelines. The market remains oligopolistic, with barriers to entry defined by specialized manufacturing capabilities, regulatory licenses, and high capital investment in hot cells and testing facilities. Companies are increasingly investing in research focused on alternative, shorter-lived isotopes or non-radioactive alternatives (like advanced linear accelerators for NDT) to mitigate long-term disposal liabilities, although gamma sources remain dominant in specific high-penetration applications.

Regional trends indicate that North America and Europe, while mature markets, command the largest share due to well-established industrial NDT infrastructure, advanced healthcare systems, and strict safety regulations mandating rigorous inspections. However, the highest growth rates are projected in the Asia Pacific (APAC) region, fueled by massive investments in infrastructure (roads, bridges, pipelines, and power generation), rapid industrialization, and the expansion of medical sterilization facilities in countries like China, India, and Southeast Asia. Regulatory environments vary significantly by region, with the U.S. (NRC) and Europe (EURATOM directives) maintaining strict control over source use and disposal, driving demand for specialized compliance services. Latin America and the Middle East and Africa (MEA) present opportunities primarily tied to the oil and gas exploration sectors and emerging medical infrastructure, where portable and reliable field-deployable sources are highly valued.

Segmentation trends show that industrial applications, particularly non-destructive testing and industrial gauging, represent the largest market segment due to the pervasive need for quality control in manufacturing and construction. The isotope type segmentation highlights Cobalt-60 and Iridium-192 as key revenue generators, with Co-60 dominating high-volume sterilization and Ir-192 being crucial for portable field radiography. While the use of Cs-137 in industrial gauges is stable, there is a gradual shift towards alternative technologies in certain non-critical applications due to heightened security concerns associated with high-activity sources. The medical segment is growing steadily, supported by the increasing global cancer incidence and the resultant demand for high-precision brachytherapy sources. Overall, the market is shifting toward sources optimized for safer handling, reduced shielding mass, and enhanced integration with digital monitoring systems to meet both regulatory and operational efficiency demands across all major end-use sectors.

AI Impact Analysis on Gamma Radioactive Sources Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Gamma Radioactive Sources Market primarily revolve around three core themes: optimizing safety and regulatory compliance, enhancing the efficiency and quality of NDT procedures, and automating the logistics and inventory management of sensitive radioactive materials. Users frequently ask how AI can predict source degradation, automate shielding calculations, or utilize machine learning to interpret complex radiographic images more accurately and faster than human inspectors. There is also significant interest in AI's role in proactive security monitoring, aiming to reduce the risk associated with "orphaned" or misused sources. Expectations center on AI transforming source management from a reactive, manual process into a predictive, automated, and hyper-compliant system. This shift is expected to decrease operational risks, minimize human exposure, and optimize the use cycle of high-value sources, thus addressing the industry's most critical regulatory and safety concerns.

The integration of AI into this highly specialized domain focuses heavily on data analytics derived from sensor-equipped source holders and monitoring systems. Machine learning algorithms are being trained on vast datasets of radiation measurements, environmental conditions, and source history to predict anomalies, optimize source calibration cycles, and determine the optimal replacement timing, maximizing utility while minimizing waste. Furthermore, in industrial radiography, AI-powered image recognition systems are dramatically improving defect detection rates. By analyzing radiographic film or digital detector array images, AI can identify microscopic flaws and categorize defects with unparalleled consistency, speeding up inspection processes crucial for sectors like pipeline integrity management and aerospace manufacturing. This capability not only reduces the time required for inspection but also minimizes the radiation exposure duration for operators, adhering to ALARA (As Low As Reasonably Achievable) principles.

Additionally, AI plays a crucial role in enhancing the security and supply chain integrity of gamma sources. Sophisticated algorithms are used to track sources in transit and storage, monitoring geolocation, temperature, and shock data in real time, alerting operators to potential security breaches or deviations from established safety envelopes. Predictive modeling helps logistics companies plan optimal, safest routes, navigating regulatory requirements across borders efficiently. This technological enhancement addresses the high-stakes security challenges associated with high-activity sources, ensuring compliance with global security initiatives such as those set by the IAEA. The application of AI is thus central to ensuring both operational efficiency and the highest level of nuclear security within the market.

- AI optimizes radiographic image analysis, improving defect detection accuracy and reducing inspection time in Non-Destructive Testing (NDT).

- Machine learning models predict source decay rates and optimal replacement schedules, maximizing source utility and minimizing radioactive waste.

- AI-driven sensor networks enhance real-time tracking and security monitoring of sources during transit and storage, mitigating theft and loss risks.

- Automated compliance auditing using AI minimizes regulatory non-conformance, particularly regarding source inventory and disposal procedures.

- Robotics and AI interface systems automate source handling in high-dose environments, significantly reducing human radiation exposure (ALARA adherence).

- Predictive maintenance algorithms improve the reliability of source delivery systems (e.g., projectors used in industrial radiography).

DRO & Impact Forces Of Gamma Radioactive Sources Market

The market for Gamma Radioactive Sources is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. Key drivers include mandatory regulatory testing for critical infrastructure integrity, the robust growth in medical sterilization demand globally, and the consistent need for reliable, penetrating radiation sources in harsh industrial environments like deep-sea oil exploration and high-temperature manufacturing. These intrinsic demands ensure a baseline level of market stability. However, the market faces significant restraints, primarily centered around stringent global regulatory frameworks governing the production, transport, use, and disposal of radioactive materials, which imposes high compliance costs and logistical hurdles. Public perception and environmental concerns regarding radiological incidents also act as a strong deterrent, fostering interest in non-radioactive alternatives where feasible. Opportunities arise from technological advancements, particularly in developing novel encapsulation methods for enhanced safety and exploring advanced logistics solutions to manage the end-of-life responsibilities (source disposal and recycling), which can transform high-cost restraints into value-added services.

Impact forces are predominantly driven by evolving security concerns and technological displacement. The persistent global effort to prevent radiological terrorism has necessitated enhanced security protocols, driving up the cost of source management but also spurring innovation in tamper-proof containers and real-time tracking systems. Concurrently, the rise of powerful, portable X-ray and linear accelerator technologies, particularly in NDT, poses a threat by offering non-radioactive alternatives for certain thickness ranges and materials, potentially eroding market share in traditional radiography. The industry must navigate this competitive landscape by highlighting the unique advantages of gamma sources—namely, superior penetration depth, power independence (no external power required), and operational simplicity in remote locations—to maintain dominance in heavy industrial and specialized applications.

Successful market participants focus on vertical integration to gain control over the complex supply chain and mitigate regulatory risks associated with source acquisition and disposal. The long-term liability associated with high-activity, long-half-life isotopes like Cs-137 and Co-60 represents a critical structural challenge, pushing innovation toward isotopes with shorter half-lives or the development of closed-loop source recycling programs. Ultimately, the market trajectory is highly sensitive to national infrastructure spending cycles and the continued, non-negotiable requirement for high-integrity inspection and sterilization across vital global sectors. The balance between maximizing source utility and minimizing radiological risk dictates investment strategy and regulatory compliance across the entire industry value chain.

Segmentation Analysis

The Gamma Radioactive Sources Market is primarily segmented based on Isotope Type, Application, and End-Use Industry. This structure allows for a detailed assessment of specific demand drivers and regulatory influences within niche areas of the market. The differentiation by Isotope Type is critical, as the choice of isotope (e.g., Co-60, Ir-192, Cs-137) dictates the source's activity, half-life, energy spectrum, and primary application—from large-scale sterilization requiring powerful Co-60 to portable industrial inspection favoring Ir-192. Segmentation by Application highlights the dichotomy between high-volume industrial use (NDT, gauging) and specialized medical use (therapy, tracers). End-Use segmentation reveals which sectors drive revenue, with Healthcare and Oil & Gas consistently being the largest consumers, each having unique demands regarding source robustness, reliability, and regulatory oversight.

- By Isotope Type:

- Cobalt-60 (Co-60)

- Iridium-192 (Ir-192)

- Cesium-137 (Cs-137)

- Americium-241 (Am-241)

- Other Isotopes (e.g., Gold-198, Iodine-125)

- By Application:

- Industrial Radiography/Non-Destructive Testing (NDT)

- Industrial Gauging (Level, Thickness, Density)

- Sterilization and Irradiation (Medical and Food)

- Medical Therapeutics (Brachytherapy, Teletherapy)

- Well Logging and Geophysical Applications

- Calibration and Standardization

- By End-Use Industry:

- Oil and Gas

- Healthcare and Pharmaceuticals

- Manufacturing and Construction

- Aerospace and Defense

- Research and Academic Institutions

- Utilities and Nuclear Power

Value Chain Analysis For Gamma Radioactive Sources Market

The value chain for Gamma Radioactive Sources is characterized by high barriers to entry, deep regulatory control, and complex logistical requirements, extending far beyond the point of sale into mandatory end-of-life management. Upstream activities begin with the procurement of target materials (e.g., stable Cobalt-59, Iridium metal) and subsequent irradiation, typically performed in highly specialized research or power reactors operated by government entities or national nuclear laboratories. This reactor access represents a critical bottleneck and point of geopolitical sensitivity. Following irradiation, the material is processed in shielded 'hot cells'—a highly capital-intensive midstream activity—where the raw radioactive material is converted into a usable form (e.g., pellets, wires) and sealed into robust encapsulation containers, ensuring compliance with international safety standards (ISO 2919). This process demands high technical expertise and strict adherence to radiological protection protocols.

Downstream activities involve specialized distribution channels and end-user services. Due to the hazardous nature of the product, distribution is highly controlled, relying on licensed carriers and specialized logistics providers capable of managing transportation documentation (e.g., Dangerous Goods Regulations, Class 7) and shielded containers. The market structure involves direct sales for high-activity, long-term installations (like industrial irradiators) and indirect channels through authorized service providers or NDT contractors for field-deployable sources. These service providers not only facilitate the deployment but also handle the critical functions of source management, calibration, maintenance, and, crucially, the eventual return or disposal of the spent source, often under contractual mandates that shift long-term liability back to the original manufacturer or national repository.

The transition from a raw material to a certified source involves rigorous quality assurance and regulatory approval at every step. Direct channels are prevalent when end-users are large, regulated entities (e.g., national healthcare systems, nuclear utilities), providing clear accountability and specialized technical support. Indirect channels, essential for smaller industrial users or remote site operations, rely heavily on the technical proficiency and regulatory compliance of the authorized distributor or service bureau. The most critical aspect of the value chain is the closed-loop accountability required for source stewardship, emphasizing secure transport, operational safety, and mandated long-term waste management solutions, making disposal services a key profit center and a major competitive differentiator in the modern market.

Gamma Radioactive Sources Market Potential Customers

The primary customers for Gamma Radioactive Sources are large industrial entities and healthcare providers whose core operations depend on the reliable and penetrating power of gamma radiation for quality assurance, sterilization, or therapeutic treatment. In the industrial sector, major buyers include international oil and gas exploration companies, pipeline operators, and large manufacturing firms (especially aerospace and heavy machinery) that utilize Non-Destructive Testing (NDT) services to ensure structural integrity and compliance with safety standards. These customers require robust, field-deployable sources, such as Ir-192, for welding inspections, or high-activity Cs-137 sources for continuous industrial gauging in environments where thickness or level monitoring is critical for process control. Their purchasing decisions are driven by source reliability, operational lifetime, safety features, and the comprehensive nature of the supplier’s logistics and disposal services.

In the healthcare and pharmaceutical sector, hospitals, specialized cancer treatment centers, and large medical device sterilization facilities represent substantial customers. These users rely heavily on Cobalt-60 for large-scale sterilization of surgical equipment and consumer products, ensuring public health safety, and on specific isotopes (like Iridium-192 or Iodine-125) encased in specialized applicators for brachytherapy—a precise internal radiation treatment for various cancers. For these medical customers, regulatory approval (e.g., FDA, CE mark), source purity, precise activity calibration, and sterile handling protocols are paramount purchasing criteria. The demand here is non-cyclical, tied directly to global healthcare expansion and increasing requirements for sterile medical environments.

Other significant customer segments include governmental and research organizations. Defense contractors and national security agencies utilize gamma sources for advanced material testing and security scanning applications, while research laboratories and universities require lower-activity calibration sources for radiation detection instrumentation and specialized material research. Furthermore, the environmental and agricultural sectors use sources for soil density measurements and food irradiation purposes. These diversified end-users collectively ensure a stable, multi-faceted demand base for gamma source manufacturers, requiring suppliers to maintain specialized product lines and specific regulatory certifications tailored to each segment’s unique operational environment and safety mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,295 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eckert & Ziegler Group, QSA Global, Inc., Best Theratronics, Nordion (part of Sterigenics), JSC Isotope, Lantheus Medical Imaging, JSC V/O Techsnabexport (TENEX), Frontier Technology Corporation, GE Healthcare (Certain applications), REVISS Services, Sentinel (a division of QSA Global), Isotrend, CIS bio International, ONET Technologies, Institute of Isotopes Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gamma Radioactive Sources Market Key Technology Landscape

The technological landscape of the Gamma Radioactive Sources Market is dominated by advancements in encapsulation science, material integrity assessment, and integrated digital monitoring systems aimed at enhancing safety, longevity, and operational efficiency. Encapsulation technology, the core function of source manufacturing, focuses on creating hermetically sealed, highly durable casings—often multiple layers of stainless steel, titanium, or specialty alloys like Hastelloy—designed to withstand extreme thermal, pressure, vibration, and chemical stress encountered in industrial environments (e.g., well logging, high-pressure pipelines). Compliance with ISO 2919 performance standards (classification C66646 or higher) is essential, driving innovation in welding techniques, particularly automated laser welding and electron beam welding, to ensure the absolute integrity of the sealed source capsule against leakage for its entire operational lifetime and beyond. Furthermore, research is ongoing to develop new cladding materials that offer enhanced corrosion resistance without significantly attenuating the useful gamma flux, optimizing performance in highly corrosive chemical plant environments or deep-sea conditions.

A secondary, yet critical, area of innovation involves the processes for isotope purification and target material preparation. High-purity isotope production ensures predictable decay characteristics and maximizes the specific activity (radioactivity per unit mass), allowing for smaller, lighter sources that require less shielding mass, thereby improving portability and reducing handling complexity. This is particularly vital for Iridium-192 sources used in portable NDT. Furthermore, the integration of advanced electronics, specifically in the field of remote monitoring, is transforming source management. Sources are increasingly housed in projectors or containers equipped with micro-sensors that track temperature, shock, source position status (e.g., exposed or shielded), and real-time geolocation via GPS/GPRS. This technological leap enables preventative maintenance, immediate security alerts, and automated audit trails, drastically improving regulatory compliance and reducing the likelihood of accidental exposure or source loss.

Finally, technology is addressing the complex issue of source retirement and disposal. Innovations in source recycling and waste conditioning technologies, such as vitrification or specialized matrix embedding, aim to reduce the long-term volume and radiological hazard of spent sources, easing the burden on national waste repositories. Manufacturers are also exploring the utilization of advanced robotic handling systems within hot cell environments, which minimizes human involvement in high-dose operations (source loading, testing, disassembly), contributing significantly to safety metrics. The key focus remains on creating sources that are intrinsically safer, easier to manage through digital integration, and engineered for a predictable, safe conclusion to their lifecycle, effectively balancing the market's reliance on gamma emission with the global imperative for nuclear security and waste minimization.

Regional Highlights

The Gamma Radioactive Sources Market exhibits distinct characteristics and growth patterns across major global regions, influenced primarily by industrial maturity, regulatory stringency, and infrastructural investment cycles.

- North America (NA): NA represents a mature market characterized by a high installed base of NDT equipment, particularly in the Oil & Gas and Aerospace sectors. The market here is driven by strict regulatory mandates (NRC/DOT) and a focus on minimizing liability, leading to high demand for advanced, digitally monitored source projectors and comprehensive source return programs. The U.S. is a major consumer of Co-60 for sterilization and Ir-192 for pipeline integrity inspections. Technological adoption, especially AI integration into radiographic analysis, is rapid, focusing on reducing human error and improving compliance documentation.

- Europe: European demand is stable, shaped heavily by EU directives (EURATOM) emphasizing radiological protection and waste management. Countries like Germany, France, and the UK are strong markets for both industrial gauging and high-precision medical brachytherapy sources. The focus is on standardization (ISO compliance) and the implementation of best practices for source tracking and end-of-life management, pushing manufacturers towards advanced, tamper-resistant source capsules and robust logistics services. Growth is moderate, driven mainly by replacement cycles and medical advancements.

- Asia Pacific (APAC): APAC is the fastest-growing region, powered by unprecedented infrastructural development in China, India, and Southeast Asia. Massive construction and pipeline projects necessitate extensive NDT, driving exponential demand for Ir-192 sources. The rise of medical tourism and expanding healthcare access also fuels demand for sterilization and therapy sources. While some countries maintain strict domestic nuclear regulations, implementation varies, making the market highly sensitive to global supply chain reliability and the availability of licensed service providers capable of operating across diverse regulatory landscapes.

- Latin America: This region's market dynamics are highly concentrated around the Oil & Gas exploration and mining industries, particularly in Brazil, Mexico, and Argentina. Demand is sporadic but intense, linked directly to major project lifecycles, requiring portable, rugged sources for remote fieldwork (well logging and radiography). Regulatory compliance is challenging due to complex local mandates and infrastructure limitations, favoring global suppliers who can provide comprehensive, turn-key source management and servicing packages.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to large-scale investments in energy infrastructure (pipelines, refineries) and diversification projects, particularly in the GCC countries. The high demand for industrial integrity testing in extreme desert conditions drives the need for highly durable and temperature-resistant source holders and projectors. Political stability and security concerns significantly influence the operational logistics and security requirements for source deployment, creating a niche demand for high-security tracking and monitoring technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gamma Radioactive Sources Market.- Eckert & Ziegler Group

- QSA Global, Inc.

- Best Theratronics

- Nordion (part of Sterigenics)

- JSC Isotope

- Lantheus Medical Imaging

- JSC V/O Techsnabexport (TENEX)

- Frontier Technology Corporation

- GE Healthcare (Brachytherapy applications)

- REVISS Services

- Sentinel (a division of QSA Global)

- Isotrend

- CIS bio International

- ONET Technologies

- Institute of Isotopes Co. Ltd.

- DuPont (Isotopes Division)

- Comecer S.p.A.

- Curium Pharma

- Advanced Cyclotron Systems, Inc. (ACSI)

- Hilger Crystals Ltd.

Frequently Asked Questions

Analyze common user questions about the Gamma Radioactive Sources market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Gamma Radioactive Sources?

The primary drivers are Industrial Radiography (Non-Destructive Testing or NDT) for pipeline and structural integrity assessment, large-scale Medical Device Sterilization, and specialized Medical Therapeutics, particularly brachytherapy for cancer treatment.

Which isotope holds the largest market share and why is it preferred?

Cobalt-60 (Co-60) typically holds the largest market share by activity due to its widespread use in high-volume, continuous industrial applications, specifically for medical device sterilization and large-scale food irradiation, owing to its long half-life and high gamma energy.

How do regulatory requirements impact the Gamma Radioactive Sources Market?

Stringent global and national regulatory requirements (e.g., IAEA, NRC) govern all aspects of the market—from production and licensing to transport and disposal. These regulations impose high compliance costs, necessitating advanced source tracking and mandatory end-of-life accountability, which in turn drives specialized service providers.

What technological advancements are enhancing the safety and security of gamma sources?

Safety is enhanced through advanced double-encapsulation techniques using durable alloys, and security is improved through the integration of real-time digital monitoring systems (GPS tracking, sensor telemetry) into source projectors and containers, mitigating risks associated with accidental exposure or theft.

Is the market threatened by the rise of non-radioactive alternatives like advanced X-ray systems?

Yes, non-radioactive alternatives, such as high-energy X-ray and linear accelerators, pose a competitive threat, particularly in Non-Destructive Testing. However, gamma sources retain dominance in applications requiring superior penetration depth, power independence, and reliability in highly remote or harsh industrial field environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager